Risk Capacity: The Real Reason Traders Blow Accounts | Ep. 4In this pre-recorded video, I unpack one of the most overlooked reasons why traders blow their accounts over and over again, and it’s not about your system, strategy, or signal.

It’s about risk capacity, the internal threshold your nervous system can handle before fear, greed, or shutdown kicks in.

This is part of my ongoing series on YouTube “Rebuilding the Trader Within”, where I reflect on the emotional and psychological dimensions of trading that no indicator can fix.

If you've ever found yourself repeating the same mistakes, feeling stuck at the same equity level, or losing composure in high-stakes trades... this might be the pattern underneath it all.

I'm still learning too, and I’d love to hear your thoughts. Drop a comment — let’s grow together.

#RiskCapacity #TradingPsychology #TraderMindset #RebuildingTheTraderWithin #ForexMentorship #TraderGrowth #InnerWork #ForexPsychology

Tradingpsyhology

10 POWERFUL INVESTING & TRADING QUOTES OF ALL TIME

Here are powerful quotes of professional traders, investors and experts in financial markets.

Let their words inspire you and help you in your trading journey.

"To succeed in the market, you must learn to think like everyone else and do the opposite." - Sir John Templeton 📈💭💡

"The four most dangerous words in investing are: 'This time it's different.'" - Sir John Templeton ⏳📉🛑

"The more you learn, the more you earn." - Warren Buffett 📚💰📈

"The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money." - Victor Sperandeo. 💪💰🚫🧠

"Investing is not about making predictions, it's about having a plan and sticking to it." - Tony Robbins 📊🔄📌

"The best time to buy a stock is when the blood is running in the streets." - Baron Rothschild 💀🔪💰

"The best investment you can make is in yourself." - Warren Buffett 💼💡💰

"The stock market is not a casino; it's a crooked casino." - Charlie Munger 🎰🎲🏛️

"Losses are part of the game. You can't win every trade." - Martin Schwartz. 📉😔💔

"The fundamental law of investing is the uncertainty of the future." - Peter Bernstein. ⚖️❓🔮

The More I trade, the more I realize how precise and meaningful are these phrases. Take them seriously, and they will help you achieve the financial success.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

5 Lessons from My First 100 TradesAfter executing and reviewing over 100 real trades in crypto, forex, and gold — I found patterns. Bad patterns. Repeating mistakes. And lessons I wish someone had told me earlier.

So I broke them down into 5 key insights that changed how I trade — and might just save you thousands.

📘 Here’s what’s inside:

1️⃣ Smart Profit-Taking:

How I turned 10 R/R into 32 R/R using a dynamic exit plan.

📘Further resource:

Cycle Mastery (HWC/MWC/LWC)

---

Multi-Timeframe Mastery

2️⃣ The Sleep Edge:

70% of my losing trades happened after bad sleep. Here’s why that matters more than emotions.

3️⃣ No More Blind Stop Orders:

Why I stopped using buy/sell stops without real candle confirmation — and what I do instead.

📘 Further reading:

Breakout Trading Mastery

---

Indecision Candle Strategy

4️⃣ Multi-Layered Setups Win:

How structure, S/R, patterns, and timing stack into high-probability entries.

5️⃣ News Trading? Just Don’t.

The data behind why most of my SLs were hit near news time — and how I avoid the trap.

💡 These aren’t theories. These are real lessons from real trades.

If this video helped you or sparked an “aha” moment, give it a boost, commenting your takeaway, and sharing it with a fellow trader.

lets grow together :)

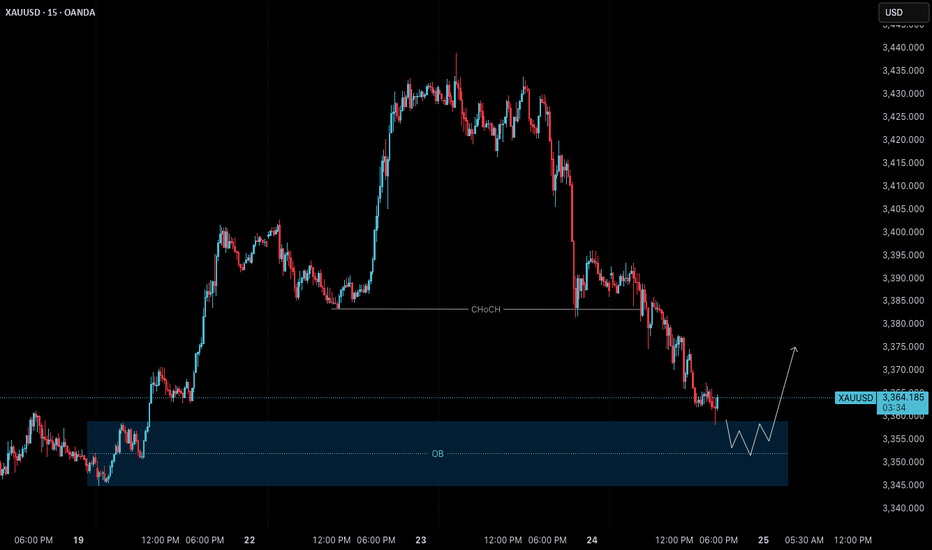

Gold – 24 July: Watching H4 OB Zone for Bullish ReversalGold – 24 July Outlook

Watching H4 OB Zone for Potential Reversal

📌 Recap of 23 July Trade:

As outlined in yesterday’s analysis, the M15 Order Block ( 3417–3412 ) held well. The market reacted precisely from this level, and our long setup successfully hit the defined 120-pip target .

