Tradingview

Current Mechanics playing out in US and Global MarketsCBOT:ZN1!

COMEX:GC1!

CME:6E1!

CME:6J1!

US Bond Market:

The US bond market—specifically US 10-year Notes—has long been considered a safe haven amid market turmoil. Historically, during periods of uncertainty, investors have flocked to these “flight to safety” assets, resulting in increased demand for US 10-year notes. Mortgage rates also tend to track 10-year note yields, meaning rising yields typically imply rising mortgage rates.

From the chart above, we can observe that ZN futures rose by 6.62% from the January 13 lows to the April 7 highs and what the next possible worst case scenario looks like.

Euro FX Futures:

Euro FX futures rebounded strongly from near-parity levels, climbing to a high of 1.15175—a substantial 12.27% increase versus the USD.

Gold:

Gold futures surged 21.84% from the January 6 lows to the April 11 highs.

What caused investors and market participants to abandon the US dollar and US 10-year notes?

As previously explained, broader macroeconomic forces are at play. Investors are not just pricing in a US recession—they're also reacting to an emerging supply-demand imbalance in the US bond markets. This imbalance is driving safety inflows into gold and other alternative assets, while simultaneously pushing yields higher on the long end of the US yield curve. As a result, the yield curve is steepening.

One noteworthy point: when the 10-year to 2-year yield spread falls below zero, a recession typically follows within 12 to 18 months. After a prolonged period of a negative yield spread during 2024, the yield curve has now steepened sharply.

Additionally, a recent 20% correction in US equities adds another layer of complexity to an already fragile economic outlook. Since the onset of the trade war, both uncertainty and volatility have escalated to extreme levels.

With inflation expectations rising and growth forecasts being revised downward, the most compelling asset class to watch in the coming months is the US dollar—and, specifically, the evolving status of the US 10-year T-Note as a risk haven.

Rising yields may point to further steepening of the yield curve and signal a broader shift away from the US as the global economic leader.

What’s truly at stake is the USD’s reserve currency status. How this unfolds remains anyone’s guess.

TradeCityPro | Bitcoin Daily Analysis #62👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

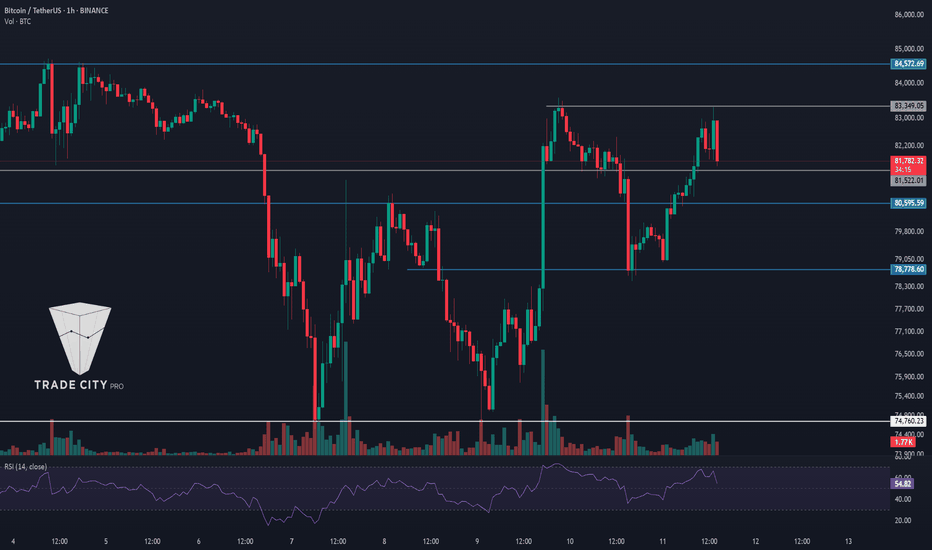

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the price has a bullish structure that is still ongoing, and currently, one of the resistance levels at 85482 has been broken, and the probability of a bullish price move is high.

✔️ If you already have a position from the break of 85482, you have likely hit neither the target nor the stop-loss yet. The target for this position could be the 88502 zone.

✨ But if you don’t have an open position and are looking for a trigger, a price pullback to the 85482 zone with confirmation, or even a break of one of the short-term resistances in lower time frames, can be a suitable trigger for a short position.

