BTC/USD Breakdown! Bearish Target: $78K🔍 BTC/USD 30-Minute Chart Analysis

📉 Market Structure:

The chart displays an ABCDE corrective pattern, likely a descending wedge or contracting triangle, which has now broken to the downside.

Price action shows a breakout below the wedge, leading to further bearish momentum.

The 200-period moving average (red line) is acting as resistance, reinforcing the downward trend.

📊 Current Price: ~$83,057

🔻 Bearish Target: $78,049 (marked as the potential support level)

🛑 Key Observations:

Rejection from wave E indicates a lack of bullish strength.

Lower highs and lower lows confirm a continuation of the bearish trend.

Potential retest of ~$85,000 before dropping further.

🚀 Trading Insights:

Bearish Bias: Short opportunities on pullbacks toward resistance.

Bullish Reversal? Look for price action near $78,049—if buyers step in, a potential bounce could occur.

⚠️ Watch out for:

Sudden Bitcoin volatility (news-driven moves).

A fake breakdown (if buyers reclaim above ~$85,000).

Tradingview

BTCUSDT - single supporting area, holds or not??#BTCUSDT.. so now market just near to his current supporting area that is 85150 around

Market holding that level in day chart as you can see day graph.

Now again that is our supporting area and below that we can expect short.

Keep close.

Good luck

Trade wisely

TradeCityPro | APTUSDT Market Drop on Trump News?👋 Welcome to the TradeCityPro channel!

Let's analyze and review one of the popular tier-2 coins together and take a look at this recent Trump news regarding the economic record

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

APT remains inside its large, volatile range, frequently bouncing between its highs and lows. However, this time, it has formed a lower high, which is not a positive sign.

Additionally, after breaking $7.78, sellers completely engulfed the weekly candle, and for the past five weeks, all candles have been red with high selling volume, confirming the downtrend.

There is no buy trigger at the moment, and I cannot recommend a buying opportunity until the market forms a new structure.

For selling, if APT drops below $4.97, it makes sense to exit and accept the loss instead of holding onto a losing position.

📈 Daily Timeframe

On the daily timeframe, APT failed to break the $14.61 resistance. Even worse, it couldn't even reach the previous high before getting rejected earlier, signaling weakness.

After breaking below $8.46, the market entered an MWC (Market Weakness Confirmation) downtrend.

Following the breakdown, a pullback retest occurred, and the daily candle engulfed the previous two days' candles, leading to further decline. Currently, APT is at $5.70, with RSI in the oversold zone, suggesting a possible short-term slowdown in selling pressure.

I personally feel that APT’s drop is sufficient for now, and we might enter a range here before a final move toward the $4.95 support. However, this does not mean it’s a buy signal. We need to wait for a new market structure before considering spot entries.

In the current situation, the market is really not very analytical and Bitcoin is likely to hit the $72,000-$74,000 level and then go for a break or bullishness, and you should pay attention to these market times! Don’t be FOMO!

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

USDJPYI don't usually trade using the RSI strategy, but for some reason, I decided to take a look at it. What I found was a very strong divergence on the 4-hour timeframe, which has been developing over 72 candles—a significant number. Based on this, I expect this candle to be the reversal candle signaling an upward move toward the targets mentioned above.

Trade safely

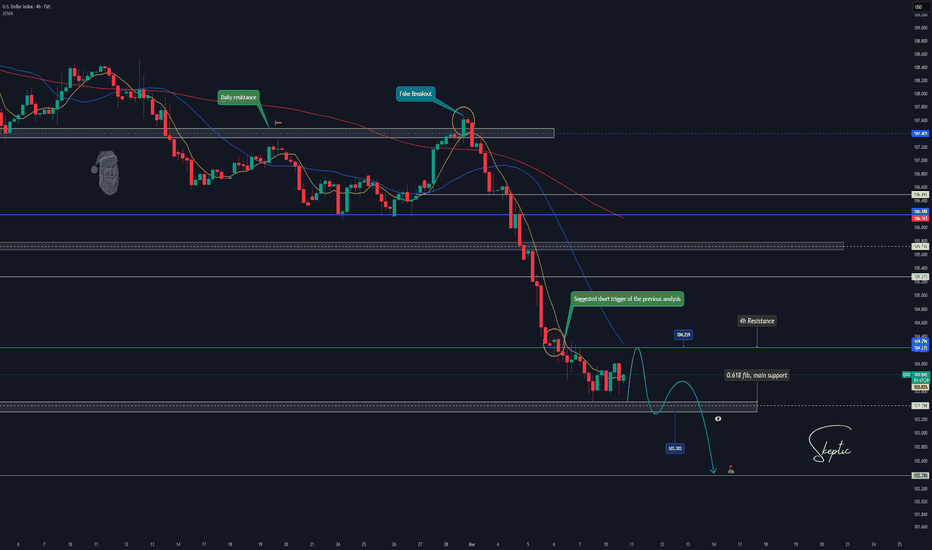

DXY Breakdown: Major Support in Play or More Downside Ahead?Welcome back, guys! 👋

I'm Skeptic , and let's kick off the week with a unique and exciting analysis of DXY.

🔍 Daily Time Frame Analysis

Starting with the daily time frame, DXY recently hit a significant peak at 109.655 , followed by a sharp decline, breaking below the critical support zone at 107.405 . This breakdown resulted in forming lower highs and lower lows, confirming a bearish structure. Afterward, DXY retraced sharply to the 0.618 Fibonacci level of its major uptrend, signaling a potential corrective phase.

Although the sentiment remains bearish for now, we must consider the possibility of a price reversal from this crucial support zone.

⏳ 4H Time Frame Analysis

Now, moving to the 4-hour time frame, as discussed in the previous analysis, we anticipated a breakdown of 104.235 , which indeed played out, hitting our target of 103.398 . Currently, the 104.235 level serves as a 4H resistance, while 103.303 acts as a daily support.

