Mastering Market Trends: Your Guide to Clearer Trading DecisionsTrends shape every decision you make in the markets, even if you’re unaware of it. Understanding how to identify and adapt to these market phases is your foundational skill - one that separates successful traders from the rest.

Today, let’s simplify and clarify the three essential types of market trends. By mastering this, you’ll approach trading decisions with more confidence and clarity.

⸻

📈 1. Uptrend – Riding the Bull

• What is it?

An uptrend is like climbing stairs upward. Each step (low) is higher than the previous one, and every leap (high) sets a new peak.

• What drives it?

Buyers dominate, optimism rules, and demand pushes prices upward.

• Trading tip:

Identify support levels and look for retracements as potential entry points. Be cautious about chasing prices that have moved too far without a pullback.

⸻

📉 2. Downtrend – Navigating the Bearish Territory

• What is it?

Visualize going down a staircase. Each step down (low) surpasses the previous one, and every upward bounce (high) falls short of the prior peak.

• What drives it?

Sellers control the market, bearish sentiment takes over, and supply outweighs demand.

• Trading tip:

Look for resistance areas to identify potential short entries or wait patiently for signs of a reversal if you’re bullish.

⸻

➡️ 3. Sideways Market – The Calm Before the Storm

• What is it?

Imagine a tug-of-war with evenly matched teams. The price moves back and forth in a narrow range without breaking decisively higher or lower.

• What drives it?

Uncertainty, indecision, or equilibrium between buyers and sellers.

• Trading tip:

Stay patient! Either look to trade range extremes (buying support and selling resistance) or wait for clear breakout signals to catch the next big move.

⸻

🔍 Pro Tip for Trend Analysis:

• Multi-timeframe analysis is key: Always check higher timeframes (weekly, daily, or hourly) to confirm the primary trend. Don’t let short-term noise mislead your trading decisions.

⸻

🚀 Why It Matters:

Aligning your strategies with the correct market trend significantly improves your odds. It’s like sailing with the wind at your back instead of battling against it.

Now, tell us in the comments: Which trend type do you find most challenging to trade?

Trade smarter. Trade clearer.

Tradingeducation

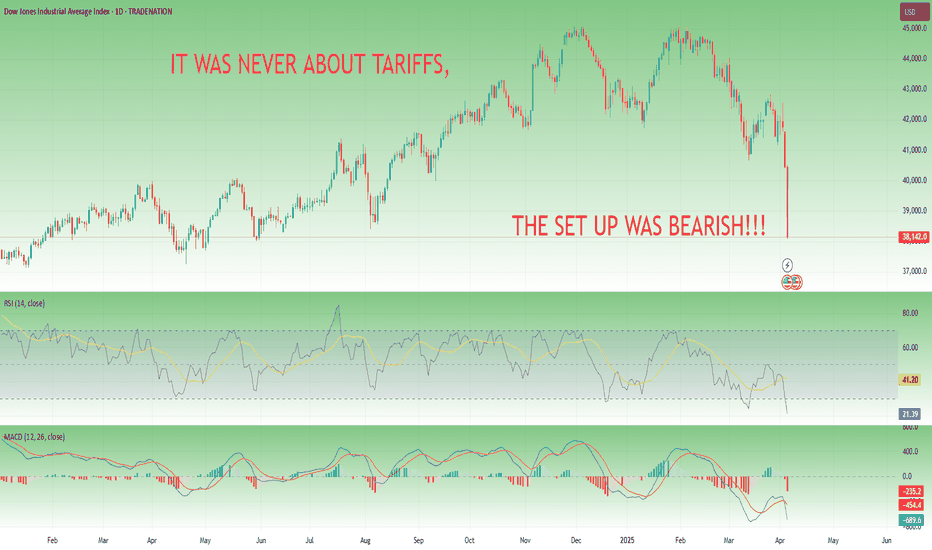

Tariffs Didn’t Cause the Correction — It Was Coming Anyway🚩 Intro: Markets Correct — They Don’t Need Permission

Every time the market drops hard, the headlines rush in to explain it. This time, it was President Trump’s dramatic tariff announcement on April 2nd. The media called it a shock.

I didn’t.

I’ve been calling for S&P 500 to drop to 5,200, and NASDAQ-100 to 17,500, since early January.

Not because I predicted tariffs. But because the charts told the story.

The market didn’t fall because of politics — it fell because it had to.

________________________________________

🔥 The Spark: Trump’s “Liberation Day” Tariffs

On April 2, 2025, Trump rolled out an aggressive trade agenda:

• 10% blanket tariff on all imports

• Up to 54% tariffs on Chinese goods

• 25% tariffs on imported cars and parts

• With limited exemptions for USMCA-aligned countries

Markets reacted instantly:

• S&P 500 dropped 4.8% — worst day since 2020

• NASDAQ-100 plunged over 6%

• Tech mega caps lost 5–14% in a day

Sounds like cause and effect, right?

Wrong.

________________________________________

🧠 The Real Cause: A Market That Was Ready to Fall

Let’s talk technicals:

• S&P 500 had printed a textbook double top at the 6100–6150 zone

• NASDAQ-100 had formed a rising wedge, with volume divergence and momentum fading

• RSI divergence was in place since February

• MACD had crossed bearish and also deverging

• Breadth was weakening while indices were still pushing highs

• Sentiment was euphoric, volatility crushed — a classic setup

You didn’t need to guess the news. The structure was screaming reversal.

SP500 CHART:

NASDAQ CHART:

________________________________________

🧩 Why Tariffs Made a Convenient Narrative

Markets love clean stories. And Trump’s tariffs offered everything:

• Emotional trigger

• Economic fear factor

• Political drama

• Global implications

But smart traders know better: markets correct based on positioning, not politics.

As soon as the wedge broke on NAS100 and SPX broke the double top's neck line the path was clear — risk off.

________________________________________

📉 I Was Calling This Since Q1

The targets were public:

SPX = 5,200. NAS100 = 17,500.

And the logic was simple:

• Overextension in AI-led tech

• Complacent VIX environment

• Crowded long positioning

• Bearish divergences and fading momentum

Double Top and Rising Wedge on SPX and Nas100

We didn’t need a reason to drop. The market had been levitating without support. All we needed was a trigger — and we got one.

________________________________________

🧭 Lesson: Trade the Structure, Not the Story

Here’s what I hope you take away:

✅ Setups come first. News comes later.

✅ If it wasn’t tariffs, it would’ve been CPI, earnings, Fed minutes, or a bird on a wire

✅ Don’t chase headlines. Anticipate setups.

The best trades aren’t reactive. They’re built on structure, sentiment, and timing — not waiting for CNBC to tell them what’s happening.

________________________________________

🔚 Conclusion: It Was Never About Tariffs

Tariffs were the match.

But the market was already soaked in gasoline.

This correction was technical, predictable, and clean.

📝 Post Scriptum — The Setup Shapes the Narrative

Let me be clear:

I’m not a Trump fan. Hoho — not by far.

But I’ll swear this on any chart:

If the setup had been the opposite — double bottom, falling wedge, positive divergences, and improving momentum — these exact same tariffs would’ve been interpreted as “bold leadership,” “pro-growth protectionism,” or “markets pricing in a stronger America.”

That’s how it works.

Price action leads. Narrative follows.

When structure is bullish, traders celebrate even bad news.

When structure is bearish, even good news becomes a reason to sell.

