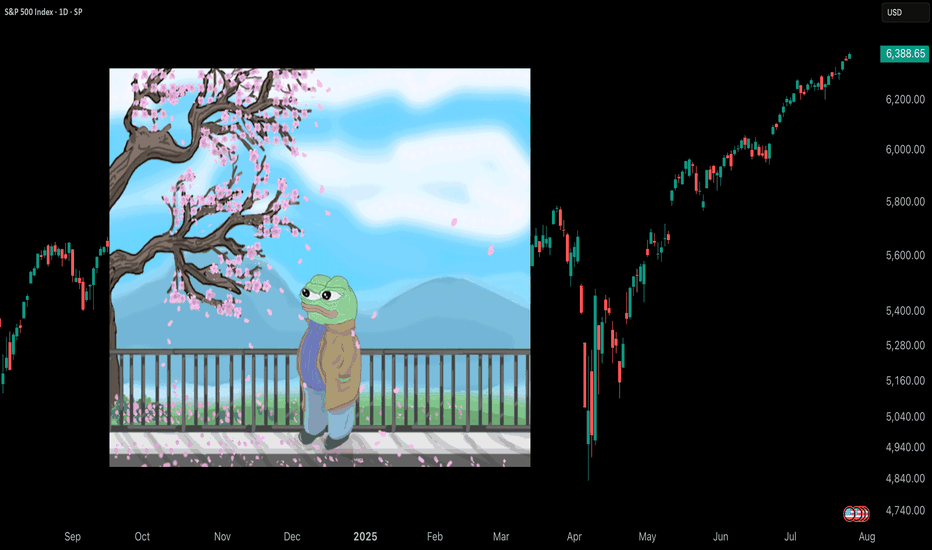

Patience Through VolatilityThere's something the market teaches you over time that no book, course, or checklist ever really prepares you for - “how to live with uncertainty” .

It's amazing how quickly the market can make you doubt yourself. You can be doing everything right - following your process, managing your risk, sticking to your plans, and then volatility hits. Suddenly, nothing seems to make sense. The moves feel random. Your setups fail. Your confidence fades. You start questioning not just your trades, but yourself.

You'll have stretches where patience feels like the hardest thing in the world. Watching markets whip up and down without direction, sitting on your hands when you want to trade just to feel in control again, it's exhausting in a different way. It's not the exhaustion of doing too much. It's the weight of doing nothing when your instincts scream at you to act.

That’s the part most people don’t talk about. It’s not the losing trades that break most traders, it’s the feeling of being stuck. The uncertainty of not knowing when the noise will fade. The frustration of watching opportunities slip by without a clear way to take part. It’s the slow grind of sitting through volatility while your discipline quietly wears down, day after day.

Patience isn’t something you can show off. Most of the time, it looks like doing nothing. And often, it feels like falling behind.

Good trading isn't about finding opportunities in every move, it's about knowing when the market favours you, and when it doesn't. It's about understanding your edge and protecting it.

Some environments aren't built for your system, your style, or your strengths. Volatile markets don't offer you clean setups or easy entries. They offer noise, confusion, and temptation.

Most traders don’t struggle because of volatility itself, but because of the impatience it creates. They force trades. They chase moves. They try to squeeze something out of the market simply because the waiting feels unbearable.

But waiting is not a weakness. Sitting still is not inaction. Restraint is a skill.

Your progress won’t always be visible. It won’t always show up on a chart at the end of the day. Sometimes, progress is simply preserving your capital. Sometimes, it’s maintaining your discipline. And sometimes, it’s protecting your mindset so you’re ready when the right opportunities finally come back into focus.

You have to learn to stomach the discomfort of volatility without tying your self-worth to every swing in your account. The noise always feels permanent in the moment. Doubt grows louder. You start questioning your system, your progress, and even yourself. (More on this in a future post.)

That's normal.

What matters is what you do with those feelings. Whether you let them push you into reckless trades just to feel something again, or whether you have the maturity to sit still, protect your capital, protect your mindset, and wait.

There’s no hack for this. No shortcut. Patience is something you earn the hard way - forged in boredom, frustration, and the silence between trades. Patience isn’t about passively waiting; it’s about actively protecting yourself, your energy, your future self from the damage you could cause today.

Not every moment in the market is meant for action. Not every day is meant for progress. Some days, weeks, or even months are simply about survival. Some seasons are for growth, and others are just for holding on. Knowing the difference is what keeps you in the game long enough to eventually see the rewards.

The market will calm. Patterns will return. Opportunities will align. Your edge will reappear. The chaos always fades. The clarity always returns. When it does, you want to be ready - not emotionally drained, not financially wrecked, and not scrambling to recover from the mistakes impatience forced on you.

But if you lose patience and start chasing just to feel active, you risk more than money. You risk undoing the very discipline you’ve worked so hard to build.

Volatility will always test you. That's its nature. Patience will always protect you. That's your choice.

If you’re in one of those stretches right now - high volatility, failing setups, doubt creeping in; remind yourself this is part of the process. It’s normal, and it’s not the time to force progress.

Let the market burn itself out.

If you can do that, you’ll find yourself ahead, not because you forced results, but because you endured the pain when others couldn’t.

The rewards won’t come from predicting the next move. They’ll come from knowing you didn’t let the storm in the market create a storm within you.

Trust that clarity will return. Your only job is to make sure you’re still here when it does.

There’s strength in waiting. There’s wisdom in restraint.

TradingView Tips

You Are NOT Your P<here was once a tree that stood alone at the edge of a cliff, overlooking the vast sea.

Some days, the sun shone bright, the winds gentle, the water below calm and peaceful. Other days brought heavy storms, fierce winds, crashing waves, rain so relentless it seemed the skies might never clear again. The seasons came and went. The skies changed again and again. But the tree never thought of itself differently because of the weather.

It did not feel more valuable on a sunny day. It did not feel broken or weak when storms battered its branches. The tree simply stayed rooted. It understood something quietly powerful - “ the weather was never personal. It wasn’t about the tree.”

The tree remained, growing slowly over years, not because the conditions were always perfect, but because it had learned to stand through all of it.

This is something most traders forget.

We step into the market with good intentions, hungry to learn, eager to succeed. But somewhere along the way, we make a mistake. We let our self-worth become tied to the numbers on the screen.

A green day makes us feel smart, in control, like we’ve cracked the code. A red day, on the other hand, shakes us to the core, makes us question our place, our skill, even our worth, like we never belonged here at all.

The danger isn’t just in the financial losses. It’s in how we let the market shape how we see ourselves.

But here’s the truth the market won’t tell you upfront: the market doesn’t know who you are, and it doesn’t care . It doesn’t remember what you did yesterday, how many hours you’ve spent learning, or how desperately you want this to work.

The market moves how it moves. Sometimes it moves with you, sometimes it moves against you. It’s neither a punishment, nor a reward. It’s just movement.

Your wins don’t make you superior. Your losses don’t make you dumb. Both are part of the same cycle, and part of the environment you’ve chosen to work in. If you build your self-image on the outcome of your last trade, you’ll forever live on a fragile edge. Every swing will shake you. Every drawdown will feel like a verdict on who you are.

But trading isn’t about who you are today. It’s about who you become over time.

Your job isn’t to seek approval from a system built on randomness and probability. Your job is to build yourself on steadier ground. To stay rooted, like a tree. To let your process define you, not your P&L.

The storms will come. They always do. Volatility, uncertainty, periods where nothing seems to work - these are all part of the environment. The traders who survive are NOT the ones who try to outmuscle the market. They are the ones who protect their capital, their energy, and their mindset through it all.

They understand that being steady is more important than being brilliant - that surviving is more valuable than being right.

Detach your self-worth from the swings. Build your identity on discipline, patience, humility - the quiet habits you control. These are your roots. And when the storm rolls in, they’re what keep you grounded.

When you stop tying your self-image to your short-term results, you begin to see the market more clearly. You stop forcing trades to make yourself feel better. You stop chasing moves to prove something. You start letting your process do its work, even when it feels slow.

You start to realise that progress in trading is quiet and unfolds slowly, almost invisibly, much like a tree growing through the seasons. Small shifts accumulate over time, often going unnoticed, until one day you look back and truly see how far you’ve come.

When you understand this, red days lose their sting. Green days lose their arrogance. Both just become part of the weather. You adapt, endure, and move forward.

