THE KOG REPORT THE KOG REPORT:

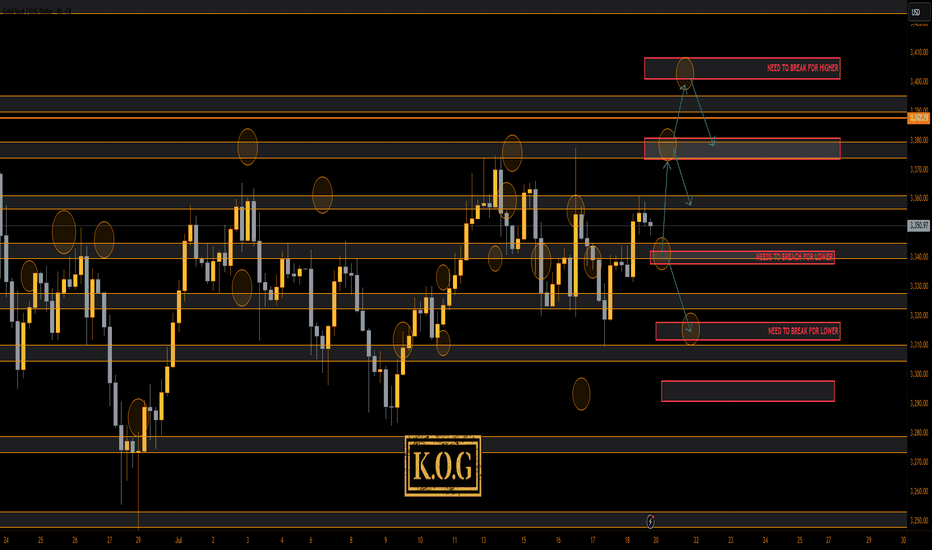

In last week’s KOG Report we said we would be looking for a price to attempt the higher level red box sitting around the 3370-75 region and if not breached, we felt an opportunity to short would be available from that region. We said if that failed and the move commenced, we would be looking at a complete correction of the move back down into the 3330-35 region, where we would then monitor price again in anticipation of a long from there or the extension level of 3310 which was also a red box short target (move complete). As you can see from the above, not only did we get that higher red box, we rejected, completed the move downside and then our traders managed to get that long trade all the way back up into the Excalibur target, red box targets and the hotspots shared in Camelot.

A decent week again, not only on Gold but also the numerous other pairs we trade, share targets on and analyse.

So, what can we expect in the week ahead?

For this week we can expect more ranging price action, but due to the previous range from last week being so tight, it looks like we’ll see a breakout coming in the latter part of the week unless there is news to bring us unexpected volume.

We have the key level below 3335-40 support and above that resistance and a red box sitting at 3375-80. This is the region that needs to watched for the break, and if broken we should hit the range high again at 3400-10. However, if rejected, we could again see this dip to attack that lower order region 3310-6 before attempting to recover.

Last week we wanted to see that curveball and although we did see some aggressive price action, I think we will see something extreme for this week. It’s that lower level 3310-6 that is a key region for bulls, if broken we can see a complete flush in gold taking us down into the 3250’s before we start the summer run. That for us would be the ideal scenario going into the month end, but, we’ll play it how we see and as usual, we go level to level and update any changes as we go along.

KOG’s Bias for the week:

Bullish above 3340 with targets above 3355, 3361, 3368, 3372 and above that 3385

Bearish below 3340 with targets below 3335, 3330, 3322, 3316, 3310 and below that 3304

RED BOX TARGETS:

Break above 3350 for 3355, 3361, 3367, 3375 and 3390 in extension of the move

Break below 3340 for 3335, 3330, 3320, 3310 and 3306 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Tradingindicator

KOG - OILQuick look at Oil. There is a pivot here in the golden zone around the 70.5 level which we can dip into. Above that level, we would be looking for higher oil with the potential target level on the chart. Note, oil is due a huge pull back, so rejection from one of these resistance levels can give us that pull back in order to get better pricing to long.

