Inflation vs. Growth : Is the Fed Behind or Ahead of the Curve?CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! CME_MINI:MES1! CBOT:ZN1!

Fed Policy recap:

There is an interesting and unusual theme to keep an eye on this week. The Fed is in a ‘blackout period’ until the FOMC meeting- this is a customary quiet period ahead of an FOMC policy meeting. Fed Chair Powell is scheduled to give a public talk on Tuesday. Although his address will be focused on the capital framework of the large banks, this appearance will be closely watched for any subtle signals on the FOMC policy stance.

Especially given that last week, Federal Reserve Governor Chris Waller made a speech, “The Case for Cutting Now” with a purpose as he stated to explain why the FOMC should reduce rate by 25 bps at the July 30th, 2025 meeting.

His stated reasons were:

1. Tariffs create one-off price level increases with transitory inflation effects, not sustained inflation momentum.

2. He argued that much of economic data points towards interest rates should be lowered to FOMC’s participants' median neutral rate, i.e, 3%.

3. His third stated reason notes that while the state of the labor market looks resilient on the surface, accounting for expected data revisions, private-sector payroll growth has peaked, with more data suggesting increased downside risks.

His speech further explains:

• Growth has decelerated sharply: Real GDP rose only ~1% annualized in 1H25, a significant slowdown from 2.8% in 2H24, and well below long-run potential.

• Consumer spending is weakening, with real PCE growth falling to ~1%, and June retail sales showing soft underlying momentum.

• Broader labor market indicators, including the Beige Book and JOLTS data, show declining labor demand and hiring caution, suggesting increasing downside risks to employment.

• Inflation is slightly above target (PCE ~2.5%) but driven primarily by temporary, one-off tariff effects. Core inflation ex-tariffs is likely near 2%, and expectations remain anchored.

• Current fed funds range (4.25%–4.50%) is well above neutral (3%), implying excessive restraint.

• With inflation risks subdued and macro conditions deteriorating, a preemptive rate cut now provides optionality and avoids falling behind the curve if the slowdown deepens. Further cuts may be warranted if trends persist.

• The tax bill contains pro-growth provisions, but its economic impact is expected to be minimal in 2025.

Source: Federal Reserve Speech, The Case for Cutting Now Governor Waller

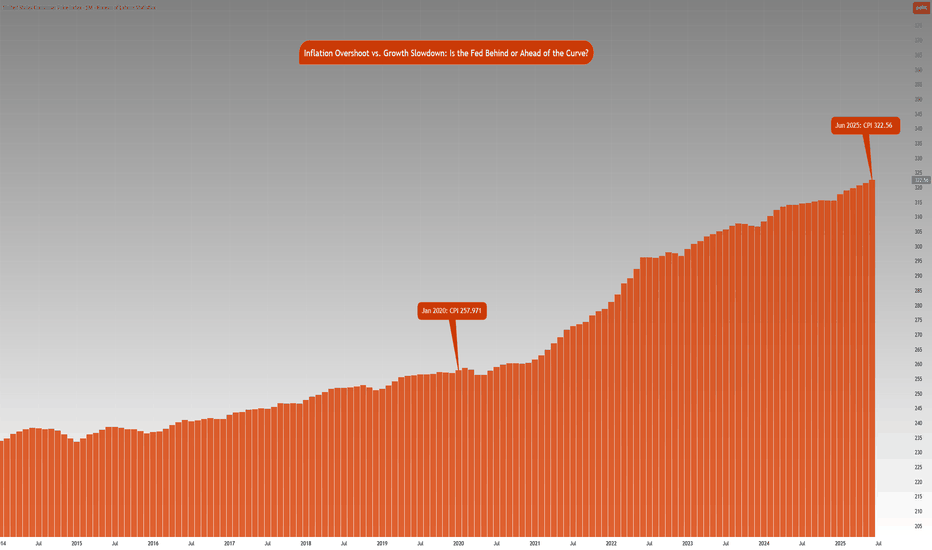

Inflation Analysis:

Let’s compare this with what we have previously mentioned regarding inflation. CPI index stood at 257.971 points in January 2020. Projecting this at a 2% Fed target, June 2025 inflation should be around 287.655 points. However, June 2025 inflation is currently at 322.56 index points, 12.2% higher above 2% the inflation trend. Effectively, this means annualized inflation since January 2020 is roughly 4.15%.

The Fed is in a real dilemma whether cutting rates given the inflation trend in the last 5 years and risks to inflation outlook justify cutting rates.

Key Questions to ask

Markets are forward looking. Investors and participants want to know:

• How will the rates impact the cost of debt service? Currently the third largest government expenditure, over $1.03 trillion.

• Will the tariff rate offset the tax revenue losses by extending tax cuts?

• Is the fiscal path sustainable?

• What happens to the long end of the yield-curve?

• Will the Fed monetize the debt issuance imbalance?

• Is this simply Governor Waller positioning himself for the next appointment of Fed Chair when Fed Chair Powell’s term expires in May 2026?

It seems there is a huge conflict between longer term implications vs quick short term fixes that align with US administration objectives.

