Detail look into “M” & “W” Structures/Patterns in Price Action

Hello everyone:

Welcome back to another price action structures/patterns video.

Today let's take a look into the “M” and “W” style structures/patterns.

Many traders may use these types of structures/patterns in their trading plan/strategies.

Let me show you guys my interpretation of them, and how I utilize them in my trading as well.

It's important to understand many of my previous price action analysis, structures/patterns videos all tie into this one as well, I will put those links below.

Essentially, a “M” or “W” style pattern is a double tops/bottoms pattern that appears mostly towards an end of a run of the current price.

They are “reversal” price action structures/patterns. They are most effective when we tie in other price action structures/patterns with it.

Let me give multiple examples of these structures/patterns in different markets and time frames.

“M” Style Pattern

-Double tops structure after price failed to continue the first initial push down.

-Top of the Right M, needs to have a reversal structure on the LTF or smaller time frames (ascending channel, H and S pattern..etc)

-Can either enter at the breakout of the reversal structure or the first correction after the impulse down

“W” Style Pattern

-Double Bottoms after price failed to continue the first initial push up.

-bottom of the Right W, needs to have a reversal structure on the LTF or smaller time frames (descending channel, Inverse H and S pattern..etc)

-Can either enter at the breakout of the reversal structure or the first correction after the impulse up

Double Top/Bottoms:

Ascending/Descending channel:

Head and Shoulder Pattern:

Continuation/Reversal Correction:

Multi-Time Frame Analysis:

As always, any questions, comments or feedback please let me know.

Thank you

Jojo

Trading Plan

Risk Management: prevent blowing a trading account

Hello everyone:

Today I want to go in depth into this particular topic as many beginner traders will make this similar mistake in trading sometimes in their trading journey.

It's important to understand that it's all part of a learning curve you must endure when it comes to consistency in trading. I myself had done this in the beginning of my trading time, and it ultimately comes down to how you manage your emotion that is going to help you to learn from this mistake and move forward. Some may go ahead and start making the mistakes that I will mention below, and accelerate into blowing their account. Some may acknowledge what's happening, and learn from their mistakes to prevent such things from happening in the future.

There are several key factors on what a trader should do and understand in order to not blow a trading account. I have made several key videos on these different topics which I will include below. I will touch on all these topics to provide a well-rounded suggestion and feedback on this matter. It's very important that you must have a good understanding of each area so it will help you to not only be consistent but to also continue to grow and compound your trading account in the future.

Few key points:

Trading Plan

A trading plan outlines your plan, rules and management for your trades. You must have a good written plan to guide you in situations. We don't make emotional decisions that may lead to many trading errors. Focus on creating one is the start. Have a few go to setups that you always look for in the market. Identify them and screenshot them so you know to take those over and over again.

Backtesting

We backtest so we are familiar with price action and the market’s movement. By backtesting, we train our brain to recognize the same/similar price action that has happened in the past. This allows us to execute without fear, or fear of missing out.

Backtest & Chartwork

Forecasting/Scanning the market:

Forecast the market is how we get a bias with the current live price action of the market. We see setups we like, and have confirmations to enter. If they don't happen or develop, no trade and move on. No need to have “ego” to prove everyone you are right.

How to scan the market

Risk management

Stick to proper risk management. 1% or a set amount is usually the best. Having a 3:1 RR is ideal when trading so even if you are less than 50% strike rate trader, you will see at least BE or small profits. Make sure you understand the exposure you are putting yourself into.

Stop Loss

When it comes to calculating your entries, you must set a Stop less on every trade. Don't just remove it in hope the price will turn around. Many new traders often don't set SL or move them as price gets close. This is how you will lose more money in the long run.

Trading Psychology: (FOMO)

Fear of missing out and fear of losing are the biggest trading psychology trader encounter. However, if you do enough backtesting, and have a plan in place, you can potentially remove these emotions. Understand that you will never capture all the moves that happen in the market, be graceful and positive on the opportunities you get.

Over Leveraged

Most new traders over leveraged their account. Having a small account with huge leverage is why traders blow their account in a short time. Leverage can work for you as well as against you. You must understand properly on leverage, margin and more. This ties you with your risk management and your SL.

