Tradingsignals

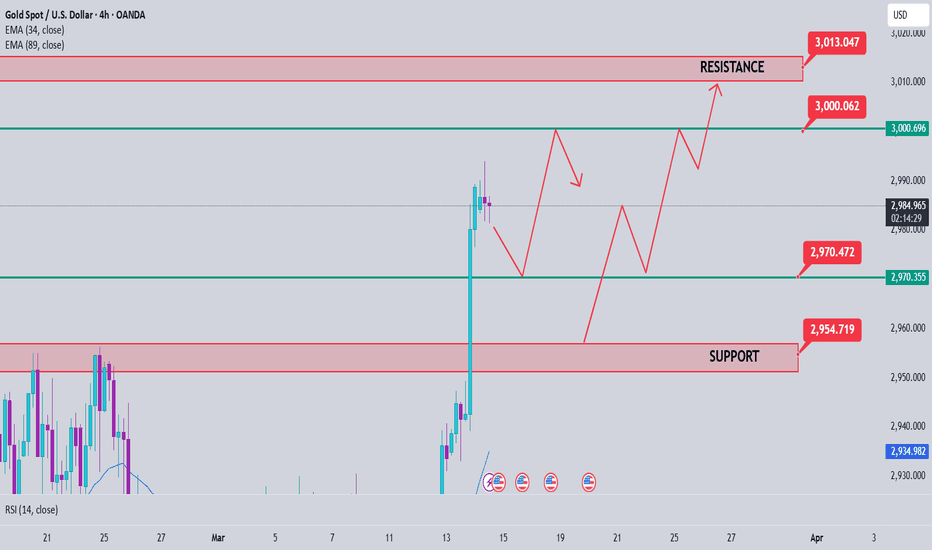

GOLD - where is current support? what's next??#GOLD.. perfect move as per our video analysis and congratulations to all followers.

now we have 3025 - 27 as a immediate supporting area guys, keep close that region because if market hold it in that case we can expect further bounce to upside.

don't be lazy here and focused on our today immediate supporting area.

good luck

trade wisely

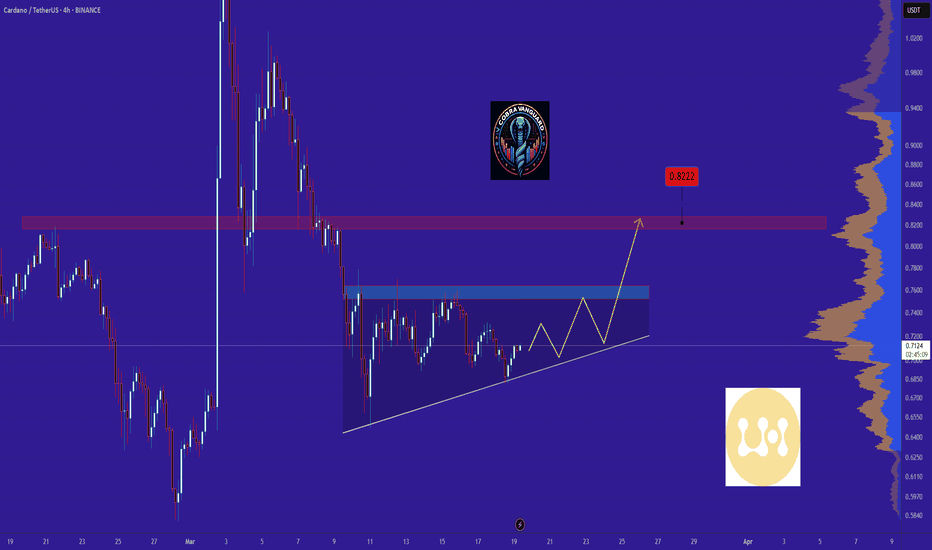

Can we be optimistic that this will come true?Can we be optimistic that this will come true? If it follows the triangle pattern, the price will rise by $0.80.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

SONIC- Time to buy again!the price can form a head and shoulders pattern. If that is happen, expect a significant price increase.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

FOMC today ?World gold prices increased by 3 USD, to 3,030 USD/ounce. In the US trading session (night of March 18), gold at one point rose to a record high of 3,035.4 USD/ounce. The safe haven demand for gold has pushed prices to a record high. Investors are worried about the increase in global trade wars and new geopolitical developments between countries, so they have bought gold.