The Week ahead:

It is a relatively light economic calendar in the US. Flash PMI readings and housing data on the docket. The primary focus as it has been for most weeks since President Trump took office, will be on the developments in trade policy and any further comments on Fed and Chair Powell. The threat of renewed tariffs starting August 1st, is also key to monitor and whether these protectionist measures will force US’s trading partners to make further concessions to negotiate trade deals.

The earnings season is off to a good start with major US banks reporting higher EPS and revenue than expectations. This week investors will be looking at Q2 earnings reports from Alphabet, Meta, Microsoft from the Mag 7 and Tesla.

Tradingview

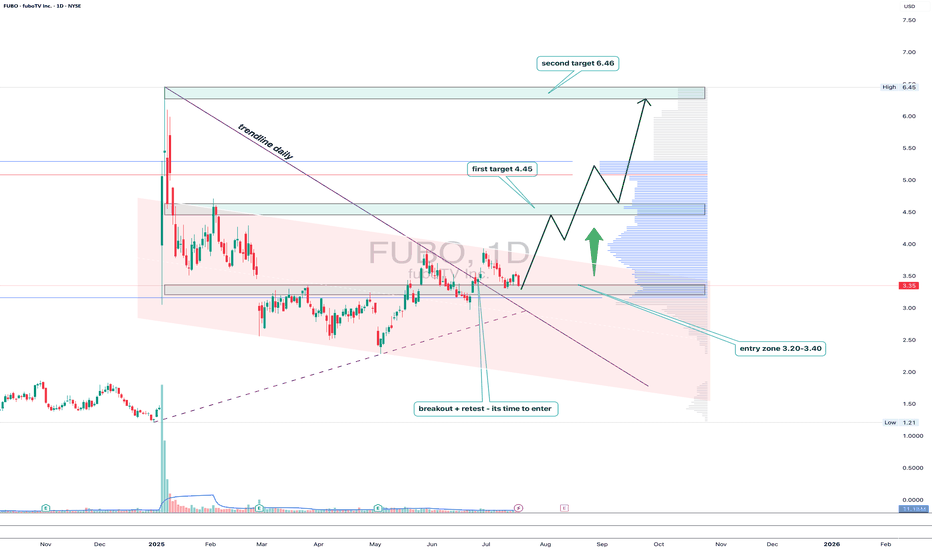

FUBO: trendline breakout with a subscription to $6.46FUBO has broken out of the descending trendline on the daily chart, followed by a clear retest and consolidation above the key 3.20–3.40 area. This zone coincides with the 0.5 Fibonacci retracement and high-volume support, confirming strong buyer interest.

As long as price holds above 3.20, the setup looks bullish with targets at 4.45 (0.382), 5.22, and finally 6.46 — the major resistance and top of the current range. Volume picked up on the breakout, validating accumulation from bigger players.

Fundamentally, FuboTV remains a niche contender in the sports streaming market. With optimized spending and new partnerships with major sports leagues, interest may spike ahead of events like the Olympics and NFL season.

Tactical setup:

— Entry zone: 3.20–3.40

— Must hold: above 3.20

— Targets: 4.45 / 5.22 / 6.46

— Invalidation: break below entry without buyer confirmation

This breakout might just be FUBO’s ticket to prime time.

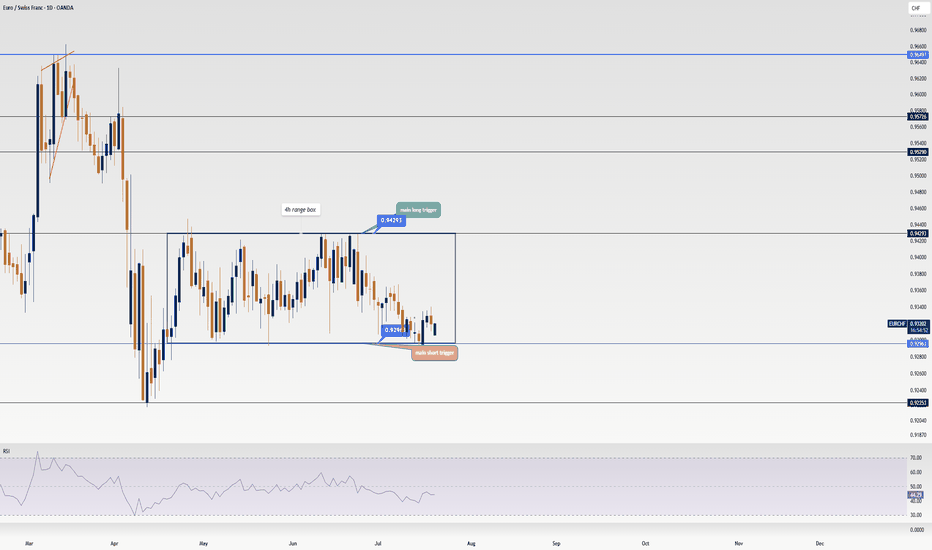

EUR/CHF Update: I just found out the next big triggerHey friends 🩵, hope you’re kicking off the week with a great vibe! It’s Skeptic from Skeptic Lab . In this video, I’m diving into EUR/CHF .

We’re stuck in a range box right now, and knowing this setup will help you miss fewer opportunities. Don’t forget money management, dodge FOMO, and have a plan for different scenarios. I also explained in the video why I personally prefer opening a short position. So, let’s get started!

