GBPUSD - Macro Trend Continues!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPUSD has been overall bullish trading within the rising channel marked in red. And it is currently retesting the lower bound of the channel.

Moreover, the green zone is a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower red trendline and structure.

📚 As per my trading style:

As #GBPUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trend

BEAM FROM A NORMAL COIN TO A GOLDEN COIN SOON!! DUBBLE EFFECTThis is exactly what we expect, depending on the data that Beamx/USDT will show an interesting break since the new data.

when the real whale entering is started, we will see diffrance price movements ( not in a stable way as we see it now)

What is the expected target

up $0,001

There is an interesting update upcoming also that can give this coin an effect from a normal coin to a golden coin.

Every good increase and cycle movement takes time.

So let's see what time this expected update will take..

XAUUSD Hello traders,

Today we're taking advantage of a great buying opportunity on the XAUUSD pair. This setup is ideal for both medium- and long-term positions. I anticipate that the price will rise toward the 3392.82 USD level in the coming weeks.

That’s why I’ve positioned this trade as a medium-term opportunity.

SPX500 Holding Bullish Structure – Eyes on 6287 BreakoutSPX500

The price maintains bullish momentum as long as it remains above 6225 and 6246.

Currently, the market is approaching the 6287 resistance level. A confirmed 4H candle close above 6287 is required to validate continuation of the bullish trend toward 6325.

However, a rejection from 6287 may trigger a short-term bearish correction, with potential pullbacks toward 6246 and 6225.

A sustained break below 6225 would shift the momentum to the downside, targeting the 6143 support level.

Pivot Level: 6264

Resistance: 6287 – 6325

Support: 6246 – 6225 – 6143

MIGGLES/USDT THE BREAK RETURN TO THE MOONMIGGLES/USDT THE BREAK RETURN TO THE MOON

We are following with live data on this coin for the next volume trend, which can have a break in the coming time.

At this moment, this coin is showing signs of an increase. When it gets confirmed, we will follow it with live updates.

BTC - Bulls Getting Ready!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈BTC has been bullish trading within the flat rising wedge marked in blue and it is currently retesting the lower bound of the wedge.

Moreover, the orange zone is a strong demand.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of demand and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #BTC approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

MArket scan shows PRIME CAN RETURN BACKMarket scan shows PRIME CAN RETURN to higher levels.

soon, more data on this update

The first smart money whales have taken the step.. lets see what can happen next with new updates below.

We can't see the future what can happen, but we can follow the data.

as long there is more whales entering this coin, we can expect an interesting return.

TAIKO/USDT NEW INCREASE VIEWThe latest data shows that this coin is entering a new uptrend, which can be confirmed in the coming time frames, see the last update.

In trading, it's about building a real, confirmed trend, starting with building and holding levels.

The keys are: Start of a new cycle, start of new smart money

This coin is at the first level of scan, and time frames should confirm if it's an interesting coin or not. Until now, there is no confirmation; only the first scan shows it can be interesting.

* This coin is a high-risk coin.

SPX500 Holds Above 6,225 – Bullish Trend Intact for NowSPX500 Update – Bullish Pressure Holds Above Pivot

SPX500 continues to show bullish momentum, as highlighted in our previous analysis. The price remains supported by strong buying volume above the key pivot zone at 6,225.

As long as the price stays above this level, a retest toward 6,225 remains possible before another leg higher.

However, a confirmed break below 6,225 would signal potential bearish momentum and shift the short-term structure.

Key Levels:

• Pivot Line: 6,246

• Resistance: 6,265 / 6,287 / 6,325

• Support: 6,225 / 6,191 / 6,143

US30 Awaits NFP – Bullish Above 44,410, Volatility Expected US30 (Dow Jones) – NFP Volatility in Focus

Today’s session is expected to be volatile due to the upcoming NFP report. Based on current forecasts, the outlook remains broadly positive for U.S. indices, though intraday swings are likely.

Technical Outlook:

As long as the price holds above 44,410, the bullish momentum remains intact, with potential upside targets at 44,750 and 44,910

A pullback toward 44,410 remains possible before any continuation higher.

However, a confirmed 4H close below 44,400 would shift the short-term structure to bearish, opening the door toward the 1st support zone around 44,180.