You don’t measure yourself by how much you made this week, this month, or even this year. You measure yourself by how well you followed your process , how calmly you handled the volatility, and how patient you remained when there was nothing to do.

The market doesn’t ask for perfection - only consistency. And consistency comes from within, not from chasing highs or avoiding lows, but from standing firm through both.

Like the tree on the cliff, your strength is not in avoiding the weather. Your strength is in understanding that the weather will pass. It always does. Your roots - your process, your discipline, your patience, are what keep you standing until it does.

⦿ Learn to protect your energy.

⦿ Learn to lose without self-doubt.

⦿ Learn to win without ego.

⦿ Learn to wait without fear.

⦿ Learn to wait patiently

Your worth is not in your wins or losses. It’s in how you carry yourself through both.

Stay rooted.

The seasons will change.

And when they do, you’ll still be here, stronger than you were before.

Survival First, Success LaterThere was once a stone that lay deep in the heart of a flowing river.

Every day, the water rushed past it, sometimes gently, sometimes with force. The stone wanted to stay strong, unmoved. It believed that by holding its ground, it could outlast the river.

For years, the stone resisted. It didn’t want to change. It believed that strength meant standing still, no matter how hard the current pulled.

But slowly, almost without noticing, the stone began to wear down. The river wasn’t trying to destroy it. The water wasn’t cruel. It was simply doing what rivers do - moving, shifting, carving its own path.

One day, the stone realised it wasn’t the same shape anymore. It was smoother now, smaller in places. It hadn’t won by resisting. It had survived by adapting. It had learned to let the river shape it without breaking it apart.

The stone couldn’t control the river. All it could do was endure without letting itself be shattered.

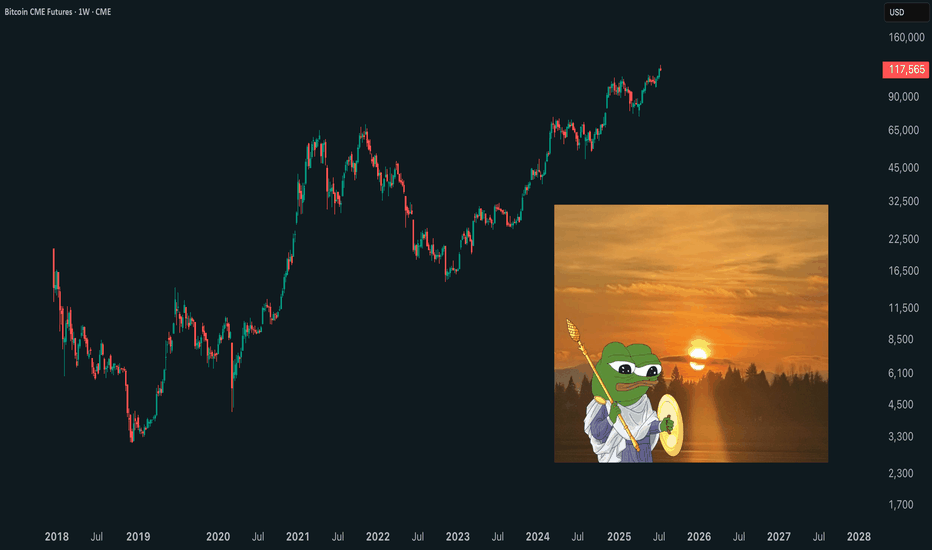

Trading is NOT so different.

The market moves like a river. It doesn’t care if you want it to go left or right. It doesn’t reward those who stand rigid against its flow. It rewards those who learn when to hold their ground, when to let go, and how to survive the constant pull of forces bigger than themselves.

This is NOT a story about rivers and stones. It’s a story about YOU.

About learning to endure without breaking. About understanding that survival comes not from fighting the current, but from learning how to live within it.

Much like the stone, every trader begins with the same illusion, that strength means control, that certainty can be conquered with enough knowledge or willpower.

But time in the markets teaches you otherwise. It shows you, again and again, that survival isn’t about resisting the flow. It’s about learning to move with it, to protect yourself from the inevitable storms without being broken by them.

And so, this is where the real story of trading begins.

Trading often appears simple from a distance. You buy, you sell, you make a profit, and then you repeat the process.

But anyone who has spent enough time in the markets will tell you the truth. This isn’t a game of certainty. This is a game of survival.

The market humbles you early. It doesn’t care how much you know, how brilliant you think you are, or how much confidence you bring. The market doesn’t reward ego; it breaks it down piece by piece.

Almost everyone starts with the same mindset. You want to win. You want to make money. You believe you can figure it out if you study hard enough, work smart enough, hustle more than the next person.

But eventually, reality steps in. You begin to understand this game isn’t about knowing where the price will go next. It’s about knowing where you will stop, where you will cut a loss, where you will step aside and wait.

The traders who survive are not the ones who chase perfection or seek to predict every move. They are the ones who learn how to lose properly - small losses, controlled losses. Losses that don’t bleed into something bigger, mentally or financially.

Most people can’t do that. They fight the market. They fight themselves. They refuse to accept small losses, believing they can somehow force a different outcome.

Those small losses eventually snowball. Blowups rarely come from one bad trade. They come from ignoring the small signs over and over again. The market isn’t cruel. It’s just indifferent. It’s your responsibility to protect yourself.

Good trading isn’t loud. It isn’t exciting. It isn’t full of adrenaline and big calls.

Good trading is quiet, repetitive, and frankly, a little boring. It’s built on discipline, not drama. Your job is to manage risk, protect your capital, and let time do its work.

There is no holy grail. There is only process. A process you can repeat with a clear head, day after day, year after year, without losing yourself in the noise.

Wins will come. Losses will come. Neither defines who you are. What defines you is how you respond.

⦿ Can you stay calm after a red day?

⦿ Can you follow your plan even after a mistake?

⦿ Can you sit on your hands when there’s nothing to do and trust the work you’ve already done?

Patience, in the end, is the real edge. Most won’t have it.

They’ll bounce between strategies, searching for certainty where none exists. They’ll burn out chasing shortcuts. They’ll forget that progress comes through small, steady steps taken over years, not through chasing big wins.

Trading is a mirror. It reflects your fear, your greed, your impatience. It shows you who you really are. Ignore what it reveals and you’ll keep paying for the same lesson until you finally learn it.

In the end, this game isn’t about the market. It’s about YOU.

⦿ Learn to protect yourself.

⦿ Learn to sit with boredom.

⦿ Learn to lose well.

⦿ Learn to wait without losing faith.

If you can do that, the market has a way of rewarding you in time.

If You’re Bored, You’re Probably Doing It RightYou think trading should be exciting?

That every day should feel like a high-stakes chess match?

That if it doesn’t feel intense, something’s wrong?

Nope.

Good trading is boring.

Systematic.

Repetitive.

Unemotional.

You take your setup. You size properly. You respect your stops. You move on.

Same rules. Same routine. Same process.

It’s not sexy. But it’s stable.

The truth?

The more exciting your trading feels, the more likely you’re slipping.

Overleveraging. Overtrading. Overreacting.

Boredom isn’t a bug. It’s a feature.

It means you’re not chasing.

You’re not forcing.

You’re following your edge — and letting the numbers do the heavy lifting.

You don’t need adrenaline.

You need consistency.

Get comfortable with boredom. That’s where the money is.

Boredom is not your enemy — it’s your ally.

Stay patient, stay consistent.

Charts & Grit

What's in a Trading Plan? Here's All You Need to Include.Ready, set… plan? In this guide, we discuss why you need to plan your trading before trading your plan. Let’s roll.

Table of Contents:

»Importance of a Trading Plan

»The Successful Trading Plan Doesn't Exi...

»What's in a Typical Trading Day?

»Markets, Strategies and Styles

»Summary

Venturing into trading without a plan is akin to setting sail on the ocean without a compass. Or taking the leap without looking first 😉. We can keep the metaphors rolling but if there’s one thing you must remember from this word salad of an article, it’s this: success in trading is possible with a plan. Without a plan, not so much.

In this guide, we'll talk about the importance of creating a trading plan, what you should include in it, and how to follow it.

📍 Importance of a Trading Plan

A trading plan is not just a list of dos and don’ts; it's the roadmap to trading success. Here's why it matters:

➡️ Streamlines Your Actions : Much like a roadmap, a trading plan outlines your objectives, time frames, strategies, and risk management techniques, and offers a clear path forward.

➡️ Limits Emotional Swings : By defining rules and parameters in advance, a trading plan helps to keep emotions in check, limiting impulsive actions that could lead to financial pitfalls.