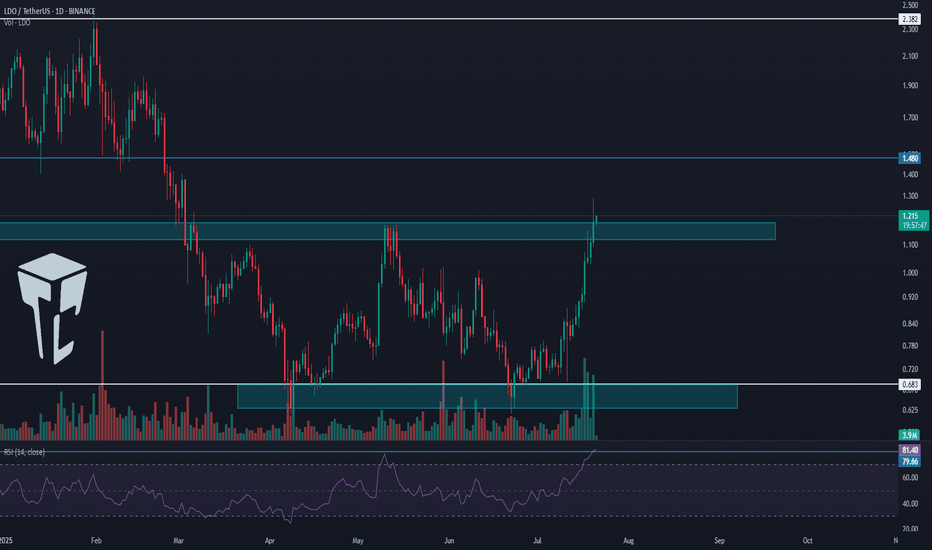

TradeCityPro | LDO Breaks Out Amid Altseason Hype Shift👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the LDO coin for you. It’s one of the well-known DeFi projects in crypto with the highest TVL in this category, and the LDO coin ranks 82 on CoinMarketCap with a market cap of $1.08 billion.

📅 Daily timeframe

On the daily timeframe, LDO has been in a range box for several months and is now starting to break out of it.

💥 After being supported at the 0.683 bottom, a large amount of buying volume entered, and a sharp bullish move occurred from this bottom to the top of the box. The RSI has also entered the Overbuy zone.

🔔 The overextended level on the RSI oscillator is 79.66, which has even been broken during this leg. Right now, I think the probability of a correction is quite high.

🔍 Yesterday's candle made a deep penetration into the top of the box, and currently, the price is sitting above the box. Since RSI is in the overextended zone, a pullback or short-term rest is likely.

🚀 However, considering the current uptrend, I believe this bullish leg might be ending, and we could see a few corrective candles. But after the correction ends, a new bullish leg might begin, pushing the price toward the resistance levels at 1.480 and 2.382.

🛒 For a long position or a spot buy, we can enter during this new bullish leg once the top breaks and a confirmation of a new wave starting is in place.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

