BTCUSD - Follow Up AnalysisTaking a look at the daily chart, price action did come down as previously expected in my last article.

Now we're heading into an area of strong support and I expect to see some sideways action until something significant happens next.

How I'm trading this price action?

I believe price action may continue to bounce around from the current price of 113,600 down to 110,000 for at least the next few days. With that said I'm implementing my range trading strategy. The range trading strategy also known as the Bitcoin Scalper scalps on the 1 and 5min timeframe creating sort of like a grid style approach but it's based on candlestick momentum. Since it trades off momentum, it's able to detect breakouts and know when to switch from the ranging strategy to the breakout strategy.

Trend Analysis

Gold Plan B For 4 Aug onwardsAs you can see that gold is moving good in channel of Bullish so next hurdle can be 3374-3380 and then it can retest the support of Non-Farm 3336-3340 and then continue this channel till further 3452-3458 and then we can expect a big fall in gold and this time support point will be 3290-3300 which will hold gold to go up again.

OTHERS.D – Perfect Reaction to Previous AnalysisAs predicted in the last update, OTHERS.D broke structure and dropped sharply toward the 7.20% demand zone — exactly as expected.

Now, we’re waiting for a potential bullish reaction from this key area. If demand holds, a move toward the upper channel boundary (~7.70%) could follow.

🧭 Technical Outlook:

• Price tapped into a key demand zone at 7.20%, which aligns with the lower boundary of a descending channel.

• A bullish reaction is forming, suggesting short-term strength in altcoins.

• A move toward the channel top near 7.70% is now on the table if demand holds.

⚠️ Important Note:

This move is likely to remain a corrective rally unless we see a proper breakout above 7.70% with volume and structure shift. Be selective with altcoin longs.

🔍 Watch for:

• Reaction at 7.50% midline

• Price behavior at 7.70% resistance

• Structure shift or failure pattern near channel top

⚠️ Caution: This remains a corrective rally unless price breaks 7.70% with structure shift.

🔗 Analysis by CryptoPilot

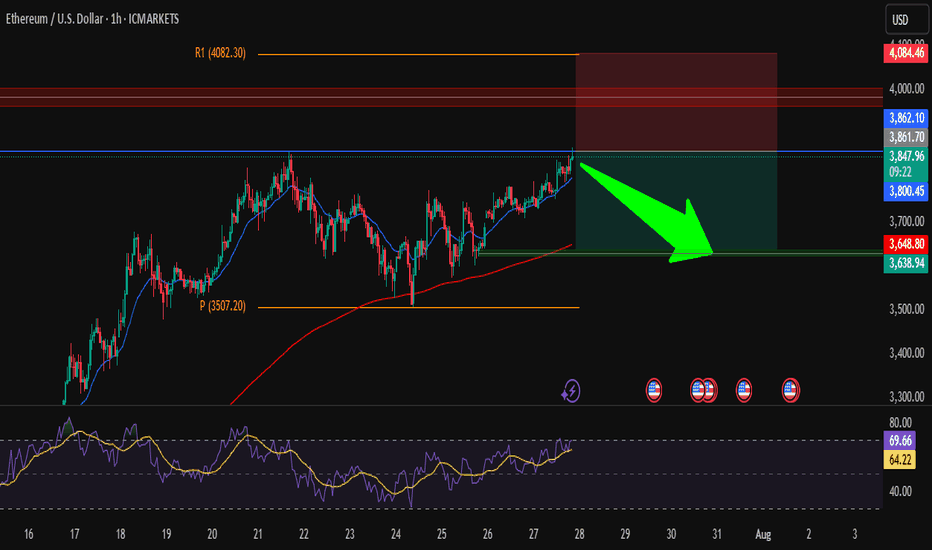

ETH/USD – Short from ResistanceHi traders ! , I opened a short position on ETH/USD as price is hitting a strong resistance zone.

