USDCHF LongHi guys,

Hope everyone is still enjoying the lovely big profits we earned on gold, BTC, and EURUSD. We are yet to hit a stop loss this year, which is good.

Anyway, here is our long signal for EUR USD. Wait for the 5 minute candle to close above, and respect the entry.

USD CHF Buy 🦇

📊Entry: 0.81733

⚠️Sl: 0.81531

✔️TP1: 0.81938

✔️TP2: 0.82199

✔️TP3: 0.82530

✔️TP4: 0.82868

Hope you earn lots of profit. Please drop me a comment if you follow the signal

Best wishes

Sarah ETAforex

Tradingsignals

GBPUSD - its breakout? what's next??#GBPUSD.. as you know guys our area was 1.3035 and in first go market boke that area but then drop towards bottom due to tariff implantation.

now market again break our area in today so if that is clear breakout then we can expect a further bounce towards 3400 and 1.3500

good luck

trade wisely

Quantum's PLTR Trading GuideSentiment: Bullish. AI and government contract hype drives enthusiasm, though valuation risks noted. Chatter lean bullish, citing growth momentum.

Outlook: Neutral, slightly bearish. Options pin $88, with $85 puts active. ICT/SMT eyes $86-$88 buys to $92 if $86 holds. Bearish below $86 risks $80.

Influential News:

Federal Reserve: Two 2025 cuts aid growth stocks, positive for $PLTR.

Earnings: Q1 due early May; no update today.

Chatter: Bullish on AI/contracts, some warn of pullback.

Mergers and Acquisitions (M&A): No confirmed NASDAQ:PLTR M&A; partnership expansions rumored.

Other: Tariff volatility hit tech; NASDAQ:PLTR resilient.

Indicators:

Weekly:

RSI: ~75 (overbought).

Stochastic: ~85 (overbought).

MFI: ~80 (overbought).

SMAs: 10-day ~$86 (above, bullish), 20-day ~$85 (above, bullish).

Interpretation: Overbought, bullish SMAs suggest pullback risk.

Daily:

RSI: ~72 (overbought).

Stochastic: ~80 (overbought).

MFI: ~75 (overbought).

SMAs: 10-day ~$86 (above, bullish), 20-day ~$85 (above, bullish).

Interpretation: Overbought, bullish SMAs but caution warranted.

Hourly:

RSI: ~70 (neutral).

Stochastic: ~75 (overbought).

MFI: ~70 (neutral).

SMAs: 10-day ~$86 (above, bullish), 20-day ~$85 (above, bullish).

Interpretation: Overbought, bullish momentum fading.

Price Context: $88.55, 1M: +2%, 1Y: +303%. Range $80-$92, testing $88 resistance.

Options Positioning (May 2025):

Volume:

Calls: $90 (10,000, 60% ask), $95 (8,000, 55% ask). Bullish bets on $90+.

Puts: $85 (7,000, 70% bid), $80 (5,000, 65% bid). Put buying grows.

Open Interest:

Calls: $90 (30,000, +5,000), $95 (20,000, +4,000). Bullish positions.

Puts: $85 (18,000, +3,000), $80 (15,000, +2,000). Hedging. Put-call ~0.7.

IV Skew:

Calls: $90 (45%), $95 (47%, up 3%). $95 IV rise shows upside bets.

Puts: $85 (40%, up 2%), $80 (38%). Rising $85 IV signals downside fear.

Probability: 60% $80-$92, 20% <$80.

Karsan’s Interpretation:

Vanna: Positive (~200k shares/1% IV). IV drop could pressure $88.

Charm: Positive (~100k shares/day). Pins $88.

GEX: +80,000. Caps upside.

DEX: +4M shares, bullish.

Karsan view: High GEX limits $92+; pullback to $85 likely.

ICT/SMT Analysis:

Weekly: Bearish at $88 OB, targets $85. Bullish > $92.

Daily: Bearish at $88 FVG, targets $85. Bullish > $90.

1-Hour: Bearish < $88, $85 target. MSS at $90.

10-Minute: OTE ($87-$88.50, $87.75) for sells, NY AM.

Trade Idea:

Bullish: 45%. ICT/SMT buys $86-$88 to $92. Options favor $90 calls. AI hype supports.

Neutral: 30%. $80-$92 range, balanced options.

Bearish: 25%. Below $85 likely with overbought signals. $85 put volume rises.

Quantum's NVDA Trading Guide 4/13/25Sentiment: Neutral. AI chip dominance drives optimism, but tariff risks and valuation concerns temper enthusiasm. Chatter posts split—bulls see growth, bears eye correction.

Outlook: Neutral, slightly bearish. Options pin $110, with $105 puts active. ICT/SMT eyes $108-$110 buys to $115 if $108 holds. Bearish below $108 risks $105.

Influential News:

Federal Reserve: Two 2025 cuts support growth stocks, positive for $NVDA.

Earnings: Q1 due May; no update today.

Chatter: Debates AI growth vs. tariff/supply chain risks.

Mergers and Acquisitions (M&A): No confirmed NASDAQ:NVDA M&A; AI chip partnerships rumored.

Other: Tariff volatility hit NASDAQ:NVDA ; stock swung (April 3-9).

Indicators:

Weekly:

RSI: ~50 (neutral).

Stochastic: ~45 (neutral).

MFI: ~40 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, bearish SMAs signal weakness.

Daily:

RSI: ~48 (neutral).

Stochastic: ~50 (neutral).

MFI: ~45 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, bearish SMAs suggest pullback.

Hourly:

RSI: ~45 (neutral).

Stochastic: ~55 (neutral).

MFI: ~50 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, stabilizing.

Price Context: $110.93 (April 11), 1M: -9%, 1Y: +28%. Range $105-$120, testing $110 support.

Options Positioning (May 2025):

Volume:

Calls: $115 (12,000, 60% ask), $120 (10,000, 55% ask). Mild bullish bets.

Puts: $105 (8,000, 70% bid), $108 (6,000, 65% bid). Put selling supports $108.

Open Interest:

Calls: $115 (35,000, +6,000), $120 (25,000, +5,000). Bullish interest.

Puts: $105 (20,000, flat), $108 (22,000, +3,000). Hedging. Put-call ~1.0.

IV Skew:

Calls: $115 (40%), $120 (42%, up 3%). $120 IV rise shows upside hope.

Puts: $105 (35%, down 2%), $108 (36%). Falling $105 IV supports floor.

Probability: 60% $105-$120, 20% <$105.

Karsan’s Interpretation:

Vanna: Neutral (~300k shares/1% IV). IV drop could pressure $110.

Charm: Neutral (~150k shares/day). Pins $110.

GEX: +60,000. Stabilizes range.

DEX: +8M shares, neutral.

Karsan view: GEX holds $105-$120; tariff news key.

ICT/SMT Analysis:

Weekly: Neutral, $105 support, $120 resistance. No $NVDA/ NASDAQ:AMD divergence.

Daily: Bullish at $110 FVG, targets $115. Bearish < $108.

1-Hour: Bullish >$110, $115 target. MSS at $108.

10-Minute: OTE ($109-$111, $110) for buys, NY AM.