However, after reaching a high near 3434 , the price failed to break above and instead rejected sharply, breaking the recent M15 higher low — a key structural sign that signals the start of a possible H4 pullback phase.

🔍 Current Market Context:

Trend Overview:

While the overall bias remains bullish, this break of M15 structure suggests short-term weakness and a corrective move in progress on the H4 chart.

Key Zone in Focus:

H4 Order Block Zone: 3359 – 3345

This is a critical zone to watch today. The market is currently trading around this area, and it could act as a potential reversal point where the uptrend resumes.

🎯 Trading Plan:

– Closely monitor the price action within the 3359–3345 zone.

– If price respects this zone and LTF (e.g., M1) shows signs of structure flip or ChoCH + BoS , it could present a fresh long setup opportunity.

– As always, only act on the trade if multiple confluences align — don’t anticipate, let the market confirm.

📈 Summary:

Bias: Watching for a bullish reversal from the 3359–3345 zone.

Setup Condition: Wait for clear LTF confirmation before entering.

Risk Management: Stick to 1:3 RR — 40 pip SL and 120 pip TP as per system.

Let the market come to your setup. Patience is your greatest edge.

📘 Shared by @ChartIsMirror

The Myth of Gold Reversals – Why Traders Keep Catching the KnifeGold is a master of deception.

It shows a clean wick into a zone, but reacts just enough to pull in early buyers or sellers — then rips straight through their stops like they weren’t even there.

The reversal looked real and the candles seemed perfect.

But the move? It was never meant for them.

This isn’t bad luck, but traders who survive aren’t trying to guess, they are the ones reading the reaction after the trap.

Let’s break down how these traps happen — and how Smart Money actually operates when XAUUSD is loading a real move.

🟥 Sell Trap – The "Instant Short" Mistake

Price pushes up into a clear reaction zone — maybe an OB, maybe an imbalance, a FVG, or a gap.

Structure looks stretched. Traders recognize a premium zone and decide it’s time to short.

The trap? Jumping in immediately on the touch, with no confirmation.

This is where Gold loves to trap sellers.

No M15 CHoCH/ BOS on M5 or real liquidity swept. Just a blind move and hope.

Price often pulls slightly higher — sweeping internal liquidity, triggering SLs — then shows a real rejection.

📌 Here’s what needs to happen before selling:

• First: look for a liquidity sweep (equal highs or engineered inducement)

• Then: price must shift — CHoCH or BOS on M15 or M5

• Finally: confirmation via bearish engulf, imbalance fill, or break + retest

• For experts: M1 can offer refined sniper triggers with minimal drawdown

💡 If none of this appears, it’s not a setup — it’s a trap.

🟩 Buy Trap – The "Wick Bounce" Illusion

Price taps a demand zone — again, a refined OB or imbalance, liquidity zone.

A long bullish wick forms. Some candles pause. It looks like a reversal.

But there’s no shift.Just hovering.

Many jump in long the second they see the wick. And then price breaks straight through.

📌 Here’s how to flip this trap into a real buy:

• Let price sweep liquidity below the zone — signs of a purge - true wick bounce

• Watch for a CHoCH or BOS on M15, M5, or even M1

• Look for a strong bullish engulf from the reactive level

• Confirm via imbalance fill or price reclaiming broken structure

📍 If all that happens — the trap becomes your entry.

If not? Stand down.

📊 What Smart Traders Actually Do Differently

They don’t chase wicks.

And never enter just because price tapped a line.

IT IS ALL ABOUT READING STRUCTURE AND PRICE ACTION.

Here’s how:

• Mark the highest probability reaction zones — above and below current price;

• Set alerts, not blind entries;

• Wait for price to come into their zone and then watch what it does there;

• Look for confirmation: CHoCHs, BOS, engulfing candles, FVG fills, clean rejections;

• And always keep one eye on the news — because Gold reacts fast and violently when volatility hits.

• Repeat this work daily until they learn how to recognize signs faster and more secure.

That’s the difference between chasing the reversal… and trading the move after the trap.

Because in this game, patience isn’t just a virtue — it’s survival.

And Gold? Well, XAUUSD has no mercy for those in a hurry and not studying its moves day by day, month after month and so on. Learn structure and price action even if you join any channel for help if you are serious about trading this amazing metal.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more trading ideas and trading psychology.

Protect Capital First, Trade SecondIn the world of trading, mastering technical analysis or finding winning strategies is only part of the equation. One of the most overlooked but essential skills is money management. Even the best trading strategy can fail without a solid risk management plan.

Here’s a simple but powerful money management framework that helps you stay disciplined, protect your capital, and survive long enough to grow.

✅1. Risk Only 2% Per Trade

The 2% rule means you risk no more than 2% of your total capital on a single trade.

-Example: If your trading account has $10,000, your maximum loss per trade should not exceed $200.

-This protects you from large losses and gives you enough room to survive a losing streak without major damage.

A disciplined approach to risk keeps your emotions under control and prevents you from blowing your account.

✅2. Limit to 5 Trades at a Time

Keeping your number of open trades under control is essential to avoid overexposure and panic management.

-A maximum of 5 open trades allows you to monitor each position carefully.

-It also keeps your total account risk within acceptable limits (2% × 5 trades = 10% total exposure).

-This rule encourages you to be selective, focusing only on the highest quality setups.

Less is more. Focus on better trades, not more trades.

✅3. Use Minimum 1:2 or 1:3 Risk-Reward Ratio

Every trade must be worth the risk. The Risk-Reward Ratio (RRR) defines how much you stand to gain compared to how much you’re willing to lose.