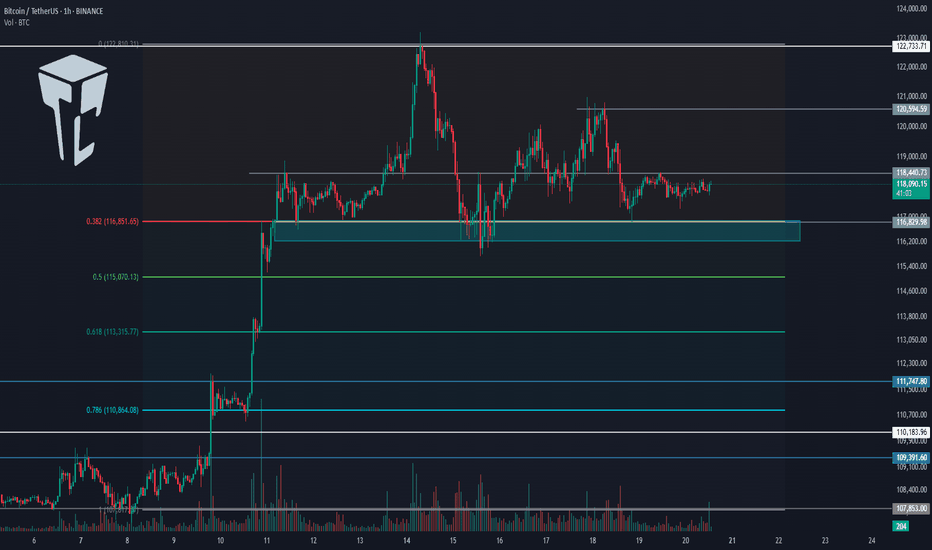

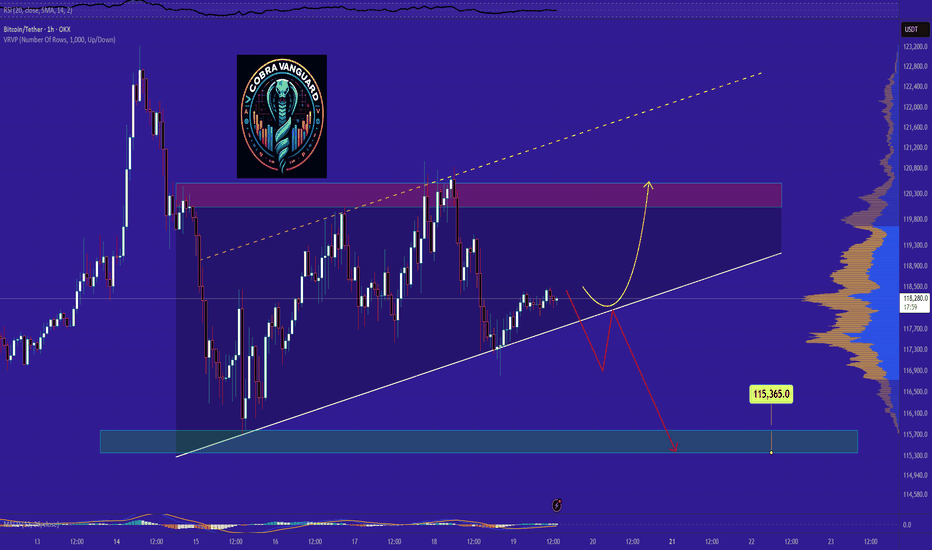

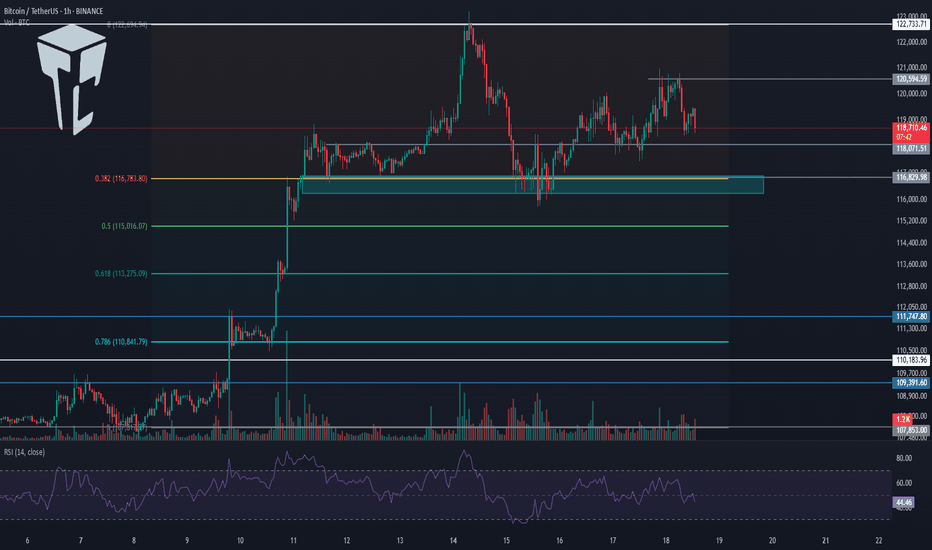

TradeCityPro | Bitcoin Daily Analysis #132👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis I’ll review the futures triggers for the New York session.

📅 1-Hour timeframe

On the 1-Hour timeframe, as you can see, Bitcoin is still holding the key support at 116829 and has been ranging between 116829 and 118440 since yesterday.

✨ Today, if the 118440 level breaks, we can open a solid long position. However, I still believe that due to Bitcoin Dominance being in a downtrend, altcoins are a much better choice for opening positions.

✔️ If you're only planning to trade Bitcoin, this trigger is suitable. The next entry points would be 120594 and 122733. If we open positions at all three triggers and the market moves upward, we can get strong risk-to-reward setups since we’ve entered with significant volume across three positions.

📊 If the 116829 level breaks downward, we might see sharper corrections. In that case, the next supports will be the 0.5 and 0.618 Fibonacci levels.

👑 BTC.D Analysis

Looking at Bitcoin Dominance, as you can see, the trend is heavily bearish and moving downward.

⭐ The downtrend in dominance is quite steep, and the next support we have is at 60.49. There’s still room for dominance to drop to this level.

📅 Total2 Analysis

Moving to Total2, yesterday the 1.46 trigger was activated and price moved to 1.5, and it is now sitting just below that level.

💫 If this level breaks, another bullish wave towards 1.62 could form.

📅 USDT.D Analysis

Looking at Tether Dominance, this index is also in a downtrend similar to Bitcoin Dominance, which shows that money is exiting both Bitcoin and Tether and entering altcoins.

🎲 So keep a close eye on altcoins in the coming days, because a lot of capital is flowing into them and they could see significant pumps.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