Israel launched airstrikes across the Gaza Strip early Tuesday morning, killing at least 400 Palestinians, including women and children, according to hospital officials. The surprise bombing broke a ceasefire that had been in place since January and threatened to completely reignite the 17-month war. Over the weekend, the US attacked Houthi targets in the Middle East and vowed to attack more.

In addition, investors are now watching the Federal Reserve Open Market Committee (FOMC) meeting, which begins Tuesday morning and ends Wednesday afternoon. The market is not expected to make any changes to interest rates at this meeting, but will closely analyze the wording of the FOMC statement and Fed Chairman Jerome Powell's press conference.

Gold price analysis March 19⭐️Fundamental Analysis

The Fed is likely to continue to pause the rate cut in March.

The policy decision will depend on the Dot Plot chart and the speech of Chairman Jerome Powell.

Donald Trump's tariff policy may affect the economy and the Fed's interest rate.

Geopolitical tensions (Israel-Gaza conflict, Ukraine-Russia) may boost gold buying demand.

The Bank of Japan (BoJ) is expected to keep interest rates unchanged, affecting the financial market.

⭐️Technical Analysis

The candle broke the ATH zone around 3038 and had a retest of the breakout zone to increase. The candle closed above 3038, confirming that the price will soon push back to the resistance zone of 3054. Support at 3020 and 3006 are still solid supports for buy signals.

$XAUUSD | Gold - Nearing ExhaustionGold has seen a strong rally over the past week – technically impressive, but from a Risk-On perspective, it’s more of a warning sign. As I mentioned in my Nvidia market report, I don’t think the Risk-Off phase will last forever. But for now, I believe we’re not quite done with it yet.

From where I stand, Gold could push a bit higher. My next target is the 161.8% Fibonacci extension at $3,038, which I expect to act as a reaction level. After that, I’m targeting a drop back down into the $2,955 to $2,930 area – this is where I expect sub-wave ((iv)) to complete.

What happens next will depend on how price reacts within that zone. Ideally, we’ll see one final move up to complete sub-wave (v) or roman ((iii)), but where exactly that ends is still unclear – I’ll reassess as we approach the zone.

For now, Gold remains strong – but I believe it's nearing exhaustion.

AUD/CHF: Consolidation Within a Defined RangeThe AUD/CHF pair continues to oscillate within a range between 0.56550 and 0.55000, recently reaching the upper boundary. Following a rebound from the support level, the price has developed an ABC move, which often precedes a pullback.

Currently, the market has approached the upper boundary of the channel and trendline, a level where price has previously faced rejection twice. Given the ongoing consolidation, there is a possibility of another rejection at resistance, potentially leading to a downward move while the sideways trend persists. The next key target is the support zone around 0.55835

ETH/USDT: Testing Key Support with Potential for ReboundThe ETH/USDT pair continues to decline, approaching a key support level last tested in October 2023. Historically, similar price movements were observed in 2021, when the price dropped from the 4,300 level before rebounding from the 1,700 support zone, ultimately leading to new all-time highs.

Currently, the price has broken above a downward trendline that had served as a resistance throughout the month. Looking ahead, the market may remain in a sideways phase over the coming weeks, with a potential upward push if buying pressure emerges from the support level. The next key target is the resistance zone around 2,190

Gold Price Analysis March 17⭐️Fundamental Analysis

Persistent concerns over escalating trade tensions and their impact on the global economy, coupled with geopolitical risks, continued to act as a bullish driver for safe-haven bullion. In addition, bets that the Federal Reserve (Fed) will cut interest rates multiple times this year further bolstered the non-yielding yellow metal.

The prospect of further policy easing by the US central bank sent the US dollar (USD) tumbling near multi-month lows touched last week, further supporting gold prices. However, a positive shift in global risk sentiment, bolstered by optimism over China’s stimulus measures announced over the weekend, capped XAU/USD’s gains. Traders also appeared reluctant, opting to wait for the outcome of the FOMC’s two-day policy meeting on Wednesday.