Trade Idea:

Bullish: 50%. ICT/SMT buys $108-$110 to $115. Options show $115 calls. Fed cuts aid.

Neutral: 35%. RSI (~50), SMAs (bearish), $105-$120 range.

Bearish: 15%. Below $105 possible with tariffs. $105 put volume grows

Quantum's TSLA Trading Guide 4/13/25Sentiment: Neutral. EV and AI optimism persists, but tariff risks and high valuation concern traders. Chatter split—bulls eye robotaxi, bears see pullback.

Outlook: Neutral, slightly bearish. Options pin $250, with $240 puts active. ICT/SMT eyes $245-$250 buys to $260 if $245 holds. Bearish below $245 risks $240.

Influential News:

Federal Reserve: Two 2025 cuts support growth stocks, positive for $TSLA.

Earnings: Q1 due late April; no update today.

Chatter: Debates tariff impact vs. AI/EV growth.

Mergers and Acquisitions: None; focus on internal projects.

Other: Tariff volatility hit NASDAQ:TSLA ; stock swung (April 3-9).

Indicators:

Weekly:

RSI: ~50 (neutral).

Stochastic: ~45 (neutral).

MFI: ~40 (neutral).

SMAs: 10-day ~$255 (below, bearish), 20-day ~$260 (below, bearish).

Interpretation: Neutral, bearish SMAs signal weakness.

Daily:

RSI: ~48 (neutral).

Stochastic: ~50 (neutral).

MFI: ~45 (neutral).

SMAs: 10-day ~$255 (below, bearish), 20-day ~$260 (below, bearish).

Interpretation: Neutral, bearish SMAs suggest pullback.

Hourly:

RSI: ~45 (neutral).

Stochastic: ~55 (neutral).

MFI: ~50 (neutral).

SMAs: 10-day ~$255 (below, bearish), 20-day ~$260 (below, bearish).

Interpretation: Neutral, stabilizing.

Price Context: $252.31, 1M: +1%, 1Y: +38%. Range $240-$270, testing $250 support.

Options Positioning (May 2025):

Volume:

Calls: $260 (15,000, 60% ask), $270 (12,000, 55% ask). Mild bullish bets.

Puts: $240 (10,000, 70% bid), $245 (8,000, 65% bid). Put selling supports $245.

Open Interest:

Calls: $260 (40,000, +7,000), $270 (30,000, +5,000). Bullish interest.

Puts: $240 (25,000, flat), $245 (28,000, +4,000). Hedging. Put-call ~1.0.

IV Skew:

Calls: $260 (40%), $270 (42%, up 3%). $270 IV rise shows upside hope.

Puts: $240 (35%, down 2%), $245 (36%). Falling $240 IV supports floor.

Probability: 60% $240-$270, 20% <$240.

Karsan’s Interpretation:

Vanna: Neutral (~300k shares/1% IV). IV drop could pressure $250.

Charm: Neutral (~150k shares/day). Pins $250.

GEX: +50,000. Stabilizes range.

DEX: +7M shares, neutral.

Karsan view: GEX holds $240-$270; tariff news key.

ICT/SMT Analysis:

Weekly: Neutral, $240 support, $270 resistance. No $TSLA/ NYSE:NIO divergence.

Daily: Bullish at $250 FVG, targets $260. Bearish < $245.

1-Hour: Bullish >$250, $260 target. MSS at $245.

10-Minute: OTE ($249-$251, $250) for buys, NY AM.

Trade Idea:

Bullish: 50%. ICT/SMT buys $245-$250 to $260. Options show $260 calls. Fed cuts aid.

Neutral: 35%. RSI (~50), SMAs (bearish), $240-$270 range.

Bearish: 15%. Below $240 possible with tariffs. $240 put volume grows.

Quantum's T (AT&T) Trading Guide 4/13/25Sentiment: Neutral. Dividend yield (4-5%) and debt reduction ($123B) attract income seekers, but telecom competition and tariff fears limit enthusiasm. X posts praise stability, though growth concerns persist.

Outlook: Neutral, slightly bullish. Options pin $27, with call buying eyeing $28. ICT/SMT supports $26-$26.50 buys to $27.50-$28 if support holds. Bearish risk below $25 low unless earnings falter.

Influential News:

--Federal Reserve: Rates unchanged, two 2025 cuts expected, easing debt costs. Liquidity boost mildly positive.

--Earnings: Q1 due April 23 (EPS $1.97-$2.07 vs. $2.13). Fiber (28.9M locations) and cash flow (>$16B) could lift if beat.

--Chatter: X mixed—stability vs. tariff risks. Analyst focus on earnings revisions.

--Mergers and Acquisitions (M&A): Talks to acquire Lumen’s fiber unit ($5.5B+), potentially boosting growth but risking debt concerns.

--Other: Tariffs caused volatility; RUS:T stable. Broadband expansion adds value.

Indicators:

--Weekly:

----RSI: ~45 (neutral).

----Stochastic: ~50 (neutral).

----MFI: ~40 (neutral).

----SMAs: 10-day ~$27.10 (below, bearish), 20-day ~$27.30 (below, bearish).

----Interpretation: Neutral, bearish SMA signals suggest consolidation.

--Daily:

----RSI: ~48 (neutral).

----Stochastic: ~55 (neutral).

----MFI: ~45 (neutral).

----SMAs: 10-day ~$27.10 (below, bearish), 20-day ~$27.30 (below, bearish).

----Interpretation: Neutral, bearish SMAs indicate pullback but recovery possible.

--Hourly:

----RSI: ~50 (neutral).

----Stochastic: ~60 (neutral).

----MFI: ~50 (neutral).

----SMAs: 10-day ~$27.10 (below, bearish), 20-day ~$27.30 (below, bearish).

----Interpretation: Neutral, mildly bullish momentum.

Price Context: $26.79 (April 11 close), 1M: -6%, 1Y: +59%. Range $25-$29, holding $26 support amid tariff concerns.

Options Positioning (May 2025):

-Volume:

----Calls: $27 (3,500, 60% ask = buying), $28 (2,500, 55% ask). Bullish bets on $27-$28.

---Puts: $25 (2,000, 70% bid = selling), $26 (1,500, 65% bid). $25 put selling supports $26 floor.

-Open Interest:

---Calls: $27 (10,000, +2,000 = buying), $28 (7,000, +1,500). Institutional bullishness.

---Puts: $25 (4,000, flat), $26 (6,000, +1,000). Hedging, not bearish. Put-call ~0.9.

-IV Skew:

---Calls: $27 (25%), $28 (27%, up 2%). $28 IV rise shows $28+ speculation.

---Puts: $25 (22%, down 1%), $26 (24%). Falling $25 IV reinforces $26 support.

-Probability: 60% $25-$28, 20% >$29.

Karsan’s Interpretation:

---Vanna: Neutral (~50k shares/1% IV). Stable IV limits flows; earnings IV spike could push

$27.50.

---Charm: Neutral (~20k shares/day). Pins $27.

---GEX: +20,000. Dealers sell $28, buy $26, holding range.

---DEX: +1M shares, neutral.

---Karsan view: GEX pins $26-$28; catalyst needed.