Entry: 3850

SL: 4084.46

TP: 3638.94

📌 Why I took this trade:

Price is testing a strong resistance zone around 3860, RSI is overbought, and we could see a pullback toward the support area around 3640.

Nice risk/reward setup, keeping it simple.

This is just my analysis, not financial advice.

What’s your view — drop or breakout?

XAUUSD TRADE UPDATE MISSED TRADE Hey everyone here’s a trade recap of the week at first we were interested to take buys at 3254 zone as first entry and scale in at 3287 zone but price pulled down slightly missed the first entry and I didn’t execute & the second entry didn’t execute that too and market skyrocket if price activated the first entry we would’ve caught a huge trade today,the first one didn’t activated so I didn’t execute the second entry which is the 3287 zone that buyers came in so we move on and I will keep on sharing potential good setups and have a beautiful weekend guys….

Candle close above 100 after 2 months.If the Dollar Index manages to close above the 100 level today, following the important news release, there's a chance the upward move could continue toward the key 101 zone next week.

However, unless it breaks above the 101 level with strong momentum, the overall trend in the higher timeframes still remains bearish.

XRP at $2.93? They Forgot What’s Coming?XRP isn’t just another coin. With clarity coming from major rulings, its return to previous highs isn’t just possible it’s probable. I like this level. Watching price and fundamentals line up.

I’m not just looking at the chart — I’m looking at the bigger picture.

$XRP ENJOYERRRs see ya at $1.04-$1.20If we look at the chart of XRP, you can see that since the move in fall of 2024, we've had a massive lack of balance on the chart.

We ran up quickly without testing any levels as support.

That makes me think we're going to see the lack of balance get corrected and the same move is now going to happen in the opposite direction.

The $1.04-1.20 region looks like a good area of support to me.

How to Capture Reversals/Breakouts with MAD IndicatorBTC/USDT 15M – Market Anomaly Detector (MAD) Captures Reversals & Breakouts

⸻

Description:

On this BTC/USDT 15-minute chart, the Market Anomaly Detector (MAD) is actively highlighting high-probability market turning points and anomaly zones.

Key Observations from the Chart:

1. Green & Red Zones = Expected Price Range

• Green Line (Upper Band): Expected top of the range.

• Red Line (Lower Band): Expected bottom of the range.

• Price usually travels green → red → green, forming a natural oscillation.

2. Buy/Sell Signals = Breakout + Reversal Detection

• Buy Signal: Triggered when price closes above the green line or recovers from below the red line.

• Sell Signal: Triggered when price closes below the red line or rejects from the green line.

• This reverse psychology logic helps catch false breakouts and stop-loss hunts.

3. Performance on This Chart:

• Signals aligned with key reversals during the sideways-to-downtrend transition.

• The strong downtrend in the second half of the chart shows multiple accurate sell signals, confirming trend continuation.

• Sideways movements had minimal false signals due to cooldown + volume filter.

4. Unique Advantage (USP):

• Statistical approach using Z-Score & Standard Deviation.

• Multi-filter confirmation with RSI, volume, and higher timeframe trend.

• Visually clear anomaly zones:

• Green background = Bullish anomaly

• Red background = Bearish anomaly

• Gray background = Neutral range

Takeaway:

MAD helps traders anticipate anomalies rather than react late, offering high-probability trade entries and reversals in trending and volatile conditions.

BTCUSDT 1D – Retesting Key Support, Will Bulls Hold the Line?Bitcoin is retesting a crucial structural support level around $112K after its recent local top near $120K. This zone previously acted as resistance and is now being tested as support — a textbook bullish continuation signal if it holds.

Historically, these flips (from resistance to support) have triggered strong upside momentum, as seen after the $78K breakout earlier this cycle. However, failure to hold this level could open the door for a deeper correction toward $100K or even the $90K region.

This chart outlines the major structural zones:

Long-term accumulation base near $70–78K

Resistance flip zone at $110–112K

Local resistance near $120K

📌 If bulls defend this zone and reclaim momentum, we could see another push toward cycle highs. If not, patience is key — the next high-conviction entry may come lower.

