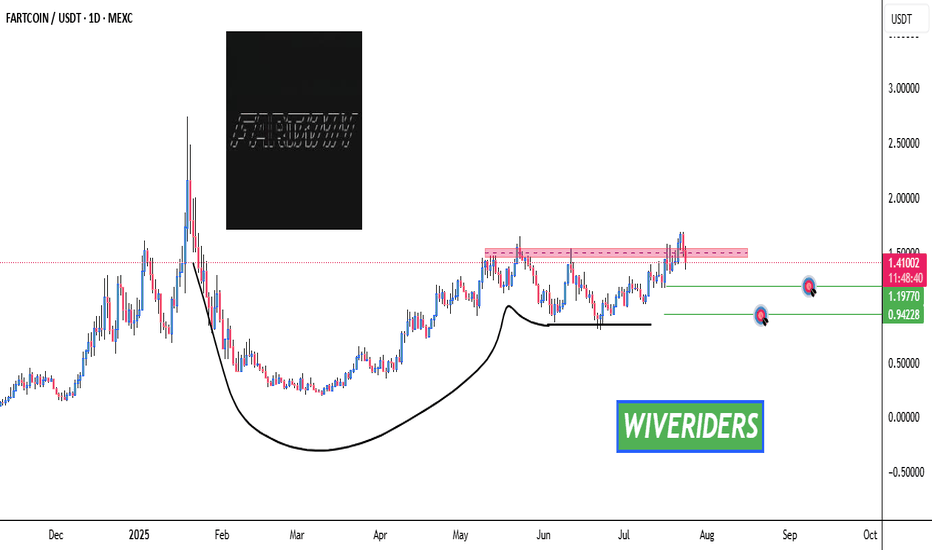

What’s Next? 🚨 $FARTCOIN Cup & Handle Pattern Forming – What’s Next? 📈

$FARTCOIN has formed a bullish Cup & Handle pattern — but is it over?

❌ Not yet. $FARTCOIN hasn’t shown any strong bearish signals for now.

🔍 We’re watching two key green line levels below.

📉 If the price drops toward these zones, we may see buyers step back in — creating a potential entry, but only with confirmation.

✅ Stay patient — no rush to jump in without a setup. Let the chart guide us.

Tradingview

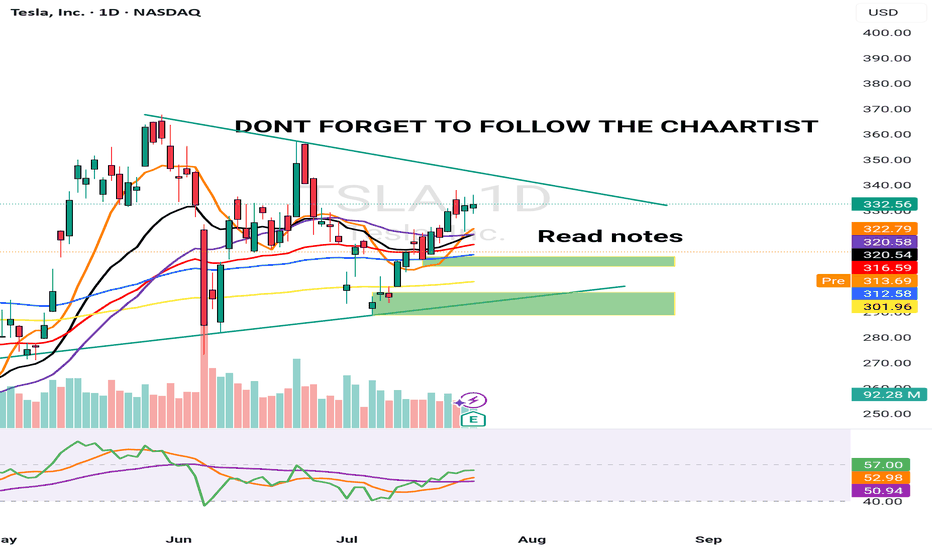

TSLA 24 JULY 2025I have marked 2 levels in green boxes. Price is inside this box pre market and TSLA is down -8.5% from the highs of $338 post market till $310 & -7.5% down from yesterday's close

A better level is the lower demand zone but its not the best. Price has not hit any major resistance.

My job is to read the data & trade. I am still bullish & 10% up down move is normal for Tesla &

This could be a "BEAR TRAP".