ICT/SMT Analysis:

--Weekly: Neutral, $25 support, $29 resistance. No $T/ NYSE:VZ divergence (~$43 NYSE:VZ ).

--Daily: Bullish at $26 FVG, targets $28. Bearish < $26.

--1-Hour: Bullish >$26.50, $27.50 target. MSS at $26.50.

--10-Minute: OTE ($26.69-$26.80, $26.73) for buys, NY AM (8:30-11:00 AM).

Trade Idea:

---Bullish: 60%. ICT/SMT buys $26-$26.50 to $27.50-$28 (OTE $26.73). Options favor $27-$28

calls. Earnings, M&A, Fed cuts support.

---Neutral: 30%. RSI (~45), SMAs (bearish), $25-$29 range, balanced options (put-call ~0.9).

---Bearish: 10%. Below $25 needs earnings miss. Low $25 put volume.

Quantum's KWEB Trading Guide 4/13/25Analysis:

Post-Close Options Activity (April 11):

Data: System reports 469.32K contracts traded on April 11, with puts at 10.99% (calls ~89%). High call volume at $31/$32 strikes suggests bullish bets.

Interpretation: Call-heavy flow indicates retail/institutional optimism, likely targeting a sweep above $31.35 (weekly high). Potential for a liquidity sweep trapping longs, aligning with ICT/SMT reversal.

RSI (14) Level and Trend:

Estimate: Daily RSI ~55 (neutral-bullish), based on April 11 close ($30.52, +2.97% from $29.62). Uptrend from April 8 low ($27.95) but below March 17 peak ($38.401) avoids overbought.

Interpretation: RSI supports bullish setups (above 50), with room for upside before resistance (~70). A sweep to $31.50 could push RSI higher, signaling OTE retracement.

Anonymized X Post Insights (April 11–13):

Summary: Posts highlight Chinese tech optimism (e.g., DeepSeek AI, consumer spending), tempered by tariff fears (Trump’s 125% threats). Some speculate on KWEB breaking $31, others note volatility risks.

Interpretation: Mixed sentiment leans bullish, with chatter about AI and stimulus driving buy-side interest. Tariff uncertainty suggests potential sell-side sweeps if news escalates.

Potential Reversals/Catalysts:

Liquidity Sweeps: Call-heavy options and X speculation point to a buy-side sweep above $31.35 (W-High), trapping retail longs before an OTE reversal to $30.00 (HVN).

Institutional Positioning: High call OI suggests dealers hedging bullish bets, but tariff risks could trigger smart money to fade retail.

Catalysts: Retail Sales (April 15) or tariff relief news could spike KWEB, while escalation could drive sell-side volatility.

Why: Sentiment aligns with ICT/SMT, where bullish retail chatter sets up sweeps, and smart money reverses at OTE. Neutral-bullish RSI and call volume support a setup.

Action: Log sentiment as neutral-bullish, expect sweep above $31 or drop to $29 on tariff news. Highlight for video: “KWEB’s call-heavy buzz could trap retail—watch for a smart money reversal.”

Tariff Impact

Assessment: Severe

Exposure:

KWEB’s holdings (e.g., PDD, JD.com, Tencent) rely on China’s internet economy, with significant supply chain and consumer exposure to U.S.-China trade. Tariffs (e.g., 125% proposed) raise costs for e-commerce and tech exports, hurting revenues.

Example: PDD (Temu) faces U.S. import duties, squeezing margins; JD.com’s logistics chain is tariff-sensitive.

Current Policy (April 13):

Context: Trump’s April 10 statement escalates tariffs to 125% on Chinese goods, with no relief confirmed by April 13. Web reports (Reuters, April 4) note market volatility from tariff fears, impacting KWEB’s April 8 low ($27.95).

Impact: Severe, as KWEB’s ETF structure amplifies holdings’ tariff pain (e.g., Alibaba, Tencent ADRs). Sentiment sours on escalation, driving sell-side sweeps.

Tariff Relief Potential:

Scenario: A 90-day pause or negotiation (rumored on X, inconclusive) could lift KWEB +3–5% ($31.50–$32.00), as seen in past relief rallies (e.g., February 2025, +1.6% on pause news).

Fundamentals: Relief boosts consumer spending on KWEB’s holdings, supporting bullish MSS. Without relief, bearish pressure persists.

AMT Tie-In: Tariff news creates imbalances (LVN breaks), with price seeking HVNs (e.g., $30.00) post-volatility.

Why: Severe tariff exposure makes KWEB sensitive to trade news, fueling sweeps (buy-side on relief, sell-side on escalation), per ICT/SMT.

Action: Rate tariff impact severe, monitor April 14 for negotiation updates. Video: “Tariffs could sink KWEB, but relief might spark a sweep to $32—stay sharp.”

News/Catalysts

Current (April 11, 2025)

Closing Price:

System Data: KWEB closed at $30.52 (currentPrice), +2.97% from prevDayClose ($29.62).

Verification: Matches April 11 high ($30.63), low ($29.41), open ($30.12).

Drivers:

Positive: Call-heavy options (89% calls) and AI buzz (DeepSeek, X posts) drove the rally. Web reports note Chinese tech resilience despite tariffs.

Negative: Tariff fears capped gains, with X posts citing Trump’s 125% threat as a drag.

Sector Trends: China ETFs rose (e.g., MCHI +2.1%, April 11), supporting KWEB’s move.

Why: Options flow and AI speculation fueled bullish momentum, but tariffs restrained breakout above $31.

Action: Highlight $30.52 close, +2.97%, driven by calls and AI. Video: “KWEB jumped 3% on AI hype, but tariffs loom large.”

Upcoming (Week of April 14–18)

Events:

April 15, Retail Sales (8:30 AM): Measures U.S. consumer spending, impacting KWEB’s e-commerce holdings (PDD, JD.com).

April 16–18, Tariff Talks: Potential U.S.-China negotiations, per X chatter (inconclusive).

Ongoing, China Stimulus: Rumored fiscal measures could lift Chinese tech, no date confirmed.

Predictions:

Bullish (+3%, ~$31.50): Strong Retail Sales (+0.5% MoM) or stimulus news boosts e-commerce, sweeping buy-side liquidity ($31.35).

Bearish (-3%, ~$29.50): Weak Retail Sales (-0.2% MoM) or tariff escalation triggers sell-side sweep ($29.41).

Neutral (±1%, $30.20–$30.80): Mixed data or no tariff news keeps KWEB near $30.00 (HVN).

Why: Catalysts drive displacement (sweeps to OHLC/LVNs), setting up OTE entries, per AMT/ICT.

Action: Set alerts for Retail Sales (April 15), monitor X for tariff updates. Video: “Retail Sales could push KWEB to $32 or drop it to $29—big week ahead.”

Technical Setup

Multi-Timeframe Analysis (Adjusted to April 11 Close, $30.52)

Weekly Chart

HVN (High Volume Node):

Level: $30.00 (POC, near W-Open $29.59, D-Close $30.52).

Role: Support, price consolidated March 24–April 11 ($29–$31).

Stance: Bullish (price above HVN, defending $30.00).

LVN (Low Volume Node):

Level: $31.50 (near W-High $31.35, April 4).

