Gold XAUUSD Summer Price Action - Trading Psychology☀️ Summer Trading Blues? Here’s How to Stay Sharp Without Burning Out

Summer trading on Gold isn’t for the impulsive or the greedy. Liquidity dries up, sessions lose momentum, and the clean, aggressive price action we love? It goes on vacation too.

But that’s not a bad thing. It’s an opportunity.

This is the season where traders either burn out... or build.

Here’s how to keep your edge sharp while the markets slow down — and why a positive, focused mindset is your biggest asset until volatility returns.

Why Summer PA Feels “Off” on Gold

You’re not imagining it — gold price action does shift in the summer, and here’s why:

🏖️ Bank Holidays & Institutional Slowdowns

• Major global banks take scheduled breaks — including in the US, UK, EU, and Asia.

• Trading desks reduce activity, and high-volume players shift into passive management mode.

• This results in lower volume, fewer impulsive moves, and more algorithmic fakeouts.

📆 Official Holidays + "August Mode"

• US Independence Day (July 4), UK Summer Bank Holiday (late August), and more → NY and London sessions thin out or lack follow-through.

• Most institutional traders go on leave. Some desks run skeleton crews. No joke.

• Unless a major geopolitical catalyst (e.g. war escalation or surprise central bank move) hits the headlines, price will drift or trap.

🏄♂️ Retail Overreach & Emotional Traps & Vacation Time

• Retail traders often “force” trades in quiet markets to stay busy.

• This leads to chasing, overtrading, and emotional fatigue — the exact trap smart traders avoid.

• Most regular traders also go on vacation or scale back — unless they’re mentally obsessed with Gold and can’t let it go.

Bottom line:

Summer PA is slower, trickier, and full of emotional bait. Learn to read the stillness — not fight it.

💡 Your Summer Trading Mindset Kit

Instead of complaining about the range, use this time to train your mindset.

Here’s how:

⚖️ Stay Emotionally Neutral — Even When Price Isn’t

Summer markets bait your emotions: fake breakouts, slow reactions, and dead zones.

To stay in control, build structure around your execution:

✅ Pre-market: Make a clear plan with meaningful zones and set alerts — don’t wing it on hopes and dreams

✅ Post-market: Write down why you stayed out or why your trade was clean — not just wins or losses

Neutrality isn’t passive — it’s disciplined clarity, even when the chart’s doing nothing.

🎯 Focus Over FOMO

Short sessions. Laser focus. Clean execution.

→ Limit distractions

→ Trade only clear, structured setups

→ Respect no-trade days as productive days

Flow isn’t magic — it’s discipline + environment.

🤝 Find the Trading Circle That Matches Your Style — to reinforce your style

Not every group fits you — and not every voice deserves your attention.

Look for people who:

• Respect structure over noise

• Give thoughtful, honest feedback

• Celebrate patience and growth, not screenshots and bragging and 20-30 pips wins

A real trading circle matches your energy and raises your game — not your cortisol.

💭 Reconnect With Your “Why”

If you’re here just to “make money,” summer will test you hard.

Purpose anchors you when price doesn’t. Ask yourself:

• Why do I trade?

• Who am I becoming through this process?

No purpose = burnout.

Purpose = clarity, even in silence.

📈 Discipline Pays When Gold Doesn’t

Forget chasing fireworks in dead markets.

Summer rewards the trader who does less but does it right:

✅ You skipped noise? That’s a win.

✅ You waited for your zone? Pro-level move.

✅ You tracked your behavior? You’re not guessing — you’re evolving.

While others burn out chasing crumbs, you’re stacking discipline — and that’s what you’ll cash in when the real moves return.

Final Words: Quiet Traders Get Loud Later

Summer might be slow. But your growth doesn’t have to be.

While others force trades, smart traders sharpen edge.

You’re not falling behind by sitting out chop — you’re building mastery for when real money moves return.

🗓️ So in September YOU are going to show up: stronger, clearer, and 3x more prepared.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Tradingpsyhology

Location, Location, Location!!!Knowledge is Power!

But how deeply do most people really understand this?

The average mind thinks power comes from possessing knowledge. But here’s a deeper truth — simply imagining yourself with mastery can trigger powerful feelings. Why? Because as Terence McKenna once described, the human brain is a chemical factory. An inspired thought — a glimpse of future achievement — can activate a cocktail of serotonin and dopamine, giving us a real sensation of power. And yet… did anything really change?

This is where ancient voices — shamans, philosophers, and modern mentors — whisper:

“You are already there…”

But are you really?

The answer is Yes… and No.

You feel the outcome, but you haven’t earned it yet. You’re not truly there until you’ve gone through the effort — the hours and hours of disciplined study, reflection, and ignoring the mental traps like “take a break,” “you have time,” or “scroll a bit.” Power, in this case, is the Knowledge itself — and to approach Power, you must become Power. Or else, it will crush you — like a boot crushes an ant. (Yes, that’s borrowed from the Avengers… we all need a laugh too.)

To actually reach that imagined reality, you must prove yourself to the knowledge itself. You have to earn it — through discipline, sacrifice, and unbroken focus. That means hours of study, observation, application, and repetition — no matter how many distractions your mind throws at you.

Focus on one subject until it bends for you.

Focus like your life depends on it.

Because in a way… it does.

🧠 Opportunity Cost = Power Equation

This focused, intentional work is what economists call Opportunity Cost. It’s the measure of how productively you spend your time. Every marked level, every reaction, every shift in volume is either:

• A step closer to mastery, or

• A missed opportunity, depending on what you choose to focus on.

TradingView becomes your journal.

A sacred workspace in the chaos.

A tool to track your evolution — mentally and technically.

🔍 The SHIBA/USDT 4H Breakdown

On the 4H chart of Shiba Inu, key swing levels are marked — targets that can serve as entry/exit decisions depending on your strategy.

But the magic is not in the lines.

It’s in how volume reacts to those levels.

🔺 Volume — The King

Currently, the 4H Volume shows signs of a bearish continuation. But lower timeframes are beginning to show the initial signs of accumulation — strength where weakness used to live.

This is the beginning of Effort vs Result analysis:

• Are we seeing strong volume but no progress? (Demand absorption?)

• Are we seeing low-effort pushes into supply that fail to break key levels?

That’s how Smart Money behaves. Quietly, strategically, and always one step ahead.

And all this happens near key demand/supply zones — where Location meets Volume.

🔄 Timeframe Psychology: Past–Present–Future

Lower timeframes = The Past (they push).

Higher timeframes = The Future (they pull).

Your active timeframe = The Now — where you make your move.

A shift on the 3M chart might hint, but until it aligns with the 1H or 4H, nothing is confirmed. That’s why true traders are observers first, executors second.

🎯 Alignment: Levels, Volume, Effort

• 📍 Levels: They are not just technical — they are psychological battlegrounds.

• 🔊 Volume: It shows us where energy is being spent and whether it’s paying off.

• 🧱 Effort vs Result: The ultimate measure of Smart Money’s hidden hand.

When everything aligns, you don’t guess — you act.

🧭 Final Thoughts

At the time of this writing — 17:26 IST on June 18, 2025 — the 4H chart remains bearish in tone. But markets shift fast, and for all I know, a power transition could be unfolding on a micro timeframe as I type. That’s the nature of this game.

TA is not rigid. It is an art.

And once mastered, it becomes a part of how you think — not just how you trade.

Use your time wisely.

Let your focus become your fortress, and that fortress will guard you through every storm.

Work Smart. Think Deep. Act with Purpose.

Study the Bitcoin and Bitcoin Dominance cycle to understand altcoin flow.

Explore previous posts — I’ve shared them to help you grow.

