DHI, DR Horton Inc. - Head & Shoulders BreakoutNYSE:DHI

Typical pattern of reversal of a trend in financial markets. Entry on the breakout of the neckline and management of the trade in trailing stop for a greater possible risk reward. The question is, "Which Broker and which financial instruments could you trade best with?" In this case, I use stocks securing them through options. This is one of my strategies that I have in my trading plan, knowing the average return compared to the risk used.

Trading is not a way to make profits by risking enough, but rather to manage the risks in the best possible way by making big profits and small losses.

Trailingstop

ANA, Acciona S.A. - Breakdown on Descending TriangleBME:ANA

Broken very well the support of this clear descending triangle. If we consider the height of this pattern the Risk Reward is 3.8/1 therefore seen the speed of the short positions with respect to the long ones, the return on the allocation is very fast if the target is reached.

CBT, Cabot Corp. - Rectangle ready to BreakoutNYSE:CBT

What would I do when the price comes close on these two clear levels?

I will be on the side where the statistic gives favorable results.

If you are curious soon you will receive information that you can use to learn how to trade in the financial markets.

Trading is not particularly difficult or unusual.

A company also trades: on products, on services, on employees.

If you do not trade (of any kind), someone else will do it on your time...

So Stay Tuned and soon there will be news.

How to connect your indicator with the Trade ManagerHi everyone

On Today's tutorial, I wanted to highlight how you can upgrade your own indicator to work with the Trade Manager

Let's take the dummy example of the double MM cross

Step 1 - Update your indicator

Somewhere in the code you'll have a LONG and a SHORT condition. If not, please go back to study trading for noobs (I'm kidding !!!)

So it should look to something similar

macrossover = crossover(MA1, MA2)

macrossunder = crossunder(MA1, MA2)

What you will need to add at the very end of your script is a Signal plot that will be captured by the Trade Manager. This will give us :

// Signal plot to be used as external

// if crossover, sends 1, otherwise sends -1

Signal = macrossover ? 1 : macrossunder ? -1 : na

plot(Signal, title="Signal")

The Trade Manager engines expects to receive 1 for a bullishg signal and -1 for bearish .

Step 2 - Add the Trade Manager to your chart and select the right Data Source

I feel the questions coming so I prefer to anticipate :) When you add the Trade Manager to your chart, nothing will be displayed. THIS IS NORMAL because you'll have to select the Data Source to be "Signal"

Remember our Signal variable from the Two MM Cross from before, now we'll capture it and.....drumb rolll...... that's from that moment that your life became even more AWESOME

The Engine will capture the last signal from the MM cross or any indicator actually and will update the Stop Loss, Take Profit levels based on the parameters you set on the Trade Manager

I worked the whole weekend on it because I wanted to challenge myself and give you something that I will certainly use in my own trading