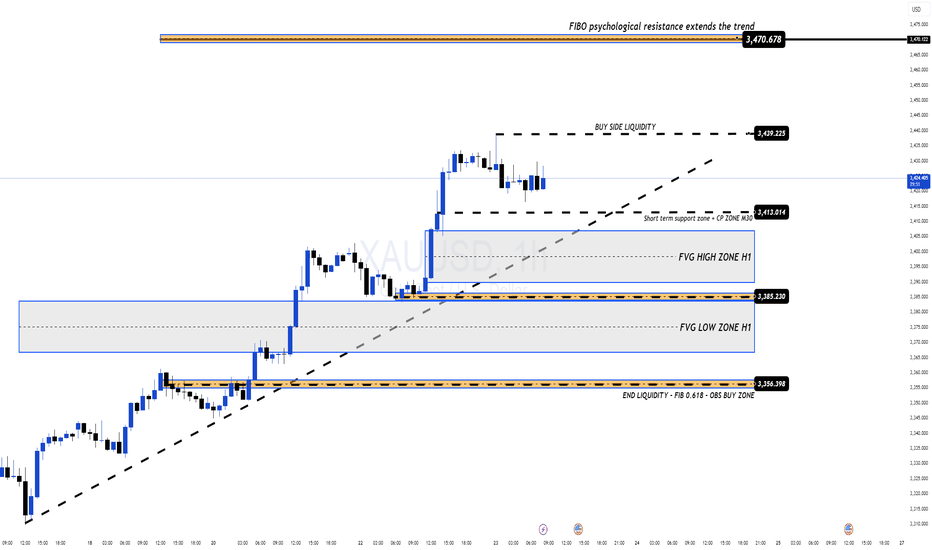

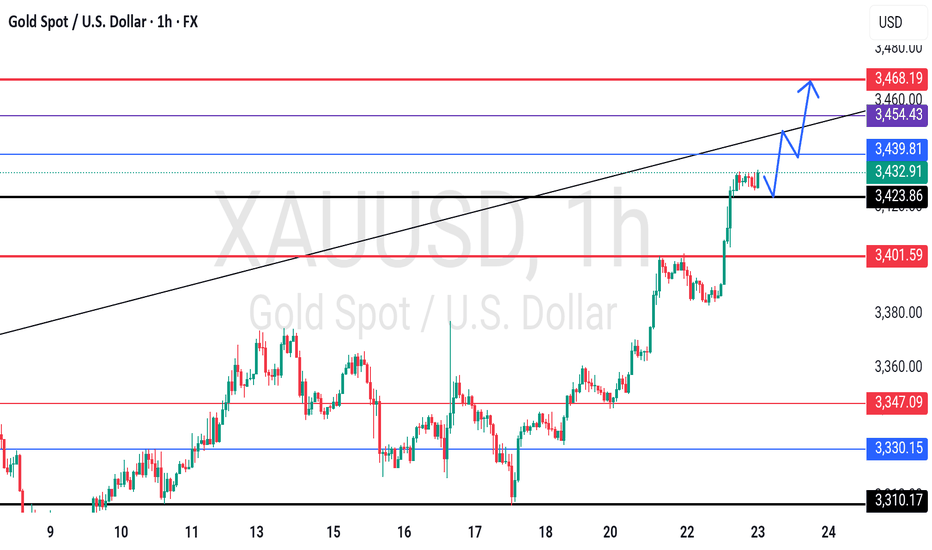

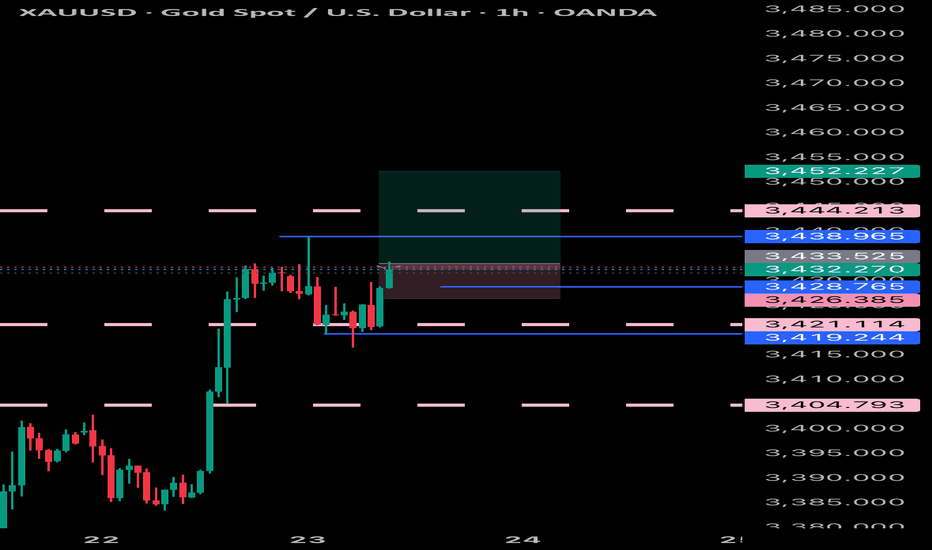

Bullish Momentum Fading? Key Correction Levels Ahead XAUUSD – Bullish Momentum Fading? Key Correction Levels Ahead (23 July)

📰 Market Overview

Gold surged strongly overnight, driven by:

A speech from Fed Chair Jerome Powell, with no hints of resignation or major policy shift.

Rising geopolitical tensions between the US, China, and the EU — with the 1st of August marked as a key deadline.

A notable drop in US bond yields and the US Dollar, triggering increased demand for safe-haven assets like gold.

While today’s economic calendar is quiet, the market remains sensitive to sudden volatility.

📉 Technical Analysis

On the H4 chart, the recent bullish wave shows signs of exhaustion. Reversal candles are now forming on the H1 and M30 timeframes — suggesting a potential correction in the short term.

The 3412 – 3410 support zone will be critical. If price breaks below and invalidates the ascending trendline, we may see a deeper pullback toward lower liquidity zones (FVGs).

Below that, the 335x region offers strong confluence (Fibonacci 0.618 + previous demand zone), making it a prime area for potential long entries if price action confirms a bounce.

📌 Trade Setups to Watch

🔻 SELL ZONE: 3469 – 3471

Stop Loss: 3475

Take Profit Targets: 3465, 3460, 3455, 3450, 3445, 3440, 3430, 3420

→ Wait for a breakout and retest before shorting.

🔸 BUY SCALP: 3385 – 3383

Stop Loss: 3379

TP Targets: 3390, 3394, 3398, 3402, 3406, 3410

→ Ideal for intraday pullback entries with clear structure.

🔹 STRONG BUY ZONE: 3356 – 3354

Stop Loss: 3350

TP Targets: 3360, 3364, 3368, 3372, 3376, 3380, 3390, 3400

→ Great long-term entry zone with technical alignment (liquidity + fib levels).

⚠️ Risk Management Reminder

Even in low-news sessions, markets may spike unexpectedly due to political statements or liquidity sweeps.

Always respect your TP/SL levels — smart trading is protected trading.

💬 Patience breeds precision. Wait for the zone, trust the plan, and manage the trade.