The market is a breathing organism, I’ve pointed this in previous ideas. If you’re in sync with it—you’ll feel it.

And for those who believe there’s more to learn—but are struggling to find answers—there’s no shame in asking questions. But remember, nothing in the market is free.

Work Smart, and you’ll earn the right to follow — and even think like — Smart Money.

Till next time, take care—and trade wisely.

XAUUSD - Overtrading and Revenge Trading - Trading PsychologyFrom Chaos to Control: Mastering the Art of Balanced Trading on Gold

Trading gold is exhilarating. It’s fast, volatile, emotional — and addictive.

But what most traders don’t realize is this: it’s not the market killing your account.

It’s you, pressing buy and sell like it’s a video game.

Over-trading is the silent account killer. It doesn’t scream. It whispers:

“Just one more entry.”

“Maybe this one will finally run.”

“Let me scalp this quick pullback…”

Before you know it, you’ve taken 12 trades by noon and your brain’s fried.

🧠1. Why Over-Trading Happens: The Dopamine Delusion

Over-trading isn’t just a strategy flaw. It’s chemical. Your brain rewards anticipation of profit — not just actual wins.

So every setup, every near-miss, every “maybe I missed the move” spikes your dopamine.

That’s why you keep clicking. Not because you saw a valid setup.

Because your brain craves the rush of imagining one.

This is why traders enter in zones they never marked, skip confirmation, and rush into impulsive entries.

The market didn’t give a signal. Your nervous system did.

📉2. The Real Damage: Not Just Losing Trades — Losing Discipline

Over-trading ruins more than your account. It ruins your edge.

• You stop following your plan

• You chase liquidity like a gambler

• You get shaken out of clean zones

• You increase risk, just to “make it back faster”

And worst of all? It feels productive.

But profits don’t come from activity. They come from precision.

If you don’t reflect about your actions, you repeat the bad ones.

💸3. The Financial Fallout: Over-Trading Blows Up Accounts

Over-trading nukes your capital.

• One extra trade becomes five

• SL gets wider or invisible because your entry was rushed

• Lot size gets heavier to “speed up” recovery

• Now you’re emotional, and revenge mode kicks in...

You’re not compounding anymore.

You’re compounding mistakes.

This is how smart traders blow up challenge accounts.

This is how funded accounts get revoked.

This is how small accounts die before they grow.

Over-trading is a trap with a $0 exit.

✅4. Tactical Fixes: Trade Smart, Live Smarter

✔️ Set a daily trade cap.

Limit yourself to 2–3 trades. If you keep entering, it’s not analysis — it’s compulsion.

✔️ Split your daily risk.

Risking 0.3% total? That doesn’t mean 0.3% per trade. Break it down, or you’ll break your account.

✔️ Set alerts — not alarms in your brain.

Stop watching every candle like it’s a soap opera.

Set TradingView alerts at your key zones and walk away.

The market doesn’t move faster just because you're glued to the screen.

✔️ Take real breaks — not just chart scrolling.

Go outside. Call someone or send time with family and friends. Eat good food.

Most traders come home from work and go right back into charts like it’s their second shift.

That’s not discipline. That’s burnout.

✔️ Build a life that doesn't revolve around entries.

The more you lose, the more you trade. The more you trade, the more you spiral.

It’s just like alcohol, drugs, gambling. Dopamine up. Reality down.

And the worst part? It looks like hard work from the outside — but it feels like slow death inside.

🧨5. From Over-Trading to Revenge Mode

If over-trading is the first crack in your foundation, revenge trading is the wrecking ball.

And it never starts from logic. It starts from pain.

You had a clean setup.

You got stopped out — maybe twice.

Now you're frustrated, humiliated… embarrassed.

You’re no longer reacting to price.

You’re reacting to loss.

Revenge trading doesn’t feel chaotic in the moment.

It feels righteous.

You convince yourself, “I just need one win to get it all back.”

😵💫6. The Emotional Spiral Traders Don’t Talk About

Over-trading and revenge trading are addictive.

You’re showing up to work. You’re posting charts. You’re pretending it’s fine.

But deep down?

You're wrecked. Emotionally, financially, and mentally.

This is the side of trading no one glamorizes.

The isolation. The loneliness. The pressure. The self-blame.

This is how people burn out — not from one bad week.

But from trying to trade their way out of pain.

⚠️ Final Word

Over-trading is not a badge of hustle.

It’s the first step toward emotional dependence on the market.

And that’s the most expensive habit you’ll ever form.

If you don’t catch it early, you’ll keep blaming the market, the spread, the broker…

when the real damage was done by your own reaction.

The market doesn’t owe you anything.

So be kind to yourself and build discipline, you will win in the long run.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

My BTC Play With a Macro BoostThis isn't about guessing.

This isn’t hype.

This is what happens when structure, liquidity, and macro fundamentals align.

Let me break it down:

Technical Perspective

BTC just pulled a classic trap.

✅ Liquidity Sweep: Price dipped below the 4PDL (Previous Day's Low), sweeping out late longs and triggering emotional shorts.

✅ Break of Structure (BOS): Price broke cleanly broke strucutre, confirming bullish intent.

✅ Fair Value Re-entry Zone: We now have a clean FVG zone if price pulls back.

But that’s not all...

🔼 Retail Pattern Detected :

Look closely, there's a textbook ascending triangle in there. Retail traders often use it to predict bullish breakouts. What they see as a triangle, we see as smart money coiling pressure before the move.

Fundamentals Supporting the Structure

This move isn’t just technical, it’s backed by real market weight:

Public companies are buying Bitcoin by the billions: MicroStrategy, Trump Media, Metaplanet they’re not “speculating,” they’re storing BTC as a treasury asset.

Institutional inflows are accelerating: ETFs, sovereign interest, and large-cap investors are building long positions — and it’s beginning to reflect in the chart.

The U.S. is formalizing a Bitcoin reserve policy.: Call it political, strategic, or monetary — either way, it reinforces that dips like this are being bought by giants.

The candle doesn’t lie but neither does the macro narrative when they both point in the same direction.

Mindset Tip: Ride Logic, Not Emotion

This setup teaches us something important:

You don’t have to catch every move. You just need to understand why it moved — and position accordingly.

If it pulls back, don’t panic. Let the market invite you, not rush you.

XAUUSD - Emotional Scalping on Gold Leads to Blown Accounts📔 “I’ll just scalp Gold on the 1-minute” — said the future blown account

Gold doesn’t care about your emotions.

It doesn’t care that you think you can catch a move before it happens.

And it definitely doesn’t care about your $50 dream from a 20-pip scalp.

Real Gold traders don’t come for 20 pips.

They come for precision, for structure, and for 80–100 pip setups backed by real confluence.

If you’re pressing buttons on the 1-minute because you “feel it,”

you’re not trading Gold — you’re feeding it.

And it will eat you alive.

⭐1. Gold is Not a Currency Pair — It’s a Metal with a Temper

You’re not trading EURUSD.

You’re trading a metal — one of the most reactive and manipulated instruments in the market.

Gold doesn’t respond like a normal pair.

It reacts like a sensor. A trigger.

🔸 Geopolitical tension? It spikes.

🔸 USD news? CPI, NFP, FOMC — massive moves.

🔸 Imbalances and inducement zones? It respects them with surgical precision.

🔸 Thin liquidity or Asian session? Expect the unexpected.

Last night, due to a political situation Gold didn’t hesitate.

It exploded — hundreds of pips — while other pairs just twitched.

And here’s the truth:

🔱 Gold is the most loved asset on the planet.

• It’s wealth.

• It’s power.

• It’s culture.