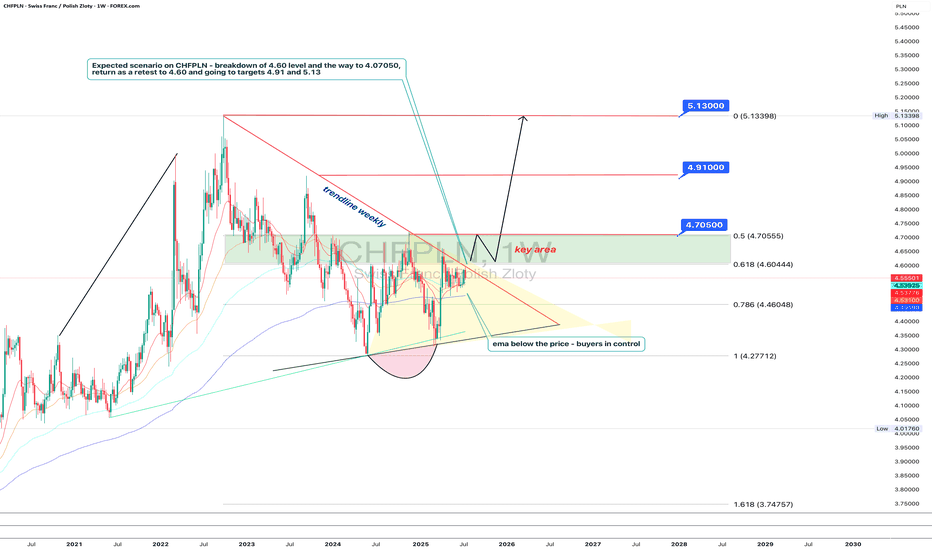

Polish zloty in trouble: Swiss franc is sharpening its teethTechnically, CHFPLN has completed a consolidation phase within a narrowing triangle and broke to the upside. The pair is now testing the 4.60 level (the 0.618 Fibonacci retracement) from below — a decisive zone. A breakout and confirmation above this area opens the path toward 4.705, which coincides with the 0.5 Fibo level and a local resistance. A pullback from that zone back to 4.60 is possible, but this time as a support retest. If the level holds, the targets remain: 4.91 and 5.13 - both marked by Fibonacci extensions and major long-term horizontal resistance. The EMAs are aligned in support of further upside, with price consistently trading above them.

Fundamentally, the Swiss franc remains a safe-haven currency, especially amidst increasing instability in the Eurozone. Weak growth in Germany, looming ECB policy easing, and rising inflationary pressures are all tilting investor interest toward CHF. Meanwhile, Poland faces political uncertainty, budgetary debates, and volatility in the agricultural and energy sectors. All of this strengthens the case for the franc in this pair.

Tactically, the game plan is straightforward: a confirmed breakout above 4.60 signals the start of a bullish impulse. The 4.60–4.705 zone is the key area of interest for buyers. If this zone is reclaimed and held, the next targets - 4.91 and 5.13 - remain valid, where large players may look to take profits.

If this scenario plays out, the zloty may soon be tuning into Polish radio to sing nostalgic songs about the golden days of its strength.

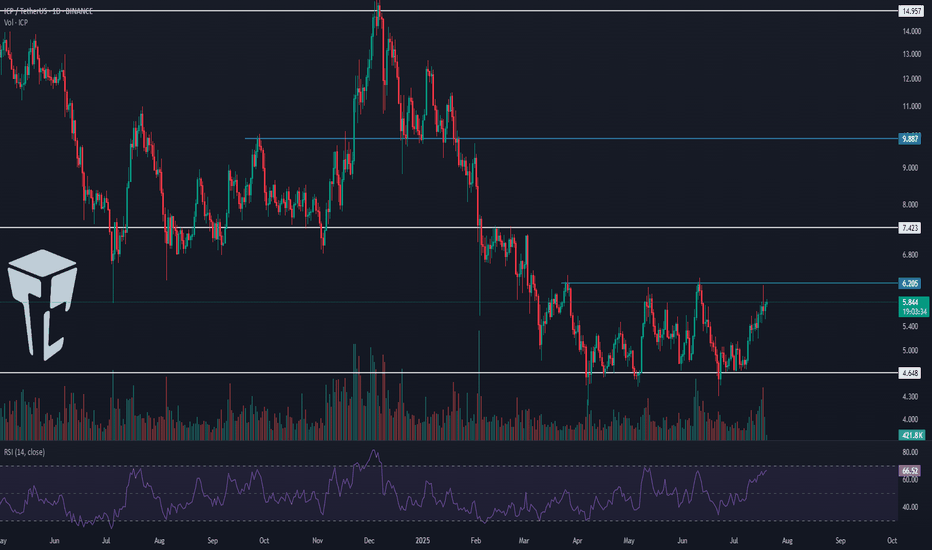

TradeCityPro | ICP Eyes Breakout as Altseason Speculation Grows 👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ICP coin for you—one of the DePIN and AI-related coins, ranked 37 on CoinMarketCap with a market cap of 3.11 billion.

📅 Daily timeframe

As you can see on the daily timeframe, a ranging box has formed around the key support at 4.648, and price is fluctuating inside this box.

🔔 The top of the box is at 6.205, and price has touched it multiple times. It just wicked into it again and got rejected.

📈 This level has become a very important resistance. If it breaks, we can enter a long position—and it’s even suitable for a spot buy.

🛒 I already hold this coin in spot from lower entry points and don’t plan to increase my spot volume, but I’ll open a futures position if 6.205 breaks.

🔽 If Bitcoin Dominance moves downward, the 6.205 trigger will be a very good entry point. A break above 70 on the RSI will also be a strong momentum confirmation.