Please send me some feedback or questions if any

Enjoy

Dave

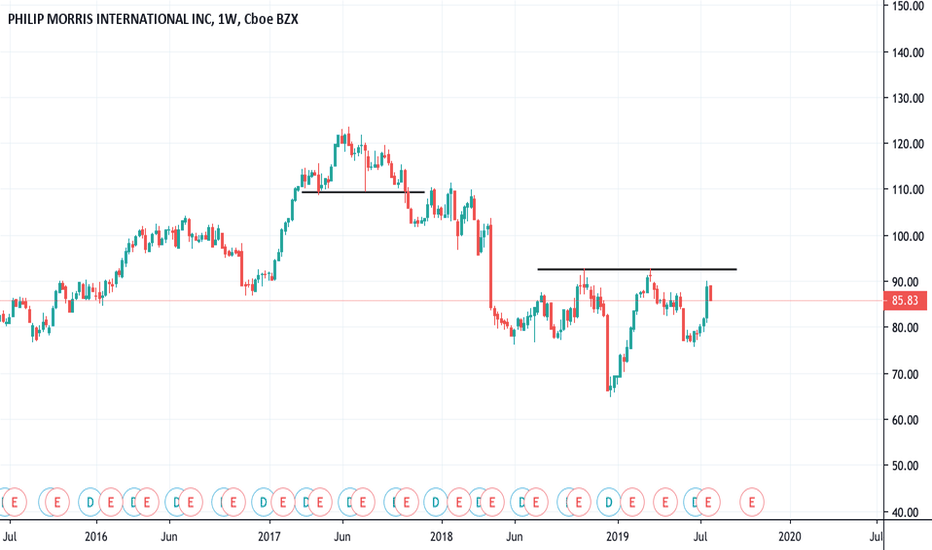

PM, Philip Morris International Inc.- Head & ShouldersNYSE:PM

Do you know this pattern? The so-called head and shoulders in the analysis of financial markets is an opportunity to be taken if you trade. Do you know why? It's all about math and probability. Staying on the statistical side in your favor is what creates potential financial growth, which in turn will give you time to do what you like.

Broadridge Financial Solution Inc. - "Trade of the Month"NYSE:BR

Our Long position on BR was the trade of the month with a 10-fold gain over the potential loss.

As always, Risk Reward and % Profitability are the fundamental data to evaluate the efficiency of your way of trading, in addition to the Mind-Set.

BEST 15M TRADE STRATEGY USING MOST CURRENT PROGRAMED INDICATORS THIS SHORT TERM TRADING STRATEGY IS USING THE MOST CURRENT PROGRAMED INDICATORS TODAY

IN THE MARKET.

Trade pairs with no news that trading session.

Trade daily trend of either the current 4H or Day chart (MACD/SIGNAL LINES, 5/10EMA LINES SHOW DIRECTION).

US session - trade anytime after CLOSE of 1st 15m bar as NYSE opens - 9:30 am ET.

Asian session - trade anytime after CLOSE of 1st 15m bar as JPY opens - 8 pm ET.

UK session - Trade anytime after CLOSE of 1st 15m bar as GBP opens - 3 am ET.

Add Kijun-Sen indicator - The Kijun-sen also means "base line" and is the mid-point of the 26-period high and low. When the price is above Kijun-sen then short- to medium-term price momentum is up (price below momentum is down). This indicator determines trade directional bias.

Add volume indicator - check volume MA box: shows you the average atr value line (choose whatever color).

Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

We look for the volume bar to have reached the volume ma line to trade 100% position size or at least reach. 75% to the volume ma line to trade 1/2 position size. Do not trade if these rules are not met. (Reset setup).

Add %R indicator - Period 10, levels -20/-80, add -50 level, your own line color preference.

Williams %R, also known as the Williams Percent Range, is a type of momentum indicator that moves between 0 and -100 and measures overbought and oversold levels. The Williams %R may be used to find entry and exit points in the market.

We look for oversold condition below -80 level to confirm short entry or over bought condition above the -20 level to confirm long entry. This is contrary to past training but this works best on smaller time frames for the %R indicator.

Add Macd - faster settings of 12 - 17 - 9, Histogram only, make all bars red & green, uncheck macd & signal lines.

We look for histogram bars to be moving towards the zero line or a cross over of the zero line to confirm entry.

Trade Management: trade anytime after trading session candle CLOSED.

1 - Position size (compare volume bar to volume ma line).

a - Candle must have reached the average volume line 100% for a full position size.

b - If 75% of average volume line then ½ position size.

2 - Enter two trades.

3 - SL for both trades will be 5 pips above Kijun-Sen+ line.

4 - 1st trade TP will be 12 pips or 1 x ATR of pair.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price or exit if price stalls.

EURAUD 15m Short Trade - 1st 15m candle close of NYSE open.

1 - Price below Kijun-Sen+ base line so bearish bias.

2 - Volume bar at ATR average line so price has momentum - trade 100% position size.

3 - %R oversold below -20 level confirms entry.

4 - Macd with red bar below 0 line confirms entry.

5 - 1st TP hit - 2nd trade SL moved to breakeven.

6 - As price continued to fall 2nd trade SL followed highs of previous candle to current price candle.

7 - Either SL was hit or exited trade because price candles stalled sideways.

Cyatophilum Bands Pro Trader V4

Hello,

This version includes a new feature, engineered to increase profitability.

About the backtest below:

Short + Long Strategy

0.05% Commission

10% of 10 000% equity per trade. Net Profit can be increased with a bigger % of equity.