📉 For a short position, if the price fakes the breakout of the 85482 resistance and moves downward, with confirmation in lower time frames and a break of the Fake Breakout trigger, we can enter a short position. The main short trigger is the break of the 83233 zone.

👑 BTC.D Analysis

Let’s take a look at Bitcoin dominance. As you can see, dominance has started another bullish leg and after breaking 63.61, it reached 63.80, and now with the break of 63.80, it's ready to carry out its main bullish move.

🔼 For now, we see the trend in dominance as bullish, so long positions on Bitcoin and short positions on altcoins are suitable.

📅 Total2 Analysis

Let’s take a look at the Total2 analysis. As I mentioned, since dominance is bullish, Bitcoin is moving more than altcoins. Right now, we can also see this in Total2, where momentum is less than Bitcoin and it has moved slightly away from its top, while Bitcoin has broken its high.

🔍 For a long position, the break of the 980 zone is still valid, and if it breaks, the price could move up to the 1.2 zone. For a short position, we have two triggers.

📉 The first trigger is the 956 zone, which is a good entry point but risky, and the chance of hitting stop-loss is high. The second trigger is the 947 zone, which is a more reliable trigger, but if it breaks, opening a position will be harder and we might not get a solid confirmation candle.

📅 USDT.D Analysis

Let’s move on to Tether dominance. You could say the entire market is waiting for Tether dominance to move, and even Bitcoin, despite breaking its resistance, hasn't moved yet because the 5.39 zone in dominance hasn't broken.

🎲 This zone is a very important one, and if it breaks, we could see a bearish leg down to the 5.24 zone, which would push the market upward. The bullish trigger for dominance for now is the break of 5.53.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | AXS: Gaming Token at Risk of New Lows or Rebound?👋 Welcome to TradeCity Pro!

In this analysis, I want to review the AXS coin for you. The AXS project is one of the crypto gaming projects, currently ranked 124 on CoinMarketCap with a market cap of $357 million.

⚡️ This project was highly hyped during the previous bull run in 2021, but after a while, the hype faded and we witnessed severe declines in this coin. It is still in a downtrend.

📅 Daily Time Frame

In the daily time frame, as I mentioned, this coin has been in a long-term downtrend, and recently, with the break of the 4.193 level, the next leg of the trend has begun, and the price has moved downward.

✔️ In the previous analysis , if you remember, I told you that to buy this coin, you should wait for the price to stabilize above the 7.366 level, and if it stabilizes below 5.439, a drop could occur.

📉 As you can see, the price never stabilized above 7.366, and after breaking 5.439, a strong bearish trend began. I hope you used this trigger and made good profits from this bearish move.

⭐ We can draw a trendline from the price lows, and in every move the price has made, it has reacted to this dynamic area and started a new leg after some correction.

🧩 Currently, the price is near an important support at the 2.2 area, and both volume and RSI strongly indicate momentum. If this support breaks and RSI enters the oversold zone, we can expect a sharp bearish move from the price.

🎲 The next support the price has is at the 1.355 level, which is the most important price support, and in my opinion, if the price makes another bearish leg, it will react to this area.

⏳ 4-Hour Time Frame

In the 4-hour time frame, as you can see, the price is in a descending channel and has now formed a range box at the bottom of the channel.

💫 The bottom of the box is at 2.2 and the top is at 2.431. A break of the box bottom can bring the price back to the box low again. A break of the box top can start a bullish leg up to the top of the channel.

💥 On the other hand, usually when a box forms at the bottom of a descending channel, the price goes through some time-based correction and likely ranges toward the channel midline.

🔍 Also, pay attention to the RSI oscillator. RSI entering the oversold zone confirms a short position, and a break of the 50 level confirms a long position.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ADA : This May Be Your Last Chance Before Exploding to Upside !!The ADA will increase 40 cents and reach to the top of the wedge in the coming weeks.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TradeCityPro | AVAXUSDT Watch the Altcoins!👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of one of my favorite coins, which is likely to make a move this week. Let’s break it down and take a closer look together!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

On the weekly timeframe, the AVAX chart is one of the smoothest and most technical charts I’ve seen—support and resistance levels work like a charm, and price patterns are fairly predictable.