➡️ Fosters Discipline : Sticking to a plan holds you accountable for your actions and allows you to see where you jump out of your rule book and into undisciplined FOMO-driven pump-chasing revenge trading.

📍 The Successful Trading Plan Doesn't Exi...

Many traders believe that you can be successful by buying and selling random selections of stocks, forex pairs, or commodities. However, the reality is that the most — if not all — successful traders have one thing in common: a well-defined trading plan. Here's what makes for a successful trading plan:

☝🏽 Adaptability : A successful trading plan is not rigid but flexible, allowing for adjustments in response to changing market conditions.

☝🏽 Consistency : A plan helps you stay on track toward your goals as a trader, allowing you to stick to predefined rules and strategies, especially when things get hot and volatile.

☝🏽 Continuous Improvement : A successful trading plan is a work in progress. The more time you use it, the higher probability you will have to refine it as you drift along diverse assets, all swayed by different factors.

📍 What's in a Typical Trading Day?

A typical trading day is a blend of preparation, execution, and reflection. And while you should leave room for new ideas, fresh approaches, and some surprises, there are mainstay components that you need to have in your trading plan.

📰 Reading the News : Staying in the know is always a good idea. For many successful traders, the first thing to do is check what’s the latest on the news front. Known as fundamental analysis, reading the news and doing your research will help you get a sense of investor sentiment.

Moreover, you can stay ahead of the curve and anticipate big market moves by following the economic calendar. Lots of those sharp swings you see in forex or stocks are caused by regular data dumps such as the monthly US nonfarm payrolls report. The Federal Reserve’s decisions on interest rates or the monthly Consumer Price Index are also keys to anticipating volatility.

And what better place to follow all that’s moving markets than the TradingView News section ?

📈 Following the Charts : if you’re here, this one won’t be too new to you. Chart reading, known as technical analysis, is one of the oldest ways to analyze anything — from stocks to crypto and even frozen orange juice.

Think of a chart as your trading canvas. It’s your space to be creative, draft ideas, look for technical patterns and formations, and anticipate potential moves. Observing the chart and watching how prices behave will help you spot where a trend may form, extend, or reverse.

Some of the most popular technical formations include double tops and bottoms, head and shoulders, cup and handle, and more. And some of the most popular technical indicators include the Simple Moving Average (SMA), the Relative Strength Index (RSI), and the Fibonacci sequence.

All of that, and much more, is readily available for you almost anywhere you click on the TradingView platform.

⚒️ Work on Your Skills : Trading doesn’t have to glue you to the screen in constant monitoring of every blip. If you don’t see anything to trade, don’t trade just for the sake of it. Sometimes the best trading position is no position at all.

Instead, use some of your idle time to build out your knowledge base. Grab some books on technical analysis or trading psychology. Or watch interviews of successful traders and investors and gain that educational edge to help you become a more aware, informed, and confident trader.

🏖️ Take a Break : Not everything you do needs to be related to productivity gains and trading improvement. Stare into space or read a great novel. Take your mind off trading and unwind, let the steam off, and recharge your batteries.

Go out, enjoy a walk or do some people-watching. Taking time to zone out every now and then will help you get back to trading sharper, smarter, and more balanced.

📍 Markets, Strategies and Styles

The world of trading is as diverse as it is dynamic, offering a flurry of markets, strategies, and trading styles to explore. Here's a glimpse into the landscape:

💹 Markets : Traders can choose from a variety of financial markets, including stocks , forex , and cryptocurrencies , each with its unique characteristics and opportunities.

When you set out to create your trading plan, think carefully whether you want your portfolio to be concentrated into any one market or asset class. Or maybe you’d like to go for a diverse approach to trading and pull in assets from several markets.

Knowing what your asset preference is will help you phase out markets so they don’t distract you.

🎯 Strategies : From technical analysis to fundamental analysis, you can adopt various strategies to identify trading opportunities and manage risk, ranging from trend following to mean reversion.

News trading is a popular approach to markets as it allows you to bet on economic reports, geopolitical events, central bank updates, and more. On the other hand, technical traders tend to stick to the chart in efforts to gauge price movements and trends. Every chart tells a story. Deciphering it is the tough part.

🌈 Styles : Trading styles are equally important and they’re all tied to a specific time frame of holding your positions. If you’re more into short-term trading, you may pick scalping and target a few pips of gains before jumping out of your trade.

Day trading and swing trading are two popular time-sensitive trading strategies that you may want to explore when building out your trading plan.

📍 Summary

Your trading plan should be exactly that — yours. Tailor it to your specific goals, risk orientation, asset preference, and find out how it stacks up against market conditions.

That way, you can navigate the markets with confidence and direction, instead of letting markets sway your decision making and lead you into uncharted waters. Embark on your trading journey armed with a well-crafted plan, and let it be your roadmap to trading success.

📣With that said, let us know in the comments: do you have a trading plan? What’s the most important element of it and are you always sticking to it?

TradingView Masterclass: The power of Bar Replay🚀 Unlocking Your Trading Potential with Bar Replay on TradingView

In the whirlwind of trading, having ace tools up your sleeve can dramatically shape your strategy and success. The spotlight shines bright on TradingView’s Bar Replay feature, a gem that offers a rewind on market movements, setting the stage for strategic mastery. Let's dive into what makes Bar Replay a must-use for traders eager to refine their game.

🕒 Understanding Bar Replay on TradingView

Bar Replay is one of TradingView's standout features, allowing traders to select any point in history on their chart and watch the market's movements replay from that moment. It's a game-changer for visualizing price actions and volume changes without the stakes of live trading. Whether you're aiming for an in-depth analysis or a quick market recap, the adjustable speed of Bar Replay caters to all your needs with unmatched flexibility.

🤿 Why Dive into Bar Replay ?

The magic of Bar Replay lies in its exceptional ability to simulate market scenarios, offering a practice ground for strategy testing and gaining insights from historical market behavior. Newcomers find a safe space to learn and experiment, while the pros get a robust tool for refining strategies. Our tutorial video steps it up by walking you through practical uses on a top company's chart—marking crucial levels, applying indicators, and making trade decisions, all within the Bar Replay environment.

✨ Conclusion: ReplayYour Path to Trading Excellence

Bar Replay isn't just another tool; it's your companion in the quest for trading excellence, turning theory into actionable insight. Whether you're just starting or fine-tuning your strategy, it bridges the gap to more informed and decisive trading.

Ready to explore Bar Replay 's power and make each session a step closer to your trading goals? Let's embark on this journey together.

❓ Ever tried Bar Replay in your trading adventures?

We're all ears! 📢 Whether it's been a strategy game-changer or you're navigating its integration, drop your stories below. Let’s navigate the market's waves together.

💖 TradingView Team

PS: Check out our other Masterclasses in the Related Ideas below 👇🏽👇🏽👇🏽 and give us a 🚀 and a follow if you don't want to miss any of our future releases!

TradingView Masterclass: Create your perfect chartDive into this video for a hands-on masterclass on TradingView's chart settings, created just for you! From the general themes to the smallest details, you'll learn how to fully customize your charts to match your unique trading style and preferences.

Discover how to access and adjust every aspect of your charts, making sure they look, present data, and integrate trading features exactly how you want. Here is what we'll cover in the video:

Make your data beautiful : Tweak symbol settings, particularly candlesticks, learning to modify colors, borders, and wicks for clarity in how you see the data.

Status Line Insights : Adjust the status line to display the information you need at a glance, keeping your charts clean and focused.

Scales and Lines : Adjust scales and lines for a clearer understanding of price movements and timelines.

Canvas Customization : Learn how to set the perfect background for your charts, adjusting colors, grid lines, and visibility of indicators for a personalized analysis space.

Integrate Trading and Events : Enhance your charts by integrating trading features and real-time events like news, earnings, and dividends, offering a complete market view directly on your chart.

Create Your Perfect Chart: Now it's your turn. Experiment with settings to find your perfect chart setup and learn how to save and access your preferred layouts and templates efficiently.

Let's unlock the full potential of your charts together!

💡Tip:

Discover additional tutorials on our YouTube channel , and keep an eye out for new video content we're incorporating into articles in our Help Center .

Diversification: What It Is, Why It Matters & How to Do ItDiversification is a market strategy that enables you to spread your money across a variety of assets and investments in pursuit of uncorrelated returns, hedging, and risk control.