-Minimum RRR: 1:2 or 1:3

Risk $100 to make $200 or $300

-This allows you to be profitable even with a win rate below 50%.

Example:

If you take 10 trades risking $100 per trade:

4 wins at $300 = $1,200

6 losses at $100 = $600

→ Net profit = $600, even with only 40% accuracy.

A poor RRR forces you to win frequently just to break even. A strong RRR gives you room for error and long-term consistency.

✅4. Stop and Review After 30% Drawdown

Drawdowns are a part of trading, but a 30% drawdown from your account's peak is a red alert.

When you hit this level:

-Stop trading immediately.

-Conduct a full review of your past trades:

-Were your losses due to poor strategy or poor execution?

-Did you follow your stop-loss and risk rules?

-Were there changes in the market that invalidated your setups?

You must identify the problem before you continue trading. Without review, you risk repeating the same mistakes and losing more.

This is not failure; it’s a checkpoint to reset and rebuild your edge.

Final Thoughts: Survive First, Thrive Later

In trading, capital protection is the first priority. Profits come after you've mastered control over risk. No trader wins all the time, but the ones who respect risk management survive the longest.

Here’s your survival framework:

📉 Risk max 2% per trade

🧠 Limit to 5 trades

⚖️ Maintain minimum 1:2 or 1:3 RRR

🛑 Pause and review after 30% drawdown

🧘 Avoid revenge trading and burnout

Follow these principles and you won't just trade, you'll trade with discipline, confidence, and longevity.

Cheers

Hexa

Why emotionless trading is out (and what to do instead)Curious about what self-compassionate trading really means?

Let’s do a little thought experiment together. Imagine you just closed a losing trade. You’re feeling disappointed and unmotivated. You invite two friends over to your home and tell them what happened. Which friend would you rather talk to?

🙋🏽♀️ Friend 1 says:

"What a failure you are. Why were you even stressed out? That’s so silly. Couldn’t you see this trade was going to be a loss? You should just give up—what’s the point of trying? I don’t understand how you could mess up the way you did. Let’s spend the afternoon going through everything you did wrong."

...Or would you prefer:

🙋🏽♀️ Friend 2 who says:

"I can see you’re feeling sad and disappointed about that last trade. I’m really sorry it didn’t go your way. But you know what? Losses are a part of trading—we all go through them. You’ll have another chance tomorrow. I can tell you’re doing your best. Let’s do something kind for ourselves today, and tomorrow you’ll get back to it. Don’t give up—I’m proud of you for chasing your dreams."

🤔 So, who would you choose?

I know this little experiment might sound a bit dramatic—but be honest, wouldn’t we all prefer Friend 2 ? And isn’t Friend 1 sounding suspiciously like that inner critic of yours?

For the longest time, trading advice has told us to "get rid of emotions" and stay completely “stress-free.” I wish it were that simple…

The truth is, trying to trade without emotions is like talking to yourself like Friend 1 . Not only is it impossible —it also builds a harsh, critical inner dialogue that damages both your confidence and motivation.

The reality is: we don’t have full control over our thoughts and emotions. They show up whether we want them to or not. If we could choose our emotional state, we’d all stay calm and focused every time we trade. But that’s not how the human mind works.

Instead of fighting our emotions, we can learn to open up to them—without judgment.

Self-compassionate trading means treating yourself like Friend 2 . It’s about acknowledging when things are tough, and being kind to yourself when stress or anxiety shows up. It’s about replacing harsh self-talk with encouragement, warmth and understanding.

👩🏽🔬 Some people think self-compassion is soft, ”girly”, or even “too emotional.” But guess what? It’s backed by tons of solid research. Studies show that self-compassion helps reduce self-criticism and improve motivation. It’s also an effective tool for managing tough emotions and reducing stress and anxiety.

Self-compassionate trading is a win-win approach—it helps you stay grounded and resilient while building a meaningful trading journey. So why not give it a try? 👇

💡 Pro Tip:

Next time you close a losing trade, find yourself in a losing streak, or just feel anxious about your performance—ask yourself:

“What would I say to a good friend who’s going through the same thing?”

Then offer that same kindness and support to yourself.

Happy (self-compassionate) trading! 💙

/ Tina the Trading Psychologist

123 Quick Learn Trading Tips - Tip #7 - The Dual Power of Math123 Quick Learn Trading Tips - Tip #7

The Dual Power of Math: Logic for Analysis, Willpower for Victory

✅ An ideal trader is a mix of a sharp analyst and a tough fighter .

To succeed in the financial markets, you need both logical decision-making and the willpower to stay on track.

Mathematics is the perfect gym to develop both of these key skills at the same time.

From a logical standpoint, math turns your mind into a powerful analysis tool. It teaches you how to break down complex problems into smaller parts, recognize patterns, and build your trading strategies with step-by-step thinking.

This is the exact skill you need to deeply understand probabilities and accurately calculate risk-to-reward ratios. 🧠

But the power of math doesn't end with logic. Wrestling with a difficult problem and not giving up builds a steel-like fighting spirit. This mental strength helps you stay calm during drawdowns and stick to your trading plan.

"Analyze with the precision of a mathematician and trade with the fighting spirit of a mathematician 👨🏻🎓,

not with the excitement of a gambler 🎲. "

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader.

Look forward to the next one! 🌟

Two Brains, One Trade: Why You Freeze Under PressureBy MJTrading:

In trading, your biggest opponent isn’t volatility.

It’s your own neural wiring.