Strategy data from 01/11/2019 to 30/04/2019

The Cyatophilum Bands, Trailing Stop Loss and Take Profit System are explained in the last version:

The access to this indicator and its Alert Setup version are included in the Cyatophilum Indicators pack available on my website blockchainfiesta.com

To get a free trial, leave a comment, thank you.

BITCOIN INDICATOR - ALL MARKETS/TIME FRAMES - BOTH DIRECTIONSBitcoin Signal Indicator trades all markets and time frames

Bitcoin Signal Indicator trades both directions

Bitcoin Signal Indicator finds Entry Point - TP - SL

Bitcoin Signal Indicator SL will adjust to a trailing stop as trades profits

PM me if you have any questions i can help you with on our Bitcoin Signal Indicator

Intermediate Trading Strategy - Part 3In the previous post we discussed risk:reward, profit taking and trailing stop losses. If you have not read part 1 and part 2 then you are highly recommended to start there.

Taking Profit

Always taking partial profits, never making decisions for the full position. This is true when entering and this is true when exiting. It minimizes anxiety and emotional decision making.

In Trending Markets: Stop loss is trailed once new highs/lows are established. If long then move it up to be slightly under the recent low and if short move it slightly above the most recent high. This can generally be illustrated with Bill Williams Fractals on the weekly and daily charts. Full profit can be taken on the third test of a trendline.

In Parabolic Markets: I like to gamble on house money, it makes me feel much more comfortable about the draw downs. Here is an example for how to take profits in a parabolic market: If +100% then take 10%-20% off the table. If +100% again then take another 15%-25% off the table. Keep doing this as long as price is making all time highs.

Take full profit if phase 4 or phase 3 of hyperwave is violated

If weekly and daily RSI (with 30 setting) are > 80 then take full profit. If Welles Wilder’s ADX is > 50 on the weekly and/or > 60 on the daily then time to take full profit.

For Bitcoin' watch for NVT to reach overbought zones and consider how this metric will be affected by Lightning Network and batching transactions.

If Trading a Pattern: A chart pattern will indicate a profit target. If your reason for entering the trade was the chart pattern then do not get greedy with the profit target! Relying on a trailing stop will often cause a trader to miss out on a large part of the profit when trading a pattern.

Be very specific about what you are investing in long term/hodling and what you are using to trade.

If investing/hodling then put into cold storage and don’t do anything for a minimum of 10 years.

In the final post we will delve into the best indicators and provide guidelines for when they are most effective.

Simple Trailing Buy & Stop StrategyAllows backtesting of different percentage Trailing Stops, with entries based on percentage based Trailing Buys.

On 4hr, 1.5% trailing stop, and 1.9% trailing buy worked best. On Daily, 4.3% trailing stop, and 1.9% trailing buy worked best. This version is for Longs only. Will write a Short and Long version next.

Are You Cutting Your Winners Short by Trying to be Right?Good trading is a curious mix between taking profits when the market makes them available, and letting profits run to capture big wins.

The problem is that, more often than not, this decision is dictated by emotion rather than reason.

Instead of trusting the statistics behind our edge, we focus on trying to be right on our current position.

Trading is a statistical game

Top traders know their probabilities. They recognise that no matter the quality of their analysis, once they have entered their position, it may or may not go for them.

If they start to second-guess which ones will go and which won’t, then chances are they will cut themselves out of some winners and degrade their system in the process.

Understand the move you are looking to capture

One of the first things to do when developing a system is to get very clear on the moves you are looking to capture.

Once you have identified the types of opportunities you are looking for, you can create a “rule-based” plan to capture those moves with the best risk/reward possible.

You should garner an understanding of how often the moves occur, how long they typically last, and how big the pullbacks can get.

How the need to be “right” manifests itself when exiting

There are three main ways that trying to be right interferes with our exits. This can happen both in the system development phase, and when trading live.

We take profit without a clear exit signal. Be cautious not to take profit just because the market has gone your way. Wait for your pre-determined exit signals, or wait for your objective to be hit.

We trail our stop-loss too tightly. Currency moves can require wide stops, so give the trade room to breathe. It’s no fun being whipsawed out of a trend because of your fear that it might end. Wait for the trade to be well in your favour before trailing your stop.

