How I Analyze Any Coin in 60 Seconds: 4-Step Masterclass!Heyy traders, it’s Skeptic from Skeptic Lab! 🩵 I’m breaking down my lightning-fast method to analyze any coin in just 60 seconds . This 4-step process is how I spot long/short triggers like a pro. Buckle up, let’s dive in:

✔️ Step 1: Identify HWC/MWC/LWC (10 seconds)

Nature’s got a cool vibe—bet a lot of you hit the outdoors on weekends. When I see an apple tree from afar, it’s majestic, but up close, I spot branches and worm-eaten fruit. From a distance, I miss the details; up close, I lose the tree’s grandeur. Markets work the same. You need different timeframes to grasp the market structure. With practice in Dow Theory, trends, and tools, spotting HWC (Higher Wave Cycle), MWC (Mid Wave Cycle), and LWC (Lower Wave Cycle) becomes second nature. For me, this takes 10 seconds.

Want a full HWC/MWC/LWC guide? Check my free article I wrote a while back—it’s a hands-on tutorial ( link Cycle Mastery ).

📊 Step 2: Draw Support/Resistance Lines (20–30 seconds)

I start with higher timeframes: Monthly, then Weekly, then Daily. Once I’ve drawn lines up to Daily, I don’t always redraw for lower timeframes—often, I just adjust them.

Pro tip : Give more weight to the right side of the (recent data) since it’s fresher and more valuable. I change line colors for 4-hour lines, so I know they’re less critical than Daily. I don’t draw lines below 4-hour, but if you’re a scalper, tweak this to your strategy. This step takes me 20–30 seconds, the longest part.

📉 Step 3: Analyze Candles, Volume, Oscillators, and Indicators (10–15 seconds)

Here, I check everything I can: candles, volume, oscillators, and indicators . The goal? Stack confirmations for my triggers. Think RSI hitting overbought, volume spikes, larger candle sizes, or momentum surges—you get the vibe. This step’s length depends on your tool mastery. For me, it’s quick because I know what to look for.

🔔 Step 4: Check Coin Dominance (5–10 seconds)

This is the most critical yet simplest step. We need to track where liquidity’s flowing . For example, if SOL/BTC is bearish, I skip buying Solana—liquidity’s exiting. BTC.D (Bitcoin Dominance) is also key. The relationships dominance creates are complex and don’t fit in one analysis, but if you want a full dominance tutorial, drop it in the comments!

🔼 Key Takeaway: Using these 4 steps—HWC/MWC/LWC, support/resistance, candles/indicators, and dominance—I analyze any coin in 60 seconds. Your speed depends on experience and knowledge. If you’re new, this might take 60 minutes per coin, but don’t sweat it— practice makes you lightning-fast . Thanks for vibing with this educational idea! <3 I’ll catch you in the next one—good luck, fam!

💬 Let’s Talk!

Want a dominance tutorial or more tips? Hit the comments, and let’s crush it together! 😊 If this guide lit your fire, smash that boost—it fuels my mission! ✌️

Tradingview

AUD/CAD’s Big Move: Don’t Sleep on This Breakout Setup!Hey traders, Skeptic from Skeptic Lab here! 🔥 While everyone’s freaking out over interest rate news and Non-Farm Employments , AUD/CAD ’s stealing the show on the daily time frame.

📉Post-tariff crash, it’s rebounding strong. A daily resistance break could kick off a major uptrend. Use RSI overbought/oversold ( linked in my TradingView article ) to confirm momentum.

👀Beware of fakeouts this week—volatility’s high! Trade smart, keep risk tight, and don’t FOMO. Share your thoughts in the comments, boost if it helps <3 🩵

ETH - simple chart and mega moveEthereum is currently the strongest and most stable asset in the market, especially after many had lost hope in it.

Now, Ethereum is back with strength, and it’s just a few steps away from breaking out of the current pattern.

📈A breakout above the upper boundary will likely lead to a new all-time high (ATH) for ETH.

My projection: Ethereum could surpass $7,000 before the end of 2025.

Best regards:

Ceciliones🎯

TradeCityPro | INJ Battles Key Resistance Amid Altseason Buzz👋 Welcome to TradeCity Pro!

In this analysis, I want to review the INJ coin for you. It’s one of the RWA and AI projects, currently ranked 63 on CoinMarketCap with a market cap of $1.51 billion.

📅 Daily Timeframe

On the daily timeframe, after a drop to the 6.94 level, this coin has bounced back and is now moving upward along with a rising trendline.

✨ A strong support has formed at 10.28, and after price reacted to this level, a new bullish leg started and pushed the price up to 16.04.

🔔 There is a Maker Seller zone around 16.04 that has repeatedly prevented the continuation of the upward move, and currently price is struggling with it again.

📈 Breaking this zone will initiate a new phase of the trend. I plan to have a long position open if 16.04 is broken.

🛒 This trigger is also suitable for spot buying, and if Bitcoin pair and Bitcoin dominance confirm the move, we can consider buying in spot too. But personally, I prefer opening a futures position.