After getting rejected at the key resistance of 53.62—a historically significant level—sellers stepped in, pushing us into a deep correction. The failure to break this level was partly because we didn’t enter overbought territory on the weekly chart.

For buying, the weekly chart is currently very bearish, so jumping in now isn’t logical. However, a break above 53.82 would be our most reliable trigger for an upward move. For exiting, if we drop below 21.02, I’d personally cash out. If we climb back above 21.02, I’d buy again—this time with fewer AVAX but the same USDT amount to manage risk.

📉 Daily Timeframe

In the daily timeframe, after a rejection at 53.96 that led to a correction, it seemed likely we’d test this resistance again. However, after the rejection, we broke below 44.21, forming a price range box.

Right now, we’re not paying much attention to resistance levels. Our trendline is showing lower highs but flat lows, indicating that our movement is driven by the trendline rather than traditional support and resistance.

With that in mind, a break of the trendline could spark a move, but we still need a trigger. The 22.71 level is our breakout trigger—not just a resistance. If we break it, we could enter a buy with a risky stop loss at 16.00. Confirmation would come from a spike in volume. For selling, if we get rejected at the trendline and break below 16.00, I’d personally exit.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice—always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

Do you think I'm joking ???Now that Bitcoin is returning to the cup-and-handle support, one can expect a strong pump up to 130k . it might happen.

⚠️ Disclaimer

Blockchain X has artificial intelligence technology that can make smart trades, allowing you to continuously make profits in the crazy world of cryptocurrency. Come and try it!

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TradeCityPro | Bitcoin Daily Analysis #61👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

🔍 Yesterday, one of our short position triggers was activated. Let’s get into the analysis to see how we can open a position today.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the trigger we gave yesterday at the 84382 level was activated and the price moved down toward the 82813 area. Today, I’ve adjusted the position of these lines since the price has created a better structure and the placement of the levels can change accordingly.

✔️ Currently, the price has formed a box between 83233 and 85482 and continues its ranging structure.

📈 For a long position, we can act if 85482 breaks. If this level breaks, since the trendline has also been broken, this time the price can move upward with more momentum, and the first target of this position would be 85482.

📊 Market volume is currently ranging, and we can’t extract specific data from this tool. But if volume increases along with an upward price movement, it would be a very good signal for the continuation of the bullish trend.

🔽 If that doesn’t happen and the price moves downward, the 83233 trigger is a very good one, and a break of this area gives us confirmation of a trend reversal, and the price can move further down.

👑 BTC.D Analysis

Let’s look at Bitcoin dominance. Dominance is still ranging and hasn’t moved much compared to yesterday.

⭐ A break of 63.61 would be suitable for a bullish move, and a break of 63.23 would be suitable for a bearish move.

📅 Total2 Analysis

Let’s move on to the Total2 analysis. This index is acting very similarly to Bitcoin and is currently near its long trigger.

🔼 For a long position, a break of 980 is suitable, and for a short position, a break of 947 is appropriate.

📅 USDT.D Analysis

Let’s check out Tether dominance. We’re still waiting for a break of 5.39, which is a very important level, and if it breaks, the price could have a long-term bearish move.

💫 For a bullish move in dominance, breaks of the 5.53 and 5.59 levels are also suitable.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

GBPUSD - its breakout? what's next??#GBPUSD.. as you know guys our area was 1.3035 and in first go market boke that area but then drop towards bottom due to tariff implantation.

now market again break our area in today so if that is clear breakout then we can expect a further bounce towards 3400 and 1.3500

good luck

trade wisely

TradeCityPro | ADA: Watching Support and RSI for the Next Move👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ADA coin for you—one of the most popular and long-standing cryptocurrencies, currently ranked 10th on CoinMarketCap with a market cap of $22 billion.

📅 Daily Time Frame

In the daily time frame, as you can see, after ADA’s previous uptrend, the price moved upward and, after breaking 0.4322, continued its bullish leg up to 1.1325.

✔️ Following this move, the price entered a corrective phase, and during its first pullback, it performed a time-based correction down to 0.8161, but after breaking this area, deeper corrections began.

📰 Coinciding with the news of the creation of a crypto reserve in the U.S., this coin—alongside other coins in that basket—saw another bullish move that once again pushed the price up to 1.1325. However, within a few days, it reversed the entire bullish move and dropped to the 0.5579 zone.

