Macro View on EUR/USDMonetary Policy Divergence

The Federal Reserve maintained its target federal funds rate at 4.25 – 4.50 percent, citing a resilient labour market and persistent inflationary pressures (Federal Reserve, 2025).

By contrast, the European Central Bank’s deposit facility rate stands at 2.00 percent, reflecting its earlier tightening cycle and more cautious approach to rate cuts (Federal Reserve Bank of St. Louis, 2025).

Inflation Differential

U.S. headline CPI rose 2.7 percent year-on-year in June 2025, with core CPI at 2.9 percent (U.S. Bureau of Labor Statistics, 2025).

Euro-area inflation was 2.0 percent in June, broadly in line with the ECB’s target (Eurostat, 2025).

Yield Spread

The 10-year U.S. Treasury yield hovered around 4.38 percent, versus roughly 2.4 percent on the bund, underpinning dollar strength (Federal Reserve Bank of St. Louis, 2025).

Growth Outlook

The U.S. economy continues to outperform, supported by robust consumption and a tight labour market.

Advanced-economy growth is projected at 1.4 percent in 2025, with the euro-area likely trailing, given headwinds from energy costs and subdued investment (International Monetary Fund, 2025).

Technical Structure

Downtrend in Place: Recent price action shows a break of the 20-day MA and loss of structure below 1.1700.

Supply Zone near 1.1750–1.1800 offers resistance.

Demand Zones at 1.1100–1.1200 and 1.0750–1.0850 coincide with long-term trendline support (see chart).

Outlook & Scenarios

Near-Term Bearish: Continued USD strength and fading risk appetite may drive EUR/USD toward the 1.1100 demand zone.

Medium-Term Range: If ECB signals a dovish pivot and U.S. data disappoints, expect a bounce into 1.1200–1.1400.

Key Pivot: A sustained break below 1.0750 would open targets toward 1.0200, the “discount” zone from late 2024.

References

European Central Bank. (2025, August 1). ECB deposit facility rate for euro area (ECBDFR) . FRED, Federal Reserve Bank of St. Louis.

Eurostat. (2025, June). Inflation in the euro area . ec.europa.eu

Federal Reserve. (2025, July 30). Federal Reserve issues FOMC statement. www.federalreserve.gov

Federal Reserve Bank of St. Louis. (2025, July 30). Market yield on U.S. Treasury securities at 10-year constant maturity . FRED.

International Monetary Fund. (2025, July). World Economic Outlook Update: July 2025. www.imf.org

U.S. Bureau of Labor Statistics. (2025, July). Consumer Price Index Summary – June 2025. www.bls.gov

Trend Analysis

EUR/USD Chart Summary (Bearish Setup):Trendline Break: A long-term bullish trendline has been broken.

Price below Ichimoku Cloud: Indicates bearish momentum.

Bearish Retest: Price pulled back to retest the broken trendline and is now forming a bearish continuation pattern.

Double Target Zones Identified:

1st Target Point: ~1.1329

2nd Target Point: ~1.1144

---

🟠 Suggested Trade Setup:

🔹 Entry (Sell):

Around 1.1585 (where price is hovering now; or on a small pullback).

🔻 Take Profit (TP):

🎯 TP1: 1.1329 (short-term target)

🎯 TP2: 1.1144 (main target if bearish momentum continues)

🛑 Stop Loss (SL):

Place above the recent swing high or cloud resistance — around 1.1670

---

📊 Risk-Reward:

TP1 = ~250 pips

TP2 = ~440 pips

SL = ~85 pips

This gives you a favorable risk-reward (1:3+ to TP

SUSDT: trend in daily time frames ((((( Each of these entries can reach the main TARGET)))))

The color levels are very accurate levels of support and resistance in different time frames, and we have to wait for their reaction in these areas.

So, Please pay special attention to the very accurate trend, colored levels, and you must know that SETUP is very sensitive.

Be careful

BEST

MT

Eliot ABC correctionThe theory maintains that markets move in repetitive fractal patterns, where each complete cycle consists of eight waves: five in the direction of the main trend (impulsive) and three in the opposite direction (corrective). Wave C, being the last component of the ABC correction, offers opportunities to enter positions favorable to the resumption of the major trend.

LTC/USDT Robbery Underway | Bullish Setup, Get In Now!🔥💎 LTC/USDT HEIST PLAN: ROB AT ANY PRICE! 💎🔥

🚨 Bullish Move Incoming | Layered Entries | Thief Trader Exclusive 🚨

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

The time has come for another high-stakes Thief Trading heist, and this time we're lockin' in on LTC/USDT – aka "Litecoin vs Tether" 💣💸

🎯 Thief’s Mission Plan: BULLISH AT ANY PRICE LEVEL!