These two levels form our main triggers:

💚 Long Trigger: Above 104.259 (confirming a potential reversal)

🔴 Short Trigger: Below 103.303 (aligned with the short-term downtrend)

The short trigger has a higher win rate and risk-to-reward ratio since it aligns with the ongoing bearish trend.

💡 Final Thoughts

Thanks for sticking with me through this analysis! I hope your week ahead is profitable and insightful.

Remember, planning and executing trades with clarity is the key to long-term success.

Catch you on the next breakdown! 🚀

TradeCityPro | Bitcoin Daily Analysis #29👋 Welcome to TradeCityPro!

Let's dive into the Bitcoin analysis and the key crypto indicators. In this analysis, as usual on Mondays, I will also review last week's weekly candle for you and examine the long-term scenarios.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, the candle that closed yesterday is a completely bearish candle that registered without a shadow and a large body, and the price has again reached the 0.382 Fibonacci area.

✨ Since this candle was within the previous candle and did not show more volatility, we can say that the market will range in the upcoming candles because the volatility range of the chart has decreased. Therefore, the likelihood that the next candle will be a range is very high.

💫 However, if the market wants to fluctuate, the 0.5 and 0.618 Fibonacci areas, which overlap with the 75000 and 71000 areas, can act as supports in case of a decline. For a market upturn, the significant areas are 90000 and 104000.

📊 The market volume has also been bearish in the last two candles and in favor of the sellers, but an important point is in the RSI. The area at 44.20 is a very important support that has started the next upward leg each time the RSI has reached this area during this uptrend.

✅ Breaking this area in the RSI would mean the loss of market upward momentum and we would receive the first sign of a trend change.

📅 Daily Timeframe

In the daily timeframe, after breaking 92354 and the price pulling back to this area, the price has moved downward and has again reached the support range between the 0.5 and 0.618 Fibonacci.

🔽 If this range is lost, the price will move towards further support areas like 72753.

🎲 Market volume has also increased last week, which is because the price has finally exited the box between 92354 and 106283, and more volume has entered the market.

☘️ If the price is supported by the Fibonacci range and moves upwards, the main trigger for confirming a trend change will be 92354.

⭐️ The current main resistance area in Bitcoin is at 106283, and breaking this area could potentially lead to further movements and the recording of new ATHs.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, as you can see, after breaking the trend line, the trigger was activated, and the price moved downward yesterday.

📉 I told you yesterday that the price could drop to the 83151 area. As you can see, this has happened, and the price has even fallen more than 83151 and now seems to be pulling back to this area.

Let's move to the one-hour timeframe to check today's triggers.

⏳ 1-Hour Timeframe

In the one-hour timeframe, as you see, after breaking 85552, the price made a downward move and dropped to around the 80000 area.

🔽 Currently, the price has moved towards the 83151 area and, after a fake break, has returned below this area.

🧩 If the price reacts to the 83550 area again, I will move the 83151 line, but if this break is a fake, a downward momentum could enter the market, and in this case, with the break of 81288, we can open a short position.

👀 The current main support that the price has is at 78940, and breaking this area would also register another corrective leg.

👑 BTC.D Analysis

Let's move to the analysis of BTC.D. As you see, yesterday dominance faked above its range box and after breaking 61.61 moved downward again, and now it can move downward with more momentum.

💥 The main trigger for the dominance to turn bearish is at 61.08; the next support in this case will be 60.40. For the dominance to turn bullish, our trigger remains the break of 61.61.

📅 Total2 Analysis

Let's move to the analysis of Total2. As you observe, after the support at 1.07 was broken yesterday, Total2 made another downward leg and reached its main support at 1.01. As you see, Total2 is at a lower level than Bitcoin because yesterday, as the market fell, Bitcoin dominance increased, causing altcoins to drop more than Bitcoin.

🧲 The trigger for opening a short position today is the break of 1.01, and for now, we have no trigger for a long position and must wait until the price creates a suitable structure for a long.

📅 USDT.D Analysis

Moving on to the analysis of Tether dominance, as you see, after breaking 5.14, we witnessed an upward leg that continued up to the ceiling of 5.50, and currently, a box has formed between 5.30 and 5.50.

🔑 If the 5.50 area is broken, we will see an upside expansion, and dominance might move towards higher targets. However, if dominance again falls below 5.30, it will move

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | NOT: Tracing the Decline of a Telegram Titan👋 Welcome to TradeCity Pro!

In this analysis, I will review NOT, one of the Tap-to-Earn projects on Telegram, currently ranked 171 on CoinMarketCap with a market cap of $213 million.

📅 Daily Timeframe

In the daily timeframe, after this coin was listed in May last year, it initially had a strong bullish movement starting from 0.004733, reaching 0.022602, providing significant profits to its early investors.

🎲 However, after this rally, a downtrend started, and in the first bearish leg, the price dropped to 0.010029. In the next leg, the decline continued to 0.005699, where the price consolidated for a long time within a range box between 0.005699 and 0.010029.

✅ With the break of the 0.005699 support, the next bearish leg started. Since there were no further historical supports on the chart, I used the Fibonacci Expansion tool to determine potential support zones. As shown, the key support levels identified were 0.002516 and 0.003382, where the price formed another range box and consolidated for some time.

⚡️ After the break of the 0.002516 low, the price initiated another bearish leg, and the next potential support zones where the price may react are 0.001728 and 0.001071.

🔽 If you already have a short position on this coin, you can wait to see which level the price reacts to before taking profits.

🛒 For those considering buying this coin, I want to make it clear that I personally do not buy this coin in the spot market, and I also do not trade it in futures with my main capital. The reason is that this project lacks strong fundamentals—it was hyped within Telegram, which temporarily attracted liquidity. However, as you can see, this liquidity exited the market, leading to its current decline.