Every trader operates with two main systems:

🧠 System 2 – Rational, deliberate, planning (Prefrontal Cortex)

🧠 System 1 – Emotional, instinctive, fast (Amygdala & Limbic Brain)

Before entry, System 2 is in control. You feel calm, logical.

But the moment money is at risk—especially in drawdown or after a missed TP—System 1 takes over.

💥 Stress hormones spike

💥 Focus narrows

💥 Long-term thinking disappears

💥 You freeze, or act impulsively

You knew what to do.

But you didn’t do it.

Because in that moment, your rational mind wasn’t driving anymore.

⚖️ Set & Forget vs. Floating Managers

Different trading personalities react differently under pressure:

🔹 Set & Forget Traders

Rely on automation or predefined exits to bypass emotional hijack.

They reduce cognitive load, but often feel regret when price goes “a little more.”

🔹 Floating Management Traders

Rely on intuition and live feeling. They stay with the chart, adjusting based on flow.

When calm and trained, they shine.

But under pressure, they’re more vulnerable to emotional loops:

– hesitation

– premature exits

– revenge tweaks

– system betrayal

🧘♂️ What can you do?

✔️ Pre-plan decisions

Make the hard calls before emotions kick in.

✔️ Mental rehearsal

Visualize trade management scenarios—yes, like athletes do.

✔️ Create fallback protocols

So if you freeze, your system still knows what to do.

🧠 For Those Who Want to Go Deeper:

“Thinking, Fast and Slow” by Daniel Kahneman

Understand System 1 & 2 thinking—and how cognitive bias shapes all decisions, not just trades.

“The Hour Between Dog and Wolf” by John Coates

A stunning look at how biology, hormones, and risk-taking collide in traders' brains.

🔓 Final Thought:

If your strategy works in theory, but breaks in real-time—

It’s time to work on your neural execution layer.

Because in trading, you don’t rise to your level of analysis—

you fall to your level of emotional wiring.

— MJTrading

#NeuroTrading #TraderTypes #TradingPsychology #SetAndForget #FloatingManagement #MindOverMarkets #EURUSD #MJTrading

Previous psychology Ideas:

Let your winners run🧠 Fear | Hope | Growth – When Trading Meets Emotion

The message on the chart isn't just poetic — it's real psychology.

🔹 Fear wants to cut your winners short.

It sneaks in after a small move in your favor.

"What if it reverses? I better lock this in."

And just like that, a great trade turns into a missed opportunity.

🔹 Hope drags you into holding too long.

It dreams: "Maybe it doubles... maybe this time it'll be massive."

But it's not guided by data — it's driven by fantasy.

🔹 Discipline is what sits in the middle.

Quiet. Neutral.

It doesn’t scream or seduce — it just follows the plan.

And that’s where Growth lives — not just on the PnL, but in your psychology.

When Bitcoin pushes toward new ATHs, these emotions get amplified.

The real question becomes: Can you manage yourself, not just your trade?

📌 A Real Example from My Desk

In my earlier BTCUSD idea — “Another Edge – Decision Time” (shared above) —

I sent that setup to one of my managed clients.

He entered long exactly at the edge of the channel — a clean, strategic buy.

Price moved beautifully in our favor…

But he manually closed the trade at 106,600 — long before the move matured.

Why?

Because fear of giving back profit overwhelmed the original plan.

The chart was right. The timing was right.

But the exit was emotional, not tactical.

✅ The trade made money.

❌ But the lesson is clear: a profitable trade doesn’t always mean a disciplined one.

🎯 Final Takeaway:

“Fear kills your winners. Hope kills your timing. Discipline grows your equity and your character.”

🗣 What would you have done in that position?

Held longer? Closed at resistance? Let it run toward ATH?

Let’s talk psychology — drop your thoughts 👇

#MJTrading

#TradingPsychology #BTCUSD #FearHopeDiscipline #LetYourWinnersRun #PriceAction #BTCATH #ForexMindset #CryptoStrategy

GOLD - The One That Survived All Ages - Trading PsychologySummer light reading between trades💫

From Ancient Gods to modern banks — Gold never needed marketing to be priceless.

Gold was never invented.

It was found, worshipped, stolen, buried, and bled for.

Long before charts, before forex pairs, before brokers — it was power.

So if you're wondering why this metal moves the world?

Let’s take it back — way back.

But before we dive into history, here’s why traders are addicted to XAUUSD:

It’s fast. Ruthless. Liquid. It can deliver a week’s profit in one candle — or wipe you out in seconds.

If you understand structure, it will reward you like nothing else.

If you’re lazy, impulsive, or just guessing?

It’ll humble you fast and without mercy.

The Discovery – Gold Before Currency

• Gold was first discovered in Paleolithic caves (~40,000 B.C.), admired purely for its beauty.

• Ancient Egyptians called it “The flesh of the Gods” — Pharaohs were buried with it, because in their mind, you couldn’t enter the afterlife without gold.

• No value was assigned — it simply was value.

Empire Fuel – Gold as the Engine of War

• The Roman Empire used Gold Coins (Aureus) to expand its reach.

• Spain and Portugal built fleets just to steal it from the Americas.

• Entire wars were started and sustained by it — Gold wasn’t a luxury; it was national survival.

Gold & the Banks – Trust in a Metal

• 1816: The UK made Gold its official standard.

• By the early 1900s, most major economies followed — every currency was tied to the physical rulling metal .

• Why? Because you can’t print trust. But you can weigh it.

• Even today, central banks don’t hoard crypto or tech stocks — they hoard Gold, quietly, relentlessly.

Collapse, Rebirth, and Chaos – The Modern Era of Gold

• 1971: U.S. President Nixon kills the gold standard.