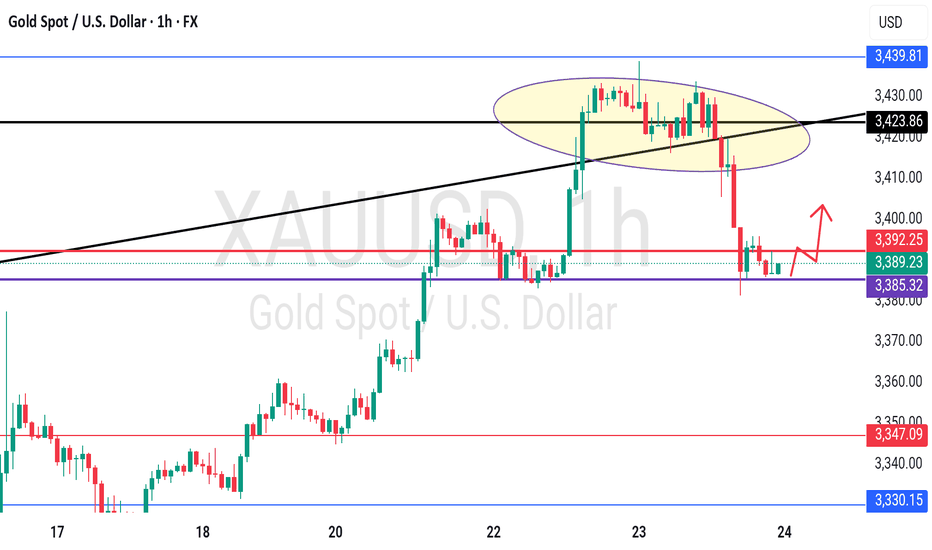

GOLD - One n Single Support, holding or not??#GOLD.. market just reached at his current ultimate supporting area and that is 3385

Keep close it and if market hold it in that case we can see again bounce otherwise not..

Note: we will go for cut n reverse below 3385 on confirmation.