📈 During this correction, we can draw a trendline from the price lows. As you can see, the price has reacted well to this trendline, and the overlap of this line with the 0.5579 zone has created a strong support, causing the price to bounce and show some bullish momentum.

📊 Currently, after bouncing from this zone, the price initially moved up strongly and with high volume. However, over the past few days—especially with the weekend—momentum has decreased, and volume has dropped as well.

📉 If this decline in volume continues, the price won’t be able to rise further, and bearish momentum could gradually return. If the 0.5579 support breaks, the price could continue moving downward.

💥 The downward trendline currently in play could act as a dynamic resistance during the next bullish legs.

🔼 For a bullish move, the key is the RSI divergence. This positive divergence, now visible with three higher lows, could support a bullish reversal. The trigger for this divergence is a break above the 50 level on RSI.

🛒 If RSI stabilizes above this level, bullish momentum will likely enter the market. In that case, breaking the 0.8161 trigger would offer a long entry or spot buy opportunity. The main trigger for price, however, remains the break of 1.1325, which is ADA's key resistance level.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#TOTAL3 #Analysis #Eddy#TOTAL3 #Analysis #Eddy

Crypto Total Market Cap Excluding BTC and ETH

Everything is clearly drawn and labeled.

For buy Long & Spot investment on altcoins, wait for the Total 3 index to reach its demand zone.

This is just my opinion and you should make your decision based on your style and strategy and get the necessary confirmations.

Be sure to take a look at this indicator on the monthly time frame.

TradeCityPro | Bitcoin Daily Analysis #60👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

🔍 Yesterday, both of the long triggers I gave were activated, and the price moved upward. Today is also an important day, and we can look for both long and short positions.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, our long triggers from yesterday — the 83899 and 84572 levels — were activated, and the price moved up to the 85552 zone.

✔️ If the position you opened had a small stop-loss, it likely already hit your target. But if you entered with a wider stop-loss, it probably hasn't reached the target yet, which is reasonable, as your position is longer-term.

⚡️ Now for today, as you can see, the price has broken its ascending trendline and it seems the trendline trigger is getting activated. If a candle closes below the 84382 level, the price is likely to move downward.

📊 The next support the price has is at 82813, and if this level breaks, we can say that the trend has changed and the price might head toward lower lows.

💥 The 50 level on the RSI is also significant, and if the break of 84382 coincides with a break below 50 on the RSI, strong bearish momentum could enter the market.

👑 BTC.D Analysis

Let’s look at Bitcoin Dominance. This index is in a range box between 63.23 and 63.80. There’s also a mid-range level at 63.51 — breaking it would give us temporary confirmation of a bullish move in dominance.

🔽 For bearish confirmation, breaking 63.23 would be suitable.

📅 Total2 Analysis

Now onto Total2: this index hasn't fully stabilized below its trendline yet and still shows slightly more bullish momentum compared to Bitcoin.

📉 For a short position, we have a 966 trigger, but it’s quite risky. Personally, I wouldn’t open my main position with this trigger — I’d wait for confirmation using Dow Theory with a lower high and lower low.

🔼 For a long position, the trigger is clear: we can enter if the 980 level breaks.

📅 USDT.D Analysis

Let’s check Tether Dominance. This index has made a bearish move and dropped to 5.39.

⭐ The next drop trigger is the same 5.39 level, which is a very good one. For a bullish scenario, we currently need to wait for a new structure to form.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | ARB: Key Levels in DeFi Coin’s Descending Channel👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ARB coin for you. It's one of the DeFi coins, currently ranked 54 on CoinMarketCap with a market cap of $1.41 billion.

⏳ 4-Hour Time Frame

In the 4-hour time frame, as you can see, we're witnessing a downtrend within a descending channel, and the price is moving downward.

✔️ There is a very important support at the 0.2501 level, which is the main support, and the price has already reacted to it once, bounced from the bottom of the channel, and is now positioned above the channel’s midline.

🔽 If the price fails to reach the top of the channel and gets rejected from lower levels such as the 0.3172 resistance, the probability of the channel breaking to the downside increases, and more bearish momentum may enter. When the price gets rejected before reaching the channel top, it indicates weakening buyer strength.