📊 If price gets rejected from the top of the box and drops to the 4.648 support, we can open a short position in lower timeframes. A break below 4.648 would confirm the bearish outlook.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Miss This Watchlist, Miss Next Week’s OpportunitiesHey friends,it’s Skeptic 🩵 hope you’re having a great weekend!I know it’s the weekend, so a lot of you are probably chilling away from the charts, but for some, trading’s such an addiction that even weekends can’t keep you away. In this video, I’m gonna break down my weekly watchlist for you. Knowing it will help you miss fewer good opportunities, avoid FOMO, and have a plan ready for different scenarios and events.

Don’t forget money management , and stay clear of FOMO. & if it helped smash that boost bottom and follow for more !

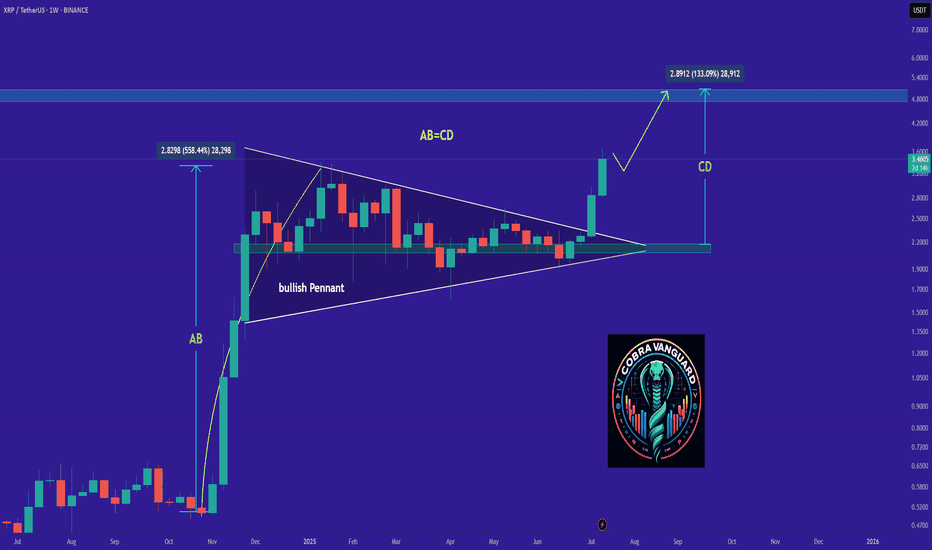

Ripple Update: Is XRP Ready for Another 500% Growth?Hey friends, it’s Skeptic 🩵 . In this video, I’m giving an update on Ripple’s conditions , reviewing past triggers, and what to do with your long positions in futures if you’re still holding. For spot, what’s the move? I dove into XRP/BTC analysis and, at the end, broke down BTC.D , which just had a major event you need to pay close attention to. Don’t forget money management, and stay clear of FOMO. Drop your thoughts on XRP in the comments so we can chat about it!

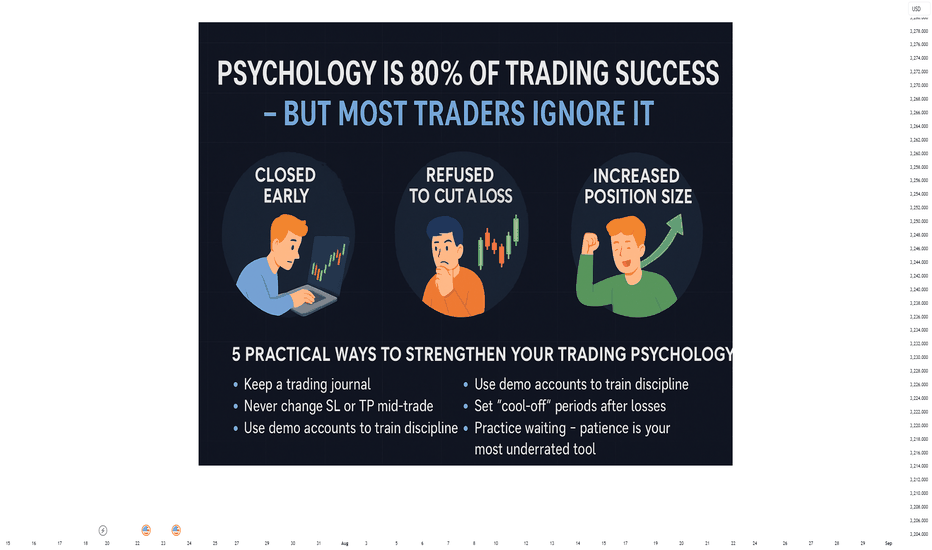

Psychology Is 80% of Trading SuccessPsychology Is 80% of Trading Success – But Most Traders Still Ignore It

Have you ever followed a perfect setup… and still lost money?

You entered at the right level.

The trend was clear.

Confirmation was solid.

But you closed the trade too early.

Or held onto a losing trade far too long.

Or took a revenge trade just to “get it back.”

This isn’t a strategy problem – it’s a psychological one.

💡 Most traders don’t fail due to poor analysis – they fail because they lose control of themselves

Let’s break down three real-world scenarios that almost every trader has experienced at some point:

🎯 1. Closing profitable trades too early – fear of giving it back

Example:

You long XAUUSD from 2360, targeting 2375.

As price hits 2366, you panic and exit early, fearing a reversal.

Later, the price hits 2375 without you.

➡️ This is classic loss aversion — where the fear of losing small gains outweighs the logic of sticking to your plan.