So no — it wasn’t about Trump. It never is. It’s about where the market wants to go. The rest is storytelling.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

What Is Momentum – And Why It’s Not Just a Trend IndicatorMost traders follow price — candles, trendlines, support/resistance. But there’s another layer that often tells the story before the price moves: momentum.

⸻

🔍 In this post, you’ll learn:

• What momentum really measures

• Why it’s not the same as price direction

• How momentum can signal a shift before the chart confirms it

• Why combining momentum with structure improves timing

⸻

📈 Momentum ≠ Direction

Price can be rising while momentum is fading. That’s often a clue of an upcoming slowdown or reversal — long before the price turns. Similarly, price can be flat, while momentum builds in one direction. That’s tension… and tension leads to moves.

⸻

🔥 Why Momentum Matters:

• It reveals intensity, not just direction

• It can act as a leading indicator — not lagging

• Momentum divergences often hint at hidden accumulation or distribution

• Tracking it helps you avoid late entries or false breakouts

⸻

🔧 Takeaway for traders:

If you’re only watching price, you’re only seeing half the picture.

Momentum shows what’s driving the move, and when that drive starts weakening.

⸻

💬 What’s your favorite momentum indicator? RSI, %R, CCI, or something else?

Starting over in trading- A short guideThe internet has made it easier than ever to learn trading for free. You have access to blogs, videos, books, podcasts, and more. Yet, most traders still fail.

Why?

Because there’s too much information. It’s overwhelming, confusing, and filled with conflicting advice.

So, if I had to start over from scratch, here’s exactly how I’d do it—step by step.

________________________________________

Step 1: Master Risk Management

No matter what type of trader you become—day trader, swing trader, options trader, quantitative trader, etc.—risk management is the foundation of long-term success.

It’s also one of the easiest things to master, and once you do, it will pay off for the rest of your trading career.

Risk Management Essentials:

✅ Never risk more than 1-2% of your account per trade.

✅ Always use stop losses to protect your capital.

✅ Focus on risk-to-reward ratios (aim for at least 1:2 or better).

✅ Manage position sizing properly to avoid blowing up your account.

Once you understand how to protect your capital, it’s time to expose yourself to the trading world.

________________________________________

Step 2: Learn & Explore Different Trading Styles

When you're just starting, you don’t know what you don’t know.

Your goal at this stage is to explore different trading strategies, tools, and methods.

What to Learn:

🔹 Candlestick patterns & price action

🔹 Indicators (moving averages, RSI , MACD , etc.)

🔹 Chart patterns (head & shoulders, triangles, etc.)

🔹 Market structures (support/resistance, trends, ranges)

🔹 Different trading styles (day trading, swing trading, scalping, momentum trading, etc.)

Mindset for This Phase:

🚀 Keep an open mind—don’t judge strategies too early.

🚀 Focus on learning rather than making money right away.

🚀 Accept that not everything will work for you—and that’s okay.

At this stage, your goal is not to become an expert in everything but to discover what resonates with you.

________________________________________

Step 3: Pick ONE Strategy & Go Deep

After exploring different strategies, you need to commit to ONE.

This eliminates information overload and allows you to focus on mastering a single trading method.

How to Choose a Strategy:

🔹 Does it fit your personality? (e.g., If you hate fast decision-making, avoid scalping.)

🔹 Does it match your lifestyle? (e.g., If you have a full-time job, swing trading might be better than day trading.)

🔹 Can you understand the logic behind it? (A good strategy should be simple, not overly complicated.)

Example: Mean Reversion Strategy in Stocks

• Identify stocks in an uptrend 📈

• Wait for a pullback (price moves lower)

• Enter when the stock shows signs of resuming the trend

• Sell on the next rally

By focusing on one strategy, you eliminate confusion and make faster progress.

________________________________________

Step 4: Create & Refine Your Trading Plan

Now that you have a strategy, it’s time to turn it into a structured trading plan.

Your trading plan should include:

✅ Market Conditions – When will you trade? Trending or ranging markets?

✅ Entry Rules – What signals will you use to enter a trade?

✅ Exit Rules – When will you take profits or cut losses?

✅ Risk Management – How much will you risk per trade?

💡 Example Trading Plan (Momentum Trading):

• Market: Trade only in strong uptrends.

• Entry: Buy when the price breaks above a key resistance level.

• Exit: Take profit at 2x risk, cut losses at a 1x risk.

• Risk Management: Risk only 1% of the account per trade.

A clear, structured plan removes emotion from trading and keeps you disciplined.

________________________________________

Step 5: Test Your Strategy (Before Risking Real Money)

You never know if a strategy works until you test it.

How to Test a Trading Strategy:

🔹 Backtesting – Analyze past data to see if the strategy has worked historically.

🔹 Forward Testing (Paper Trading) – Trade in a demo account without real money.

What You’ll Learn from Testing:

✔️ Does the strategy make money over time?

✔️ How often does it win vs. lose?

✔️ How big are the drawdowns?

✔️ Does it match your risk tolerance?

If the strategy performs well in testing, you now have a solid foundation to trade with real money.

If it doesn’t work, tweak and improve it—this is part of the process.

________________________________________

Final Thoughts: The Key to Long-Term Success

Starting over isn’t about finding the “perfect” system —it’s about following a structured approach.

Here’s the Path to Trading Success:

1️⃣ Master Risk Management – Protect your capital first.

2️⃣ Learn & Explore – Understand different strategies & tools.

3️⃣ Pick ONE Strategy – Focus on a proven method.

4️⃣ Create a Trading Plan – Define your rules clearly.

5️⃣ Test & Improve – Validate your strategy before going live.

🔥 Bonus Tip: Trading success is 80% psychology and 20% strategy. Stay patient, disciplined, and treat trading like a business—not a get-rich-quick scheme.

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would anticipate a potential curveball and that being that price may just support on the open at the immediate support level and give the move upside into the 3010 and above that 3020 region which was achieved. We then updated traders with the FOMC report suggesting a further move upside into the 3050-55 region which is where we suggested the potential short will come from.

After the push up into the level and then some accumulation, Friday gave us the volume we needed to break away from the range and complete the move downside to end the week.

Again, nearly all of our bias level targets were completed, the bias level worked well, Excalibur performed well and the red box indi’s worked a dream, even in the choppy market conditions.

So, what can we expect in the week ahead?

We have an issue with gold at the moment, although it’s broken the immediate range, it’s still above 3000 with a larger range low around the 2990 and below that 2970-75 region. That potential swing point below is an area of interest for us this week and leading up towards the end of the month. For that reason, if we can support at the first red box below, and continue the move that started on Friday up into those 3025, 3030 and above that 3035-7 price points we’ll want to monitor this careful for a reversal to form. If we can get it, an opportunity to add or take the short may be available to traders, this time in attempt to break below the 3000 level into those lower support level mentioned and shown on the chart, which also correspond with the red boxes. As many of you have seen over the last year or so, we’ve been sharing these indicator boxes on the 4H for the wider community for free, as they are extremely powerful in identifying turning points and entry and exit points for traders. So let’s keep an eye on them this week for the break and closes, RIP’s and rejections.

We’re mostly looking for this one move to complete, however, there has to be a flip! This week, the flip is breaking above that 3035-37 level which will also be this week’s bias level. If we do breach, we’ll be looking at this to then continue higher, breaking 3050 and then resuming the move into the active Excalibur targets above which ideally, we don't want to see happen yet!

So, we know we want higher, what we do want though is better entry levels for the longs, until then, if we can capture these short trades we’ll of course gratefully take them.