Good luck

Trade wisely

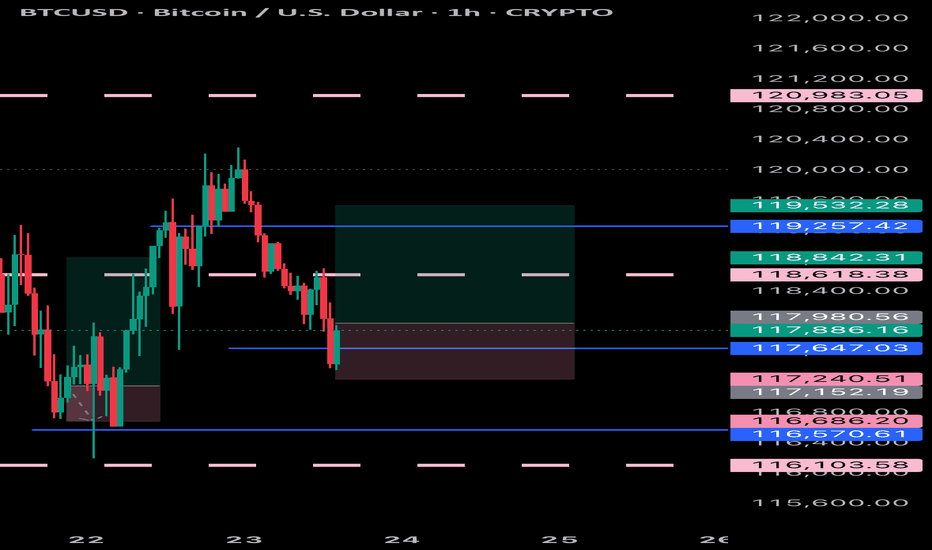

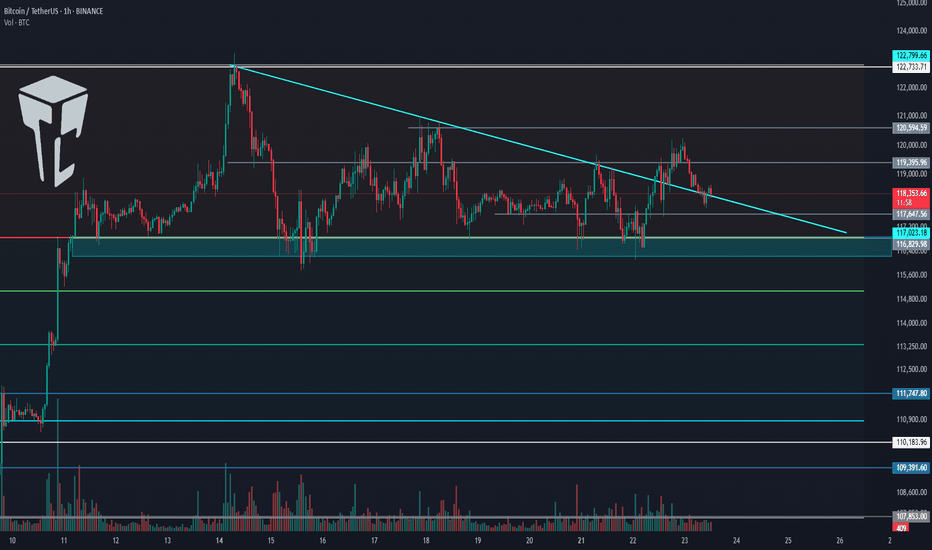

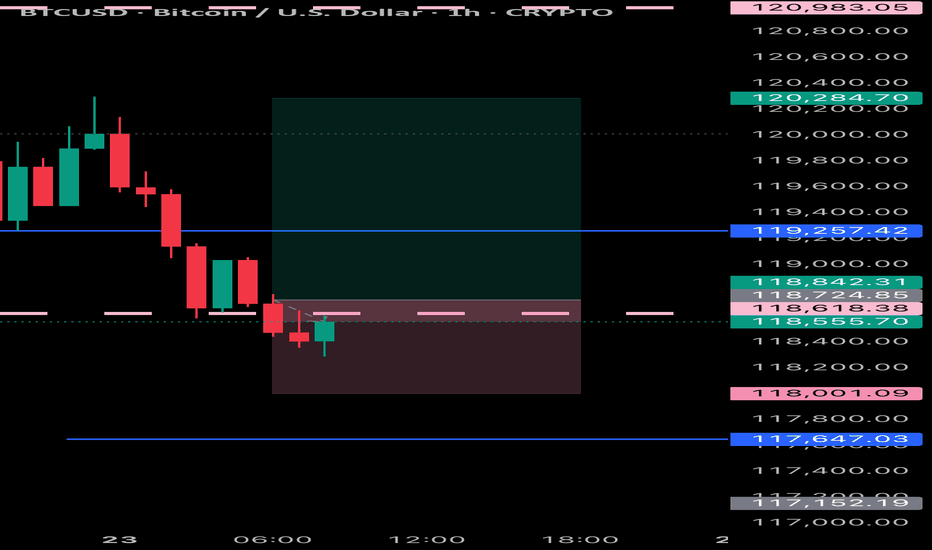

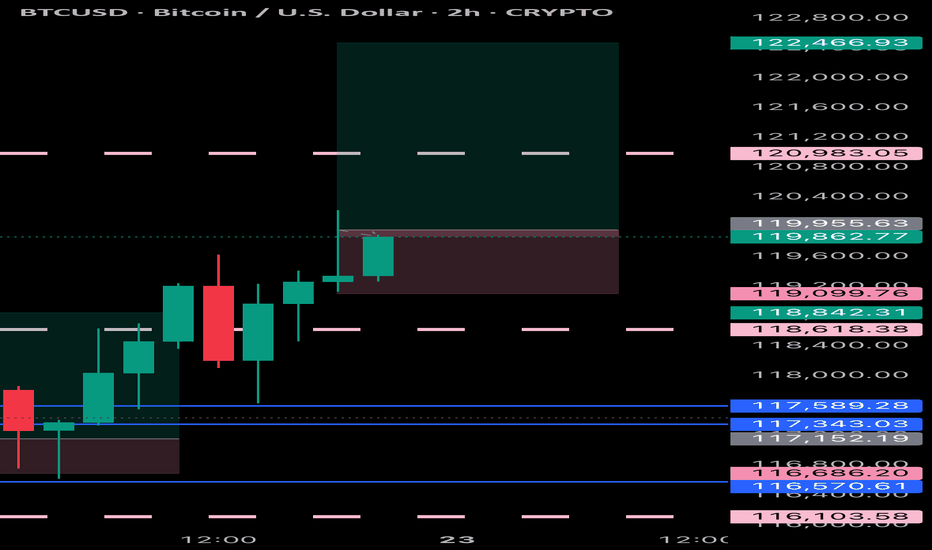

TradeCityPro | Bitcoin Daily Analysis #135👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and major crypto indices. In this analysis, as usual, I’m going to review the futures triggers for the New York session.

⏳ 1-Hour Timeframe

Yesterday, Bitcoin broke the 119,395 level but couldn’t hold above it and has now returned below this level, currently sitting on its previous trendline.

✔️ Today, the market will probably try to form more structure, and I think Bitcoin will range.

⭐ However, if it wants to move, we can enter a long position with the trigger at 120,594.

🔽 For a short position, we can enter if the 116,000 support area breaks.

👑 BTC.D Analysis

Let’s move on to Bitcoin Dominance. Yesterday, dominance had a bullish move, and finally, a support floor managed to prevent further drop in dominance.

🧩 A retracement to 61.20 has occurred. If this retracement continues, the upper levels are 61.53 and 62.

A break of 60.46 will start the next bearish leg.

📅 Total2 Analysis

Let’s go to Total2. This index has formed a range box between 1.48 and 1.55 and is still oscillating within it.

🎲 If 1.55 breaks, we can open a long position, and on the other hand, if 1.48 breaks, the price could correct to lower support levels.

📅 USDT.D Analysis

Let’s move on to Tether Dominance. This index also has a range box and is still moving inside it.

🔑 Breaking 4.13 is very important for the future market trend and could lead to a drop in dominance.

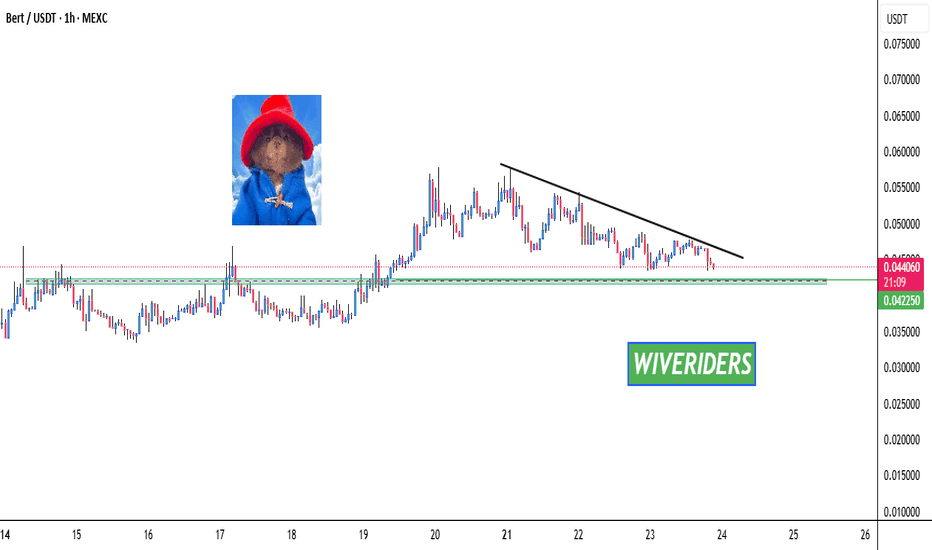

BERT Approaching Green Support Zone 🚨 BERT Approaching Green Support Zone 🟢📉

BERT is now approaching a key support level in green.

This area has shown buyer interest in the past, and the price could potentially bounce from this zone.

📌 Wait for confirmation before entering long.

If confirmed, it could offer a strong risk/reward opportunity.