We're going full stealth mode with a layering strategy — stacking multiple limit orders like a true pro thief preparing for a clean escape! 🔪📉📈

🚪 ENTRY: "Anywhere, Anytime" 🚪

📈 Buy from any price level — but for optimal entry:

🟢 Use Buy Limit orders near recent lows (15-30 min TF)

🔔 Don’t forget to set alerts for breakout confirmation!

🛑 STOP LOSS: Strategic Defense 🛑

🗣️ "Listen up, team! Stop loss ain’t a maybe — it’s your armor. Place it smart, or prepare for pain." 🔥

📍Recommended SL: 100.00

🔐 Adjust based on your lot size & how deep you stack your orders.

🏁 TARGET: 130.00 🏁

💸 But always Escape Early if the plan gets too hot!

Use a Trailing SL to lock in gains and slip out clean 😎🧨

🧠 PRO TIPS from the THIEF:

🔎 Only Buy. No Shorting!

💣 Scalpers: Jump in with the trend, not against it.

🧲 Swing Traders: Stay patient, and execute the full heist.

🚀 Use Trailing Stops – Let profit ride, but stay protected!

📢 MARKET INSIGHT:

🔥 Bullish Bias backed by:

✅ On-Chain Metrics

✅ Sentiment Shifts

✅ Macro Flows

✅ COT Reports

✅ Intermarket Divergence

⚠️ TRADING ALERT: Stay Sharp!

📰 News Events = Volatility.

💡 Avoid fresh entries during high-impact events.

📉 Use Trailing SL to secure your running trades.

💖 SUPPORT THE CREW 💖

🚀 Smash that Boost Button if you believe in the Thief Style Strategy

👑 Let's rob the market together, one level at a time.

🧠 Stay sharp, stay sneaky – and I’ll see you at the next target 🎯

— Thief Trader 🐱👤💰🚁🌍

Sell NATGAS into OCT/NOVNatalie has fromed a H&S and has broke through all of the supporting EMAs leading to most of the indicators turning bearish.

My approach for the forseeable is seeling bounces until the winter season approaches.

Of course Natalie is extremely susceptible to trend changes due to economical data and has to be monitored closely. Currenlty I'm a bear.

Only selling once it breaks and retests, where I will once again reasses based on economics such as storage, production, imports and demand.

Target around $2.5 where interestingly a gap (red rectangle) sits from Nov - 24.

Elliot Wave (although not a great fan) kind of aligns as well as the 0.786 fib level which began forming at the beginning of 2024.

Storage | Volatility | Price Outlook

U.S. natural gas markets are stabilizing as volatility trends back toward seasonal norms.

📉 Volatility has dropped from 81% in Q4 2024 to 69% in mid-2025

🏪 Storage is currently at 3,075 Bcf,

🔻 4.7% lower YoY

🔺 5.9% higher than the 5-year average

🚢 LNG exports remain strong—up 22% YoY and 74% above the 5-year average

🔌 Domestic demand is seasonally weaker but steady

➡️ Despite being below last year’s levels, storage surplus vs. the 5-year average acts as a soft ceiling on price.

➡️ Historical analogs suggest a fair value range between $2.50–$3.20/MMBtu in the short term.

📊 Current price action around $3.00–$3.40 looks slightly overheated unless a fresh catalyst emerges (heatwave, export spike, etc.).

🧭 Watching for:

Injection trends over the next few weeks

Cooling demand in power sector

Resistance around $3.40

Support near $2.80

DXY bullish into AUGUSTThe dxy seems poised to rally following a rally above PMHs. The August OPEN decline could end up being nothing but a retracement as we rally high. Monday, Tuesday and Wednesday could range, while Thursday and the NFP push us above August's current highs. An expansion below Friday's New York AM lows (H4) could signal continued decline as we seek to establish weekly LOWS. Patience as the market unfolds is hand is ALWAYS key. Let's chat.

QQQ: Expecting Bullish Continuation! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy QQQ.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Ethereum Breakdown Imminent: Bearish Triple Tops confirmedEthereum has fired off multiple bearish signals that traders and investors cannot ignore. A confirmed triple top on the daily chart suggests exhaustion at resistance, while the appearance of a hanging man candlestick pattern adds weight to the reversal thesis.

The daily RSI has confirmed a bearish divergence, and the MACD has officially crossed below the zero line—marking a shift in momentum and confirming bearish control.

In this video, I’ll break down:

• The triple top formation and its implications

• Why the 200 EMA is the next major support target

• The significance of RSI and MACD confirmations

• What traders should watch for in the coming sessions

This isn’t just noise—Ethereum’s technicals are flashing red. Make sure you’re prepared.