➤ Until then, every dollar had to be backed by real gold in U.S. vaults.

➤ After that? Dollars became promises, not assets.

• Welcome to the fiat era — where money has no anchor, just hope.

• Gold, no longer “money,” became something more powerful:

➤ The panic button, the global fallback, the last honest asset when everything else crumbles.

• And crumble it did:

🔹 2008: Banks collapse — Gold soars.

🔹 2020: Global lockdown — It explodes.

🔹 2022–2024: War, inflation, debt ceilings, de-dollarization — Gold reclaims the throne.

When fear wins, this metal doesn’t blink. It rises.

From Ancient Tombs to 2025 – Gold’s Unshakable Throne

• Today, you stare at candlesticks.

You mark order blocks, gaps, and key level zones.

But beneath that technical setup is a story written in blood, empire, and survival.

• Gold has outlived Kings. Outlasted currencies. Outsmarted every attempt to replace it.

You can crash a stock. You can ban a coin.

But you can’t cancel this number 1.

• And now? It’s 2025.

The world is uncertain. Digital assets are volatile.

And Gold is still the most traded, most hoarded, most feared asset on Earth.

• You’re not here by accident. You chose to trade this beast — not because it’s easy, but because you know what it means to master chaos.

So you’re not trading a metal.

You’re trading a legacy, so pay respect.

Every setup is a whisper from history — and every move on Gold is just the past repeating itself…

Only this time, the empire isn’t outside.

It’s YOU.

And your chart is your battlefield. So make an effort and study XAUUSD before trading it.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

The Market Rewards the PatientLast week was probably one of the slowest weeks I’ve ever had. I found two setups, but neither one truly materialized. They just didn’t meet all the conditions in my plan. It was tough. I won’t pretend it wasn’t tempting to drop my rules and chase other strategies just so I could be in the market.

But deep down, I knew exactly what I wanted. I want to be consistent . I want to trade like a professional . So I held back. All week, I watched and waited. No trades taken. It was boring, honestly . But that boredom protected my capital.

Instead of forcing trades, I spent the entire weekend backtesting , drilling into my strategy even more. I wanted to be sure that when my moment came, I’d recognize it without hesitation.

Then this week started. I didn’t know if it would be any different, but I trusted my process and stayed ready. Eventually, one clean setup appeared. I shared it here on TradingView. I managed my risk properly , took half my usual size at just 0.5%, and let the trade run. It almost hit my stop, but I didn’t touch it. It was simple: either TP or SL .

And this time, it hit TP. A clean 1:4.

This was a powerful lesson. Following my plan didn’t just lead to a winning trade. It protected my capital all of last week when the market wasn’t offering quality setups. That patience and discipline paid off.

That’s how you build consistency. That’s how you survive long enough to catch the trades that truly matter.

The Power of Setting SL and TP: Secret to Mastering Your TradeThe Power of Setting SL and TP: The Secret to Mastering Your Trade

Hey there, traders! 👋 Let’s talk about something that can make a world of difference in your trading journey – Stop Loss (SL) and Take Profit (TP). These simple tools may look basic, but they are essential for every trader to stay consistent and profitable in the long run.

In today’s post, we’ll dive into the importance of setting SL and TP for each trade and how these two tools can change your trading game. Whether you’re new to trading or have been in the game for a while, understanding and applying SL and TP correctly is key to building a solid and profitable trading strategy. Let’s get started!

1. What Exactly Are SL and TP?

Stop Loss (SL):

A Stop Loss is the level where you decide to cut your losses if the market moves against your trade. It's your safety net, ensuring that your losses stay manageable. For example, if you’re trading XAU/USD at $1800 and don’t want to lose more than $50, you’d set your SL at $1750.

Take Profit (TP):

Take Profit is the level at which you’ll close your trade once the price reaches your desired profit. This helps you lock in profits automatically, without the temptation to stay in the market too long. For example, if you think gold will rise to $1850, you’d set your TP at that level to secure the profit.

2. Why Are SL and TP Crucial?

A. Eliminating Emotion from Your Trades

One of the hardest challenges in trading is keeping emotions out of the equation. Fear and greed can cause you to hold onto losing positions for too long or exit too soon. SL and TP automate your exits, allowing you to trade with a clear plan and reduce emotional decision-making.

B. Managing Risk Like a Pro

Risk management is the backbone of any successful trading strategy. SL limits your losses by setting a predefined level where your trade will automatically close. Without SLs, you could risk losing more than you intended, which can damage your trading account.

C. Securing Consistent Profits

TP helps you to capture profits at the right time. Without it, you might let your profits slip away as the market moves against you. A TP ensures you don’t miss out on locking in gains when the market reaches your target.

D. Building Consistency

By setting SL and TP, you create a consistent and structured approach to your trading. If you trade with a 1:2 risk-to-reward ratio, where you risk $1 to make $2, you can build long-term profitability, even if you lose some trades along the way. Consistency is the key to success in trading.

3. How to Set SL and TP Like a Pro

A. Start with Proper Analysis

Before entering any trade, always analyze the market context. Use technical analysis (like support and resistance levels, Fibonacci, and trendlines) to place your SL and TP at logical levels. For example, set your SL slightly below support for a buy trade, or slightly above resistance for a sell trade.

B. Risk-to-Reward Ratio

A good rule of thumb is to have a 1:2 risk-to-reward ratio. This means if you risk $50 on a trade, you aim to make at least $100. This allows you to lose half of your trades but still come out ahead in the long run. Always set your TP in relation to your risk tolerance.