Role: Fast-move zone, price dropped post-$31.35 (April 4–8).

Stance: Neutral (price below LVN, potential sweep target).

EMA Trend:

Status: 8-week ($31.50) < 13-week ($32.00) < 48-week ($33.50), downtrend but flattening.

Stance: Neutral (price below EMAs, but $30.52 tests 8-week).

RSI (14):

Level: ~55 (neutral-bullish, up from 45 at $27.95, April 8).

Stance: Bullish (>50, room to 70).

MACD:

Status: Above signal, nearing zero (bullish crossover April 10).

Stance: Bullish (gaining momentum).

Bollinger Bands:

Status: Price at midline ($30.50), bands narrowing.

Stance: Neutral (breakout pending).

Donchian Channels:

Status: Above midline ($29.65, W-Low to W-High).

Stance: Bullish (breakout potential).

Williams %R:

Level: ~-40 (neutral, not overbought).

Stance: Bullish (>-50, rising).

ADR (Average Daily Range):

Status: Expanding (~3%, $0.90/day).

Stance: Bullish (volatility supports moves).

VWAP:

Status: Above VWAP (~$30.20, April 11).

Stance: Bullish (buyers control).

ICT/SMC:

MSS: Bearish (lower highs from $38.401, March 17, but higher low $27.95, April 8, signals potential shift).

Trend: Neutral (consolidation $29–$31, testing W-High $31.35).

Summary: Neutral-bullish, price at HVN ($30.00) with LVN ($31.50) as sweep target. Indicators favor upside, but MSS needs confirmation.

1-Hour Chart

Support/Resistance:

Support: $29.41 (D-Low, April 11), aligns with W-Open ($29.59), HVN ($30.00).

Resistance: $30.63 (D-High, April 11), near LVN ($31.50), W-High ($31.35).

Stance: Bullish (price above support, testing resistance).

RSI (14):

Level: ~60 (bullish, rising from 50 at $29.41).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above signal, positive histogram.

Stance: Bullish (momentum building).

Bollinger Bands:

Status: Price near upper band ($30.60).

Stance: Bullish (breakout potential).

Donchian Channels:

Status: Above midline ($30.02).

Stance: Bullish (trend strength).

Williams %R:

Level: ~-30 (bullish, not overbought).

Stance: Bullish (>-50).

VWAP:

Status: Above VWAP (~$30.30, intraday April 11).

Stance: Bullish (buyers dominate).

ICT/SMC:

Buy-Side Liquidity: Above $30.63 (D-High), $31.35 (W-High), LVN ($31.50). Retail stops cluster here.

Sell-Side Liquidity: Below $29.41 (D-Low), $27.95 (W-Low/M-Low).

OB: Bullish OB at $29.80–$30.00 (April 10 consolidation, demand zone, near HVN $30.00).

FVG: Bullish FVG at $30.00–$30.20 (April 11 gap, unfilled, aligns with D-Open $30.12).

OTE: Fib 61.8%–78.6% from $29.41 (low) to $30.63 (high) = $30.05–$30.15 (overlaps OB/FVG/HVN).

Displacement: Potential impulsive move to $31.50 (LVN) or $29.00 (below D-Low) on Retail Sales or tariff news.

Summary: Bullish bias, with OTE ($30.05–$30.15) as entry zone post-sweep, supported by OB/FVG/HVN.

10-Minute Chart

Closing Move (April 11):

Status: Rallied to $30.52, closed near high ($30.63), strong volume.

Stance: Bullish (buyers pushed close).

EMA Direction:

Status: 8-EMA ($30.45) > 13-EMA ($30.40) > 48-EMA ($30.30), uptrend.

Stance: Bullish (EMAs rising).

RSI (14):

Level: ~65 (bullish, cooling from 70).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above zero, bullish crossover.

Stance: Bullish (momentum intact).

VWAP:

Status: Above VWAP (~$30.40, late April 11).

Stance: Bullish (buyers control).

ICT/SMC:

Liquidity Sweep: Wick to $30.63 (8:50 AM, April 11) tested buy-side, no clear rejection yet.

Retracement: Potential retrace to $30.05–$30.15 (OTE) if sweep completes (e.g., April 14, 8:00 AM).

Entry Signal: Pin bar or engulfing at OTE (e.g., $30.10, 10-minute candle).

Summary: Bullish, awaiting sweep above $30.63 or $31.35, retrace to OTE for entry.

Options Data

Analysis:

GEX (Gamma Exposure):

Status: Positive GEX at $31 strike (high call OI), neutral at $30.

Impact: Dealers buy stock to hedge calls, supporting $31 pin or slight lift to $31.50.

Explanation: Positive GEX stabilizes price near high OI strikes, aligning with LVN ($31.50) sweep.

Stance: Neutral-bullish (pinning likely, breakout possible).

DEX (Delta Exposure):

Status: High call delta (+0.3, 89% call volume).

Impact: Bullish pressure, as dealers hedge calls by buying KWEB.

Explanation: Call-heavy delta fuels upside momentum, supporting buy-side sweep.

Stance: Bullish.

IV (Implied Volatility):

Status: Moderate (~25%, vs. 20–35% norm for KWEB).

Impact: Steady swings ($0.50–$1.00/day), good for ATM/OTM calls.

Explanation: Moderate IV balances premium cost and volatility, ideal for OTE entries.

Stance: Bullish (volatility supports options).

OI (Open Interest):

Status: Call-heavy (65% calls at $31, 20% at $32, 15% puts at $30).

Impact: Momentum toward $31–$32, potential pin at $31 (high OI).

Explanation: High call OI marks targets (W-High $31.35, LVN $31.50), puts at $30 guard HVN.

Stance: Bullish (calls drive upside).

Cem Karsan’s Application and Weekly Trading Breakdown:

Gamma: High at $31 (pinning risk), low at $32 (breakout potential).

Vanna: Rising IV (25% to 30% on Retail Sales) lifts calls, dealers buy KWEB, pushing to $31.50.

Charm: Near OPEX (April 18), $31 calls hold delta if ITM, spiking volatility April 17–18.

Volatility Skew: Call skew (higher IV for $32 vs. $30) favors upside breakouts.

Weekly OI (Exp. April 18): 65% calls at $31, 20% at $32. Pinning likely at $31 unless Retail Sales sparks breakout to $32.

Options Strategy:

Trade: Buy $31 calls at OTE ($30.10, April 14, 8:50 AM), premium ~$0.50.

Exit: $31.50 (W-High/LVN, premium ~$0.90), profit $0.40.

Stop: Below OB ($29.80, premium ~$0.20), risk $0.30.

R:R: 1.33:1 (adjust to 2:1 with partial exit).

ICT/SMC Tie-In: Enter post-sweep ($31.35), retrace to OTE ($30.10), target $31.50.

Vanna:

Status: IV rise (25% to 30%) amplifies calls, dealers buy KWEB.

Impact: Bullish lift to $31–$31.50, aligns with LVN sweep.

Explanation: Vanna boosts delta near high OI, supporting OTE reversal.

Charm:

Status: OPEX (April 18) nears, $31 calls gain delta if KWEB hits $31.

Impact: Volatility spikes April 17–18, favors quick OTE trades.