GOLD - single supporting area, further bounce??#GOLD - market perfectly moveed as per our video analysis and above our cut n reverse area as well.

Now market have single supporting area, tha tia around 3423-24

Keep close it and if market hold it then upside further bounce expected.

Good luck

Trade wisely

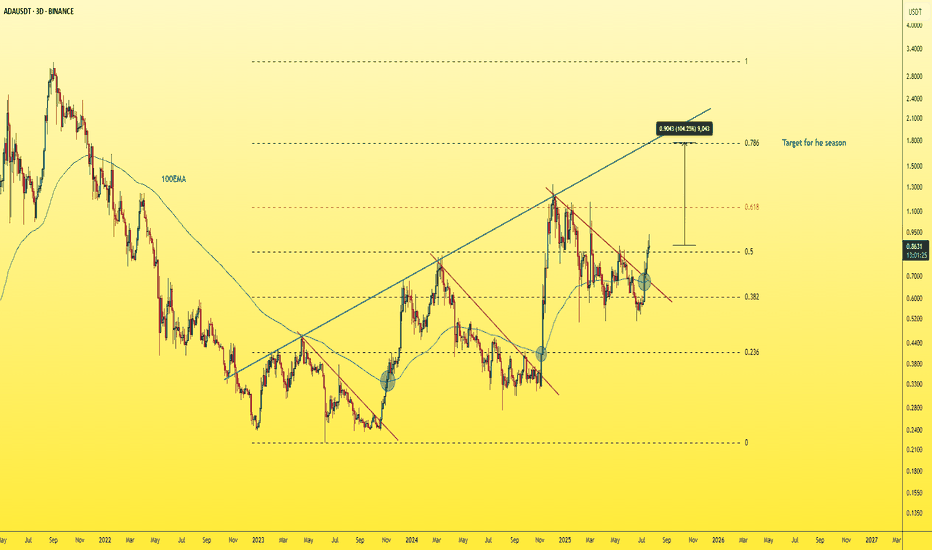

ADAUSDT - Buy or Regret!As clear and simple as the chart is… the target is just as clear and reliable.

ADA is showing strong bullish structure on the 3-day chart — breaking above the red trendline with a successful retest, and also breaking above the 100 EMA.

The blue trendline represents a strong hidden resistance level that many traders are overlooking.

The upside move is likely to end around the 0.786 Fibonacci level, which intersects with this blue trendline — in the $1.50–$1.70 range.

A strong project. A fundamentally sound coin that respects technical analysis.

A logical and high-probability target.

Best regards Ceciliones🎯

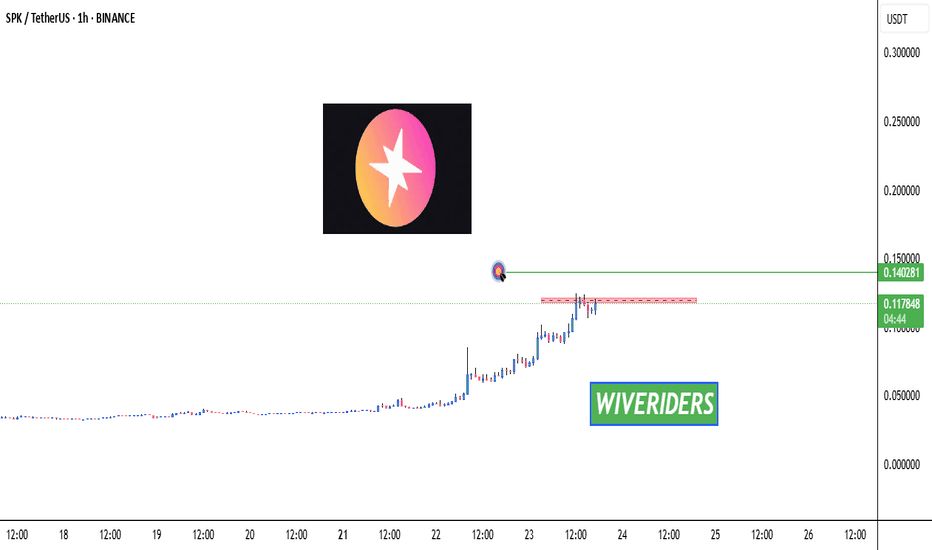

SPK Testing Red Resistance Zone 🚨 INDEX:SPK Testing Red Resistance Zone 🔴📈

INDEX:SPK is now testing the red resistance zone.

📊 Watch for breakout confirmation — if successful:

🎯 First Target → Green line level

This could signal the beginning of a new move up if buyers push through the resistance.

Let’s track it closely for a potential entry! 💼📈

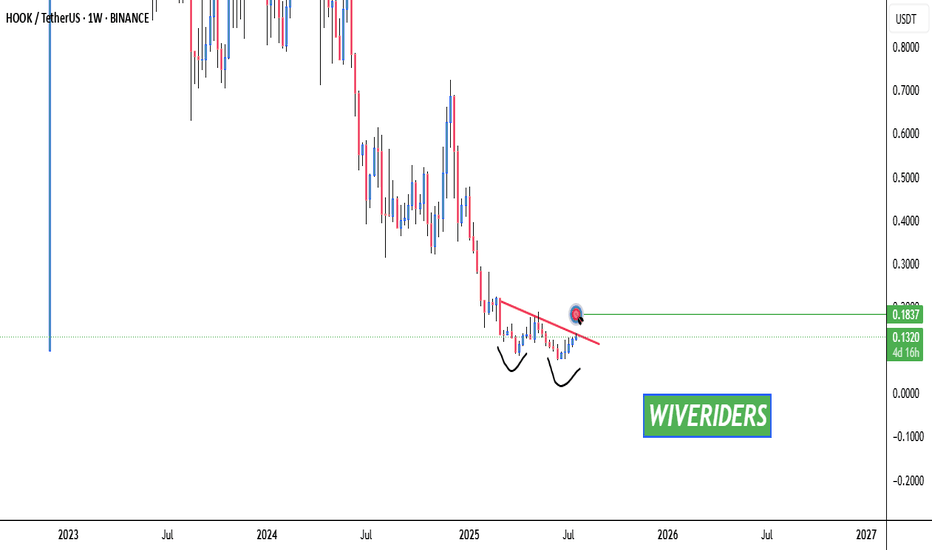

HOOK Testing Red Resistance & Forming Double Bottom🚨 HOOK Testing Red Resistance & Forming Double Bottom 🔴📈

HOOK is currently testing the red resistance trendline and has formed a bullish double bottom pattern, which could indicate a potential reversal.