Revenge trading

When new traders start losing money, they tend to want to “revenge” their losses by entering random trades, multiple trades and more. This combining with over leverage is how a new trader can blow their account in 1 day.

Journal:

Last but not least, journal down every single trade that you have taken. Whether it resulted in profit or loss. This is how you can learn from your past experiences. Do not deviate from this. Most new traders feel this is unnecessary and choose not to do it. Unfortunately, if you don't do them, your trading journey will not move forward. You will still make the same mistakes over and over again. Blowing an account is something no one wants to go through, but if a trader does not acknowledge his/her mistakes, then it is very likely to happen again and again.

So these are the few key areas where a trader should pay close attention to in order to not blow their trading account. The different strategies you trade aren't the issues why some blow their accounts, rather it's about their plan, management, mindset, emotion, psychology and expectations that ultimately decide the faith of the trading account.

Thank you

Jojo

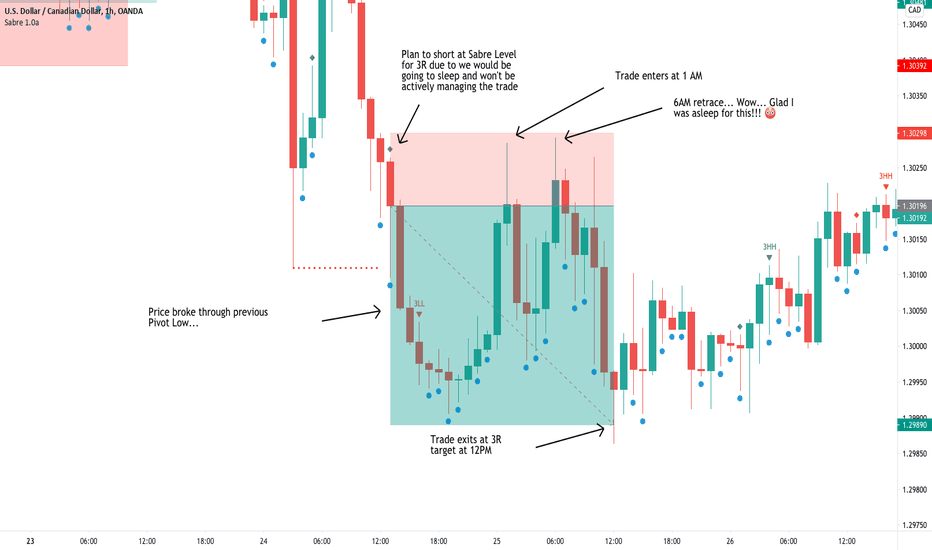

USDCAD Backtesting & Chart Work session on Price Action AnalysisHello everyone:

Welcome to a backtesting/charting session on price action analysis.

Many have inquired about how to properly identify market phrases (Impulse phrase vs corrective phrase).

In addition, how to use trendline properly to identify a structure/pattern as a continuation or reversal correction.

This session will be the start to all these.

So let's take a look into this. To start, make sure you have a new chart layout just for backtesting/charting work.

his won't get overlapped on your current chart for your normal analysis.

Utilizing tradingview’s feature on “replay”, this is how we can backtest and do chart work on previous price action that has already happened.

As we already see the price moved in that period of time, we then look for potential buy/sell bias entries to get familiar with the move within the market.

1. Start from the Higher time frames, top down approach. Utilize multi-time frame analysis to your advantage.

2. Identify what market phrase you are in, is the current price in a HTF impulse phrase ? or in a corrective phrase.

3. Now that you have a more clear bias on the HTF, then go down to the lower time frame to confirm your bias.

Do we see the same bearish/bullish price action on the LTF as well ? If so then that's a good indication that both HTF and LTF have the same buy/sell opportunity.

Look for possible entries on the LTF.

4. Repeat this process with different pairs, different markets to “program” our minds into looking for the similar buy/sell setups in the current, live market.

This is how we don't get FOMO, or fear of losing. If you have done enough backtesting and charting, then you simply remove the emotion out of the equation.

You have seen the move play out over and over again, then it comes down to probabilities.