We've added the red boxes from the indicator to help you navigate the move.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

THE KOG REPORT Bank Holiday tomorrow so we'll keep it simple and update the KOG Report on Tuesday ready for the week ahead. Please have a look at the last few KOG Reports to see how it went, wasn't a bad week at all.

This week, immediate red boxes are on the chart, there is a red box active above and the indicator is suggesting a potential retracement on the move. So we'll look for price to attempt the high, if failed we can expect the move downside into the order region where we may settle.

RED BOXES:

Break above 3365 for 3370, 3376, 3381, 3390 and 3403 in extension of the move

Break below 3350 for 3343, 3335, 3330, 3323 and 3310 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Statistically Probable that Bitcoin Has Not ToppedBitcoin: No Statistical Evidence of a Top Yet 🚀

Based on the analysis using statistical extremes, there is no confirmation that Bitcoin has reached a market top at this time. This indicator is designed to identify historically extreme conditions, signaling when price action is statistically overextended.

🔍 Key Observation:

Unlike previous cycle tops, where extreme readings were clearly registered, the current market environment has not yet reached those levels. This suggests that Bitcoin may still have room to run before hitting an exhaustion point.

📊 What This Means for Traders & Investors:

✅ Momentum Still Intact – No statistical evidence of a peak.

✅ Potential for Further Upside – Historically, markets tend to top only after hitting extreme conditions.

✅ Caution & Confirmation Needed – While no extreme has been detected, market conditions can change, and risk management remains essential.

⚠️ Disclaimer: This is not financial advice. Historical probabilities do not guarantee future results. Always conduct your own research before making trading decisions.

What do you think? Could Bitcoin be headed higher? Let’s discuss! 👇 🚀

PVRINOX PlungesPVRINOX on the 1-day timeframe demonstrated a sharp bearish move, successfully hitting all targets in a precise short trade setup. Identified using the Risological Swing Trading Indicator , this trade perfectly captured the market's downward momentum.

PVRINOX Key Levels:

Entry: ₹1520.80

SL: ₹1570.40

TP1: ₹1459.45 ✅

TP2: ₹1360.25 ✅

TP3: ₹1261.05 ✅

TP4: ₹1199.75 ✅

Technical Analysis:

The trade initiated at ₹1520.80 with a calculated stop-loss at ₹1570.40, offering an impressive risk-to-reward ratio.

The consistent downtrend was confirmed as prices respected the resistance levels marked by the Risological indicator.

The achievement of all targets reflects the trade's efficiency and the indicator's accuracy.

The break below key support levels and sustained bearish momentum ensured the targets were met seamlessly.

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for the levels of resistance above at the 2670-75 region where we anticipated the short trade to come from and the lower levels of support standing at 2630 where we wanted to see a reaction in price. We managed to get the short just below around the 2665 region giving us a nice start to the week in Camelot, targeting lower and breaking through 2630. We then continued to short completing the bias target levels as well as the red box targets which were shared with the wider community.

Pre-FOMC we suggested traders pause and wait for the reversal which we managed to get based on the indicator and the FOMC report enabling us to capture the move upside into the close of the week, giving us a phenomenal pip capture on Gold. Add to that the other pairs we’ve traded and analysed through the week, and it was a nice end to week giving us an opportunity to now take it lightly for the remainder of the year.

So, what can we expect in the week ahead?

For this week we will be expecting thin volume so potential for ranging and slow movement with sudden burst of unexpected volume. We again have the key level of 2630-35 above which is a reasonable target region for the start of the week as long as the support level just below here holds us up 2610. If we can start the week with a move into that region we feel an opportunity to long is there with the first region being 2630 and above that 2635. 2635 is the level we’re anticipating a break of into the higher levels of 2650-55 and above that 2660-6, which is where we ideally want to be waiting for the short opportunity to take this back down into the lower levels with potential to then break below the 2600 level.