🎯 If breakout is confirmed:

✅ First Target – Green line level

📊 A confirmed breakout of both the resistance trendline and the double bottom structure could signal strong bullish momentum.

Watch for confirmation before entering! 💼💸

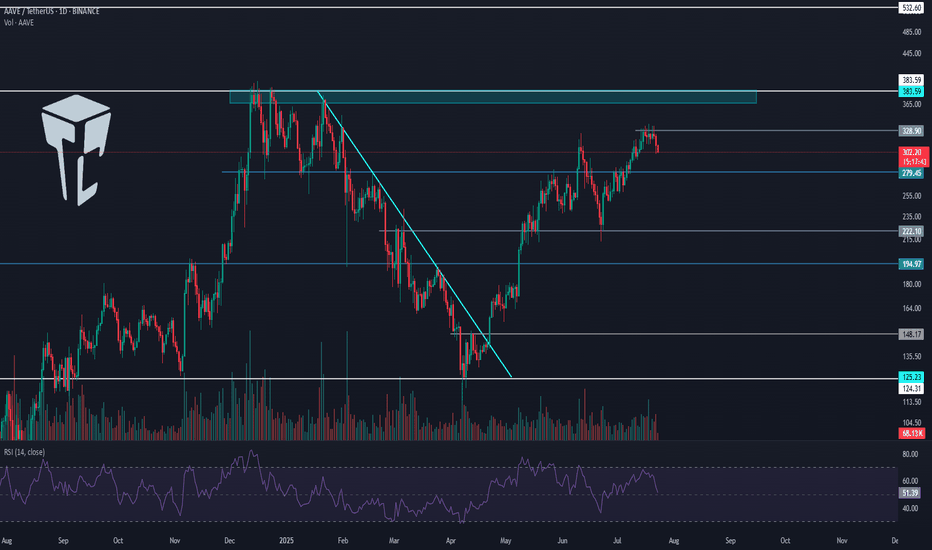

TradeCityPro | AAVE Holds Gains as Altseason Optimism Builds👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the AAVE coin for you. It’s one of the major DeFi coins active in the lending sector and currently ranks number 1 in terms of TVL.

✔️ The token itself has a market cap of $4.58 billion and is ranked 29 on CoinMarketCap.

📅 Daily Timeframe

On the daily timeframe, since our last analysis, the price has increased by over 100%, and the trigger for long or buy positions was activated.

🔄 There was a descending trendline on this coin, and the trigger for its breakout was 148.17. After breaking that level, we could open a long position.

🚀 However, the main trigger was 194.97, and the primary uptrend started with the break of that level, continuing up to a high of 328.9.

📊 The issue with this current uptrend is that, as you can see in the second leg, there is clear weakness, which is not a good sign for the continuation of this trend.

📈 The current top at 328.9 is not far from the previous high, forming a double top-like structure, leading to a strong bearish divergence in the RSI.

💥 If RSI confirms a breakdown below 50, this divergence will become active and a correction toward 222.10 may occur. A break of that level would be the first signal of a potential trend reversal for AAVE.

⭐ On the other hand, if price wants to continue upward, we have a very important resistance at 383.59.

🔍 Breaking this resistance would initiate an uptrend in higher cycles and could even lead to a new ATH for this coin.

💼 I plan to open a long position if the 328.9 resistance is broken, and for spot purchases, I will wait for a breakout of 383.59.As long as the price remains above 279.45, I am not considering any short positions.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

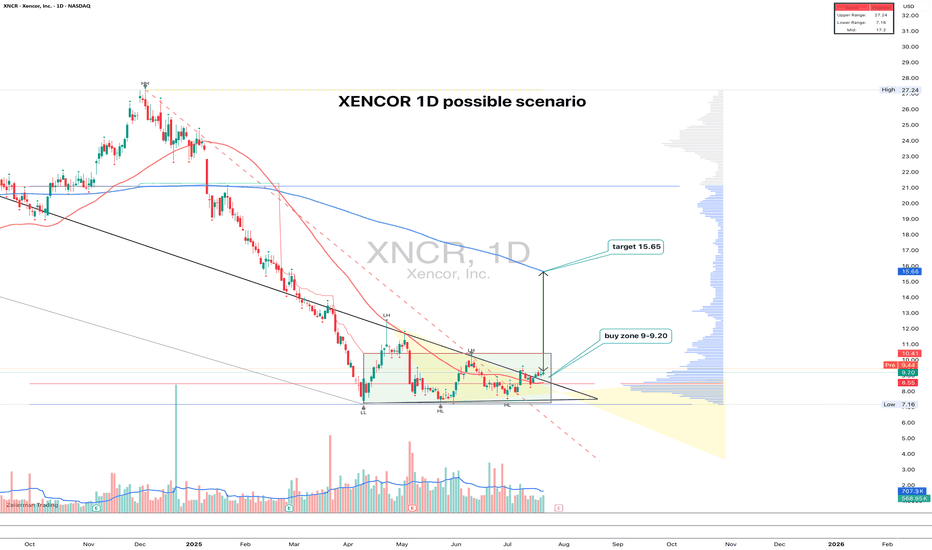

XNCR 1D time to growth?XNCR: the uptrend hasn't started yet - but someone's quietly accumulating

XNCR spent nearly 4 months building a base and finally broke out of consolidation with a clear upward move. The pattern looks like a range with a narrowing triangle at the bottom — the breakout came with rising volume. Entry makes sense in the 9.00–9.20 zone on a retest. Volume profile and Fib levels confirm the importance of this area, plus there’s a clean support shelf at 9.00. The target is 15.65, which aligns with the height of the structure. The 200-day MA is still above price, but a push beyond 11.00 could open the door to acceleration.