Moving the stop to breakeven. A breakeven stop can be a good thing. However, if you find you are getting stopped out of winning trades because you have quickly moved your stop to breakeven, then perhaps it is not serving the best purpose.

I’m sure there are several other ways this bias appears in our trading, so remain self-aware.

Journal your interference

Perhaps you are a guru with the skill to know exactly when to get out of your positions.

How to tell?

Make sure you mark in your journal any discretionary exit decisions you make. That way, you can track how well they compare to a “rules-based” approach.

Alternatively, you can allow yourself a small percentage of the position to add and remove at will. By increasing our options this way, we feel good about being right, while still letting our profits run on the majority of the trade.

Good Luck!

XPloRR S&P500 Stock Market Crash Alert GeneratorXPloRR S&P500 Stock Market Crash Alert Generator

Long-Term Trailing-Stop study detecting S&P500 Stock Market Crashes/Corrections and showing Volatility as warning signal for upcoming crashes

Detecting or avoiding stock market crashes seems to be the 'Holy Grail' of strategies/studies.

This study detects all major S&P500 stock market crashes and corrections since 1980 depending on the Trailing Stop Smoothness parameter. The 5 crashes/corrections of 1987, 1990, 2001, 2008 and 2010 were successfully detected with the default parameters.

With the default parameters this study generates 5954% profit, with 6 closed trades, 100% profitable, while the Buy&Hold strategy only generates 2427% profit, so this strategy beats the Buy&Hold strategy by 2.45 times!

The script shows a lot of graphical information:

the green area shows a trading period (between buy and sell)

the close value is shown in light-green. When the close value is temporarily lower than the buy value, the close value is shown in light-red. This way it is possible to evaluate the virtual losses during the trade.

the trailing stop value is shown in dark-green.

the EMA and SMA values for both buy and sell signals are shown as colored curves

the Volatility is show below in green and red. The alert threshold (red) is default set to 200 (see Volatility Warning Threshold parameter below)

Trailing Stop Smoothness value:

Adjust the Trailing Stop Smoothness parameter to hide/show smaller corrections/crashes:

96: 6 trades, 100% profit, 5954% profit, detected crashes: 1987, 1990, 2001, 2008, 2010

90: 8 trades, 100% profit, 5347% profit, detected crashes: 1984, 1987, 1990, 2001, 2008, 2010, 2011

74: 9 trades, 100% profit, 4964% profit, detected crashes: 1984, 1987, 1990, 2001, 2008, 2010, 2011, 2015

41: 10 trades, 100% profit, 4886% profit, detected crashes: 1984, 1987, 1990, 1998, 2001, 2008, 2010, 2011, 2015

How to use this alert generator?

Add to your alerts to get an automatic warning (via e-mail) of an upcoming stock market crash

Optimize parameters using the strategy settings icon, you can increase/decrease the parameters

More trades don't necessarily generate more overall profit. It is important to detect only the major crashes and avoid closing trades on the smaller corrections. Bearing the smaller corrections generates a higher profit.

Watch out for the volatility alerts generated at the bottom (red). Threshold can by changed by the Volatility Warning Threshold parameter (default 2% ATR). In almost all crashes/corrections there is an alert ahead of the crash.

Although the signal doesn't predict the exact timing of the crash/correction, it is a clear warning signal that bearish times are ahead!

The current correction in march 2018 is not yet a major crash but there was already a red volatility warning alert. If the volatility alert repeats the next weeks/months, chances are higher that a bigger crash or correction is near.

As can be seen in the graphic, the deeper the crash is, the higher and wider the red volatility signal goes. So keep an eye on the red flag!

Information about the parameters: see below

If you are interested in buying this S&P500 Stock Market Crash Alert Generator, please drop me a message to receive the code (Price 99$).