Key Levels:

• Resistance: 44,750 / 44,910 / 45,090

• Support: 44,410 / 44,180 / 43,970

Stay cautious — volatility is expected to spike around the release of the jobs data.

INJ - Back from the Dead?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

INJ has been hovering within a wide range between our two green zones, spanning from $10 to $16.

For the bulls to take control in the medium term, a break above the last major high marked in blue is needed.

To confirm long-term bullish dominance, a breakout above the upper boundary of the green range is required.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

EURUSD - Macro Trend Shift Soon?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈From a macro perspective, EURUSD has been bearish trading within the falling red channel.

Medium-term, EURUSD has been in a correction phase trading within the rising channel in orange.

Moreover, the green zone is a massive monthly resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red and orange trendlines and resistance.

📚 As per my trading style:

As #EURUSD is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD - Trading The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GA has been hovering within a big range.

This week, GA is retesting the upper bound of the range acting as a resistance.

As long as the resistance holds, we will be looking for shorts on lower timeframes, targeting the lower bound of the range.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Copper is gonna to complete the 2nd leg??Hi all trading lovers and copper buyers...

Seems that after BREAKOUT from Descending Triangle and Pullback to breakout level, price is going to complete the 2nd BULLISH Leg in Weekly uptrend with a round level target (5.5555)...

(Pullback could be a bit deeper...)

PLEASE NOTE THAT IS ONLY AN ANALYSIS AND COULD BE WRONG...

MARKET IS BASED ON POSSIBILITIES AND UNCERTAINTIES...

MANAGE YOUR RISK...

#Forex #Trading #Analysis #Copper #Chart #Spike #Wedge #Uptrend

AUDJPY - let's do it again!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last AUDJPY analysis (attached on the chart), it rejected the first blue circle zone and surged in a parabolic manner.

📈AUDJPY is currently retesting the intersection of the blue trendline and red support.

📚 As per my trading style:

As #AUDJPY is around the latest blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

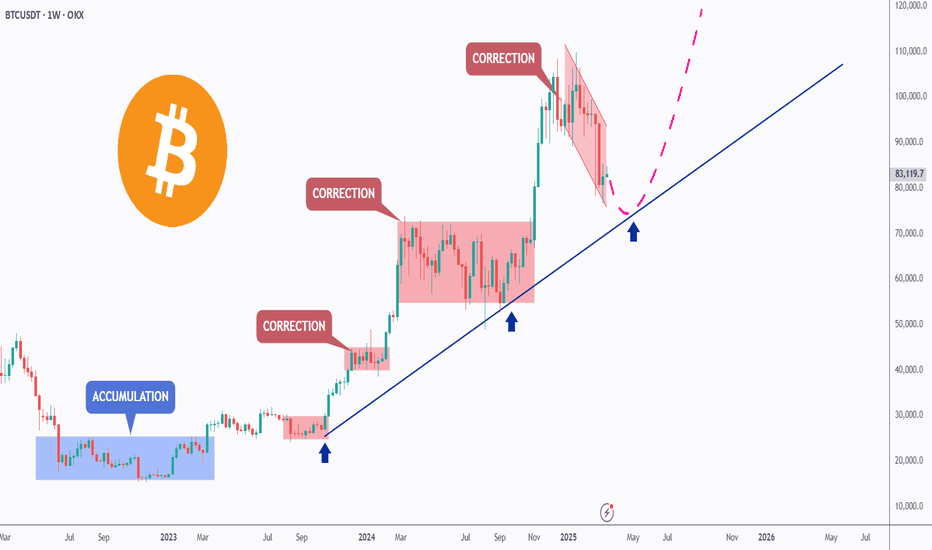

BTC HIGH DATA SHOW BREAKDOWN TO 85K FOR BITCOIN SOON.Bitcoin Market Update

BTC SEEMS TO ENTER A NEW CORRECTION PHASE SOON.

Recent data suggests that the current Bitcoin (BTC) cycle is coming to an end. As a result, we may soon see a downward move in BTC's price. The key target in this potential drop is around $85,000, with expectations that BTC will fall below $100,000.