🔼 Nevertheless, if you still want to buy this coin, the first condition is to wait for a trend reversal.For now, the trend reversal confirmation level is the breakout of 0.003382. However, if the price forms higher highs and higher lows and we get Dow Theory confirmation, then a buy entry can be considered.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Bitcoin (BTC/USD) Bearish Breakdown Potential – Key Support Leve:

🔍 Technical Analysis:

Resistance Zones (Purple Rectangles at the Top)

The price recently hit a resistance area around $92,000.

It also tested an ascending trendline (red line) and failed to break higher.

Support Zones (Purple Rectangles at the Bottom)

There are two significant support areas:

First zone around $87,500 - $88,000.

Second zone around $82,000 - $83,000.

Bearish Expectation (Black Arrow)

The price is projected to break down from the current level.

A potential lower high formation suggests further decline.

Target areas: $88,000 first, then possibly $82,000.

🔥 Conclusion

Bearish bias if the price fails to reclaim the resistance.

A breakdown below $88,000 could accelerate the drop.

Watch for rejection signals at resistance zones before confirming short trades.

BTCUSDT- at his current supporting area? What's next??#BTCUSDT.. market perfectly move as per our last idea and now market just reached at his current supporting area that is around 82120

Keep close that area because if market clear that level then it will leads you towards downside next supporting levels.

Good luck

Trade wisely

Weekly Watchlist & Market Outlook (#1)Welcome back, guys! I’m Skeptic , and today, I’m breaking down my weekly watchlist with key market setups. Having a structured plan before the trading week starts helps you stay mentally prepared, avoid impulsive trades, and stick to your strategy. So, let’s dive in!

1. XAUUSD (Gold) 🟡

Daily TF:

Gold has maintained a strong major uptrend and recently completed a price correction to 2842.15 (36% Fib) before resuming its upward movement. This signals a potential continuation of the bullish trend.

Trigger (Daily): Break above 2954.24 🔼

4H TF:

Price is currently in a range between 2896 (support) and 2927 (resistance).

Long trigger:Breakout above 2927

Short trigger: Below 2896 (although trading in the trend’s direction is recommended for better R/R).

2. EURJPY 💶

Daily TF: The pair is ranging between 155.551 (support) and 161.166 (resistance).

4H TF:

Long trigger: Breakout above 161.166 📈 (RSI entering overbought territory could add confluence).

Short trigger: Break below 159.291 targeting the range’s bottom.

3. GBPAU D

Daily TF: The key resistance at 2.02396 has been broken, signaling a new uptrend.

4H TF:

Long trigger: Breakout above 2.05139 🔼 for trend continuation.

Short trigger: If 2.02396 fails as support (fake breakout), look for lower TF confirmation.

4. GBPNZD

Daily TF: Similar to GBPAUD, 2.23992 resistance has been broken, and price has pulled back.

4H TF:

Long trigger: Breakout above 2.26565 📈 for continuation.

Short trigger: If 2.23992 fails (fake breakout scenario).

5. AUDNZD

Daily TF:

A strong uptrend was recently broken, potentially signaling a price correction.

4H TF:

Short trigger: Break below 1.10115 🔻 (sign of further downside).

Long trigger: If price reclaims the broken trendline, indicating a fake breakdown.

Final Thoughts 💡

Thanks for following this week’s watchlist! If you have specific pairs or assets you’d like me to analyze, drop them in the comments.

Growing alone may be fast, but in the long run, teamwork wins. Let’s grow together. ❤️

TradeCityPro | Deep Search: In-Depth Of Uniswap👋 Welcome to TradeCity Pro

Today, we have a Deep Research on the Uniswap project. In this analysis, I will fully review this project. First, let's go over the project's details, and then I'll analyze UNI technically.

🔍 What is Uniswap?

Uniswap is a decentralized exchange (DEX) operating on the Ethereum blockchain that allows users to swap ERC-20 tokens without relying on traditional order books. Instead, it uses an Automated Market Maker (AMM) model, where liquidity providers add funds to pools and earn trading fees.

Uniswap was founded by Hayden Adams and launched in 2018. Since then, it has gone through multiple upgrades, with Uniswap V3 being the most recent version, offering improved capital efficiency.

🗝 Key Features:

Decentralized & Permissionless: No central authority controls trading.

Liquidity Pools: Users provide liquidity and earn a share of trading fees.

AMM Model: Uses the x*y = k formula to maintain price balance.

Non-Custodial: Users retain control over their assets.

No Listing Fees: Anyone can list tokens, unlike centralized exchanges.

🔍 UNI Token Overview

UNI is the governance token of Uniswap, allowing holders to vote on protocol upgrades and treasury decisions.

🔹Tokenomics

Total Supply: 1 billion UNI

Inflation Rate: After September 2024, a 2% perpetual annual inflation will be introduced.

Circulating Supply: UNI is released gradually over 4 years.

Current Circulating Supply: About 550M UNI

🔹Token Allocation

Governance: 45% - 450M UNI

Team: 21.3% -212.66M UNI

Investors: 18%- 180.44M UNI

Community Token Distribution:15%- 150M UNI

Advisors: 0.69%- 6.9M UNI

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

🔹Uniswap’s Evolution: V1, V2, V3

Uniswap V3 Innovations

-Concentrated Liquidity: LPs can set price ranges for providing liquidity.

-Multiple Fee Tiers: Traders can select different fee levels (0.05%, 0.3%, 1%).

-Capital Efficiency: More precise liquidity allocation for better returns.