We say it a lot but this week and most probably for the remainder of the year we will be taking this level to level, hence the report is showing you’re the 4H red boxes which together with our 15min and 1H indicators work well to capture the moves for intra-day trading across all pairs.

KOG’s bias for the week:

Bearish below 2660 with targets below 2610, 2596, 2580 and 2578

Bullish on break of 2660 with targets above 2667 and above that 2670

RED BOXES:

Break of 2625 for 2630, 2635, 2645 and 2660 in extension of the move

Break of 2610 for 2606, 2590, and 2680 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

How to Build a Forex Trading Indicator How to Build a Forex Trading Indicator

In the dynamic world of financial trading, understanding how to build a trading indicator is a valuable skill. This article is designed to navigate you through the essential steps of creating your own trading indicators, offering a blend of technical and practical insights to potentially enhance your market analysis and trading decisions.

Understanding Trading Indicators

Trading indicators are essential tools in analysing financial markets, offering traders valuable insights into market trends and potential trading opportunities. These mathematical calculations are applied to various market data points like price, volume, and sometimes open interest. In forex trading, indicators play a crucial role in analysing currency pair movements.

There are several types of indicators, each serving a specific purpose:

- Trend indicators help identify the direction of market movements.

- Momentum indicators gauge the speed of these movements.

- Volume indicators look at trading volumes to understand market strength.

- Volatility indicators provide insight into the stability or instability of currency prices.

While there are hundreds of indicators to choose from, some traders choose to develop their own based on their unique market observations.

Basic Components of a Trading Indicator

The core components of a trading indicator are price, volume, and time. These elements are fundamental in analysing market data and building various tools.

- Price: The most critical component, price, is used in almost every trading indicator. It includes open, high, low, and close prices of trading instruments. Price data is essential for constructing trend-following tools like moving averages and oscillators like the Stochastic RSI.

- Volume: Volume indicates the number of contracts traded in a given period. It provides insights into the strength or weakness of a market move. Volume-based tools, like the Volume Oscillator or On-Balance Volume (OBV), help traders understand the intensity behind price movements.

- Time: Indicators use time periods to analyse market trends. This could be short-term (minutes, hours), medium-term (days, weeks), or long-term (months, years). Time frames influence the sensitivity of an indicator, with shorter periods typically offering more signals.

Choosing the Right Data and Tools

Selecting appropriate data and tools is a critical step in building effective trading indicators. For data, accuracy and relevance are paramount. Traders typically use historical price data alongside volume data.

For tools, traders consider user-friendly platforms that offer robust functionality for creating and testing tools. Platforms like TradingView and MetaTrader offer extensive libraries and community support, facilitating the development of customised indicators.

Additionally, programming languages like Python, C# and R, known for their data analysis capabilities, can be powerful tools for creating more complex indicators. FXOpen’s TickTrader, for instance, supports custom C#-based indicators and offers powerful backtesting tools.

How to Build a Trading Indicator: A Step-by-Step Walkthrough

Developing an indicator involves several key steps, each crucial to ensure the final tool is effective and aligns with your trading strategy.

1. Define the Objective

Begin by clearly defining what you want your tool to achieve. Is it to identify trends, pinpoint entry and exit points, or gauge market volatility? Your objective will guide the type of indicator you develop, such as trend-following, momentum, or volatility-based.

2. Select the Formula

Choose or develop a mathematical formula that your tool will use. This could be a simple moving average, a complex algorithm involving multiple data points, or something entirely unique. The formula should reflect the market phenomena you aim to capture.

3. Coding the Indicator

Translate your formula into code. If using platforms like TradingView, MetaTrader or TickTrader, their scripting languages (Pine Script for TradingView, MQL4/5 for MetaTrader, C# for TickTrader) are designed for this purpose. Ensure the code is clean, well-documented, and easily adjustable.