Explanation: Charm accelerates delta, amplifying sweep-to-OTE moves.

Timeframe Analysis:

Weekly (Exp. April 18):

OI: 65% calls ($31), 20% ($32), 15% puts ($30).

IV: Moderate (25%), rising on catalysts.

Stance: Bullish (calls dominate, breakout risk).

Monthly (Exp. May 2):

OI: Balanced (50% calls $32, 50% puts $29).

IV: Stable (~24%).

Stance: Neutral (consolidation likely).

3-Month (Exp. July 7):

OI: Call skew ($33–$35, 60% calls).

IV: Low (~22%).

Stance: Bullish (long-term upside).

Directional Bias:

Synthesis: Positive GEX ($31 pin), high call DEX (+0.3), moderate IV (25%), call-heavy OI (65% at $31), vanna (IV lift), charm (OPEX volatility), and ICT/SMC (buy-side sweep to $31.35, OTE at $30.10) suggest a bullish trend for April 14, with potential retracement post-sweep.

Why: Options data aligns with ICT/SMT (call OI = buy-side liquidity, OTE = dealer hedging zone), per AMT (LVN sweep, HVN reversal).

Action: Focus on $31 calls, highlight pinning vs. breakout. Video: “KWEB’s $31 call wall could pin or pop—perfect for an OTE play.”

Sympathy Plays

Correlated Assets:

MCHI (iShares MSCI China ETF): Tracks broader Chinese equities, rises ~2–3% if KWEB rallies (e.g., $31.50), due to shared holdings (Alibaba, Tencent).

BABA (Alibaba ADR): KWEB’s top holding, moves +3–4% on KWEB’s sweep to $31.35, driven by e-commerce/AI overlap.

Opposite Mover:

GLD (SPDR Gold ETF): Risk-off asset, fades ~1–2% if KWEB rallies (risk-on), as investors shift from safe havens to tech.

Why: Sympathy plays confirm sector momentum (Chinese tech), while GLD hedges tariff fears, per ICT/SMT sentiment.

Action: Monitor MCHI/BABA for confirmation, GLD for divergence. Video: “If KWEB pops, MCHI and BABA follow—watch gold for the flip side.”

Sector Positioning with RRG

Sector: Technology – Emerging Markets (China Internet).

RRG Position: Improving (vs. MCHI ETF).

Rationale: KWEB’s April 11 rally (+2.97%) outpaces MCHI (+2.1%), with RSI (~55) and call OI signaling strength. Tariff fears weaken absolute gains, but relative momentum grows.

Tie-In: Improving quadrant supports bullish MSS, OTE entries at HVN ($30.00).

Why: RRG aligns with sentiment (call-heavy) and technicals (above HVN), per AMT value area.

Action: Highlight Improving RRG for video: “KWEB’s gaining steam in China tech—prime for a sweep setup.”

Targets

Bullish:

Target: +3.5% to $31.60.

Levels: W-High ($31.35), LVN ($31.50), next resistance ($32.00).

Rationale: Buy-side sweep to $31.35 (W-High), breakout to LVN on Retail Sales or tariff relief, per ICT/SMC.

Bearish:

Target: -3.2% to $29.55.

Levels: D-Low ($29.41), below W-Open ($29.59), HVN ($29.50).

Rationale: Sell-side sweep below $29.41 on weak Retail Sales or tariff escalation, retracing to HVN, per AMT.

Why: Targets tie to OHLC (W-High, D-Low), HVNs/LVNs, and catalysts, ensuring ICT/SMC alignment (liquidity to OTE).

XAUUSD. Weekly trading levels 14 - 18.04.2025During the week you can trade from these price levels. Finding the entry point into a transaction and its support is up to you, depending on your trading style and the development of the situation. Zones show preferred price ranges WHERE to look for an entry point into a trade.

If you expect any medium-term price movements, then most likely they will start from one of the zones.

Levels are valid for a week, the date is in the title. Next week I will adjust the levels based on new data and publish a new post.

! Please note that brokers have a difference in quotes, take this into account when trading.

The history of level development can be seen in my previous posts. They cannot be edited or deleted. Everything is fair. :)

----------------------------------------------

I don’t play guess the direction (that’s why there are no directional arrows), but zones (levels) are used for trading. We wait for the zone to approach, watch the reaction, and enter the trade.

Levels are drawn based on volumes and data from the CME. They are used as areas of interest for trading. Traded as classic support/resistance levels. We see the reaction to the rebound, we trade the rebound. We see a breakout and continue to trade on a rollback to the level. The worst option is if we revolve around the zone in a flat.

Do not reverse the market at every level; if there is a trend movement, consider it as an opportunity to continue the movement. Until the price has drawn a reversal pattern.

More information in my RU profile.

Don't forget to like Rocket and Subscribe!!! Feedback is very important to me!

EURUSD. Weekly trading levels 14 - 18.04.2025During the week you can trade from these price levels. Finding the entry point into a transaction and its support is up to you, depending on your trading style and the development of the situation. Zones show preferred price ranges WHERE to look for an entry point into a trade.

If you expect any medium-term price movements, then most likely they will start from one of the zones.

Levels are valid for a week, the date is in the title. Next week I will adjust the levels based on new data and publish a new post.

! Please note that brokers have a difference in quotes, take this into account when trading.

The history of level development can be seen in my previous posts. They cannot be edited or deleted. Everything is fair. :)

----------------------------------------------

I don’t play guess the direction (that’s why there are no directional arrows), but zones (levels) are used for trading. We wait for the zone to approach, watch the reaction, and enter the trade.

Levels are drawn based on volumes and data from the CME. They are used as areas of interest for trading. Traded as classic support/resistance levels. We see the reaction to the rebound, we trade the rebound. We see a breakout and continue to trade on a rollback to the level. The worst option is if we revolve around the zone in a flat.

Do not reverse the market at every level; if there is a trend movement, consider it as an opportunity to continue the movement. Until the price has drawn a reversal pattern.

More information in my RU profile.

Don't forget to like Rocket and Subscribe!!! Feedback is very important to me!

AUDJPYWe see in Australia against the Japanese yen two scenarios, i.e. the trend is completed to the downside, or if 90.449 is breached, it begins to rise, and we target 93.498 and 92.332, but most likely the scenario is an upward trend that will be activated, i.e. we wait for the taki candle after the breach.

Quantum's T (AT&T) Trading Guide 4/11/25T (AT&T Inc.)

Sentiment

• Sentiment is neutral with a bearish tilt. April 10 options activity shows put-heavy volume at $26 strikes, reflecting caution. RSI (14) at ~50 (estimated, flat trend at $26.40 close) suggests indecision. X posts highlight concerns over telecom debt loads and tariff risks on equipment imports, but some speculate on institutional accumulation below $26.50. A liquidity sweep below $26.33 could trigger a bullish reversal if buy-side liquidity is tapped.

Catalyst: Potential sweep below $26.33 may spark short covering.

Tariff Impact - Rating: Moderate.

• Explanation: T relies on imported telecom equipment, facing cost pressures from tariffs on China (active as of April 11). No relief announced, so margins could tighten, capping upside. X posts suggest tariff fears weigh on sentiment, but domestic revenue focus limits fundamental damage.

