TradeCityPro Academy | Dow Theory Part 3👋 Welcome to TradeCityPro Channel!

Welcome to the Educational Content Section of Our Channel Technical Analysis Training

We aim to produce educational content in playlist format that will teach you technical analysis from A to Z. We will cover topics such as risk and capital management, Dow Theory, support and resistance, trends, market cycles, and more. These lessons are based on our experiences and the book The Handbook of Technical Analysis.

🎨 What is Technical Analysis?

Technical Analysis (TA) is a method used to predict price movements in financial markets by analyzing past data, especially price and trading volume. This approach is based on the idea that historical price patterns tend to repeat and can help traders identify profitable opportunities.

🔹 Why is Technical Analysis Important?

Technical analysis helps traders and investors predict future price movements based on past price action. Its importance comes from several key benefits:

Faster Decision-Making: No need to analyze financial reports or complex news—just focus on price patterns and trading volume.

Better Risk Management: Tools like support & resistance, indicators, and chart patterns help traders find the best entry and exit points.

Applicable to All Markets: Technical analysis can be used in Forex, stocks, cryptocurrencies, commodities, and even real estate.

In the previous session, we explained Principles 3 and 4 of the Dow Theory. Be sure to review and study them, and if you have any questions, let us know in the comments.

📑 Principles of Dow Theory

1 - The Averages Discount Everything (Not applicable to crypto)

2 - The Market Has Three Trends

3 - Trends Have Three Phases

4 - Trend Continues Until a Reversal is Confirmed

5 - The Averages Must Confirm Each Other

6 - Volume Confirms the Trend

📈 Principle 5: Trends Persist Until a Clear Reversal Signal Appears

Full Explanation:

Dow Theory says that once a market picks a direction—like going up (bullish trend) or down (bearish trend)—it keeps moving that way until something big and obvious says, “Nope, we’re turning around!” Think of it like momentum: the market’s lazy and sticks to its path unless it gets a solid reason to switch.

What’s a Trend? It’s the market’s overall direction. Uptrend means higher highs and higher lows (prices keep climbing). Downtrend means lower highs and lower lows (prices keep dropping). Sideways means it’s stuck in a range.

What’s a Reversal Signal? In an uptrend, if prices stop making new highs and start forming lower highs and lows, plus break a key level (like support), that’s a sign the trend’s flipping. In a downtrend, it’s the opposite—higher highs and lows plus breaking resistance mean it’s turning up.

Why Does This Happen? Markets reflect crowd behavior. When everyone’s buying or selling, the trend builds steam and doesn’t stop until the crowd’s mood shifts big-time.

Key Point: Small dips or spikes don’t count. A little drop in an uptrend? Normal. You need a clear pattern or a big break to call it a reversal.

Practical Use: Traders use this to avoid panic-selling on tiny moves and wait for strong signals before jumping ship.

Simple Example:

It’s like riding a bike downhill—you keep rolling fast until you hit a wall or slam the brakes.

📊 Principle 6: Trends Must Be Confirmed by Volume

Full Explanation:

This principle says a trend isn’t legit unless trading volume backs it up. Volume is how much is being bought or sold. If the trend’s real, volume should match it—high volume means lots of people are in on it, low volume means it might be fake or weak.

Uptrend: Prices rising with growing volume? That’s a strong bull run—buyers are all in. Prices up but volume’s tiny? Could be a fluke or manipulation.

Downtrend: Prices falling with big volume? Sellers mean business—bear trend’s solid. Falling prices with low volume? Might just be a quick dip, not a real crash.

How Volume Confirms: It’s like a lie detector for trends. Big volume says, “This move’s for real!” Low volume says, “Eh, don’t trust it yet.”

Extra Detail: In an uptrend, if volume starts dropping, it’s a warning—buyers might be losing steam. In a downtrend, low volume could mean sellers are running out of ammo, hinting at a bounce.

Why It Matters? Dow believed volume shows the market’s true energy. No crowd, no power—simple as that.

Practical Use: Traders check tools like OBV (On-Balance Volume) or volume bars. If a stock jumps but volume’s dead, they might skip it it’s a trap.