Fundamentally, Xencor is a biotech company focused on monoclonal antibodies. After a tough 2023–2024 and cost reductions, the market is beginning to price in signs of recovery. Key partnerships remain intact, the pipeline is alive, and recent data for XmAb7195 was well received at industry events. Valuation remains low, and biotech ETF flows are slowly picking up.

Still a relatively low-volume name, but the structure is clean, the setup is readable, and fundamentals are turning. With a tight stop below 8.50, the risk-reward looks solid.

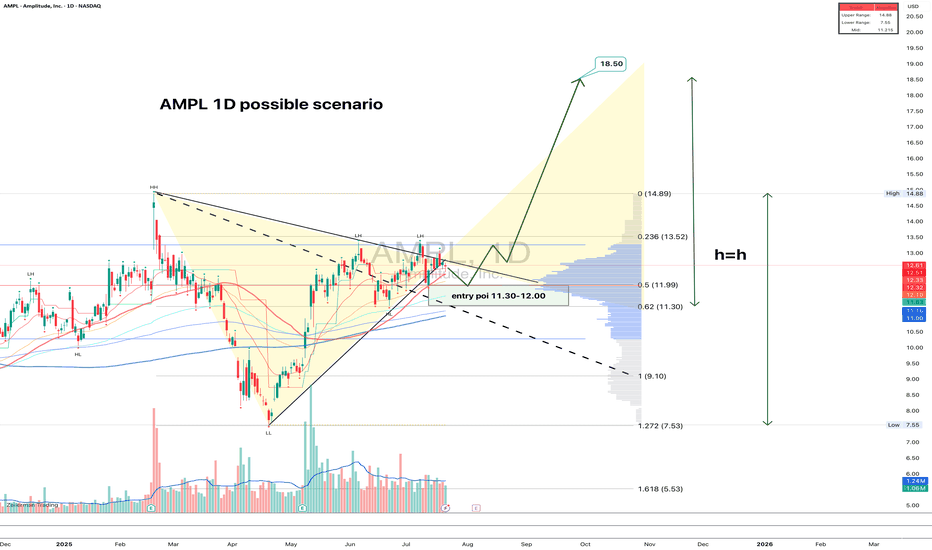

AMPL: structure clean, volume right, fundamentals warming upAMPL just broke out of a symmetrical triangle on the daily chart. The breakout was confirmed with decent volume, and now price is calmly pulling back into the 11.30–12.00 zone — exactly the kind of textbook retest that gets serious traders interested. The 0.618 Fib level sits at 11.30, and 0.5 at 11.99, strengthening this entry area. Volume has tapered off post-breakout, which is typical before a continuation. Moving averages are stacked bullish, confirming the trend shift. First upside target is 13.52, followed by 14.89, and if the full h = h move plays out, price could reach 18.50. A natural stop sits just below 11.00. Clear structure, solid risk control — this is one of those setups that checks all the boxes.

On the fundamental side, Amplitude remains a key player in product analytics and digital optimization. After a slow 2024 marked by cost-cutting and stagnating revenue, the company is showing early signs of recovery this year. The broader SaaS market has stabilized, and AMPL is benefiting from renewed enterprise demand, especially for AI-driven user behavior analytics. Recent earnings came in better than expected, and institutional interest has quietly returned. Valuation is still moderate at these levels, giving it room to re-rate if momentum builds.

A clean breakout with technical alignment and an improving macro picture - when both sides of the story match, it's worth paying attention.

Cup & Handle Formation 🚨 XETR:HOT Testing Red Resistance – Cup & Handle Formation 📈

XETR:HOT is currently testing the red resistance zone and has formed a bullish Cup & Handle pattern on the chart — a classic continuation setup.

If breakout is confirmed, potential upside:

✅ First Target: Green line level

✅ Second Target: Green line level

🕵️♂️ Wait for clear breakout confirmation before entering long.

This pattern often signals strong momentum if buyers step in.

Trade smart. Let’s monitor for the perfect entry! 💹💼

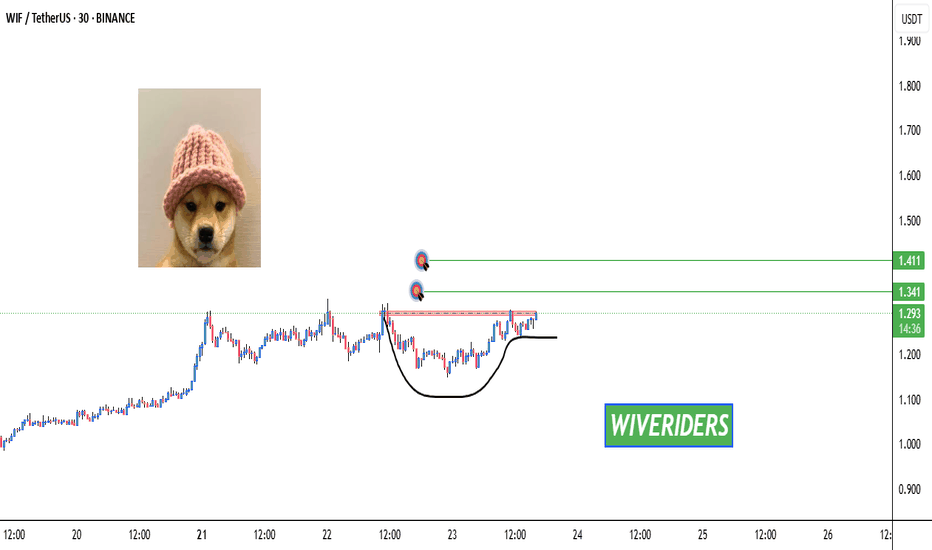

Bullish Cup & Handle Pattern Formed 🚨 SEED_WANDERIN_JIMZIP900:WIF Testing Red Resistance – Bullish Cup & Handle Pattern Formed 📈

SEED_WANDERIN_JIMZIP900:WIF is currently testing the red resistance zone and has formed a bullish cup and handle pattern on the chart.

