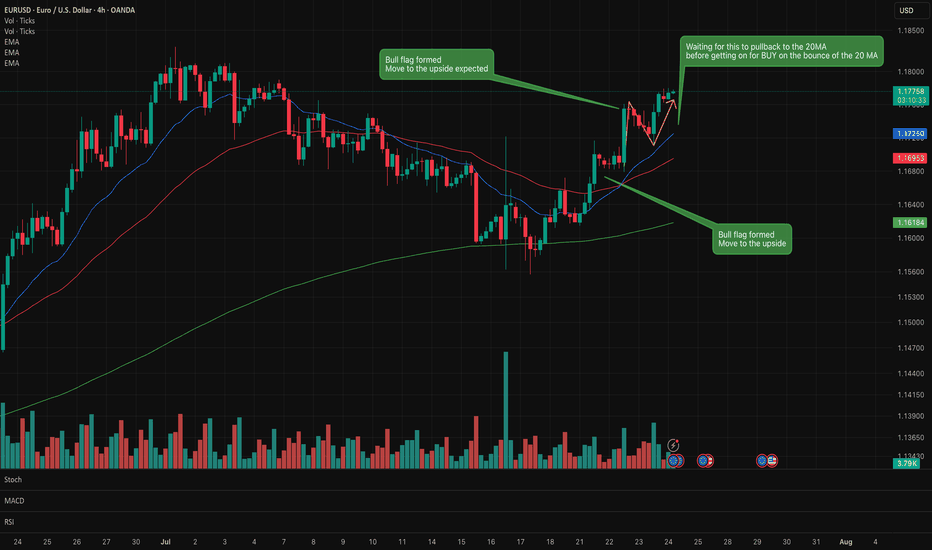

EUR/USD Lots of bull flags formed on the recent chart. Buy/Long Lots of bull flags on this chart which confirmed a move to the upside.

Waiting for a little pullback to the 20MA before considering a buy long order

Waiting to see if this small bear flag forms.

A very interesting instrument to watch at the moment. Full of various signals.

Tradingforex

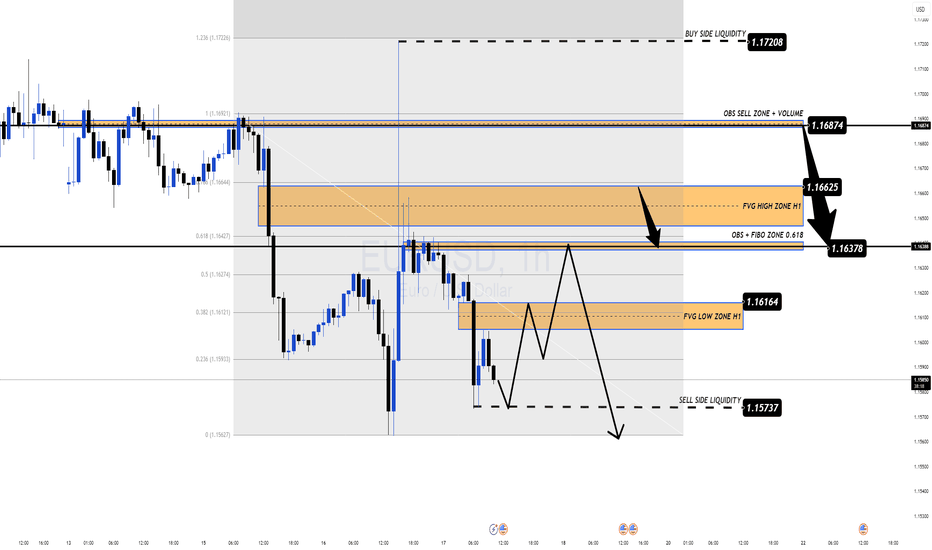

EUR/USD Forecast – Bears in Control Ahead of US Jobless DataEUR/USD Forecast – Bears in Control Ahead of US Jobless Data

🌐 Macro View: Dollar Regains Strength Amid Uncertainty

EUR/USD remains under selling pressure as the greenback finds renewed strength following midweek weakness. The market is bracing for fresh U.S. jobless claims data, expected to show a slight rise to 235K. A print below 220K could reignite USD demand, while a surprise above 240K may offer a temporary lifeline for the euro.

Amid geopolitical and economic turbulence, the euro continues to underperform as investors shift to the dollar for safety and yield advantage.

📉 Technical Outlook – MMF & Smart Money Perspective

The recent breakdown below 1.1600 confirms the bearish momentum. Based on the MMF (Market Momentum Flow) methodology, price action is currently moving within a controlled distribution structure, suggesting further downside potential.