• It’s fear and greed — in physical form.

That’s why it dominates the market.

That’s why it’s unpredictable.

And that’s why you need to approach it with respect — not emotion.

⏱️ 2. The 1-Minute Trap: Why You’re Always Late

On M1, there is no structure — only speed.

By the time you “see a pattern,” you’re already the exit liquidity.

Order blocks? FVGs? Choch?BOS?

They’re there… but barely readable in real time unless you’re hyper-trained.

You’re not early.

You’re late — many, many times.

And Gold punishes late entries without mercy.

So what should you do instead?

🧭 Zoom out. Reset. Re-anchor.

Start with D1-H12-H4-H1. Mark the structure.

Drop to M30/15/5 to refine your zones.

Then — and only then — use M1 as a trigger, not a chart to trade blindly on.

M1 is for confirmation — not discovery.

It shows behavior, not bias.

And if you treat it like a full chart, it will bury your account one candle at a time.

🤓3. If You're New — Respect the Timeframes

If you’ve been trading Gold for less than 6 months,

you don’t need more entries. You need more patience.

Work with:

✅ 1H

✅ 30m

✅ 15m

That’s where the story unfolds — clean, structured, readable.

Yes, study the lower timeframes.

Flip through M1, M3, M5, M7, M10…

Zoom in, zoom out. Train your eye.

And slowly, you’ll start to recognize the way Gold breathes — how it baits, spikes, pauses, and traps.

But execution?

Execution stays clean, until your structure reads faster than your fear.

🚨4. Gold Doesn’t Just Move Fast — It Gets You Hooked

Gold isn’t just volatile — it’s addictive.

You win once… you feel unstoppable.

Twice… now you think you’re the chosen winner.

And just like that, you’re hooked.

You start ignoring your loss, because those two wins gave you more dopamine than a full week of consistency.

You don’t even notice you’re in a loop:

→ Two wins

→ Five losses

→ One clean trade

→ Three more losses

→ Still confident… because of one high

You’re not trading structure.

You’re chasing a chemical high — and Gold is your dealer.

That’s why M1 destroys accounts.

Because the more you “almost catch it,” the more obsessed you get.

You don’t need a new setup.

You need to break the loop.

Walk away, breathe, come back and trade less.

😶🌫️ 5. If Your Mind is Not Calm — Stay Off the Chart

Gold will test your technicals — but it’ll destroy your psychology if you’re not stable.

Had a bad day at work? Argued with someone? Feeling off?

Do. Not. Trade. Gold!!

This metal feeds on instability.

It senses when you’re not focused.

And it will punish you faster than you can say “SL hit.”

💬 “You trade what you feel. So if you’re a mess inside, your chart becomes chaos too.”

🔚 Bottom Line: You Don’t Need More Trades. You Need Better Vision.

Scalping Gold on M1 sounds smart.

Feels efficient. Looks exciting.

Until you’re left with a blown account and a broken mindset.

🫶 Want to stop gambling and start dominating?

Start with patience. Stick to timeframes. Learn the rhythm.

Gold is not for the impulsive — it’s for the precise.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

XAUUSD - Trader's psychology - Hesitation⭐The Setup Was Perfect, and You...

You did everything right.

Marked the zone. Waited for price. Saw the reaction.

But you didn’t take the trade — or you hesitated, entered late, and missed the real move.

Sound familiar?

This article isn’t about strategy. It’s about what happens between your plan and your execution — and why even the most perfect setups won’t save you if you’re not mentally ready to pull the trigger.

🚨 Why Hesitation Happens

Most traders don’t miss trades because the setup wasn’t unclear.

They miss because of inner conflict.

❗ They doubt their read

❗ They chase confirmation

❗ They fear being wrong

❗ They overanalyze instead of executing

The irony? The more they learn, the worse it gets — because more information means more pressure to be right.

🔁 Here’s how it usually looks:

You watch price approach your zone.

It taps in — but instead of entering, you stare, waiting for a candlestick pattern or a feeling of “certainty.”

By the time you move, the market already made the move.

Now you’re chasing, or watching in frustration.

It’s not your setup that failed.

It’s your ability to act in the moment.

🧩 The Identity Problem

You don’t trade what you see.

YOU TRADE WHAT YOU BELIEVE ABOUT YOURSELF. (Read this again and again!)

A trader who doesn’t truly believe they deserve to win will sabotage themselves in the most subtle ways:

They’ll wait too long

Or enter too early

Or close too fast

Or move the SL to feel “safe”

Not because the chart said so — but because their inner narrative said:

“You’re probably wrong. You mess it up too much. Play it safe.”

If you act like a spectator, you’ll always miss like one.

The market doesn’t reward analysts. It rewards conviction.

🔁 The Real Pattern: Overthinking > Hesitating > Missing > Frustration > Revenge

It’s a loop. And it starts with not trusting your process.

Once you hesitate, everything spirals:

You miss the clean entry

You enter late and take a worse R:R

You get stopped out or close early

You enter another trade out of revenge

You lose again — and blame the setup

But the setup wasn’t the problem.

You weren’t ready.

🔨 Fixing the Execution Gap

How do you stop hesitating?

Not with journaling. Not with meditating. Not with fluff.

You stop by building clarity — fast.

✅ Before the session, take a few minutes.

Ask yourself:

What setup am I waiting for?

What would cancel it?

Say it out loud. That’s it.

✅ When price enters the zone, say:

“This is it. Let’s go.”

No overthinking. No pause. No doubt.

Imagine this: you’re watching Gold hit a reaction zone you’ve marked all morning.

Instead of watching five indicators, you’ve already made the decision.

Price touches → you execute. Done.

✅ After the trade, ask just one question:

Did I do what I said I’d do?

If yes, you won. Even if it lost.

🎯 Train the Moment

Want to build real confidence?

Start training the execution moment — not just the strategy.

Here’s how:

Visualize 2 types if entry before each trade.

“If price hits this zone and does X, I enter. If not, I don’t.”

🧠 Rehearse mentally.

Visualize the actual mouse click. Imagine price entering your zone and you acting decisively.

👁 Review only one thing each day:

Did I trust the zone and act — or did I hesitate again?

Execution is a skill. It gets sharper the more you drill it — before the trade is live.

💬 Final Thoughts

You already know the zones.

You already understand structure.

You just need more courage.

🎯 Learn to enter with intention.

🧠 Learn to trust the plan you built.

And start becoming the trader you keep pretending you already are.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Gold execution psychology - why do your trades fail on XAUUSD?🎯 You Knew the Zone but the trade failed.

Execution psychology for Gold traders who are tired of guessing.

You marked the zone.

You waited for price to tap into it.

Maybe you even caught a reaction — but the trade failed anyway.

Not because the zone was wrong.

Because the execution broke down.

🧠 1. The Problem Isn’t the Zone. It’s the Trader.

There are two valid entry styles:

🔹 Bounce Entry

→ Enter on first touch of the zone

→ Works best when:

• Structure supports your bias

• Liquidity has been swept

• You're using a refined zone (OB, FVG, confluence)

→ SL must sit outside the zone — not inside it

→ Fast entries, fast rejections — but high responsibility, not for beginners.

🔹 Confirmation Entry

→ Wait for CHoCH or BOS on M5/M15

→ Enter on the retest

→ Cleaner invalidation, but slower execution

→ Less drawdown, but requires patience

⚔ 2. Your Stop Loss Was a Suggestion, Not a Standard

Gold isn’t EURUSD.

This pair moves 100–300 pips in minutes — and it will wipe out shallow SLs for fun.

