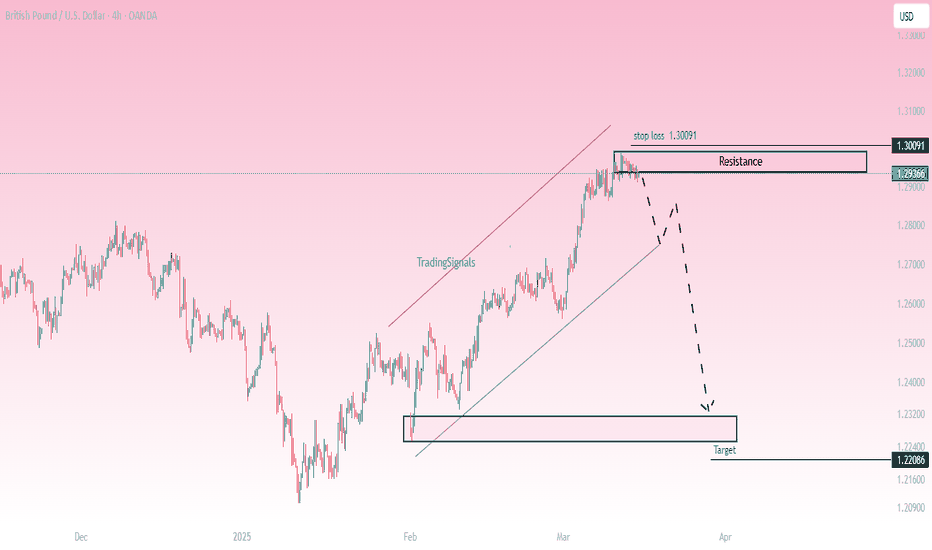

GBP/USD - Potential Bearish Reversal Setup

📉Market Structure:

The pair has been in an uptrend, forming a rising channel. However, price is now facing strong resistance around 1.2936 - 1.3009, showing signs of exhaustion. A potential reversal could be forming.

🔍 Key Levels:

Resistance Zone: 1.2936 - 1.3009

Current Price: 1.2936

Target Support: 1.2208

📊 Trade Idea:

A rejection from the resistance zone could initiate a bearish move.

A confirmed breakdown below 1.2900 may trigger further downside toward the 1.2208 target zone.

Stop-loss placed above the 1.3009 resistance to manage risk.

🚨 Confirmation & Risk Management:

Bearish Confirmation: Rejection from resistance with strong selling momentum.

Invalidation: A breakout above 1.3009, indicating bullish continuation.

Risk Management: Stop-loss at 1.3009 with a favorable risk-to-reward ratio.

This setup suggests a short opportunity if price respects resistance and begins a downward move. Traders should watch for confirmation signals before entering.

Tradingsignalservice

EURJPY LongHi Everyone,

Hope you're ok. Here is our signal for EURJPY. I hope that it brings profit for you all.

We want the 15 minute candle to close above the entry, and then respect the entry. Then we will enter.

RiskReward is essential. If you are blowing an account, only once, you are doing something wrong. Probably your lot size is too big. Take the time to learn.

EURJPY Buy 🦇

📈Entry: 162.160

⚠️SL: 160.435

✔️TP1: 163.899

✔️TP2: 165.902

✔️TP3: 168.548

Happy trading hope you all make lovely profit. Drop me a like if you do.

Best wishes

GOLD 1H ROUTE MAP & TRADING PLAN UPDATEHey Everyone,

And another repeat of yesterday with our levels being respected to perfection.

We had another drop into the retracement range and once again, as stated for the perfect bounce into 2155 Goldturn and now once again heading towards 2166 Goldturn gap.

We just need to keep in mind a failure to break into the 2166 level will likely see the 2147 Goldturn support level test and break and open the swing range.

Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we share every week in the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGETS

2166

EMA5 CROSS AND LOCK ABOVE 2166 WILL OPEN THE FOLLOWING BULLISH TARGETS

2175

2182

BEARISH RETRACEMENT TARGETS

2155 - DONE

2147 - DONE

EMA5 CROSS AND LOCK BELOW 2147 WILL OPEN THE SWING RANGE

SWING RANGE

2137 - 2129

EMA5 CROSS AND LOCK BELOW 2129 WILL OPEN THE STRUCTURE SUPPORT

STRUCTURE SUPPORT

2113

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

Mr Gold

GoldViewFX

FTT LONG IDEA hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Please also refer to the Important Risk Notice linked below.

XAUUSD H4 - Short Signal UpdateXAUUSD H4

In all honesty, was expecting a little more from this void once we had breached that 1935/oz price. That being said, we are going to be moving into the NA overlap sessions soon which hopefully should see this setup unfold somewhat with the increase volume the overlap session brings.

Hoping for a dump to 1925 before any corrective play. Following with subsequent lower lows and lower highs.

DXY D1 - Long SetupDXY D1

We have now pretty much seen the correction on the USD that we were expecting. 103.350 has been pinned and we are now looking for something to catalyse the upside dollar continuation.

ADP employment could do exactly that. Lets see what unfolds over the next few hours, NA overlap and ADP figures at 13:15 UK time.

GoldViewFX - 4H CHART GOLD PROJECTION FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets.

We are still in bearish formation on this chart with our descending channel being respected. We have 1894, as the immediate Bullish target with a break and lock above this level will provide the momentum to test the channel top.

We also have an immediate bearish target at 1882 retracement range, where we expect a reaction. However, EMA5 cross and lock below 1882 will open the swing range.