Simple Example:

It’s like a party if tons of people show up dancing, it’s a real vibe. If just two guys are there, it’s probably lame.

🎉 Conclusion

We’ve reached the end of today’s educational segment! We’ll start by explaining all of Dow Theory’s principles, and in the future, we’ll move on to chart analysis and the strategy I personally use for trading with Dow Theory. So, make sure you fully grasp these concepts first so we can progress together in this learning journey!

💡 Final Thoughts for Today

This is the end of this part, and I must say we have a long journey ahead. We will continually strive to produce better content every day, steering clear of sensationalized content that promises unrealistic profits, and instead, focusing on the proper learning path of technical analysis.

⚠️ Please remember that these lessons represent our personal view of the market and should not be considered financial advice for investment.

Tradingview

Univers Of signals | HBARUSDT Better Condition Than the Market!👋 Welcome to the Univers Of signals channel!

Let's go together and examine one of the popular coins in the market that has experienced less correction recently and is in better condition than other altcoins!

📊 Weekly Timeframe

We go to the weekly time frame and see that hbar's condition is much better than other altcoins, and this is precisely due to the entry of momentum and Bitcoin's bullishness!

After we broke through the support at 0.04339 and engulfed the previous weekly candle, it was a bullish sign, and after the trigger at 0.06219 was activated, we broke this resistance and momentum entered this coin!

If you made your purchase in the spot section from this level, the situation is okay for now, but you can save profit or withdraw the principal capital. If you want to re-enter, you can make your purchase after the 0.33056 break.

📈 Daily Timeframe

In the daily time frame, we have higher levels and a better situation than the rest of the coins, and in a situation where most altcoins are forming lower bottoms, this has not even lost its main level.

After the 0.06470 and daily box break, we experienced a movement of about 500%, and if we draw a Fibonacci, we are currently at the 0.382 level, and this in itself increases the importance of this level! If the 0.37350 ceiling is broken, it shows us that we are going to experience a new movement!

This daily candle can be a good trigger to buy again, and the reason is that we are rising from a good support level and it is also a good Fibonacci level, but this trigger is risky and after the break of 0.26486 it will be a better trigger to welcome, and for a temporary exit, you can also temporarily exit with a break of 0.18653.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

univers Of Signals | TWT: Navigating Trust Wallet's Market Moves👋 Welcome to univers Of Signals !

In this analysis, I'll be reviewing the TWT coin, a part of the Trust Wallet project, which is currently ranked 126th on CoinMarketCap with a market cap of $358 million.

📅 Daily Timeframe

As you can see in the daily timeframe, we're observing a very large range box from 0.7832 to 1.5725, where the price is currently near the bottom of this box.

✅ The floor of this box is a significant support range from 0.7832 to 0.8321 and is acting as a demand zone for the price.

🔽 Currently, the price has reached the 0.8321 area, tested it once with a shadow, and received support from it. If this area breaks, we'll enter the support zone, and we'll need to see how the price reacts to this zone.

📊 The market volume is very low, and for now, it seems there isn't enough strength and momentum in the market to break this area, but if a selling volume enters the market and the RSI goes into oversell, the likelihood of breaking this area increases. In this case, the next support will be at 0.6215.

🛒 For buying this coin, I recommend waiting until it exits the range box it has created, as this would indicate upward momentum entering the market. Currently, there is no momentum in the market. Thus, the best trigger from my perspective is the breakout at 1.5725.

📈 However, for a long position or a risky spot purchase, you could enter upon the breakout of 1.0556. I mainly consider this trigger for futures, and for spot purchases, I would wait until the main resistance is broken.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, as you see, we had a box between 0.9395 to 1.0556, which has been cleanly broken from below, and you could open a short position with price consolidation below this area.

💥 Currently, the price has reached the next support at 0.8321 and has shown some reaction. The RSI is currently in oversell, and if it receives support from this area, it could return to the normal range.

📉 For short positions, the triggers at 0.8321 and 0.7832 are suitable. The 0.8321 trigger is riskier, and I suggest waiting until the 0.7832 support is lost before opening a more secure position.