—

🔒Token Unlock & Vesting Schedule

Current Unlock Progress

- Unlocked: 55% (549.94M UNI)

- Untracked: 45% (450M UNI)

- Locked: 0% (All tokens are being tracked or unlocked)

—

🔹Vesting Schedule

Group - Vesting Duration - Unlock

Team : 47 months (ended Aug 2024) -2.08% monthly

Investors: 47 months (ended Aug 2024)- 2.08% monthly

Community Distribution:Fully unlocked- 100% at TGE

Advisors: 47 months- 2.08% monthly

⚠️Important: The untracked 450M UNI tokens can be unlocked at any time, making them a potential source of market volatility.

—

Uniswap Governance & DAO

The Uniswap DAO allows token holders to participate in protocol decisions.

Governance Process:

1) Proposal Submission – Requires 25,000 UNI votes to enter deliberation.

2) Consensus Check – Needs 50,000 UNI votes to proceed.

3) Final Governance Vote – 40M yes-votes required for approval.

Uniswap DAO Treasury

$1.6 Billion worth of assets.

Previously largest DAO, now second (behind BitDAO).

—

❗️Security & Risks

🔹Security Measures

1) Smart Contracts Audited – Regular security reviews.

2) Decentralized Governance – Protocol updates are voted on by UNI holders.

3) Non-Custodial – Users always control their own funds.

🔹Risks

1)Ethereum Gas Fees – High network congestion leads to expensive swaps.

2) Impermanent Loss – LPs may lose value if token prices shift.

3) Governance Risks – Power concentrated among whales.

4) Smart Contract Exploits – DeFi platforms remain high-risk targets.

🖼NFT Expansion – Uniswap Acquires Genie

Uniswap acquired Genie, an NFT marketplace aggregator, to integrate NFT trading into its ecosystem.

🔹Genie Features:

-Aggregates NFTs from multiple marketplaces.

-Batch NFT purchases in one transaction (reducing gas fees).

-Plans for USDC airdrops to early Genie users.

Uniswap had previously launched NFT-backed Unisocks (2019), linking real-world assets to NFTs.

—

👛Best UNI Wallets

MetaMask

Trust Wallet

Ledger

Coinbase Wallet

SafePal

Solflare

OKX Wallet

—

💲Uniswap Team & Key Investors

Hayden Adams: Founder & CEO

Mary-Catherine Lader: COO

Marvin Ammori: CLO

💵Major Investors

Coinbase Ventures

Defiance Capital

Paradigm

ParaFi Capital

Delphi Digital

💰Total Funding Raised: $188.80M

🎯Uniswap's 2025 Roadmap and UNI Token Developments

In early 2025, Uniswap introduced Uniswap v4, marking a pivotal evolution in its protocol. This version emphasizes developer flexibility through the integration of "hooks," modular plugins that allow for tailored functionalities such as dynamic fees and automated liquidity management. These enhancements position Uniswap v4 as a versatile platform for DeFi developers, fostering innovation and adaptability within the ecosystem.

Unichain: Uniswap's Layer-2 Scaling Solution

To address scalability and transaction efficiency, Uniswap launched Unichain, its proprietary Layer-2 solution, on January 6, 2025. Built on the OP Stack, Unichain aims to deliver faster transactions and reduced fees, enhancing the overall user experience. The mainnet launch follows a successful testnet phase that processed over 50 million test transactions, underscoring its readiness for broader adoption.

—

🔹Several reputable platforms for creating liquidity pools

Uniswap

Pancakeswap

Raydium

Shibaswap

Biswap

MDEX

Balancer

Thena

Quickswap

Defiswap

Honeyswap

Warden

—

🔹Certik: 94.28

📈On-Chain Analysis of UNI

Analyzing Uniswap’s on-chain data, we observe key trends in profit and loss positioning, whale activity, and network engagement:

Around the $7.40 price level, approximately 39.55 million UNI tokens are in a loss position, indicating a potential resistance zone. Meanwhile, support levels remain weak due to a lower volume of profitable tokens.

Large transactions show slight spikes during price declines, suggesting a lack of strong buying interest from major investors.

Whales hold 51% of the total supply, making their trading activity crucial. Currently, addresses with holdings between 100 million to 1 billion UNI and 10 million to 100 million UNI are engaging in selling, adding downward pressure on price.

Network activity, including active and new addresses, is on a declining trend, signaling reduced user engagement and transaction volume.

Based on on-chain metrics, there is no significant buying pressure or demand at the moment, raising concerns over short-term price recovery.

📊Uniswap TVL Analysis

Since early December, Uniswap's Total Value Locked (TVL) has shown a slight increase, rising from 1.72 million ETH to 1.94 million ETH. However, this growth remains considerably lower compared to the levels observed in 2021, reflecting a slower pace of liquidity accumulation.

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

📅 Weekly Timeframe

In the weekly timeframe, we observe a long-term range-bound trend with a slight upward slope. Currently, the price is experiencing a downward move, with the primary support at 5.841.

💫 If this level breaks, the price may continue declining, and the next key support is at 4.025. On the other hand, if RSI does not drop below 38.74 and the price holds above 5.841, we can have more confidence in a potential price increase.

🎲 In this scenario, the key resistance levels are 11.638 and 18.794. The main trigger for buying is the breakout of 18.794, and the major sharp price movement will occur after breaking the ATH resistance at 42.92.

🔽 The critical support level that should not be lost is 4.025, as breaking below this level could result in a sharp bearish movement, and in that case, we will use Fibonacci tools to determine the bearish targets.

📅 Daily Timeframe

Now, let’s move to the daily timeframe for a more detailed view.

🔍 As seen in this timeframe, after price consolidation below 12.559, the second corrective wave has begun, and the price has currently fully retraced the previous bullish wave, reaching 6.670.

📉 If this level breaks, the next key supports are 5.556 and 4.025, with 4.025 overlapping with the 1.5 Fibonacci extension.

⚡️ If the price finds support at the current level, an appropriate trigger for a long position would be the breakout of 43.54 in RSI, which can serve as a momentum confirmation. Once RSI breaks this level, we can look at lower timeframes to define a precise entry trigger.