C. Use Indicators to Help

Use indicators like EMA, RSI, Fibonacci retracements, and pivot points to determine the best levels for your SL and TP. For example, if you see a strong bullish trend and are entering a buy position, placing your TP near the next Fibonacci extension level is a great strategy.

D. Keep Volatility in Mind

Market volatility plays a big role in where you place your SL and TP. In highly volatile markets, tight SL might get hit too early. Adjust your SL to reflect the market’s movement. Similarly, your TP should be flexible enough to account for volatility.

4. Benefits of Setting SL and TP

A. Reducing Emotional Trading

Emotional trading is the quickest way to lose money. SL and TP take emotion out of the equation, making trading more objective and disciplined. You know exactly when you’re getting in, and when to get out – no guessing!

B. Avoiding Overtrading

Without clear SL and TP levels, you might overtrade, holding positions for too long or exiting too early. This lack of structure leads to emotional decisions and bad habits. Having SL and TP in place ensures that you trade only when it makes sense.

C. Gaining Confidence

By setting clear SL and TP levels, you gain confidence in your trading strategy. You know that your risk is limited and your profits are protected. This allows you to trade with a calm mindset, focusing on quality trades instead of rushing into everything.

5. Conclusion

Setting SL and TP is one of the most important skills for any trader, whether you're new to the market or experienced. They help you manage risk, capture profits, and build a disciplined approach to trading. By incorporating SL and TP into your trading plan, you can protect your capital, lock in profits, and ensure consistent growth in your trading journey.

So remember, Plan your trade and trade your plan – and always set your SL and TP before entering any trade.

Happy Trading! Stay disciplined, stay profitable! 💰🚀

Wait for your EDGE...

Discipline is what separates professionals from amateurs.

Stay patient. Wait for your edge. Let the probabilities work in your favor.

👉 “Agree with this? Hit Boost to spread the message.”

#TradingPsychology #Discipline #BTC #Bitcoin #Forex

#TradingMindset #AlBrooks #TradingDiscipline #PriceAction #ForexTrading #CryptoTrading #StockMarket #MJTrading #TradingQuotes #TraderLife #MindOverMarkets

Why Gold Trading is Not Easy for Beginners - Trading PsychologyGold Doesn’t Just Teach Trading. It Teaches You Discipline.

1. Why Gold? Why Not Everything Else?

Gold is the most honest manipulator in the market.

It respects structure down to key intraday levels—but builds traps around it like a pro.

It fakes direction, sweeps liquidity, teases early entries, then moves beautifully for anyone patient enough to wait.

And it’s daily: one premium buy and one killer sell almost every day—hundreds of pips on the table for eyes that can see.

Other assets feel slow once you lock into Gold’s rhythm.

So what to expect:

2. The Phases Before Profit

• Lucky Dumb Money

Early wins boost your confidence. You increase your risk. It all feels easy—until the market proves otherwise.

• The Slap

Suddenly, things don’t work anymore. Indicators stop making sense. Emotions interfere. Results shift, and frustration creeps in. This is the breaking point for most traders. 6 months to 1 year on XAUUSD and they are out.

• The Awakening

This is when clarity begins. Indicators are dropped. Structure, liquidity, and timing take center stage.

What once looked random now starts to make sense.

Progress begins the moment YOUR EGO gets quiet.

Consistency only follows those who choose patience over panic.

3. Gold Is a Mirror

Gold doesn’t just reflect your trades — it reflects YOU.

Every personal flaw shows up on the chart: impatience, doubt, greed, fear, ego.

It mirrors your decisions, your reactions, your emotional patterns — all of it.

Blaming the market delays growth.

But the moment you turn inward, you begin to see the truth:

your results reflect your level of discipline, clarity, and self-awareness.

Gold forces you to evolve.

Not just as a trader, but as a thinker, a decision-maker, a human.

That’s why it’s not for everyone. Some people are not ready to recognize who they truly are yet.

4. What Leads to Profitability

What actually leads to profitability in Gold?

It’s fast. It’s full of adrenaline.

But you have to get a routine - consistent, structured, and effective — when applied with discipline.

→ One pair only. Mastery on XAUUSD

→ Structure first. Liquidity, imbalance, session timing

→ Fewer trades, cleaner entries

→ Smaller lots, more control = emotions are in check

→ Relentless observation. Learn from each execution and adjust with intention

This is what leads to results.

Not noise. Not hope. Just precision and presence — again and again.

5. You Won’t Win Until You Commit

You don’t need to destroy your schedule or stay up all night.

But you do need to make time for growth.

Signals won’t help if you’re not willing to understand the asset you’re trading.

Gold filters out shortcuts, distractions, and surface-level effort.

But those who take it seriously earn every pip — and they earn it with clarity, not luck.

So stop asking,

“How long until I’m profitable?”

Start asking,

“Am I ready to do what Gold actually demands?”

CONCLUSION:

Most traders don’t fail because Gold is too complicated—

they fail because they try to figure it out alone.

They chase signals, skip the process, and ignore the real path to consistency:

invest in education, proper mentorship, and trading psychology coaching.

The ones who grow fastest are those who seek guidance early—

from people who live and breathe this market, and understand structure, mindset, and pressure.

If you choose to go at it alone, that’s also a good choice.

Just know: it will take longer. It will test your patience and your clarity.

But when the structure clicks… when you stop chasing setups and start executing with confidence…

When you secure 3–4 solid trades a week and avoid unnecessary losses—

everything changes. Trading becomes calm. Focused. Even enjoyable.