🔼 For long positions, there's a very suitable ceiling at 1.0556, and breaking this area could lead to opening a long position.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

XAU/USD: Another Fall Ahead ? (READ THE CAPTION)By analyzing the 2-hour timeframe for gold, we see that the price remains range-bound with no clear directional trend. Currently, gold is trading around the $2900 level, and if it fails to break above $2913 again, we can expect a downward correction. Potential targets for this correction are $2870, $2861, and $2853. Keep an eye on price reactions at each of these key levels, as all three could present opportunities for buy positions!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

TradeCityPro | Bitcoin Daily Analysis #31Welcome to TradeCity Pro!

Let's move on to Bitcoin analysis and important crypto indicators. In this analysis, as usual, I want to review the triggers of the New York Futures Session for you.

1-hour time frame

In the 1-hour time frame, after the price reached 77598, the fall ended and we witnessed an upward correction to the 83281 area.

The 83281 area has become a very important resistance and the price is reacting well to it. A reverse head & shoulder pattern is visible on the chart that has not yet been activated, and with the failure of the 77598 area, we will confirm the activation of this pattern.

If 77598 is broken, the price can move at least to the 83281 area. The next resistances are also within reach of the price, and if strong momentum enters the market, the price can register higher targets.

The buying volume in the market is much less than the selling volume, and the sellers' power is still greater than the buyers'. However, if the 83281 area is broken, this volume can be more in favor of the buyers and the price can move up.

For a short position, if the price rejects the 83281 area or if the failure of this resistance is faked, you can enter a short position with the trigger 81466 to the target 77598.

I have no more talk about Bitcoin, let's move on to the analysis of the indicators so that we can also check the conditions of the altcoins.

BTC.D Analysis

Let's move on to the analysis of Bitcoin Dominance, Dominance has finally stabilized above the 61.61 area and reached the 62.19 area. If this area is broken, Dominance can start its new upward leg.

If Dominance rejects this important ceiling, Dominance's downward leg can continue to 61.61. Dominance's main support is currently 61.08.

Total2 Analysis

Let's move on to Total2 analysis, as you can see, this indicator is at a lower level and has not yet reached the ceiling in the 1.04 area and has recorded its new resistance in the 1.01 area.

The reason for this is Bitcoin's dominance, which has become bullish and more money has entered Bitcoin than altcoins. However, if Dominance breaks 1.01, you can enter a position if Dominance falls.

For short, the first trigger is 984 and the main trigger is 953.

USDT.D Analysis

Let's move on to the Tether Dominance analysis, as you can see, Dominance has broken the trend line it had and is now ready to fall. If it breaks 5.30, you can get confirmation of Tether's Dominance falling.

To confirm Dominance's bullishness, we can get confirmation if it breaks 5.49, which means the market can fall and if these triggers overlap with the Total2 trigger, you can find an altcoin and open a position.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

$CDRE: Cadre Holdings – Riding the Safety Wave?(1/9)

Good afternoon, everyone! 😊

NYSE:CDRE : Cadre Holdings – Riding the Safety Wave?

With CDRE at $30.20, is this stock a safe bet or a risky ride? Let's dive into the world of safety gear and see if Cadre's holdings hold up! 😎

(2/9) – PRICE PERFORMANCE

• Current Price: $30.20 as of March 12, 2025 😏

• Recent Moves: Down 11% from $34.02 a week ago 😬

• Sector Vibe: Safety equipment sector is growing, driven by stricter regulations and demand for safer workplaces. 📈

Short commentary: The stock's taken a hit, but the sector's looking good. Maybe it's just a temporary dip? 🤔

(3/9) – MARKET POSITION

• Market Cap: Approximately $1.23 billion 💰

• Operations: Manufacturing and distributing safety and survivability products for law enforcement, first responders, military, and now, the nuclear market. 🛡️

• Trend: Expanding into new markets with the acquisition of nuclear safety brands. 🚀

Short commentary: They're diversifying, which is usually a good sign. More markets mean more opportunities. 😉

(4/9) – KEY DEVELOPMENTS

• Acquisition of Carr's Engineering Limited's Engineering Division for nuclear safety solutions, announced on January 16, 2025. 📈