Table of Contents

What is portfolio diversification?

Brief history of the modern portfolio theory

Why is diversification important?

An example of diversification at work

How to diversify your portfolio

Components of a diversified portfolio

Build wealth through diversification

Diversification vs concentration

Summary

📍 What is portfolio diversification?

Portfolio diversification is the strategy of spreading your money across diverse investments in order to mitigate risk, hedge and balance your exposure in pursuit of uncorrelated returns. While it may sound complex at first, portfolio diversification could be your greatest strength when you set out to trade and invest in the financial markets.

As a matter of fact, once you immerse yourself into the markets, you will be overwhelmed by the wide horizons waiting for you. That’s when you’ll need to know about diversification.

There are thousands of stocks available for trading, dozens of indices, and a sea of cryptocurrencies. Choosing your investments will invariably lead to relying on diversification in order to protect and grow your money.

Diversifying well will enable you to go into different sectors, markets and asset classes. Together, all of these will build up your diversified portfolio.

📍 Brief history of the modern portfolio theory

“ Diversification is both observed and sensible; a rule of behavior which does not imply the superiority of diversification must be rejected both as a hypothesis and as a maxim. ” These are the words of the father of the modern portfolio theory, Harry Markowitz.

His paper on diversification called “Portfolio Selection” was published in The Journal of Finance in 1952. The theory, which helped Mr. Markowitz win a Nobel prize in 1990, posits that a rational investor should aim to maximize their returns relative to risk.

The most significant feature from the modern portfolio theory was the discovery that you can reduce volatility without sacrificing returns. In other words, Mr. Markowitz argued that a well-diverse portfolio would still hold volatile assets. But relative to each other, their volatility would balance out because they all comprise one portfolio.

Therefore, the volatility of a single asset, Mr. Markowitz discovered, is not as significant as the contribution it makes to the volatility of the entire portfolio.

Let’s dive in and see how this works.

📍 Why is diversification important?

Diversification is important for any trader and investor because it builds out a mix of assets working together to yield returns. In practice, all assets contained in your portfolio will play a role in shaping the total performance of your portfolio.

However, these same assets out there in the market may or may not be correlated. The interrelationship of those assets within your portfolio is what will allow you to reduce your overall risk profile.

With this in mind, the total return of your investments will depend on the performance of all assets in your portfolio. Let’s give an example.

📍 An example of diversification at work

Say you want to own two different stocks, Apple (ticker: AAPL ) and Coca-Cola (ticker: KO ). In order to easily track your performance, you invest an equal amount of funds into each one—$500.

While you expect to reap handsome profits from both investments, Coca-Cola happens to deliver a disappointing earnings report and shares go down 5%. Your investment is now worth $475, provided no leverage is used.

Apple, on the other hand, posts a blowout report for the last quarter and its stock soars 10%. This move would propel your investment to a valuation of $550 thanks to $50 added as profits.

So, how does your portfolio look now? In total, your investment of $1000 is now $1,025, or a gain of 2.5% to your capital. You have taken a loss in Coca-Cola but your profit in Apple has compensated for it.

The more assets you add to your portfolio, the more complex the correlation would be between them. In practice, you could be diversifying to infinity. But beyond a certain point, diversification would be more likely to water down your portfolio instead of helping you get more returns.

📍 How to diversify your portfolio

The way to diversify your portfolio is to add a variety of different assets from different markets and see how they perform relative to one another. A single asset in your portfolio would mean that you rely on it entirely and how it performs will define your total investment result.

If you diversify, however, you will have a broader exposure to financial markets and ultimately enjoy more probabilities for winning trades, increased returns and decreased overall risks.

You can optimize your asset choices by going into different asset classes. Let’s check some of the most popular ones.

📍 Components of a diversified portfolio

Stocks

A great way to add diversification to your portfolio is to include world stocks , also called equities. You can look virtually anywhere—US stocks such as technology giants , the world’s biggest car manufacturers , and even Reddit’s favorite meme darlings .

Stock selection is among the most difficult and demanding tasks in trading and investing. But if you do it well, you will reap hefty profits.

Every stock sector is fashionable in different times. Your job as an investor (or day trader) is to analyze market sentiment and increase your probabilities of being in the right stock at the right time.

Currencies

The forex market , short for foreign exchange, is the market for currency pairs floating against each other. Trading currencies and having them sit in your portfolio is another way to add diversification to your market exposure.

Forex is the world’s biggest marketplace with more than $7.5 trillion in daily volume traded between participants.

Unlike stock markets that have specific trading hours, the forex market operates 24 hours a day, five days a week. Continuous trading allows for more opportunities for price fluctuations as events occurring in different time zones can impact currency values at any given moment.

Cryptocurrencies

A relatively new (but booming) market, the cryptocurrency space is quickly gaining traction. As digital assets become increasingly more mainstream, newcomers enter the space and the Big Dogs on Wall Street join too , improving the odds of growth and adoption.

Adding crypto assets to your portfolio is a great way to diversify and shoot for long-term returns. There’s incentive in there for day traders as well. Crypto coins are notorious for their aggressive swings even on a daily basis. It’s not unusual for a crypto asset to skyrocket 20% or even double in size in a matter of hours.

But that inherent volatility holds sharpened risks, so make sure to always do your research before you decide to YOLO in any particular token.

Commodities

Commodities, the likes of gold ( XAU/USD ) and silver ( XAG/USD ) bring technicolor to any portfolio in need of diversification. Unlike traditional stocks, commodities provide a hedge against inflation as their values tend to rise with increasing prices.

Commodities exhibit low correlation with other asset classes, too, thereby enhancing portfolio diversification and reducing overall risk.

Incorporating commodities into a diversified portfolio can help mitigate risk, enhance returns, and preserve purchasing power in the face of inflationary pressures, geopolitical uncertainty and other macroeconomic risks.

ETFs

ETFs , short for exchange-traded funds, are investment vehicles which offer a convenient and cost-effective way to gain exposure to a number of assets all packaged in the same instrument. These funds pull a bunch of similar stocks, commodities and—more recently— crypto assets , into the same bundle and launch it out there in the public markets. Owning an ETF means owning everything inside it, or whatever it’s made of.

ETFs typically have lower expense ratios compared to mutual funds, making them affordable investment options.

Whether you seek broad market exposure, niche sectors, or thematic investing opportunities, ETFs are a convenient way to build a diversified portfolio tailored to your investment objectives and risk preferences.

Bonds

Bonds are fixed-income investments available through various issuers with the most common one being the US government. Bonds are a fairly complex financial product but at the same time are considered a no-brainer for investors pursuing the path of least risk.

Bonds have different rates of creditworthiness and maturity terms, allowing investors to pick what fits their style best. Bonds with longer maturity—10 to 30 years—generally offer a better yield than short-term bonds.

Government bonds offer stability and low risk because they’re backed by the government and the risk of bankruptcy is low.

Cash

Cash may seem like a strange allocation asset but it’s actually a relatively safe bet when it comes to managing your own money. Sitting in cash is among the best things you can do when stocks are falling and valuations are coming down to earth.

And vice versa—when you have cash on-hand, you can be ready to scoop up attractive shares when they’ve bottomed out and are ready to fire up again (if only it was that easy, right?).

Finally, cash on its own is a risk-free investment in a high interest-rate environment. If you shove it into a high-yield savings account, you can easily generate passive income (yield) and withdraw if you need cash quickly.

📍 Build wealth through diversification

In the current context of market events, elevated interest rates and looming uncertainty, you need to be careful in your market approach. To this end, many experts advise that the best strategy you could go with in order to build wealth is to have a well-diversified portfolio.

“ Diversifying well is the most important thing you need to do in order to invest well ,” says Ray Dalio , founder of the world’s biggest hedge fund Bridgewater Associates.

“ This is true because 1) in the markets, that which is unknown is much greater than that which can be known (relative to what is already discounted in the markets), and 2) diversification can improve your expected return-to-risk ratio by more than anything else you can do. ”

📍 Diversification vs concentration

The opposite of portfolio diversification is portfolio concentration. Think about diversification as “ don’t put your eggs in one basket. ” Concentration, on the flip side, is “ put all your eggs in one basket, and watch it carefully. ”

In practice, concentration is focusing your investment into a single financial asset. Or having a few large bets that would assume higher risk but higher, or quicker, return.

While diversification is a recommended investment strategy for all seasons, concentration comes with bigger risks and is not always the right approach. Still, at times when you have a high conviction on a trade and have thoroughly analyzed the market, you may decide to bet heavily, thus concentrating your investment.