💥 Breaking the 72.87 zone on the RSI will be a solid confirmation for the entry of bullish momentum, and with this breakout, a new bullish leg can begin.

🔽 If a correction happens, I will wait for the trendline to break and will not open a short position for now.

Currently, the first trigger we have for a short is at 10.28.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

SUI - Just one step away from the explosion!The last candle on the daily chart just confirmed a BOS (Break of Structure) — a clear and strong sign of bullish continuation for the asset.

✅ This is a textbook entry for a long position.

🎯 Next target: $5 — and so far, no bearish signs in sight.

Best regards,

Ceciliones 🎯

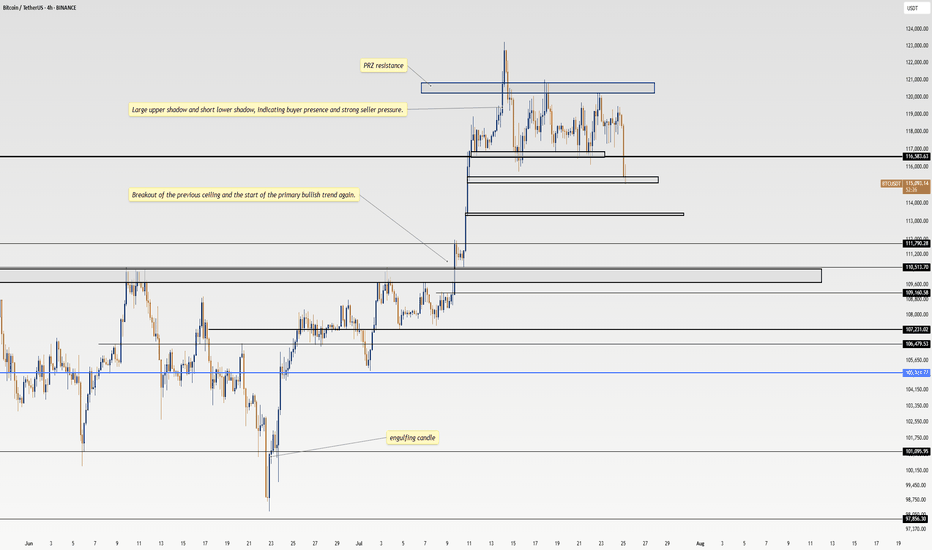

TradeCityPro | Bitcoin Daily Analysis #137👋 Welcome to TradeCity Pro!

Let’s go over the Bitcoin analysis. I’m making a change to how I analyze Bitcoin — I will no longer include indicators like dominance charts.

🔍 From now on, I’ll be analyzing Bitcoin in daily, 4-hour, and 1-hour timeframes only.

📅 Daily Timeframe

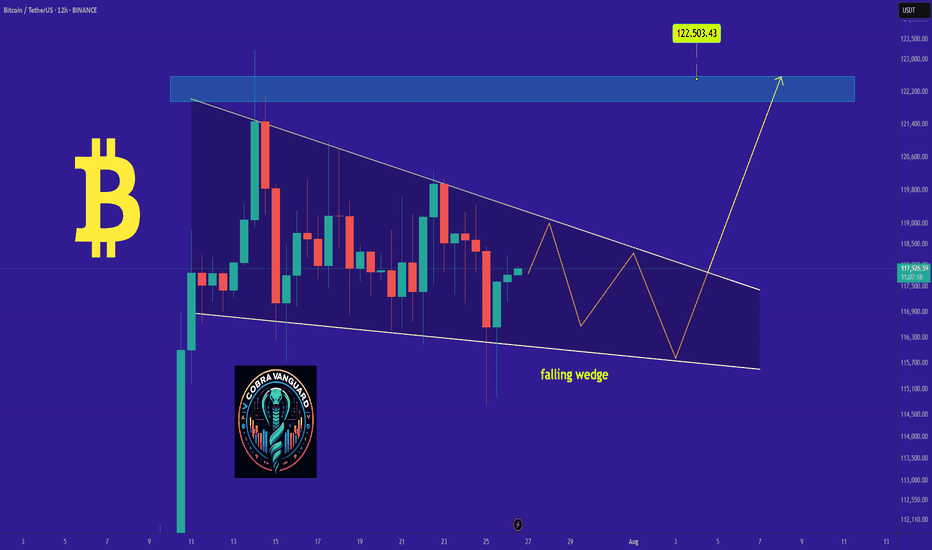

On the daily timeframe, Bitcoin is in a strong uptrend that started from the 78,397 level and in two bullish legs has reached the 122,733 zone.

✅ This level, along with the 0.618 Fibonacci Extension, has created a strong resistance zone. Although price has attempted multiple times to break into or above this area, it has not yet succeeded in closing a candle above or inside the range.

🎲 We also have a curved trendline from higher timeframes, which the price is reacting to even on the daily chart. Currently, the price is near this trendline. There is a possibility that price consolidates over time until it reaches this trendline and then begins its next bullish leg.