• Expected to close in the first half of 2025. ⌛

• Market Reaction: The stock has seen a recent dip, possibly reflecting integration concerns or broader market volatility. 😐

Short commentary: This should bring in new revenue streams and expand their international presence. Let's see how it plays out. 🌍

(5/9) – RISKS IN FOCUS

• Integration risks from the acquisition. ⚙️

• Supply chain disruptions. 🚚

• Regulatory changes in the nuclear sector. 📜

Short commentary: These are all things to keep an eye on, but every company has some risks. Stay vigilant! 🕵️

(6/9) – SWOT: STRENGTHS

• Strong reputation in safety equipment. 🏆

• Diverse product portfolio. 🌈

• Recent acquisition expanding into the nuclear market. 🌟

Short commentary: They're well-known and have a broad range of products, which is great. Keep up the good work! 👍

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Potential over-reliance on government contracts, integration challenges. ⚠️

• Opportunities: Growth in nuclear safety market, increasing global demand for safety products. 🌐

Short commentary: They need to manage their dependencies and make sure the acquisition goes smoothly, but there's a lot of potential for growth. Let's hope they nail it! 📈

(8/9) – CDRE at $30.20 – what's your call? 🗳️

• Bullish: Price could rise to $35+ soon, due to successful acquisition and sector growth. 🚀

• Neutral: Price remains steady, as the market digests the acquisition news. 😐

• Bearish: Price could drop to $25, due to integration risks and market volatility. 📉

Drop your pick below! 💬

(9/9) – FINAL TAKEAWAY

Cadre Holdings' $30.20 stance shows a robust portfolio and strategic expansion, but recent price dips and integration risks are concerns. Volatility’s our ally—dips are DCA treasure. Snag low, soar high!

This could be a bitter end for Ethereum or an opportunity !!!This could be a bitter end for Ethereum or an opportunity. If the triangle is broken from below, the price will drop to $1300.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Ready for CorrectionThe price cannot break this resistance and has been repeatedly rejected, indicating a corrective move to 2.880.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

WTI Crude Oil Analysis: Is the Downtrend Still in Play?Welcome back, guys! 👋 I'm Skeptic , and today we’re diving into a quick analysis of WTI Crude Oil (WTI) . Let’s break it down.

📉 4-Hour Time Frame Analysis

In the 4-hour time frame, WTI has shown a very strong corrective move, and despite trying to hold the support zone PRZ, it even failed to maintain it, suggesting a potential downtrend. Now, we have an opportunity to focus more on our short setups, but we’ll need to manage the risk as well.

🔮 Short Setup

For short positions, a break below the 4-hour support at 65.183 would be a good trigger to enter a short position. Place the stop loss just above the broken PRZ, around 67.024 , and keep an eye on price action as a sharp movement down could follow. If the support breaks, we’re likely to see a continuation towards the next support level, so the move could be pretty sharp, but make sure your stop loss is tight to manage risk effectively.

💡 Long Setup

For the long setup, we’ll wait for a potential fake breakout below the support and then look for a return above 67.024 . If we break above the resistance at 67.639 , we’ll look for a possible long continuation. However, since the current trend is bearish, we’ll reduce our risk and wait for confirmation from the 4-hour or daily time frames before entering.

Let me know your thoughts and ideas on WTI! 💬 Drop any questions in the comments, and I’ll be happy to discuss them. Let’s grow together, not alone! 🔥

FILUSDT - Buy now or regret later!FIL is literally one of the hidden gems in the market.

The probability of a strong rebound is increasing significantly in the coming days. The coin has reached its strongest support level, a key historical reversal point.

Investing in it now is a golden opportunity, with a target of $27.

The bottoms have already formed across many altcoins—now is the best time to buy

Best regards Ceciliones🎯

Bullish Pattern Forming & Key Resistance Test📊 $SOL/USDT Market Update – Bullish Pattern Forming & Key Resistance Test

📈 Solana ( CRYPTOCAP:SOL ) is currently forming a bullish pattern. A breakout above the black resistance line could signal further upside momentum.

🔄 If CRYPTOCAP:SOL successfully breaks this resistance:

First target: Blue line level (previous Lower High - LH).