However, you need to be careful with concentrated bets as they can turn against your portfolio and wreck it if you’re overexposed and underprepared. Diversification, however, promises to cushion your overall risk by a carefully balanced approach to various financial assets.

📍 Summary

A diversified portfolio is essentially your best bet for coordinated and sustainable returns over the long term. Choosing a mix of various types of investments, such as stocks, ETFs, currencies, and crypto assets, would spread your exposure and provide different avenues for growth potential. Not only that, but it would also protect you from outsized risks, sudden economic shocks, or unforeseen events.

While you decrease your risk tolerance, you raise your probability of having winning positions. Regardless of your style and approach to markets, diversifying well will increase your chances of being right. You can be a trader and bet on currencies and gold for the short term. Or you can be an investor and allocate funds to stocks and crypto assets for years ahead.

Potential sources of diversification are everywhere in the financial markets. Ultimately, diversifying gives you thousands of opportunities to balance your portfolio and position yourself for risk-adjusted returns.

🙋🏾♂️ FAQ

❔ What is portfolio diversification?

► Portfolio diversification is the strategy of spreading your money across diverse investments in order to mitigate risk, hedge and balance your exposure in pursuit of uncorrelated returns.

❔ Why is diversification important?

► Diversification is important for any trader and investor because it creates a mix of assets working together to yield high, uncorrelated returns.

❔ How to diversify your portfolio?

► The way to diversify your portfolio is to add a variety of different assets and see how they perform relative to one another. If you diversify, you will have a broader exposure to financial markets and ultimately enjoy more probabilities for winning trades, increased returns, and decreased overall risks.

Do you diversify? What is your strategy? Do you rebalance? Let us know in the comments.

Liked this article? Give it a boost 🚀 and don't forget to follow us if you want to be among the first to be informed.

What Is Bitcoin Halving? Here's All You Need to KnowWhat Is Bitcoin Halving? Here's All You Need to Know.

Halving is the event of slashing Bitcoin's mining rewards every 210,000 blocks, or roughly every four years. Read all about it here.

Table of Contents

Overview

What Is Bitcoin Halving?

When Is the Next Bitcoin Halving?

Deep Dive into Blockchain

How Are Miners Rewarded?

Why Halving Matters?

The Big Picture

What About Bitcoin’s Price?

Halving and the Way Forward

Overview

Bitcoin’s halving is a milestone event for the crypto space. Essentially, halving pushes back the moment we see all 21 million BTC tokens pulled out of their cryptographic hash puzzles.

Satoshi Nakamoto, the individual or group who created Bitcoin , programmed it to a fixed amount of 21 million coins. In other words, the total amount of Bitcoin can never exceed 21 million. Presently, miners have picked up just over 19 million through a process called Bitcoin mining.

This amount is over 90% of the total supply with mining having started with the creation of Bitcoin 15 years ago. That leaves just about 2 million tokens to be unearthed before the final Bitcoin enters our dimension. How long should we wait until this mammoth of a milestone happens? More than a century, or around the year 2140 , according to forecasting wizards.

The logic behind this peculiar mechanism lies in the so-called halving and this guide will help you understand all about it.

What Is Bitcoin Halving?

Halving, in its simplest form, is the process of gradually reducing the rewards of Bitcoin mining. As we mentioned, Satoshi Nakamoto originally hard-coded Bitcoin to a fixed supply of 21 million. All of them will come to life at an increasingly slower rate. More precisely, the pace at which Bitcoin is created is “halved” every 210,000 blocks.

The current block reward is 6.25 Bitcoin as the last halving occurred on May 11th, 2020.

When's the Next Bitcoin Halving?

In April 2024, miners will add the next batch of 210,000 blocks. And that only means one thing - they will have their revenue immediately slashed in half to 3.125 Bitcoin.

All halvings are evenly spread out approximately every four years, consistent with Bitcoin’s hard-coded design. This way, supply will keep increasing, just at a slower clip. The reason is simple - the Bitcoin halving rewards will continue to reduce.

Deep Dive into Blockchain

In order for new Bitcoin to come into circulation, miners need to create blocks in a chain, hence the term ‘blockchain’.

Network operators—the hardworking miners—uncover blocks through computer-powered mining operations. These crypto diggers compute hashes as quickly as possible. What they do is search for the successful fixed-length output that they add to the block.

The more hashes per second (hashrate), the more chances for hacking out new blocks and adding them to the blockchain.

How Are Miners Rewarded?

Generally, miners have two ways to reward themselves for the effort. The first one is to earn revenue from transaction fees of users who send and receive Bitcoin. That’s when they act as decentralized network operators and validate transactions without a central authority.

At their height during the crypto boom in April 2021, the Bitcoin network fees reached as much as $60 per transaction and took hours to complete. After all, the network can only handle 4-7 transactions per second. To compare, payment giant Visa can validate 24,000 transactions per second.

Average transaction fee of Bitcoin, USD

Timeframe: April, 2021

Source: bitinfocharts.com

The other way to reward Bitcoin miners is to let them pocket the newly-minted Bitcoin contained in the block. Halving is basically a reward system for miners.

But more broadly, halving is part of the proof-of-work model associated with high levels of energy consumption. Millions of mining rigs soak up that energy and crank out new Bitcoin.

Why Halving Matters?

Halving the block reward for mining Bitcoin is a way to protect its integrity. This immutable feature of the OG crypto makes it stand out as a unique asset class. In this light, it is also an alternative to inflation-prone national currencies, also known as fiat money.

With that in mind, in a world that craves disruptive innovation, a technology that’s rewiring the global financial system has progressively moved into the limelight. The growing role of Bitcoin as a new investment vehicle is apparent, factoring in the elevated investor appetite .

Bitcoin transacts tens of billions of dollars of daily volumes, with a peak of more than $126 billion on May 19, 2021. The figure is sufficient to prove it has piqued the interest of enough crowds to form a market around it.

Before we revisit Bitcoin as an investable asset, let’s take a breather and trace the original crypto back to its origins where halving was introduced.

The Big Picture

Just over 15 years ago, the mysterious Satoshi Nakamoto mined the initial “genesis” block . For the effort, the clandestine developer(s) earned a hefty reward of 50 Bitcoin. And also bothered to leave a message hooked to the chunk of transactions. The message read: " The Times 03/Jan/2009 Chancellor on brink of second bailout for banks. "

Since then, the Bitcoin network has witnessed three halving events:

On November 28, 2012, Bitcoin’s block reward was cut from 50 BTC to 25 BTC.

On July 9, 2016, Bitcoin’s block reward was slashed from 25 per block to 12.5 BTC.

The last one occurred on May 11, 2020, when the reward was axed to 6.25 BTC.

The next Bitcoin halving event is on deck for April 19, 2024. Rewards will fall to 3.125 BTC.

The Bitcoin halving dates may vary and we're yet to get a confirmation over the next one. Estimations indicate that every 10 minutes or so all network operators add a new block to the Bitcoin blockchain. With the current reward of 6.25 Bitcoin per block, miners dig out around 900 new Bitcoin a day.

At today’s prices , this is equal to around $50 million worth of Bitcoin extracted daily. This is where the halving becomes interesting not just to the geeks among us.

Halving events play a key part in shaping up supply and demand and weigh on the price of Bitcoin. Speaking of price movement, how does the rate at which new Bitcoin is churned out affect valuations?

What About Bitcoin's Price?

Bitcoin, as the world’s first cryptocurrency in a sea of many, is the quintessence of scarcity premium. Investment professionals are quick to say that Bitcoin carries a unique glamor as the only large tradeable asset with a predictable emission leading to a hard cap.

In that light, analysts consider Bitcoin to be the newest entrant in the store-of-value category. An investment product that holds its purchasing power over time. Ideally coming with consistent price increases.

This is possible thanks to halving - the brilliant mechanism hard-wired into the Bitcoin protocol. The minds behind the original digital currency conceived it as deflationary. A concept alien to the present financial system, flooded with central-bank cash and government stimulus.

The reason is that, contrary to fiat currencies that inflate over time, Bitcoin should not be debased by inflation. Satoshi Nakamoto explained this inflation-rate flaw in an online forum around the time of Bitcoin’s inception.

"The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Halving and the Way Forward

If there’s a need to draw broad conclusions, here are some of the more salient points to make a compelling argument.