If a breakout occurs, potential upside toward:

✅ First Target: Green line level

✅ Second Target: Green line level

Wait for breakout confirmation before entering long. 📊

Patience is key—watch this closely! 💼💸

GRAB 1W: Two Years of Silence — One Loud BreakoutGRAB 1W: When stocks go quiet for two years just to slap bears across both cheeks

The weekly chart of GRAB shows a textbook long-term accumulation. After spending nearly two years in a range between $2.88 and $4.64, the price is finally compressing into a symmetrical triangle. We’ve already seen a breakout of the descending trendline, a bullish retest, and the golden cross between MA50 and MA200. Volume is rising, and the visible profile shows clear demand with little resistance overhead.

The $4.31–$4.64 zone is key. Holding this level opens the path to $5.73 (1.0 Fibo), $6.51 (1.272), and $7.50 (1.618). The structure is clean, momentum is building, and this accumulation doesn’t smell like retail — it smells institutional.

Fundamentally, GRAB is a leading Southeast Asian tech platform combining ride-hailing, delivery, fintech, and financial services. Yes, it’s still unprofitable (–$485M net loss in 2024), but revenue is growing fast, recently crossing $2.3B. Adjusted EBITDA has been improving steadily, and the company holds $5.5B in cash equivalents with minimal debt — giving it excellent liquidity and expansion flexibility.

Valued at ~$18B, GRAB operates in the world’s fastest-growing digital market, with increasing institutional exposure from players like SoftBank and BlackRock. The 2-year base hints at smart money preparing for the next big move.

Tactical plan:

— Entry: by market

— Targets: $5.73 → $6.51 → $7.50

— Stop: below $4.00 or trendline

If a stock sleeps for 2 years and forms a golden cross — it’s not snoring, it’s preparing for liftoff. The only thing left? Don’t blink when it moves.

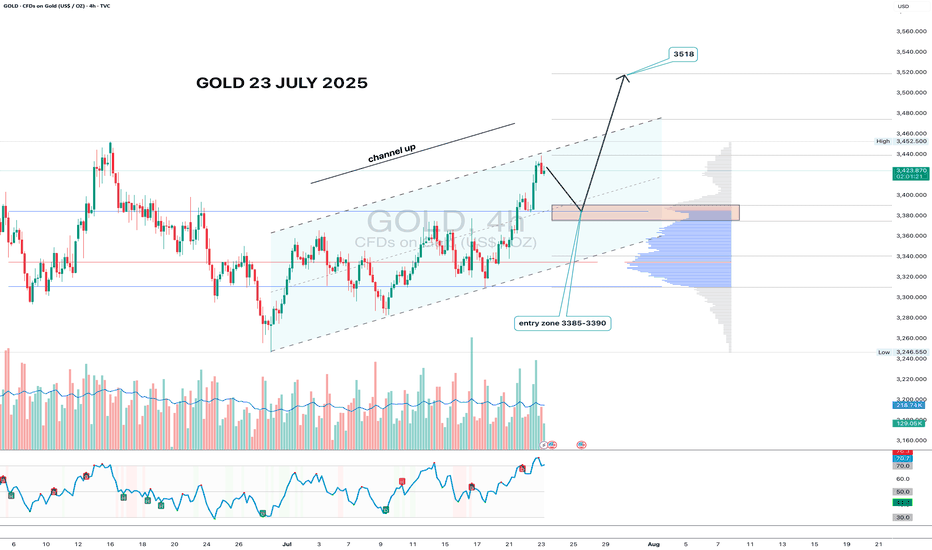

Gold 4H - channel breakout, looking for 3518 nextGold has formed a clean ascending channel on the 4H chart, broke out above resistance, and is now pulling back into the 3385–3390 zone. This area aligns with volume clusters - a perfect entry zone for bulls waiting on the sidelines.

If price holds this zone and prints a reversal candle with volume, the upside target remains at 3518 - the 1.618 Fibonacci extension and historical resistance. Volume increased during the breakout move, confirming interest. RSI still has room to go higher, supporting the bullish continuation.

Fundamentally, gold remains a safe-haven asset amid geopolitical tension, USD weakness, and potential Fed easing. Central bank accumulation further supports the bullish case.

Tactical setup:

— Entry zone: 3385–3390

— Trigger: candle confirmation + volume

— Target: 3518

— Invalidation: break below 3360 without buyer volume

If the plan plays out — gold might shine bright while bears squint in disbelief.

TradingView Show: Trade Ideas You Can't Miss with TradeStationJoin us for a timely TradingView live stream with David Russell, Head of Global Market Strategy at TradeStation, as we break down the latest rebound in the markets and what it could mean for traders and investors. In this session, we’ll dive into:

- New sectors to watch, like homebuilders

- Prior insights on companies like Coinbase and Micron

- What trades are setting up, why, and educational concepts to plan for them

- Upcoming economic news and more to have on your calendar

- Key charts, indicators, and technical patterns to watch for signs of sustained momentum

- Essential strategies for navigating market recoveries, corrections, and upcoming Federal Reserve decisions

Bonus: Discover our latest broker integration update with TradeStation—now supporting equity options trading directly on TradingView. This upgrade brings advanced tools like the strategy builder, options chain sheet, and volatility analysis to your fingertips, making it easier to trade through uncertain market conditions.

This session is sponsored by TradeStation, whose vision is to provide the ultimate online trading platform for self-directed traders and investors across equities, equity index options, futures, and futures options markets. Equities, equity options, and commodity futures services are offered by TradeStation Securities Inc., member NYSE, FINRA, CME, and SIPC.