Your SL must sit:

• Below the OB (not inside it)

• Outside the liquidity sweep

• Beyond the structural invalidation point

💰 Lot Size Must Match Your SL — Not Your Ego

We don’t increase lot size because we hope it will go perfect.

We always trade small — because Gold doesn’t need size to give payout.

The wider the SL, the smaller the lot.

That’s how you control risk and let price move.

We don’t chase leverage.

We prioritize precision, patience, and profit.

📉 3. After One Loss, You Lost the Plot

One trade didn’t go your way — now you’re flipping bias, skipping rules, and forcing setups.

That’s not trading. That’s emotional spending.

Real traders analyze the loss.

They re-read the setup.

They take the next trade — only if structure allows, even skip trading to the next day.

✅ So How Do You Fix It?

1. Define your entry style

2. Keep lot size small — even with 100 pip stops

3. Move SL to BE when appropriate

4. Walk away after 2 losses.

Accept that one good trade is better than 5 emotional entries, clear mind -cleaner executions.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us for more published ideas.

Trader’s Metabolism : “Dragon, Well Done… Please”Trading isn’t just skill.

It’s survival.

And survival isn’t a phase—it’s a permanent residency. It’s 90% of the job. The other 10%?

We’ll get to that when you’ve stopped bleeding.

Because when the market burns you down, it doesn’t just torch your wallet.

It leaves a mark. Personal. Intimate.

Like an ex who knew your passwords and your childhood traumas.

You don’t just lose money—parts of you are marked with an invisible highlighter and then used against you. That is the feeling. No specific term for it—it’s different for everyone, but it’s there.

A delayed punch. The shock hits first, then the sting.

You thought you were unfazed? Cute. It always hits.

Every loss leaves a signature.

You’re basically a walking hall of fame. Who’s fame though?

The market makers, the "manipulators" as some may say?

Of course there are traders who rise. It’s not because they cracked the code.

It’s because they paid the maintenance fee.

Not in dollars—but in discipline.

And the only way to pay that? You keep your trading metabolism in check—at all costs.

That spark of momentum?

Momentum doesn’t arrive in grand gestures.

It sneaks in through the absurd:

• Scrubbing your stove like it insulted your ancestors.

• Folding socks with military precision.

• Blending kale and chia like it’s alchemical fuel that could summon capital gains.

It’s ridiculous.

But it’s survival.

These micro-wins? They’re dopamine.

Pure. Primal.

When the market denies you progress, you hunt that feeling down elsewhere. Anywhere.

Invisible anchors.

Here’s the con:

You set a goal—“By this day, I’ll hit X and I’ll buy Y.”

Sounds motivational. Feels empowering.

It’s not. It’s a booby-trap with your name on it.

You just promised your nervous system salvation through consumerism. And when the market delays the payout?

That thing you prescribed? It becomes poisonous.

You’re not chasing gains—you’re fleeing your own unmet expectations. It drags. It suffocates. It taunts.

Euphoria’s Dark Side:

Dopamine doesn’t care if you’re building an empire or torching it.

You set a magic number. You dream about the condo. You think shiny gear will fix your edge.

Sure. Until it doesn’t. Then what?

You start resenting dreams you haven’t bought. Blaming the strategy that wasn’t the problem. Watching motivation rot into mockery.

Your trading plan looked good—right up until your emotions co-signed the exit.

That trade wasn’t bad.

You were.

And that’s the part we don’t backtest.

The Metabolic Reset:

How do you fight back?

You stop begging the market for meaning.

You stop trading for things.

You start building systems for hardcore exposure and unkind weather.

Discipline becomes your operating system—one that doesn’t crash, only upgrades.

We tend to address and slay the exterior dragons first:

Habits.

Routines.

Appearance.

Our environment.

Don’t get me wrong, they are an absolute must.

The acrobatic part is to turn inward—face the lurking dragons hidden beneath layered gates of facade in your psyche:

It’s typically titled, “This is how I am”.

The market doesn’t see you, let alone your dreams.

However it will mirror your chaos back to you, with laser precision. Like a funhouse reflection—only it costs real money and sanity.

This 2D screen you look at was built on leveraging you against yourself. Whoever made it is a sick genius who carved a niche in demand. Props to them. Diabolical. Elegant.

Honestly, deserves a Netflix origin story.

Maybe call it:

"The Algorithm: A Love Letter to Human Delusion. Starring you… as every character.”

The Fuel. This is your metabolism.

Messy. Brutal. Relentless.

But it’s also the separator. Between those who stay the same—and those who evolve.

So kill the fantasy.

Drop the anchors.

Burn the wishlist.

And if you ever do buy that yacht? Do Keep the AC running. Because the second you slack on overhead maintenance cost—you’re not sailing, you’re renovating… again.

So when you rebuild yourself for the ninth, twentieth, seventy-fifth time…thinking, “Surely this is it. I’m done now.”

You’re not.

It’s infinite.

Like they say, “More money, more problems…”

Well, more experience? More sophisticated problems.

The only thing left to do…is see yourself clearly enough that the market can’t use you against you anymore.

Keep slaying.

The tides do turn.

Just don’t forget: dragons respawn.

Craft

Learn the Harsh Truth About Success & Failure in Trading

The picture above completely represents the real nature of trading:

We all came here because we all wanted easy money.

Being attracted by catchy ads, portraying the guys on lambos, wearing guccies and living fancy lives, we jump into the game with high hopes of doubling our tiny initial trading accounts.

However, the reality quickly kicks in and losing trades become the norm.

The first trading account will most likely be blown .

In just one single month, 40% of traders will be discouraged and abandon this game forever.

The rest will realize the fact that the things are not that simple as they seemed to be and decide to start learning.

The primary obstacle with trading education though is the fact that there are so much data out there, so many different materials, so many strategies and techniques to try, so the one feels completely lost .

And on that stage, one plays the roulette: in the pile of dirt, he must find the approach that works .

80% of the traders, who stay after the first month, will leave in the next 2 years. Unfortunately, the majority won't be able to find a valid strategy and will quit believing that the entire system is the scam.

After 5 years, the strongest will remain. The ones that are motivated and strong enough to face the failures.

With such an experience, the majority of the traders already realize how the things work. They usually stuck around breakeven and winning trades start covering the losing ones.

However, some minor, tiny component is still missing in their system. They should find something that prevents them from becoming consistently profitable.

Only 1% of those who came in this game will finally discover the way to make money. These individuals will build a solid strategy, an approach that will work and that will let them become independent .

That path is hard and long. And unfortunately, most of the people are not disciplined and motivated enough to keep going. Only the strongest ones will stay. I wish you to be the one with the iron discipline, titanic patience and nerves of steel.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The Most Overlooked Setup in Trading: Your Own Decision ProcessTrading psychology at its finest — where the real edge begins.

Over time, I’ve realized that most traders obsess over systems, setups, and signals... but very few ever stop to ask: “How do I actually make decisions?”🧩

The truth is — every trade I take is a result of an internal process. Not just some rule from a strategy, but a sequence of thoughts, comparisons, and feelings I go through (sometimes without even realizing it). And when I mapped it out, it changed the way I approached the market. 🔄

Here’s what I found:

1.There’s always a trigger.

Sometimes it’s a chart pattern. Other times, it’s a shift in sentiment or an alert I’ve set. But that moment when I *start* to consider entering — that’s the spark. Recognizing that moment is the first step. ⚡

2.Then comes the operation phase.

That’s when I begin scanning. I look for setups, patterns, confluences — not just at face value, but through the lens of my experience. I start running mental “what-if” simulations, visualizing what the trade could become. 🔍

3.The test phase is critical.