Feel free to ask me questions, comments or feedback :)

Thank you

How To Follow Earnings and News From Your ChartIn this video we show you the basics of following earnings and news from your chart. This is especially helpful for equity investors and traders, but it also applies to those interested in crypto, forex, and futures because you will learn how to follow breaking news directly from your chart. All TradingView members have access to high quality news by clicking the News icon 📰 on the right-side toolbar.

Here are the three key features we cover in this video:

1. Read breaking news about any ticker symbol by clicking the News icon 📰 on the right-side toolbar. This news is real-time and will update instantly when big events happen. Additionally, the news will automatically update and reflect the ticker on your chart. When big price movements happen, open your newsfeed to see what's happening.

2. You can chose to show the Earnings icon on your chart. This Earnings icon will reveal when a company reports earnings and some basic facts about that earnings report including date and EPS estimates. To show or hide your Earnings icon right-click on the chart, click Events, and then select "Show Earnings on Chart."

3. The Earnings Calendar 📆 is a way for you to see who is report earnings, when, and what their EPS Estimates are. Never miss another earnings report. Open your Earnings Calendar daily and quickly scan for upcoming reports so you don't get caught off guard. In the Calendar you can also see upcoming Economic Events. Pro tip: we also have a dedicated Earnings Page that gives you even more details into upcoming earnings.

We hope this video helps you get started with earnings, news, and other events! Please leave any questions or comments below. Our team appreciates your feedback, support, and questions.

Weekly Trading Recaps: AUDJPY, XLMUSD, SUGAR, BTCUSD Jan 24 2021Hello everyone

Welcome back to another quick weekly trade recap video on the positions.

I am currently in the mountains (lol) so may not get to my usual weekly outlook stream due to internet. But hopefully still update analysis :)

AUDJPY - Second position got out for BE. Currently in the third position in.

XLMUSD - Took out for a 1% loss.

BTCUSD - Still Holding, currently @ 3% profit.

SUGAR - Still holding, currently @ 2.5% profit.

Any questions, comments, or feedback welcome to let me know below.

Thank you

Setting up and utilize tradingview (layout, drawing panel)Hello everyone:

Welcome back to a quick video on tradingview setups. Many of you have asked me about how you should set up your charts, your settings, customizations, watchlist..etc. So I will make a quick explanation video on this.

Chart:

-Create a blank chart

-Save under different names for different purposes

-candlesticks

-timeframes

-screens

-syncing

Setting/customization:

-color

-appearances

Drawing Panels:

-favorite the ones you're gonna use the most.

Watchlist:

-create watchlist

-flagging

Alerts:

-set only the ones with high probability potential, do need to set like 30 alarms.

As always, any questions, comments or feedback please let me know.

Thank you

How to connect a brokerage and join the Broker AwardsIn this video we show you how to connect a brokerage to your account. We also talk about rating your favorite brokerage and participating in our upcoming Broker Awards. 🏆

When you connect a brokerage you can trade, invest, and follow markets with advanced tools built directly into our platform. To get started, find and click the Trading Panel button at the bottom of your chart. Once your brokerage is connected, you can use the Order Panel to create orders and manage risk including take profit targets and stop losses. When you place an order, it will appear on your chart. This is one of the biggest advantages of trading with a connected brokerage - see your trades directly on the chart. Make a plan and then visualize the risk and reward.

As a TradingView member with a connected brokerage you are allowed to rate and review your favorite brokerage. Your reviews will help others find the perfect brokerage for their needs. Together, we can build a transparent marketplace with real reviews by real traders. Get started by visiting our Top Brokers page.

Remember, your reviews are important because they will determine our first-ever Broker Awards. Here are the awards we will be giving out based on what you say:

• Broker of the year

• Most popular broker

• Social champion

• Most innovative tech

• Best multi-asset broker

• Best futures broker

• Best forex broker

• Best crypto broker

If you have any questions or comments, please leave them below. We look forward to seeing your reviews and announcing the awards on Jan 20, 2021.

Weekly Institutional COT Analysis (Majors 1) 🎥🎯 This is weekly overview to the institutional positions of the commercials and non-commercials which is big part of the decision making for my strategies next to the technicals.

