Morning Star Pattern: how to trade?🌟

❗️The Morning Star pattern is a market reversal pattern consisting of three candlesticks that indicate bullish superiority. This pattern warns us about the weakness of the ongoing downtrend, which, in turn, suggests the beginning of an uptrend.

⚠️Traders observe the formation of the "Morning Star" pattern on the price chart, and then confirm with the help of other technical tools on the Forex currency market.

✅Morning Star pattern: Three forming candles

⏺Big Bearish Candle

⏺A small bullish or bearish candle

⏺Big Bullish Candle

The most important thing to remember is always that the market must be in a downtrend in order to trade according to the "Morning Star" pattern.

In order to confirm the downtrend, mark the lowest lows and the lowest highs.

1️⃣The big bearish candle is the first part of the Morning Star reversal pattern. This candle indicates that the bears are in full control of the market, which means that sellers continue to pressure the market.

At the moment, you should only look for sale deals, since there are no signs of a reversal yet. Here the Morning Star pattern is just beginning its formation.

2️⃣A small bullish/bearish candle is the second candle that starts with a bearish gap down. This candle indicates that sellers are unable to lower the price, despite very great efforts.

The price action ends with the formation of a rather small bullish/bearish candle (Doji candle).

If this candle is bullish, then we have an early sign of a trend reversal.

3️⃣A large bullish candle is the third candle that has the greatest significance, because here the real pressure of buyers is manifested. If the candle starts with a break, and buyers can push prices up by closing the candle even above the first red candle, this is a clear sign of a trend reversal.

✅Morning star: how to trade this pattern on Forex?

As we already know, the Morning Star pattern is a reversal pattern. As a rule, it indicates that bulls are capturing the trend, and bears are losing control.

Most beginners trade using the "Morning Star" pattern on their own, without using technical tools, or at least tips from more professional traders.

We do not recommend doing this — it is not as reliable as it may seem. Always connect this pattern with other reliable indicators, support and resistance levels, as well as trend lines.

So, in this strategy, we combined the Morning Star pattern with volume. Volume plays an important role in the formation of the model.

If the first red candle shows a low volume, then this is a good sign for us. Then, if the second candle is green and the volume is growing, this indicates buyer pressure.

After all, the volume of the third long green candle should be high. The large volume of the last candle indicates the confirmation of the upcoming trend and the entrances to purchase transactions.

If the third bullish candle has a low volume, do not pay attention to the fact that the Morning Star is forming. This volume does not indicate a bullish reversal.

To sum up: do you observe the closing of the third candle with a large volume? Open buy positions and move along with the uptrend until there are signs of a reversal.

✅Morning Star pattern: entry, take profit and stop loss

We have to open a deal when the next green candle closes. There are many ways to lock in profits.

We can close a position in any resistance zone or supply-demand zone. In this deal, we hold our positions because we have opened a deal since the beginning of a new trend.

You can also close your positions when the price approaches a significant resistance level on the higher timeframe.

⚠️Combining this pattern with volumes makes trading more reliable. Therefore, you need to place a stop loss just below the second candle.

❤️ Please, support our work with like & comment! ❤️

Tradingbasics

What is a Gap in Trading? | Different Types of Gaps Explained 📚

Hey traders,

In this article, we will discuss a very common pattern that is called gap.

In technical analysis, the gap is the difference between the closing price of the previous candlestick and the opening price of the next candlestick.

📈Gap up represents a situation when the price bounces up sharply at the moment of a transition from one candlestick to another. The price gap that appears between them is called gap up.

📉Gap down represents a situation when the price drops sharply at the moment of a transition from one candlestick to another, the price gap between the closing price of the previous candle and the opening price of the next candle is called a gap down.

From my experience, I realized that with a high probability the gap tends to be filled. For that reason, once you see a gap, consider trading opportunities around that.

Depending on the market conditions where the gap appears, there are several types of a gap to know:

1️⃣Common gap appears in a weak, calm market. When the trading volumes are low and the market participants are waiting for some trigger, or the asset reached a fair value price.

2️⃣Breakaway gap appears in a situation when the price suddenly breaks a structure (support or resistance) in a form of a gap.

Such a gap usually confirms a structure breakout.

3️⃣Runaway gap usually appears when the market is growing or falling sharply. It signifies the dominance of buyers/sellers and highly probable continuation. Usually, such gaps are not filled.

4️⃣Exhaustion gap is, in contrast, appears around major key levels and signifies a highly probable reversal. The exhaustion gap is usually confirmed by a consequent strong opposite movement that fills the gap.

Learn to recognize gaps on a chart and learn to interpret them. It will increase the accuracy of your technical analysis.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Support & Resistance Levels | Trading Basis📚

❗️The concepts of support and resistance are fundamental concepts of technical analysis of financial markets. They are applicable to almost any market, be it stocks, Forex, gold or cryptocurrency.

❗️And although these concepts are easy to understand, in practice they are quite difficult to master, since the definition of levels is completely subjective, and their behavior depends on many conditions. So first of all it is important to learn to distinguish their types. To do this, you will have to familiarize yourself with a lot of graphs, and this guide will help you.

✅What is support and resistance?

🟢At the most basic level, support and resistance are simple concepts. To determine them, the maximum and minimum price indicators are displayed, acting as a kind of barrier. At the same time, the lower values of the chart represent the support level, and the upper values represent the resistance level. In fact, the level of support can be viewed from the point of view of demand, and the level of resistance – from the point of view of supply.

🟢Despite the fact that support and resistance levels are usually denoted by lines, in reality they usually look different. It should be borne in mind that markets are not governed by any physical law that does not allow indicators to go beyond a certain level. Therefore, it is more appropriate to consider support and resistance levels as areas. You can imagine these areas as ranges on the price chart, the approach to which is likely to cause increased activity of traders.