Whichever path you take, the outcome depends on the same thing:

Gold won’t just test your trades.

It will develop your discipline.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Master the Trio => to Level Up Your Trading🧠Most traders obsess over chart patterns and price action—but lasting success comes from mastering three pillars together:

Technical Analysis. Risk Management. Trading Psychology.

Miss one, and the structure collapses.

Let’s dive into each one, and see how they work together like a high-performance trading engine:

📈 1. Technical Analysis – Think in Layers, Not Lines

Most traders draw lines. Great traders read behavior.

Instead of asking “Is this support holding?”, ask “Why would smart money defend this level?”

Markets aren’t driven by lines—they’re driven by liquidity, trapped traders, and imbalances. That’s why:

A fakeout isn’t failure—it’s often a feature.

A breakout isn’t a buy signal—it’s bait.

Trendlines aren’t magic—they’re just visualizations of collective bias.

🔍 Advanced tip: When analyzing a chart, map out:

Where liquidity is resting (above equal highs/lows, tight consolidations)

Who’s likely trapped (late buyers at resistance, early sellers during accumulation)

Where the market must not go if your bias is correct (invalidations)

The real edge? Seeing the chart as a battle of intentions, not just candles.

🛡️ 2. Risk Management – Your License to Play the Game

Every trade is a bet. But without proper risk, it’s a gamble.

Risk management isn’t just about stop losses—it’s about position sizing, asymmetry, and survival.

I risk no more than 1% per trade , regardless of conviction.

I aim for 2R minimum —because even with a 50% win rate, I still grow.

I define my invalidation before I enter, never after.

You can’t control the outcome, but you can control your exposure. That’s professional.

🧠 3. Trading Psychology – Where Most Traders Break

You can have the perfect setup and smart risk, but still sabotage yourself.

Why? Because emotion overrides logic —especially when money is on the line.

Ever moved your stop? Chased a candle? Closed a trade too early, only to see it hit your TP later?

That’s not lack of skill—it’s lack of emotional discipline.

What works for me:

Journaling every trade—not just the result, but how I felt

Practicing “sit tight” discipline after entries

Reminding myself that no single trade matters—only the process does

You don’t trade the chart—you trade your beliefs about the chart. Master yourself first.

🔄 Final Thoughts

Trading isn’t just about entries.

It’s a mental game played on financial charts, where edge lies in understanding market mechanics, protecting capital, and staying emotionally grounded.

TA shows you the “what”

Risk shows you the “how much”

Psychology decides the “how well”

Master all three—and you’ll separate yourself from 95% of traders.

💬 Which of the three is your strongest? And which one needs more work?

Let’s grow together—drop your thoughts in the comments 👇

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Embracing Uncertainty

In trading, the illusion of certainty is often our biggest enemy.

Even the cleanest setups—like a MTR (Major Trend Reversal)—can fail.

Mark Douglas said it best:

“Anything can happen.”

This simple truth is what keeps professional traders humble and disciplined.

Respect the market, manage your risk, and never assume you know what comes next.

Stay sharp.

#MJTrading

#GoldTrading #XAUUSD #TradingPsychology #AnythingCanHappen #MarkDouglas #ForexMindset #TradingQuotes #PriceAction #RiskManagement #MindOverMarkets #ChartOfTheDay #MJTrading

Master Your Edge: It’s Not About Just Being Right

Most traders obsess over being right on every trade. But the truth is, consistent profitability doesn’t come from perfect predictions—it comes from disciplined risk management.

Mark Douglas reminds us:

“Trading is not about being right or wrong. It’s about how much you make when you’re right and how much you lose when you’re wrong.”

Focus less on proving yourself right, and more on protecting your capital when you’re wrong. That’s how professionals thrive in uncertain markets.

#MJTrading

#TradingPsychology #MarkDouglas #ForexMindset #TraderMindset #EURUSD #TradingQuotes #ForexLife #RiskManagement #TradingDiscipline #ForexEducation #ChartOfTheDay #PriceAction #MindOverMarkets

XAUUSD - Prop firm or your own account? - Trading Psychology"$100K Funded? Or $1K account you own?? Welcome to the Inside Battle of Every Trader"

You want capital, freedom and win big.

But the question is: do you do it with your own money, or someone else’s?

You’ve got the $100K funded dream on one side. Big leverage, strict rules, payout drama.

And on the other side? Your own $1K account. Zero limits, zero support, and a whole lot of emotional damage.

This is a breakdown of what really happens behind both paths — the adrenaline, the self-sabotage, the mind games, and the payouts that sometimes never come.

The Prop Firm Path: Pass, Survive, Then Pray

Phase 1: You trade with hunger.

You’ve got the goal in sight, and every move is calculated. You’re alert, focused, mechanical. The structure helps. The rules feel like a challenge. Everything feels possible.

Phase 2: You trade with fear.

Now you’re tiptoeing. The target’s smaller, but the pressure is suffocating. Hesitation.Overthink. You play defense — and that’s when you lose. You stop executing your edge and start trading to avoid failure.

Funded: The real test begins.

You go live, you trade well, you hit payout… and suddenly the firm has a problem. A new rule is “suddenly” enforced. A clause is reinterpreted. A delay happens. You’re told to wait. Or worse — your account is shut with no warning.

That’s the part no one prepares you for: the waiting, the silence, the mental snap.

Passing isn’t the end. It’s barely the middle.

✅ So, Should You Go Prop? Here's What You Need to Know

Yes — if you’re ready to treat this like a hostile contract.

If you’re trading a prop account, you are trading their rules, their terms, their timing. You are not a partner — you are a performer. And they are very comfortable pulling the plug.