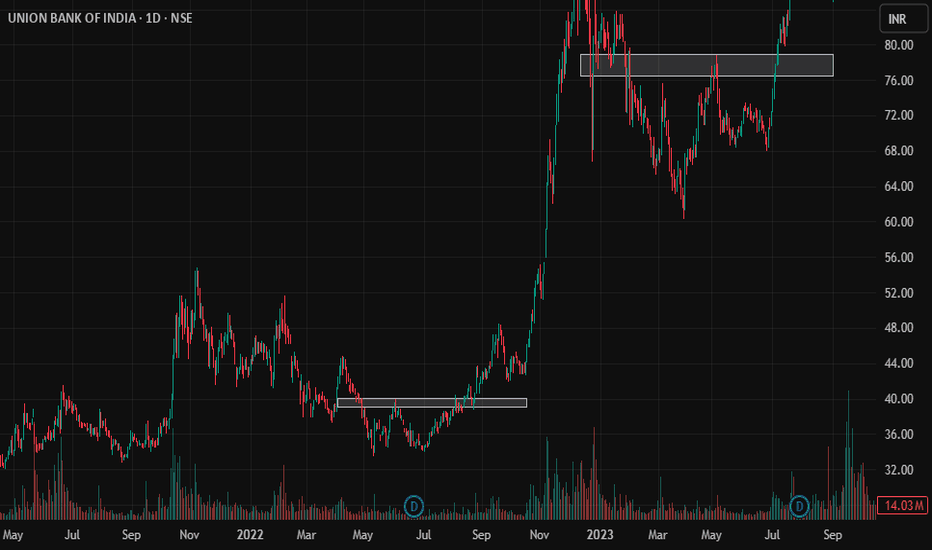

Huge breakout in Union Bank

After it's Q1 results Union bank is trading near it's previous breakout level, and is ready for a huge upside from here.

If we look at the past trends of Union Bank ( See below Images )

We can clearly see after a correction of about 40 to 50%, share rises with a huge breakout and it always rises for more than 100%.

Whoever missed the opportunity at first, this is the best to get into the stock for a potential profit target of 250.

SILVER My Opinion! SELL!

My dear friends,

Please, find my technical outlook for SILVER below:

The price is coiling around a solid key level - 37.026

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 36.725

Safe Stop Loss - 37.189

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

JUVUSDT Forming Bullish MomentumJUVUSDT is showing signs of a strong recovery from its recent consolidation phase, with a clear bullish momentum starting to emerge. The price action has bounced confidently from a well-defined support zone, highlighted in the chart, and buyers have stepped in aggressively. This indicates strong market interest and could be the early stage of a new upward trend. The expected upside potential ranges from 30% to 40%+, supported by increasing volume and favorable sentiment.

The token is now trading just above a key breakout zone, which has historically acted as resistance but is now turning into strong support. This shift in market structure is often a signal of a bullish reversal. Given the recent breakout attempt and minor pullback for retesting, the chart suggests JUVUSDT may be gearing up for a significant push toward the next resistance level. Technical indicators such as RSI and MACD also hint at further bullish continuation if current levels hold.

Investor interest in JUV is steadily growing, with fundamentals and market sentiment aligning to support a short-to-mid-term rally. The project’s presence in the fan token sector, along with improving volume trends on major exchanges like Binance, reflects increasing confidence among traders and crypto investors.

Traders keeping a close eye on potential breakout setups should not overlook JUVUSDT. The current technical setup offers a promising opportunity with a favorable risk-reward ratio, especially if the bullish momentum accelerates from here.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ETH VS AI?Hi

Asked AI on the next movement ETH

Predicted Target = 4 847

Time Projection 20 days → 15 Aug 2025

Probability (%) Attenuation × 100 = 183.6 %

Variance vs. Today (Target) 4 847 − 3 507 = 1 340

Projected Retracement Price 3 886 − 599 = 3 287

Variance vs. Today (Retrace) 3 287 − 3 507 = −220

All the best

Caveat emptor

Not a guru

DowJones The Week Ahead Key Support and Resistance Levels

Resistance Level 1: 44390

Resistance Level 2: 44720

Resistance Level 3: 45100

Support Level 1: 43360

Support Level 2: 43140

Support Level 3: 42800

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EUR/USD Daily Chart Analysis For Week of August 1, 2025Technical Analysis and Outlook:

In this week's trading session, the Euro experienced a significant drop, reaching the 1.139 level, and completing what is referred to as the Inner Currency Dip. As a result of the completion, the currency reversed direction and made a strong rebound, hitting the Mean Resistance level at 1.160. Recent analyses suggest that the Euro is likely to enter a sustained downward move after retesting the Mean Resistance at 1.160, with the target set to revisit the completed Inner Currency Dip at 1.139. However, it is essential to consider the possibility of continued upward momentum towards the Mean Resistance level of 1.177. Such a movement could trigger a significant rebound and lead to the completion of the Outer Currency Rally at 1.187.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of August 1, 2025Technical Analysis and Outlook:

In this week's trading session, the Bitcoin market experienced a notable pullback. The primary reason for this movement was the Key Resistance level, which led to a decline that reached our Mean Support level of 113000. This anticipated pullback is prompting the completion of the Outer Coin Dip target of 111000, with a strong likelihood of moving towards the Mean Support level of 108000.

BankNifty levels - Jul 04, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!