🔽 On the other hand, if RSI enters the Oversold zone, the likelihood of breaking 6.670 or even 5.556 increases.

🛒 For a spot buy, the current valid trigger is a breakout of the $10 level, which is the last local high in this timeframe. The exact number for this breakout level will be determined based on price action and its reaction when it approaches the area.

💥 If the price experiences further decline and establishes new highs and lows, the spot buy entry should be based on the breakout of the newly formed high in the downtrend.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | Bitcoin Daily Analysis #28👋 Welcome to TradeCityPro!

Let's dive into Bitcoin analysis and key crypto indices. As usual, I’ll review the futures session triggers for New York.

✨ Market conditions haven’t changed at all compared to yesterday, and Bitcoin has a ranging box that might break today.

⏳ 1-Hour Timeframe

As you can see, in the 1-hour timeframe, after breaking the trendline, the 85552 trigger is crucial. If this level is broken, it confirms the trendline break, which means the price could move toward lower support levels.

✅ Currently, the price has broken this area, and the RSI trigger has also been activated. If you opened a position with this break, I recommend waiting to see from which area the price gets rejected.

🔽 For a short position today, there isn’t really any specific trigger, so if you don’t have a position, you should observe for now. However, if the 85552 break turns out to be fake, bullish momentum could enter the market. In that case, you can enter a position with a break of 86949.

⚡️ I don’t have any other moves for Bitcoin because the short trigger is already activated, and today is Sunday, so there’s no need to focus too much on altcoins. Let’s move on to dominance analysis to assess altcoins' conditions.

👑 BTC.D Analysis

Looking at Bitcoin dominance, you can see that it is still ranging and hasn’t started any particular trend yet.

🧲 If 61.61 breaks, it confirms bullish dominance, while a break of 61.08 would confirm bearish dominance. The main range is between 60.40 and 62.19.

📅 Total2 Analysis

Checking Total2, just like Bitcoin, this index has also activated its entry trigger and is moving downward.

🎲 Currently, after breaking the 1.07 area, the next support level is at 1.01, and the probability of reaching this level is high. If this downward move turns out to be fake, the 1.09 trigger would be suitable for a long position.

📅 USDT.D Analysis

Looking at Tether dominance, you can see that after yesterday’s pullback to 5.08, the 5.14 trigger has been activated, and dominance is moving upward.

💫 The issue I mentioned yesterday was that there was no momentum, but now bullish momentum is visible. The target it can move towards is the 5.30 area.

📊 If the 5.14 break turns out to be fake, the 5.08 trigger would be suitable for confirming the fake break.

🧩 Overall, there aren’t any significant triggers in the charts today. If you didn’t open a position during the London session and want to have one, you should look for altcoins that haven’t activated their triggers yet.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BITCOIN Outlook after the Dip. What to expect NOW?Now that Bitcoin is returning to the cup-and-handle support, one can expect a strong pump up to 130k . it might happen.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Goldman Sachs - Too Cheap to Ignore?NYSE:GS and the general financial services sector as a whole has faced extreme trauma over this past month. However, one that particularly stands out is the "bad guy" of the industry who has taken the equivalent to a roundhouse kick to the face, and the chart shows it. But does this mean that someone looking for a dip shouldn't pick up strong equity on a discount? I say no, lets be greedy while other are fearful just like that one guy said. Warren something... I don't really remember his name.

Let's examine the numbers before we do the finance equivalent of astrology. This means that value investing and it's rather elementary techniques are going to give us some sort of indicator of a buy or a sell. Here's what you need to know.

1. Sachs has an attractive dividend yield of 2.14% ($11.50/share) and a gleaming dividend payout ratio (DPR) of 21.50%.

2. It is far from its high annual EPS sitting at 41.21 sliding from its high last December at 60.35.

3. It's price to earnings ratio (PE) is lounging nicely at 14.00 meaning we are at a generally cheap share price. This metric is what we're looking for.

4. Unfortunately, it has a rather higher price to book ratio (PB) at 1.64 which somewhat contradicts the PE ratio examined in #3.

5. Other metrics to keep in mind is an EV/EBITDA at 53.90 and a PEG at 16.23 which are both considered undesirable to investors.

So as far as statistics are concerned, Goldman is sending some mixed signals making a decision difficult at the moment. This means we're going to have to examine the general sector sentiment and general outlook.

Firstly, I'd like to point out Goldman's enterprise value. Sachs' EV is currently reported at 855.93 billion, 673 billion (78.63%) being debt (long term or short). This means NYSE:GS is a debt heavy company and we all know how debt works (the entity taking on the debt owes principal + interest). Well, this means that NYSE:GS is heavily going to be influenced by interest rates even considering their strong revenue. So, if we plan on interest rates being lowered long term (which I'm sure we all do), Goldman will be able to borrow from the Fed at a cheaper interest price while simultaneously owing account holders and bond holders less in interest (or APY yield for that matter). However, in the event that inflation runs wild and the Fed raises rates, NYSE:GS will face some turmoil along with the other commercial investment banks.

Great, so now for the fun part. Let's see what the charts have to say about this and what it could be implying.

Here is the 4H chart looking back into last October.

As you can see, Goldman posted a sweet rally followed by our current pullback. However, we are being flashed with various bullish technical patterns and a strong explanation for the drop (even considering the tariffs threats and indices pullback). In summary, we are examining a stock in gradual freefall towards what appears to be several safety nets.

On a psychological level, I find that most investors in the business of "smart money" wont let Goldman drop too low before they put their boot down. I also imagine this will happen pretty soon, but we need to hold the $540 price level.

As far as the MACD is concerned, we are experiencing weakness from the buyers are the bears are clearly on offense.