This is where I mentally compare the current opportunity with past winners or losers. Does it “look right”? Does it “feel like” a good trade? That moment where a setup clicks isn’t just about indicators — it’s about internal alignment. 🧠

4.Exit isn’t just a price level — it’s a decision threshold.

Knowing when to act (or not) often comes down to a shift in internal state. For me, it’s usually a combination of visual confirmation + a gut signal. When both align, I act. 🎯

📌 Why does this matter?

Because most failed trades aren’t just “bad signals” — they’re *poorly made decisions*. If I don’t understand my internal process, I’m flying blind. But when I do, I can refine it, track it, and improve it.

If you’ve never mapped out your decision-making strategy, do it. You’ll learn more about your trading than any indicator could ever teach you. 💡

👉 Keep following me for decision-making insights and real trading psychology facts — the stuff that actually moves the needle.

Price Played Out Exactly As Predicted — Jan 14 Setup RevisitedOn January 14, I shared this precise setup here on TradingView. At the time, it didn’t get much attention—but I trusted the analysis.

Today, price played out exactly as projected. Every level respected. Every zone reacted to. This isn’t hindsight—this is foresight, documented and time-stamped.

Key Notes:

• Clean market structure

• Precise liquidity sweep and shift

• Institutional confluence at premium/discount zones

• Patience + precision = result

I’m sharing this not to say “I was right”—but to highlight what’s possible with disciplined analysis. If you’re serious about trading or just want to see how I break down charts in real-time, feel free to drop a follow.

Let the chart speak

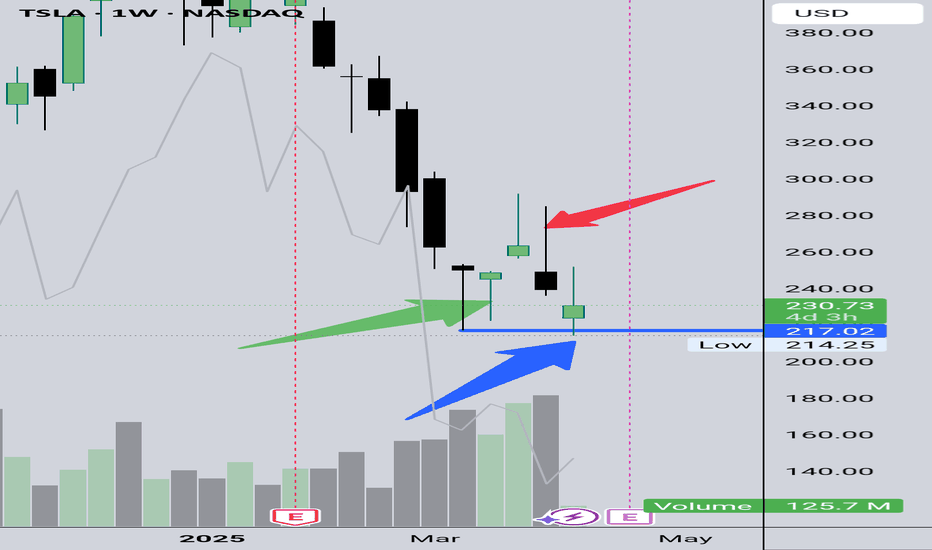

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

$100, $1,000, $100,000 — When Numbers Become Turning PointsHey! Have you ever wondered why 100 feels... special? 🤔

Round numbers are like hidden magnets in the market. 100. 500. 1,000. They feel complete. They stand out. They grab our attention and make us pause. In financial markets, these are the levels where price often slows down, stalls, or makes a surprising turn.

I’ll admit, once I confused the market with real life. I hoped a round number would cause a reversal in any situation. Like when I stepped on the scale and saw a clean 100 staring back at me, a level often known as strong resistance. I waited for a bounce, a sudden reversal... but nothing. The market reacts. My body? Not so much. 🤷♂️

The market reacts. But why? What makes these numbers so powerful? The answer lies in our minds, in market dynamics, and in our human tendency to crave simplicity.

-------------------------------------

Psychology: Why our brain loves round numbers

The human mind is designed to create structure. Round numbers are like lighthouses in the chaos — simple, memorable, and logical. If someone asks how much your sofa cost, you’re more likely to say "a grand" than "963.40 dollars." That’s normal. It’s your brain seeking clarity with minimal effort.

In financial markets, round numbers become key reference points. Traders, investors, even algorithms gravitate toward them. If enough people believe 100 is important, they start acting around that level — buying, selling, waiting. That belief becomes reality, whether it's rational or not. We anchor decisions to familiar numbers because they feel safe, clean, and "right."

Walmart (WMT) and the $100 mark

Round numbers also carry emotional weight. 100 feels like a milestone, a finish line. It’s not just a number, it’s both an ending and a beginning.

-------------------------------------

Round numbers in the market: Resistance and support

Round number as a resistance

Imagine a stock climbing steadily: 85, 92, 98... and then it hits 100. Suddenly, it stalls. Why? Investors who bought earlier see 100 as a "perfect" profit point. "A hundred bucks. Time to sell." Many pre-set sell orders are already waiting. Most people don’t place orders at $96.73. They aim for 100. A strong and symbolic.

At the same time, speculators and short sellers may step in, viewing 100 as too high. This creates pressure, slowing the rally or pushing the price back down.

If a stock begins its journey at, say, $35, the next key round levels for me are: 50, 100, 150, 200, 500, 1,000, 2,000, 5,000, 10,000…

Slide from my training materials

These levels have proven themselves again and again — often causing sideways movement or corrections. When I recently reviewed the entire S&P 500 list, for example $200 showed up consistently as a resistance point.

It’s pure psychology. Round numbers feel "high" — and it's often the perfect moment to lock in profits and reallocate capital. Bitcoin at $100,000. Netflix at $1,000. Tesla at $500. Walmart at $100. Palantir at $100. These are just a few recent examples.

Round number support: A lifeline for buyers

The same logic works in reverse. When price falls through 130, 115, 105... and lands near 100, buyers often step in. "100 looks like a good entry," they say. It feels like solid ground after a drop. We love comeback stories. Phoenix moments. Underdogs rising. Buy orders stack up and the price drop pauses.

Some examples:

Meta Platforms (META)

Amazon.com (AMZN) — $100 acted as resistance for years, then became support after a breakout

Tesla (TSLA)

-------------------------------------

Why round numbers work for both buyers and sellers

Buyers and the illusion of a bargain

If a stock falls from 137 to 110 and approaches 100, buyers feel like it’s hit bottom. Psychologically, 100 feels cheap and safe. Even if the company’s fundamentals haven’t changed, 100 just "feels right." It’s like seeing a price tag of $9.99 — our brain rounds it down and feels like we got an epic deal.

Sellers and the "perfect" exit

When a stock rises from 180 to 195 and nears 200, many sellers place orders right at 200. "That’s a nice round number, I’ll exit there." There’s emotional satisfaction. The gain feels cleaner, more meaningful, when it ends on a round note.

To be fair, I always suggest not waiting for an exact level like 200. If your stock moved through 145 > 165 > 185, don’t expect perfection. Leave room. A $190 target zone makes more sense. Often, greed kills profit before it can be realized. Don’t squeeze the lemon dry.

Example: My Tesla analysis on TradingView with a $500 target — TESLA: Money On Your Screen 2.0 | Lock in Fully…

Before & After: As you see there, the zone is important, not the exact number.

-------------------------------------

Round numbers in breakout trades

When price reaches a round number, the market often enters a kind of standoff. Buyers and sellers hesitate. The price moves sideways, say between 90 and 110. Psychologically, it’s a zone of indecision. The number is too important to ignore, but the direction isn’t clear until news or momentum pushes it.