Key zones identified from H1 structure:

OBS + FVG High Zone (1.1662 – 1.1687): Strong supply zone + volume imbalance.

1.1637: Mid-key level and possible liquidity magnet.

1.1616 – 1.1573: Ideal area for sweeping sell-side liquidity before any sustainable bounce.

If price reclaims 1.1662, intraday bullish correction may be in play. However, as long as 1.1687 holds, bears remain in control.

🧭 Trade Plan for Today

🔴 SELL ZONE: 1.1662 – 1.1687 (FVG + OBS Volume Zone)

SL: 1.1710

TP: 1.1637 → 1.1616 → 1.1590 → 1.1573

✅ Preferred entry zone aligned with high-volume imbalance & MMF rejection pattern.

🟢 BUY ZONE (Scalp Only): 1.1575 – 1.1580 (Sell-side Liquidity Zone)

SL: 1.1550

TP: 1.1612 → 1.1630 → 1.1645

⚠️ Use with caution — only upon clear price reaction at lower liquidity sweep area.

🔍 Strategy Insight

This is a classic scenario of a controlled pullback within a larger bearish structure. Patience is key — let price tap into imbalanced zones before executing. Given today's U.S. data, volatility may spike during the New York session, so risk management is crucial.

💬 What’s Your Take?

Do you expect EUR/USD to retest the 1.1550s zone, or could a surprise from U.S. job data flip the narrative?

👇 Drop your analysis below & follow for more MMF-based setups.

GBP/CAD (Two Trade Recaps) EUR/NZD Long and GBP/JPY LongEUR/NZD Long

Minimum entry requirements:

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

GBP/JPY Long

Minimum entry requirements:

- Tap into area of value.

- 1H impulse up above area of value.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EUR/AUD Short, EUR/NZD Short, NZD/USD Long and AUD/NZD ShortEUR/AUD Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

EUR/NZD Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

NZD/USD Long

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart.

- If tight structured 1H continuation forms, 1H risk entry within it.

AUD/NZD Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart.

- If tight structured 1H continuation forms, 1H risk entry within it.

EUR/AUD ShortEUR/AUD Short

Minimum entry requirements:

- 1H impulse down below area of interest.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

Trading at the Market OpenTrading at the Market Open

The market open marks a critical juncture in the financial world, presenting a unique blend of opportunities and challenges for traders. This article explores the essence of trading at the open across stocks, forex, and commodities. It delves into the heightened volatility and liquidity characteristic of this period, offering insights and strategies to navigate these early market hours effectively, setting the stage for trading opportunities.

What Does the Open Mean in Stocks, Forex, and Commodities?

The open signifies the start of the trading day for various financial markets. It's a time when trading activity surges, marked by a rush of orders that have accumulated since the previous close. In stock markets, this includes shares, indices, and Exchange-Traded Funds (ETFs). The influx of orders often leads to significant price movements as the market absorbs overnight news and global economic developments.

For forex and commodity markets, the open can vary by region, reflecting their 24-hour nature. This period is crucial for setting the tone of the trading day, offering insights into sentiment and potential trends. Traders closely watch the market open to gauge the strength of these movements, which can indicate broader market trends or sector-specific shifts.

Volatility and Liquidity at Market Open

Trading at the open is often marked by enhanced volatility and liquidity. Heightened volatility is primarily due to the influx of orders accumulated overnight, reacting to various global events and news. As traders and investors assimilate this information, rapid price movements are common, especially in the first few minutes of the session. These price fluctuations can present both opportunities and risks for traders.

Increased liquidity, which refers to the ease with which assets can be bought or sold without causing significant price movements, is also a characteristic of the open. A higher number of market participants during this period may result in better order execution and tighter bid-ask spreads, particularly in highly liquid markets like forex and major stock indices.

What to Know Before the Market Opens

In terms of things to know before the stock market opens, it's essential to review the overnight and early morning news that can affect stocks. This includes company earnings reports, economic data releases, and geopolitical events. Traders also check pre-market trading activity to gauge sentiment and potential opening price movements.

For forex and commodities, understanding global events is crucial. Developments in different time zones, like policy changes by central banks or shifts in political scenarios, can significantly impact these markets. Additionally, reviewing the performance of international markets can provide insights, as they often influence the US open.

It's also vital to analyse futures markets, as they can indicate how stock indices might open. Lastly, around the forex, commodity, and stock market openings, indicators and other technical analysis tools applied to the previous day can also offer valuable context for the day ahead.