We will continue to buy dips using the weighted support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we share every week last 18 months, you can see how effectively they can be used to trade with or against short terms swings and trends.

Retracement and swing ranges have been updated for correctional retests.

BULLISH TARGETS

1894 -

EMA5 CROSS AND LOCK ABOVE 1894 WILL OPEN THE FOLLOWING BULLISH TARGETS

1903 -

1913 -

BEARISH TARGETS

1882 -

EMA5 CROSS AND LOCK BELOW 1882 WILL OPEN THE SWING RANGE

SWING RANGE

1870 - 1860

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

AUDUSD Signal 7Aug2023I have noticed a correction in the H1 timeframe. The most recent HH was unable to reach the SND area, resulting in a FTR (Failed to Return) and a subsequent drop in corrected prices. For this AUDUSD analysis, we can set up a buy limit in the SND area with a ratio of RR reaching 1:6. It is important to use a good MM.

GoldViewFX - GOLD LOOKING FOR BREAKOUTHey Everyone,

Another piptastic day for us getting a repeat action of yesterday. We caught the buy from the first dip into 1966 once again for a perfect exit. 1966 is a weighted level so a failure to ema5 lock once again followed with a rejection now back into the retracement range clearing the bearish targets along the way.

We will now patiently wait to see if the retracement range holds or breaks with ema5 lock. Failure to lock and we should see another clean bounce up.

We will continue to see price play between the weighed levels 1966 or 1937, until one of the weighted level crosses and locks with ema5 to open the new range.

We will continue with our plans to buy dips and track the movement level to level.

Our long term projection still remains Bullish.

BULLISH TARGETS

1966 - DONE

EMA5 CROSS AND LOCK ABOVE 1966 WILL OPEN 1979

BEARISH TARGETS

1957 - DONE

1947 - DONE

1937

EMA5 CROSS AND LOCK BELOW 1937 WILL OPEN THE SWING RANGE

SWING RANGE

1918 - 1904

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

GoldViewFX - 4H CHART UPDATED LEVELS & TARGETSHey Everyone,

Please see our 4H chart updated weighted Goldturn levels and targets.

Our 4h chart retracement zone is sitting at 1967 Goldturn, which is providing support. This is likely to provide support for a bounce to challenge resistance at 2005. However, if we see 1967 cross and lock with EMA5 then we can expect price to fall within the swing range.

We will keep this in mind and use the swing range Goldturns to buy dips as part of our long term plans.

BULLISH TARGETS

1993 -

2005 -

EMA5 CROSS AND LOCK ABOVE 2005 WILL OPEN UPPER LEVELS UPTO 2O39

BEARISH TARGETS

1980 -

1967 -

EMA5 CROSS AND LOCK BELOW 1967 WILL OPEN THE SWING RANGE

SWING RANGE

1942

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

GoldViewFX - Market UPDATEHey Everyone,

And BOOOOOM!!! Just like we analysed and called, our 1977 TARGET was HIT today, giving plenty of opportunities throughout the week to get in from the retracement range. This allowed us to milk this target more than once until the final TP today.

We will now wait patiently to see if EMA5 crosses and locks above 1977 to open the upper highlighted targets. Should 1977 fail then we will continue to track back into the retracement range and trade this level to level.

Our plans to buy dips has been playing our perfectly and we will continue to do this unless we updated otherwise. While many are struggling to trade gold in this range, we do it like no other!!!!!

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

GoldViewFX - END OF WEEK UPDATEHey Everyone,

Another great day today finishing of our week strong.

The retracement range on our 1H chart has been playing out all week giving plenty of entries and exits (SEE BELOW)

WEEKLY CHART LAST UPDATE

As highlighted last week, we got the EMA5 cross and lock above 1858 with our next target of 1928 HIT last week. The weekly candle failed to close above this level , which may now follow with some retracement but ultimately the last longer range target above remains open, now that we have the cross and lock above 1858.

- This is playing out as expected and now I would love to see if we finish of todays weekly candle above the 1928 level. Although we remain Bullish long term, we will need to keep in mind the ema5 detachment we now have two weeks running, which leaves room for a retracement down.

We will now come back Sunday with our multi timeframe analysis and trading plans for the coming week.

Hope you all have a great weekend and please don't forget to like, comment and follow to support us, we really appreciate it and it helps us to continue to share regular updates and content with you all.

GoldViewFX

XAUUSD TOP AUTHOR

GoldViewFX - Market 1H RANGE VIEW UPDATEHey Everyone,

Quick morning update with our RANGE boxes defining the range we are playing in and testing.

Zooming out and identifying ranges with Rangeview gives you a clearer picture of potential swing ranges.

We are currently testing Rangebox 3 entrance with 1640 Goldturn acting as support. A cross and lock below this will open the full rangebox. We will keep this in mind when planning fresh long positions from the bottom. A failure to break down will see price test range box 2 at 1660.

This is not the range to keep adding new positions in. We will now wait patiently for the market to make its move.

As always, we will keep you all updated with regular updates throughout the week and how we manage the setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

BULLISH BIAS ON AUD/USDThe AUD/USD had been on my radar for over 2 weeks now and I have been waiting for the right break to long the pair as heavy as possible, the last week's 100% correction to the spike that happened a week prior to last was really convincing.

But it all went down really great because the price has risen back to the same bullish zone.

The Friday bullish flag formation is a friendly indicator to the buyer because it reveals that the bear's strength is fading away and the buyers are ready to pump the price higher.

A technical setup will be to wait for the price to break above the 0.7430 resistance level then wait for a pullback to retest that same resistance level but this time using it as a support.

Let's wait for the breakout + retest = Bullish