When the direction is up and the market breaks above a key level, round numbers work brilliantly for breakout trades or strength-based entries.

Slide from my training materials

People are willing to pay more once they see the price break through a familiar barrier. FOMO kicks in. Those who sold earlier feel regret and jump back in. And just like that, momentum builds again — until the next round-number milestone.

Berkshire Hathaway (BRK.B) — every round number so far has caused mild corrections or sideways action. I’d think $500 won’t be any different.

-------------------------------------

Conclusion: Simplicity rules the market

Round numbers aren’t magic. They work because we, the people, make the market. We love simplicity, patterns, and emotional anchors. These price levels are where the market breathes, pauses, thinks, and decides. When you learn to recognize them, you gain an edge — not because the numbers do something, but because crowds do.

A round number alone is never a reason to act.

If a stock drops to 100, it doesn’t mean it’s time to buy. No single number works in isolation. You need a strategy — a set of supporting criteria that together increase the odds. Round numbers are powerful psychological levels, but the real advantage appears when they align with structure and signals.

Keep round numbers on your radar. They’re the market’s psychological mirror, and just like us, the market loves beautiful numbers.

If this article made you see price behavior differently, or gave you something to think about, feel free to share it.

🙌 So, that's it! A brief overview and hopefully, you found this informative. If this article made you see price behavior differently, or gave you something to think about, feel free to share it & leave a comment with your thoughts!

Before you leave - Like & Boost if you find this useful! 🚀

Trade smart,

Vaido

The Power of Commitment in Trading Psychology: A Key to Success

The Power of Commitment in Trading Psychology: A Key to Success 📈💡

Hey TradingView community! I’ve been diving into some trading books lately, and one chapter really hit home: it’s all about commitment. Turns out, it’s the key to making it as a trader—especially in the crypto space where volatility can test your emotions. Here’s what I learned and how I’m applying it to my trading mindset.

Commitment isn’t just about showing up—it’s about promising yourself to be the best trader you can be. I read about a guy who made a ton of money but lost it all because he wasn’t fully in. It made me realize: you can’t just dabble in this game. You gotta go all in. For me, this means sticking to my trading plan, even when the market (or my emotions) tempts me to stray. In crypto, where prices can swing wildly, this is crucial.

One big thing that messes with commitment is the battle between wanting quick wins and sticking to a plan. I’ve caught myself following random advice without thinking—anyone else been there? It’s a trap. Commitment means getting your mind, emotions, and actions on the same page. I’m working on staying disciplined by focusing on my system, even during losing streaks. For example, I use stop-losses and take-profits to keep my emotions in check when trading BTC or ETH.

Here’s a 3-step process I picked up to build commitment:

1️⃣ Figure out what you really want from trading (e.g., steady growth, not just mooning coins).

2️⃣ Spot what’s getting in your way (like fear of losses or FOMO).

3️⃣ Make a plan to push through—like setting clear risk management rules.

For me, this has been a game-changer in staying consistent, especially in volatile markets like crypto.

Psychology matters so much! A lot of traders fail not because their system sucks, but because they can’t stick with it. I’m starting to see how knowing myself better helps me stay committed. Some practical stuff I’m trying: starting small to build confidence, sticking to my system no matter what, learning from experienced traders, and not letting fear of losses throw me off. My current focus is on keeping my position sizes small (1-2% risk per trade) and reviewing my equity curve weekly to ensure I’m on track.

Biggest takeaway: commitment is what makes or breaks you as a trader. It’s about knowing yourself, staying disciplined, and pushing through the tough times. I’m ready to step up—how about you?

What’s your biggest challenge with staying committed in trading?

Let’s discuss in the comments! 👇

123 Quick Learn Trading Tips - Tip #6 - Defensive or Aggressive?123 Quick Learn Trading Tips - Tip #6 - Defensive or Aggressive?

To make money in trading, you need to control your emotions.

Traders often fall into two emotional traps:

Overly Aggressive: After several wins , a trader may become too confident. They might increase their position sizes or take on riskier trades. This can lead to significant losses if the market turns.

Overly Defensive: After several losses , a trader may become too fearful. They might hesitate to enter good trades or exit trades too early. This can lead to missed profit opportunities.

Maintaining a balance between these states is key. Learn to recognize and control your emotions. Discipline and a calm mind are essential for successful trading.

In trading, you must simultaneously be

defensive and aggressive.

Balance is Key ⚖️

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader. Look forward to the next one! 🌟

The Four Fears of Trading and the Law of HarmonyTrading is not just about charts, strategies, and numbers. It’s a psychological battlefield, where fear dominates — but there’s also an often-overlooked factor: harmony. WD Gann’s Law of Harmony teaches that markets, like people, have unique vibrations. When you trade in sync with stocks or currency pairs that ‘resonate’ with you, your confidence and performance improve. Let’s explore how combining Gann’s insights with an understanding of the Four Fears of Trading can create a balanced, more successful trading mindset.

What Is the Law of Harmony?

The Law of Harmony is one of WD Gann’s foundational principles. Gann believed that everything in the universe moves according to natural laws, and markets are no different. Each stock, commodity, or currency pair has its own ‘vibration’ or rhythm — a unique frequency that determines how it behaves. When a trader finds a market whose vibration aligns with their own psychological makeup and trading style, they experience greater clarity, confidence, and success. This is trading in harmony.

Gann used this principle to select markets that matched his analysis style, making it easier to forecast price movements. He believed that recognizing harmony between the trader and the market was just as important as the technical setup itself. He meticulously studied time cycles, price patterns, and astrological influences to find markets that moved in predictable, harmonic ways — and traded only those that felt “right.”

In essence, Gann’s Law of Harmony is about working with the market’s natural flow, not against it. When you’re in sync, trades feel clearer, decisions become easier, and success feels almost effortless.

The Four Fears of Trading

In a recent Twitter poll I conducted, 45% of traders admitted that fear was their toughest emotional challenge — more than greed, hope, or overconfidence. Fear in trading can be broken down into four key categories: the fear of losing money, fear of missing out (FOMO), fear of being wrong, and fear of leaving money on the table. Let’s explore each one — and how the Law of Harmony can help conquer them.

1. Fear of Losing Money

This is the most common fear among traders — nobody wants to lose money. The reality, however, is that losses are an inevitable part of trading. Trading is a game of probabilities, with each trade having around a 50% chance of success.

Many traders react to losses with irrational decisions like closing trades too early or holding onto losing trades in the hope they’ll bounce back. This behavior stems from loss aversion — the natural human tendency to avoid losses more than we seek equivalent gains.

How the Law of Harmony helps:

Trade assets that ‘vibe’ with you. Some stocks or forex pairs will naturally feel clearer and easier to predict — that’s harmony.

Stop forcing bad trades. If you consistently lose on a specific pair, stop forcing it. It might not align with your psychology.

Backtest your system. Develop and backtest a trading system over multiple market conditions (trending, sideways, volatile). When you find one that feels ‘right,’ stick with it.

2. Fear of Missing Out (FOMO)

FOMO drives traders to jump into unplanned trades, often near market tops, for fear they’ll miss a big move. This leads to poor entries, increased risk, and reduced potential rewards. The irony? These impulsive trades often result in losses.

How the Law of Harmony helps:

Shift your mindset from “making money” to “following a process.” Money is a byproduct of trading in harmony with the right instruments.

Accept that the market is endless. Opportunities are like waves — there’s always another one coming. When you trade in sync with a market’s natural rhythm, better setups come to you.

3. Fear of Being Wrong

From childhood, we’re conditioned to avoid mistakes. In trading, however, losses are not failures — they’re feedback. The fear of being wrong can cause traders to hold onto losing trades, cut winners short, or avoid taking trades altogether.