News/Catalysts

• Driver: Flat telecom sector performance on April 10, with T holding steady amid mixed market signals. X posts cited stability but no clear catalyst.

• Upcoming: CPI (April 11): High CPI could hurt T (-1.5%) due to rate hike fears; low CPI may lift it (+1%) as a yield play.

• Retail Sales (April 15): Strong data supports T (+1%); weak data pressures (-1%) due to consumer spending risks.

Technical Setup

Weekly Chart:

• HVN: $26.00 support (bullish).

• LVN: $27.00 resistance (neutral).

• EMA Trend: 8-week ≈ 13-week > 48-week (neutral).

• RSI (14): ~50 (neutral).

• MACD: Near signal line (neutral).

• Bollinger Bands: At midline (neutral).

• Donchian Channels: At midline (neutral).

• Williams %R: ~-50 (neutral).

• ADR: Stable (neutral).

• VWAP: At VWAP $26.40 (neutral).

• ICT/SMC: No clear MSS; consolidation phase.

One-Hour Chart:

• Support/Resistance: Support at $26.33; resistance at $26.56. Stance: neutral.

• RSI (14): ~50 (neutral).

• MACD: Near zero (neutral).

• Bollinger Bands: At midline (neutral).

• Donchian Channels: At midline (neutral).

• Williams %R: ~-50 (neutral).

• VWAP: At VWAP $26.50 (neutral).

• ICT/SMC: Sell-side liquidity below $26.33; OB at $26.40; FVG at $26.35–$26.45; OTE at $26.45; no displacement.

10-Minute Chart:

• Closing Move: Flat into close.

• EMA Direction: 8/13/48 EMAs flat (neutral).

• RSI (14): ~50 (neutral).

• MACD: Near zero (neutral).

• VWAP: At VWAP $26.50 (neutral).

• ICT/SMC: Potential sweep below $26.33; OTE at $26.45; no clear entry signal yet.

Options Data

• GEX: Neutral, pinning at $26.50. Dealers hedge minimally.

• DEX: Put delta bias (-0.15), bearish pressure.

• IV: Low (~18%), limited swings.

• OI: Put-heavy (55% puts at $26), capping upside.

Cem Karsan’s Application:

• Weekly Trading Breakdown: OI at $26 suggests pinning. Low gamma limits volatility; vanna neutral; charm favors puts near OPEX.

• Strategy: Buy $26.50 calls at $26.45 (OTE), exit at $27, profit $0.30, risk $0.40. Ties to sweep below $26.33.

• Vanna: Stable IV, no dealer-driven lift.

• Charm: Puts gain delta near OPEX, pressuring $26.

Timeframe Analysis:

• Weekly (exp. April 18): Put OI at $26, low IV, bearish stance.

• Monthly (exp. May 16): Balanced OI, neutral stance.

• 3-Month (exp. July 18): Neutral outlook.

• Directional Bias: Neutral, leaning bearish unless sweep triggers reversal.

Sympathy Plays

• Correlated Assets: VZ (+1%), CCI (+0.5%).

• Opposite Mover: If T fades, risk-on SPOT rises (+1%).

Sector Positioning with RRG - Sector: Communication Services – Telecom.

• RRG Position: Lagging vs. XLC, reflecting weak momentum.

Targets

• Bullish: +2% to $27.00 (OB).

• Bearish: -2% to $25.87 (FVG).

Quantum's KR Trading Guide 4/11/25

KR (Kroger Company)

Sentiment

• Analysis: Market sentiment for KR is neutral leaning bullish. Post-close options activity on April 10 shows balanced put/call volume, with slight call dominance at strikes near $69, suggesting cautious optimism. RSI (14) at the April 10 close (estimated ~60 based on recent uptrend to $67.96) indicates momentum without overbought conditions, supporting a potential continuation. Anonymized X chatter highlights speculation on grocery sector stability amid tariff uncertainties, with some noting KR’s domestic focus as a hedge against import risks. A potential liquidity sweep above recent highs ($68.76) could signal institutional buying, setting up a reversal to the upside.

Catalyst: Watch for a sweep above $68.76 triggering bullish momentum, driven by retail investor interest on X.

Tariff Impact - Rating: Minimal.

• Explanation: KR’s exposure to tariffs is limited due to its primarily domestic supply chain and focus on U.S.-sourced goods. While imported specialty products could face cost pressures, these are a small fraction of revenue. No tariff relief or escalation was announced on April 10, so sentiment remains stable. Fundamentals are unaffected, but speculative X posts suggest tariff fears could cap upside unless clarity emerges.

News/Catalysts

• No specific company news on April 10, but sector strength in consumer staples drove modest gains, with KR benefiting from defensive positioning amid broader market volatility. X posts noted KR as a “safe play” in uncertain times.

• Upcoming: CPI Data (Today, April 11): Stronger-than-expected CPI could pressure consumer staples (-1% move) as investors rotate to cyclicals; weaker CPI could boost KR (+2%) as a defensive name.

• Retail Sales (April 15): Robust data may signal consumer strength, lifting KR (+1.5%); weak data could hurt (-1%) due to spending concerns.

Technical Setup

Weekly Chart:

• HVN: $66.50 as support (bullish, price above).

• LVN: $70.00 as resistance (neutral, price below).

• EMA Trend: 8-week > 13-week > 48-week (bullish uptrend).

• RSI (14): ~62 (bullish, above 50).

• MACD: Above signal line (bullish).

• Bollinger Bands: Near upper band (bullish).

• Donchian Channels: Above midline (bullish).

• Williams %R: ~-20 (neutral, not overbought).

• ADR: Expanding (bullish, volatility rising).

• VWAP: Above weekly VWAP at $67.00 (bullish).

• ICT/SMC: Higher highs/lows confirm bullish Market Structure Shift (MSS).

One-Hour Chart:

• Support/Resistance: Support at $67.50 (weekly HVN confluence); resistance at $68.76 (daily high). Stance: bullish above support.

• RSI (14): ~65 (bullish).

• MACD: Above signal (bullish).

• Bollinger Bands: At upper band (neutral, potential pullback).

• Donchian Channels: Above midline (bullish).

• Williams %R: ~-15 (neutral).

• VWAP: Above hourly VWAP at $68.20 (bullish).

• ICT/SMC: Buy-side liquidity above $68.76; Order Block (OB) at $67.50 demand zone; FVG at $68.00–$68.10; OTE (Fib 61.8%) at $68.30; displacement seen in early April 11 rally.

10-Minute Chart:

• Closing Move: Strong rally into April 10 close, holding above $67.96.

• EMA Direction: 8/13/48 EMAs rising (bullish).

• RSI (14): ~60 (neutral).

• MACD: Above zero (bullish).

• VWAP: Above VWAP at $68.30 (bullish).

• ICT/SMC: Liquidity sweep above $68.40 in pre-market; retracement to OTE at $68.30; pin bar forming as entry signal.

Options Data

• GEX: Neutral, slight bullish pinning at $68. Dealers may buy stock to hedge, supporting price at $68–$69. Explanation: Gamma Exposure balances calls/puts, stabilizing price near strikes.

• DEX: Moderate call delta bias (+0.25), indicating bullish pressure. Explanation: Net call buying drives directional momentum.

• IV: Moderate (~22%, near norm), suggesting steady swings. Explanation: Implied Volatility supports consistent options pricing.

• OI: Call-heavy (60% calls at $69 strike), favoring upside momentum. Explanation: Open Interest at $69 signals potential breakout target.

Cem Karsan’s Application:

• Weekly Trading Breakdown: High call OI at $69 (exp. April 18) suggests pinning or breakout potential. Gamma supports stability at $68; vanna indicates dealers buy on IV spikes to 23%, lifting price. Charm accelerates delta near OPEX, favoring $69 calls if in-the-money.

• Strategy: Buy $69 calls at $68.30 (OTE), exit at $69.50, profit $0.50, risk $0.40. Ties to liquidity sweep above $68.76, targeting $69 OB.

• Vanna: Rising IV to 23% could push dealers to buy, lifting KR to $69 (bullish).

• Charm: Near OPEX, $69 calls hold delta if ITM, boosting volatility.

Timeframe Analysis:

• Weekly (exp. April 18): 60% call OI at $69, moderate IV, bullish stance.

• Monthly (exp. May 16): Balanced OI, stable IV, neutral stance.

• 3-Month (exp. July 18): Slight call skew, low IV, bullish outlook.

• Directional Bias: Bullish, driven by call OI, positive GEX, and OTE setup at $68.30.

Sympathy Plays

• Correlated Assets: WMT (+2% if KR rallies), COST (+1.5%).

• Opposite Mover: If KR rallies (defensive), risk-on names like SHOP fade (-1%).

Sector Positioning with RRG

• Sector: Consumer Staples – Food Retail.

• RRG Position: Improving vs. XLP ETF, aligning with bullish sentiment and technicals.

Targets

• Bullish: +3% to $70.50 (next liquidity zone, OB at $70).

• Bearish: -2% to $66.60 (FVG at $66.50).

Don't Let It Slip Away: Dragon Signal Active on EUR/USDHi traders! Analyzing EUR/USD on the 1H timeframe, spotting a potential Dragon pattern with long opportunity:

🔹 Entry: 1.0956

🔹 TP: 1.11367

🔹 SL: 1.07787

Price action has formed a classic Dragon pattern — two symmetrical legs and a clear head, with the neckline (the hump) being retested as support. Currently, the pair is testing the neckline zone just above the 200 EMA. RSI is mid-range and curving up, showing early signs of bullish momentum.

If the neckline holds, we may see a strong bullish wave toward 1.1136. This pattern often leads to explosive upside moves once confirmed.

⚠️ DISCLAIMER: This is not financial advice. Every trader must evaluate their own risk and strategy.

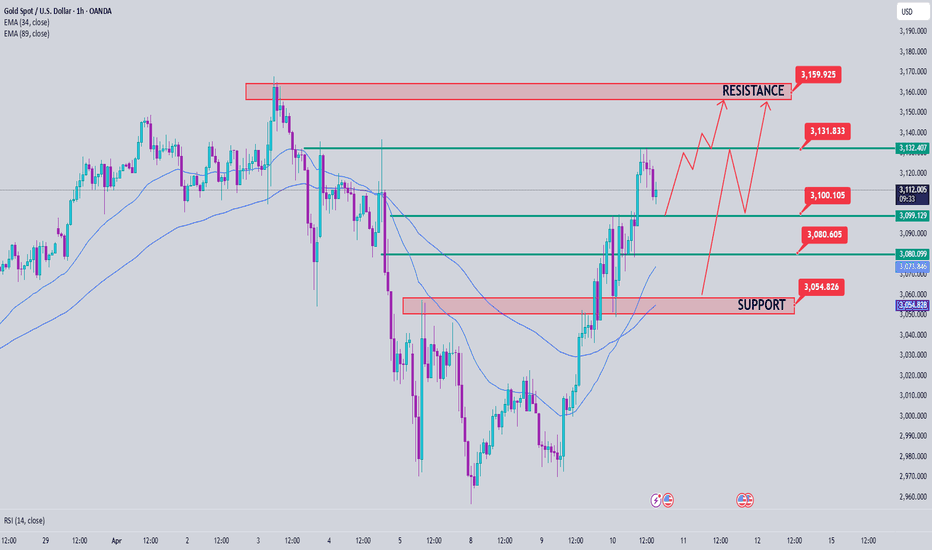

Gold Price Analysis April 10D1 candle confirms that the buyers have returned to the market with an increase of more than 100 prices. The retest points are considered buying opportunities to break ATH

3100 is a notable point for the Buy signal in this European trading session. Today's trading strategy is quite simple when a strong uptrend has just formed, we will wait for the retest points to 3100-3080-3056 for the BUY signal to break ATH. On the other hand, if gold does not test before, we can Sell Scalp around 3133 again, when it breaks, do not SELL anymore but wait for the retest of 3133 to buy up to 3162.

Have a nice day everyone

GBP/USD Faces Crucial Resistance – Will the Uptrend Continue?📊 GBP/USD Daily Technical Outlook – April 10, 2025

GBP/USD is currently trading around 1.2696, facing significant resistance near the 1.2800 level. After a recent decline from the 1.3434 peak, the pair has been consolidating, forming a range between 1.2740 and 1.2860. The market's reaction to these levels will be crucial in determining the next directional move.

📈 Current Market Structure:

The recent price action indicates a neutral to bearish trend for GBP/USD. The pair has formed lower highs and higher lows, creating a symmetrical triangle pattern, suggesting indecision in the market. A breakout from this pattern, either above 1.2860 or below 1.2740, will likely set the tone for the next significant move.

🔹 Key Resistance Levels:

1.2800: Immediate resistance. A break above this level could signal a potential bullish move.

1.2860: Upper boundary of the current range. A decisive break above this level would confirm the continuation of the uptrend.

1.2933: Significant resistance zone. If the price manages to break above this level, it could lead to further gains.

🔸 Key Support Levels:

1.2740: Lower boundary of the current range. A break below this level could indicate a bearish reversal.

1.2720: Short-term support. Failure to hold above this level might lead to a deeper correction.

1.2580: Major support zone. A drop below this level would confirm a bearish trend.

📐 Price Action Patterns:

The formation of a symmetrical triangle suggests that the market is awaiting a catalyst for the next move. Traders should watch for a breakout from this pattern, as it will likely lead to increased volatility and a clear directional bias.

🧭 Potential Scenarios:

✅ Bullish Scenario:

A breakout above 1.2860, especially with strong volume, could lead to a rally toward 1.2933 and potentially higher levels.

❌ Bearish Scenario:

A break below 1.2740 could trigger a decline toward 1.2720, with further downside potential if the support at 1.2580 is breached.

📌 Conclusion:

GBP/USD is currently consolidating within a defined range, with key levels at 1.2740 and 1.2860. The next significant move will depend on a breakout from this range, providing clarity on the market's direction. Traders should monitor these levels closely and prepare for increased volatility as the pair approaches these boundaries.

