Tradingviewindia

GOLD - at resistance ? Holds or not??#GOLD.. .market perfect dropped below our area that was around 3320

Now market bounced back and just near to his resistance area 3295 96

That will be market final area and only holdings of that region means another drop expected.

Note: we will plan for cut n reverse above that region.

Good luck

Trade wisely

GOLD - at CUT n REVERSE Area? holds or not??#GOLD.. market palced around 3317 18 as day low so far but hour closed above 3323 that was our area.

so keep close our region that is around 3320 to 3323

that is our ultimate region for now and if market hold it in that case we can expect bounce again

NOTE: below 3320 we will go for cut n reverse on confirmation.

good luck

trade wisely

GOLD - at CUT n REVERSE area? Holds or not??#GOLD ... Perfect holdings of our upside resistance area that was actually 3357

And now market just at his current ultimate supporting area, that is 3336-37

Keep close that area and if market thold it in that case we can expect again bounce otherwise not.

NOTE: we will go for cut n reverse below 3336-37

Good luck

Trade wisely

GOLD- at CUT n REVERSE Region? What's next??#GOLD - perfect drop after Iran Israel casefire and now market just reached at his current ultimate swing region.

That is around 3343 to 3346-47

Keep close that region and only hold buying positions above tha.

NOTE: we will go for cut n reverse belowt that in confirmation .

Good luck

Trade wisely

#USOIL - CUT n REVERSE region, still holds??#USOIL.. well guys in first go market perfectly holds our region then again n again..

Now again. Market is in our resistance region and if market hold again then again drop expected.

But

Keep in mind that above that region new will go for cut n reverse on confirmation .

Good luck

Trade wisely

DOGEUSDT - near support? Holds or not??#DOGEUSDT... market just reached near his supporting area even ultimate area. That is around 0.10 and current market price is around 0.15

If market holds current supporting area then we can expect a bounce from here.

Below 0.10 we will never see again bounce ... Note that.

Good luck

Trade wisely

GOLD - At CUT n REVERSE Region? Holds or not??#GOLD .. perfect move as per our analysis and now market just at his CUT N REVERSE region, that is around 3367-68 to 3370-71

Keep close that region because that is our ultimate region of the week and month.

Only holdings of that region means you can see again bounce for now otherwise not.

NOTE: we will go for cut n reverse below that region on confirmation.

Good luck

Trade wisely

USOIL - Near CUT n REVERSE Area? holds or not??#USOIL.. straight bounce after #IranvsIsrael war situation, and now market just reached near to his current Resistance Area / region

keep close that region and if market holds then drop expected otherwise not at all.

NOTE: we will go for cut n reverse above region on confirmation.

good luck

trade wisely

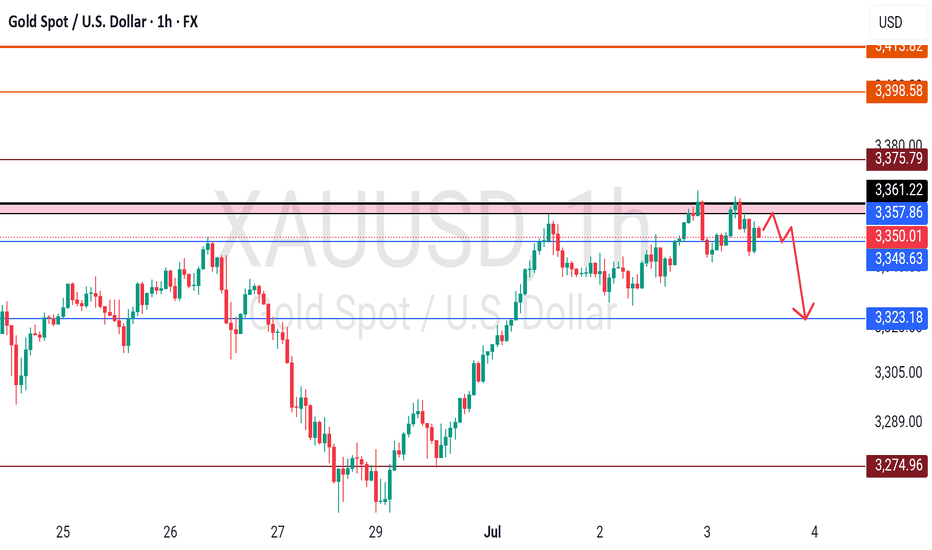

GOLD - at resistance, what's next??#GOLD .. perfect bounce from our supporting area as we discussed in our weekly analysis video and now market have today most important resistance 3398.50

Keep close that area and if market hold then drop expected from here.

Note: we will go for cut n reverse above 3398 on confirmation .

Good luck

Trade wisely

GOLD - Near to his resistance region? Cut n reverse area??#GOLD.. .market just reached near to his current resistance region that is around 3451-52 to 3460-61

Keep close that mentioned region and keep in mind that is our ultimate region and only short expected below that.

Note: we will go for cut n reverse abo w that region on confirmation.

Good luck

Trade wisely

GOLD - where is current support? What's next??#GOLD.. perfect move as per our last idea regarding gold with fundamental support of Israel attacked.

Now market have 3410-11 as immediate supporting area and if market sustains above that then we can expect further push to upside.

Good luck

Trade wisely

GOLD - at support ? Holds or not??#GOLD - well guys in today we have 3323-24 as a immediate n most important support of the day.

Keep close and if market thold it in that case we can expect a bounce from here.

Note: keep in mind that we will go for cut n reverse below that on confirmation.

Good luck

Trade wisely