How the Law of Harmony helps:

Focus on pairs or stocks that feel intuitive. When you feel more connected to an asset’s behavior, the fear of being wrong diminishes.

Accept that not every market resonates with you — and that’s okay.

Embrace losing trades as a natural part of the business. Even in harmony, some trades won’t work — that’s part of the rhythm.

4. Fear of Leaving Money on the Table

This fear emerges when a trader exits a trade too soon, only to watch the market continue in their favor. It’s frustrating, but trying to capture every last pip is a recipe for disaster. Markets are unpredictable, and no one catches the exact top or bottom consistently.

How the Law of Harmony helps:

Trust the market’s rhythm. If you’re aligned with the right instrument, more opportunities will come.

Define your exit strategy before entering a trade.

Let go of perfection. Accept that partial profits are better than no profits. In a harmonious market relationship, consistency matters more than squeezing every move.

Final Thoughts: Finding Harmony in Trading

Fear is a natural part of trading — it’s part of being human. The goal isn’t to eliminate fear but to manage it. By identifying which type of fear affects you the most and combining it with Gann’s Law of Harmony, you’ll make more rational decisions and improve your long-term performance.

Imagine you’re at a party. A mutual friend introduces you to a new group of people. You might vibe with some, while others give you an uncomfortable feeling. Stocks and forex pairs work the same way. You naturally gel with some, understanding their behavior and making profitable trades, while others consistently lead to losses.

The secret to long-term trading success is not forcing trades or chasing markets — it’s about finding what resonates with you. Focus on the process, trade in harmony, and the profits will follow.

Remember: The market doesn’t reward those who fight it. It rewards those who flow with it.

Happy trading!

Trading Psychology or Technical Analysis—When Mind Meets MatterThere’s an age-old battle in trading that makes the bull vs. bear debate look like a game of pickleball (no offense, finance bros). It’s the clash between the traders who swear by their charts and the ones who insist it’s all about mindset.

The technicals versus the psychologicals. Fibonacci retracements versus fear and greed. RSI versus your racing heart.

TLDR? Both matter—a lot. But knowing when to trust your indicators, when to trust yourself, and when to blend both is the fine line that separates those who thrive from those who rage-quit.

⚔️ The Cold, Hard Numbers vs. the Soft, Messy Brain

Think of technical analysis as your sometimes inaccurate GPS in trading. It’s structured, predictable, and gives you clear entry and exit points—until it doesn’t. Because markets, much like a GPS in a tunnel, don’t always cooperate.

That’s where psychology creeps in. Your mind is the ultimate trading algorithm, but it’s often running outdated software. Fear of missing out? That’s just your brain throwing a tantrum. Revenge trading? A glitch in emotional processing. Overconfidence after three wins in a row? Well done, you genius.

Technical analysis gives you signals, but trading psychology determines how you act on them.

🤷♂️ When the Chart Says One Thing, and Your Brain Says Another

Picture this: You’ve mapped out the perfect setup. The moving averages align, volume confirms the breakout, and everything screams BUY .

But then your brain whispers, What if it reverses? What if this is a trap? What if I’m about to donate my account balance to the market gods?

You hesitate. The price moves without you. Now, frustration kicks in, and suddenly, you’re clicking BUY at the worst possible moment—just in time for a pullback.

Sometimes, the best trade is the one you don’t take. And sometimes, trusting the chart over your overthinking brain is the only way forward.

🔥 The Big Guys and Their Choices

Legendary investors have picked their sides in this debate. Howard Marks, the co-founder of Oaktree Capital, has long been a big believer in market psychology. He argues that understanding investor sentiment is more valuable than any chart pattern because markets are driven by cycles of greed and fear.

On the other hand, Paul Tudor Jones—one of the greatest traders of all time—leans on technicals, famously saying, “The whole trick in investing is: ‘How do I keep from losing everything?’ If you use the 200-day moving average rule, you get out. You play defense.”

Both approaches work. The question is: Are you the type who deciphers market mood swings, or do you trust that a well-placed moving average will tell you when to cut and run?

🌀 Overtrading: The Technical Trap and the Psychological Spiral

Overtrading usually starts with a good trade, a small win, and a rush of dopamine that convinces you you’ve cracked the code. So, you take another trade. Then another. And before you know it, you’re firing off entries like a caffeinated gamer, except your PnL is the one taking the damage.

Technical traders fall into this trap because they see too many setups. Every candlestick pattern, every little bounce, every “potential” breakout becomes a reason to trade.

Psychological traders, on the other hand, may overtrade out of boredom, frustration, or the need to “make back” losses.

The result? An emotional rollercoaster that ends with an account balance you don’t want to check the next morning.

The fix? Trade selectively. The best setups don’t come every five minutes, and forcing trades is like forcing a bad joke—it just doesn’t land.

💪 Fear, Greed, and the Art of Holding Your Ground

Every trader knows the feeling: You’re in profit, but instead of letting the trade play out, you close early because profit is profit, right?

Wrong.

Fear of losing profits is what keeps traders from maximizing their wins. And greed—the evil twin of fear—is what makes traders hold losing trades, hoping for a miracle. It’s the classic “let winners run, cut losers short” rule in reverse.

Technical traders know where their stops and targets are. The problem? They often ignore them when emotions take over. Psychological traders “feel” the market but get crushed when that gut feeling betrays them.

The best traders find the balance—using technicals to set logical targets and psychology to actually stick to the plan.

🤝 The Solution? A System That Checks Both Boxes

So, what’s the verdict? Do you put matter over mind or mind over matter?

The truth is, great traders do both. They develop strategies based on technicals but manage execution with discipline. They respect risk management rules not just because the chart says so, but because they know how destructive emotions can be.

Here’s what the best do differently:

✅ They journal trades —not just the setups but how they felt during the trade.

✅ They stick to a trading plan so they can trust their system over impulse.

✅ They set rules that help them to properly bounce back from losses .

✅ They know the value of knowledge and never stop learning. (We’ve got you covered here, too. Go check the Top Trading Books if you’re a trader and stop by the Top Books on Investing if you’re an investor).

💚 Final Thoughts: Mind and Market in Harmony

In the end, trading is never just one or the other. It’s not pure math, and it’s not pure mindset. It’s a dance between structure and instinct, strategy and psychology. The ones who get it right aren’t just great at reading charts—they’re great at reading themselves.

2025 ICT Mentorship: Premium & Discount Price Delivery Intro2025 ICT Mentorship: Lecture 4_Premium & Discount Price Delivery Intro

Greetings Traders!

In this video, we dive into the fundamental concept of Premium and Discount Price Delivery—a crucial aspect of smart money trading that helps us understand how institutions approach the market with precision and efficiency.

Understanding Currency Pairs

Before we explore premium and discount dynamics, it's essential to grasp the basics of currency pairs. A currency pair, like EUR/USD or GBP/USD, represents the value of one currency against another. For example, EUR/USD shows how many U.S. dollars (the quote currency) are needed to purchase one euro (the base currency). Just like any other tradable asset, currency pairs fluctuate in value due to various economic and market factors.

Trading Is Part of Everyday Life

Believe it or not, everyone in the world is a trader. Whether you're buying groceries at a store or negotiating for goods and services, you're participating in trading activities daily. Some people aim to purchase items at a discount, while others can afford to pay a premium—it’s simply part of life.

However, banks and financial institutions take trading to another level. They don’t just trade haphazardly—they operate with extreme precision, aiming to make high-quality investments by executing trades at premium prices and targeting discount levels. This strategic approach allows them to capitalize on market inefficiencies and ensure profitable outcomes.