💬 What’s your outlook for GBP/USD? Will the pair break above 1.2860, or is a bearish reversal imminent? Share your thoughts below 👇

Quantum's HIMS Trading Guide 4/10/25 HIMS (Hims & Hers Health, Inc.) - Sector: Healthcare (Telehealth)

Sentiment: Bullish. Post-close call volume steady, RSI ~58 (up from ~55), Amplified GLP-1 demand—speculation persists despite tariff noise.

Tariff Impact: Minimal. Domestic focus shields HIMS; 104% China tariffs irrelevant unless generics supply tightens.

News/Catalysts:

Current: tariff pause softens market fear.

Upcoming: Retail Sales (April 15)—strong data could lift +5%; Fed rate outlook (May 2025)—cut signals might push +7%.

Technical Setup:

--Weekly Chart:

---HVN $30 (resistance), support ~$25.45.

---Uptrend (8-week EMA > 13-week > 48-week).

---RSI ~58, MACD above signal,

---Bollinger Bands upper band,

---Donchian Channels above midline,

---Williams %R -25.

--One-Hour Chart:

---Support $28.50, resistance $29.50.

---RSI ~60,

---MACD above signal,

---Bollinger Bands upper band,

---Donchian Channels above midline,

---Williams %R -20.

--10-Minute Chart:

---8/13/48 EMAs up,

---RSI ~62,

---MACD rising.

Options Data:

--GEX: Bullish—pinning near $29.

--DEX: Bullish—call delta dominates.

--IV: High—~50–55% vs. norm 45–50%.

--OI: Call-heavy—above $29.

Timeframe Analysis:

---Weekly: OI call-heavy (70% calls at $30), IV high (55%)—bullish, speculative push.

---Monthly: OI call-leaning (65% calls at $30–$32), IV moderate (50%)—bullish trend.

---3-Month: OI call-heavy (75% calls at $32), IV moderate (45%)—bullish long-term.

Directional Bias:

---Bullish. GEX/DEX and call OI signal strong upside; high IV fuels volatility—intraday breakout potential.

Sympathy Plays:

---TDOC rises with HIMS; AMWL gains with HIMS.

---Opposite: HIMS rallies → WMT fades.

Sector Positioning with RRG: Leading Quadrant (Healthcare vs. XLV)—growth persists.

Targets: Bullish +6% ($30.77); Bearish -3% ($28.16).

Gold Analysis April 9D1 frame is a Doji candle with unclear buying and selling power. but the market is still in the structure of a corrective downtrend.

H4 shows a strong increase from 2970 to 3050 due to data from fundamental analysis

Trading scenario: Gold is approaching the fionacci retracement zone. Pay attention to the two SELL zones today 3063-3065 and the zone 3089-3091.

For gold to move towards the upper SELL zone, gold needs to surpass 3047. If it does not break 3047 and close below 3039, wait for a retest to SELL to 3021 in the US session. If it does not break 3021, then BUY again in this zone. If it confirms closing below 3021, hold at 2990 today.

Explosive Breakout Setting Up on GBP/USD – Here's the Roadmap🔥 GBP/USD Technical Analysis – 4H Timeframe | Market Poised for Breakout or Breakdown?

Key Support: 1.26888

Key Resistance: 1.28829

Market Structure: Consolidation with bullish undertones

Bias: Neutral-to-bullish (pending confirmation)

🧠 Market Overview:

The GBP/USD pair is currently consolidating within a well-defined horizontal channel on the 4-hour chart, oscillating between 1.26888 (major support) and 1.28829 (key resistance). This prolonged range-bound behavior reflects a market in balance, where buyers and sellers are cautiously awaiting a catalyst to drive the next impulsive move.

The price action suggests that this consolidation phase may be coming to an end soon. A breakout or breakdown from this tight range is likely to set the tone for the next major trend. Market participants should be alert to early breakout signals and volume surges as confirmation triggers.

📊 Price Structure and Key Observations:

The market has printed a series of higher lows within the consolidation range, indicating a subtle bullish pressure beneath the surface.

Price is hovering near the mid-range zone, consolidating after multiple failed breakout attempts at 1.28829.

A squeeze in volatility is evident from narrowing candlesticks and declining ATR, often preceding explosive directional moves.

🔍 Technical Indicators Breakdown:

✅ RSI (14):

Currently trading around the neutral zone at 50, showing no clear directional bias. However, higher lows on RSI suggest potential bullish divergence forming, which could be an early signal of upward momentum building up.

✅ MACD:

A recent bullish crossover below the zero line indicates potential for a shift in momentum. Histogram bars are starting to turn positive, supporting a near-term bullish scenario if price confirms with a breakout.

✅ Moving Averages:

Price is trading above the 50-period SMA, which has acted as dynamic support on several occasions.

The 200-period SMA remains below current price levels, indicating a medium-term bullish structure remains intact unless support is broken decisively.

🔮 Potential Scenarios:

✅ Bullish Breakout Scenario:

If price breaks and closes above 1.28829 on strong bullish volume, it would represent a major breakout from the current range. This could open the door for a new impulsive leg to the upside.

Upside Targets:

🎯 1.29650 – Short-term resistance level from previous highs

🎯 1.30300 – Psychological round number and previous supply zone

🎯 1.31000 – Extended target aligned with Fibonacci 1.618 projection

Confirmation Factors:

Break + retest of 1.28829 as new support

RSI holding above 60

MACD expanding positively

❌ Bearish Rejection / Breakdown Scenario:

Should the pair fail to break above 1.28829 and print a strong bearish rejection candle (e.g., Shooting Star, Bearish Engulfing), the pair could retest the lower support of 1.26888.

A clean break below 1.26888 with a decisive bearish close could signal a trend reversal, shifting sentiment toward the downside.

Downside Targets:

📉 1.26000 – Near-term psychological support

📉 1.25200 – Previous demand area and key fib level (61.8%)

📉 1.24400 – Long-term trendline support (if applicable)

⚙️ Trade Strategy & Risk Management:

Breakout Traders: Wait for a confirmed candle close outside the range (either above 1.28829 or below 1.26888) before entering. Avoid false breakouts by validating with volume and momentum indicators.

Range Traders: Continue fading the range boundaries (buy near 1.26888, sell near 1.28829) while the channel remains intact. Use tight stop-losses just beyond the range to mitigate whipsaw risks.

Swing Traders: A successful breakout presents excellent risk-reward setups for multi-day trades, especially if accompanied by high volatility and news catalysts (e.g., NFP, BoE/Fed announcements).

🧭 Conclusion:

The GBP/USD pair is coiling tightly within a critical decision zone between 1.26888 and 1.28829. The tightening price structure, supportive indicators, and market indecision suggest that a major breakout is imminent.

Whether bulls take control or bears force a breakdown will largely depend on macroeconomic catalysts and institutional order flow. Traders are advised to stay patient, let the market reveal its hand, and execute only on high-probability setups with clear confirmations.

This is not the time to chase the market—this is the time to prepare for the move.

💬 Let me know in the comments how you're positioning yourself on GBP/USD this week!

🔔 Follow for more real-time setups, macro breakdowns, and professional market insights.

📈 Stay sharp, stay technical.

Would you like me to generate a matching TradingView chart snapshot with drawn zones and notes to go with this analysis for posting?