📊 If that happens, breaking 122,733 or 120,140 would be triggers for opening a long position on the daily timeframe.

I do not recommend buying Bitcoin on spot right now, because I believe we’re close to the top of this bullish cycle, and this current leg might be the last one.

⭐ A breakout of 76.50 on the RSI would be a strong confirmation of bullish momentum, and would mark the continuation of the uptrend.

🔑 If we get a pullback, the price could correct to dynamic zones like SMA25 or SMA99. Important static support levels are at 110,183 and 100,763.

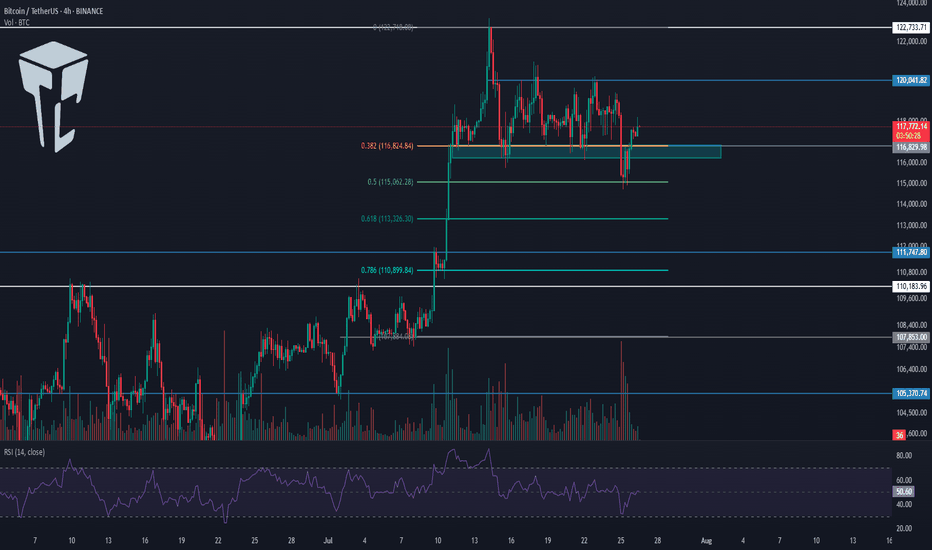

⏳ 4-Hour Timeframe

In the 4-hour chart, we can see more details of the bullish leg. After the sharp move to 122,733, a correction phase began, forming a range box.

💥 The bottom of the box is around 116,829, which I’ve marked as a zone. It also overlaps with the 0.382 Fibonacci, making it a very important PRZ (Potential Reversal Zone).

The top of the range is at 120,041.

🧩 Yesterday, price made a fakeout to the downside. As you can see, it dumped hard with heavy selling volume and hit the 0.5 Fibonacci level, but couldn’t hold there and quickly bounced back above 116,829.

🧲 Today, I think it's better not to go below the 4-hour timeframe and avoid getting caught up in small market noise.

A break above 120,041 can trigger a long entry.

Another breakdown from the box might trigger a deeper correction.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | JUP Eyes Breakout as Altseason Momentum Builds👋 Welcome to TradeCity Pro!

In this analysis, I want to review the JUP coin for you. It’s one of the projects in the Solana ecosystem, currently ranked 59 on CoinMarketCap with a market cap of $1.65 billion.

📅 Daily Timeframe

On the daily timeframe, this coin is currently sitting below a very important resistance zone at 0.6312. This is a strong resistance area and serves as the main trigger for a trend reversal in this coin.

✔️ The main support floor for JUP is located at 0.3409, a level price has tested twice before. Now it has returned to 0.6312, and we can see increased market volume at this level, which indicates tension between buyers and sellers.

✨ A breakout of 0.6312 would be a good trigger for a long position, and I plan to open a long if this level breaks. This could potentially be a long-term position with a high risk-to-reward ratio.

🔔 The next major resistance zones are at 0.7858 and 1.1435, which we can use as targets for this position.

🔽 If the price gets rejected from the top and moves down, breaking 0.4186 and 0.3409, we can look to open a short position.

🧩 The break of 0.3409 would confirm the start of a downtrend, and it's one of the key zones where I’ll definitely look to hold a short position if it breaks.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

5 Lessons from My First 100 TradesAfter executing and reviewing over 100 real trades in crypto, forex, and gold — I found patterns. Bad patterns. Repeating mistakes. And lessons I wish someone had told me earlier.

So I broke them down into 5 key insights that changed how I trade — and might just save you thousands.

📘 Here’s what’s inside:

1️⃣ Smart Profit-Taking:

How I turned 10 R/R into 32 R/R using a dynamic exit plan.

📘Further resource:

Cycle Mastery (HWC/MWC/LWC)

---

Multi-Timeframe Mastery

2️⃣ The Sleep Edge:

70% of my losing trades happened after bad sleep. Here’s why that matters more than emotions.

3️⃣ No More Blind Stop Orders:

Why I stopped using buy/sell stops without real candle confirmation — and what I do instead.