✅How Traders Use Support and Resistance levels

🟢Technical analysts use support and resistance levels to identify areas of interest on the price chart. At these levels, the main trend is likely to change its direction.

🟢Market psychology plays an important role in the formation of support and resistance levels. Traders and investors are guided by price levels that previously caused increased interest and trading activity. These areas will contribute to increased liquidity as many traders will be tracking the same price levels. Often, support and resistance zones create ideal conditions for entry or exit from a position for large traders.

🟢The concepts of support and resistance levels are key to effective risk management. Your trading opportunities may depend on your ability to consistently identify these zones. Usually, after the price reaches the support or resistance area, two possible events are possible. It either bounces off this area, or breaks through it and continues moving in the direction of the trend to the next potential support or resistance area.

🟢It is best to enter a trade when the price is near the support or resistance level, mainly because of its relative proximity to the cancellation point, where a stop loss order is usually placed. In case of a breakthrough of the area and invalidation of the transaction, traders will be able to reduce their losses, because the further the entry is from the supply or demand zone, the further the point of invalidation of the transaction.

🟢At the same time, you need to understand how these levels will change depending on changes in the situation on the chart. As a rule, a breakdown in the support area can turn it into a resistance area. Conversely, a broken resistance area may turn into a support area when it is retested. This pattern is called the support-resistance flip.

⚠️How to draw support levels correctly?

⏺Reduce the timeframe of your charts so that you can see the bigger picture.

⏺Draw the most obvious levels that tend to have the strongest price bounces.

⏺Adjust your levels to get the maximum number of touches.

❤️ Please, support our work with like & comment! ❤️

10 Trading Commandments of a Successful Trader 📜

Hey traders,

In this post, we will discuss 10 divine rules that every trader must obey:

1️⃣ - Accept that risk and losses are a necessary part of trading.

Even though most of the traders are looking for a holy grail, for a system that produces 100% win rate, in fact, losses are inevitable, they are part of the game.

No matter how good you are as a trader, occasionally, the market will outsmart you.

2️⃣ - Have a proven trading system.

Trade only with a trading strategy that you backtested, that proved its accuracy and efficiency.

3️⃣ - Concentrate on the risk, not the reward.

Cut losses, and control your risk. Remember about risk management and never neglect that.

4️⃣ - Never trade without stop loss.

Some traders say that they can easily control losses without stop loss. Don't listen to them. Always set a stop loss once you are in a trade.

5️⃣ - Have an attainable target.

Setting a stop loss remember to know where to close your trade in profit. Follow strict rules and do not let your greed take you under control.

6️⃣ - Take your emotions under control.

No matter whether you are losing, winning, or do not see any trading setups to trade, your emotions will always try to distract you.

Be cold-hearted.

7️⃣ - Always stick to your trading plan.

Never break your rules, follow your system, and do not deviate.

Your trading plan is your only map.

8️⃣ - Limit your losses, never limit your profits.

While your gains can be scalable, your risks and losses must be fixed.

9️⃣ - Treat your trading as a business.

Trading should be treated with the same discipline as a business.

Every business has a solid business plan which entails how the day-to-day running of the business is done, and this also guides the decision-making process.

🔟 - Always journal your trades.

Always keep a trading journal. Record your winners and losers, entry reasons, mistakes, failures etc. Revise and learn from your mistakes.

Of course, that list can be extended and more commandments and rules can be added. However, these 10 in my view are the most important. Print this list and let it guide you in your trading journey.

What would you add to that list?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Keep your trading charts clean!🧹

✅Keeping Charts Clean: Since a trader's charting platform is his or her portal to the markets, it is important that charts improve rather than hinder a trader's market analysis. Easy-to-read charts and workspaces (the entire screen, including charts, news feeds, order entry windows, etc.) can improve a trader's situational awareness, allowing him to quickly decipher market activity and react to it. Most trading platforms allow you to largely customize the color and design of the chart, from the background color, style and color of the moving average to the size, color and font of the words that appear on the chart. Setting up clean and visually appealing charts and workspaces helps traders use indicators effectively.

✅Information overload: Many modern traders use multiple monitors to display multiple charts and order entry windows. Even if six monitors are used, you should not consider every square inch of the screen as technical indicators. Information overload occurs when a trader tries to interpret so much data that in fact they are all lost. Some people call this analytical paralysis; if too much information is presented, the trader will most likely not be able to respond. One way to avoid information overload is to exclude any extraneous indicators from the workspace; if you don't use it, lose it – this will help reduce clutter. Traders can also view charts to make sure they are not burdened with multicollinearity; if multiple indicators of the same type are present on the same chart, one or more indicators can be deleted.

✅Tips for organizing: Creating a well–organized workspace using only relevant analysis tools is a process. The set of technical indicators that a trader uses may change from time to time depending on market conditions, strategies used and trading style.

❗️On the other hand, charts can be saved if they are configured in a user-friendly form. There is no need to reformat the charts every time the trading platform closes and reopens. Trading symbols can be changed together with any technical indicators without disturbing the color scheme and layout of the workspace.

✅Recommendations for creating easy-to-read diagrams and workspaces include:

⏺Colors. The colors should be easy to view and provide great contrast so that all data can be easily viewed. In addition, one background color can be used for order entry charts (the chart that is used to enter and exit a trade), and a different background color can be used for all other charts of the same symbol. If more than one symbol is traded, you can use a different background color for each symbol to simplify data isolation.