Bitcoin’s purchasing power is likely to avoid debasement thanks to the halving mechanism. With less than 10% of Bitcoin still to come to the surface, it will take more than 100 years for the last unmined Bitcoin to pop out.

Once all the 21 million Bitcoin spring to life, miners will no longer stake their livelihood on uncovering new tokens. Instead, they will earn revenue from network fees for their work on validating transactions. But that’s only if the network sticks to the plan.

FAQ

❔ "What is the purpose of halving?"

► Halving maintains a decreasing pace of block rewards, which emphasizes on the idea of scarcity in Bitcoin.

❔ "When is the next Bitcoin halving?"

► The next Bitcoin halving event is scheduled to occur on April 19, 2024. This date is approximate, and the actual date may be different, depending on the time it takes to complete one full batch of 210,000 blocks.

❔ "Is halving related to price increase?"

► Technically, when the supply of new Bitcoin is cut in half, and demand remains the same, prices may go up. But the price discovery of Bitcoin does not obey archetype models of economics.

❔ "When will the last Bitcoin be mined?"

► Estimates point that the last available Bitcoin will be mined in the year 2140.

How-To: Use the TradingView Paper Trading featureTradingView's Paper Trading isn't just for practice; it's a detailed educational platform that closely simulates the real trading environment, all without the risk of losing money. This feature is carefully crafted to mimic actual market scenarios, offering users a realistic preview of how their trading plans might fare.📖🧾

The video is packed with valuable tips 💡 on making the most of the Paper Trading feature. From initiating your paper trading account to executing trades, tracking your positions, and evaluating your trading approach, this guide is essential for anyone looking to refine their trading skills on TradingView.

Engaging in paper trading means more than just trial runs; it integrates you into a community of well-informed traders. It encourages the prudent, yet proactive mindset advocated by TradingView. Such a strategy distinguishes the most successful traders. 📈

In summary, the Paper Trading feature reflects TradingView's dedication to providing its users with the necessary knowledge 📚 and tools ⚒️ for trading success. It champions the "look first, then leap" approach, ensuring that your venture into trading is informed, confident, and well-prepared. Immerse yourself in the video 🎥, delve into the Paper Trading feature, and start your path to becoming a knowledgeable and prosperous trader. 💹

❓Have you tried our Paper Trading feature yet? How did you find it? Love it 🥰, hate it 👎🏽, we want to know especially with our upcoming competition where you could win up to $10,000 paper trading right here on TradingView.

More on that later ⏰ ;)

Happy trading, and always remember – look first, then leap! 👀🦘

ℹ️ More info on the TradingView Paper Trading feature can be found here:

www.tradingview.com

Don't want to miss out on more tips and tricks? Give us a follow!

TradingView Masterclass: Paper TradingIn this Masterclass, you’ll learn how to use our official paper trading tool. Paper trading gives trades the capability to test their trading skills in a simulated environment without risking real money. For all the new traders out there, you’ll want to make paper trading your best friend. Why? Have all the fun you want, practice endlessly, and never lose a dime.

Reminder: With Black Friday nearing (seriously… it’s coming soon), now is the time to master one of our most important tools. You’ll be ready to go the second you activate your upgraded account.

To get started, follow the steps below:

Step 1 - Click the ‘Trading Panel’ button located at the bottom of the chart.

Step 2 - Once you click the ‘Trading Panel’ button, a list of brokers in your region will appear, but also, at the very top, a Paper Trading account powered by yours truly, TradingView.

Step 3 - Click Paper Trading and you’ll now start the process of opening your free, simulated trading environment, entirely powered by us.

You made it! Time to celebrate! 🕺💃

Alright, let’s go a little deeper and talk about the buttons you’ll want to understand now that you’ve got your Paper Trading account opened.

While still having the Trading Panel open, click the button that says “Trade” and an order slip will appear. It’ll look like this:

As you get started, here are some tips to keep in mind:

Take Paper Trading seriously. Work Paper Trading as if it were a real account:

Record your trades, the reasons, the results obtained and the lessons learned.

Explore different approaches like intraday trading or swing trading.

Maintain emotional discipline, your trading strategy and risk management.

Practice, practice, practice - that’s what this is all about, getting better at trading through practice.

It gets better, because there are multiple ways to trade and customize your paper trading experience. Open the chart settings menu or right click on the chart, and you can add specific trading features to the chart as needed.

In-fact, we’ll explain all of the features available to you in the chart settings.

🟥🟦 Buy/Sell buttons :

When these are turned on, you’ll see a Buy and Sell button at the top right of the chart. When it comes to buying and selling, there are three primary order types:

Market (executed at the current market price),

Limit (executed at a defined specific value), and

Stop (executed when the price falls below a certain level).

👆 Instant Orders placement :

This option allows you to open positions at the market price by simply clicking the buy and sell buttons. You can choose the quantity by clicking on the number below the spread.

⏰ Play Sound for executions :

You can enable this option to receive an audible notification when a trade is executed, with eight different tones to choose from.

📲 Notifications :

Receive notifications for All events or Rejection orders only.

Tip : You can open the order panel by using the Shift + T shortcut or by right-clicking on a chart, then selectings Trade > Create a new order.

👁🗨 Positions :

Uncheck this box if you don’t want to see your active trading positions.

🔺🔻 Profit & loss :

This option allows you to view the profit and loss changes in your trades, which can displayed in both ticks and percentages.

🔃 Reverse button :

When enabled, a button is added to your active trading positions that allows you to reverse your trade.

👁 Orders :

See your current open unexecuted orders by checking this box.

🔺🔻👁 Brackets profit & loss :

It functions similarly to the Profit & Loss option, but for pending orders.

⏪ Executions :

It displays the past executed orders on the chart.

Execution labels :

Enable this option to view specific information about past execution orders, including trade direction, quantity, and executed price.

Extended price line for positions & orders :

It creates an extended horizontal line for your active trades.

⬅⬆➡ Orders & positions alignment :

You can move the alignment of your orders to Left, Center and Right in your charts.

🖥 Orders, Executions and Positions on screenshots :

Check this box if you want to download screenshots (shortcut: Ctrl + Alt + S) with active and pending orders.

Thanks for reading and we hope this tutorial helps you get started! We look forward to reading your feedback.

- TradingView Team

TradingView Masterclass: How To Use Drawing ToolsWe continue with our Masterclass series, which we created to teach people how to get started with charting, research, and analysis. In this lesson, you’ll learn all about the Drawing Panel located on the left side of your chart. Let’s get started!

Drawing tools 🎨

There are eight categories in the drawing tool section: Cursors, Trend line tools, Fibonacci tools, Patterns, Forecasting and measurement tools, Geometric shapes, Annotation tools, and Icons. In addition, just below these categories, there are handy features that augment and optimize your research in specific situations, such as zooming in/out, measuring, and a magnet tool for selecting specific price points. Let’s analyze each of these in detail:

- Cursors: Located at the very top corner of the drawing tool section, Cursors gives you the capability to change your mouse as you move around the chart. For example, we have other variations such as the dot cursor or the simplest of all, the arrow cursor. Finally, we have an eraser tool to remove objects from the chart by clicking on them.

- Trend lines: Trend lines can be used to identify and visualize the direction of a price trend, and are sometimes used for drawing support or resistance lines as well. In this section, you can also find trend channels and pitchforks.

- Gann and Fibonacci tools: These advanced tools are often used by technical analysts and quants to locate retracements, pullbacks, measured moves, and advanced price sequences. The Fibonacci tools include retracement, extension, fans, arcs, and more. The Gann tools include box, square, and fan.

- Patterns: In this section, you’ll find popular drawing tools for mapping our complex patterns that require several different points to be drawn such as Elliott waves, head and shoulders, and impulses.

- Forecasting and measurement tools: These invaluable tools are used to make projections either long or short, study specific stats such as time or price ranges, and also give you the capability to analyze volume with VWAP and volume profiles.

- Geometric shapes: These tools are where you can find the brush tool to freely draw on your chart, but it also goes deeper than that, as there are also important shapes whereby a trader can highlight important areas on the chart with a rectangle or arrow such as accumulation or historical rebound zones.

- Annotation tools: These can be used to write notes, reminders, prices, and journal entries. These are key tools for traders who want to track their progress over time and always have specific notes attached to the chart. It also includes the ability to insert X links and images from your computer.

- Icons: Need a little more color or character on your chart? This section gives you hundreds of emojis, icons, and stickers to add to your chart. Highlight an area, add more art to your chart or spice up your creativity.