📘 Further reading:

Breakout Trading Mastery

---

Indecision Candle Strategy

4️⃣ Multi-Layered Setups Win:

How structure, S/R, patterns, and timing stack into high-probability entries.

5️⃣ News Trading? Just Don’t.

The data behind why most of my SLs were hit near news time — and how I avoid the trap.

💡 These aren’t theories. These are real lessons from real trades.

If this video helped you or sparked an “aha” moment, give it a boost, commenting your takeaway, and sharing it with a fellow trader.

lets grow together :)

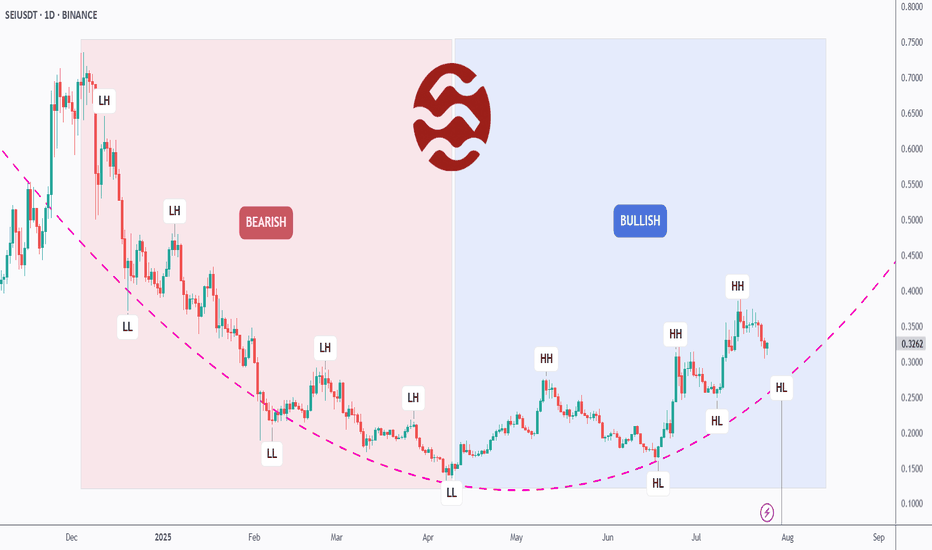

[Deep Dive] SEI – Edition 2: From Pain to Power: A Bull Cycle?SEIUSDT may have just flipped the script.

After months of consistent lower highs and lower lows, SEI has officially broken its bearish structure and is now printing clear higher highs (HH) and higher lows (HL) — a textbook sign of a trend reversal.

📉 Left Side: Bearish Breakdown

From late 2023 to Q2 2025, SEI was stuck in a painful macro downtrend. The structure was brutally clean: LH → LL → LH → LL. Each bounce was weaker than the last, reflecting exhausted buyers and relentless supply.

But something changed in late Q2…

📈 Right Side: Bullish Rebuild

Since its final low around April, SEI began to carve a new path. What started as a subtle accumulation quickly morphed into a solid structure of higher highs and higher lows.

The arc-shaped pink trendline tracks this momentum shift — and we’re now watching a potential continuation of the bullish cycle.

The most recent HL is forming exactly on that curve — a critical moment where bulls may step in for the next impulsive move.

🔥 What’s Fueling the Shift?

SEI is gaining traction as a high-performance Layer 1 designed for trading apps, with native parallelization and a focus on speed and throughput.

Its recent ecosystem growth — including projects in DeFi, gaming, and infrastructure — has started to attract both retail and VC attention.

On-chain metrics are showing increased activity, and whispers of upcoming protocol incentives could be the spark that pushes SEI toward the $0.45–$0.50 range.

🧠 What We’re Watching

- The current HL zone — will bulls defend this level?

- If SEI can break above the previous HH, the bullish structure strengthens.

- A failure to hold this HL would suggest a range or even deeper correction — so risk management is key.

Let’s recap:

- Structure has flipped bullish ✅

- SEI is riding a fresh higher low ✅

- Fundamental momentum is building behind the scenes ✅

It’s now up to the market to decide if this was just a bounce — or the beginning of a much bigger move.

💬 What do YOU think: Is SEI building steam for a breakout, or just teasing us with a fakeout?