⏺Layout. Having more than one monitor helps to create a comfortable workspace. One monitor can be used for entering orders, and the other for price charts. If the same indicator is used on several charts, it is recommended to place similar indicators in one place on each chart using the same colors. This makes it easier to find and interpret market activity on individual charts.

⏺Sizes and fonts. Bold and clear font makes it easier for traders to read numbers and words. Like colors and layout, font style is a preference, and traders can experiment with different styles and sizes to find a combination that creates the most visually pleasing result. Once convenient labels are found, fonts of the same style and size can be used on all diagrams to ensure continuity.

⚠️It is important to note that technical analysis deals with probabilities, not certainty. There is no combination of indicators that accurately predicts market movements in 100% of cases. While too many indicators or improper use of indicators can blur a trader's view of the markets, traders who use technical indicators carefully and effectively can more accurately determine trading attitudes with high probability, increasing their chances of success in the markets.

❤️ Please, support our work with like & comment! ❤️

MAIN ELEMENTS OF YOUR TRADING PLAN | Trading Basics 📝

Hey traders,

One month ago I wrote an article about the importance of a trading plan. Now it is time to discuss what should be inside your trading plan.

Before we start let me note that a trading plan is a very personal thing and depending on your personality you may have some other elements. In this article, we discuss key elements that must be in every trading plan.

🔰Trading Strategy.

I want you to realize that a trading strategy is not a trading plan. A trading strategy is simply one of its main elements.

A trading strategy defines a set of rules and market conditions that one is looking for to open a trade and then manage that.

🔰Trading Time.

Relying on your trading strategy you should know exactly when you trade. The time range must be precise and fixed. If you think that today you can trade the opening of the London session, tomorrow the Asian one, and then the US opening, I have very bad news for you.

Your trading hours must be fixed and objective.

🔰Trading Instruments.

As with your trading time, you should have a fixed trading list. A set of financial instruments that you monitor on a daily basis.

🔰Trading Journal.

You should learn to journal your trades. Just a single performance is not enough. You should note the exact market conditions that made you open the trade and many other factors that you consider to be important.

Then learn from your mistakes and improve your trading strategy based on your journal.

🔰Risk Management.

Having the best trading strategy in the world one can fail simply because of neglecting the rules of risk management.

Define your risk per trade, maximum drawdown, and biggest losing streak you can take.

Optimize your trading to keep your losses under control.

Of course, that list can be extended. We can add, for example, trading psychology into that.

As I said, a trading plan is a very personal thing and while you mature in trading it will become more and more sophisticated.

The elements that we discussed in this article are crucial for your success in trading. In my view, their absence will lead you to a failure.

What do you want to learn in the next article?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Why do I need a stop loss and how to set it?📈

❗️A stop loss is a limit order that protects you from further losses when the price moves against your position.

Correctly used stop loss:

🟢Allows you not to lose the entire deposit in one transaction.

🟢Liquidates losses and frees margin for new transactions.

🟢Minimizes possible losses.

✅Trading with a stop loss limits your losses and saves your trading deposit from a sudden price movement that is not in your favor. You can perceive a stop loss as a kind of insurance. You have to constantly pay small premiums, but insurance will protect you from large monetary losses in case of sudden market movements against your position.

✅The rules for setting a stop loss are often misunderstood in conventional retail. However, it should be clear that you can never enter a trade without a stop loss. Not only because you risk losing too much on one trade, but you also easily fall victim to emotional trading mistakes.

✅When you know where your stop loss is (and why you are placing it there), you will feel less tempted to break your stop loss rules and are more likely to stick to your original plan.

🟡What are the ways of setting stops?

There are three ways to set stop losses that can be used in trading:

1️⃣Volatility based stop loss.

2️⃣Time based stop loss.

3️⃣Structure based stop loss.

1️⃣Volatility based stop loss.

The volatility stop loss takes into account the current price volatility in the market. The indicator that measures volatility is the average true range or the ATR indicator.

You need to determine the current ATR value and multiply it by the coefficient of your choice.

2️⃣Time based stop loss

The time stop determines when to exit the trade depending on the time that has passed since the start of the position opening. Instead of exiting the market depending on the value of the price, you exit after a certain amount of time has passed.

3️⃣Structure based stop loss.

The structural stop loss takes into account the current state of the market relative to the levels. For example, the price usually reverses from the support level and goes up. Therefore, the stop loss can be placed under the support level.

In this method, you know exactly when you will be wrong if the market structure is broken. On the other hand, if the levels are far apart, you will need a fairly large stop loss. Therefore, you will have to reduce the position size in order to maintain the current level of risk.

⚠️Stop losses should not be used in situations where the reasons for the transaction are exclusively fundamental. The price should have the opportunity to "take a walk" before the idea is implemented. Risk management is carried out by selecting the optimal share of the portfolio allocated to the transaction. Often, stop-losses are not used in long-term portfolio investment based on an unambiguous fundamental approach.

❗️Stop losses should be used in transactions where there are clear technical grounds for its placement. In such strategies, many adhere to the tactic that the potential profit exceeds the possible loss in a ratio of at least 2 to 1 or 3 to 1 (this is individual). Stop-losses are necessary for speculative trades with large "shoulders" and/or trades with a small movement potential, where the filigree execution of entry and exit is important.

❤️ Please, support our work with like & comment! ❤️

How to Read a Candlestick | Beginners Guide 🕯

Hey traders,

If you follow me for quite a while you probably noticed that I apply a candlestick chart for the market analysis.

In this post, we will discuss how to read an individual candlestick and we will outline its important elements.

🔰The candlestick reflects the price movement for a selected period of time.

An hourly candle will show you a price action within an hour and a daily candle within a day.

🔰The candlestick pattern has a very specific shape:

it is composed of a body and a wick.