BCHUSD 4H BITCOIN INDICATOR SIGNAL STRATEGYThis is the Bitcoin Signal Strategy indicator

It finds when price breaks out of our proprietary ATR channel lines

Short or Long signals are painted on the chart

Stop Loss is red signal line based on a 2 to 1 risk ratio

Stop Loss is then a trailing price stop loss as price continues it move

Target Profit is blue signal line based on a 2 to 1 risk ratio

Trade will exit when price hits the blue take profit signal line

PM me if you would like more information. I will be happy to help

XPloRR S&P500 Stock Market Crash Detection StrategyXPloRR S&P500 Stock Market Crash Detection Strategy

Long-Term Trailing-Stop strategy detecting S&P500 Stock Market Crashes/Corrections and showing Volatility as warning signal for upcoming crashes

Detecting or avoiding stock market crashes seems to be the 'Holy Grail' of strategies.

Since none of the strategies that I tested can beat the long term Buy&Hold strategy, the purpose was to detect a stock market crash on the S&P500 and step out in time to minimize losses and beat the Buy&Hold strategy.

So beat Buy&Hold strategy with less then 10 trades. 100% capitalize sold trade into new trade.

With the default parameters the strategy generates 5954% profit, with 6 closed trades, 100% profitable, while the Buy&Hold strategy only generates 2427% profit, so this strategy beats the Buy&Hold strategy by 2.45 times!

Also the strategy detects all major S&P500 stock market crashes and corrections since 1980 depending on the Trailing Stop Smoothness parameter, and steps out in time to cut losses and steps in again after the bottom has been reached. The 5 crashes/corrections of 1987, 1990, 2001, 2008 and 2010 were successfully detected with the default parameters.

The script shows a lot of graphical information:

the close value is shown in light-green. When the close value is temporarily lower than the buy value, the close value is shown in light-red. This way it is possible to evaluate the virtual losses during the trade.

the trailing stop value is shown in dark-green. When the sell value is lower than the buy value, the last color of the trade will be red (best viewed when zoomed)

the EMA and SMA values for both buy and sell signals are shown as colored curves

the buy and sell(close) signals are labeled in blue

the Volatility is show below in green and red. The alert treshold (red) is default set to 200 (see Volatility Warning Treshold parameter below)

Trailing Stop Smoothness value:

Adjust the Trailing Stop Smoothness parameter to hide/show smaller corrections/crashes:

96: 6 trades, 100% profit, 5954% profit, detected crashes: 1987, 1990, 2001, 2008, 2010

90: 8 trades, 100% profit, 5347% profit, detected crashes: 1984, 1987, 1990, 2001, 2008, 2010, 2011

74: 9 trades, 100% profit, 4964% profit, detected crashes: 1984, 1987, 1990, 2001, 2008, 2010, 2011, 2015

41: 10 trades, 100% profit, 4886% profit, detected crashes: 1984, 1987, 1990, 1998, 2001, 2008, 2010, 2011, 2015

How to use this Strategy ?

Look in the strategy tester overview to optimize the values Percent Profitable and Net Profit (using the strategy settings icon, you can increase/decrease the parameters), then keep using these parameters for future buy/sell signals on the S&P500.

More trades don't necessarily generate more overall profit. It is important to detect only the major crashes and avoid closing trades on the smaller corrections. Bearing the smaller corrections generates a higher profit.

Watch out for the volatility alerts generated at the bottom (red). Threshold can by changed by the Volatility Warning Threshold parameter (default 200 = 2% ATR). In almost all crashes/corrections there is an alert ahead of the crash.

Although the signal doesn't predict the exact timing of the crash/correction, it is a clear warning signal that bearish times are ahead!

The current correction in march 2018 is not yet a major crash but there was already a red volatility warning alert. If the volatility alert repeats the next weeks/months, chances are higher that a bigger crash or correction is near.

As can be seen in the graphic, the deeper the crash is, the higher and wider the red volatility signal goes. So keep an eye on the red flag!

To use this strategy for future trades, set the end date past today and set the Sell On End Date value to false

Information about the parameters: see below

UUSDJPY trend is broken, correction is comingI has already shared my opinion about USDJPY market at the beginning of this week, an this idea is quite profitable for me today. Follow me for getting more valuable ideas :)

Now we have one important trend line broken and it gives opportunity to open some very safe positions, with TP/SL coefficient around 6. I have added to my position and see 2 goals here - Moving Averages and the old one - weekly trend line. My plan is to close half on each. In the MAs area I am going to turn my trailing stop on (500 points). In the case of SL and turning up again I will reopen. Anyway I'll post my progress on this idea.