4. Incorporate Visualisation

Decide how the indicator will visually appear on the chart or in a separate window. This could be in the form of lines, bars, dots, or other graphical representations. The visual aspect should make it easy to interpret signals at a glance.

5. Backtesting

Before applying your indicator in live trading, it’s crucial to backtest it using historical data. This topic is expanded on below.

Testing and Refining Your Indicator

Testing and refining your trading indicator is a critical phase in its development, ensuring its potential effectiveness and reliability in real market conditions.

- Backtesting: This is the process of testing your indicator against historical data. Backtesting helps evaluate how it would’ve performed in different market scenarios, revealing its strengths and weaknesses. It's essential to test over various time frames and market conditions to ensure robustness.

- Analysing Results: Assess the indicator's accuracy, consistency, and responsiveness to market changes. Look for patterns in its performance, such as frequent false signals or lag in response to price movements.

- Refinement: Based on the backtesting results, refine your indicator. This could involve tweaking the formula, adjusting parameters like time periods or thresholds, or enhancing the visualisation for clearer signals.

- Forward Testing: After adjustments, conduct forward testing in a simulated or live trading environment with real-time data. This helps verify its performance in current market conditions.

Remember, no indicator is perfect; the goal is to develop a tool that consistently aids in your trading outcomes.

The Bottom Line

The journey of building an indicator is both challenging and rewarding. From selecting the right data and tools to carefully coding and testing your creation, each step plays a vital role in crafting an effective aid for trading decisions. For those looking to integrate their custom indicators into a professional trading environment, opening an FXOpen account offers the opportunity to leverage your unique tools in the dynamic TickTrader platform.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

HBLPOWER MASSIVE 50% INTRADAY PROFITSHBL Power on the 15-minute timeframe delivered an extraordinary performance, achieving and exceeding all profit targets in a single intraday session. This long trade setup was precisely captured using the Risological Swing Trading Indicator , showcasing its capability to identify explosive moves.

HBL Power Key Levels:

TP1: 644.55 ✅

TP2: 654.65 ✅

TP3: 664.75 ✅

TP4: 671.00 ✅

HBL Power Technical Analysis:

The trade was initiated at an entry point of 638.30, with a tightly managed stop-loss at 633.25. HBL Power displayed strong upward momentum, clearing all resistance levels and skyrocketing past the final target.

The stock's bullish trend and breakout were effectively pinpointed by the Risological trend line, making this trade a textbook example of high-probability intraday trading.

The result was a massive 50% intraday profit, a testament to the precision and effectiveness of the Risological system.

Good luck!

Namaste!

ITI Hits TP1! Target ₹450—Daily Chart Breakout!Indian Telephone Industries (ITI) on the daily timeframe has achieved TP1 and shows strong bullish momentum, making it highly probable to achieve TP2, TP3, and TP4. This trade was identified using the Risological Swing Trading Indicator , providing clear entry, stop-loss, and target levels.

Key Levels:

TP1: 301.40 ✅

TP2: 357.90 (Pending)

TP3: 414.40 (Pending)

TP4: 449.30 (Pending)

Technical Analysis:

The trade entry at 266.50 was confirmed with a breakout above key resistance levels, supported by bullish price action. The stop-loss is tightly placed at 238.25, ensuring risk is well managed. The current upward trajectory aligns with the Risological trend, signaling strong continuation toward the upper targets.

Traders should monitor the price action near TP2 and TP3 for any signs of consolidation or resistance, with the expectation of further upside potential.

Sonata Software Races to ₹675! TP4 Within Reach!Sonata Software, on the 1-hour timeframe, demonstrates a strong bullish momentum with TP1, TP2, and TP3 successfully achieved. TP4 is within close range and is likely to hit as the trend continues on the Risological Swing Trading Indicator.

Sonata Software Key Levels:

TP1: 587.45 ✅

TP2: 621.10 ✅

TP3: 654.75 ✅

TP4: 675.55 (Pending)

Sonata Software Technical Analysis:

The trade was initiated at 566.65, following a clear breakout above the Risological Trend Line. The consistent upward momentum indicates a strong trend, with well-marked take-profit levels and a tight stop-loss at 549.85 to manage risk effectively.

With TP4 nearly achieved, the bullish momentum suggests further upside potential. Traders should closely monitor the price action near TP4 for possible profit-taking or further extension.

Namaste!

ARIES AGRO: 50% Profit in Intraday TradeARIES AGRO (15-Minute Timeframe) - Intraday Sensation!

Trade Overview:

Aries Agro delivers a phenomenal intraday performance, achieving a 50% gain with 5x margin trading. All targets are marked with clear progression on the chart using the Risological trading indicator.

Key Levels:

Entry: 283.40

Stop Loss (SL): 281.75

Take Profit Targets:

TP1: 285.35

TP2: 288.60

TP3: 291.80

TP4: 293.80

Technical Insight:

The price rallied sharply, riding strong bullish momentum, with each target systematically achieved.

The Risological Swing Trader Indicator confirmed the long trade setup early, providing a low-risk, high-reward opportunity.

The upward slope of the moving averages added further confidence to the bullish scenario.

Strategy Tip:

Intraday traders using margin positions are advised to monitor momentum near TP4 for potential reversals or consolidation. Always ensure disciplined stop-loss placement.

A true powerhouse intraday trade — Aries Agro showcases the magic of leveraged trading!

KOG's RED BOXES - GOLDRed Boxes:

Break above 2755 for 2762, 2768, 2780

Break below 2742 for 2732, 2720, 2709

Many of us sit and wait for the perfect entry, I can tell you, unless you're scalping, this hardly ever happens. The key to get an entry is identifying your target region first! Once you have identified that target region, then start looking not for a precise entry, but a region or a zone you want to be testing your entry in. The skill is not getting in too early, and if you get in too late, you're usually going to be the wrong side of the market. So, use the bias and the red boxes, bullish/bearish above/below. Most new traders struggle with basic support and resistance or identifying zones; hence they’ll usually enter the market at the wrong time and place. This is where red boxes are really helpful, you can use them to identify key regions if you’re scalping or use the higher or lower ones for day trading and managing trades in-between.

KOG’s Red boxes are part of our strategy and are added to our targets to further fine tune our entries and exits. We also use them combined with our hotspots and Excalibur/LiTE targets to keep us in the right direction of the markets, allowing us to trade between the levels, scalp in ranges or in low volume periods as well as identify possible turning points on the pair we’re trading.

We’ve been using these now for a few years and they have proven to work extremely well when combined with our other strategy as well as a standalone strategy in itself, once you have experience. You need to have a plan and you will need to have basic knowledge of price action, you can add MA’s, indicators of your choice, and use these with your own strategy to limit your drawdown and identify when you may be in the wrong side of the market.

You will notice the boxes, just like usual support and resistance will give RIPs. Keep an eye on KOG’s bias of the day together with the targets as well as the analysis we share on the KOG Report updates. This will help you to make a plan for the day, then add the red boxes to your charts and hopefully you’ll notice a difference in your trading.

As always, trade safe.

KOG

AFFIRM HOLDINGS (AFRM) Short Trade Setup and AnalysisAFFIRM HOLDINGS (AFRM) on the 15-minute timeframe:

Trade Summary

Position: Short Trade

Entry: $46.84

Stop Loss: $48.47

Take Profit Targets:

TP1: $44.84 (Hit)

TP2: $41.59 (Hit)

TP3: $38.34 (Pending)

TP4: $36.33 (Pending)

Technical Analysis

The price action for AFRM has shown a steady downtrend in alignment with the bearish market sentiment. The position was initiated near the entry point of $46.84, with the Risological dotted trendline indicating a continuous bearish pressure, thus validating the short entry.