🎯 2. Holding onto losers – hoping the market will turn

Example:

You short EURUSD expecting a pullback, but price breaks resistance and climbs.

Instead of cutting your losses, you widen your stop and hold on.

The loss grows, and you exit in frustration.

➡️ This is denial – refusing to admit you're wrong, letting hope override discipline.

🎯 3. Increasing risk after a winning streak – “I can’t lose” mindset

Example:

After two wins, confidence spikes. You double your position size, despite a weaker setup.

One loss later – your previous gains are wiped out.

➡️ This is overconfidence bias – common after wins and extremely dangerous to consistency.

📊 Technical knowledge accounts for 20% of success – the remaining 80% lies in mindset and behaviour

You can:

Understand market structure

Use advanced indicators

Develop a robust strategy

But if you:

Ignore your stop-loss

Trade out of boredom or revenge

Break rules when under pressure

Then your edge disappears.

Your system becomes irrelevant if your psychology breaks down.

🧠 5 Practical Ways to Strengthen Your Trading Psychology

✅ Keep a trading journal – especially note your emotions

Ask yourself: “Was this trade part of my plan, or based on impulse?”

✅ Never adjust SL or TP mid-trade

Stick to your original parameters. Trust your plan, not your feelings.

✅ Use demo accounts to practise discipline, not just execution

Treat them like live accounts. Emotions will surface if you're honest.

✅ Pause trading after consecutive losses

Two losses in a row? Step away for 24 hours. Protect your decision-making clarity.

✅ Learn to wait – no trade is often the best trade

Patience is a trader’s secret weapon. Pros trade less, but with precision.

🔁 Trading isn’t about predicting the market – it’s about managing yourself within it

A 55% win-rate system can make you consistent profits

If you’re disciplined, calm, and structured.

But…

A 70% win-rate system can still blow your account

If your emotions are calling the shots.

🎯 Final Thought:

Financial markets don’t reward traders with the best strategy.

They reward those who stay rational under pressure.

You don’t need to be the smartest person in the room.

You don’t need a complex system.

But you do need emotional control, patience, and trust in your process.

Knowledge helps you spot the trade. Psychology helps you survive it.

🔔 If you found value in this, follow me for more content on trading mindset, discipline, and long-term consistency – because true success begins in the mind.

BABA: triangle with tensionOn the weekly chart, BABA has already formed a golden cross - price is above both MA50 and MA200, confirming a bullish trend shift. The stock is now approaching the upper edge of the symmetrical triangle and the key resistance at $122, which also aligns with the 0.5 Fibonacci level.

The numbers inside the triangle represent the contraction phases, not Elliott waves. This is a classical consolidation before a potential breakout. If the $122 level is broken and retested, upside targets are $128 (0.618), $137 (0.786), and eventually $148–181 (1.0–1.618 extension).

Volume is rising, MACD is flipping bullish, and RSI is climbing out of oversold territory — all signs point to growing bullish momentum.

Fundamentally, Alibaba benefits from China's economic rebound, possible regulatory relief, and ongoing share buybacks. With Chinese tech rotating back into favor, BABA could lead the rally.

So if you're still waiting for a signal - it's already here. The golden cross is done, price is flying above moving averages, and all that’s left is a clean breakout. Watch $122 — that’s the launchpad.

TradeCityPro | Bitcoin Daily Analysis #131👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis, I’ll review the futures session triggers for New York.

⏳ 1-hour timeframe

Over the past few days, the market hasn't been very focused on Bitcoin, and altcoins have been moving more strongly to the upside.

⚡️ Bitcoin is still ranging between 116829 and 122733 and is fluctuating between these two levels.

💥 Currently, a local top has formed at 120594, and if that level breaks, we can open a long position. The main long trigger will be the breakout of 122733.

📈 If the market decides to correct, key support levels are 118071 and 116829. I’m setting the stop-loss for my previously opened positions below the 116000 zone.

👑 BTC.D Analysis

Let’s look at Bitcoin Dominance. The reason I’m saying Bitcoin isn't currently the center of attention is exactly this dominance chart.

🔔 As you can see, BTC Dominance is in a very sharp downtrend with strong momentum, which means capital is flowing out of Bitcoin and into altcoins—giving us better long setups on alts.

✨ For now, I see the trend as bearish, and the next supports are at 61.34 and 60.49.

📅 Total2 Analysis

Total2 is still moving upward and has broken above 1.46, continuing its upward momentum.

✔️ The new top is at 1.5, and a breakout above this level can be used as a trigger for long entries.

📅 USDT.D Analysis

Let’s move to Tether Dominance. The 4.22 support was broken yesterday, and the index is now moving downward.

