TradeCityPro | BNB: Analyzing Its Position in the Crypto Titans👋 Welcome to TradeCity Pro!

From today, we're returning to our usual routine on the channel, where we will provide two altcoin analyses and one Bitcoin analysis daily.

🔍 In this analysis, I want to review the BNB coin for you. It's one of the most important cryptocurrencies, with a market cap of $84 billion, ranking 5th in CoinMarketCap.

👀 This coin is officially for Binance exchange and is part of the projects that are profiting from the crypto space with a positive balance sheet. Let’s technically analyze this coin as well.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, there is a very large range box from 208 to 662 where the price has been moving since 2021.

💫 Currently, in the last leg where the price moved, it was supported at the area of 208 and began to form a base, then after breaking 352, it started an upward movement up to the resistance area of 662 to 746.

✔️ After reaching this area, a corrective and resting phase of the price began, and a box has formed between this area and the 501 area. The 501 area overlaps with the 0.236 Fibonacci, making it a very important PRZ for BNB.

❌ If you already own BNB, you can set your stop loss if the price consolidates below the 501 area because if this area is broken, the next significant support the price has is the 352 area, which is the most crucial support in this trend and overlaps with the golden Fibonacci area, and a fall to this area could happen.

🛒 For buying in spot, first of all, you must wait until buying volume enters the market so that the price can move upwards. The main trigger for spot is the break of 746, and if this area is broken, the main upward trend can start because the box that the price has built since 2021 will also be broken.

💥 Let’s move to the daily timeframe to analyze the price movement in the short term.

📅 Daily Timeframe

In this timeframe, we also have a range box from 484 to 750, and in this leg, an expanding triangle has formed, which causes the market volatility to increase and the price to show less reaction to static areas.

⭐ On the other hand, because we have a range box and the price is ranging, we can't rely much on indicators and oscillators because they give us incorrect data.

🎲 In this market condition, we shouldn't check too much data and unnecessarily clutter the chart. For a long position, you can enter with the break of the 638 area. It would be better if this break occurs simultaneously or after the triangle break, allowing for more risk.

🔼 The main trigger for buying in spot, as mentioned in the weekly timeframe, is 746, which becomes 750 in this timeframe, and you can proceed with your spot purchase if this area is broken.

📉 For short positions and in general for a bearish scenario, the first trigger is 569, which is a very risky trigger, and in my opinion, we should wait for the price to react to it to be sure of the exact place of this area.

✨ The next triggers are 531 and 484, where 531 is a logical trigger and 484 is the main trigger for a trend change in the large market cycle.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Tradingview

BTC Weekly Chart Update📉 CRYPTOCAP:BTC Weekly Chart Update

It looks like a double top pattern is clearly forming on the BTC weekly chart — and honestly, doesn't it remind you of a similar structure we’ve seen before? 👀

Patterns like these often signal potential trend reversals, so this is definitely a chart to watch closely.

Do you see the similarity with the previous one? Let me know your thoughts in the comments 👇

🔴 Bearish scenario could continue unless we break above key resistance.

TradeCityPro | APTUSDT The Beginning of a New Downtrend!👋 Welcome to TradeCityPro Channel!

Let's go back to the day when Trump imposed tariffs on the United States again, causing stocks and cryptocurrencies to fall and gold to rise. Let's take a look at our attractive altcoin chart

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

APT remains inside its large, volatile range, frequently bouncing between its highs and lows. However, this time, it has formed a lower high, which is not a positive sign.

Additionally, after breaking $7.78, sellers completely engulfed the weekly candle, and for the past five weeks, all candles have been red with high selling volume, confirming the downtrend.

There is no buy trigger at the moment, and I cannot recommend a buying opportunity until the market forms a new structure.

For selling, if APT drops below $4.97, it makes sense to exit and accept the loss instead of holding onto a losing position.

📉 Daily Time Frame

In the daily time frame, the power is in the hands of the sellers! After the parabolic line broke, we experienced a Sharpe decline, accompanied by the formation of a lower ceiling and floor, which has continued our downward trend.

The parabolic movement itself is a very rapid and bullish movement, and every time the price hits it, it quickly returns to its trend and is supported, but when this line is broken, that trend is practically over and we suffer, or we experience a Sharpe decline like this chart!

After the drop and the formation of a box between 5.136 and 6.491, the selling force was clearly evident in this space, because the last time we moved towards the ceiling of 6.491, we could not reach this ceiling and we were rejected earlier.

This rejection made us return to this support faster with a number of red candles, unlike the previous attempt where we moved up with a larger number of candles. Yesterday's daily candle also engulfed the previous 3 candles and is exactly ready to break 5.136.

If today's daily candle closes in the same way, the probability of a drop in the coming days will increase and increase. If you are a holder of this coin, it is logical to sell and after returning to the box and breaking its ceiling, buy with the same number of Tethers and reduce the probability of a drop and loss of capital for yourself!

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

Skeptic | EUR/USD at a Crossroads: Breakout or Reversal?Welcome back, guys! 👋 I'm Skeptic.

Today, we're diving deep into EUR/USD , analyzing key levels and potential triggers.

🔍Recap & Current Structure:

As mentioned in our previous analysis , after the previous uptrend, EUR/USD entered a consolidation phase. Our short trigger at 1.07124 played out well, reaching an R/R of 2—if you followed the idea, you saw the results!

Now, we’ve formed a new structure , which is more visible on the 1H timeframe. After breaking the descending trendline and pulling back , we've now created a higher high , indicating a potential move toward the top of the box at 1.09453 .

With DXY weakening, the expectation leans towards an uptrend continuation, but we remain flexible—if our short trigger activates, we'll take it as well because we approach the market with a two-sided, skeptical view rather than a fixed bias.

📈 Bullish Scenario (Long Setup):

Trigger: Break & close above 1.08454

Confirmation: 7 SMA below the candle during the breakout + RSI entering overbought

]Invalidation: Rejection + close back below 1.07666

📉 Bearish Scenario (Short Setup):

Trigger: Rejection at 1.08278 + drop below 1.07666

Confirmation: RSI entering oversold

⚠️ Key Notes:

Fundamentals: This Friday is NFP day—a crucial event for the markets.

Given the recent uptrend in EUR/USD, a pullback is likely, so stay prepared for both triggers.

Risk Management: Avoid overleveraging—wait for confirmed breaks before entering.

Stay sharp, and I’ll see you in the next analysis!

Skeptic | GBP/USD Deep Dive: Major Trend, Trade Setups!Hey guys, welcome back! 👋 I'm Skeptic.

Let’s dive into GBP/USD , a pair that’s been in a strong uptrend and has the potential for another solid price jump. We’ll break it down across multiple timeframes , do a deep analysis , and at the end, I’ll share high-probability long & short setups with clear triggers—so stick around!

Daily Timeframe Analysis

As you can see, GBP/USD has been respecting an uptrend channel , reacting well to both the upper, lower, and midlines —a key characteristic of a strong trend. Each time price makes a jump, it enters a range box (re-accumulation phase) before breaking out to continue the trend.

Currently, we’re inside another range between 1.28720 - 1.29883 . A breakout in either direction can give us a trading opportunity, but given the major trend is bullish , I prefer trading in the direction of the trend unless we get a clear reversal signal.

4H Timeframe Analysis

The uptrend channel remains intact , and we’re still within the Consolidation phase . We recently saw a fake breakout , which could mean that the next breakout might happen with stronger momentum.

Trade Setups

✅ Long Setup:

- Entry: After a confirmed breakout of 1.29883

- Confirmation: RSI breaking above 65.33 (which acts as an overbought signal in this case)

- Preferred Order: Stop Buy above resistance to catch momentum

❌ Short Setup:

- Entry: After a confirmed break of 1.28682

- Risk Management: Since this is against the trend, take quick profits and use a tighter SL to manage risk efficiently.

What are your thoughts on GBP/USD? Drop your opinions in the comments! Let’s grow together, not alone. 🚀🔥

TradeCityPro | Bitcoin Daily Analysis #51👋 Welcome to TradeCity Pro

Let's move on to the fiftieth analysis of Bitcoin and key crypto indices. In this analysis, as usual, I want to review the New York futures session triggers for you.

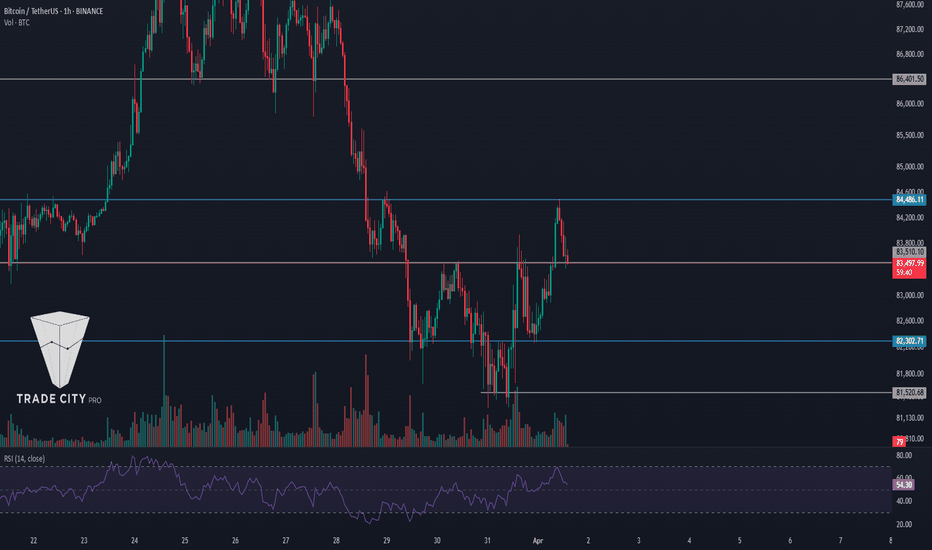

⏳ 1-hour timeframe.

As you can see in the 1-hour timeframe, after the news of US tariffs, the market experienced a drop to the support zone, and now, for the second time, it has penetrated this area.

🔍 If this range between 81520 and 82302 is broken, the price could start the next bearish leg, but another important support is located at 80105, which might prevent further decline.

🔽 For a short position, breaking this range is suitable. For a long position, it's better to wait until a new structure forms.

👑 BTC.D Analysis

Moving on to Bitcoin dominance, the 62.64 zone has also been broken, and dominance has pulled back to it and is now moving upward.

💫 I cannot determine a resistance level at the moment, and we need to wait until the price structure forms new resistance levels.

⚡️ For now, I see Bitcoin dominance as bullish, so it's better to choose Bitcoin for long positions and altcoins for short positions.

📅 Total2 Analysis

Moving on to the Total2 analysis, yesterday the price pulled back to 990 and has now reached 953.

✔️ If this zone is broken, the price could experience a sharp bearish movement and start the next leg. For a long position, like Bitcoin, we need to wait for a new structure to form.

📅 USDT.D Analysis

Moving on to USDT dominance, a very sharp upward move with strong momentum has occurred, and a higher low compared to 5.05 has been formed.

🧩 Currently, there is an important resistance at 5.56, and the price has reached this level. If this zone is broken, dominance will turn bullish.

💥 For a bearish move in dominance, like other indices, we need to wait for a new structure to form.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

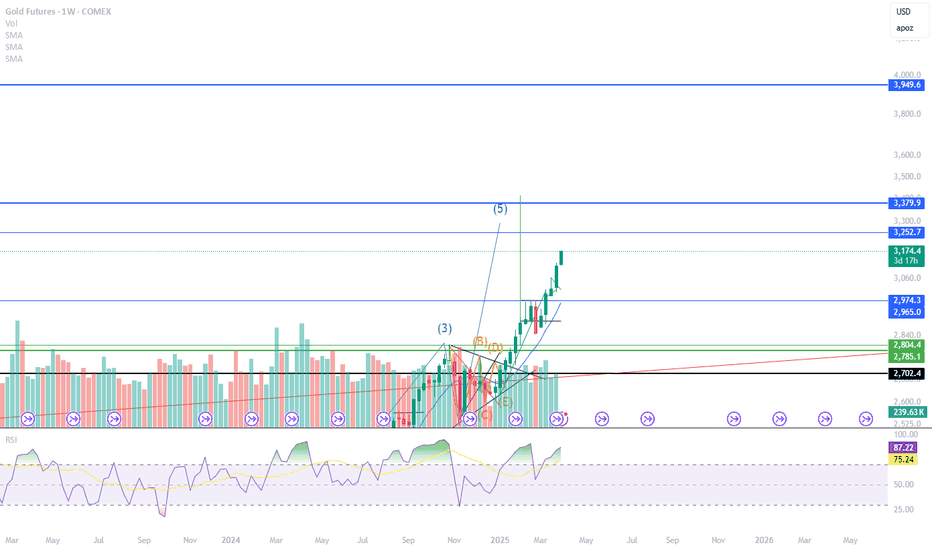

Gold Futures: Flight of the PhoenixCOMEX:GC1!

Gold Futures Analysis:

Gold futures are currently presenting a clearer picture compared to equity index futures. Crude oil futures, on the other hand, have already priced in much of the recent tariff news, with a reversal observed from the 2025 mid-range back towards $65. Despite heightened volatility, the WTI crude oil market remains relatively balanced, with bearish sentiment materializing, if prices drop below and stay below the $65 mark.

Gold futures, however, are offering more defined risk-reward opportunities at the moment. Our analysis shows a macro bullish trend in gold, along with price discovery and market auction trends visible on lower timeframes.

On the 4-hour chart below, we observe a rising upward channel, with key levels identified and reasoning for these levels labeled on the chart.

Key Levels:

• ATH: 3201.6

• HVN (High Volume Node) for long entry: 3115

• LVN (Low Volume Node)/LIS for short entry: 3095.1

• Key LVN Support: 3003.7-3018

Scenario 1: Bearish Continuation

If Gold futures stay below the trend line that defines both our long and short trade ideas, the bearish scenario could materialize. For a short trade to be viable, we would look for a close below the LVN/LIS level (3095.1) and enter on a pullback, targeting the major LVN support zone around 3018.0.

Example trade parameters for Scenario 1:

• Entry: 3095.1

• Stop: 3125

• Target: 3018

• Risk: 29.9 points

• Reward : 77.1 points

• Risk to Reward Ratio: RRR=77.1/29.9 ≈2.58

Scenario 2: Bullish Reversal

In the event that Gold futures push back towards all-time highs due to heightened uncertainty and a flight to safety, we expect initial profit-taking by shorter timeframe traders to provide a pullback. This could present a long opportunity towards the all-time highs.

Example trade parameters for Scenario 2:

• Entry: 3115

• Stop: 3095

• Target: 3200

• Risk : 20 points

• Reward : 85 points

• Risk-to-Reward Ratio: RRR= 85/20 = 4.25

Important Notes:

• These are example trade ideas, and traders are encouraged to do their own analysis and preparation before entering any positions.

• Stop losses are not guaranteed to trigger at specified levels, and actual losses may exceed predetermined stop levels.

GBPUSD - near to his very expensive region, what's next??#GBPUSD... market just trade in range just below is most expensive region and that is market swing region as well.

keep close that region and only only buy above that region.

means don't holds your shorts above that region.

upside we have long leg if market clear that region.

good luck

trade wisely

GOLD - where is current support ? What's next??#GOLD... perfect move as per our discussion and now market again at his current support (that was our resistance )

Keep close the supporting region and if market holds then we can expect a further rise towarss next resistance areas.

Good luck

Trade wisely

GOLD - single supporting area , holds or not??#GOLD. well guys now we have 3112 as immediate supporting area and upside we have 3125 as immediate resistance area so keep close and if market hold 3112 then we can expect another bounce towards upside next targets.

keep in mind that 3112 is our single supporting area so if market clear that level then we will go for short means cut n reverse but on confirmation.

good luck

trade wisely

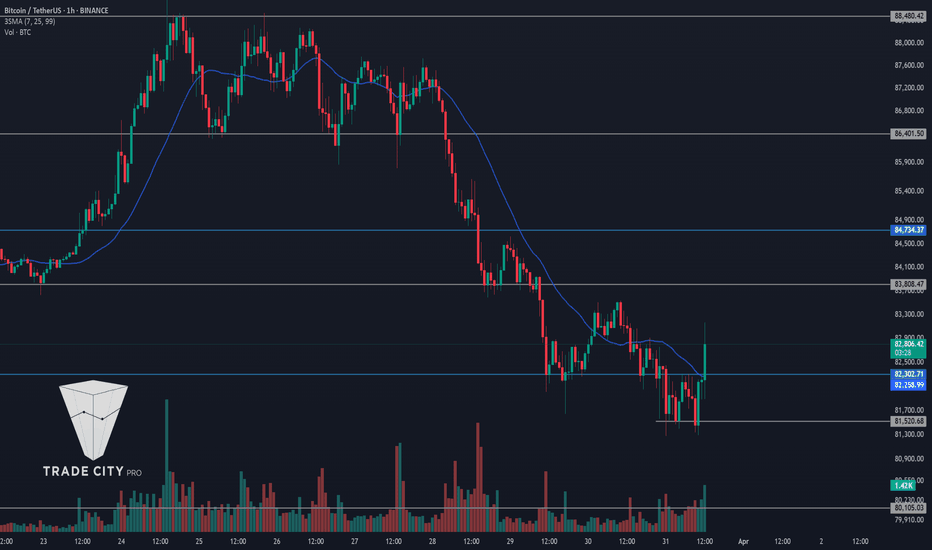

TradeCityPro | Bitcoin Daily Analysis #50👋 Welcome to TradeCity Pro

Let's move on to the 50th analysis of Bitcoin and key crypto indices in this analysis as usual I want to review the New York futures session triggers for you

🫶 Before starting the analysis I want to thank you for all the support you have given us along the way so that we could reach the 50th analysis I hope that the number of these analyses increases much more and that we are always with you and that you also benefit from the analyses❤️

⏳ 1-hour timeframe

Yesterday Bitcoin rose from the 82302 zone and moved upward finally forming a base after the sharp and deep decline it had and even managed to go above the 83808 zone

⚡️ I slightly adjusted this zone and moved it to 83510 because the price reacted better to this zone

💫 Currently, we are witnessing a rejection from the 84486 zone which has pushed the price back towards 83510 if selling volume increases the price may drop further

✔️ If the price goes below the 83510 zone again in lower timeframes and with the activation of the fake breakout trigger we can open a short-term short position the main trigger is in the 82302 zone

🔼 For a long position breaking 84486 is suitable and with this breakout, the price can start the next bullish leg the entry of RSI into Overbuy will also be a momentum confirmation and can cause us to see large bullish candles

👑 BTC.D Analysis

Moving on to Bitcoin dominance today dominance faced a rejection from 62.35 which could cause dominance to decline

💥 The trigger for confirming this rejection and the downtrend is in the 62.06 zone and breaking this zone could move the price towards the 61.81 and 61.63 zones

📈 Stabilization of dominance above 62.35 will also confirm the uptrend again

📅 Total2 Analysis

Moving on to the Total2 analysis yesterday the 1.01 trigger was activated and the price has also pulled back to it but today we have a trigger for both long and short positions

🔽 For a short position breaking 990 and for a long position breaking 1.02 can confirm opening positions on altcoins

📅 USDT.D Analysis

Moving on to USDT dominance a Head and Shoulders pattern has formed where the neckline in the 5.41 zone has also been broken and the price is pulling back to it

📉 If the price is rejected from the 5.41 zone we will confirm the activation of this pattern and with the break of 5.33 we can confirm the downtrend of dominance

⭐ For an uptrend in dominance breaking 5.41 and invalidating the pattern can be a suitable trigger

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | INJUSDT Best Trade Setup of the Week?👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the most popular cryptocurrency coins, which is in a more favorable situation than the majority of altcoins together!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

On the weekly time frame, I see that the seventh period is stable, inj, and compared to the majority of altcoins that have their own low price levels, it is in a better space and is engaged in its own supports!

After breaking the primary trend ceiling, namely 9.28, we experienced a sharp upward movement and formed a historical ceiling at $53, and after forming a distribution box and breaking the important floor of 16.20 and pulling back to it, we experienced a continued decline.

We have now reached support again, which was previously a very important resistance, and now, as a result, it is probably not lost, but the weekly candle is a very good and bearish candle! Don't forget to save your profit, your strategy booklet and your positions, otherwise you will have made a 450% move without adding anything to your capital!

📉 Daily Time Frame

On the daily time frame, our trend is completely bearish as you can see and the events are completely accompanied by the formation of a downward bottom and top, but we are likely to suffer for a while.

After getting rejected from 34.16 and forming a box between 20.16 and 25.93 and losing the bottom, it made a move and then while pulling back with low volume and the next conversion to red, it became an inverted Sharpe, we experienced a decline!

Currently, we are forming a box between 8.63 and 10.68, and for selling and short positions, you can do this by breaking 8.63, and for the trigger spot risk and buying, if you feel the price is good, it is better to wait for the trend to break and do the trigger at 10.68. Let it structure.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

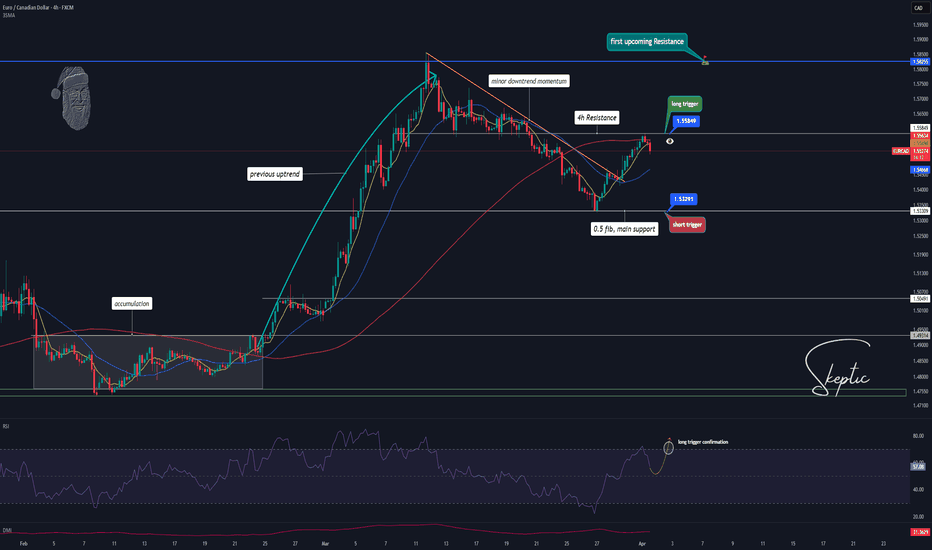

Skeptic | EUR/CAD at Crossroads: 1.55849 vs. 1.53291Welcome back, guys! 👋 I'm Skeptic.

Today, we’re diving deep into EUR/CAD, analyzing key levels and potential triggers. 🔍

Market Structure & Current Outlook

Looking at the 4H time frame , we initially saw an accumulation phase from February 3rd to February 24th. After breaking out from the accumulation range, price rallied strongly, continuing the major uptrend until 1.58552 .

Following this peak, EUR/CAD entered a corrective phase, forming a secondary downtrend that retraced to the 0.5 Fibonacci level.

Now, the minor downtrend has broken , signaling a potential continuation of the major 4H uptrend. With strong confluence for a bullish move, we’ll be looking for a long setup, but we’ll also prepare for a potential short trigger in case price reverses. Remember, as traders, we analyze the market from both perspectives and execute based on confirmations—skeptical eyes always! 🔮👽

📈 Bullish Scenario (Long Setup):

🔹 Trigger: Break & close above 1.55849

🔹 Confirmation: 7 SMA below the breakout candle

RSI entering overbought zone

🔹 Invalidation: Rejection & close back below 1.54325

📉 Bearish Scenario (Short Setup):

🔹 Trigger: Drop below 1.53291

🔹 Confirmation: RSI entering oversold zone

⚠️ Key Notes & Risk Management

🔹 Fundamentals:

This Friday is NFP day, a crucial event that could create volatility in the market.

Always consider fundamental catalysts when executing trades.

🔹 Risk Management:

Avoid overleveraging.

Wait for confirmed breaks before entering positions.

Stick to your trading plan and stop-loss strategy.

Stay sharp, and I’ll see you in the next analysis! 🚀

TradeCityPro | Bitcoin Daily Analysis #49👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, I will review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the downtrend continues, and yesterday the price dropped below 82,302, now reaching 81,520.

📊 Selling volume has increased in the market, and the SMA 25 has been tracking the price movement effectively in this cycle. Currently, as the price pulls back to 82,302, it is also testing the SMA 25, placing it in a critical zone.

🔽 For a short position, considering this pullback to the SMA 25, you can enter a trade if 81,520 breaks. The next support level in case of a further decline is 80,105.

📈 For a long position, we still need to wait for a proper trend reversal structure to form. There is no valid trigger for a long entry at this moment.

👑 BTC.D Analysis

Now, let’s analyze Bitcoin dominance. Yesterday, the ascending trendline was broken, but the trigger at 62.06 was not activated, leading to a bullish move instead.

⚡️ Currently, 62.30 has broken, and if this breakout holds, dominance could rise to 62.66.

💥 However, if the 62.30 breakout turns out to be a fakeout, a break below 62.06 would confirm a bearish trend reversal.

📅 Total2 Analysis

Moving on to Total2, yesterday the 0.984 support broke, but it now appears to be a fakeout, as the price is stabilizing back above this level.

💫 For a short position, confirmation will come if the price closes below 0.984. If that happens, the next downside target would be 0.953.

🔼 For a long position, a break above 1.01 would confirm the trend reversal, given the fakeout at 0.984.

📅 USDT.D Analysis

Now, let’s analyze USDT dominance. A range has formed between 5.41 and 5.56, and dominance has rejected from 5.41, now moving downward again.

✔️ If 5.41 breaks, it would be the first confirmation of a trend change.

✨ For a bullish continuation, a break above 5.56 would confirm the next bullish leg.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Can we be optimistic that this will come true?( road to 300k )I might be wrong and this might never happen, but it might come true From a technical perspective!!!

Remmember

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Skeptic | EURCHF: Trend Strength or Weakness? Trade SetupsWelcome back, guys! 👋I'm Skeptic.

Today, I’m bringing you a multi-time frame analysis of EURCHF , including both long and short triggers, along with a few educational tips. Let's dive in!

---

🕰️ Daily Time Frame Analysis:

After a solid accumulation phase and breaking above resistance, we've successfully shifted the trend to uptrend . Given the major trend direction, it's better to focus on long positions .

---

⏳ 4-Hour Time Frame Analysis:

Following the uptrend, we've formed a bullish ascending triangle, indicating a potential continuation. You might think that the RSI downtrend signals trend weakness, but here’s the key point:

- Lack of follow-through on the downside shows trend strengt h. If it was genuine weakness, we’d have seen a sharp downward move already.

This makes the bias towards long positions stronger .

---

🚀 Long Setup:

After breaking the resistance at 0.9649 7, we can consider a long position. A breakout of the RSI trendline to the upside would be an extra confirmation.

📉 Short Setup:

To go short, we first need a breakdown from the ascending triangle, followed by a break below the key support at 0.95726.

---

🎯 Target Setting:

You can use the height of the triangle or your own support/resistance levels to set targets. I’m not here to tell you where to place your stop loss or take profit since that heavily depends on your strategy, stop size, and R/R ratio.

---

💬 Final Thoughts:

I always provide the key levels and setups, but it's up to you to adapt them to your own strategy.

Thanks for sticking around until the end of this analysis.

See you on the next one!💪🔥

BTCUSDT - single supporting area , holds or not??#BTCUSDT - just reached at his current important supporting area that is around 83600

keep close that level,

overall market stay in range as per our last idea regarding #BTCUSDT.

so now below 83600 market can drop towards his old supporting areas.

good luck

trade wisely

Be careful with DOGE !!!Perhaps this is a cup and handle pattern, and if that's the case, it could push the price up to around 90 cents.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TradeCityPro | Bitcoin Daily Analysis #48👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, in this analysis, I will review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, yesterday the price made a pullback and a correction, briefly moving above the SMA 25, but now it has dropped back below this level.

🔍 This correction has reinforced the 82,302 level as a stronger support, making a break below this area even more significant.

💫 If 82,302 breaks, I strongly recommend having a short position, as breaking this level could initiate the next bearish leg.

🔼 For a long position, our current trigger is 83,808, but this is a risky trigger, and I believe it's better to wait for the market to establish a new structure.

👑 BTC.D Analysis

Now, let’s analyze Bitcoin dominance. The dominance remains bullish and is currently stabilizing above 62.30.

✔️ If this level holds, the next resistance will be 62.66, and dominance could initiate another bullish leg toward this zone.

🔽 For a bearish move, we need to wait for the ascending trendline to break and then confirm the downtrend with Dow Theory before considering short positions.

📅 Total2 Analysis

Moving on to Total2, yesterday the price closed below 1.01, and now it has pulled back to retest this level. It seems ready to initiate the next bearish leg.

📉 For a short position, breaking 0.984 remains the key trigger. If this level breaks, you can enter a position.

🔼 For a long position, we need to wait until the strong bearish momentum fades and buyers start entering the market.

📅 USDT.D Analysis

Now, let’s analyze USDT dominance. As you can see, dominance has completed a bullish leg, followed by a slight correction, and now it has regained bullish momentum and is moving upward again.

💥 For further upside, breaking 5.49 is the key trigger to enter a long position.

⚡️ For a bearish move, we need to wait for a new bearish structure to form before considering short positions.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | TONUSDT From Pavel’s Release to Blockchain Events👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of TON, one of the most efficient and widely used blockchain projects that is making significant waves in the space.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you that we have moved the Bitcoin analysis to a separate section based on your requests. This allows us to discuss Bitcoin’s status in more detail and analyze its charts and dominance separately.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

🚀 Pavel Durov’s Release!

Pavel Durov, Telegram’s founder, has returned to Dubai after months of restrictions in France. He was detained in August 2024 over content monitoring allegations but announced on March 17, 2025, that he has finally returned to his main residence and Telegram’s headquarters in Dubai.

Durov thanked his team and lawyers, emphasizing that Telegram had gone beyond its legal obligations. While investigations in France continue, this return could be a turning point for Telegram’s future.

At the same time, the TON blockchain is gaining attention with its NFT ecosystem, including projects like GetGems and TON Diamonds. From Telegram usernames as NFTs to event tickets, TON is building a fast, scalable, and practical ecosystem that’s making headlines.

🔍 Deep Research

In our previous analysis, we conducted an in-depth fundamental review of TON—covering team background, blockchain developments, and ecosystem growth. Since investing requires a full understanding of a project, make sure to check out the previous analysis if you haven’t already.

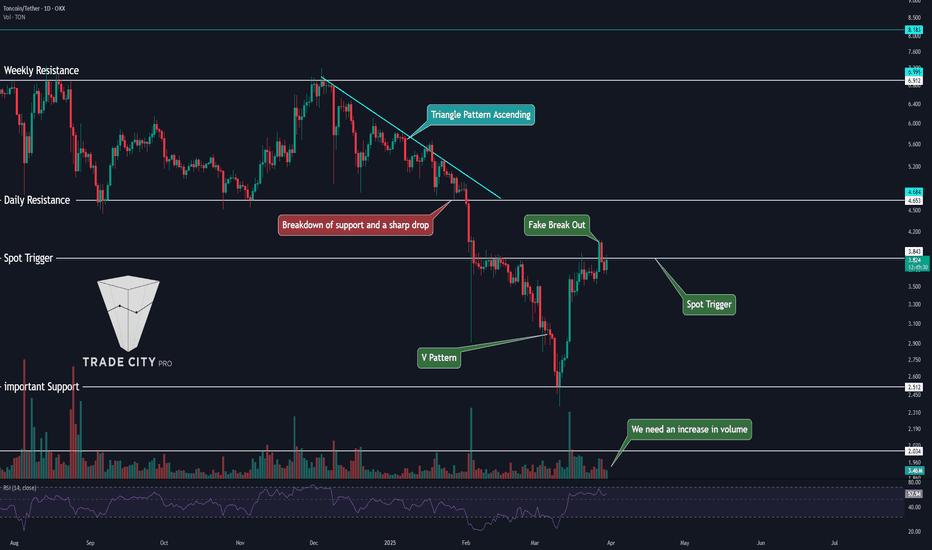

📊 Weekly Time Frame

TON is one of the strongest altcoins in the market right now. While most altcoins have reached or formed new lows, TON is still holding above major supports.

After forming its all-time high of $8.288, TON entered a distribution zone. Due to overall market corrections, it lost the $4.765 support, leading to a sharp drop that reached the $2.650 support an area we previously identified for entries.

This support level is crucial, as it represents nearly 50% of the chart’s structure. Additionally, the 0.786 Fibonacci level and previous long-term resistance reinforce its importance. As seen on the chart, after touching this level, TON bounced sharply.

There is no clear spot buying trigger at this time frame yet. However, if TON forms a higher low, the chart will turn fully bullish.

For exit strategies, I am currently utilizing my TON within its ecosystem (NFT trading, etc.), so I do not plan to sell unless the price drops below $1.914.

📉 Daily Time Frame

After getting rejected at $6.912, TON entered an ascending triangle pattern—which is typically a bearish continuation pattern. The chart continued forming lower highs and lower lows, indicating that selling pressure outweighed buying interest.