Subscribe, this video is released every saturday.

📌 GET COT INDICATOR HERE

⏬add this script to your charts

✅ Unfortunately due to data limitation I cant import my complete indicator to trading view so this is just limited for last 10 weeks.

Wish you good hunt in next week !!

Dave FX Hunter ⚔

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

❗❗ This is Pre-plan

That means my view can change, depends on how the price will arrive to the level and what will be happening on the M30 in my level of interest for entry. Then I will decide if I will enter or not. So please don't just blindly follow this. FX market is quickly changing environment and it requires full focus on the levels for the precise entry with low risk.

❗❗ DISCLAIMER

We are the only one person who is responsible for our health, relationships, success and money in our life's. So taking a risk on the markets based on this idea is only and only your decision. You deserve the profit and you are responsible for your potential loss. Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice. Author of the analysis does not accept liability for any loss or damage.

❗❗ Legal Risk Disclosure

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

In depth look at continuation bull/bear flag structures/patterns

Hello everyone:

Welcome back to another quick educational video on price action structures/patterns.

Today let's go deeper into the continuation correctional structure. Specifically, the continuation bull/bear flag structure.

First it's important to understand that a bullish/bearish flag is a continuation correction.

They are representing a correctional phrase of the price action, before resuming the previous impulse phrase.

As price action traders, we must be able to identify what correction we are seeing.

This will allow you to get ahead and make your forecasting so you are prepare to any potential entries

Second, bullish/bearish flag correction will appear in any time frames, any markets, and in different sizes.

Typically a flag correction will have at least 2 swing highs and 2 swing lows and relatively even and proportion in angle or length.

They can be slightly slanted or very parallel to each other. Remember the market is not perfect, it wont always present us picture perfect, textbook structures.

Thirds, So its important to understand multi-time frame analysis, top down approach.

A LTF bullish/bearish flag may or may not have the potential to start taking off massively due to the higher time frame showing us a conflicting bias.

So its important to add as much confluence to your trade as possible.

As always, any questions, feedback or comments please let me know :)

See you all in my next weekly outlook stream.

Thank you

HOW-TO If you get two MTP Setups on the same BarIn this help Tutorial, I would like to cover what to do if you get two different MTPredictor Trade Setups on the same Bar.

As explained in the video, this can arise sometime because we have two Scripts, one containing our Standard MTP Trade setups, the other containing our Advanced MTP Trade Setups. We have had to code two Scripts to overcome Pine Coding limits.

In the video, I cover 3 possible trade management strategies, based on how experienced or aggressive a Trader you are. Every Trader is different, and will have a different Trading Plan that is individual to them.

The first strategy is for the more conservative, or risk adverse, Trader who may look to consider the neatest Profit Target to look to come out of the market earlier. The second, more aggressive, Trader may wish to look to use a further out Target of the Wave 3 swing as calculated in the MTP Advanced Trade setup Script. The last option is to use the Higher Time Frame Chart, which in this case would be the Daily DP support zone.

As you can see, there is no "one size fits all" in Trading, we are all different and have different levels of experience as well as different risk profiles. As such, it is important that we develop our own, and unique, Trading Plan that fits us, only then can we apply it time and time again in the markets.

I hope this video has helped and given some guidance as to how to handle the situation if you get two different MTPredictor Trade Setups on the same Bar.

Please note: this is not a trade recommendation, you should all perform your own Analysis. Losses can and will unfold when Trading, please always uses Stops and keep your losses small.

In depth look into double tops/bottoms price action structures

Merry Christmas everyone:

Hope everyone is well and healthy, and enjoy the holiday season as much as we can :)

Back here with another quick educational video on price action structures/patterns. I am going to go into detail on double tops/bottoms type of price action.

Many of you have asked me to elaborate more on what double tops/bottoms truly mean, and they sometimes get confused with a support/resistance. I will go into more detail on this topic to clarify the differences.

In addition, I will bring out some different examples in the market, and demonstrate how I see double tops/bottoms the way that works for my trading and its analysis.

How I confirmed what a true double tops/bottoms is, and how to look for potential entries once you see them form.

Understanding that multiple time frame analysis, nature of the market plays a big role to determine if the double tops/bottoms are “valid” and to give us more confidence to enter a position.

The higher the time frame, the more significant it is to that double tops/bottoms and the potential reversal move from it.

As always, any questions or feedback please let me know.

Merry Christmas and happy new year everyone :)

Thank you

Jojo

How to scale into the impulsive phrase of the market condition? Hello everyone:

I want to go over an important topic of scaling into the market. This is something more advanced in my opinion, and should be used cautiously when applicable.

First you will need to understand that it's important to fully accept the risk when you try to scale in a trade.

Essentially you are doubling down on a trade when you do so. What is your risk management when it comes to scaling in ?

Second thing to watch out for is managing your first initial position.

I would generally move my SL to at least BE or in 1:1 profit. This way even if the second trade that I scale in end up to be a lost, I am BE overall on the two trades.

Third point to remember is before you scale in the trade, is there enough R:R to justify it?

No random entries just because there is a continuation correction on the 5 min chart as an example.

Some price action must be present and give you enough confidence that the price is likely to continue from a structure, and then look to scale in the trade.

Any questions or comments please let me know :)

Thank you

HOW-TO: Backtest Your Forex Strategy & Increase Your Win-RateIn my earlier article, " Proving Your Trading System with Backtesting ", I demonstrated how, in the Futures market, you could backtest your trading system, see what works and what doesn't, change your variables, and rinse & repeat until you have a winning trading formula.

You GET this winning formula by torture-testing (ahem, *back*testing) your system under every market condition.

My last video backtested Futures as an example and I received dozens of requests to demonstrate and develop a similar system using Forex, so here it is! This video will show you HOW you can backtest your own Forex Trading system over time, determine its results, and refine it until it is bulletproof (or marketproof!).

All you need is a Trading System, a Spreadsheet, and a great trading platform (ahem, like TradingView) :-)

Trading can be the most rewarding of careers, but only after putting in the hours of hard work. And like everything else in life, if you don't put in the work, you won't get the results. And if you put in the work AHEAD of time, you won't have to put a DIME of your hard-earned capital into the market until you are CONFIDENT that your system will multiply that money in your account rather than feed the market monster.

I hope you enjoy the video... but more importantly I hope it will help you become a better trader. If this was beneficial to you please feel free to leave a like, a follow, or a comment... I'd love to hear from you and stay in touch as we all move forward in our trading journeys!

Trade hard, and trade well!

-Anthony

Take a closer look at price action analysis in trading Hi traders:

Hope all is doing well. I want to do another quick educational video on price action analysis.

Many have asked me to elaborate on this topic, and I thought video is the best way to do so.

So basic understanding of price action analysis is that after a strong impulse phrase in the market, we will get a period of consolidation (correction) before the price is likely to resume the direction.

This is what we can structures and patterns when the correction begin to form.

Understand that when we dont see a correctional structure after a strong impulse, this is usually a sign from the market telling us the price may reverse soon.

Its important to fully acknowledge what the market is presenting to us, and if we are seeing different clues from the market, then accept it, and change your analysis's view.

As always let me know if you have any questions or comments.

Thank you

How to utilize Multi-time frame analysis in your trading

Hello everyone:

In this educational video, I will discuss how I utilize multi-time analysis in my trading.

-What multi-time frame analysis does is to help us to get more clarity on what the overall market is doing from a top down approach.

-Analysis should always start on the higher time frames such as Monthly/Weekly/Daily.

-Then, drop down to the lower time frames such as 4H/1H,30/15/5 Min to confirm the HTF move and look for possible entries.

Price action and structures work inter-related with multi-time frame analysis.

-In a HTF impulsive phrase, there will be many LTF impulses and corrections to push the price up/down.

-In a HTF correctional phrase, there will also be LTF impulses and corrections, but within the larger HTF correction.

The key to multi-time frame analysis is to properly identify the next HTF impulsive phrase, and capitalize it by entering on the LTF price action. This allows you to maximize your R:R greatly.

In addition, combining multi-time frame analysis with price action will also give you clues on where the price is likely to go, hence calculating your targets and anticipating the movement from the market.

As always any questions or feedback please let me know :)

Thank you

Backtesting Part 2: Testing Your Trading System in 3 Easy StepsIn my earlier article, " Proving Your Trading System with Backtesting ", I outlined the HOWs and WHYs of backtesting. Does your trading system work under all conditions? Under what conditions might it *not* work? Can you remove those instances from your plan? Under what conditions might you *improve* your win rate? In another article, " The Unexamined Trader ", Just as an unexamined life is not worth living, the unexamined trader should not be trading a system that has not been tested under every market condition (and I mean TORTURE tested under HUNDREDS of trades).

This video will show you HOW you can backtest your own system over time, determine its results, and refine it until it is bulletproof (or marketproof!).

All you need is a Trading System, a Spreadsheet, and a great trading platform (ahem, like TradingView) :-)

It will take some time and effort, but like everything else in life, if you don't put in the work, you won't get the results. And if you put in the work, you won't have to put a DIME of your precious capital into the market until you are CONFIDENT that your system will multiply that money in your account rather than feed the market monster.

I hope you enjoy the video... but more importantly I hope it will help you become a better trader. If this was beneficial to you please feel free to leave a like, a follow, or a comment... I'd love to hear from you and stay in touch as we all move forward in our trading journeys!

Trade hard, and trade well!

-Anthony

How forecasting can benefit your trading journey

Hi everyone:

In this quick educational video, I will go over how I incorporate “forecasting” in my trading, and how that helps me to be a better trader overall emotionally and psychologically.

Couple things you “forecast” prior to the actual entry:

1. You should draw out the different possibilities on the price’s movement.

Different possible scenarios if possible. IF you are looking for short, then draw out the actual move from where the current price is, and take a screenshot of the possible move.

This allows you to remember your plan to execute the position once it appears.

2. You should also think about a back up plan, what if the price goes up now instead of down from your analysis ?

Are you still looking for short then? Or are you going to change your bias if price action then develops bullish price action instead?

You should prepare yourself if your bias is wrong, then what would you do next.

3. Utilize the R:R tool box, “forecast” the actual entry, SL, potential TP.

This will allow you to understand your R: R and where you would set your first, second targets.

Take screenshots if necessary to remember.

4. Forecast what you will do once price hits your TP.

Are you simply just going to exit the trades now, or will the further development of price action give you extra confidence that the trade can keep going, and you should hold on to the trade?

What do you want to see from the price action in order to change your thoughts?

This will eliminate emotions as to whether to hold onto a trade or take profit.

As you do more and more of these forecasts, the actual entry will be relatively easy.

You have already forecast the possible scenarios, entry, SL, TP, continuation..etc. So there won't be any fear of losing, or fear of missing out.

That will help you to keep your emotions at bay, and execute the trades accordingly.

Many beginner traders often lose money because they are not prepared for what the market will do. When something happens, then they react to the situation. Often enough it's too late, and they will make a decision based on emotion.

Forecasting allows you to eliminate those emotions, and let your plan run.

As always, let me know if you have any questions or comments.

Thank you

EURNZD Trade Recap, Analysis, Management

Hi everyone:

In this quick educational video, I will go over my 2 trades in EURNZD short. What was my analysis, management and thoughts on this bearish run.

I will always start my analysis from the HTF, looking at what the price action is telling me will give me a better edge to enter higher probability setups. I want the HTF to be clear on the bias that I have on the direction.

Then, using multi-time frame analysis, looking at what the LTF is telling you. Is it showing you the same price action like the HTF bias ?

Wait for the market to give you the confirmation, i.e. continuation corrections, reversal price action structure, LTF impulses...etc that will give you the confidence to enter a trade.

Manage the trade accordingly, move the SL to BE in profits depending on the strategies and style.

Don't get emotional about the result of the trade, rather if you follow your plan, and you made the decision based on what the market and price action is telling you .

Then, repeat consistently for every month, year. :)

Thank you

Why I don't use MA/EMA indicators in my analysis

Hello everyone:

In this video, I am going to explain my reasonings on why I personally don't use MA/EMA in my analysis.

I will start off by saying that I have nothing against traders who use them and are consistent and profitable.

I am sure there are many who do use indicators in their analysis along with their trading plan, risk management that find success in trading in given marker conditions.

For me, my trading style focuses on price action structures/patterns. I am analyzing the market in its pure form of movement.

In order for me to be clear on the price action, I need to “remove” all sorts of other “noise” on the chart.

This is when having MA/EMA, and other common indicators can create potential issues for my style of trading.

When we have indicators on the chart, it normally does help traders to identify “trending” markets, overbought/sold, as an example.

The most used ones such as MA/EMA are going to help traders to find trends of continuations, but it doesn't necessarily become a target or support/resistance for the price to bounce off.

Many find trading through such an “area” would be not ideal, hence they can take profit or target that general area.

While, some can use that as a stop loss area, so long the price will “reverse” from it.

However, when I see the price action on the HTF is in the impulsive phrase of the market conditions, on the LTF the indicators will not “catch up” to the most current price conditions.

As the indicators are calculated based on the price movement, and since an impulse pushes up/down the price very aggressively, it takes time for them to take the movement into its equations and move according to it.

The important thing is to not “overload” your chart with too many indicators and lines going across. There will be too many “contradicting” biases and it will confuse you as a trader. Simplicity is best, and less is more.

Thank you

Trading Psychology: Over Leveraged Trading Hello traders:

Welcome back for a quick educational video on over leveraged trading. This ties with Trading Psychology greatly, and I want to elaborate on this a bit more to give new and experienced traders my understanding on this topic.

It's important to know that leverage can work for you as well as against you. You may already hear this a lot when you open a new broker account. However, it's only when you actually start trading then you will understand the true meaning of this.

When you enter a trade with leverage, you are entering with a great risk behind if you don't have proper risk management. Since leverage is a “double edge sword”, trades that are in profit or losses will be magnified. You are easily over traded, meaning you can have multiple entries on the same pair or same move/run. Again, this would be nice if the trades are going in your favor, but if not then you are going to have a huge drawdown of your account. Professional traders understand drawdown is evitable, but they also minimize it so when they are in profit, they can easily make the drawdown backs.

Let's take an example of what an over leveraged trading combine with trading psychology could look like:

---enter a trade, and with a big position (no risk management, and not consistent with trading plan)

---begin to see price fall, then either he/she will have a SL and get taken out, or no SL then price will continue to drop then the small account is gone in no time due to the big position.

---If he/she did have a SL, then they are taken out, but just lost a bigger % of their account. Now the emotions kick in to try to “chase” the money back. So revenge trading emotions start.

---Because the account has high leverage, the person can easily open a bigger lot position, double the previous one in fact (same strategy out there says to do this) and make back your losses. If first trade was risking 5%, then this next trade is 10%)

---After several losses, the account is already cut in ½, and he/she can no longer open the high lot positions.

---They will then reduce their position size, but still at maximum leverage allows.

---Soon the account will get blown out, and the person will either blame the market, strategy, lesson and more.

I see this cycle of trading all the time in new traders, and it has a combination factor such as emotion, mindset, risk management, trading plan and more. But what is easily controlled by you is to reduce leverage allowed on the account. Simply dropping it down to less leverage will help the trader to not over leverage, and maintain a few trades only with smaller position sizes.

So, I encourage the new traders to really think about this topic and reflect on yourself to see if you ever fall into this cycle before. You may not blow your account, but certainly have experienced revenge trading and over leverage trade when the emotions kick in. I myself included it at the beginning of my trading journey also.

That is all I gotta say on this one.

Let me know if you have questions and feedback :)

I will chat with everyone next time in my live stream.

Thank you

Impulse VS Correction - Price Action Analysis Hello everyone:

In this educational video, I will go over what an impulse and a correction is in the market.

I will point out how to distinguish them in different time frames, and give a few examples on them as well.

The market can only be in two phrases.

Either its in an impulsive phrase, or a corrective phrase.

It doesn't matter what market or the time frames you are looking at, there will always be impulses and corrections.

So, what is an impulse, and what is a correction?

Impulse - price is in the high momentum period, and it's moving very fast.