With TP1 and TP2 already achieved, the price is moving in line with the projected downtrend. The decreasing volume and proximity to the trailing targets suggest that there is further room for downside potential, aiming towards TP3 and TP4.

Market Insights

Volume: 5.59M (below the 30-day average of 9.08M), indicating moderate sell-off interest.

Key Levels:

Day’s Range: $40.63 - $42.47, which reflects a steady decline.

52-Week Range: $16.50 - $52.48, showing that the stock is approaching the lower side of its yearly range.

Upcoming Earnings: In 12 days, which could further influence AFRM’s trend based on market expectations.

This technical setup aligns with the broader market indicators and the prevailing bearish momentum in AFRM. Further downside potential remains viable as the trend continues.

BDL Short-Term Long Trade on 15m Time Frame: TP4 ReachedWe initiated a short-term long trade setup in Bharat Dynamics LTD (BDL) on the 8th of October at 9:45 am, entering at 1114.45 based on the bullish signal from the Risological Swing Trader. The price action was strong, and we successfully reached TP4 (1225.90) by the 11th of October at 9:15 am.

Target Points Achieved:

TP 1: 1135.70

TP 2: 1170.15

TP 3: 1204.60

TP 4: 1225.90

Stop Loss (SL): 1097.20

This trade exemplifies the power of the Risological Swing Trader in identifying profitable setups and executing with precision. We’ll continue leveraging this strategy for future market moves.

PARA Paramount Global Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PARA Paramount Global prior to the earnings report this week,

I would consider purchasing the 11usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $0.36.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

THE KOG REPORT - CPI/FOMCTHE KOG REPORT – CPI/FOMC

This is our view for CPI/FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

In all honesty, we would prefer to let them move the markets today into the level they want, then look for a set up to get in on the retracement tomorrow. At the moment, due to CPI and FOMC being on the same day, it’s likely to be an extremely aggressive move. We’re going to put the KOG Report plan to one side for now, as the whipsaw can cause spikes and key levels turn to extreme levels and we’ve taken what we needed on gold for now.

We have the range formed now and accumulation under way with sentiment standing at neutral. We have key level support below at the 2303-5 region, which if tapped could give a bounce upside, unless broken into the first key level 2335 which was on the KOG Report and then the extension of the move into the 2347-55 region. This is where there may be an opportunity to long into, or, on the flip capture the move downside into the immediate support levels, potentially even lower!

If you look at the illustration on the chart with path, we have highlighted the extreme level above sitting at 2385-90, this for us is on the break and would be ideal. If they take it there, this is the level we want to watch and is sticking out to us as a potential curveball, so please be careful!

On the flip, they take this down, we’ll sit back and wait, shorting with volume is a bad idea as the intermediate swings can go against you. So, we’ve highlighted the key levels below that have potential for a reaction in price.

We’ve put this report together this time to show you what the market can be capable of if they really want to move it. The circles are our hotspots, together with our targets they will help us navigate the move. They will want to slip new traders up and get them trading with the candles, this is a recipe for disaster, on days like this quick money trades are not an option. It’s either above or below for us on this occasion, otherwise we’ll come back to gold tomorrow and make our move.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

The Fundamental Concepts of Technical IndicatorsTrading indicators are essential tools used by traders and investors to analyze price data, identify trends, and make informed decisions in financial markets. They provide valuable insights into market dynamics, helping market participants gain a competitive edge. This comprehensive explainer will delve into what trading indicators are, how they are utilized, and the differences between two prominent strategies: trend following and mean reversion. Additionally, we will explore the importance of using binary and discrete indicators together to enhance trading effectiveness.

Part 1: Understanding Trading Indicators

1.1 Definition of Trading Indicators

Trading indicators are mathematical calculations based on price, volume, or open interest data that provide graphical representations of market conditions. These calculations help traders visualize price trends, momentum, volatility, and potential reversals. Indicators serve as a supplementary layer of analysis, offering a structured and objective approach to interpreting market behavior.