💫 The next support level is 4.08, and breaking that will confirm continuation of the downtrend.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

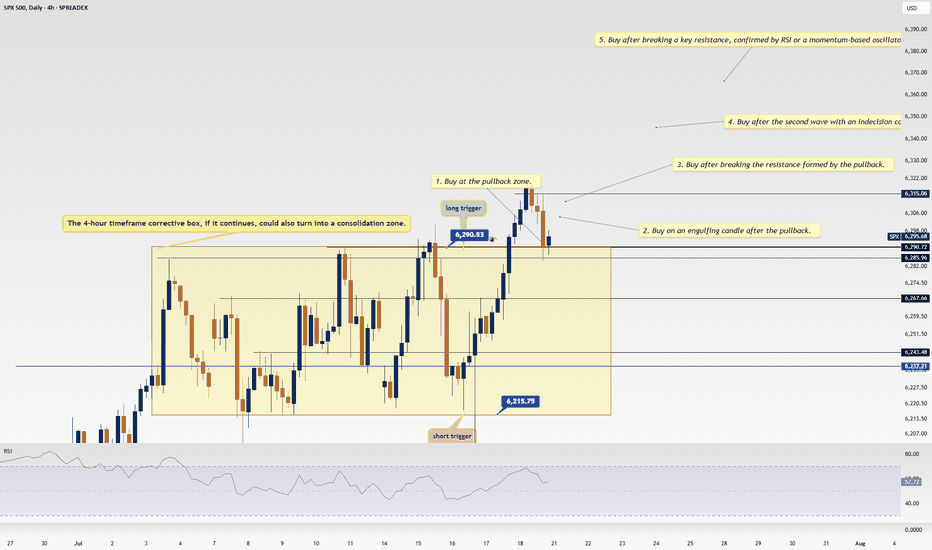

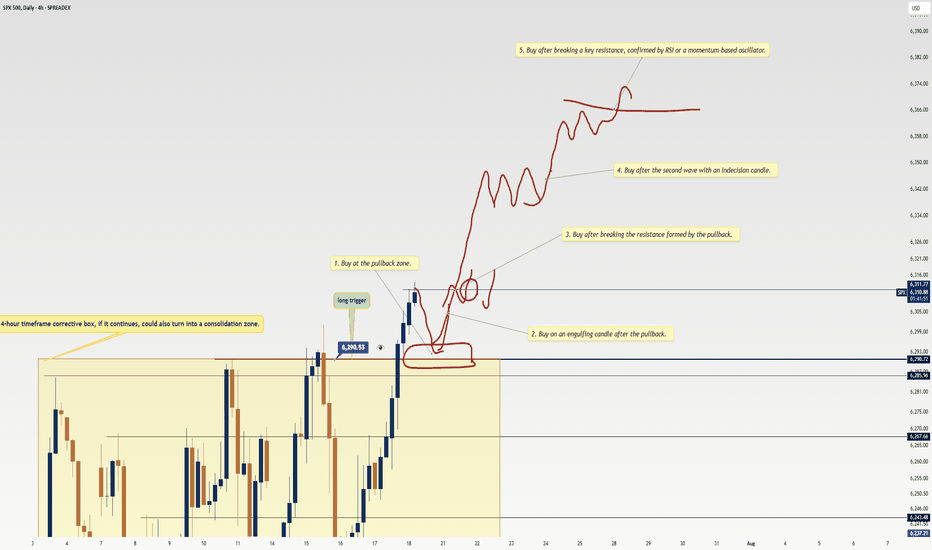

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

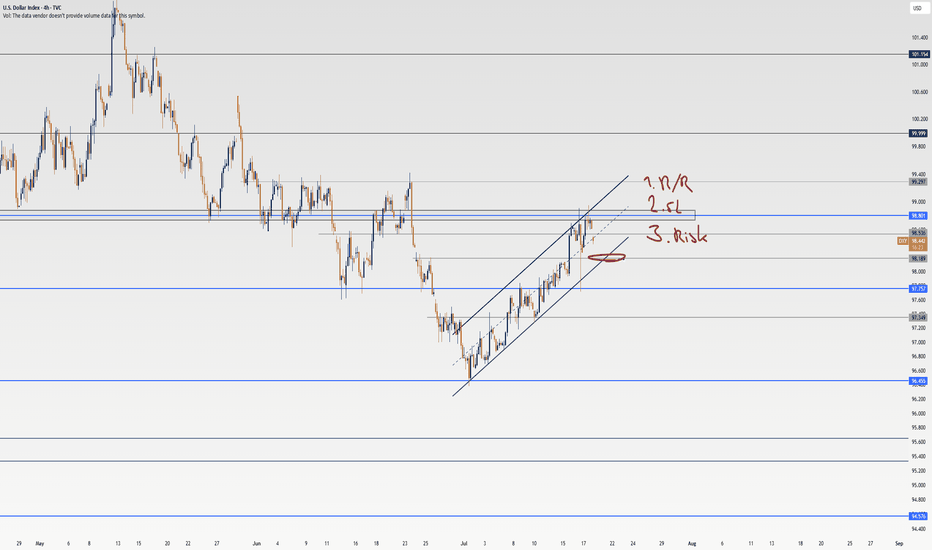

Has the DXY got you confused? Well, check out this analysis.Welcome back, traders, it’s Skeptic from Skeptic Lab! 😎 , the DXY has entered a corrective phase over the past weeks. In this analysis, I’ve broken down the technicals and chart with a skeptical eye, outlined long and short triggers on the 4h timeframe , and tried to give you a solid multi-timeframe view of the setup. At the end, I’ve shared a key educational tip that can seriously boost your win rate and R/R , so make sure you check out the full analysis.

💬If you’ve got a specific symbol in mind for analysis, drop it in the comments. Have a profitable Friday, fam <3