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

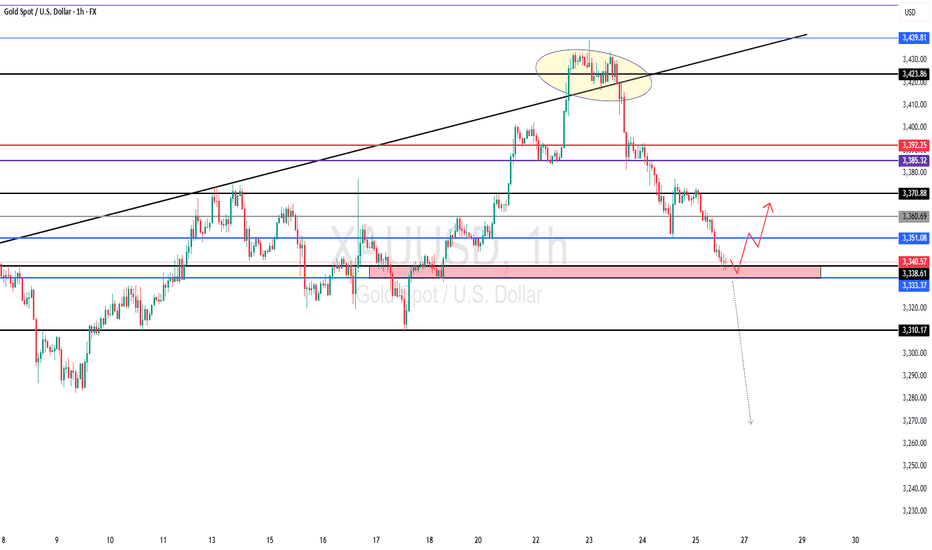

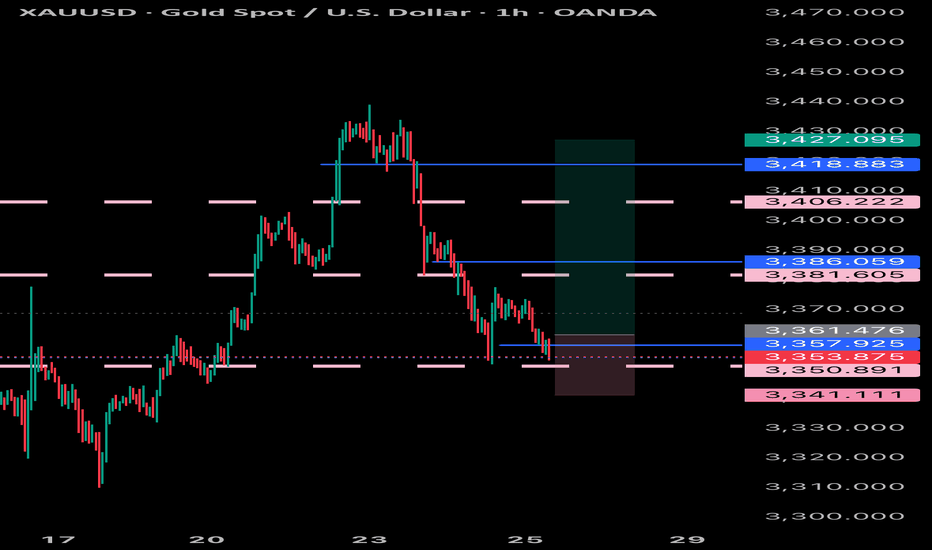

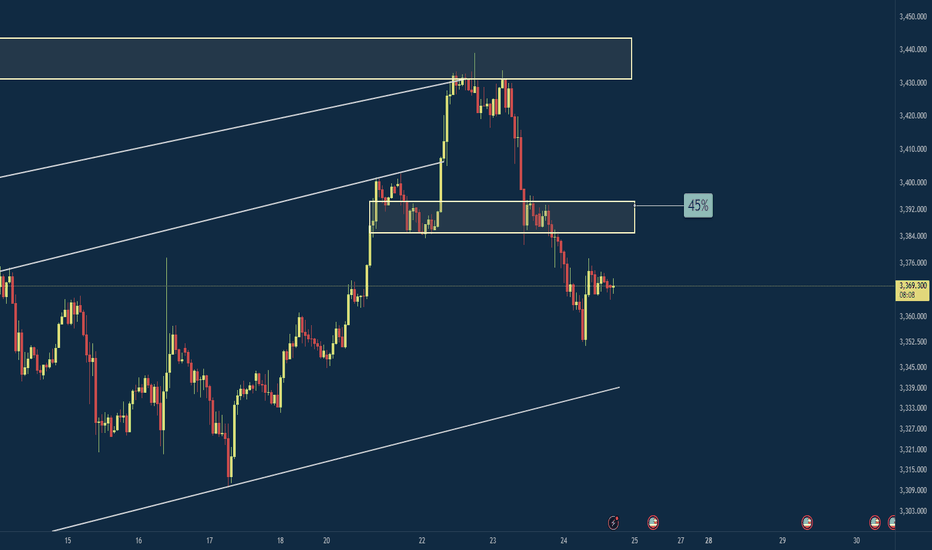

Gold at Key Support – Will Bulls Step In or Drop Continue?🌐 Market Overview

Gold has struggled to recover after yesterday's sharp drop, driven by macro-political concerns and profit-taking at recent highs.

🔻 On July 24, former President Trump made an unexpected visit to the US Federal Reserve, sparking speculation that he's pressuring the Fed to cut interest rates soon.

While the Fed has yet to make any dovish moves, short-term bond yields dipped slightly, showing growing market expectations for policy easing.

The US dollar remains strong, reflecting some skepticism around the Fed’s possible shift despite recent economic strength.

📉 Technical Outlook

On the H2 chart, gold still maintains an overall bullish structure. However, it's approaching a critical support level near 3338, which aligns with the VPOC and the ascending trendline.