And lastly, the GS implied volatility shows that options traders aren't pricing in anything particularly unusual, and the most usual movement for the market is to climb higher so that's good news.

So, what's the conclusion. In my humble opinion, I believe that Goldman Sachs' stock is trading too low to not buy. Financially, the company is not showing anything particularly concerning and may just need to show some strength before the mass cash chases this play. As of right now, I am long on NYSE:GS considering the financial statistics, general industry sentiment, and technical analysis which was used as an assistance tool. This trade could be last anywhere from 1 day to 1 year, but I am prepared to hold for much longer.

TradeCityPro | FILUSDT Continuing the Analysis of U.S. Coins👋 Welcome to TradeCityPro Channel!

Let’s analyze another coin with a U.S. base, which has the potential to be listed in ETFs in the future, as the U.S. currently has the most influence on the market!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

We are still within the weekly box, and the coin’s situation is not very favorable, as it is currently fluctuating around its most important support level.

After failing to reach the top of the weekly box and facing an early rejection, the market has experienced a decline in recent price corrections. Currently, the price is fluctuating around 3.139, which is the most crucial support level at the moment.

From a price perspective, this is a good buying zone, but since the market is highly bearish, I personally wouldn't buy without confirmation. I'd prefer to let the price range a bit and form a structure, or wait for a strong green candle. Otherwise, my buy trigger would be a breakout above 9.899.

📈 Daily Timeframe

The main trend is still bearish, meaning we continue forming lower highs and lower lows. Currently, the price is ranging between 2.995 and 3.753.

After a rejection from 8.051, the price formed a support level at 4.836. However, after breaking this support and retesting it (which has now turned into resistance), the price engulfed the previous three candles, leading to a drop to 2.995.

If the price breaks above 3.573, the Fibonacci levels that we have drawn will act as strong resistance zones for further upward movement. The most important of these levels is 4.836, which previously caused a significant rejection.

For buying, the more the price ranges within the 2.995 - 3.573 box, the stronger the 3.573 breakout trigger will be. For selling, I recommend exiting below 2.995. If the price moves back above 3.573, you can reinvest with the same USDT amount, but in a smaller quantity of FIL, to manage your risk.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends!

TradeCityPro | Bitcoin Daily Analysis #27👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and the key crypto indices. Today, as usual, I want to review the important futures triggers for the New York session.

📰 Yesterday, Trump and Powell had speeches, but contrary to expectations, they didn't make any significant statements. As you can see, their remarks had little to no impact on the charts.

⏳ 1-Hour Timeframe

On the 1-hour timeframe, as observed, Bitcoin hasn’t reacted to yesterday’s events, and price action has been normal, with no unusual candles. Therefore, we will ignore the news and focus on our regular trading triggers.

✅ Currently, Bitcoin has broken the trendline formed yesterday and is near its trigger level at 85,552. Market volume is extremely low, which indicates that a big move is approaching. If this level breaks, a position can be opened.

📊 However, keep in mind that one reason for the low volume is that today is Saturday, a market holiday, meaning the price might continue ranging, and volume could drop even further.

📉 Regardless, the break of 85,552 is a crucial trigger, and if this level fails, Bitcoin could drop to lower supports like 83,151 and 78,940. Therefore, I will open a short position if this trigger is activated. The break of 37.93 on RSI will confirm this position.

🔼 For a long position, a major resistance has formed at 86,849, and if this level breaks, the trendline breakdown will be invalidated, and the price could push higher.

👑 BTC.D Analysis

Moving on to Bitcoin dominance, as seen on the chart, nothing has changed—BTC.D is still ranging.

⚡️ If BTC.D breaks below 61.08, it could drop to 60.40.If BTC.D breaks above 61.61, more capital will flow into Bitcoin.

🎲 Overall, BTC dominance has been ranging for a long time, making it hard to analyze. As a result, there aren't many scenarios to discuss.

📅 Total2 Analysis

Now, let’s analyze Total2 and find suitable triggers for this index.

⚡️ The trigger for this index has not yet been activated.For a short position, enter if 1.07 is broken.For a long position, the closest trigger is at 1.13.

📅 USDT.D Analysis

Moving on to Tether dominance, this index has finally confirmed a breakout above 5.08 and even pulled back to retest this level.

💥 However, as seen from the candles above this area, there is no strong momentum in either direction. The price has no clear upward or downward acceleration.

🌿 A strong bullish confirmation for USDT.D would be a powerful green candle closing above this zone.

🔽 A bearish confirmation would be a drop back below 5.08, which would serve as the first sign of weakness in Tether dominance.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | LDO: Comprehensive Market Analysis and Prediction👋 Welcome to TradeCity Pro!

In this analysis, I want to review LDO for you. It is one of the key DeFi platforms, and its token currently holds a market cap of $945 million, ranking 72nd on CoinMarketCap.

📅 Weekly Timeframe

On the weekly timeframe, we can see a range box between the $0.957 and $3.389 levels, where the price has been fluctuating for almost two years.

🔽 If you already hold this coin, I recommend activating your stop-loss in case the $0.957 level is broken and waiting for bullish momentum to re-enter the market before buying again.

📈 If the price holds above the $0.957 support, it could rally back toward the top of the range at $3.389. The key trigger levels between the current price and the top of the box are $1.447 and $2.488.

🚀 The main buying trigger is at $3.389, as breaking this level could lead to significant capital inflows, potentially initiating a long-term bullish trend.

📅 Daily Timeframe

On the daily timeframe, a range box between $1.447 and $2.387 had formed, which was broken to the downside, leading to a bearish leg. The main support level is $0.957, and if it fails to hold, the price could enter a new bearish cycle.

🛒 For spot buying, there isn’t a clear trigger yet, so we need to wait for a new structure to form. However, if the price rallies sharply, you could consider entering on a break above $1.489.