The wick of the candle indicates the range of the price action within the candle. Its upper wick will show you the highest price during that time period and its lower wick will show the lowest price, while the body of the candle indicates its opening and closing price.

🔰From the color of the body of the candle, we identify its direction.

Green signifies a bullish candle while red signifies a bearish one.

🔰The lower boundary of a body of a bullish candle will show its opening price and its upper boundary its closing price.

🔰The upper boundary of a body of a bearish candle indicates its opening price and its lower boundary its closing price level.

With so many elements within a single candlestick, one can derive a lot of valuable information.

Some candlesticks have a very specific form and are called candlestick patterns. They are applied for predicted the future market behavior.

A proper reading of a candlestick chart may unveil a lot of insights about the market so it is very important for you to learn to work with that.

❤️Please, support this idea with like and comment!❤️

Classic Trend Reversal Patterns📚

✅It is difficult to overestimate the importance of the classic continuation and reversal patterns. For a real trader trading on the Forex market, it is huge, because these patterns make it possible to predict the behaviour of the price.

⚠️If one of the trend continuation patterns appears in front of us on the chart, it means that the usual correction (rollback) is taking place. After its completion, it becomes possible to profitably enter the market at the existing rate.

📈📉Head & Shoulders

🟢The Head and shoulders pattern is a reversal pattern that is usually formed during a bullish trend and creates a top — the first shoulder. After the correction, the price creates a higher top — the head. After the next correction, the price creates a third top, which is below the head — the second shoulder. So, we have two shoulders and a head in the middle.

🟢Of course, the head and shoulders reversal pattern has its inverse equivalent, which turns bearish trends into bullish ones. This pattern is called the Inverted Head and Shoulders pattern.

🟢Confirmation of the pattern occurs when the price breaks the line that runs through two bases on either side of the head. This line is called the neckline. When the price overcomes the neck line, we get a reversal signal.

📊Double Top and Double Bottom

🟢A double top consists of two peaks on the chart. These peaks are either at the same resistance level, or the second peak is slightly lower. A sample of a double top usually looks like the letter "M".

🟢A double top has its opposite, which is called a double bottom. This model consists of two bases, which are either located at the same support level, or the second base is slightly higher. The double bottom pattern usually looks like the letter "W".

🟢Confirmation of the Double top pattern comes at the moment when the price breaks through the minimum between the two tops. This level is marked by a line on the chart and is called a signal line.

🟢The stop loss order should be placed directly above the second top. The minimum profit target is equal to the distance between the neck and the center line that connects the two tops.

❗️The double bottom looks and works exactly the same.

💎Diamond

🟢It is quite difficult to see this pattern on a real chart – it looks like a standard flat, but with unstable volatility. A diamond means, at least, medium-term market uncertainty, when the probability of movement in any direction is almost the same. But the longer it takes to form, the stronger the breakdown and the subsequent trend will be.

☕️Cup with Handle

🟢The cup with handle pattern is considered a bullish continuation pattern, so it is necessary to determine the previous uptrend. This can be done by analyzing price dynamics or technical indicators, such as moving averages.

The cup should be more U-shaped, not V-shaped, and the upper points on both sides of the cup should be approximately at the same level.

❤️ Please, support our work with like & comment! ❤️

The Iceberg Illusion of Success in Trading 🏔️

When people see a consistently profitable trader they do not consider all the costs a successful trader has paid overtime (below the surface) to get to what they see (above the surface).

So many things happen below the surface that nobody can see.

Here are some of the below the surface things that compose the top of the iceberg that everyone sees:

🔰Dedication – you need to be loyal to your dream of becoming a pro trader. Your belief must be that strong so no one could dissuade you. You need an iron discipline to make it happen.

🔰Hard work – you should work day after day not letting yourself give up. Charts must be in front of you as much as it is possible. Trading terminal must become your best friend.

🔰Good habits – follow your trading plan, do not break your rules of risk management, avoid FOMO, etc. This is the set of habits that will be your satellite in your trading journey. Do them consistently and they will become a natural part of your life.

🔰Disappointment – it does not matter how hard you try. Occasionally things will fall apart anyway: you will face losing streaks and a strategy will refuse to work. It will hurt. "Stand up straight with your shoulders back". Treat disappointments as temporary things.

🔰Sacrifice – to become a consistently profitable trader you should pay the price. Losses, time, nerves. Your prosperous future will have a tremendous cost.

🔰Failure – while you are learning how to trade you will inevitably blow a couple of trading accounts, you will spend time on strategies and techniques that do not work. Occasionally you will fall. If so, stand up and keep going.

🔰Persistence – keep doing what you are doing no matter what. Do not let others persuade you that you can't make it. Even if things get tough, stay strong.

🔰Focus – always know what is your end goal, know where are you going, and what is your end destination.

🔰Flexibility – be prepared for sudden changes in the environment. Keep your focus on the goals that you set learning to adjust to the changing circumstances.

🔰Consistency – you will not get the desired results immediately. Be ready to do the same again and again, hundred times until the goal is achieved.

Overnight success does not exist. If you want to become a consistently profitable trade be prepared for years of struggling and pain. And do not be afraid, it is worth it.

❤️Please, support this idea with like and comment!❤️

Know When to Stop Trading⛔️

✅Today we will talk about one of the most important things in trading, about what most traders around the world cannot do, even though they are well aware of the need for these actions. It will be about suspending and completely stopping their trading activities.

✅What to do if the trading system has failed, the market has changed, emotions fail or something has gone wrong. It is in this situation that the rules of action in extreme trading situations come to our aid.