Market Open in Different Time Zones

Market open times vary globally due to different time zones, significantly impacting trading strategies. For instance, the New York Stock Exchange (NYSE) opens at 9:30 AM Eastern Time, which corresponds to different times in other parts of the world. For traders in London, this translates to an afternoon session, while for those in Asian markets like Tokyo, it's late evening.

Forex, operating 24 hours a day during weekdays, see overlapping sessions across different regions. For example, when the Asian trading session is concluding, the European session begins and later overlaps with the North American session. Such global interconnectivity ensures that forex markets are active round the clock, offering continuous trading opportunities but also requiring traders to be mindful of time zone differences and their impact on liquidity and volatility.

Strategies for Trading at Market Open

Trading at market open requires strategies that can handle rapid price movements across all markets. Here are some effective approaches:

- Pay Attention to Pre-Market Trends: This helps traders assess how a stock might behave at the market open. If a stock is fading from post-market highs, it might be wise to wait for a trend change before entering.

- Gap and Go Strategy: This involves focusing on stocks that gap up on positive news at market open, an indicator of potential further bullishness. Traders look for high relative volume in pre-market and enter trades on a break of pre-market highs. This strategy is fast-paced and requires quick decision-making.

- Opening Range Breakout (ORB): The ORB strategy uses the early trading range (high and low) to set entry points for breakout trades across all types of assets. The breakout from this range, typically the first 30 to 60 minutes of the session, often indicates the price direction for the rest of the session. Time frames like 5-minute, 15-minute, and 30-minute are commonly used for ORB.

- Gap Reversal: The gap reversal method is used when the price creates a gap, but then the range breaks in the opposite direction. If the gap is bullish and the price breaks the lower level of the opening range, it signals a gap reversal. The same concept applies to bearish gaps but in reverse.

The Bottom Line

In essence, understanding unique features of market open trading is vital for those participating in stock, forex, and commodity markets. The opening moments are characterised by heightened volatility and liquidity, driven by global events and sentiment. However, savvy traders may capitalise on these early market dynamics with effective strategies.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EUR/USD Short and GBP/USD ShortEUR/USD Short

Minimum entry requirements:

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

- If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

GBP/USD Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart.

- If tight structured 1H continuation forms, 1H risk entry within it.

USD/CHF ShortUSD/CHF Short

Minimum entry requirements:

- Corrective tap into area of value.

- 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

- Tap into area of value.

- 1H impulse down below area of value.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

AUD/JPY Short, EUR/JPY Short, GBP/JPY Short and USD/CHF ShortAUD/JPY Short

Minimum entry requirements:

- 1H impulse down below area of value.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EUR/JPY Short

Minimum entry requirements:

- If structured 1H continuation forms, 1H risk entry within it.

GBP/JPY Short

Minimum entry requirements:

- If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart.

- If tight structured 1H continuation forms, 1H risk entry within it.

USD/CHF Short

Minimum entry requirements:

- Corrective tap into area of value.

- 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

- Tap into area of value.

- 1H impulse down below area of value.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

USD/JPY Short, AUD/NZD Short, AUD/JPY Neutral and EUR/USD ShortUSD/JPY Short

Minimum entry requirements:

- If tight non-structured 5 min continuation forms, reduced risk entry on the break of it.

- If tight structured 5 min continuation forms, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

AUD/NZD Short

Minimum entry requirements:

- If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

AUD/JPY Neutral

Minimum entry requirements:

- If structured 1H continuation forms, 1H risk entry within it.

Minimum entry requirements:

- 1H impulse down below area of value.

- If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

- If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EUR/USD Short

Minimum entry requirements:

- Tap into area of value.

- 1H impulse down below area of value.

- If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

- If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EURUSD - TECH. 2Hello Traders! It's Nika.

In this technical work, as we see here, there is a few things happening at the same moment.

First thing to focus on is that we have formatting double double-head acceding triangle.

We need wait or also go short for that with small time period. After that my prediction is the price will enter that channel in price range 1.13917 - 1.13247. So, after that we can wait for the market price confirmation and only after going Buy or Sell.

After all, what we got here is two good options.

1. Open short when market will open until the price will hit "Double-head acceding triangle" bottom.

2. Go into the position after a few days, when the price will enter & left channel range 1.13917 - 1.13247.

In long time period sell and buy probability, there is price marks on chart! So, you can use it as your TP.

Thank you!