Why Premium and Discount Matter?

The concept of premium and discount price delivery is foundational for understanding how the market moves. By recognizing where the market is trading at a premium (overvalued) versus a discount (undervalued), traders can make more informed decisions and align their strategies with institutional order flow.

Stay tuned as we break down how to identify these zones on a chart and how to incorporate them into your trading strategy. Make sure to like, subscribe, and turn on notifications so you never miss an update!

Happy Trading,

The_Architect

Will it move in a BEARISH direction? GBPUSDI am checking GBPUSD schematics, waiting for bearish confirmation in this wyckoff schematics. Full of Liquidity Manipulations since last week march 3-7 2025. Patience is key as it develops.

-Once it confirms the direction I will join Bearish Traders here. 😁😁

Rundown of TF:

Daily---> 4H---> 1H---> 15min----> 5 min.

#proptrader

#discipline

#growthoriented

#consistency

What to do after you missed a big price move (Example: EUR/USD)There was a big fast move in EUR/USD last week.

The ‘European currencies’ did especially well versus the US dollar, including GBP/USD and USD/CHF as well as the ‘Skandies’ SEK/USD and NOK/USD.

If you rode the move, then job done. If you did ride the move up, you might have taken full profits already - or maybe you are leaving a little bit of the position open to ride any continuation of the move.

But, what to do if you missed it completely?

Explosive moves in the market usually mean traders who were on the ‘losing’ side step out for a while, having lost confidence in their view. For example if you were bearish and the market makes a significant move higher - you’re probably going to be a lot less confident in your bearish view - but perhaps also not ready to take an opposite bullish view. The loss of sellers in the market can see the up-move continue with minimal pullback.

This might suggest buying any small dips to ride the next leg higher, and emotionally it would offer some salvation to capture the second leg of the move even if you missed the first leg. However, what you are doing here is ‘chasing the market’.

One trouble is that after a big move in the market, there is no definitive place to put your stop loss, except at the beginning of the move - which is now far away. That's a bad risk: reward.

It is tempting to place a closer (more manageable) stop loss under lower timeframe levels of support - but then you find yourself trading an unknown strategy that requires different rules to follow because it is based on a lower timeframe.

And indeed, after a sharp move in the market - there is still a chance for a sharp pullback to match. Why? Because buyers quickly take profits on their unexpected quick gains, which will create selling pressure into minimal support - because the next support level is far away.

A sharp pullback would mean an opportunity to buy into the uptrend at a lower level, closer to the previous support. But then the flipside of the sharp pullback is that it raises questions over the sustainability of the initial move.

Probably the biggest takeaway here is not to think about this ‘explosive’ move in isolation.

Instead of forcing a trade, consider:

1. Waiting for the right setup in the same market. If your strategy is based on structured breakouts, wait for the next clean consolidation or pattern before re-engaging. A big move often leads to a new setup—but forcing a trade in the middle of a volatile move isn’t a strategy, it’s FOMO.

2. Looking at uncorrelated markets. Just because EUR/USD already made a big move doesn’t mean you have to trade it now. If you want to be in at the start of a move, shift focus to another market that hasn’t yet made its move.

3. Sticking to your edge. If your strategy works over hundreds of trades, don’t abandon it just because one market moved without you. The next opportunity will come—if not in this market, then in another.

Again, the best trades don’t come from reacting to what already happened, but from positioning for what’s about to happen. If you missed the move, accept it, reset, and wait for the next high-quality setup—whether in the same market or somewhere else.

The Right Questions to Ask Before Entering a TradeEvery day, traders—especially beginners—ask the same recurring question:

❓ What do you think Gold will do today? Will it go up or down?

While this seems like a logical question, it’s actually completely wrong and one that no professional trader would ever ask in this way.

Trading is not about predicting the market like a fortune teller. Instead, it's about analyzing price action, managing risk, and executing trades strategically.

So, instead of asking, "Will Gold go up or down?" , a professional trader asks three critical questions before taking any trade.

Let's break them down.

________________________________________

Step 1: Identifying the Right Entry Point

Let’s say you’ve done your analysis, and you believe Gold will drop. That’s great—but that’s just an opinion. What really matters is execution.

🔹 Where do I enter the trade?

Professional traders don’t jump into the market impulsively. They use pending orders instead of market orders to wait for the right price.

If you believe Gold will fall, you shouldn’t just sell at any price. You need to identify a key resistance level where a reversal is likely to happen.

For example:

• If Gold is trading at $2900, and strong resistance is at $2920, a professional trader will set a sell limit order at that resistance level rather than shorting randomly.

This approach ensures that you enter at a strategic point where the probability of success is higher.

________________________________________

Step 2: Setting the Stop Loss

🔹 Where do I place my stop loss?

A trade without a stop loss is just gambling. Managing risk is far more important than being right about market direction.

The key is to determine:

✅ How much risk am I willing to take?

✅ Where is the invalidation level for my trade idea?

For example:

• If you are shorting Gold at $2920, you might place your stop loss at $2935—above a recent high or key technical level.

• This way, if the price moves against you, you have a predefined maximum loss, avoiding emotional decision-making.

Professional traders never risk more than a small percentage of their account on a single trade. Risk management is everything.

________________________________________

Step 3: Setting the Take Profit Target

🔹 Where do I set my take profit, and does the trade make sense in terms of risk/reward?

Before taking any trade, you must ensure that your reward outweighs your risk.

For example:

• If you risk $15 per ounce (short at $2920, stop loss at $2935), your take profit should be at least $30 away (for a 1:2 risk/reward).

• A good target in this case could be $2890 or lower.

This means that for every dollar you risk, you aim to make two dollars—ensuring long-term profitability even if only 40-50% of your trades succeed.

If the trade doesn’t offer a good risk/reward, it’s simply not worth taking.

________________________________________

Conclusion: The “Set and Forget” Mentality

Once you’ve answered these three key questions and placed your trade, the best approach is to let the market do its thing.

✅ Set your entry, stop loss, and take profit.

✅ Follow your trading plan.

✅ Avoid emotional reactions.

Many traders lose money because they constantly interfere with their trades—moving stop losses, closing positions too early, or hesitating to take profits.

Instead, adopt a professional approach: set your trade and let it run.

📌 Final Thought:

The next time you find yourself asking, “Will Gold go up or down today?” , stop and ask yourself:

📊 Where is my entry?

📉 Where is my stop loss?

💰 Where is my take profit, and does the risk/reward make sense?

This is how professional traders think, plan, and execute—and it’s what separates them from amateurs.

👉 What’s your biggest struggle when it comes to executing trades? Let’s discuss in the comments! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

2025 ICT Mentorship: Institutional Market Structure Part 22025 ICT Mentorship: Lecture 3_Institutional Market Structure Part 2

Greetings Traders!

In Lecture 3 of the 2025 ICT Mentorship, we dive deep into the core principles of market structure, focusing on how institutions truly move the market. Understanding this is essential for precision trading and eliminating emotional biases.

Key Insights from the Lecture

🔹 Distinguishing Minor vs. Strong Swing Points – Learn to differentiate between structural noise and true market shifts.

🔹 Marking Market Structure with Precision – Objectively analyze price action to refine your decision-making process.

🔹 Institutional Market Structure Techniques – Align with smart money to enhance accuracy and consistency.

Why This Matters

Mastering market structure allows traders to anticipate price movement, reducing impulsive trades and reinforcing a disciplined approach. By integrating institutional strategies, we position ourselves for more accurate and confident executions.

Stay focused, keep refining your skills, and let’s continue elevating our trading game.

Institutional Market Structure Part 1:

Enjoy the video and happy trading!

The Architect 🏛️📊