1️⃣Three shots and you're dead — the rule of stopping trading within a day

🟢The main essence of this rule is contained in the title. And its essence is to stop trading if 3 consecutive losing trades were made during the trading session. No more deals are opened on this trading day. The trader has received a clear signal that something has gone wrong and the problem is either with the strategy or with the market or with the trader.

🟢Especially psychologically strong people who are sure that they will not be drawn to recoup, can continue to monitor the market, but it would be better to just close the trading platform and do something else, and after the trading session to analyze and find out what the problem was.

2️⃣Three volleys and you're dead — the rule of stopping trading for 2 days

🟢This rule is quite simple in formulation and just as complex in execution, in fact, as all the rules of risk management and capital management.

🟢If the three-shot rule has worked for three days in a row, then trading stops for 2 days. The principle is the same as in the previous rule, but in this case, the trader receives a signal that the problem is more serious than originally thought and it will not be possible to simply wait it out, serious measures need to be taken to analyze and correct the situation.

3️⃣The 30% trading capital rule

🟢If 30% of the trading capital was lost during trading, then trading stops completely until the moment when this loss is made up in any other way (of course legal). This rule will help to save your main working tool — trading capital and will allow you to relieve psychological stress because the trader will come out of a stressful state and realize that he has other ways of earning income, i.e. trading is not conducted with the last money.

❗️Observing these 3 simplest rules of stopping trading, you can be sure that you will never lose your deposit and even in the worst case scenario you will always be able to stop and beat the excitement that pushes many traders to return to the market again and again until zero remains on the account.However, all of the above is true only under one small condition — all three rules are strictly observed

❤️ Please, support our work with like & comment! ❤️

PRICE ACTION TRADING | INVERTED HEAD & SHOULDERS PATTERN 🔰

Hey traders,

Inverted head and shoulders pattern is a classic reversal pattern.

It signifies the weakness of buyers in a bearish trend and a bullish accumulation.

⭐️The pattern has a very peculiar price action structure:

Trading in a bearish trend the price sets a lower low and retraces setting a lower high (left shoulder),

then the market goes lower setting a new low but instead of setting a new lower high, the price returns back to the level of a previous lower high setting an equal high (head).

After that bears start pushing again but with an amplifying bullish pressure, the market sets a higher low and returns back to equal highs setting a new one (right shoulder).

🔔Equal highs form a horizontal structure called a neckline.

Once the pattern is formed it is still not a trend reversal predictor though.

The trigger that is applied to confirm a trend reversal is a bullish breakout of a neckline of the pattern.

📈Then a long position can be opened.

For conservative trading, a retest entry is suggested.

Safest stop is lying at least below the right shoulder.

However, in case the heights of the right shoulder and head are almost equal it is highly recommendable to set a stop loss below the head level.

🎯For targets look for the closest strong structure resistances.

What pattern do you want to learn in the next post?

❤️Please, support this idea with like and comment!❤️

5 Important Candle Patterns You Need to Know📚

🟢Candlestick patterns and models in technical analysis can be used to predict future price movement.

⚠️There are many different candle patterns. Not all of them work equally well and often their form is quite subjective. Therefore, it is not necessary to make trading decisions based on patterns alone. It would be best to combine them with support and resistance levels, moving averages or other technical analysis indicators that strengthen signals to enter the market.

❗️Remembering a lot of different candle patterns is not as useful as understanding what is really behind their appearance, and who is currently controlling the situation in the market — bulls or bears.

Let's look at the most popular and easiest to define patterns.

✅Bearish Engulfing

It is formed during the upward momentum of the price at the local highs of the chart. The first small green candle of the pattern indicates that the bulls are already tired and they need a break. The large red candle that appeared next, swallowing the green one with its body, indicates that the bears took advantage of the situation and actively moved into a counteroffensive.

Further movement of quotations downwards leads to the beginning of a downward correction. Confirmation of the beginning of the downward movement will be the price falling below the minimum of the second, large bearish candle pattern.

✅Bullish Engulfing

It is formed during the downward movement at the local minima of the price chart. The first small red candle of the pattern shows that the bears' strength is already running out, after which a large green candle appears, completely absorbing the body of the first one. This suggests that the bulls felt the weakness of the bears and actively went on the offensive.

Further upward movement of the price leads to the beginning of an upward correction. Confirmation of its beginning is the growth of quotations above the maximum of the second, large bullish candle pattern.

✅Doji

In fact, doji can be one of the most important patterns in combination with other technical analysis tools.

It shows indecision in the market and at its breakdown - it is possible to draw conclusions about the further probable price movement.

✅Shooting Star

A clear sign of the dominance of sellers.

After the opening of the candle, prices moved towards growth, but at the closing of the candle, sellers began to dominate buyers and the price closes near or below the opening price.

The tail of this candle shows that it was in it that sellers began to "Crush" buyers.

With such a pattern, there is a possibility of further decline.

✅Pin bar

A clear sign of the dominance of buyers.

After the opening of the candle, prices moved downward, but at the close of the candle, buyers began to dominate sellers and the price closes near or above the opening price.

The tail of this candle shows that it was in it that buyers began to "crush" sellers.

With such a pattern, there is a possibility of further growth.

❤️ Please, support our work with like & comment! ❤️

Why Do You Need a Trading Plan?📝

If you want to become a consistently profitable trader you have two choices:

1️⃣strictly follow your trading plan

or

2️⃣fail.

Trading plan is essential for achieving your financial goals.

It is a set of actions to follow for making trading decisions

guiding you on how to react to certain events.

It reflects your personality and characteristics.

Moreover, its entire structure and content are primarily based on them.

Your way to success will be full of obstacles.

A lot of things will come in your way:

losses, drawdowns, and losing streaks;

mistakes, scams, and emotional decisions.