💫 As seen on the chart, the red candle volume is significantly higher than the green candles, indicating strong seller dominance. Additionally, the RSI is near the 30 level, and if it breaks below this zone, the bearish scenario becomes more likely.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | Bitcoin Daily Analysis #26👋 Welcome to TradeCity Pro!

Let's delve into Bitcoin analysis. Today is a pivotal day for the market with significant news and meetings that could greatly impact the market's future direction.

✨ Today, instead of dominance analysis, I want to explore the potential outcomes of today's sessions.

✅ The first session tonight is the Federal Reserve meeting where Jerome Powell will speak and announce the U.S. central bank's policies.

📈 In this session, if Powell announces a rate cut, we will definitely witness a market pump. This scenario seems plausible as U.S. inflation is currently under control, and there's no reason for an interest rate hike.

📊 If the interest rates are announced to remain steady and Powell indicates that no cuts are planned for a long duration, the market will likely fall. If the rates are raised, it will induce panic in the market, leading to significant drops.

⚡️ The next session is Trump's speech about the Crypto Reserve. Officially, it was decided yesterday that the U.S. will have a Crypto Reserve, but it will not enter the market as a buyer for now. Instead, it will introduce blocked funds, such as those from Silk Road, into this reserve.

🧲 Today's session where Trump speaks is crucial as it's the first time a U.S. president will hold a session specifically about crypto, making every statement he makes significant.

🔼 If he speaks positively about crypto, we will definitely witness a market pump, especially among American altcoins. Considering Trump himself owns a significant amount of crypto, it's highly likely he'll speak positively.

💫 On the other hand, there's no reason for Trump to speak negatively about crypto as it would undermine the enactment of the Crypto Reserve, which is very important to him.

💥 However, given the significant differences between Trump and Powell regarding crypto, these differing views could lead to unusual market volatility.

☘️ For instance, Powell might keep the interest rates steady or even increase them, which would cause the market to drop. On the other hand, to assert his influence, Trump might speak very positively about crypto, causing the prices to pump.

🔍 These manipulations in the short term lead to severe volatility and are not good for the market, but we need to see how these two sessions conclude and the statements made to carry out a long-term analysis.

📄 Here's a list of attendees at Trump's session:

🔹 Senior officials and figures from the crypto industry at the White House.

🔹 A crypto summit held by Trump at the White House on March 7th is one of the most significant events in history. The list of confirmed guests at this summit is as follows:

✅ Confirmed officials from the White House:

Bo Hines - Executive Director of the Presidential Advisory Council on Digital Assets

David Sacks - Special Advisor on AI and Digital Currencies

Mark Uyeda - Interim Chair of the U.S. Securities and Exchange Commission (SEC)

Caroline Pham - Interim Chair of the U.S. Commodity Futures Trading Commission (CFTC)

✅ Confirmed figures from the crypto industry:

Michael Saylor - Founder of Strategy

David Bailey - CEO of Bitcoin Magazine

Matt Huang - Co-founder of Paradigm

JP Richardson - CEO of Exodus

Kyle Samani - Managing Partner at Multicoin Capital

Zach Witkoff - Co-founder of Trump-linked World Liberty Financial

Sergey Nazarov - Co-founder of Chainlink

Brian Armstrong - CEO of Coinbase

Vlad Tenev - CEO of Robinhood

Arjun Sethi - CEO of Kraken

Kris Marszalek - CEO of Crypto.com

Brad Garlinghouse - CEO of Ripple

🎲In the unconfirmed section, notable names such as Vitalik Buterin, Scott Bessent, and Hoskinson are seen, though they have not been officially confirmed yet.

⭐️ Now that we've reviewed these sessions, let's move on to Bitcoin analysis to see what technical events might occur today.

⏳ In the 1-hour timeframe, it's clear that traders are waiting for Trump's and Powell's speeches to decide their actions based on today's meetings.

📈 I can't give you a specific trigger today because any position you open will be influenced by the news, and opening positions today is akin to gambling, entirely dependent on the statements made in the sessions.

🔽 If the news is negative, the important support areas are 86802, 83151, and 78940, which can prevent a price drop if the news is negative but doesn't induce panic.

📉 If the news causes panic, we might even see a 20% red candle, in which case no support levels will be respected, and we'll have to see when the market panic ends.

🔼 If the news is positive for the market, the significant resistance areas are 94355 and 98482, which can act as supply zones.

⚡️ That's all for today's analysis. Be very cautious with the market today, and I recommend that you closely monitor the market during the session to experience this significant event.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC at a Crossroads: Key Levels & Market Triggers Ahead of NFPWelcome back, guys! I'm Skeptic, and let's dive into today's BTC analysis.

Daily Time Frame Overview

As previously mentioned in past analyses, the 85K level , followed by the 80-82K range , has been a crucial support zone for BTC. So far, price has reacted well to this level, showing strong buying pressure. Additionally, BTC has reached the Pivot Point 4 weekly level , meaning we could expect either a range-bound movement or a potential price rebound. However, the market remains highly volatile due to external factors—mainly Trump's recent actions.

On Sunday , Trump’s tweet triggered a market pump, only to be reversed the following day after his tariff war statements. Given this unpredictability, if you’re looking to buy BTC for a long-term hold, here are two key triggers to consider:

Trigger 1 : Wait for daily candle closure above 90,700 before entering, with a stop-loss below 80,645.37 (~12-13% SL size).

Trigger 2: A breakout above 106,378.17 could be another entry point, with a stop-loss below 90,555.54 (~15% SL size).

💡 Risk Management Tip: In case of a stop-loss hit, limit losses to a max of 5% of your capital to preserve long-term profitability.