📌 If this zone breaks, price may rapidly fall toward deeper liquidity zones in the 332x – 329x range.

🎯 Trade Setups

🔽 BUY SCALP (Quick Reaction Play)

Entry: 3338 – 3336

Stop Loss: 3332

Take Profit: 3342 – 3346 – 3350 – 3354 – 3360 – 3365 – 3370 – 3380

🟢 BUY ZONE (Deep Buy Area – Long-Term Potential)

Entry: 3312 – 3310

Stop Loss: 3305

Take Profit: 3316 – 3320 – 3325 – 3330 – 3340 – 3350 – 3360 – 3370 – 3380

🔻 SELL ZONE (if market retests)

Entry: 3374 – 3376

Stop Loss: 3380

Take Profit: 3370 – 3366 – 3360 – 3355 – 3350 – 3340 – 3330

🔍 Key Levels to Watch

Support: 3350 – 3338 – 3325 – 3310 – 3294

Resistance: 3374 – 3390 – 3400 – 3421

⚠️ Risk Note

As we head into the weekend, liquidity sweeps are common – especially on Fridays. Be cautious of sharp moves.

Focus mainly on scalp setups today. Avoid early long entries unless strong confirmation appears at lower liquidity zones.

Always follow your TP/SL strategy to protect your capital.

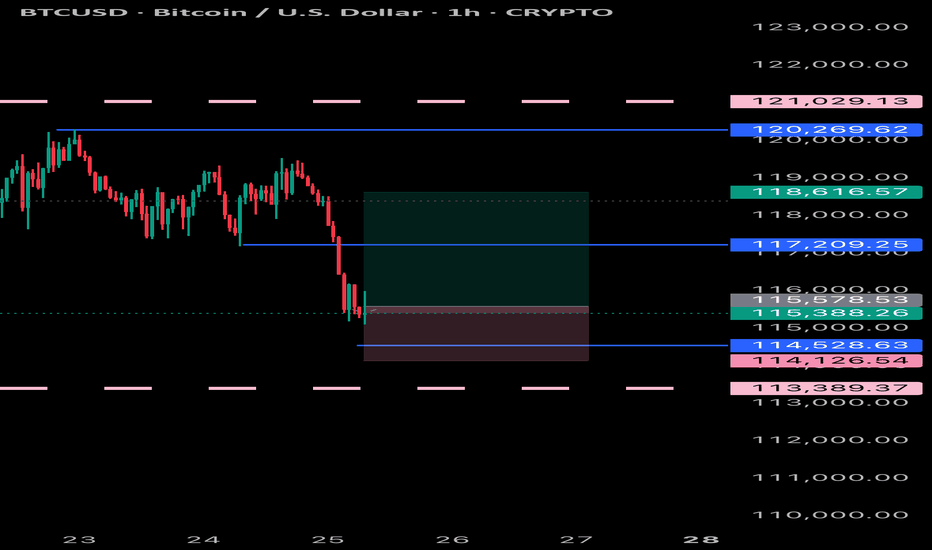

Bitcoin’s Epic Run from 80K to 120K: What’s Next for BTC?Yo traders, it’s Skeptic from Skeptic Lab! 🩵 Diving into Bitcoin’s wild ride from 80K to 120K—breaking down the key supports, resistances, and what’s next for BTC.

From the $76k bounce to smashing $110K, we’re eyeing the $120K PRZ. Will it correct or keep soaring? Check the video for the full scoop! Drop your thoughts or coin requests in the comments, boost if it vibes & Let’s grow together!

MARA: shoulders done, now walk toward the targetOn the daily chart, MARA completed a textbook inverse Head & Shoulders reversal with a clear breakout above the descending trendline. A corrective pullback followed, and the price is now heading into the key buy zone at 15.21–15.77 - aligning with the 0.72 and 0.79 Fibonacci retracements, and the upper boundary of the broken channel. This is the area to watch for a potential continuation of the bullish impulse.

Volume on the breakout was above average, confirming strong buyer interest. The EMAs are trending below the price, supporting the upward structure. The first target is located at 21.57 (previous resistance), with a potential extension to 28.77 (Fibonacci 1.618).

Fundamentally, MARA remains highly correlated with BTC and crypto sentiment. As interest returns to crypto-related assets due to ETF flows and possible Fed easing, mining stocks like MARA gain attention. Recent reports also show improved production efficiency and lowered costs - a tailwind for bulls.

Tactically, the best setup would be a confirmed reaction from the buy zone — whether a strong candlestick formation, volume surge, or reclaim of a key level. If that happens, aiming for 21.57 and 28.77 becomes a solid plan.

The pattern played out - now it's time for the market to walk the talk.

SPK Market Update – Key Levels Ahead 🚨 SPK Market Update – Key Levels Ahead 🔄📉📈

SPK previously formed a bearish Head and Shoulders pattern, which was confirmed by a breakdown. So, what’s next?