Only your trading plan will show you a correct path, it ensures you will stay on track on your journey to your desired destination.

When you make a wrong turn, it knows to make adjustments, and it points you back in the right direction.

It is your guard from making any hurried decisions you could later regret.

Trading without a trading plan wouldn’t be a smart idea. You wouldn’t know how to get to your destination and it’s highly likely that you get lost.

Most importantly, if you suck at trading (and you certainly will in the beginning), you will know it is down to one of only two reasons: either there’s a problem in your trading plan or you are not sticking to your trading plan.

Stick to your plan traders. "If you fail to plan, you plan to fail".

❤️Please, support this idea with like and comment!❤️

What are Moving Averages & how to make money on them?📚

🟢The main rule of using Moving Average is to track the general direction of the moving average: it indicates the dominant trend in the market. It is worth making deals only in the direction of this movement. Such a simple rule makes the moving average method a convenient tool for short-term forecasting.

🟢A universal tool in almost all markets is a simple moving average (SMA) with a 200-day averaging period. A longer-term moving average will allow you to see the global rise or fall of the asset, avoid short-term fluctuations or minor consolidation of the exchange rate. As a rule, short moving averages allow you to react more actively to price movements and are designed to search for short-term trends. When analyzing the price chart on a daily or even shorter interval, many traders use "fast" EMAS with different averaging periods (5, 7, 13, 21, 50).

✅To date, there are many recommendations for the period of the moving average (3, 5, 7, 13, 21, ...), as well as methods of its calculation (SMA, WMA, EMA). The general postulates are as follows:

✅The "faster" the MA (EMA) and the shorter the calculation period (3, 5, 13, ...), the more likely it is to receive false or ambiguous signals;

✅The "slower" the MA (SMA) and the longer the calculation period (50, 100, ...), the more likely the moving average is to lag behind the real state of affairs in the market.

❗️The moving average method is still a universal way to determine the trend in the asset market. Ease of use and unambiguous interpretation of the result allow the investor to determine the prevailing trend with a high degree of probability. This minimizes the risk of making unprofitable deals. The use of the method as an independent tool when deciding on a transaction is controversial, since all possible successful combinations of the intersection of moving averages or the average and the asset price are subject to cyclicity and sometimes give false or ambiguous signals.

❤️ Please, support our work with like & comment! ❤️

Learn Trend Analysis | Impulse & Retracement Legs 📈

Hey traders,

As you asked me, in this educational post we will discuss some price action basics.

No matter whether you are a fundamental trader or a technical trader you should be able to execute trend analysis.

You should always know where the market is going; if it is bullish or bearish.

One of the simplest ways to execute trend analysis is to perceive a price chart as a sequence of impulses and retracements.

➖The impulse leg is a trend-following move.

It is characterized by heightened movement dynamics and speed.

Usually the completion point of the impulse:

sets a new lower low in a bearish trend,

sets a new higher high in a bullish trend.

➖A retracement leg is a correctional movement within the trend.

Its’ initial point is the completion point of the impulse or retracement leg and

its completion point might be an initial point of a new retracement leg or of a new impulse leg.

Usually, a retracement leg is characterized by a slow zig-zag movement.

Usually the completion point of the impulse leg:

sets a lower high in a bearish trend,

sets a higher low in a bullish trend.

Perceiving the price chart as the set of impulses, one can easily and objectively identify a global, mid-term and short-term market trend, price action trend-following, reversal and correctional patterns.

What do you want to learn in the next educational articles?

❤️Please, support this idea with like and comment!❤️

Japanese Candlesticks: learning to read and understand🕯

✅Japanese candlesticks are the most popular way to read the price movement on charts. They are visual, easy to learn and the main thing is that they work.

✅The first mention of candle patterns can be found in the Japanese rice trader Homma Munehisa in the 1700s. Almost 300 years later, candles were rediscovered by Steve Neeson in his book titled "Japanese Candles. Graphical analysis of financial markets".

✅Candlestick charts provide much more information compared to linear charts and are currently the preferred market analysis tool for traders and investors.

What are Japanese candles?

🟢Each of the candles tells us four facts about itself: the opening price, the maximum price movement, the closing price, and the minimum price movement.

⏺A bullish candle is formed when the price rises. In financial markets, the term bullish means a long position or a buy.

⏺A bearish candle is formed when the price falls. In financial markets, the term bearish refers to a short position or sale.

❗️The body of the candle is the space between the opening and closing of the candle. If the body is green, it means that the closing price of the candle is higher than the opening price. If the color is red, it means the closing price is lower than the opening price of the candle.

❗️Candle wicks represent the highest or lowest points that the candle has reached.

🟢Each candle represents a selected time frame or time interval during which it opens and closes. For example, on a 4-hour chart, candlesticks open and close every 4 hours.

🟢If we line up several candlesticks, we can compare them with a linear chart. Candle wicks also show price fluctuations. Thus, we immediately get the maximum information that we need for effective market analysis.

⚠️A trader who knows how to analyze and interpret candlestick patterns or patterns already understands the actions of financial market participants a little better.

❤️ Please, support our work with like & comment! ❤️

The Only Proven Way To Success in Trading 🥇

Hey traders,

Like any discipline, consistently profitable trading requires many years of practice.

In this post, we will discuss the only proven way to become successful in trading.

🔰First, let's start with the axiom: there are no inborn traders, trading is a skill, a skill that can be learned. Though talent may help you in some manner it does not guarantee your success.

One more axiom that is logically derived from the first one is the fact that trading is a complex skill.

The one that can be split into dozens of subskills.

Making that statement we may assume that our success in trading directly depends on mastering each subskill, each domain that it consists of.

But how do we master these skills?🤔

The only way to do that is to practice. Practice means doing something regularly in order to be able to do it better.

With your first attempts, you are doomed to fail. Inevitable you will suffer and you will feel miserable because of your incompetence.

Trying and doing the same thing again and again, at some moment you will feel the progress and growth. Your perseverance will bear fruit.

Knock, and it shall be opened to you.

And as a consequence, with some attempt, you will feel that finally the skill is mastered, that one more stage in your journey is passed.

Polishing the entire set of subskills and learning to apply that as a single unit will make you a consistently profitable trader.

Just stipulate the domains properly, name them and be ready to work hard.

❤️Please, support this idea with like and comment!❤️

ELON MUSK QUOTES. For powerful thinking👨🎓

1️⃣"When it is important enough, you do it even if the odds are not in your favor."

2️⃣"No, I don't ever give up. I'd have to be dead or completely incapacitated."

3️⃣"Persistance is very important. You should not give up unless you're forced to give up."

4️⃣"I think it is possible for ordinary people to choose to be extraordinary."

5️⃣"Don't confuse schooling with education, I didn't go to Harvard, but people who work for me did."

6️⃣"Constantly think about how you could be doing better and keep questioning yourself."

❤️ Please, support our work with like & comment! ❤️

5 Possible Outcomes Of Your Trades | Trading Basics 👶

Hey traders,

Depending on your actions, you can get 5 completely different results

taking just one single trade.

1️⃣The first outcome is a small win.

By a small win, I mean a winning trade producing up to 2.5% account growth.

2️⃣The opposite situation leads to a small loss.

To me, a small loss is a losing trade producing up to -1% account decline.

3️⃣Occasionally once the price starts moving in the predicted direction, one can protect his trading position moving his stop to entry and making a position risk-free.

Being stopped out such a trade produces 0% profit. The level where the position is closed is called a breakeven point.

4️⃣If one perfectly predicts a future direction of the market and opens a trading position accordingly, occasionally, a huge profit can be made.

A winning trade producing more than 2.5% net account growth is called a big win.

5️⃣Being wrong in the predictions, however, one can adjust and trail a stop loss not letting himself be stopped out. Such behavior may lead to a substantial loss or even a margin call.

A losing trade that produces more than -1% net loss is called a big loss.

❗️Learning how to trade, I strongly recommend you eliminate the 5th outcome. Managing not to lose more than 1% of your account will substantially improve your trading.

❤️Please, support this idea with like and comment!❤️

WHAT IS AN ETF? (Exchange-Traded Fund)📚

✅An ETF is an exchange-traded investment fund. The fund's management company draws up a strategy and acquires assets in its portfolio, and then issues shares - small shares of this portfolio. When selling an ETF, the investor pays tax in the same way as if it were ordinary shares.

✅If 40 years ago only 6% of American families invested money in investment funds, now they are about 46%. At the end of the third quarter of 2020, $29.5 trillion was invested in open-ended investment funds in the United States — this is almost half of all assets managed by funds around the world.

⚠️What instruments are included in the ETF

🟢The fund's portfolio may consist of any instruments traded on the stock exchange. For example, stocks, bonds, currency, precious metals. Their ratio depends on the fund's strategy. Once in a certain period, the management company reviews the portfolio and rebalances, that is, sells some assets and buys others.

🟢All actions are subject to strict rules, from which managers cannot deviate. All information about the composition of the ETF and the frequency of portfolio rebalancing is available in the fund's documentation.

🟢ETFs can consist of securities, precious metals, derivatives - there are practically no restrictions. Therefore, today there are thousands of funds with very different structures. For example, there is the Global X Millennials ETF— which is a fund for shares of brands beloved by millennials. Or Direxion Work From Home ETF - it invests in services that benefit from the widespread transition to remote work.

❗️What are ETFs

🔴When a fund copies a stock index, it applies replication, that is, it exactly repeats the composition of the index. There are two types of replication — physical and synthetic. If an ETF uses physical replication, it buys the index assets themselves - stocks, bonds, and everything else.

🔴If a fund uses synthetic replication, it does not buy the index assets themselves. Instead, the fund uses an index derivative — an agreement between the parties that the transaction will be executed. A change in the value of the index entails a change in the value of the derivative. On the one hand, this is beneficial for the investor, but on the other hand, a complete repetition of the index may be inaccurate. In addition, there is a risk that the derivative provider will not fulfill its obligations.

🔴In index ETFs, the investor should pay attention to the error of following or tracking error. Let's say the IMOEX index has gained 12% over the year, and the ETF for this index has only 11%. The management costs in this fund are 0.5%, which means that the remaining 0.5% is a follow-up error. This indicator should not be too large, because, in the end, it affects the profitability of the fund. If the fund deviates greatly from the index, the managers do not do their job well.

‼️How the price of an ETF is formed

🔴Shares in ETFs are called shares, they have a market and settlement price - iNAV.

🔴The estimated price is the value of all assets included in one share of the ETF. It can be viewed on the fund's website and the stock exchange.

🔴The market price depends on the supply and demand in the market and differs from the estimated price. It is not profitable for the Fund that the difference between them is too large, otherwise, investors will not buy shares. The market maker makes sure that the price on the stock exchange does not fluctuate much. He puts out large bids in a certain range. The current market price of the fund's shares can be viewed on the stock exchange or in the terminal.

🔴ETFs are a convenient and simple solution for investors who want to get "all in one". For example, they do not want to make a portfolio with their own hands or buy index assets separately. This tool is easy to buy and sell at any time. We can say that an ETF is trust management without red tape with documents and time limits.

❤️ Please, support our work with like & comment! ❤️

MOVING AVERAGE | 4 Efficient Methods To Apply

Hey traders,

The moving average is one of the most popular technical indicators.

It is applied in stocks/forex/crypto trading and proved its high level of efficiency.

There are hundreds of trading strategies based on MA.

In this post, we will discuss the 4 most popular ways to apply the moving average.

1️⃣The first method is applied to identify the market trend.

While the price keeps trading above the MA, one considers the trend to be bullish and looks for buying opportunities.

Once the price starts trading below the MA, the trend is considered to be bearish and a trader is looking for shorting opportunities.

2️⃣The second method applies the combination of 2 MA's: preferably a long-term one and a short-term one.

The point is that once a short-term moving average crosses above a long-term MA, with high probability it signifies the initiation of a bullish trend.

Alternatively, a crossover of short-term and long-term MA's to the downside indicates a start of a bearish trend.

3️⃣The third method applies MA as a structure.

While the moving average is lying above the price, it is considered to be a dynamic resistance.

Staying below the price it serves as a strong dynamic support.

Perceiving MA as the structure, one applies that for trade entries.

4️⃣The fourth method is aimed to track the crossover of the moving average and the price.

The idea is that a bullish violation of the MA by the price gives an early signal for a possible trend reversal.

While a bearish breakout of the MA by the market indicates a highly probable bullish trend violation.

Backtest different MA's inputs and learn to apply that for predicting the future direction of the market and for trading it.

Do you use MA?

❤️Please, support this idea with like and comment!❤️

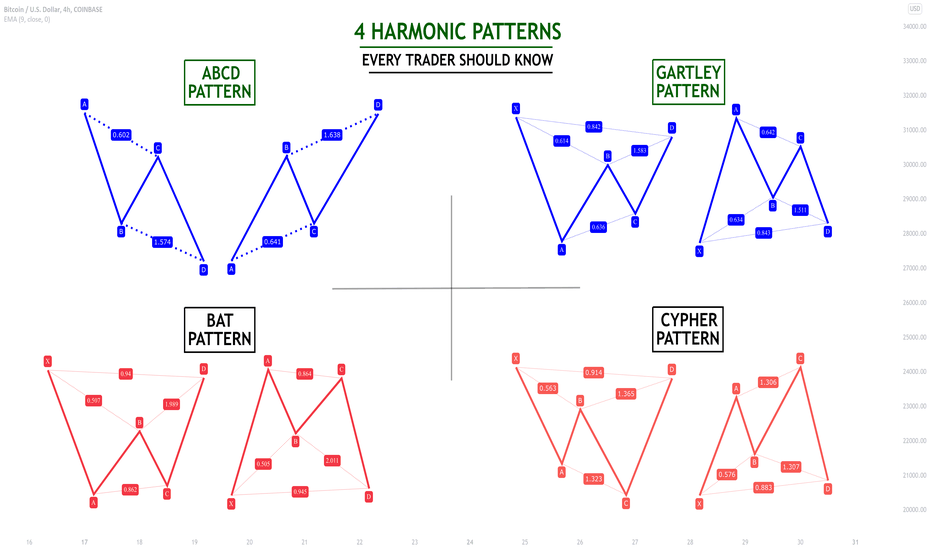

4 Harmonic Patterns Every Trader Should Know 📚

Hey traders,

In this post, we will discuss 4 phenomenally accurate harmonic patterns that you must know.

1️⃣The first and the simplest harmonic pattern is called ABCD pattern.

This pattern is based on 3 legs of a move:

✔️Initial impulse (bullish or bearish). AB leg

✔️Retracement leg with a completion point lying within the range of the initial impulse. BC leg.

✔️Second impulse with a completion point lying beyond the range of the initial impulse (it must have the same direction as the initial impulse). BD leg

Equal AB and CD legs indicate a highly probable retracement from D point of the pattern.

❗️Please, note that the time horizon and the length of the impulses must be equal.

2️⃣The second harmonic pattern is called Gartley Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Gartley Pattern we measure the retracement of B/C points with Fib. Retracement tool and extension of D point of a harmonic pattern with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.618 level and 0.786 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.618 and 0.786

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - D point should lie strictly on 1.272 extension of AB leg (Fib. Extension of AB)

*it should strictly touch 1.272

Such a formation indicates a highly probable retracement from D point of the pattern.

3️⃣The third harmonic pattern is called Bat Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Bat Pattern we measure the retracement of B/C/D points of a harmonic pattern with Fib. Retracement tool:

✔️ - The retracement of B point should lie between 0.5 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch 0.5 but it can’t touch 0.618

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - The retracement of D point should lie strictly on 0.886 level of XA leg (Fib.Retracement of XA)

*it should strictly touch 0.886

Such a formation indicates a highly probable retracement from D point of the pattern.

4️⃣The fourth harmonic pattern is called Cypher Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form with C point lying beyond the range of XA leg.

To identify a Harmonic Cypher Pattern we measure the retracement of B point with Fib. Retracement tool and extension of C point with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.382 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.382 and 0.618

✔️ - The extension of C point should lie between 1.272 level and 1.414 level of XA leg(Fib. Extension of XA)

*it can touch both 1.272 and 1.414

✔️ - D point should lie strictly on 0.786 retracement of XC leg (Fib. Retracement of XC)

*it should strictly touch 0.786

Such a formation indicates a highly probable retracement from D point of the pattern.

🦉What is good about these patterns is the fact that they are objective.

Since each point of the pattern is measured with Fibonacci levels, one can avoid subjectivity.

Try harmonic pattern trading and you will see how efficient this strategy is.

Do you trade harmonic patterns?

❤️Please, support this idea with like and comment!❤️