✨ So, if the price gets rejected from the 0.3172 resistance, we can open a suitable position. The lower the rejection, the higher the probability of a drop. A rejection from the channel top or even a fake breakout can also act as a valid trigger.

📉 The main trigger for a short position is the break of the 0.2501 level, which is a very strong support, and its break can lead to a significant bearish leg.

⚡️ For a long position, the first trigger is the break of 0.3172, which is a good area but very risky, because just above it lies the channel ceiling, and the price might get rejected from there and move downward.

🔼 Therefore, it's better to wait for the channel to be broken first and then look for a long trigger. Currently, the most reliable trigger for a long position after a channel breakout is at 0.4018, but this level is quite far. So, for a long position, we can also enter on a pullback to the channel or after getting confirmation from Dow Theory.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | VETUSDT Keep an Eye on the Charts!👋 Welcome to TradeCityPro Channel!

Let’s dive into the days when the world is buzzing with interesting events—countries are forming alliances, and news of Trump’s tariffs to negotiations is everywhere. You need to keep a sharp eye on the financial markets and your assets!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

After the bullish move from the 0.01963 support, we got rejected at 0.08271, essentially wiping out the entire move and fully retracing our steps.

We’ve now returned to the 0.01963 support, where we’re forming a solid green indecision candle, backed by noticeable buying pressure. This level has shown a strong reaction, acting as a reliable support.

This could serve as a decent buy trigger with low risk, offering a good entry point. Personally, though, I’m holding off on buying until we see stronger momentum in the chart and market, and until Bitcoin dominance experiences a deeper pullback.

📉 Daily Timeframe

In the daily timeframe, VET is among the coins that have faced a brutal sell-off! From its last peak, it’s dropped roughly 77%, and those without proper risk management have likely been wiped out.

After forming a support box between 0.04224 and 0.05298, we saw a fakeout above the box, signaling further downside. The last time we held support at 0.04224, we couldn’t reach the box’s ceiling, leading to a sharp drop. But after hitting 0.01942, the price has calmed down a bit.

For buying in spot or even futures positions, we’d need a break of the trendline and its trigger at 0.02352 to confirm entry, given the trendline’s retracement nature. If we get rejected from this trendline, a short position in a lower timeframe could make sense. Should 0.01942 break, the downtrend will likely continue. For spot entry confirmation, a surge in volume and a break above 48.68 RSI would be a strong signal.

✍️ Final Thoughts

Stay level-headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

TradeCityPro | Bitcoin Daily Analysis #59👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. In this analysis, as usual, I’ll review the futures session triggers for New York.

🔄 Yesterday, one of the long triggers was activated, and the price moved up to the 83899 zone. Let’s see what triggers we can identify from today’s price action.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the price broke through the 83349 level yesterday and moved up to 83899. However, the candles weren’t strong enough to break this zone, and the price reached the resistance range between 83899 and 84572, then got rejected.

✨ An ascending trendline that started from the 74760 low has been accompanying the price, and each time the price has touched this trendline, the following bullish leg has been shorter, indicating a gradual weakening in bullish momentum.

✔️ Currently, the price is near the trendline, and if bearish momentum enters the market and selling volume increases, breaking the trendline trigger can give us a short position.

💫 The current trendline trigger is at 83813, and if it breaks, the price could open positions down to 80595 or even 78778.

💥 As mentioned, there is a resistance zone above the current price, which seems quite strong. The first trigger to break this resistance is 83899, and the second is 84572. The first trigger is riskier and more likely to hit the stop-loss. The second trigger, being higher, might not give a good candle setup, making it harder to enter a position, but it’s more reliable.

📊 If buying volume increases, a bullish move toward 88502 is likely. If selling volume increases, the likelihood of the trendline breaking also rises.

🔑 The RSI oscillator is also oscillating in the upper half. Entering the overbought zone could be a signal for long positions, while a break below 50 would be suitable for shorts.

👑 BTC.D Analysis

Let’s take a look at Bitcoin Dominance. Yesterday, BTC.D had a bullish move up to 63.80 but got rejected from that area and has now returned to the range between 63.30 and 63.50.

⭐ Today, a bearish confirmation for BTC.D comes with a break below 63.30, while a bullish continuation is confirmed with a break above 63.50.