📌 Failure to break the resistance may lead to a pullback before another breakout attempt.

Rounding Top Formation & Key Support📊 TVC:GOLD (XAU/USD) Market Update – Rounding Top Formation & Key Support Test

📉 Gold is currently forming a rounding top pattern, indicating potential weakness in momentum.

🔄 Current Scenario:

If the price returns to the green support zone, it could act as a strong support level.

Buyers may step in at this zone, leading to a potential bounce and renewed bullish momentum.

📌 Traders should watch for confirmation signals at the green zone to assess whether buyers regain control.

TradeCityPro | HBARUSDT Better Condition Than the Market!👋 Welcome to the TradeCityPro channel!

Let's go together and examine one of the popular coins in the market that has experienced less correction recently and is in better condition than other altcoins!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

We go to the weekly time frame and see that hbar's condition is much better than other altcoins, and this is precisely due to the entry of momentum and Bitcoin's bullishness!

After we broke through the support at 0.04339 and engulfed the previous weekly candle, it was a bullish sign, and after the trigger at 0.06219 was activated, we broke this resistance and momentum entered this coin!

If you made your purchase in the spot section from this level, the situation is okay for now, but you can save profit or withdraw the principal capital. If you want to re-enter, you can make your purchase after the 0.33056 break.

📈 Daily Timeframe

In the daily time frame, we have higher levels and a better situation than the rest of the coins, and in a situation where most altcoins are forming lower bottoms, this has not even lost its main level.

After the 0.06470 and daily box break, we experienced a movement of about 500%, and if we draw a Fibonacci, we are currently at the 0.382 level, and this in itself increases the importance of this level! If the 0.37350 ceiling is broken, it shows us that we are going to experience a new movement!

This daily candle can be a good trigger to buy again, and the reason is that we are rising from a good support level and it is also a good Fibonacci level, but this trigger is risky and after the break of 0.26486 it will be a better trigger to welcome, and for a temporary exit, you can also temporarily exit with a break of 0.18653.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

AUD/NZD Multi-Timeframe Breakdown: Trend Shift or Retracement?Welcome back, guys! 👋 I’m Skeptic , and today we’re diving into a multi-timeframe analysis of AUD/NZD. (As I mentioned this pair on our weekly watchlist on March 9th.) At the end, I’ll also share some solid long and short triggers that you definitely don’t want to miss—so let’s get into it!

📉 Daily Time Frame Analysis

In the daily time frame, we can clearly see a strong major uptrend that has been holding the price upward. However, recently, the upward trendline has broken, which could indicate the start of a retracement . This break hints at a potential shift or correction rather than a complete trend reversal, so we need to stay cautious.

🔍 4H Time Frame Analysis: Finding Triggers

Moving on to the 4-hour time frame, it’s clear that we’ve had a clean pullback to the previous upward trendline. As I pointed out in my weekly watchlist analysis, the main trigger for a short position was at 1.10115 , which has just been activated . If you took that trade with me, you’re in profit right now!

But don’t worry if you missed it—you still have a chance to catch the next move. Since the trendline is broken, we could see a sharp uptrend retracement movement if the price breaks our 4h support level.

Short Trigger: I’ll be waiting for a breakout below 1.10087 to look for another short opportunity.

Long Trigger: I’ll be watching for a higher high and higher low to confirm that the uptrend is still intact. Specifically, a breakout above 1.10544 would signal a potential long entry.

💡 Always remember:

trading in the direction of the main trend typically yields higher R/R and win rates. Don’t trade against the trend unless you have a very strong reason to do so.

I’d love to hear your thoughts on AUD/NZD —drop your opinions in the comments below! Also, if you have any questions about trading or strategy, just ask—I’ll make sure to reply. Let’s keep growing together, not alone! 💪

TradeCityPro | Bitcoin Daily Analysis #30👋 Welcome to TradeCityPro!

Let's dive into the analysis of Bitcoin and key crypto indices. As usual, today I will review the futures triggers for the New York session.

✨ Yesterday, our short trigger was activated, and we were able to open a good position. We also have a trigger today, so let's go through the analysis to check these triggers.