🔹 Option 1:

Price could move down to the two blue support levels — these zones may offer potential long entries, as buyers were active here before. Watch for confirmation! 👀

🔺 Option 2:

We also have a red resistance zone, located around the right shoulder of the H&S.

If INDEX:SPK breaks above this zone, it may signal the return of buyers and a potential bullish reversal.

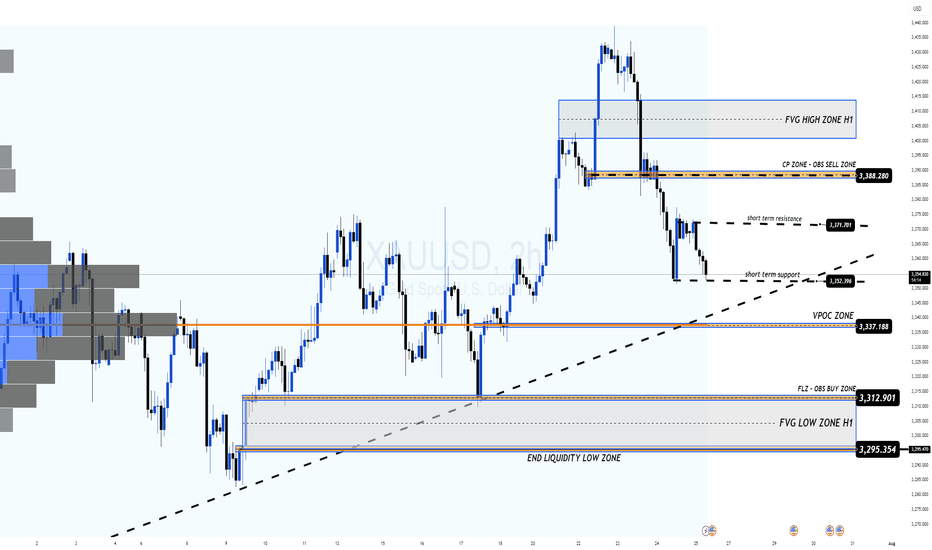

Welcome Back! Gold Trading Strategy & Key Zones to WatchIn this week’s welcome back video, I’m breaking down my updated approach to XAU/USD and how I plan to tackle the Gold markets in the coming days. After taking a short break, I’m back with fresh eyes and refined focus.

We’ll review current market structure, identify key liquidity zones, and outline the scenarios I’m watching for potential entries. Whether you’re day trading or swing trading gold, this breakdown will help you frame your week with clarity and confidence.

📌 Covered in this video:

My refreshed trading mindset after a break

Key support/resistance and liquidity zones

Market structure insights and setup conditions

What I’ll personally avoid this week

The “trap zones” that might catch retail traders off guard

🧠 Let’s focus on process over profits — welcome back, and let’s get to work.

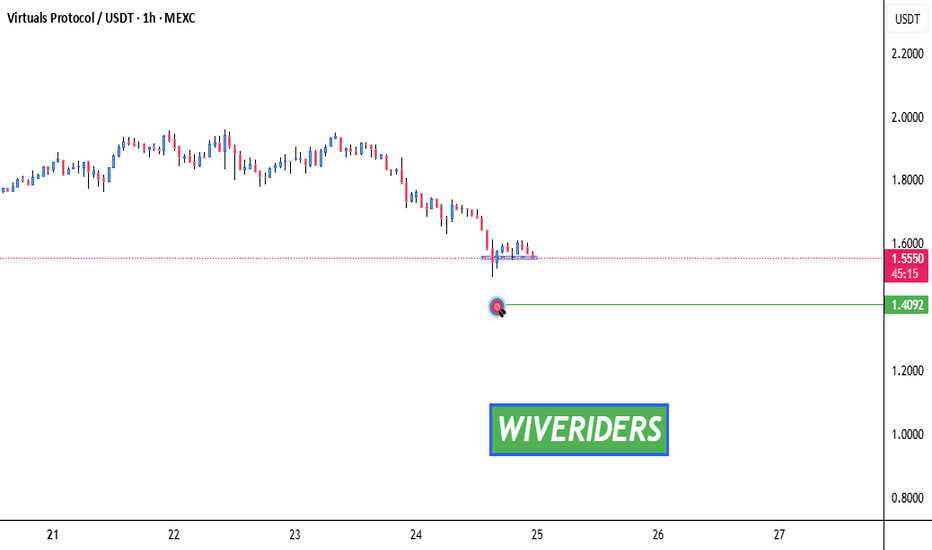

Testing Blue Support – Key Level Ahead!🚨 SPARKS:VIRTUAL Testing Blue Support – Key Level Ahead! 📉🔵

SPARKS:VIRTUAL is currently testing the blue support zone.

📊 If a breakdown occurs, we could see a move toward the green line level as the next target.

🛑 Watch for confirmation — this could signal further downside if sellers take control.

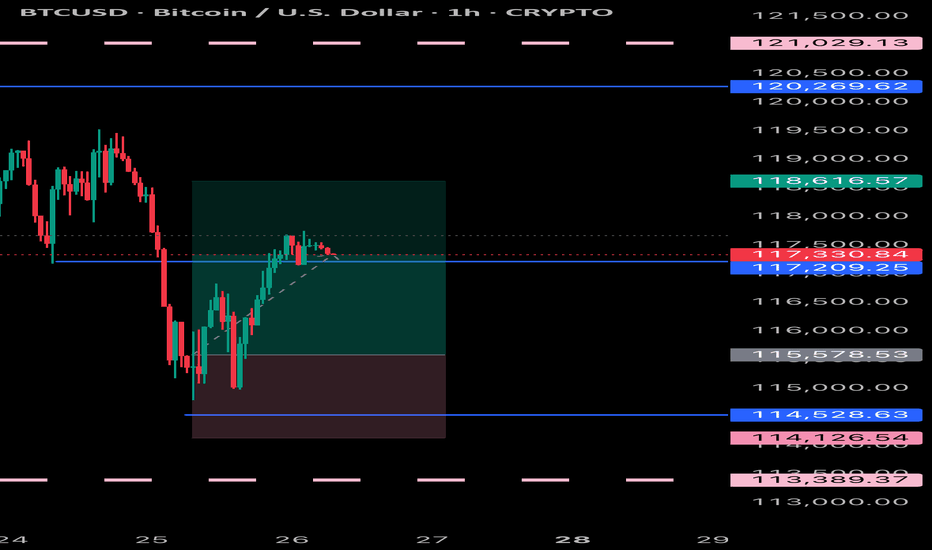

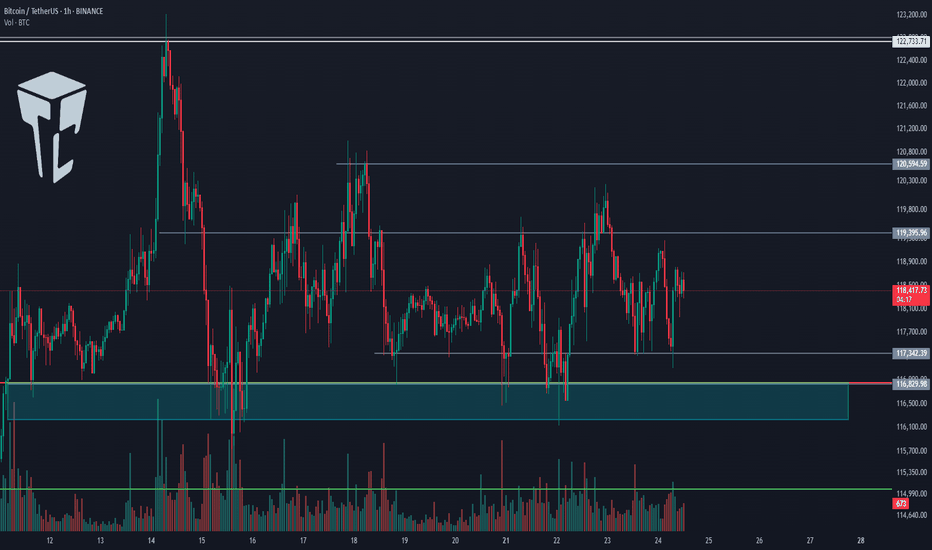

TradeCityPro | Bitcoin Daily Analysis #136👋 Welcome to TradeCity Pro!

Let’s get into the analysis of Bitcoin and major crypto indices. As usual in this analysis, I’m going to review the futures triggers for the New York session.

⏳ 1-Hour Timeframe

On the 1-hour timeframe, price is still ranging inside the box, and none of its triggers were activated yesterday.

✔️ The support floor is at 117,342, and another key support zone is around 116,000.

✨ If these zones break, Bitcoin may begin a deep correction. In that case, we can open short positions or close long-term long positions that we’re already holding.

⭐ For long positions, we still have the 119,395 and 120,594 triggers. A breakout of either zone could provide a very good entry point for the next bullish leg of Bitcoin.

👑 BTC.D Analysis

Let’s move on to Bitcoin Dominance. Yesterday, dominance stabilized above the 61.20 zone, and as I mentioned before, breaking this zone led to a bullish leg, which continued up to 62.41, and currently, it has more bullish momentum.

💥 If 62.41 breaks, the bullish momentum will intensify. However, I still believe the overall trend is bearish, and if 60.46 breaks to the downside, the decline could continue.

📅 Total2 Analysis

Let’s go over Total2. This index has continued to correct and has now dropped to the 1.41 zone, which corresponds to the 0.5 Fibonacci level. It has now created a trigger around 1.47.

⚡️ If 1.47 breaks, we can open a long position. Our next trigger will be 1.53.

A breakout of 1.53 would signal the start of the next bullish wave.

📅 USDT.D Analysis

Now to Tether Dominance. This index has finally exited its range box and has broken the 4.25 level.

The current resistance stopping price is 4.36.

🔔 If dominance drops back below 4.25, strong bearish momentum could hit, increasing the likelihood of a breakdown of 4.13.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.