1.2 Types of Trading Indicators

Trend Indicators: Identify the direction and strength of prevailing trends, such as Moving Averages (MA), Moving Average Convergence Divergence (MACD), and Ichimoku Cloud.

Oscillators: Measure overbought and oversold conditions, such as Relative Strength Index (RSI), Stochastic Oscillator, and Commodity Channel Index (CCI).

Volume Indicators: Assess trading volume to confirm price movements, like On-Balance Volume (OBV) and Volume Weighted Average Price (VWAP).

Volatility Indicators: Gauge the level of price fluctuations, including Bollinger Bands and Average True Range (ATR).

Part 2: Utilizing Trading Indicators

2.1 Trend Following Strategy

Trend following is a popular trading strategy that capitalizes on the continuation of established trends. Traders using this approach seek to identify uptrends or downtrends and ride them for extended periods. Trend following indicators are ideally suited for identifying the direction of a trend and capturing profits during strong market movements.

Example of Trend Following Indicator: Fourier Smoothed Stochastic (FSTOCH)

(Indicators like the FSTOCH help traders reveal underlying trends in the market)

The Fourier Smoothed Stochastic is an advanced tool that utilizes the Stochastic Oscillator in combination with Fourier Transform analysis to identify and ride prevailing trends. By providing smoother signals, it helps traders stay on course with the established trend, allowing for more accurate entries and exits. Its ability to filter out market noise makes it an ideal choice for trend followers seeking a clearer view of market momentum, enabling them to capitalize on prolonged price movements.

2.2 Mean Reversion Strategy

Mean reversion is a counter-trend strategy that assumes prices will revert to their average or mean over time. Traders using this approach aim to profit from price reversals when an asset's price deviates significantly from its historical average. Mean reversion indicators are ideal for identifying overbought and oversold conditions and anticipating potential reversals.

Example of Mean Reversion Indicator: Bollinger Bands Percentile (BBPct)

(The BBPct indicator marks out price extremes which may lead to potential reversals)

The BBPct (Bollinger Bands Percent) is an indicator designed for mean reversion trading strategies. It utilizes Bollinger Bands to determine overbought and oversold conditions in the market. The indicator calculates the percentage of the current price's position within the Bollinger Bands' upper and lower boundaries. When the price is near the upper band, it suggests an overbought condition, indicating a potential mean reversion towards the lower band. Conversely, when the price is close to the lower band, it indicates an oversold condition, suggesting a possible mean reversion towards the upper band. Traders can use this information to identify potential reversal points and make informed decisions to capture price movements back towards the mean.

Part 3: Trend Following vs. Mean Reversion

3.1 Key Differences

Direction: Trend following aims to identify and ride established trends, while mean reversion seeks to capitalize on price reversals.

Risk Profile: Trend following strategies typically involve higher risk, as traders enter positions in the direction of the trend, which may be challenging to time accurately. Mean reversion strategies are often considered less risky as traders expect price reversals to occur relatively soon after significant deviations from the mean.

Market Conditions: Trend following tends to perform well in trending markets, while mean reversion thrives in ranging or sideways markets.

3.2 Combining Trend Following and Mean Reversion

While trend following and mean reversion strategies have distinct approaches, they can complement each other when used in confluence. Combining both strategies can provide a more comprehensive view of the market and reduce reliance on a single indicator. For example:

Confirming Trend Reversals: Mean reversion indicators can be used to confirm potential trend reversals identified by trend-following indicators, increasing the probability of successful entries and exits.

Managing Risk: Trend following indicators can help traders stay in trends longer and avoid premature exits when using mean reversion strategies.

Identifying Range-Bound Markets: Mean reversion strategies can be employed during periods of low volatility or when the market lacks a clear trend, while trend following indicators can be set aside until a new trend emerges.

Part 4: Binary and Discrete Indicators

4.1 Binary Indicators

(The Super Schaff gives out binary signals when it detects a potential change in trend)

Binary indicators provide straightforward, yes-or-no signals, indicating the presence or absence of a particular condition. Examples include Moving Average Crossovers and Super Schaff, which produce buy (long) or sell (short) signals when specific conditions are met.

4.2 Discrete Indicators

(The Volume-Trend Sentiment displays the overall implied sentiment based on volume and price action)

Discrete indicators generate signals based on a range of values or levels. These indicators offer more nuanced insights into market conditions, allowing traders to interpret the strength or weakness of signals. Examples include RSI and VTS.

Part 5: The Importance of Using Both

5.1 Diverse Perspectives

Combining binary and discrete indicators provides traders with diverse perspectives on market conditions. Binary indicators offer clear entry and exit signals, while discrete indicators offer a finer understanding of price trends and potential turning points.

5.2 Enhanced Decision-Making

Using both types of indicators helps traders make more informed and confident decisions. By cross-referencing binary and discrete signals, traders can filter out false signals and identify high-probability trading opportunities.

Conclusion:

Trading indicators play a vital role in modern financial markets, providing traders and investors with valuable insights into price trends, momentum, and market conditions. Trend following and mean reversion strategies offer distinct approaches to trading, each with its unique advantages and risk profiles. However, combining these strategies and utilizing both binary and discrete indicators can provide a comprehensive and powerful toolkit for traders seeking consistent success in the dynamic world of finance.

Check out the indicators mentioned in this post:

MYEG: POTENTIAL UPWARD PROFIT 12%MYEG is forming a nice HH and HL and finding support level at 0.83, however volume is still low, if next bar show better volume can potential for an upward breakout to reach 1st resistance level at 0.91 and 2nd resistance level at 0.96.

Short trade setup on US30 , Analysis using Price action.Short trade setup building on US30 Analysis using Price action:

On chart we can see multiple descending wedges on 30m,15m. price broken Trendline of 180m wedge, the price is breaking below the Higher timeframe Channels. The overall bias is bearish as well.

Risk to Reward is 1:1

RISK DISCLAIMER

Any and all liability for risks resulting from investment transactions or other asset dispositions carried out by the customer based on information received or a market analysis is expressly excluded by Badshah.E.Alam . All the information made available here is generally provided to serve as an example only, without obligation and without specific recommendations for action. It does not constitute and cannot replace investment advice. We therefore recommend that you contact your personal financial advisor before carrying out specific transactions and investments.

EUR/USD PUMP INCOMING 🔥🔸️Ticker Symbol: EUR/USD 🔸️Timeframe: 4 Hour 🔸️3X Bull Pattern 🔸️Investment Stratey: Long

TECHNICAL ANALYSIS: EUR/USD is setting up for a nice push higher in the market. I really like how the price action has just recently made a higher low showing bullish momentum. You can also tell on the bottom dashboard that we now have a green key EMA crossover while our white line which represents Money Momentum is also making a higher low. Historical this pattern has resulted in an increase in EUR/USD.

4X 🟢 Bull Pattern Confirmation Requirements

✅️ Linear Regression Indicator Increasing

✅️ Money Momentum Shifting Higher

✅️ Green Dot: Key EMA Crossover to Upside

✅️ Green Middle Band: Bull Market Momentum

4X 🔴 Bear Pattern Confirmation Requirements

🔻 Linear Regression Indicator Declining

🔻 Money Momentum Shifting Lower

🔻 Red Dot: Key EMA Crossover To Downside

🔻 Red Middle Band: Bear Market Momentum

🔔 Follow for daily stock, crypto and forex technical analysis.

⚠️ Trading is risky and I understand nothing is guaranteed. Proper risk management should be in place at all times to minimize losses. Please consult a financial advisor before trading. All Inclusive Trading LLC is not a financial advisor and may not be held liable for any losses which may occur.