⏳ 1-Hour Timeframe

As I mentioned yesterday, if the break of the 83151 area was fake, you could have entered a position at the trigger of 821288, which indeed happened. This trigger was activated, and the price moved down to the area of 77598. Currently, the price has moved up again and has made a correction up to the 821288 area again.

💥 This trigger was for one-time use, and we opened a position with it yesterday, so I have removed it from the chart since we no longer need to use it and the price has not reacted to it anymore.

✅ Currently, I am waiting to see what new structure the price will form, from which area it will reject, and what structure it will create. For now, to consider a long position, we must first wait for this new structure to form. If this structure does not emerge, you can enter a long position if 83151 breaks again.

🔽 For short positions, the situation is quite clear: if the floor of 727598 breaks, you can enter a short position targeting 72753. An important note about the recent upward movement is that market volume is decreasing, indicating a weakness in the trend, and it seems that the power still lies with the sellers.

💫 The RSI has risen above the area of 50. If it goes back below 50, you can take that as a confirmation of momentum for a short position.

👑 BTC.D Analysis

Let's move on to the analysis of Bitcoin dominance. Finally, dominance has exited the small range box that was formed between the areas of 61.07 and 61.61, and it broke this box upwards as the market fell.

🎲 This situation caused the altcoins and indices like Total2 to fall more than Bitcoin itself. As you can see, dominance has approached the very important resistance area of 62.19. If dominance can stabilize above this area, the next resistance for dominance will be 62.66.

🧩 The trigger for Bitcoin dominance turning bearish is still the area of 61.61 for now.

📅 Total2 Analysis

As you can see, our trigger in the area of 1.01 was activated yesterday, and Total fell to $953 billion, finally falling below $1 trillion after a long time.

☘️ Currently, after the breakdown and the price reaching a lower support, we witnessed a reaction from the buyers that caused the price to rise slightly. Now it seems that the price is setting a lower high compared to its previous high. If this event occurs, with the break of the area of 953, we can open a short position.

⭐️ However, for long positions, I am currently waiting for the chart to form a new structure. If there is a sudden upward movement without significant structure formation, the only trigger for a long position remains the break of 1.01.

📅 USDT.D Analysis

Let's move on to the analysis of Tether dominance. As you can see, Tether dominance also experienced a breakout yesterday, breaking the area of 5.49 and moving upwards. The resistance that was above dominance was at 5.86, which dominance did not reach but came close before moving downwards again.

🧲 Currently, it seems that dominance has re-entered below the area of 5.49. If it can consolidate below this and break its ascending trendline, we can say that the increase in Tether dominance will finally halt. In this case, dominance could move lower, and the market might undergo a slight bullish correction.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | TWT: Navigating Trust Wallet's Market Moves👋 Welcome to TradeCityPro!

In this analysis, I'll be reviewing the TWT coin, a part of the Trust Wallet project, which is currently ranked 126th on CoinMarketCap with a market cap of $358 million.

📅 Daily Timeframe

As you can see in the daily timeframe, we're observing a very large range box from 0.7832 to 1.5725, where the price is currently near the bottom of this box.

✅ The floor of this box is a significant support range from 0.7832 to 0.8321 and is acting as a demand zone for the price.

🔽 Currently, the price has reached the 0.8321 area, tested it once with a shadow, and received support from it. If this area breaks, we'll enter the support zone, and we'll need to see how the price reacts to this zone.

📊 The market volume is very low, and for now, it seems there isn't enough strength and momentum in the market to break this area, but if a selling volume enters the market and the RSI goes into oversell, the likelihood of breaking this area increases. In this case, the next support will be at 0.6215.

🛒 For buying this coin, I recommend waiting until it exits the range box it has created, as this would indicate upward momentum entering the market. Currently, there is no momentum in the market. Thus, the best trigger from my perspective is the breakout at 1.5725.

📈 However, for a long position or a risky spot purchase, you could enter upon the breakout of 1.0556. I mainly consider this trigger for futures, and for spot purchases, I would wait until the main resistance is broken.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, as you see, we had a box between 0.9395 to 1.0556, which has been cleanly broken from below, and you could open a short position with price consolidation below this area.