Tip: Keyboard shortcuts 🔠

Did you know that you can use keyboard shortcuts for the most popular drawing tools? To find out the command, you need to open the drop-down menu of one of the 8 drawing tool categories and you will see the command on the right side of some tools. For example:

Alt + T = Trendline

Alt + F = Fib retracement

Alt + H = Horizontal line

Alt + V = Vertical line

Alt + I = Invert chart

Alt + W = Add current symbol to watchlist

If you're a Mac user, use ⌥ instead of Alt.

Measure and zoom 📏🔎

When you use the Measure tool (the ruler icon just below the 8 drawing tool category icons), you can see at a glance how much an asset has fallen or risen in numbers, percentages, bars and days. Combined with the Zoom tool (the magnifying glass with +/- icons), you can also focus on the most important areas of the chart. For both measuring and zooming, the procedure is the same: select the tool, click on the point where you want to start measuring or from where you want to zoom, and end with another click where you want to end. You can also use the "Shift" hotkey instead of the icon. To remove a measurement, simply click on the chart.

Magnet mode 🧲

Magnet mode is a wizard that helps you to bring the drawing tools closer to the nearest price bars that you hover over with the mouse. There are 2 modes: Weak magnet and Strong magnet. This tool allows traders to perfectly connect a drawing tool to a specific price point. The current values are OHLC, meaning when Magnet mode is turned on, all drawing tools will connect to the nearest open, high, low or close value. Want to draw support lines that always connect to a specific price? Use this tool.

Stay in drawing mode 🎨

If you are going to make several drawings on the chart at the same time, you may find it useful to activate this option (pencil + padlock icon), as it will allow you to make as many drawings as you want without deactivating the selected drawing tool. Remember that you must deactivate this option to return to normal mode.

Lock all drawing tools 🛑

Once the chart has been configured, if you do not want to make any further changes, you can lock everything that has been drawn with this option (padlock icon) so that you do not accidentally delete elements in the future.

Hide/Show drawings/indicators/positions & orders 👁🗨

This option allows you to toggle the visibility of the drawings, indicators, positions & orders or even all three to make comparisons with a blank chart. The keyboard shortcut is "Ctrl + Alt + H".

Drawing sync 🔄

This allows you to synchronize the drawings of the selected charts in the current layout or in all layouts (globally). You’ll surely want to test this feature as it’s perfect for those who perform multi-timeframe technical analysis and research across multiple charts or timeframes. For example, when this tool is turned on, if you draw on one chart, all of your drawings will appear on your other charts that have the same symbol.

Delete objects 🗑

With a single click, you can delete all drawings or indicators, or even both at the same time. There are also a few other options to remove specific things on your chart. Use this tool wisely and don’t accidentally delete everything!

Show favorite drawing tools toolbar ⭐

To set up the favorites toolbar, first, you must first go to one of the eight drawing categories and click on the gray star in one of the tools. When you click on it, it turns orange and the quick access toolbar for drawing tools is created. Once you have selected all your favorites, move the favorites toolbar around so that you can use it conveniently every time you want to draw something on the charts.

That’s a wrap! We hope you found this guide valuable. We'd love to hear about your favorite drawing tool, so please share your thoughts in the comments below. Additionally, if you have any feedback or suggestions, drop us a line.

- TradingView Team

We’ve Paid Over $25,000 To Our Creators and CodersOur vibrant community is not only for professional investors, everyday traders and Pine scripters, it’s also home to content creators who share their wisdom, experiences, and market insights. We love our content creators and that’s why we recently launched our first-ever community content rewards program that gives $100 cash to anyone who is selected to Editors’ Picks and Pine Script Picks .

Since the launch of our program, we’ve given out over $25,000 .

Yep - $25,000 to our best creators, contributors, and coders.

Because of the success of this program, we’ve decided to keep it going, and invite more of you to join our social network whether it’s for meeting other traders, growing a brand or sharing insightful content about financial markets. If you still don’t know how to use our social network, we have plenty of resources available:

👉 Our official Help Center documentation about our content program and more

👉 Familiarize yourself with these guidelines for crafting exceptional ideas

👉 And, of course, don't forget to revisit our House Rules!

For those of you who want to learn more about earning $100, don’t fret, as we also wrote out a few simple steps below to get you started:

Open a chart.

Click the Publish button in the top right-hand corner or the Pine Editor button at the bottom of the chart.

Write your idea or code your script (if you’re up for a challenge), and when you’re ready, publish it to our network.

Our network values creativity, deep research, and insightful content. Here are some recent examples to showcase what our network values: example 1 , example 2 , and example 3 .

If you’re lucky enough to be selected to Editors’ Picks, you’ll earn $100 at the end of the month. There are no limitations to how many times you can publish per week. For example, say you’re selected five times in a month - that means you’ll earn $500.

Congratulations to our Editors Pick Authors so far.

April Editors Pick Authors

@akikostas @Be_Capy @Bullfighterr @ChristopherDownie @dchua1969 @DeGRAM @Donfelice @EXCAVO @financialflagship @FOREXN1 @inspirante @JimHuangChicago @Julien_Eche @LeviathanCapital @LuxAlgo @LuxAlgo @MacrodesiacTim @Nico.Muselle @norok @Options360 @Pandorra @peacefulLizard50262 @PropNotes @QuantVue @SolCollector @SPY_Master @SPYvsGME @SquishTrade @tbiktag @timwest @Tradersweekly @transparent-fx @Trendoscope @VasilyTrader @Vestinda @WayanEko @WillSebastian @WyckoffMode

May Editors Pick Authors

@allanster @bitdoctor @ChristopherDownie @CMT_Association @djmad @dudebruhwhoa @EXCAVO @FOREXN1 @G_Foster @Goontata84 @HoanGhetti @inspirante @Investroy @kaigouthro @konhow @LeafAlgo @Mayfair_Ventures @mintdotfinance @neo_karma @norok @Options360 @peacefulLizard50262 @QuantVue @RicardoSantos @RLinda @ShaquanLopez @ShawnMCR @SquishTrade @Steversteves @sudoMode @This_Guhy @Timonrosso @timwest @tradeforopp @transparent-fx @Trendoscope @veryfid @WalterMoon

June Editors Pick Authors

@AfnanTAjuddin @aneekaguptaWTE @Be_Capy @BitcoinMacro @ChristopherDownie @Crypto4light @DeGRAM @fikira @financialflagship @FOREXN1 @fract @HL-TradingFX @Investroy @JakeWuMarketResearch @JimHuangChicago @kaigouthro @KarimSubhieh @Keeleytwj @Lingrid @LuxAlgo @MarthaStokesCMT-TechniTrader @Mayfair_Ventures @mintdotfinance @Money_Dictators @moonypto @Moshkelgosha @Nemo_Confidat @NinjaTradingServices @norok @QuantVue @SquishTrade @Steversteves @Sublime_Trading @the_sunship @TheTradingParrot @This_Guhy @Thomas_Zito @Timonrosso @tradeforopp @Tradersweekly @Trendoscope @Vestinda

July Editors Pick Authors

@Akil_Stokes @Amphibiantrading @aneekaguptaWTE @ARESABI @BluetonaFX @ChristopherCarrollSmith @ChristopherDownie @CryptoCheck- @DeGRAM @financialflagship @FOREXN1 @Honestcowboy @Ingwina @Intetics @JimHuangChicago @KioseffTrading @LeafAlgo @LordWrymouth @LuxAlgo @Options360 @optionsswing @PrepForProfit @propfirmalec @PukaCharts @RodCasilli @SquishTrade @Steversteves @StewySongs @the_sunship @This_Guhy @Timonrosso @Trendoscope @VasilyTrader

August Editors Pick Authors

@Akil_Stokes @anthonycrudele @BluetonaFX @Celestial-Eye @fikira @financialflagship @Gentleman-Goat @JimHuangChicago @joerivdpol @KioseffTrading @LeafAlgo @LuxAlgo @MarcPMarkets @MarthaStokesCMT-TechniTrader @Mayfair_Ventures @MikeMM @mikezaccardi @mintdotfinance @Moshkelgosha @MUQWISHI @MXWLL-Capital-Trading @optionfarmers @PropNotes @PukaCharts @RicardoSantos @rossgivens @sabricat @Steversteves @The_STA @timwest @Tradersweekly @tradingwithanthony @Trendoscope @Vestinda @Victoredbr @WillSebastian @without_worries @WyckoffMode

September Editors Pick Authors

@Akil_Stokes @Algo_Alert @algotraderdev @anthonycrudele @ATradeSniper @basictradingtv @blackcat1402 @BradMatheny @bryandowningqln @CME_Group @CMT_Association @Crypto4light @DeGRAM @ImmortalFreedom @Investroy @jason5480 @KioseffTrading @konhow @LeviathanCapital @Madrid @mintdotfinance @MoneyMantraCha @Moshkelgosha @Paul_Varcoe @PeterLBrandt @PropNotes @PukaCharts @sofex @SpyMasterTrades @Steversteves @stocktechbot @the_sunship @ThinkLogicAI @This_Guhy @timwest @TradeAndMeApp @Trendoscope @VasilyTrader @Vestinda @without_worries @Yaroslav_Krasko

One final note: If you think we’re missing your ideas or scripts, please drop a link to your work in the comments section below. Our team is always looking to meet new community members and read the outstanding content being created.