This week, Bitcoin completed its cycle trend and is now entering a processing or transitional phase. Once this phase ends, we anticipate another decline in price.

This outlook is based on recurring patterns seen in previous BTC cycles, which have shown similar behavior in the past.

BTC can play on the low time frame with uptrends and downtrends, but if we will choice a side, then it will be the red trend.. since BTC cycle is ending.

XAU/USD – Testing 2H/1H Supply Zone | Breakout or Rejection?XAU/USD – Testing 1H/2H Supply Zone | Bullish Continuation or Rejection Ahead

Gold has rallied strongly from the support zone around 3,238–3,255, breaking multiple intraday resistance levels and now approaching a critical 1H/2H Supply Zone near 3,348–3,366.

This area previously acted as a strong sell-off zone, making it a key decision point.

Scenario 1: Bullish Continuation

If price breaks and closes above 3,366 with momentum, we could see further upside toward the next resistance at 3,400 and possibly retest the ATH zone at 3,486. A short consolidation or retest within the zone would confirm strength.

Scenario 2: Rejection from Supply Zone

If the supply holds, a rejection from the zone could lead to a pullback toward:

3,320.48 (minor support)

3,297.08 (support line)

Or deeper retracement to the 3,255–3,238 support zone

Key Technical Levels

Supply Zone: 3,348 – 3,366

Resistance: 3,400 – 3,486 (ATH)

Support Levels: 3,320 – 3,297 – 3,255 – 3,238

Pivot Line: 3,348

BTC - Bullish SOON!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

BTC has been in a correction phase, and it feels like it's taking forever! ⏳

As long as the blue trendline holds, the overall bias remains bullish. 📈

As BTC approaches the blue trendline—perfectly aligning with a demand zone and support—we'll be watching for trend-following longs to catch the next big impulse move upward. 🚀

For now, we wait! ⏳

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XAUUSD – Key Inflection Zone Before Core PCE Price Index m/mGold opened today with a bearish gap, once again struggling to stay above the 3327–3305 support zone, the same range where it hovered yesterday. While the price did form a higher low and higher high structure on the lower timeframes, this move still lacks the strength to signal a proper reversal—rather, it looks more like a minor consolidation ahead of tonight’s US GDP and Unemployment Claims release.

At this point, gold is trapped between two key forces:

A resilient resistance zone formed by the downtrendline, unfilled gap from earlier this week, and confluence of MA50 & MA200

A rising minor support trendline, creating a tightening range and indicating that the next breakout may provide a clearer direction.

⚠️ Technical Outlook

As long as gold remains below 3366–3367, the prevailing downtrend structure remains valid. Any rally into that zone should be viewed cautiously, especially if accompanied by weak volume or rejection candles. However, if gold manages to break and close H4 above 3367, it could trigger a short-term correction toward 3396 or even higher, aiming to fill the previous gap.

But so far, the momentum remains bearish, and lower highs continue to dominate the mid-term structure.

🔽 Trade Idea (Cautious Swing Trade)

Due to the wide stop-loss required, we recommend using reduced position size to maintain proper risk management.

🔵 Sell Area: 3358 – 3367

❌ Stop Loss: 3396 (above the trendline and prior key high)

🎯 Take Profit 1: 3331

🎯 Take Profit 2: 3306

🎯 Take Profit 3: 3289

🧠 Risk Level: Moderate to High (Lot size should be adjusted)

R3: 3379

R2: 3366

R1: 3350

Pivot: 3327

S1: 3305

S2: 3286

S3: 3256

Market SIGNALS SHOW THAT BTC CAN FALL TO 85K USDMarket follow-up study shows that there is a good chance BTC can fall to 85K in the coming time period. The market cycle seems to end the green trend and to enter a new red zone.

Time will show what really can happen with BTC.

The market can make a fake trend, with a trend fall on a high time frame.

The crash can also happen on the main markets.

This is not trading advice, trade always only depending on your plan.

USDCHF - Bearish => Bullish => Now Bearish?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDCHF has been overall bearish trading within the falling channel marked in orange. And it is currently retesting the upper bound of the channel.

Moreover, the green zone is a strong resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper orange trendline and resistance.

📚 As per my trading style:

As #USDCHF approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.