How are you positioning around this zone? Let me know in the comments 👇

GBPUSD : NEW WEEK TECHNICAL BIAS (MARKET OPEN)CONTEXT

(Strictly Technical Outlook – No Fundamental Overlays)

▪︎ Higher Timeframe (HTF) Price Action from the previous week signals a potential pullback or reversal, as last month closed with a strong bearish momentum candle.

▪︎ However, the broader bullish structure remains intact — current Descend Sequence is interpreted as a corrective leg into discounted territory.

▪︎ I anticipate price to trade lower into the Monthly Price Inefficiency Zone (M-PIZ) and further toward the discount zone of the prevailing price leg.

▪︎ A rally toward the 1.33502 – 1.34014 region would offer a high-probability zone for short setups. A sweep or reclaim of 1.31739 may precede this rally.

▪︎ The premium OCZ appears unlikely to be reached — unless employed as a Trap.

▪︎ Downside targets include:

i. Monthly PIZ

ii. 1.29442 and potentially levels below

Invalidation:

Bearish setup will be invalidated if price trades above 1.36942 with microstructure confirming an Ascend Sequence continuation.

Note: Bias is developed strictly from chart structure using IntelEdge Technical Protocol – no fundamental overlays included.

📌 Disclaimer: is a strategic directional bias, not financial advice. Execute only with confirmation and proper risk management.

Up only desuTon has crashed a lot from its all time high and it seems to be rebounding now. Today will be the fifth daily green candles in a row and yesterday's daily closed above EMA 200

IN ADDITION TO THIS

Some bullish news for Ton i found from elfabot

The recent surge in CRYPTOCAP:TON price is primarily attributed to strong ecosystem activity, including significant NFT purchases by Pavel Durov (Telegram’s founder), such as buying a Plush Pepe NFT for 15,000 TON (about $53,000), which has boosted market confidence and demonstrated TON’s real-world utility. This has been widely discussed in the crypto community and cited as a bullish catalyst (source).

⦁ Additional bullish factors include Grayscale considering investment in TON, the launch of new Telegram NFT features, and US users being able to access TON Wallet directly inside Telegram without a VPN (source).

So, yea, i think we're breaking previous ATH and hitting $10 soon

cheers

Bitcoin’s Game Has Changed: Fresh Support Zone, Targets Sky-HighHey Dear Friends,

Until recently, Bitcoin had been stuck in a range between 112,331 and 105,344 for quite some time. But that range has now been clearly broken. So, what does this mean? This zone, which used to act as resistance, is now expected to flip and act as support.

According to my weekly trading model, the long-term target levels I’m tracking for Bitcoin are: 127,818 – 137,000 – 146,000.

Since this is a weekly setup, it might take a while for these targets to play out. Even if we see pullbacks to the 112K, 105K, or even 100K levels, I expect to see strong buying pressure from that zone.

I’ll keep sharing regular updates as this setup develops.

To everyone who’s been supporting and appreciating my work—thank you, truly. Your encouragement means the world to me and keeps me motivated to keep showing up. Much love to all of you—I’m grateful we’re in this journey together.

The End of BTC correction? BTC analysis 2/8/2025In my point of view, BTC has completed its correction and is now ready for a strong upward move, potentially targeting the $137,000–$139,000 range, based on the following factors:

1. Confirmation of the Butterfly Harmonic Pattern

The recent reversal occurred within the expected range of the Butterfly harmonic pattern. Typically, the XD leg in a Butterfly harmonic extends to 1.27, but in practice, this can stretch up to 1.414, which is commonly used as a flexible stop-loss zone. After testing the 1.27–1.414 range, a clear 5-wave impulse followed—testing a key trendline and making an attempt to break above the recent high. This sequence, followed by a corrective move, suggests that the broader correction may be complete.