Have a profitable day. :)

BEST XAUUSD M30 BUY SETUP FOR TODAY 📈 Gold (XAU/USD) is showing bullish momentum on the 30-min chart, trading within a rising parallel channel. Price has recently bounced from lower support and is aiming for the resistance zone near $3,331. 🔼 A breakout above this level could signal further upside, continuing the bullish wave structure. Traders should watch for pullbacks to the lower trendline as potential buying opportunities. 🧠💡 As long as price stays above the $3,251 support, the bullish bias remains intact. 📊✨

USDJPY Analysis week 23Fundamental Analysis

Tokyo's core CPI (excluding fresh food) - a key inflation gauge - rose 3.6%, higher than forecast and last month. This increases the possibility that the Bank of Japan (BoJ) will continue to raise interest rates this year, although most experts predict the BoJ will keep rates unchanged until September.

Meanwhile, the USD rose sharply after a US appeals court overturned the decision to remove most of the tariffs imposed by Mr. Trump. However, the Yen still appreciated slightly against the USD.

Technical Analysis

After consecutive declines on Friday, the pair is sideways waiting for the next development. 142.900 is the next support zone that the pair faces, this is the breakout zone and also the trendline meeting. Break this price zone must wait 141,200 for weekly support zone

145,900 last week's peak resistance zone acts as resistance for the pair's price reaction towards this week's resistance peak around 148,000

EUR/NZD Short and CAD/JPY ShortEUR/NZD Short

Minimum entry requirements:

• If tight non-structured 5 min continuation forms, reduced risk entry on the break of it.

• If tight structured 5 min continuation forms, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

CAD/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EUR/AUD Short, CAD/JPY Short and GBP/AUD LongEUR/AUD Short

Minimum entry requirements:

• If structured 1H continuation forms, 1H risk entry within it.

CAD/JPY Short

Minimum entry requirements:

• Break above area of value.

• 1H impulse down below area of interest.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

GBP/AUD Long

Minimum entry requirements:

• Break below area of value.

• 1H impulse up above area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EUR/USD Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

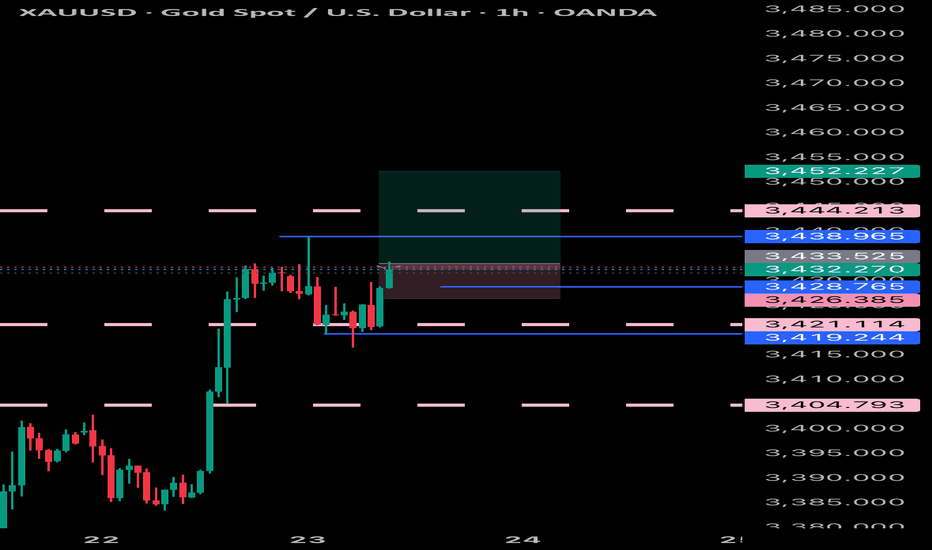

4H FVG level is indicating a strong bullish sentiment.Market Analysis – Gold (XAU/USD)

Gold is currently trading within a bullish Fair Value Gap (FVG) on the 4-hour timeframe, accompanied by notable volume activity. Just below this zone lies a weekly FVG, and multiple other FVG and Breaker Block (BPR) formations have emerged in the same region. The price action around the 4H FVG level is indicating a strong bullish sentiment.

However, on the 1-hour chart, the market has recently formed a bearish FVG in the 3214–3220 range. If the price breaks above this level with strength, the bullish momentum could potentially drive the market toward the following upside targets: 3233, 3240, 3250, and 3260.

Let’s monitor closely and remember: Do Your Own Research (DYOR).

GBP/JPY Short and CAD/JPY ShortGBP/JPY Short

Minimum entry requirements:

• Corrective tap into area of value.

• 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

CAD/JPY Short

Minimum entry requirements:

• Corrective tap into area of value.

• 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.