📅 Total2 Analysis

Moving on to Total2: today this index continued its bullish movement and even broke the 957 trigger. If this move continues up to 989, altcoins could experience significant growth—especially considering the weakening momentum in BTC Dominance.

🧲 Today, there is no long trigger for Total2, but if this move turns out to be a fakeout, the 934 zone will be a good trigger for a short position.

📅 USDT.D Analysis

Now for Tether Dominance: its short trigger has been activated. The next support level is at 5.41, and if this zone breaks, we could see a sharp downward move.

⚡️ For a bullish reversal in dominance, the first trigger is the 5.59 area, and if dominance stabilizes above this level, we can consider opening short positions on Bitcoin and altcoins.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | STX: Watching for a Breakout in Bitcoin’s L2 Star👋 Welcome to TradeCity Pro!

In this analysis, I want to review the STX coin for you. This coin is one of Bitcoin’s layer-2 projects and, with a market cap of $933 million, ranks 67th on CoinMarketCap.

📅 Daily Time Frame

In the daily time frame, as you can see, this coin has been in a downtrend. Its most recent upward move began after breaking 1.332, and then it dropped within an expanding triangle structure down to the 0.533 area.

🔍 Currently, the main price support is at 0.453, which the price hasn't reached yet, but the 0.533 area is also strong and could mark the end of the downtrend.

✨ If the price bounces from the 0.533 area and starts moving upward, the likelihood of the triangle breaking to the upside increases. Since the price hasn’t reached the triangle’s bottom and could form a higher low, bullish momentum may enter.

📊 Market volume during the last bearish leg was decreasing, and now with supportive candles forming, volume is increasing—which, if it continues, also increases the likelihood of the triangle breaking.

🛒 If this happens, the buy trigger in spot is at 0.731, which, besides being suitable for a spot entry, can also provide a good futures position in lower time frames.

✔️ The RSI oscillator is also near the 50 level, and if it breaks above that and moves up, the price can head toward higher targets.

📉 On the other hand, for short positions, the 0.533 support is very important, and breaking it could justify opening a short. But note that this area is very close to 0.453, so if you're opening a short, be aware it's very risky and the price could reverse at any moment.

❌ If you already hold this coin and are looking for a good stop-loss level, a break and confirmation below 0.453 is appropriate. However, keep in mind that if your stop-loss is triggered and the price moves back above the support area, you should find a new trigger and buy again so you don’t miss the move.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | Bitcoin Daily Analysis #58👋 Welcome to TradeCity Pro!

Today, we'll delve into the analysis of Bitcoin and key crypto indices. As usual, I want to review the triggers for the New York futures session.

🔄 Yesterday, the price broke through the support zone between 80,595 and 81,522, retracing down to 78,778. Let's see what triggers the market could offer us today.

⌛️ 1-Hour Timeframe

On the 1-hour timeframe, as you can see, after breaking the 78,778 level, the price quickly recovered and climbed back above the 81,522 zone. Currently, it is hovering near 83,349.

🔍 Today, for a long position, we can consider opening a trade upon breaking the 83,349 resistance. The next resistance level at 84,572 could act as the following trigger point.

🔽 For short positions, we need to wait for a new market structure to form and observe whether the 81,522 or 80,595 zones can serve as our triggers.

⭐️ The RSI oscillator is near the Overbought zone, and a breakout above 70 into Overbought territory would provide good confirmation for a long position.

📊 Market volume has been increasing since the bullish leg started from 78,778. If this volume growth continues, the probability of breaking through the 83,349 resistance will rise.

👑 BTC.D Analysis

Now, let's move to Bitcoin Dominance (BTC.D). Yesterday, the 63.50 resistance was broken, and as Bitcoin's price climbed, its dominance also rose. This has caused altcoins to underperform compared to Bitcoin.

🔼 Currently, the next resistance for BTC.D is at 63.86. A break above this level would confirm the next bullish leg in Bitcoin Dominance.

📉 For a bearish move in dominance, the Futures triggers are at 63.50 and 63.30. However, for a confirmation in spot trading, we would need a break below 62.65.

📅 Total2 Analysis

Moving on to the Total2 (altcoin market cap excluding Bitcoin), I've slightly adjusted the zones and updated the triggers for altcoins.