⭐️Technical analysis

Gold is in a difficult trading phase when the price range is unclear for buying and selling zones, pay attention to the 2980 zone today for BUY strategies. If it breaks this zone, the strategy will only SELL to 2955. In case gold breaks 2994, there will be a new AT H in the last trading sessions in Europe and America today.

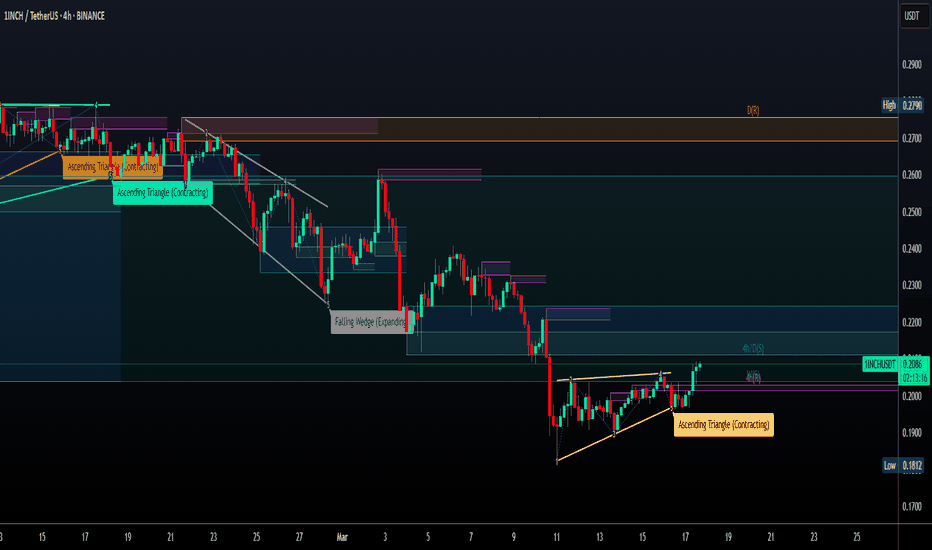

1INCHUSDT: The Invisible Forces Driving Price Right Now - 1inch◳◱ Ever seen the Bollinger Band Breakout Super Trend on a chart? It's exciting to watch! With the price hovering around 0.2093, there's potential for a breakout above 0.2203 | 0.2433 | 0.2859. Support at 0.1777 | 0.1581 | 0.1155 provides confidence for bulls.

◰◲ General Information :

▣ Name: 1inch

▣ Rank: 199

▣ Exchanges: Binance, Kucoin, Huobipro, Gateio, Mexc, Hitbtc

▣ Category / Sector: Financial - Decentralized Exchanges

▣ Overview: The 1inch Network unites three separate decentralized protocols, aggregating liquidity from a variety of decentralized exchanges to facilitate cost-efficient transactions.

Its native token, the 1inch token (1INCH) serves two primary purposes: As a governance token granting voting rights towards the 1inch DAO and as a utility token, where it is used as a connector to achieve high-efficiency routing in the 1inch Liquidity Protocol. It will also be used in the tokenomics of all future protocols developed by the 1inch Network.

◰◲ Technical Metrics :

▣ Current Price: 0.2093 ₮

▣ 24H Volume: 3,767,156.011 ₮

▣ 24H Change: 3.358%

▣ Weekly Change: 4.06%%

▣ Monthly Change: -21.88%%

▣ Quarterly Change: -56.72%%

◲◰ Pivot Points :

▣ Resistance Level: 0.2203 | 0.2433 | 0.2859

▣ Support Level: 0.1777 | 0.1581 | 0.1155

◱◳ Indicator Recommendations :

▣ Oscillators: NEUTRAL

▣ Moving Averages: BUY

◰◲ Summary of Technical Indicators : BUY

◲◰ Sharpe Ratios :

▣ Last 30 Days: -3.94

▣ Last 90 Days: -4.16

▣ Last Year: -0.69

▣ Last 3 Years: -0.39

◲◰ Volatility Analysis :

▣ Last 30 Days: 0.79

▣ Last 90 Days: 0.78

▣ Last Year: 0.93

▣ Last 3 Years: 0.87

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: 0.53 - Bullish

▣ Reddit Sentiment: 0.60 - Bullish

▣ In-depth BINANCE:1INCHUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

LTC Ready for PUMP or what ?The price can encounter a strong pump after declining to the bottom of the triangle, and after breaking the triangle, it can reach the desired targets.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

DIA ETF, just wait a little more to buy!European investors pulled money from U.S. equity ETFs in February for the first time since May 2023, showing a stark contrast with their American counterparts.

U.S. equity ETFs based in Europe recorded $514.7 million in outflows during February, according to Morningstar Direct data. This reversal came despite an increase in overall European ETF inflows to $35.3 billion during the same period.

finance.yahoo.com

Gold Price Analysis March 14⭐️Fundamental analysis

Optimistic comments from the White House and Canada, along with news that enough Democrats have voted to avoid a US government shutdown, have boosted investor sentiment. However, gold's gains were capped by a stronger US dollar, which was bought for the third consecutive session.

However, expectations that the Fed will cut interest rates multiple times this year could limit the strong recovery of the US dollar. In addition, concerns about former President Trump's tough trade policies and their impact on the global economy continue to support gold prices. This suggests that any correction in gold could be a buying opportunity, helping the precious metal maintain its upward trend for the second consecutive week.

⭐️Technical analysis

any pullback today is considered a reasonable buy 2970 is the area where the European session Gold can find deeper and 2953 are the two BUY zones today. The sell zone is still noticeable around the 3000 round resistance and the 3015 border is considered resistance today. When gold has ATH, the FOMO is very high, so this is a difficult time to trade. Pay attention to volume and good capital management.

GOLD READY TO SURGE? USD WEAKNESS SIGNALS A BIG MOVE!📌 Market Overview

The US Dollar (USD) has been weakening for the past three months, signaling significant shifts in global financial markets. The latest CPI report came in weaker than expected, putting additional short-term pressure on the USD. However, long-term projections suggest a possible recovery.

Meanwhile, Gold continues to gain momentum, benefiting from USD weakness on both fundamental and technical fronts. As per our previous analysis, the bullish trend remains intact, and we will continue looking for BUY opportunities at key support levels while monitoring resistance zones near all-time highs (ATH).

📊 CPI Impact on USD & GOLD – What’s Next?

🔹 Short-term USD Weakness, But Potential Recovery?

The lower-than-expected CPI report has increased bearish pressure on the USD.

However, in the long run, the USD may find stability and enter a recovery phase.

For now, USD weakness continues to support Gold’s upside potential, bringing it closer to key resistance zones.

🔸 Gold’s Strength – Will It Hit New All-Time Highs?

With USD weakening and market uncertainty rising, Gold remains a preferred safe-haven asset for investors.

Our primary strategy remains BUY on dips, anticipating further upside.

Tonight’s Producer Price Index (PPI) report could be a major catalyst for USD and Gold volatility.

📉 Key Technical Levels for GOLD

🔹 Major Resistance Levels:

2,945 - 2,956 - 2,972 - 2,988

🔻 Major Support Levels:

2,931 - 2,922 - 2,914 - 2,906 - 2,898

🎯 Trading Plan for Today

🟢 BUY ZONE: 2,922 - 2,920

📍 SL: 2,916

🎯 TP: 2,926 - 2,930 - 2,935 - 2,940 - 2,950

🔴 SELL ZONE: 2,955 - 2,957

📍 SL: 2,961

🎯 TP: 2,950 - 2,946 - 2,942 - 2,938 - 2,930

⚡ PPI Report Tonight – Market Volatility Alert!

📌 The US Producer Price Index (PPI) report is set to release today, a key indicator of inflation at the production level.

📌 If PPI data is weaker than expected, USD could face further pressure, pushing Gold higher.

📌 On the other hand, stronger PPI figures could help the USD recover, leading to potential Gold corrections.

📢 Are you ready for high volatility? Stick to your TP/SL to keep your capital safe! 🚀🔥

💬 Will Gold hit a new all-time high, or is a USD recovery imminent? Drop your thoughts in the comments!