💥 Currently, the price has reached the next support at 0.8321 and has shown some reaction. The RSI is currently in oversell, and if it receives support from this area, it could return to the normal range.

📉 For short positions, the triggers at 0.8321 and 0.7832 are suitable. The 0.8321 trigger is riskier, and I suggest waiting until the 0.7832 support is lost before opening a more secure position.

🔼 For long positions, there's a very suitable ceiling at 1.0556, and breaking this area could lead to opening a long position.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ADA Ready for PUMP or what ?The price has formed a Triangle on the daily time frame, and if it breaks out, it can drive the price up to around $1.5 .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Gold (XAU/USD) – Bearish Momentum Towards Key SupportGold (XAU/USD) Technical Analysis – 1H Chart 🏆📉

🔹 Overview:

The chart shows Gold (XAU/USD) in a downtrend after failing to break above resistance.

Key zones are marked: Resistance (~$2,920 - $2,960) and Support (~$2,840 - $2,860).

A potential bearish move is suggested towards the support area.

📌 Resistance Zone (~$2,920 - $2,960) 🚧

Price has struggled to break this level multiple times, leading to rejection.

Sellers are likely in control, pushing the price lower.

📌 Support Zone (~$2,840 - $2,860) 🛡️

This area has historically acted as a strong demand zone.

Possible price reaction here, with a bounce back up if buyers step in.

📉 Bearish Scenario:

A retest of minor resistance (~$2,900) before continuing downward.

If price reaches support, a reversal or further breakdown could occur.

📈 Bullish Recovery?

Only a strong breakout above $2,920 would shift momentum to bullish.

🔥 Conclusion:

Short-term bias: Bearish 📉

Key watch: Price action at support (~$2,840) for possible bounce 📊

BTC/USD Breakdown! Bearish Target: $78K🔍 BTC/USD 30-Minute Chart Analysis

📉 Market Structure:

The chart displays an ABCDE corrective pattern, likely a descending wedge or contracting triangle, which has now broken to the downside.

Price action shows a breakout below the wedge, leading to further bearish momentum.

The 200-period moving average (red line) is acting as resistance, reinforcing the downward trend.

📊 Current Price: ~$83,057

🔻 Bearish Target: $78,049 (marked as the potential support level)

🛑 Key Observations:

Rejection from wave E indicates a lack of bullish strength.

Lower highs and lower lows confirm a continuation of the bearish trend.

Potential retest of ~$85,000 before dropping further.

🚀 Trading Insights:

Bearish Bias: Short opportunities on pullbacks toward resistance.

Bullish Reversal? Look for price action near $78,049—if buyers step in, a potential bounce could occur.

⚠️ Watch out for:

Sudden Bitcoin volatility (news-driven moves).

A fake breakdown (if buyers reclaim above ~$85,000).

BTCUSDT - single supporting area, holds or not??#BTCUSDT.. so now market just near to his current supporting area that is 85150 around

Market holding that level in day chart as you can see day graph.

Now again that is our supporting area and below that we can expect short.

Keep close.

Good luck

Trade wisely

TradeCityPro | APTUSDT Market Drop on Trump News?👋 Welcome to the TradeCityPro channel!

Let's analyze and review one of the popular tier-2 coins together and take a look at this recent Trump news regarding the economic record

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

APT remains inside its large, volatile range, frequently bouncing between its highs and lows. However, this time, it has formed a lower high, which is not a positive sign.

Additionally, after breaking $7.78, sellers completely engulfed the weekly candle, and for the past five weeks, all candles have been red with high selling volume, confirming the downtrend.

There is no buy trigger at the moment, and I cannot recommend a buying opportunity until the market forms a new structure.

For selling, if APT drops below $4.97, it makes sense to exit and accept the loss instead of holding onto a losing position.

📈 Daily Timeframe

On the daily timeframe, APT failed to break the $14.61 resistance. Even worse, it couldn't even reach the previous high before getting rejected earlier, signaling weakness.

After breaking below $8.46, the market entered an MWC (Market Weakness Confirmation) downtrend.