If you do it:

• Be colder than the system.

• Read every rule twice.

• Trade Phase 2 like a surgeon — no ego, no rush.

• And never treat a payout like it's guaranteed — treat it like a fight you have to win more than once.

You don’t just pass. You survive.

And if you’re not ready to survive, stay out.

🚨 Do not forget — It’s Simulated Capital. And That’s the Game.

Let’s not pretend it’s hidden:

You’re NOT TRADING REAL MONEY. You’re executing on a simulated account that mirrors real conditions — nothing more.

When you get paid, it’s not because you “grew” capital. It’s because you performed better than the masses who failed their challenges and fed the payout pool.

This isn’t shady. It’s the model — and it works because most traders lose.

So don’t delude yourself into thinking you’re managing funds.

You’re monetizing discipline inside a challenge-based system.

And if you know how to work that system? You get paid.

If you don’t? You become someone else’s payout.

🔓 Trading Your Own Money: Real Freedom or Emotional Damage?

With your own capital, there’s no one watching — and no one helping.

You set the rules. You decide how aggressive, how cautious, how chaotic.

But the second you click “Buy,” your psychology comes for you like a debt collector.

Because real trading isn’t what’s on the screen — it’s what’s happening between your ears.

You lose your money, you lose your confidence.

You win big, and suddenly you think you’ve figured out the market — until the market slaps you for it.

There’s no one to blame, and that makes it ten times harder.

But here’s the part no one can take away from you: every lesson is yours.

Every win is clean. Every loss hits deep. And if you make it — you really made it.

💡 How to Make Self-Funded Work for You

✅ Start with small capital — but also invest in your trading education.

Join a group that teaches you how to trade, not signal groups that just give you orders when to buy or sell, without explaining why.

✅ Join a real trading community.

Surround yourself with people who post actual breakdowns — who teach, not flex.

Avoid ego chats. Avoid circus chats. Find people who show the why, not just the entry.

(If you’re reading this, you already found the right space.)

✅ Focus on fixing mistakes — not faking wins.

Nobody cares how many pips you caught if you blew 5 trades getting there. Get real about your risk management and lot size.

✅ Learn to stop after a win.

Don’t feed your dopamine. Protect your equity. Walk away while you’re still in control.

✅ Respect your losses. Don’t chase them.

Red days don’t destroy traders. Revenge trading does. Stop. Reset. Come back sharper.

✅ If you’re not paying yourself yet, don’t panic.

Some seasons are for building, not cashing out. Don’t force results just to feel good — let the system earn before it pays.

🔄 The Hybrid Advantage: Rent the rules. Own the skill.

Some traders don’t pick a side.

They use prop firms like a hired weapon — fast, effective, disposable and

Personal accounts like a vault — protected, scalable, sacred.

They switch between them based on market conditions, mental load, and long-term goals.

You don’t need to be loyal to a style just be loyal to your results.

🧠 Final Word:

Trading becomes real, sustainable, and successful only when your mind is at peace with the path you chose.

If you wake up anxious about your account — if you feel pressure before you even open the chart — that’s not discipline, that’s misalignment.

This doesn’t mean trading should feel easy. But it should feel right.

You should wake up curious to read price, not terrified to take a trade.

Whether you trade $100K or $1K, the real account is always in your head.

You should feel like this work belongs to you — not like you’re trying to survive someone else’s idea of success.

Whether you trade with a prop firm or your own account, or both, the goal is the same:

Mental clarity. Emotional control. Strategic confidence. You’ll know you’re on the right path the moment the stress fades — and the obsession becomes patience, structure and joy with success.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Your Edge Isn’t Just Technical, It’s PersonalMost traders obsess over their strategy: Which indicator? What session? What entry signal?

But very few stop to ask the question that could change everything: “Does this style actually fit who I am?”

The Truth Most Don’t Talk About

Trading success is not about copying someone else’s edge. It’s about discovering your own edge, and that begins with self-awareness .

And it hit deep because this is the part of trading psychology we often skip.

Some Real Talk

If you’re naturally calm and risk-averse, trying to scalp news spikes will drain you.

If you’re fast-thinking, decisive, and love volatility, swing trading might feel like watching paint dry.

If you thrive on rules and structure, discretionary trading might feel chaotic.

If you're intuitive and adaptive, being forced into mechanical rules may kill your edge.

You’re not underperforming because you lack discipline, you’re likely just misaligned.

What Changed for Me

I stopped trying to “be the trader” everyone said I should be. And I started trading like me.

I built a system that fits my mental rhythm.

I gave myself permission to simplify.

I became consistent not because of a new setup, but because I removed internal friction.

Final Thought:

Your best trades don’t just come from the chart. They come from a place of alignment, when your mindset, risk tolerance, and system flow together. So before chasing another strategy, ask yourself: “Is my trading style in tune with my personality?”

Your Trading System Isn't the Problem. Your Discipline Is.📘 Your Trading System Isn't the Problem. Your Discipline Is.

Hard truth:

Your endless search for a new system is a smokescreen.

The best system in the world can't save you from poor discipline.

Here's why discipline matters more than your strategy:

You quit your system after a few losses, never allowing it to prove its value.

You deviate from your rules when emotions run high—wrecking consistency.

You're focused on shiny objects instead of sharpening the knife you already have.

🎯 The solution?

Commit to discipline. Track your adherence rigorously. Measure your success by consistency, not immediate outcomes.

TrendGo’s power isn’t just in clear signals—it's in enabling disciplined action.

🔍 Stop blaming your tools. Own your discipline.