KOG’s bias for the week:

Bearish below 3040 with targets below 3010, 3006, 2997, 2985 and below that 2978

Bullish on break of 3040 with targets above 3050, 3055, 3063 and above that 3067

RED BOXES:

Break above 3037 for 3040, 3047, 3050, 3055, 3063 and 3066 in extension of the move

Break below 3010 for 3006, 3000, 2997, 2990 and 2985 in extension of the move

This should give you an idea of your levels, please use them!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Possible vs. Probable in Trading — Most Traders Ignore ThisOne of the biggest mistakes traders make — especially beginners — is confusing what is possible with what is probable.

This confusion leads to poor decisions, unnecessary risks, and eventually, losses that could have been easily avoided.

Possible and Probable Are NOT the Same Thing

Let's make this very clear:

• Possible means it can happen.

• Probable means it is likely to happen, based on evidence and context.

In life, many things are possible — but that doesn’t mean we should live our lives preparing for each possible (and often extreme) event.

To give you a real-life example: it’s possible that something falls from the roof top of a builing and hits you while shopping and die. Sadly, this actually happened in Romania about a month ago.

But as rare and tragic as it is, it’s not probable. And it definitely doesn’t mean that we should stop going outside, right?

Trading Is a Game of Probabilities, Not Possibilities

When trading, we are not betting on what is possible.

If we did, we would enter trades every time we imagine a price could go higher or lower — and that would be a disaster.

Instead, we are betting on what is probable — based on:

• Technical analysis

• Price action

• Market context

• Volume

• Sentiment

⚠️ Yes, it is always possible for price to go in either direction.

But our edge comes from identifying what is more likely to happen based on the data we have.

Why This Difference Is Crucial for Your Trading Success

✅ Focusing on probabilities means:

• You enter only high-probability setups.

• You manage risk properly because you accept that nothing is 100% sure.

• You avoid chasing trades just because "it’s possible" something happens.

❌ Focusing on possibilities leads to:

• Overtrading

• Emotional decisions

• Hoping instead of following a plan

• Blowing up accounts

Conclusion: Trade Like a Professional — Trade Probabilities

Remember:

"Anything is possible, but not everything is probable."

If you want to survive and thrive in the markets, focus on probabilities — not on fantasies of what could happen.

You are not trading "maybe this happens", you are trading "this is likely to happen, and I’m managing my risk if it doesn’t".

Make this shift in mindset, and you’ll already be ahead of most traders out there.

3 Best Entry Points For Swing Trading (Forex, Gold)

What is the best entry point for swing trading?

You will learn 3 safest places/zones to buy or sell the market from, best swing trading time frame, and the most accurate swing trading setups.

Best Entry 1

Swing Trading After a Confirmed Trend Reversal

It can be a bearish trend violation and a start of a new bullish trend.

Look at a price action on WTI Crude Oil on a daily.

The market violated a bearish trend and started to trade in a new bullish trend, confirming the reversal.

In such a case, your best entry will be the closest daily support.

Alternatively, it can be a bullish trend violation and an initiation of a new bearish trend.

USDCAD was in an uptrend, steadily growing within a parallel channel.

Its violation confirmed the change of sentiment and start of a downtrend.

In this situation, your safest entries will be from the closest daily resistance.

Best Entry 2

Swing Trading with the Trend After Pullback

In a bullish trend, you should wait for

a completion of a bullish movement,

wait for a pullback

swing buy the market after it completes.

AUDCAD is in a rising trend.

A pullback tends to complete on a key support.

That will be your zone for buying.

Otherwise, in a bearish trend, you should let the price:

finish a bearish impulse

start a correctional movement

sell the market after the correction ends.

USDCHF was in downturn and updated the low. A local bullish movement started then.

It usually completes after a test of a key resistance. That will be the area where you should look for swing selling.

Best Entry 3

Swing Trading After Key Level Breakout

Bearish violation of a key daily support is a perfect signal to sell.

It is an important sign of strength of the sellers and a strong indication that the price will continue falling.

NZDUSD broke and closed below a key daily support cluster. After a breakout, it turns into a potentially strong resistance.

For us, the best entry is a retest of a broken structure.

Bullish breakout of a key daily resistance is a reliable signal to buy.

After a violation of a horizontal resistance, it became a support on USDCHF Forex pair on a daily.

Your perfect entry for swing buying is its retest .

The entry zones that we discussed will provide the safest trading opportunities.

Learn to combine that with your trading strategy, it will help you to dramatically increase the profitability of your swing trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

7 Practical Exercises to Build Patience in TradingI often talk about patience, planning, strategy, and money management, yet many of you tell me that you lack patience, can’t resist impulses, and struggle to follow your plan when emotions take over.

So today, we’re skipping the theory and diving straight into practical exercises that will help you train your patience just like you would train a muscle. If you want bigger biceps, you do dumbbell curls. If you want more patience in trading, try these exercises.

________________________________________

1. The “Observer” Exercise – Train Yourself to Resist Impulsive Trading

Goal: Improve discipline and reduce the urge to enter trades impulsively.

How to do it:

• Open your trading platform and set a timer for 2 hours.

• During this time, you are not allowed to take any trades, only observe price action.

• Write down in your journal: What do you feel? Where would you have entered? Would it have been a good decision?

Advanced level: Increase the observation time to a full session.

✅ Benefit: This exercise reduces impulsiveness and helps you better understand market movements before making decisions.

________________________________________

2. The “One Trade Per Day” Rule – Eliminate Overtrading

Goal: Train yourself to select only the best setups.

How to do it:

• Set a rule: “I am allowed to take only one trade per day.”

• If you take a trade, you cannot enter another, no matter what happens in the market.

• At the end of the day, analyze: Did you choose the best opportunity? Were you tempted to overtrade?

✅ Benefit: Helps you filter out bad trades and eliminates overtrading, a common issue for impatient traders.

________________________________________

3. The “Decision Timer” – Avoid Impulsive Entries

Goal: Help you make better-thought-out trading decisions.

How to do it:

• When you feel the urge to enter a trade, set a 30-minute timer and wait.

• During that time, review your strategy: Is this entry aligned with your trading plan? Or is it just an emotional impulse?

• If after 30 minutes you still think the trade is valid, go ahead.

✅ Benefit: This exercise slows down decision-making, helping you think rationally rather than emotionally.

________________________________________

4. The “No-Trade Day” Challenge – Strengthen Your Self-Control

Goal: Prove to yourself that you can stay out of the market without feeling like you're missing out.

How to do it:

• Pick one day per week where you are not allowed to take any trades.

• Instead, use the time to study the market, analyze past trades, and refine your strategy.

• At the end of the day, reflect: Did you experience FOMO? Was it difficult to resist trading?

✅ Benefit: Increases discipline and teaches you that you don’t have to be in the market all the time to succeed.

________________________________________

5. The “Walk Away” Method – Stop Micromanaging Trades

Goal: Reduce stress and prevent over-monitoring after placing a trade.

How to do it:

• After placing a trade, walk away from your screen for 1 to 2 hours.

• Set alerts or use stop-loss/take-profit orders so you’re not tempted to constantly check the price.

✅ Benefit: Reduces emotional reactions and prevents overmanagement of trades.

________________________________________

6. The “Frustration Tolerance” Drill – Train Yourself to Accept Losses and Missed Opportunities

Goal: Build resilience to emotional discomfort in trading.

How to do it:

• Watch the market and deliberately let a good opportunity pass without taking it.

• Observe your frustration, but do not act. Instead, write in your journal: How does missing this opportunity make me feel?

• Remind yourself that there will always be another opportunity and that chasing trades leads to bad decisions.