Following the breakdown, a pullback retest occurred, and the daily candle engulfed the previous two days' candles, leading to further decline. Currently, APT is at $5.70, with RSI in the oversold zone, suggesting a possible short-term slowdown in selling pressure.

I personally feel that APT’s drop is sufficient for now, and we might enter a range here before a final move toward the $4.95 support. However, this does not mean it’s a buy signal. We need to wait for a new market structure before considering spot entries.

In the current situation, the market is really not very analytical and Bitcoin is likely to hit the $72,000-$74,000 level and then go for a break or bullishness, and you should pay attention to these market times! Don’t be FOMO!

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

USDJPYI don't usually trade using the RSI strategy, but for some reason, I decided to take a look at it. What I found was a very strong divergence on the 4-hour timeframe, which has been developing over 72 candles—a significant number. Based on this, I expect this candle to be the reversal candle signaling an upward move toward the targets mentioned above.

Trade safely

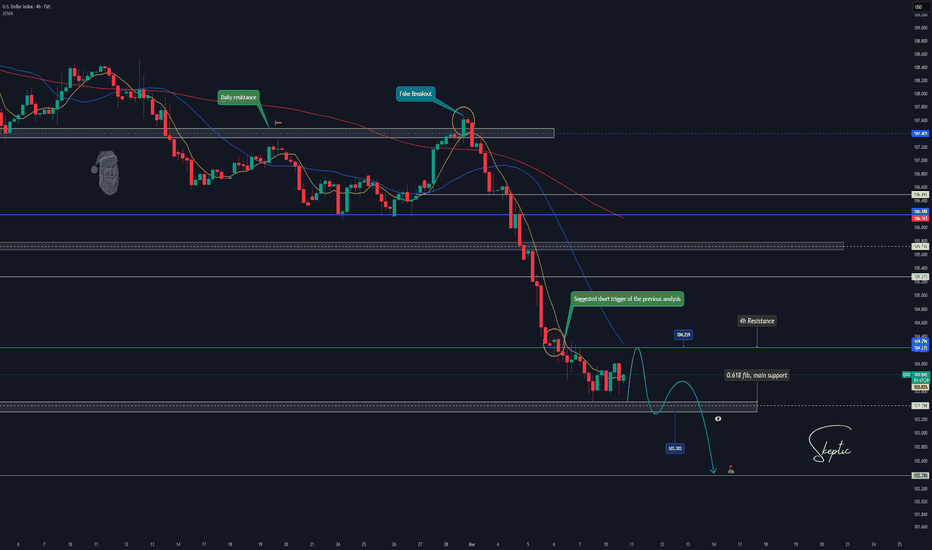

DXY Breakdown: Major Support in Play or More Downside Ahead?Welcome back, guys! 👋

I'm Skeptic , and let's kick off the week with a unique and exciting analysis of DXY.

🔍 Daily Time Frame Analysis

Starting with the daily time frame, DXY recently hit a significant peak at 109.655 , followed by a sharp decline, breaking below the critical support zone at 107.405 . This breakdown resulted in forming lower highs and lower lows, confirming a bearish structure. Afterward, DXY retraced sharply to the 0.618 Fibonacci level of its major uptrend, signaling a potential corrective phase.

Although the sentiment remains bearish for now, we must consider the possibility of a price reversal from this crucial support zone.

⏳ 4H Time Frame Analysis

Now, moving to the 4-hour time frame, as discussed in the previous analysis, we anticipated a breakdown of 104.235 , which indeed played out, hitting our target of 103.398 . Currently, the 104.235 level serves as a 4H resistance, while 103.303 acts as a daily support.

These two levels form our main triggers:

💚 Long Trigger: Above 104.259 (confirming a potential reversal)

🔴 Short Trigger: Below 103.303 (aligned with the short-term downtrend)

The short trigger has a higher win rate and risk-to-reward ratio since it aligns with the ongoing bearish trend.

💡 Final Thoughts

Thanks for sticking with me through this analysis! I hope your week ahead is profitable and insightful.

Remember, planning and executing trades with clarity is the key to long-term success.

Catch you on the next breakdown! 🚀