2. Complex WXYXZ Correction Structure

In my previous analysis, I underestimated the duration and depth of the correction. The wave (4) (blue), which is part of the wave (iii), has taken considerable time—likely to allow wave (5) to extend sufficiently to break above the $130,000 level. This would support the assumption that wave (5) (purple) is the extended wave. The overall corrective structure appears highly complex, and can be counted as a W–X–Y–X–Z pattern, supported by the presence of multiple internal corrections within the wave components.

3. 0.618 Fibonacci Retracement of Wave (3)

Wave (4) has now reached the 0.618 Fibonacci retracement level of wave (3), which is significant. Historically, BTC’s corrections rarely retrace beyond the 0.87 level. This deep retracement suggests wave (4) is likely complete—unless price were to fall below that threshold, which would invalidate this assumption.

GOLD – SMC ProTrading Breakdown Plan Next WEEK GOLD – SMC ProTrading Breakdown | Clinton Scalper | 4H Timeframe

XAUUSD is currently displaying clear institutional order flow behavior after a deep liquidity sweep at the end of July. Here’s a full breakdown using advanced SMC (Smart Money Concepts) methodology:

🔍 1. Liquidity Sweep at the Low

Price maintained a series of lower highs and bearish structure until it executed a classic liquidity grab between 3,270 – 3,290. This is a textbook move by Smart Money: sweep retail stop orders before initiating a reversal.

This zone aligned with:

✅ Untapped Fair Value Gap (FVG)

✅ Reversal Order Block (OB)

✅ Fibo 0.236 of the mid-term bullish leg

After the sweep, the market printed a micro CHoCH, indicating early signs of smart money accumulation.

🧠 2. CHoCH → BOS → Reaccumulation Structure

CHoCH (Change of Character) marks the first break in the bearish microstructure – suggesting a possible shift.

Then, price delivered a BOS (Break of Structure) around the 3,334 zone, confirming bullish intent.

Buy-side is now:

Positioned from a deep discount zone

Mitigating key inefficiencies

Targeting higher liquidity zones above current price

Price is currently reacting to a previous supply OB around 3,362.

📐 3. Institutional Order Flow & Target Zones

Now that price is in a key reaction zone, we prepare for two high-probability scenarios:

🅰️ Continuation Scenario (Reaccumulation)

A retracement to the 3,317–3,311 zone (Fibo 0.5–0.618) could offer a premium re-entry

This area is stacked with:

FVG

Order Block

Equal lows liquidity

🔼 From there, potential targets include:

🎯 TP1: 3,371 – previous imbalance zone

🎯 TP2: 3,392 – minor liquidity cluster

🎯 TP3: 3,429 – premium OB and high-liquidity zone

🅱️ Distribution Scenario (Bearish Rejection)

If price fails to hold bullish structure and forms a bearish CHoCH around 3,392–3,429

This would signal a distribution zone, and potential reversal back toward 3,290 support

🔂 4. Smart Money Flow Logic

“Smart Money doesn’t follow price. They lead price to liquidity.”

This chart reflects the complete Sweep → CHoCH → BOS → Mitigation → Expansion sequence. A classic SMC Pro model where:

Liquidity is engineered and swept

Structure is shifted

Price returns to mitigate institutional entries

Price expands into external liquidity

📌 Clinton Scalper Outlook:

We don’t chase reversals – we track the footprints of capital. The real edge is understanding where smart money is positioned, and aligning with their narrative.

🔔 Stay tuned for continued updates using this precise and probability-driven Pro SMC framework.

Nifty levels - Jul 04, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

XRP/USD Breakout Watch: $3.22 Target in SightA key blue trendline on the XRP/USD chart that reflects market sentiment. If price breaks above it with strong volume, we could see a rally toward $3.22.

Support zone: $0.55–$0.60

Bullish case: Improved sentiment, easing tariffs, and regulatory cooling

Strategy: Wait for breakout confirmation before entering

Share your thoughts — are you preparing for a breakout?