We look forward to seeing your content!

- Team TradingView

TradingView Masterclass: How To Use The Top ToolbarIn this guide, you’ll learn about all the different tools that are available to you on the chart. Specifically, we’ll be looking at the toolbars that are located at the top, bottom, left and right of the chart:

To summarize the chart above, the breakdown looks like this:

Top toolbar: Chart tools

Left-side toolbar: Drawing tools

Right-side toolbar: Community tools

Bottom toolbar: Advanced tools

Now, let’s dive into each one starting with the top toolbar where you’ll find many of the most important chart tools for all your research needs. Keep in mind that we’ve ordered each item below as if we are moving from the furthest point at the top left to the furthest point to the top right. Let’s begin!

Symbol Search (Keyboard shortcut: type the ticker)

Open the symbol search at the top left-hand corner to access over 100,000 global assets across equities, forex, crypto, futures, and more. You can find them by their ticker (e.g., type NVDA for NVIDIA Corporation) or by their description names (e.g., type the name Apple to find AAPL stock). It’s also possible to find your favorite symbols with partial searches, that is, to write part of the ticker or description name and then select the corresponding asset in the search results. If you want to filter by asset type, you can select one of the following: Stocks, Funds, Futures, Forex, Crypto, Indices, Bonds and Economy (economic indicators).

Time Intervals (Keyboard shortcut: press ,)

Select the time interval for the chart. For instance, say you’re looking at a candlestick chart and you choose a daily chart. That means each trading day will be represented by 1 candle. The most common time intervals are: 1m, 5m, 30m (intraday setups) 1h, 4h (swing trading setups) and 1D, 1W and 1M (long-term trading setups). Traders can create custom intervals as well by clicking on the Time Interval arrow and then selecting the specific parameters needed. Don’t forget to add it to your favorites if you want it to be featured in the Quick Access toolbar.

Chart types

We have more than 15 chart types available to analyze all price movements, including the new HLC area, Line with markers and Step line. Most traders prefer to use Bars, Candles and Area charts, but everyone has a different approach to markets. Be sure to find the chart type that fits your style.

Indicators, Strategies, and Metrics (Keyboard shortcut: press /)

Indicators, Strategies, and Metrics are designed to provide additional insight and information that may otherwise be difficult to see. We have over 200 technical and financial indicators while also supporting over 100,000 custom scripts coded by our community. The best way to get started here is to start exploring the Indicators, Strategies, and Metrics menu as soon as possible.

Indicator Templates

Here, you can save your custom indicator setups so that you can load them at any point in time. This tool is essential if you utilize different forms of analysis. For example, if you chart technicals and fundamentals, you can make two separate templates that can be loaded at any point depending on your need.

Alert (Keyboard shortcut: Alt + A)

Alerts are used to create custom price alerts. Instead of watching markets 24/7, go ahead and create an alert at a precise level and then wait for that alert to trigger. Let our alerts do the heavy lifting. They’re always watching markets for you. It is also possible to configure them different notifications so that you can be alerted through email, our free app or with a webhook.

Bar Replay

Bar Replay is a powerful, yet simple tool for backtesting. All experience levels can use Bar Replay for backtesting, practicing or learning about price history. To get started, click the Bar Replay button and then select a historical moment to rewind the chart backward to that point in time. Then, you can press play or pause, and retrade that moment to see how your strategy performs.

Undo/Redo Scroll (Keyboard shortcut: Ctrl + Z / Ctrl + Y)

Any changes made to the charts such as drawings or indicators can be deleted or recreated. This works just like a Word document you might create on Microsoft or Google. Use the keyboard shortcuts to quickly undo or redo specific actions.

Multi-chart Layout

If you have an Essential, Plus, Premium, or Ultimate plan, you can analyze multiple charts on your screen at the same time. Simply choose one of the available layouts from the menu to get started. You can also synchronize symbols, intervals, crosshairs, time and data ranges with the selected layout.

Manage Layouts

Create, rename and load all the layouts that you save. You can also share your layout and enable the autosave option, which is very handy so that all of your work is saved automatically. Managing your layouts is an essential part of your analytical process because it enables multiple different chart layouts to be accessed as quickly and easily as possible.

Quick Search

Need to find a function or tool on your chart? Open and use Quick Search to do that. The name of the tool is just as it can be used: quickly search for the things you need to edit, add or remove on your chart, and do it in a flash.

Chart Settings

This is where you can customize all of the fine details about your chart. The Chart Settings menu has everything from the chart color, to the gridlines and labels, the text of the scales, and more.

Fullscreen Mode (Shift + F)

When this is enabled, you will see only the chart. To exit Full screen mode, click ‘Esc’.

Snapshot and Publish

Here you can download your charts as images, copy links, share tweets, publish ideas, create live streaming video content, and comment on assets with our latest feature Minds. If you want to share your expert analysis or get feedback from others, you’ll surely want to learn how these social tools work. Go ahead and give it a try - join our community of traders.

Thanks for reading and we hope this post helps all traders and investors. Whether you’re an experienced professional or someone just getting started, we plan to create more guides like this to ensure you know how to maximize the features on our platform.

Next week, we’ll share part two of this series, and cover the drawing tools menu on the left-side of the chart.

- Team TradingView

Improve Your Research With MindsOur new social feature, Minds, is now available on our free mobile app for iOS and Android.

Minds is an exclusive chat for your favorite symbols. Want to read what other investors are saying about AAPL? Head to the AAPL Mind. Curious to discuss Bitcoin’s price action? Check out the BTCUSD Mind. There’s now a place to chat about every symbol no matter how obscure or popular. Gather around a specific symbol with other traders and start sharing your mind.

To celebrate the launch of Minds on mobile, we’d like to show you how it works and specifically showcase how it can improve your research. If you don’t have our mobile app, get it now .

How to use Minds from your mobile phone:

Open the TradingView app and select a symbol from your watchlist.

Then, find and select the tab that says “Minds” - depending on your screen size, you may have to scroll down.

Now you can read what everyone is saying about that specific symbol!

To post your own ideas, thoughts and analysis, click the cloud with a plus at the bottom right-hand corner of the screen.

Type your message and then press the button that says “post” to share your message with everyone.

This new social feature will make it incredibly easy to meet, chat, and discuss your favorite symbols with others. You now have access to a highly specific chat only for those who care the most about specific symbols. Remember: this is a community feature, so the more active you are, the better it’ll be for you and everyone else involved.

Note: If you’re having trouble accessing Minds, double check that the Show symbol screen feature is on, which can be activated from the settings menu.

Wait… don’t go anywhere yet! We have some tips to share because Minds creates a whole new way to research your favorite symbols. Keep reading…

How can you improve your research with Minds?

1. Real-time sentiment analysis

With Minds, you will be able to read what other people think about your favorite symbols. It is very common to see new perspectives with this approach and avoid one of the biggest mistakes in trading, which is believing you’re always right. You know what they say… one big mistake is enough to blow your account, so reading what other people are saying can open your mind in that sense.

2. Concise Insights

Condensing intricate concepts or analysis into easily digestible bite-sized updates makes information accessible to a wider audience. Even those without a deep understanding of the charts can gain insights and stay informed, thereby fostering a more inclusive and informed community.

In today's world, there's a lot of information everywhere, and it can be overwhelming. The Minds’ updates make things clear and simple. They show you just what you need to know, making it easier to stay in the loop without getting lost in the noise.

3. See how other traders use technical and fundamental analysis