After breaking down from this triangle, TON experienced a sharp 50% drop from the breakout point. However, upon reaching the $2.512 support, the price suddenly pumped, partly influenced by Pavel Durov’s release and new TON blockchain developments.

Even without the fundamental catalysts, this support level was critical, and a bounce was likely. This move has now formed a V Pattern, which is bullish.

If TON breaks above $3.857, we could see further price increases, making this a potential buy opportunity. Confirmation signals include RSI entering overbought territory and increased volume.

⏳ 4H Time Frame

TON is on my watchlist for long positions due to its strong hype and ecosystem developments.

🟢 Long Position:

We are currently testing a major resistance at $4.076. If this level breaks, we can safely enter a long position. If a lower time frame trigger appears, it may be worth entering early.

🔴 Short Position:

I generally don’t recommend shorting TON, but if it breaks below $3.569, it could trigger a decent short trade. However, since TON is still ranging in the daily time frame and market volume is low at the end of the month, be cautious—unpredictable wicks are likely.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

TradeCityPro | Bitcoin Daily Analysis #47👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, in this analysis, I will review the futures session triggers for the New York market.

⌛️ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, yesterday the 83,808 trigger was activated, and the price moved down to the next support at 82,302.

⚡️ The 19.70 level in the RSI is a crucial area, as the price has reacted to this level in the last two bearish legs, leading to slight corrections.

✔️ Today, it might be a bit late to open new positions, as the price is slightly oversold, suggesting that the move has already extended sufficiently.

🔽 This situation means we should enter positions with lower risk today. The short trigger for today is 82,302, and if this level breaks, the price could decline even further.

📈 For a long position, we need to wait for confirmation of a trend reversal. First, the SMA 25 must reach the price, and then a Dow Theory confirmation should establish a new bullish trend.

👑 BTC.D Analysis

Now, let’s analyze Bitcoin dominance. As you can see, this index increased yesterday as the market dropped. It briefly faked out above 62.14 before reversing downward again.

🎲 At the moment, 62.14 remains a key trigger for bullish dominance, while the main support level is 61.81.

📅 Total2 Analysis

Moving on to Total2, this index is in bad shape. It has broken its key support at 1.01 and is now moving toward 0.984.

💥 I can't provide any specific trigger for this chart today because it has dropped significantly without any corrections. For now, we need to wait for a new structure to form.

📅 USDT.D Analysis

Now, let’s look at USDT dominance. Yesterday, dominance finally stabilized above 5.34, which triggered a market drop.

🔍 Currently, USDT dominance has reached the next resistance at 5.48 and has shown a reaction to this level. To confirm further upside, we need a break above 5.48. If a correction starts and we see more red candles, the price could retrace back down to 5.34.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | ATOMUSDT Restarting Daily Analyses!👋 Welcome to TradeCityPro Channel!

Let's get back to our daily analysis routine starting today! From now on, I’ll be sharing daily altcoin analyses again. Today, we’re focusing on one of my favorite coins for futures trading: ATOM.

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

ATOM is currently neither in a great position nor in a terrible one. Unlike some altcoins like BNB, SOL, and SUI that have moved towards their highs, ATOM hasn’t made a significant move towards $44 yet. However, it also hasn’t lost its major lows.

The strong green candle from the past two weeks bounced off the $3.728 support level, confirming that this level remains significant and won’t be easily lost. But this alone is not a reason to buy. After the candle closed, the price did not make a significant move.

If you are holding ATOM (like me, as I have staked ATOM in my wallet), I would exit below $3.728 because there is a high probability of a sharp drop toward $1.824.

For buying opportunities, setting a stop-buy order above $5.088 could be an option. We’ll discuss this more in the daily time frame section.

📉 Daily Time Frame

After bouncing off the $3.58 support, we started a bullish move but couldn’t reach $14.184. Instead, after getting rejected at $10.434, we formed a lower high and continued the price correction.

Following this rejection, we continued forming lower highs and lower lows based on Dow Theory. After breaking $5.665, which was an important support, we experienced a sharp drop, reaching the $3.585 support level. After bouncing, a V Pattern was formed.

$4.948 is an important level to watch as it triggers both the V Pattern activation and the trendline breakout.

I will only open short positions below $4.337, but I will not sell my coins unless $3.585 is broken, in which case I will exit my holdings.

⏳ 4H Time Frame

After getting rejected at $4.948, the price dropped to the $4.424 support level. Since it’s Saturday and the market is relatively slow, we might see range-bound movement around this level.

🔴 Short Position:

If $4.424 breaks and RSI enters the oversold zone with increased volume, we could see a short opportunity targeting $4.020.

🟢 Long Position:

I am currently waiting and prefer to open a long position on MKR instead. I don't want to waste the $4.948 trigger, so I will wait for a confirmed breakout before entering a position.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️