4H Time Frame - Futures & Short-Term Setups

Currently, the market lacks direction and is dominated by FOMO trading. Why? Because of high-impact events happening tomorrow, which include:

📊 NFP (Non-Farm Payroll) Data Release🎤 Trump & Powell’s Speeches

These could create significant volatility, making any positions riskier than usual. If you’re looking to trade BTC futures, consider these setups:

Long Trigger: Above 92,200, but for a safer entry, you can wait for confirmation at 94,628.59 or even 98,600 to ride the uptrend confidently.

Short Trigger: Due to the PRZ (Potential Reversal Zone) around 85K and 82K, I personally won’t short here. However, if you must, you could enter a short below 88,213.36, but only if volume confirms the move and RSI enters oversold territory.

🔔 Final Thoughts:

BTC remains highly volatile due to fundamental catalysts.

If you’re unsure, staying out of the market is also a position.

Drop a comment if you want me to analyze a specific coin or forex pair next!

Let’s grow together, not alone. Help me help you! ❤️

DXY at a Critical Level – Reversal or Continuation?Welcome back, guys! I’m Skeptic, and let’s break down the DXY.

If you’ve been following my previous analysis, I mentioned that we are currently in a secondary downtrend, and that still holds true. However, it’s wise to gradually reduce risk and secure profits earlier for two key reasons:

1️⃣ We are approaching a critical support zone – the 60% Fibonacci retracement, which aligns with multiple key support levels.

2️⃣ The weekly candle structure – Looking at the weekly chart, we’ve already hit the four-week pivot point, meaning the market could either range here or even start a price reversal.

Interesting stat: So far, this weekly candle is the largest since November 202 2 and the second-largest since March 2020, which signals significant market movement.

4H Timeframe Breakdown

In my last analysis, I mentioned:

🚨 The main short trigger is at 106.188, but depending on momentum, we could potentially enter even earlier on lower timeframes.

Now, 104.250 has already been broken, and the next key support sits at 103.398.

🔹 If you’re holding short positions, this 103.398 level is a great zone to secure profits.

🔹 No new triggers for now – I don’t expect immediate continuation, and as mentioned, we could see a range formation or even a reversal from here.

Let’s see how price action develops. See you in the next analysis! 🔥📉

TradeCityPro | Bitcoin Daily Analysis #25👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and the key crypto indices. Today, I want to review the important futures triggers for the New York session. Yesterday, the market made an upward leg. Let’s analyze to see what triggers are suitable for today.

⏳ 1-Hour Timeframe

As observed in the 1-hour timeframe, following the activation of the trigger at 88258, the price moved upwards and broke through the 90513 area, and is currently pulling back to this area.

⚡️ An interesting point about the Fibonacci zones is that even now, as the price is projecting after correction, it is respecting the Fibonacci zones as resistance. As seen, breaking through each of these zones results in a short upward leg that can be traded in shorter timeframes.

✅ A negative aspect visible from yesterday till now is the divergence in volume, which is decreasing during upward legs and seems to increase during corrections, indicating a divergence.

📊 Given that the price has not yet reached the 94355 ceiling and is currently forming a lower peak relative to this area, breaking 90513 and 53.29 on the RSI could allow for a risky short position. Be cautious as this position isn't very secure due to the weak trend momentum, potentially preempting a trend change.

🔼 The primary short position can be entered upon the breach of 88258. This area is currently a significant support, and if the price consolidates below this area, it could move towards 83151.

🛒 For long positions, the only trigger we currently have is 94355, and I can't provide an earlier trigger because the price is very close to this area. Taking a long position before this area is breached might lead to a stop-out. However, if you're eager for a long position and a pullback to 90513 is confirmed, you might consider entering a very risky long position.

🔑 If you already have multiple open positions from previous triggers, you might consider securing profits or closing one. If you have a single position open, you need to decide whether to take the risk of Trump’s session and keep it open in hopes of a market pump or play it safe and close it beforehand.

👑 BTC.D Analysis

As observed, dominance continues to oscillate between 60.40 and 61.61, having been rejected from the 61.61 ceiling and returned to the box.

🎲 Given the current downward momentum of dominance, we can expect a continued decline to the bottom of the box, which could potentially propel altcoins upwards. However, if dominance successfully closes above 61.61, more capital will flow into Bitcoin, pushing it higher.

📅 Total2 Analysis

Yesterday, we saw an upward movement in Total2 after it solidified above the 1.13 area, allowing some altcoins to make an upward leap. We don’t have a specific trigger for long positions in Total2 today, but a crucial note about altcoins is that American-origin altcoins like HBAR, AAVE, XRP, ADA could pump significantly if Trump makes positive remarks about crypto, so keep an eye on these if they trigger.

🎲 For short positions, the only trigger in Total2 currently is the fake breaking of the 1.13 breach.

📅 USDT.D Analysis

USDT dominance found support at 4.82 and formed a green candle on this level. Given it had previously faked a break of this area, we might prematurely confirm its bullish turn.

🌿 If the 4.82 level is broken again, we can confirm the downward trend in dominance, which could cause the market to move upward. For a bullish confirmation, a higher low and high above 4.82 would confirm a bearish market direction.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

GBP/JPY Potential Bullish Breakout – Key Levels to Watch:

📉 Descending Trendline Breakout Setup

The price has been in a downtrend, following a descending trendline.

It is currently testing this trendline with signs of potential breakout.

📊 Key Support & Resistance Zones

Support Zone (~187.5 - 189.0): Price has bounced multiple times from this area.

Resistance Zones (~192.5 & ~200.0): First target is around 192.5, then 200.0 if momentum continues.

📈 Possible Bullish Scenario

If price breaks the trendline and holds above 192.5, we could see an upward push towards 200.0.

The expected move follows the drawn path: breakout → retest → continuation.

⚠️ Risk Factors

If the price fails to break above 192.5, it might return to the support zone.

A break below 187.5 would invalidate the bullish outlook.

Overall, this setup suggests watching for a breakout confirmation above resistance before entering long trades. 🚀