✨ As I mentioned in the Bitcoin Dominance analysis, altcoins have been lagging behind Bitcoin. Even though Bitcoin reached 83,349, Total2 failed to retest its previous highs and instead formed a lower high.

✔️ For long positions on altcoins, a break above 940 would be ideal. For short positions, you can look for confirmation if 903 is broken.

📅 USDT.D Analysis

Finally, let's analyze USDT Dominance (USDT.D). Yesterday, it bounced from the 5.53 support level, climbing to 5.84 before starting a new downtrend, now approaching 5.53 again.

⚡️ To continue the bearish move, a break below 5.53 would be significant. Conversely, for a bullish move, the first trigger is at 5.84.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | GALA: At Key Support, Wait for Bitcoin Dominance👋 Welcome to TradeCity Pro.

In this analysis, I want to review the GALA coin for you. It is one of the first gaming crypto projects, currently ranked 86th on CoinMarketCap with a market cap of 628 million dollars.

📅 Weekly timeframe

In the weekly timeframe, as you can see, a very long-term range box has formed between the zones of 0.01307 and 0.08243, and the price has been ranging between these two areas for quite a while.

🔍 An interesting point regarding the volume within this box is that every time the price moved upward from the bottom to the top of the box, the volume increased, and during the price declines from the top to the bottom, the volume decreased.

📊 However, if we only look at the candles, we can see that the bearish momentum has been much stronger than the bullish momentum, and the probability of the bottom breaking is higher than the top. But this divergence between the price and the volume reduces the probability of the bottom breaking because, in my opinion, volume is more important than candles.

📉 Currently, this coin is located at the bottom area of its box, and we can say that there is a support zone between 0.01307 and 0.01547, which is almost the last support area for the price, and if this zone is broken, a new all-time low will be recorded.

💥 There is also an important area in the RSI, which is the 35.93 zone, and breaking this zone in the RSI increases the probability of breaking 0.01307.

🛒 For buying this coin in spot, the trigger at 0.08243 is suitable, but in my opinion, even if this zone is broken, do not buy any altcoins until Bitcoin dominance becomes bearish. I personally will wait until dominance changes trend and, for now, will not buy any altcoins.

🎯 The main target that the price might be able to reach is the 0.73643 zone, which is the all-time high, but considering that the inflation of this coin has been very high, the probability of reaching its all-time high is very low.

📅 Daily timeframe

In the daily timeframe, we can review the last bearish leg that the price has had in more detail.

🎲 As you can see, after the price reached the 0.06136 resistance and got rejected from this area, the bearish trend started and the price continued along a descending trendline down to the 0.01276 zone.

⚡️ Currently, the 0.01276 support is the most important support for the price, and as we saw in the weekly timeframe, if this zone is broken, a new all-time low will be recorded. The RSI entering the oversell zone brings bearish momentum into the market and helps the break of this zone.

🔼 However, for spot buying in this timeframe, we can use earlier triggers. The best trigger is the break of the trendline, and currently, the trendline trigger is around the 0.01761 zone, and you can buy if this zone is broken.

✔️ An important point, as I mentioned in the weekly timeframe, is that Bitcoin dominance is still bullish, and as long as it does not turn bearish, buying any altcoin is not logical.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

AUDJPYWe see in Australia against the Japanese yen two scenarios, i.e. the trend is completed to the downside, or if 90.449 is breached, it begins to rise, and we target 93.498 and 92.332, but most likely the scenario is an upward trend that will be activated, i.e. we wait for the taki candle after the breach.

AUDUSDWe await a retest and withdrawal of liquidity and a correction to the area we specified at points 0.6135 and 0.61084. From this area, we wait for a confirmation candle and a buy entry, targeting 0.62555. But noticing any movement in the market may change the goals. This is a region, so we will wait and see what update we publish.

XAU/USD: Ready for another Fall? (READ THE CAPTION)By examining the gold chart on the 30-minute timeframe, we can see that yesterday the price once again moved exactly as expected, hitting all four targets: $3022, $3016, $3010, and $3000, and even dropped further to $2956, resulting in a total return of over 700 pips!

Currently, gold is trading around $3003, and if the price stabilizes below $3014, we can expect further downside.

All key demand and supply zones are marked on the chart and are fully tradable.

If the drop continues, the next bearish targets will be $2997, $2991, $2984, and $2976, respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban