Trend Analysis

BITCOIN 15-Min Chart – Key Support Retest with Bullish PotentialThis 15-minute BTCUSD chart shows Bitcoin retesting a strong support zone near $112,680 after a clear downward move. The price is currently reacting at a previous demand area, marked in blue, just above the session’s LOW. A possible bullish reversal setup is forming if the support holds, targeting the previous HIGH around $114,000 and a potential TP at $114,200. Traders may look for confirmation signals (e.g., bullish engulfing, order block reaction) before entering long positions.

XAUUSDXAU/USD represents the exchange rate between one troy ounce of gold (XAU) and the US dollar (USD). It shows how much in US dollars is required to purchase one ounce of gold. This pair is widely traded across forex and commodities markets and is considered a key indicator of global economic stability and investor sentiment.

Historically, gold was pegged to the US dollar under the Bretton Woods Agreement from 1944 to 1971. During this period, one ounce of gold was fixed at $35, and the US government guaranteed the convertibility of dollars into gold. In 1971, President Richard Nixon ended the gold standard, allowing gold to trade freely on global markets. This led to significant volatility in the price of gold, which began to reflect real-time market forces such as supply, demand, inflation, and geopolitical events.

In the decades that followed, gold experienced several major price movements. In 1980, gold surged to around $850 per ounce due to high inflation and geopolitical instability. It then declined and remained relatively low through the 1990s, reaching a low near $270 in 2000. Starting in the mid-2000s, gold began a strong upward trend driven by concerns about inflation, financial crises, and central bank policies, culminating in a peak near $1,920 in 2011 during the Eurozone crisis and Federal Reserve monetary easing.

In 2020, gold hit a new all-time high around $2,070 during the global uncertainty of the COVID-19 pandemic. Since then, it has continued to be influenced by economic data, interest rate decisions, inflation trends, and geopolitical developments. In 2024 and 2025, gold has remained strong, supported by central bank buying and expectations of future rate cuts. As of August 2025, the current price of gold has reached $3,363 per ounce, reflecting heightened demand and ongoing macroeconomic uncertainty.

XAU/USD is influenced by many factors, including the strength of the US dollar, inflation expectations, geopolitical risks, and investor demand for safe haven assets. When the dollar weakens or global uncertainty increases, gold typically gains value. Traders and investors often use gold to hedge against economic instability, inflation, or currency devaluation.

Today, gold remains one of the most important assets in global markets, and XAU/USD continues to be a major pair for both short-term traders and long-term investors.

GOLD: NEW WEEK TECHNICAL BIAS (MARKET OPEN)CONTEXT

▪︎ HTFs Bias: Bullish stance remains intact until a valid structural breach occurs.

▪︎ Monthly Context: Despite consistent upper wick rejections, price continues to close above prior monthly opens — suggesting bullish resilience.

▪︎ Weekly View: Current price action reflects a Value Compression Phase (VCP) within the premium zone of the active range, implying potential buildup for a bullish Impulse Drive.

▪︎ Daily Alignment: Daily price behavior mirrors the Weekly context, supporting a continuation thesis.

Preferred Scenario: Leaning towards a Retrace Precision Entry (RPE) before the Ascend Sequence resumes. Watching:

• Point A (shallow pullback) near B/C level, or

• Point B (deep pullback) into the pending Rejection Zone (ARB).

Invalidation Trigger: A structural breach below 3336, backed by bearish momentum and microstructure shift, targets first 3280, then levels below.

Uncertainty Variable: Will price first sweep 3433.2 before retracing? Or will it retrace from market open? This remains unclear and demands a patient, reactive stance.

📌 Disclaimer: This is a strategic directional bias, not financial advice. Execute only with confirmation and proper risk management.

BTCUSD - Follow Up AnalysisTaking a look at the daily chart, price action did come down as previously expected in my last article.

Now we're heading into an area of strong support and I expect to see some sideways action until something significant happens next.

How I'm trading this price action?

I believe price action may continue to bounce around from the current price of 113,600 down to 110,000 for at least the next few days. With that said I'm implementing my range trading strategy. The range trading strategy also known as the Bitcoin Scalper scalps on the 1 and 5min timeframe creating sort of like a grid style approach but it's based on candlestick momentum. Since it trades off momentum, it's able to detect breakouts and know when to switch from the ranging strategy to the breakout strategy.

Gold Plan B For 4 Aug onwardsAs you can see that gold is moving good in channel of Bullish so next hurdle can be 3374-3380 and then it can retest the support of Non-Farm 3336-3340 and then continue this channel till further 3452-3458 and then we can expect a big fall in gold and this time support point will be 3290-3300 which will hold gold to go up again.

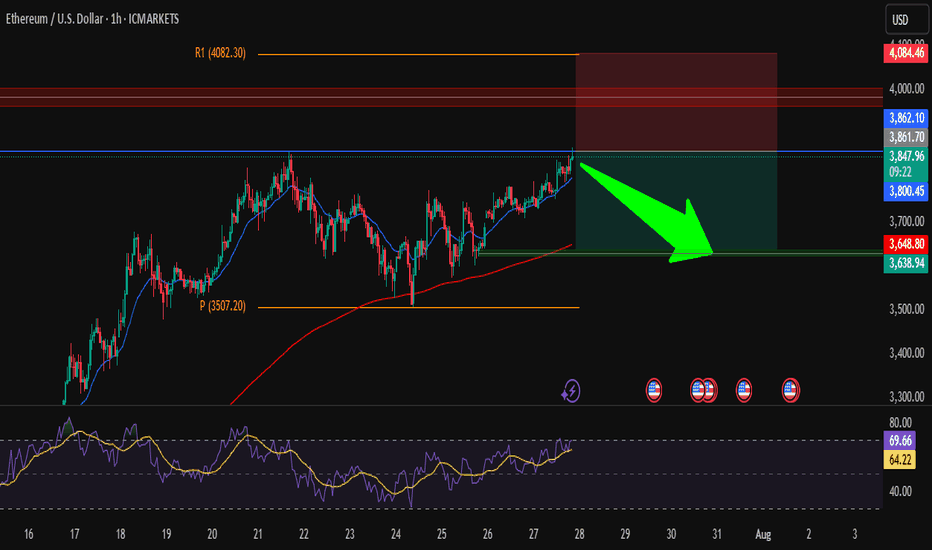

ETH/USD – Short from ResistanceHi traders ! , I opened a short position on ETH/USD as price is hitting a strong resistance zone.

Entry: 3850

SL: 4084.46

TP: 3638.94

📌 Why I took this trade:

Price is testing a strong resistance zone around 3860, RSI is overbought, and we could see a pullback toward the support area around 3640.

Nice risk/reward setup, keeping it simple.

This is just my analysis, not financial advice.

What’s your view — drop or breakout?

ETHEREUM ETHUSDTTHE structure and strategy will never lie. Watch demand and supply roof .

from the top layers ,we have seen the 3touch supply roof sending Ethereum tanking again expect the retest of the broken supply from the bottom to provide buy opportunity

trading is 100% probability, please lower your expectations and know that any key level can fail.

#ethusdt #ethereum #bitcoin #btc #crypto

DOGEUSDT Technical Analysis – Bullish Reversal Anticipated DOGEUSDT Technical Analysis – Bullish Reversal Anticipated

🔍 Key Technical Zones:

Support Zone: $0.1990 – $0.2015

Strong bullish reactions noted from this level in previous attempts.

Confluence with volume accumulation on the left (as seen in the Volume Profile).

Signifies a strong demand zone where buyers are stepping in.

Resistance Zone / Target: $0.2220 – $0.2240

Previous structural high and supply zone.

Marked as the first major liquidity area.

Also aligns with imbalance and CHoCH (Change of Character), a common SMC concept.

🔄 Market Structure:

CHoCH (Change of Character) marked multiple times, indicating attempts by bulls to reclaim structure.

Recent price action shows accumulation near support.

Sideways consolidation suggests potential for a bullish breakout.

Liquidity sweep of recent lows could indicate that smart money is accumulating positions before a move higher.

🎯 Trade Setup Idea:

Entry Area: Between $0.2000 – $0.2060 (inside the support zone)

Target: $0.22396 (as marked)

Stop Loss: Below $0.1980 (below the visible support range)

🔧 Indicators and Tools Used:

Volume Profile (VRVP): Shows most volume traded around $0.205 – $0.207, indicating strong positioning from market participants.

Smart Money Concepts (SMC): CHoCH and liquidity concepts signal potential accumulation and reversal.

Price Action Analysis: Clean swing structure with support-resistance rotation visible.

📌 Conclusion:

DOGEUSDT is currently trading in a range-bound structure with a bullish bias from the support zone. If the price sustains above $0.205 and breaks above minor resistance, the upside target of $0.22396 is likely. This setup is supported by strong volume accumulation and smart money structure shifts.

Smart Money Watching BTC Dominance – Rotation to Alts IncomingAfter a deep correction, BTC Dominance has entered a corrective upward phase inside an ascending channel.

Wave A rallied from 60.5% to 62.3%, followed by Wave B retracing to 60.74%.

Currently, Wave C is developing and has reached around 62.2%.

The key resistance sits near 62.7%, exactly at the upper trendline of the channel. This could act as a reversal point, potentially ending Wave C and triggering a bearish move.

💡 Implication:

If dominance drops from this zone, we could see capital rotation into altcoins, supporting a bounce across the broader altcoin market.

How to Capture Reversals/Breakouts with MAD IndicatorBTC/USDT 15M – Market Anomaly Detector (MAD) Captures Reversals & Breakouts

⸻

Description:

On this BTC/USDT 15-minute chart, the Market Anomaly Detector (MAD) is actively highlighting high-probability market turning points and anomaly zones.

Key Observations from the Chart:

1. Green & Red Zones = Expected Price Range

• Green Line (Upper Band): Expected top of the range.

• Red Line (Lower Band): Expected bottom of the range.

• Price usually travels green → red → green, forming a natural oscillation.

2. Buy/Sell Signals = Breakout + Reversal Detection

• Buy Signal: Triggered when price closes above the green line or recovers from below the red line.

• Sell Signal: Triggered when price closes below the red line or rejects from the green line.

• This reverse psychology logic helps catch false breakouts and stop-loss hunts.

3. Performance on This Chart:

• Signals aligned with key reversals during the sideways-to-downtrend transition.

• The strong downtrend in the second half of the chart shows multiple accurate sell signals, confirming trend continuation.

• Sideways movements had minimal false signals due to cooldown + volume filter.

4. Unique Advantage (USP):

• Statistical approach using Z-Score & Standard Deviation.

• Multi-filter confirmation with RSI, volume, and higher timeframe trend.

• Visually clear anomaly zones:

• Green background = Bullish anomaly

• Red background = Bearish anomaly

• Gray background = Neutral range

Takeaway:

MAD helps traders anticipate anomalies rather than react late, offering high-probability trade entries and reversals in trending and volatile conditions.

BTCUSDT 1D – Retesting Key Support, Will Bulls Hold the Line?Bitcoin is retesting a crucial structural support level around $112K after its recent local top near $120K. This zone previously acted as resistance and is now being tested as support — a textbook bullish continuation signal if it holds.

Historically, these flips (from resistance to support) have triggered strong upside momentum, as seen after the $78K breakout earlier this cycle. However, failure to hold this level could open the door for a deeper correction toward $100K or even the $90K region.

This chart outlines the major structural zones:

Long-term accumulation base near $70–78K

Resistance flip zone at $110–112K

Local resistance near $120K

📌 If bulls defend this zone and reclaim momentum, we could see another push toward cycle highs. If not, patience is key — the next high-conviction entry may come lower.

How are you positioning around this zone? Let me know in the comments 👇

GBPUSD : NEW WEEK TECHNICAL BIAS (MARKET OPEN)CONTEXT

(Strictly Technical Outlook – No Fundamental Overlays)

▪︎ Higher Timeframe (HTF) Price Action from the previous week signals a potential pullback or reversal, as last month closed with a strong bearish momentum candle.

▪︎ However, the broader bullish structure remains intact — current Descend Sequence is interpreted as a corrective leg into discounted territory.

▪︎ I anticipate price to trade lower into the Monthly Price Inefficiency Zone (M-PIZ) and further toward the discount zone of the prevailing price leg.

▪︎ A rally toward the 1.33502 – 1.34014 region would offer a high-probability zone for short setups. A sweep or reclaim of 1.31739 may precede this rally.

▪︎ The premium OCZ appears unlikely to be reached — unless employed as a Trap.

▪︎ Downside targets include:

i. Monthly PIZ

ii. 1.29442 and potentially levels below

Invalidation:

Bearish setup will be invalidated if price trades above 1.36942 with microstructure confirming an Ascend Sequence continuation.

Note: Bias is developed strictly from chart structure using IntelEdge Technical Protocol – no fundamental overlays included.

📌 Disclaimer: is a strategic directional bias, not financial advice. Execute only with confirmation and proper risk management.

Up only desuTon has crashed a lot from its all time high and it seems to be rebounding now. Today will be the fifth daily green candles in a row and yesterday's daily closed above EMA 200

IN ADDITION TO THIS

Some bullish news for Ton i found from elfabot

The recent surge in CRYPTOCAP:TON price is primarily attributed to strong ecosystem activity, including significant NFT purchases by Pavel Durov (Telegram’s founder), such as buying a Plush Pepe NFT for 15,000 TON (about $53,000), which has boosted market confidence and demonstrated TON’s real-world utility. This has been widely discussed in the crypto community and cited as a bullish catalyst (source).

⦁ Additional bullish factors include Grayscale considering investment in TON, the launch of new Telegram NFT features, and US users being able to access TON Wallet directly inside Telegram without a VPN (source).

So, yea, i think we're breaking previous ATH and hitting $10 soon

cheers

Bitcoin’s Game Has Changed: Fresh Support Zone, Targets Sky-HighHey Dear Friends,

Until recently, Bitcoin had been stuck in a range between 112,331 and 105,344 for quite some time. But that range has now been clearly broken. So, what does this mean? This zone, which used to act as resistance, is now expected to flip and act as support.

According to my weekly trading model, the long-term target levels I’m tracking for Bitcoin are: 127,818 – 137,000 – 146,000.

Since this is a weekly setup, it might take a while for these targets to play out. Even if we see pullbacks to the 112K, 105K, or even 100K levels, I expect to see strong buying pressure from that zone.

I’ll keep sharing regular updates as this setup develops.

To everyone who’s been supporting and appreciating my work—thank you, truly. Your encouragement means the world to me and keeps me motivated to keep showing up. Much love to all of you—I’m grateful we’re in this journey together.

The End of BTC correction? BTC analysis 2/8/2025In my point of view, BTC has completed its correction and is now ready for a strong upward move, potentially targeting the $137,000–$139,000 range, based on the following factors:

1. Confirmation of the Butterfly Harmonic Pattern

The recent reversal occurred within the expected range of the Butterfly harmonic pattern. Typically, the XD leg in a Butterfly harmonic extends to 1.27, but in practice, this can stretch up to 1.414, which is commonly used as a flexible stop-loss zone. After testing the 1.27–1.414 range, a clear 5-wave impulse followed—testing a key trendline and making an attempt to break above the recent high. This sequence, followed by a corrective move, suggests that the broader correction may be complete.

2. Complex WXYXZ Correction Structure

In my previous analysis, I underestimated the duration and depth of the correction. The wave (4) (blue), which is part of the wave (iii), has taken considerable time—likely to allow wave (5) to extend sufficiently to break above the $130,000 level. This would support the assumption that wave (5) (purple) is the extended wave. The overall corrective structure appears highly complex, and can be counted as a W–X–Y–X–Z pattern, supported by the presence of multiple internal corrections within the wave components.

3. 0.618 Fibonacci Retracement of Wave (3)

Wave (4) has now reached the 0.618 Fibonacci retracement level of wave (3), which is significant. Historically, BTC’s corrections rarely retrace beyond the 0.87 level. This deep retracement suggests wave (4) is likely complete—unless price were to fall below that threshold, which would invalidate this assumption.