✅ Benefit: Helps reduce FOMO and makes you a calmer, more disciplined trader.

________________________________________

7. The “Trading Plan Repetition” Exercise – Build a Strong Habit

Goal: Reinforce discipline and reduce deviations from your plan.

How to do it:

• Every morning, before opening your trading platform, write down your trading rules by hand.

• Example:

o “I will not enter a trade unless all my conditions are met.”

o “I will not move my stop-loss further away.”

o “I will close my platform after placing a trade.”

• Handwriting strengthens mental reinforcement, and daily repetition turns it into a habit.

✅ Benefit: Increases self-discipline and keeps you committed to your strategy.

________________________________________

Final Thoughts

If you’ve read this far, you now have a concrete plan to build patience in trading. Remember, trading success isn’t just about technical analysis and strategies—it’s about discipline and emotional control.

Just like a bodybuilder follows a structured routine to develop muscles, you must practice patience and discipline daily to master trading psychology.

Harsh Truth About Forex & Gold Trading: In Books VS In Reality

Most traders start their trading journey by studying theory first, reading books or taking video courses before putting these newfound skills into practice. But once they start trading on a real market, they quickly realize that things are not as straightforward as the books make them out to be.

In this educational article, we will take a critical look at the difference between theoretical knowledge and practical experience.

📍And first of all, do not get me wrong. I am not trying to imply that trading books or courses are bad.

Theoretical knowledge is essential for successful trading, and of course the books are the best source of that.

The problem is, however, that books can be misleading . The examples in books are always tailored. When the authors are looking for the examples of the patterns, of key levels, they are looking for the ideal cases.

📍The problem becomes even worse, when one start studying the trade examples in books. And of course, the authors choose the brilliant winning trades with huge take profits and tiny stop losses.

I guess you saw these pictures of "sniper" entry trades with 5/1 R/R.

The inexperienced trader may start thinking that the markets are perfect and act in total accordance with the books.

That all the trades that he will take will bring tremendous profits.

That the identified patterns will work exactly as it was described.

📍The harsh truth is that books and courses are simply the compositions of different examples, cases and market situations.

In reality, each and every trading setup is unique .

The reaction of the price to the same pattern will be always different .

Please, realize the fact that books are only good for acquiring the knowledge. But in order to survive on financial markets, you need the experience . And the experience will be gained only after studying thousands of real market examples in real time.

📍Here is the example of a double top pattern that we were trading with my students on AUDJPY.

In books, double tops are always perfect . Once the market breaks the neckline, the price retests that and then quickly drops.

So the one can set a tiny stop loss and a big take profit.

However, after a retest of a broken neckline, AUDJPY bounced and the market maker was stop hunting the newbies. Our stop loss was way above the head, and we managed to survive.

Even though the pattern triggered a bearish movement, the reaction of the market was far from perfect.

Be prepared, that the market will much different from what you see in the books.

Good luck to you!

❤️Please, support my work with like, thank you!❤️

To fade or not to trade? (Example: EUR/USD)There is a correction taking place in the US dollar uptrend. Do we trade against the prevailing trend, or sit on our hands and do nothing? To fade or not to trade, that is the question.

On a surface level, the current environment is a trading range - following a long downtrend.

When a strong major trend has been in place for around 3 months - sometimes sooner - sometimes later (we have observed 3 months as a good benchmark) something has to change - either there is a significant correction or the trend reverses.

The challenge lies in distinguishing between the two. Reacting too early risks fighting momentum, while reacting too late means missing an opportunity.

After years of trading, I’ve realised the goal is not to guess – but to follow a structured trading system that tilts the odds in our favor. The system doesn’t work every time of course but it gives you a way to approach the market.

Let me outline now - a system using Fractals & the 30-Week Moving Average to help you decide which way to trade the market

1. Identify the Primary Trend

Use the 30-week moving average (30 WMA) as the trend filter.

Uptrend: Price is consistently above the 30 WMA, and the slope is rising.

Downtrend: Price is consistently below the 30 WMA, and the slope is falling.

A strong trend remains in place as long as price respects the 30 WMA. A violation suggests a shift is possible.

2. Look for Fractal Confirmation of a Shift

In an uptrend, a higher low followed by a higher high confirms continuation.

In a downtrend, a lower high followed by a lower low confirms continuation.

* The key fractal to watch for a potential bottom after a downtrend – is the first higher low after a downtrend correction that made a higher high (potential bottom)

* The key fractal to watch for a potential top after an uptrend – is the first lower high after an uptrend correction that made a lower low (potential reversal)

So, how about what’s happening now?

The weekly chart shows a base has formed at 1.02 in EUR/USD.

Price closed last week right at support-turned-resistance around 1.05.

A ‘higher high’ was formed followed by a ‘higher low’ as demonstrated by the green and red fractals accordingly.

However, the price remains below the 30-week moving average.

We can see the setup better on the daily chart as a shallow downtrend line.

The pattern beneath the trendline is a messy inverse head and shoulders. As such, should the trendline break to the upside it is a bullish signal. And if the trendline holds, it signals the trend is still just consolidating before a continuation lower.

We think there’s a good chance this trendline breaks given the alignment of the weekly fractals.

So fade the downtrend or ignore the move upwards?

To answer that it helps to think about the next step. If the price does break higher, how high is it likely to go? There is resistance at 1.06 from the late November and December peaks. Then the 50% Fibonacci retracement and the 30-week moving average come in around 1.07.

The reason fading a trend has a lower probability of success vs trading with the trend is because there is so much nearby resistance (in the case of trading a bottom).

You can absolutely fade this trend but our experience tells us the price often fails at a nearby resistance level, capping the risk:reward potential on long positions- and simultaneously offering a nice opportunity for short positions.

But - as always - that’s just how the team and I are seeing things, what do you think?

Share your ideas with us - OR - send us a request!

Drop us a comment!

cheers!

Jasper

The Main Elements of Profitable Trading Strategy (Forex, Gold)

There are hundreds of different trading strategies based on fundamental and technical analysis.

These strategies combine different tools and trading techniques.

And even though, they are so different, they all have a very similar structure.

In this educational article, we will discuss 4 important elements and components every GOLD, Forex trading strategy should have.

What Do You Trade

1️⃣ The first component of a trading strategy is the list of the instruments that you trade.

You should know in advance what assets should be in your watch list.

For example, if you are a forex trader, your strategy should define the currency pairs that you are trading among the dozens that are available.

How Do You Trade

2️⃣ The second element of any trading strategy is the entry reasons.

Entry reasons define the exact set of market conditions that you look for to execute the trade.

For example, trading key levels with confirmation, you should wait for a test of a key level first and then look for some kind of confirmation like a formation of price action pattern before you open a trade.

Above, is the example how the same Gold XAUUSD chart can be perceived differently with different trading strategies.

3️⃣ The third component of a trading strategy is the position size of your trades.

Your trading strategy should define in advance the rules for calculating the lot of size of your trades.

For example, with my trading strategy, I risk 1% of my trading account per trade. When I am planning the trading position, I calculate a lot size accordingly.

Position Management

4️⃣ The fourth element of any trading strategy is trade management rules.

By trade management, I mean the exact conditions for closing the trade in a loss, taking the profit and trailing stop loss.

Trade management defines your actions when the trading position becomes active.

Make sure that your trading strategy includes these 4 elements.

Of course, your strategy might be more sophisticated and involve more components, but these 4 elements are the core, the foundation of any strategy.

❤️Please, support my work with like, thank you!❤️

Portfolio Selection for the Week – 10th February 2025This portfolio selection is for educational purposes only!

The key to successful trading lies in consistency. Consistent decision-making, combined with a positive edge, is what leads to long-term success in the markets. This is why we regularly conduct portfolio selection.

At present, the Japanese Yen (JPY) is the strongest currency, followed by the US Dollar (USD), Australian Dollar (AUD), and Canadian Dollar (CAD). On the weaker side, we see Swiss Franc (CHF), Euro (EUR), New Zealand Dollar (NZD), and British Pound (GBP).

Most currency pairs have been experiencing secondary trends. Once this phase concludes, we can look to align trades with the dominant market trend.

If you find this content valuable, hit the boost and share your thoughts in the comments!

Wishing you a profitable trading week! 🚀📈

CADJPY: Strong Reversal After Liquidity GrabEducational Insight

The market surged to the upside, targeting liquidity highs to trigger stop losses. Once liquidity was cleared, price stalled and reversed sharply.

By marking key candle highs and lows, we identified swing points to count the market waves. We applied the 2 Data Points Rule to validate the break of support or resistance—this is a crucial concept in confirming true market structure shifts.

Additionally, we analysed the wavesofsuccess wave structure, focusing on the Momentum Low and what to anticipate when price reaches this level.

🚀 If this insight adds value to your trading, smash the boost and drop a comment!

Blessings.

Top 5 Tips to Increase Your Profits in Trading

In this educational article, I will share with you very useful tips how to improve your profitability in trading the financial markets.

1. Decrease the number of financial instruments in your watch list. ⬇️

Remember that each individual instrument in your watch list requires attention. The more of them you monitor on a daily basics, the harder it is to keep focus on them.

In order to not miss early confirmation signals and triggers, it is highly recommendable to reduce the size of your watch list and pay closer attention to the remaining instruments.

2. Avoid taking too many positions. ❌

For some reason, newbie traders are convinced that they should constantly trade and keep many trading positions.

Firstly, I want to remind you that the management of an active position is a quite tedious process that requires time and attention.

Therefore, more positions are opened, more time and effort is required.

Secondly, if the newbies can not spot a good setup, they assume that they are obliged to open some positions and they start forcing the setups.

Remember, that in trading, the quality of the trading setup beats the quantity. I advise taking less trades, but the better ones.

3. Let winners run if the market is going in the desired direction. 📈

Once you caught a good trade and the market is moving where you predicted, do not let your emotions close the trade preliminary.

Try to get maximum from your trade, closing that only after the desired level is reached.

4. Open a trade after multiple confirmations.✅

Analyzing a certain setup remember, that more confirmations you spot, higher is the accuracy of the trade that you take. In order to increase your win rate, it is recommendable to wait for at least 2 confirmations.

5. Don't trade on your cellphone. 📱

A good trade always requires a sophisticated analysis that is impossible to execute on the small screen of the cellphone.

A lot of elements and nuances simply will not be noticed. For that reason, trade only from a computer with a wide screen.

Relying on these tips, you will substantially increase your profits.

Take them into the consideration and good luck to you in your trading journey.

❤️Please, support my work with like, thank you!❤️

Key Elements in Trading & Investing ManagementKey Elements in Trading & Investing Management: Your Blueprint for Success 📊

🔍 Risk/Reward Analysis:

Every trade or investment should start with a thorough risk/reward assessment. This ensures you're not just chasing gains but are aware of the potential downside.

🎯 Clear Entry & Exit Strategies:

Define your entry and exit points before you trade. This discipline keeps your strategy on track, whether the market moves in your favor or against it.

🏞️ Embrace Market Volatility:

Accept drawdowns as part of the trading journey. Just as you'd celebrate profits, handle losses with the same composure to maintain your strategic approach.

🔄 Consistency in Strategy:

Avoid tweaking your strategy after a loss. Stick to your rules to foster a consistent trading methodology.

🔧 Utilize All Available Tools:

Leverage every tool at your disposal on platforms like TradingView—indicators, charts, and risk management features—to make informed decisions.

🎯 Set Profit Targets & Stop Losses:

Implement break-even points and stop-loss orders to secure profits and minimize losses, ensuring each trade is managed with precision.

💰 Focus on Capital Preservation:

Your primary goal should be to protect and grow your capital, not just to celebrate short-term wins. Long-term sustainability is key.

📈 Compound Your Success:

Use your gains wisely to compound your investments rather than risking them on speculative bets. Let your edge work for you over time.

🌟 Master Your Trading Edge:

Identify what gives you an advantage in the market, be it technical analysis, fundamental insights, or a unique approach, and harness it consistently.

💵 Implement Dollar Cost Averaging for Stability:Dollar Cost Averaging (DCA) is your ally for those looking to invest without timing the market. By investing a fixed amount at regular intervals, you buy more shares when prices are low 📉 and fewer when prices are high 📈, averaging out the cost over time. This strategy mitigates the impact of volatility 🌪️ and reduces the risk of investing a lump sum at a peak price.

Consistent Investment: Set up a schedule to invest, say, weekly or monthly, into your chosen assets. 🗓️

Emotional Discipline: DCA helps remove emotion from investing decisions, promoting a disciplined approach. 😌

Long-Term Growth: Over time, this method can lead to significant returns as you accumulate more shares at varied price points. 🌱📈

Incorporate DCA into your broader strategy to enhance your risk/reward balance, ensuring that you're not just reacting to market highs and lows but methodically building your investment base. 💡

THE KOG REPORT - ELECTION SPECIAL COMPLETEDKOG first published this chart at the beginning of November prior to the US Election with our view of the movement expected and the trade plan for the month.

We highlighted the path with the Red arrows and added the green arrows with the actual movement. As you can see, we weren't too far off with the projection using it to then trade the levels intra-day and for the swings successfully. It's worked well and combined with our tools, indicators, algo and target activations we can honestly say it's been another great year in Camelot.

We will end this idea here and mark it as completed at the green arrow point above.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Understanding Trends and Waves in TradingIntroduction

In trading education, recognising price movements is crucial. Prices move in trends, and these trends move in waves. Understanding these waves is essential for successful trading.

The Two Types of Waves

Impulsive/Primary Trend

Comprises a minimum of five waves.

Dictates the overall direction of price movement.

Corrective/Secondary Trend

Comprises a maximum of three waves.

Provides insights into the ongoing trend.

This phase is the most critical for traders to master.

Conclusion

To trade successfully in a trending market, it’s vital to learn how to accurately count waves. Mastering this skill can significantly enhance your trading decisions. Best wishes for your trading success!

Learn How to Avoid Margin Call in Trading

Hey traders,

In this educational article, I will share with you 5 simple tips that will help you not to blow your trading and avoid margin call.

1️⃣ Always Use Stop Loss.

Let's start with the obvious - with the stop loss order.

Never ever trade without that. Before you open your trade, plan in advance its placement, stick to it once the position becomes active and never remove it.

2️⃣ Manage Your Position Sizes

I know that most of you are trading with a fixed lot. That is a bad habit. You should measure the lot size for each trading position you take. You should define in advance the risk percentage you are willing to lose per trade and calculate the lot sizes for your trades accordingly, then.

3️⃣ Avoid Taking Too Many Positions

Remember that in trading, quantity does not imply quality. The more trades you take, the harder it is to manage each position individually. I would suggest opening maximum 5 trades per day and holding no more than 8 trades simultaneously.

4️⃣ Avoid Trading Too Many Markets

The wider is your watch list, the harder it is to focus on each individual element inside. Do not try to control as many markets as possible, instead, narrow your watch list and concentrate your attention on your favorite trading instruments.

5️⃣ Remember About Volatility

The more volatile is the market that you trade, the harder it is to trade it and the bigger stop losses you need to keep your positions safe. Remember, that the volatility is the double-edged sword. It can bring substantial profits, but it can also blow your entire account in a blink of an eye.

Following these 5 simple rules, you will make your trading much safer. Study them and add them in your trading plan.

❤️Please, support my work with like, thank you!❤️

Mastering the "IF-THEN" Mindset: The Key to Stress-Free TradingIn this video, I’ll share how using IF-THEN statements helps me stay balanced in my trading. It’s simple: IF the price does this, THEN I’ll do that. Having a plan like this keeps me from getting caught up in emotions and helps me react to what’s actually happening in the market – not what I wish would happen.

This mindset keeps things smooth, makes trade management easier, and keeps me consistent. It’s all about staying ready for whatever the market throws your way.

If this vibe clicks with you, drop a comment, like, or follow – I’ve got plenty more insights to share!

Mindbloome Trading

Trade What You See

This One Emotion Could Be Destroying Your Trading ProfitsIn the world of trading, emotions play a pivotal role in shaping decision-making, and one of the most powerful and potentially dangerous emotions traders face is GREED . Greed, when left unchecked, can lead to impulsive decisions, high-risk behaviors, and significant losses. On the flip side, mastering greed and learning to manage it can make you a more disciplined and successful trader. In this article, we will explore what greed in trading looks like, how it affects performance and practical strategies for managing it.

Greed in Trading?

Greed in trading is the overwhelming desire for more – more profits, more wins, more success – often without regard to risk, logic, or a well-structured plan. It can manifest in different ways, such as overtrading, chasing unrealistic returns, holding on to winning positions for too long, or abandoning a proven strategy in the hope of making quick gains.

How Greed Manifests in Trading:

📈Overtrading: A greedy trader may take on far more trades than necessary, often without proper analysis or risk management, simply to increase exposure to potential profits. Overtrading increases transaction costs, dilutes focus, and leads to emotional burnout.

🏃♂️Chasing Profits: Greed can cause traders to chase after price movements, entering trades impulsively based on fear of missing out (FOMO). This often leads to poor entry points, increased risk, and diminished returns.

⚠️Ignoring Risk Management: A greedy trader might ignore risk parameters like stop losses or over-leverage positions, believing they can maximize profits by taking on more risk. This is a dangerous path, as a single market movement in the wrong direction can wipe out large portions of capital.

⏳Failure to Exit: Holding on to winning trades for too long is another sign of greed. Instead of securing profits according to a trading plan, traders might hold positions with the hope that prices will continue to rise indefinitely, only to see their gains evaporate when the market reverses.

How Greed Affects Trading Performance

Greed can distort your decision-making process. It leads to overconfidence and clouds judgment, causing you to believe that the market will always behave in your favor. This overconfidence pushes traders to abandon their strategies or take unnecessary risks, resulting in:

Emotional Trading: The trader begins to react emotionally to every small market movement, making decisions based on feelings rather than rational analysis.

Impaired Risk Management: Greed often blinds traders to the importance of managing risk, which is the backbone of long-term trading success. A single high-risk move inspired by greed can erase months or years of gains.

Missed Opportunities: By focusing on unrealistic gains or trying to squeeze every bit of profit from a trade, a trader may miss more reliable and smaller, but consistent, opportunities.

The Psychology Behind Greed

Greed is rooted in our psychology and is amplified by the very nature of the financial markets. Trading offers the possibility of instant gains, which triggers a dopamine response in the brain, making us feel rewarded. The lure of quick profits encourages traders to take greater risks or deviate from their trading plans in pursuit of bigger wins.

However, the emotional high from successful trades is often short-lived. Traders can become addicted to this feeling, pushing them to take on more trades or stay in positions for longer than they should. Eventually, this leads to bad habits and unsustainable trading practices

How to Manage Greed in Trading

While greed is a natural human emotion, it can be controlled with the right mindset and strategies. Here are some practical ways to manage greed in trading:

1. Set Realistic Goals

The first step in managing greed is setting clear, realistic trading goals. Rather than aiming for massive, one-time profits, focus on steady, consistent returns. Define what "success" looks like for you on a daily, weekly, and monthly basis. Having measurable goals helps anchor your trading behavior and keeps you grounded.

Example: Instead of aiming for a 100% return in a short period, set a more achievable target like 5%-10% monthly. This may not sound as exciting, but it's more sustainable in the long term.

2. Stick to a Trading Plan

A well-defined trading plan is your safeguard against impulsive decisions driven by greed. Your plan should outline entry and exit points, stop-loss levels, and risk-reward ratios. By adhering strictly to your plan, you can resist the temptation to hold on to trades longer than necessary or jump into trades impulsively.

Key elements of a good trading plan include:

-Entry and exit criteria are based on analysis, not emotion

-Risk management rules (like how much to risk per trade, stop-loss settings)

-Profit-taking strategy, deciding when to lock in gains

3. Use Risk Management Techniques

Effective risk management is the antidote to greed. By setting strict risk parameters, you limit the impact of poor decisions driven by emotions. Always use stop-loss orders to protect yourself from significant losses, and never risk more than a small percentage of your trading capital on any single trade (example 1-2%).

Avoid over-leveraging, as leverage amplifies both profits and losses. While it may be tempting to use high leverage to chase bigger gains, it significantly increases the risk of catastrophic losses.

4. Take Profits Regularly

One way to counteract greed is to develop a habit of taking profits regularly. When you set profit targets ahead of time, you can ensure that you lock in gains before they evaporate. Don’t wait for an unrealistic price surge. Exit trades once your profit target is reached, or scale out by selling a portion of your position as the trade progresses.

5. Practice Emotional Awareness

Being aware of your emotional state is crucial in trading. Take the time to self-reflect and recognize when greed is influencing your decisions. Keep a trading journal to track not just your trades, but also your emotions during the process. This will help you identify patterns and emotional triggers that lead to poor decisions.

Example: After a series of winning trades, you may feel overconfident and tempted to take bigger risks. By noting this in your journal, you can remind yourself to remain disciplined and not deviate from your plan.

6. Focus on Long-Term Success

Trading is a marathon, not a sprint. Focus on the long-term process rather than short-term profits. Greed often leads traders to forget that consistent, small gains compound over time. By shifting your mindset to long-term wealth-building, you’re less likely to take excessive risks or engage in reckless behavior.

Greed is a natural emotion in trading, but it can be highly destructive if not managed properly. The key to success lies in discipline, risk management, and a well-structured trading plan that aligns with your goals. By understanding the psychological drivers of greed and taking proactive steps to control it, traders can make more rational decisions, protect their capital, and increase their chances of long-term success.

Avoiding the Pump and Dump: A Beginner's GuideAvoiding the Pump and Dump: A Beginner's Guide to Protecting Your Investments

In the dynamic world of stock trading, new traders are constantly seeking ways to maximize profits and minimize risks. Unfortunately, one of the most deceptive and harmful schemes that can easily trap beginners is the infamous pump and dump scheme. This fraudulent practice has been around for decades, targeting unsuspecting traders by artificially inflating a stock's price and then swiftly cashing out, leaving the victims with significant losses. For traders on platforms like TradingView, especially those just starting, it’s crucial to understand how to spot these schemes and avoid falling prey to them.

This guide will provide you with the knowledge you need to recognize pump and dump schemes by analyzing monthly, weekly, and daily charts, identifying repetitive patterns, and understanding market sentiment. By the end, you'll know exactly what to look for to safeguard your investments.

What is a Pump and Dump?

A pump and dump scheme occurs when a group of individuals, often coordinated through social media or private channels, artificially inflates the price of a stock. They "pump" up the stock by spreading misleading information or creating hype around the asset, leading to increased buying interest. Once the stock price has risen significantly, the perpetrators "dump" their shares at the elevated price, leaving uninformed buyers holding a stock that will soon plummet in value.

The key elements to watch out for are:

Unusual price spikes without any corresponding fundamental news.

High trading volume during these spikes, suggesting that a group of individuals is actively manipulating the price.

Aggressive promotion through emails, forums, or social media channels, often making exaggerated claims about a stock's potential.

Understanding Timeframes: Monthly, Weekly, and Daily Charts

One of the most effective ways to spot pump and dump schemes is by analyzing various timeframes—monthly, weekly, and daily charts. Each timeframe provides different insights into the stock's behavior, helping you detect irregular patterns and red flags.

Monthly Charts: The Big Picture

Monthly charts give you a broad overview of a stock's long-term trends. If you notice a stock that has been relatively inactive or stagnant for months, only to suddenly surge without any substantial news or developments, this could be a sign of manipulation .

What to look for in monthly charts:

Sudden spikes in price after a prolonged period of flat or declining movement.

Sharp volume increases during the price rise, especially when the stock has previously shown little to no trading activity.

Quick reversals following the price surge, indicating that the pump has occurred, and the dump is on its way.

For example, if a stock shows consistent low trading volume and then experiences a sudden burst in both volume and price, this is a classic sign of a pump. Compare these periods with any news releases or market updates. If there’s no justifiable reason for the spike, be cautious .

Weekly Charts: Spotting the Mid-Term Trend

Weekly charts help you see the mid-term trends and can reveal the progression of a pump and dump scheme. Often, the "pump" phase will be drawn out over several days or weeks as the schemers build momentum and attract more buyers.

What to look for in weekly charts:

Gradual upward trends followed by a sharp, unsustainable rise in price.

Repeated surges in volume that don’t correlate with any fundamental analysis or positive news.

Recurrent patterns where a stock has previously been pumped, experienced a sharp decline, and is now showing the same pattern again.

Stocks used in pump and dump schemes are often cycled through multiple rounds of pumping, so if you notice that a stock has undergone several similar spikes and drops over the weeks, it’s a strong indicator that the stock is being manipulated.

Daily Charts: Catching the Pump Before the Dump

Daily charts provide a more granular view of a stock's price movement, and they can help you detect the exact moments when a pump is taking place. Because pump and dump schemes can happen over just a few days, monitoring daily activity is critical.

What to look for in daily charts:

Intraday price spikes that happen suddenly and without any preceding buildup in momentum.

A huge increase in volume followed by rapid price drops within the same or subsequent days.

Exaggerated price gaps at market open or close, indicating manipulation during off-hours or lower-volume periods.

On a daily chart, if a stock opens significantly higher than the previous day's close without any news or earnings report to back it up, this could be the start of the dump phase. The manipulators are looking to sell their shares to anyone who has bought into the hype, leaving retail traders holding the bag.

Repeated Use of the Same Quote: A Telltale Sign of a Pump and Dump Scheme

Another red flag is when the same stock or "hot tip" keeps resurfacing in social media, forums, or emails. If you notice that the same quote or recommendation is being promoted repeatedly over time, often using the same language, this is a strong sign of manipulation. The scammers are likely trying to pump the stock multiple times by reusing the same tactics on new, unsuspecting traders.

Be cautious of stocks that:

Have been heavily promoted in the past.

Show a history of sudden spikes followed by rapid declines.

Are promoted with vague, overhyped language like "the next big thing" or "guaranteed gains."

If the same stock is mentioned multiple times in trading communities, check its historical chart. If the stock has undergone previous pumps, you will likely see sharp rises and falls that align with the promotional periods.

How to Avoid Pump and Dump Schemes

Now that you know how to spot the signs, here are actionable steps you can take to protect yourself from becoming a victim of a pump and dump scheme:

Do Your Research: Always verify the information you receive about a stock. Check if there’s legitimate news, earnings reports, or significant company developments that justify the price movement. Avoid relying solely on social media or forums for your stock tips.

Look at Fundamentals: Focus on stocks with solid fundamentals, such as earnings growth, revenue increases, and strong management. Stocks targeted for pump and dump schemes often have weak or non-existent fundamentals.

Use Multiple Timeframes: As we've discussed, examining stocks across different timeframes—monthly, weekly, and daily—can help you spot abnormal price behavior early on.

Monitor Volume and Price Movements: If you see large, unexplained surges in volume and price, be skeptical. Legitimate price increases are usually accompanied by news or fundamental changes in the company.

Avoid Low-Volume Stocks: Pump and dump schemes often target low-volume, illiquid stocks that are easier to manipulate. Stick to stocks with healthy trading volumes and liquidity.

Set Stop Losses: Always use stop losses to protect yourself from sudden price drops. Setting a stop loss at a reasonable level can help limit your losses if you accidentally invest in a stock being manipulated.

Be Wary of Promotions: If a stock is being aggressively promoted, ask yourself why. More often than not, aggressive promotions are a sign that the stock is part of a pump and dump scheme.

Conclusion

Pump and dump schemes prey on traders’ fear of missing out ( FOMO ) and the allure of quick profits . However, by using a disciplined approach to trading, analyzing charts across multiple timeframes, and paying close attention to volume and price movements, you can avoid falling victim to these schemes.

Remember: If something seems too good to be true, it probably is. Protect your investments by staying informed, doing thorough research, and trusting your analysis. By following these guidelines, you can navigate the markets with confidence and avoid the pitfalls of pump and dump schemes.

Happy trading, and stay safe!

AlgoTrading Basics for Beginners and Advanced StrategiesHello,

1 Introduction

Algotrading or Algorithmic trading has brought about a revolution in the financial markets: automation of trades with the help of complex algorithms. These algorithms execute trades according to predefined rules and are quicker in capturing market opportunities compared to manual trading. HFT in gold HFT-based algotrading has also greatly skewed the transaction volumes in recent years, but even though these trades are very short-term, they can tell us something about longer-term trading strategies.

---

2 What is Algorithmic Trading?

Algorithmic trading is a method of executing orders using automated, pre-designed trading instructions that account for variables such as trade timing, price, and volume. The platform has found application in the work of large financial institutions, hedge funds, and individual traders to facilitate the ease of trading strategy selection and optimization.

One might be, a set of rules that tells it to buy the gold if it falls below a certain level and sells as soon as the price of that gold hits a specified level. Traders can take advantage of small price movements without sitting in front of their screens all day.

---

3 Why use Algorithmic Trading?

There are various reasons as to why one would engage in Algotrading:

Speed: It is obvious that technology is used to carry out trades and computers do this faster than people. This proves extremely useful in fast markets like gold trading where prices may change in milliseconds.

Emotionless Trading: An individual does not deviate from the proposal; emotional elements like fear and greed that affect traders do not affect its operation.

Backtesting: Trading systems risk analyses can be done using test histories which access the performance of trading systems on historical figures, thus preventing any risk when trading.

Precision and Consistency: Algorithms maintain accuracy levels in trade initiation with almost never deteriorating without human intervention as only information is required regarding trading and no emotions.

---

4 Core Principles of Algorithmic Trading

Apart from trading in shares, forex or even taking a position in gold (XAUUSD) there are a few primary principles common to all algorithmic trading:

a Data Mining And Data Management

Technical Indicators – Besides backtesting and strategy optimization, algorithms employ very prominent technical indicators such as Moving Averages (MA), Relative Strength Index (RSI), Bollinger Bands, or other indicators associated with detecting trends or momentum.

Price Patterns – Other factors that might be of influence include pattern recognition algorithms which can be trained to identify specific shapes such as heads and shoulders, flags, or triangles, and thereby predicting price movements.

Volume Analysis – Volume analysis can be instrumental in price movement validation. Volumes increase during up-trend or down-trend and their analysis is essential when confirming trends or reversals.

b Machine Learning Models

Machine learning models aim to work in this way in modern algorithms with a view to predicting price changes in the near future. Algorithms that one develops or wires are fed with data sets and they learn patterns and devise methods of trading faster or more efficiently anyway as the case might be. There are other strategies like SVM, Random Forests, and Neural Networks that one can use to enhance predictive power.

c High-Frequency Trading

HFT involves placing numerous orders and getting them executed in split seconds and on some occasions microseconds. That is particularly attractive in cash markets like a gold market where there are narrow price bands in which one can place determinants and capitalize on the fluctuations.

---

5 Advanced Techniques in Gold (XAUUSD) Algorithmic Trading

Trading gold presents unique challenges and opportunities in the algorithmic trading world. Here are some advanced techniques tailored to the XAUUSD market:

Reinforcement learning has emerged as a powerful technique in gold trading. RL works as the trading systems interact with the market and improvise over the strategy by solving the problem by trying it in the market. This is useful for gold trading, as RL strategies are adaptable to external shocks such as economic news or investor sentiment changes.

They include sentiment predictions around precious metals.

Gold as an asset class has a unique character because it is a ‘safe-hoard’ asset and hence its price is subject to global and domestic conditions, military conflicts and general investor feel. Sentiment algorithms incorporate news, social networks, and reports on economics and stock markets to identify the mood of the investor's community. If there is a piece of news pointing to some uncertain or negative times ahead, then the algorithm predominantly directed by the sentiment may initiate purchases of gold.

---

6 The Future of Algorithmic Trading

Although this form of trading has not yet reached widespread use, the potential of quantum computing in investment strategies including gold markets is promising. Quantum calculations have been demonstrated to outperform classical computation in solving combinatorial optimization problems and processing big data. This can allow the development of new and better trading strategies and more effective utilization of unnecessary.

---

7 Practical Use of the Traders on Platforms like TradingView

With the inception of platforms like TradingView, algorithmic traders have been aided with a design, a test, and an automated strategy submission in the most reliant fashion.

a Algorithmic Strategies Implemented Using Pine Script

On its part, TradingView accepts user-written trading algorithms. Pine Script programming language is based on TradingView. These traders favor strategies resting on either technical indicators, patterns, or custom conditions. For instance, one can formulate a strategy to place a gold (XAUUSD) order whenever the price rises above its 50-day moving average and a closing order whenever the price goes down.

b Strategic Testing

Strategies (algorithms) are tested using back-testing methods incorporated in the trading software, this process is known as back-testing. A feature of the TradingView platform is that a trader can run their algorithms on record and see how those algorithms would have played out on historical data. This is important for adjusting the entry and exit plus the risk control parameters and further the performance of a strategy.

c Community Insights

Another benefit of using the TradingView platform is the community of traders around it who can post their strategies, exchange ideas, and learn from each other. You will be able to learn how other traders have taken to algorithmic trading with gold and other assets and be able to develop better strategies.

---

8 Tactics to Consider for New and Intermediate Trading Positions

The strategies provided for algorithmic trading may vary from simple to complex in levels. Below are some typical strategies that every trader should consider implementing in their trading practice:

a Trend Following

This is perhaps the most basic type of algorithmic trading. The idea is very simple; one buys those assets that are on the uptrend (bullish) and sells those that are on the downtrend (bearish). For example, in gold trades, a strategy for a trader may be quite simple: moving averages. For instance, an algorithm could be designed in such a way that it buys gold whenever the 20-day moving average of gold crosses the 50-day moving average upwards and sells when this situation is reversed.

b Arbitrage

Arbitrage strategies, as the very definition suggests, enable traders to exploit all such situations which emerge, due to the mispricing corrects routinely. In gold trading, for instance, this would refer to the action of selling short shares in an exchange retrieved in one exchange, where that price, would include a premium orchestrated by other markets.

c Mean Reversion

Mean reversion strategies originate from the classic concept that there is a high likelihood of prices returning to their average or mean. For instance, an algorithm buys an asset such as gold if its average is lower than the over its certain period moving average and sells whenever it is above that average.

d High-Frequency Trading (HFT)

HFT although it calls for many resources, there are traders who have this kind of approach to gold markets in that they seek to benefit from price changes within seconds or rather milliseconds HFT. This strategy also calls for other aspects such as having very good network connectivity to enable very fast execution of trades as well as high volume trades.

---

9 Conclusion

Algorithmic trading opens a world of opportunities for all kinds of traders. It doesn't matter whether you're a beginner looking into simple tactics such as trend-following or a seasoned trader putting more sophisticated approaches to work with gold (XAUUSD), there has never been a time that the tools and methods are more readily available to you for successful algotrading. Traders can use existing platforms such as our TradingView to develop, back & optimize their strategies to keep up with today’s fast-moving financial markets.

The financial world is evolving and staying up to date with these new breakthroughs in technology, including machine learning, sentiment analysis, and quantum computing will help give the traders the edge. Algorithmic trading can become everyone’s thing if one is patient, disciplined, and keeps learning.

Regards,

Ely

Entry Types Simplified: The Essential Guide for New Traders!Key Structures and Formations:

Ascending Channel:

The price has been moving within this channel for a while. An ascending channel indicates an uptrend but also signals that the price is forming higher highs and higher lows, which can later break either direction.

Bull Flag:

A classic continuation pattern where after a strong bullish move (flagpole), the price consolidated before continuing upwards. This was a great entry point for traders watching for bullish momentum.

Failed Flag:

It appears there was a bull flag that failed to continue upwards and instead reversed direction. This type of failure is a strong indication for traders to reconsider their long positions or take partial profits. Often when a flag fails, it can lead to an aggressive move in the opposite direction.

Zones:

4HR, 1HR, 15M LQZ (Liquidity Zones):

These zones mark areas where liquidity is expected to be high, which means these are key levels to watch for price reactions.

The 4HR LQZ around 2,622 and the 1HR LQZ around 2,639 are critical areas for price retracement or reversals, particularly in a trending market.

Current Price Action:

The price is currently hovering near the 15M LQZ (2,655.443), which could act as a short-term support/resistance level. Watching how the price reacts to this zone will provide insight into the next move.

If the price continues to drop, the 1HR LQZ around 2,639 may provide support. If that fails, the next likely target is the 4HR LQZ near 2,622.

Recommendations Based on Confluence:

Check for Multi-Touch Confirmation: If the price interacts with the 4HR or 1HR LQZ zones multiple times and forms a base, this could serve as strong confirmation of a potential reversal or continuation.

Comprehensive Patterns: The failed flag within the larger ascending channel provides a great example of how smaller patterns (failed flag) can give clues about larger moves (channel break).

Follow the Trinity Rule: As per the Trinity Rule, wait for multiple confirmations across different structures before entering a trade. The liquidity zones and patterns within patterns provide a good basis for this.