Correction - price is consolidating, and moving sideway, or slowing ascending/descending sideway price action.

Determine what is impulse, and what is correction will give you a better edge in the market. You don't want to get trapped in the consolidation within the corrections.

How can I utilize this to my analysis ?

Multi-time frame analysis:

From HTF, top down approach, Understand what HTF is doing and go down to LTF for confirmation and entries for the best R:R.

Thank you

My journey in trading, experiences, ups and downs.

Hello everyone:

In this video (all talking in this one) I am gonna talk about my trading journey and experiences. All the ups and downs that I have been through in hope to give new and experienced traders a honest raw example of a trader’s journey.

Of course everyone learns and absorbs information differently, and I am sure there are people out there who didn't have to go through the way I did, but I thought sharing my journey would help some of us who are still struggling to find consistency in trading.

So, a little bit about my trading journey:

Beginning Stage

-Not profitable the first 2+ years, gone through the roller coaster ride of a trader’s journey

-Start with S.R and indicators. Does work and makes profit, but doesn't suit my personality.

-Was not consistent, some weeks in profit, some months in losses

-Made all the mistakes, wanted to give up and quit many times.

-Had negative trading emotions, mindset, and no idea on trading psychology

-Not following the trading plan, no risk management

-Over trading, over risking, revenge trading

-Emotional when I miss out potential runs of the market

-Blame the market on my losses

Turning Stage:

-Did not give up

-Admit all my mistakes, work on them, change them.

-Truthy admit you are in control of your trading account, not the market, strategies, mentors or other external factors

-Put in the time and effort, understand that this is something it can be your career for the next 30 years, what is it to you to put in a few years of hard work ?

Acknowledge the market will evolve and change, and we need to adapt as a trader

-Understand trading is a probability game, not right or wrong. I can be wrong, and won't affect my emotions.

-Want to be the "house" rather than a "player" in a casino setting,

-Learn about price action and structures.

-Have no problem missing trades and profits, understand the abundance of opportunities in trading

-Follow my trading plans, make goals, back testing, forecasting, journaling

-Acknowledge my expectations in trading,

3:1 RR, 15-20 trades, 1% risk per trade, 35-40% strike rate (higher strike rate requires less R:R). Looking for consistent growth of accounts and capital

-Understand once you are consistent, there will be more opportunities and investors who are willing to let you trade

-Continue to have a humble attitude in trading and market

-Continue to learn and grow

So I hope I answer most of the questions that you have asked, but if you have additional questions on my journey and anything else, let me know below. :)

Thank you

In Depth Look at Continuation & Reversal Structures/Patterns

Hi everyone:

In this educational video, I will explain how I determine reversal and continuation structures/patterns in the market.

Many have asked me to break this topic down more in depth and in live, so I hope I can address all the questions I get on this.

So, in my opinion there is only 2 main type of structures/patterns:

Continuation Structures

Reversal Structures

The key to find consistency in price action trading is to identify what kind of correction the structure is forming. Is it a reversal, or is it a continuation?

Since after a correction is finished, we are likely to see an impulse move from that structure, and it's good to understand when and how likely that structure will either continue or reverse the current price.

Below I will list out some of the most commonly identified reversal and continuation corrections.

To me, it's not too important what people call these structures/patterns, but what you need to determine is, is it a reversal or continuation structure?

Because, the market is ever evolving, and price action structures/patterns are also evolving.

Sure we can learn a lot from the typical “Textbook” structure and patterns, but they often or not won't be picture perfect,

and we need to utilize what else the market is telling us to determine the structures.

Continuation Structure

-flag

-channel

-triangle

-pennant

Reversal Structure

-wedge

-ascending/descending channel

-Double Tops/Bottoms (M and W pattern)

-Head and Shoulder

Understanding how the price has been moving thus far, will give you a more clear understanding of what the structure is going to form.

For example:

-When we see price at the top of a HTF structure, slowing down and correcting itself up, you will be looking for reversal structure from the top, and looking for the sell.

-When we see prices broken out of the HTF structure, you will be looking for a continuation structure to form and continue the buy.

As always ,feel free to ask me questions or comments.

Thank you