PENGU 8H – 297% MACD Strategy Long Call BreakdownPENGU’s recent move is the kind of textbook trend trade that makes systems like the MACD Liquidity Tracker shine.

The strategy stayed flat throughout the entire sideways grind in June — filtering out chop with its 60/220 EMA trend filter. It wasn’t until late June that MACD flipped bullish and price reclaimed both EMAs. That was the trigger — and from there, it was lift-off.

The system held through a clean +297.95% move from sub-$0.012 to just under $0.045. No early exits. No fakeouts. Just a single, conviction-based trade.

The exit signal hit near the top as momentum waned and MACD rolled over. Since then, price has retraced and is now hovering right above the 60 EMA — a level that's acted as dynamic support all run long.

📊 Strategy Overview:

– MACD Settings: 25 / 60 / 220

– EMA Trend Filter: 60 & 220

– Mode: Normal

– Timeframe: 8H

⚠️ If price holds above the EMA and MACD stabilizes, bulls may still have fuel. But a breakdown below ~$0.029 would shift structure back into bearish territory.

Let the chart tell the story — this was pure momentum trading in action.

Trend Analysis

Tesla (TSLA) – VolanX Forecast: The Calm Before the Storm?📊 Tesla (TSLA) – VolanX Forecast: The Calm Before the Storm?

Wave structure analysis + liquidity map + roadmap to $513

🧩 The Story So Far – Compressed Potential

Tesla has spent the past three months inside a contracting triangle (ABCDE) — a classic Elliott Wave corrective pattern that signals energy compression before expansion. From the May high (Wave (1)), price has been coiling within tightening range boundaries, forming lower highs and higher lows. The triangle culminates with leg (E), now hovering near support.

🟠 VolanX flags this as a terminal wedge—an area where institutions test both sides of the book, hunting liquidity.

🌀 Wave Forecast – Impulse Awakening

If the triangle completes as expected, we enter Wave (3)—typically the most explosive wave in Elliott sequences.

Here's how the projected roadmap unfolds:

Wave (2) ends around $288.20–$271.00 (key demand/liquidity zone)

Wave (3) initiates from this springboard, aiming toward:

📈 1.0 Fib Extension at $367.71

📈 1.618 Extension at $457.84

Consolidation expected at that level forms Wave (4)

Final thrust into Wave (5) targets $513.51, aligning with extended Fib projection and historical order block

This sequence respects classical Elliott impulse structure: 5-wave motive into macro target zone.

🧪 Timing & Liquidity – Watch the Clock, Watch the Flow

🗓 Key Windows from chart verticals:

Aug 27–Sep 1, 2025: Liquidity test at $288.20 zone

Oct 1–15, 2025: Expansion toward Wave (3)

By mid-November 2025: Completion of Wave (5) → exhaustion at $513 zone before probable macro retracement

🔍 Liquidity Zones:

$288.20 – Institutional reaccumulation level (VolanX confirms large resting bids)

$271.00 – Final sweep zone. Break below would invalidate bullish count

Above, $336.70–$351.19 is the first liquidity magnet

Major stops above $457.84, then final cluster $513.51

🧠 VolanX Opinion – AI View on Risk & Opportunity

VolanX signals high-probability breakout setup, with confluence across:

Liquidity clusters

Fibonacci symmetry

Elliott sequencing

Gamma positioning (institutional hedging tilts long below $290)

📈 Current predictive bias: 68% probability of breakout from triangle resolving bullishly, conditional on $288 support holding.

If tested and respected, AI favors aggressive repositioning in long gamma, echoing historical TSLA breakout behavior.

📌 Strategy Summary:

“I think they shall test this… I could be wrong. But if momentum holds, $288.20 bounce is likely. If not, wait for structure to rebuild before long.”

🧭 Trade Setup (Not Financial Advice):

Watch zone: $288–271

Confirmation: Strong rejection wick + volume delta flip

Stop: Below $267.57

Targets: $367.71 → $457.84 → $513.51

🔻 Risk comes from invalidation below $271.

⚡ Reward stems from recognizing compression before expansion.

#TSLA #VolanX #ElliottWave #LiquiditySweep #WaveAnalysis #FibonacciLevels #SmartMoney #OptionsFlow #TeslaForecast #AITrading #WaverVanir

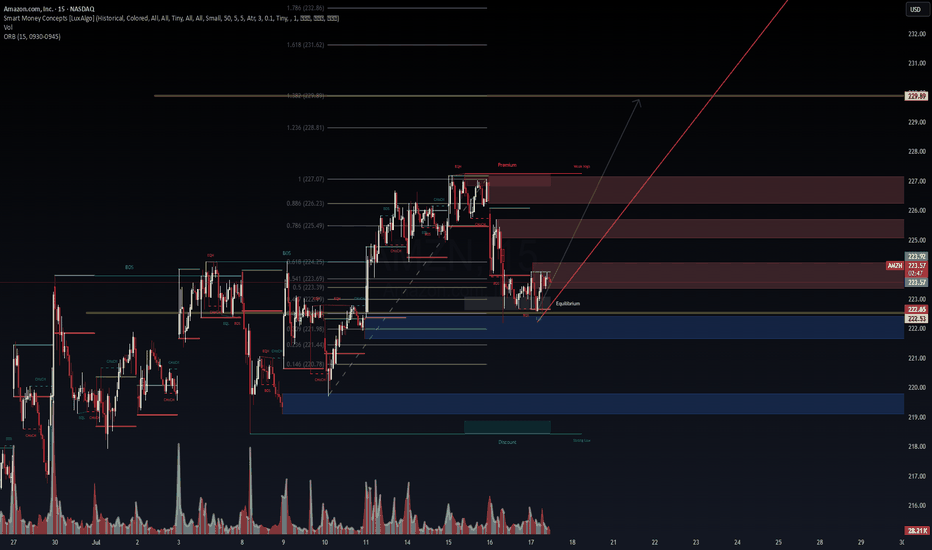

AMZN 15m – Institutional Demand Reclaim in Progress | VolanX Pro📈 AMZN 15m – Institutional Demand Reclaim in Progress | VolanX Protocol Alert

Amazon (AMZN) is staging a potential bullish reversal from a deep discount zone following a strong rejection near the 0.146–0.236 Fibonacci confluence at ~$220.78–221.44. We are now consolidating near the equilibrium zone (223) with signs of early accumulation.

📊 Technical Thesis:

Break of Structure (BOS) at 223.92 sets short-term bullish intent.

Reclaiming the ORB high and equilibrium.

Price rejected from deep demand (blue zone) and now printing EQH + BOS microstructures.

Premium liquidity sits above 227–229, with a magnet at FIB extension 1.618–1.786 = 231.62–232.86.

Volume profile shows declining sell pressure post-demand sweep.

📌 Key Levels:

Support: 222.53 | 221.44 | 220.78 (deep value zone)

Resistance: 226.23 (0.886 FIB) → 229.89 (FIB target zone)

Smart Money Premium: 226.5–229.8

🧠 VolanX Protocol Bias:

This is a long-biased setup, favoring institutional reaccumulation. If AMZN maintains above 223 with volume absorption, we anticipate a liquidity sweep through the premium zone, targeting 229.89.

🎯 Probabilistic Targeting:

60% → Retest 226.23 (EQH magnet zone)

30% → Breakout and reach 229.89 (measured move)

10% → Breakdown below 222.53 invalidates the setup

⚠️ Risk Note (VolanX Standard):

This post reflects strategic technical modeling, not financial advice. Trade your own system. View this as a signal integrity alignment, not a directive.

Why Apple Could Be Entering a Structural Correction🍎📉 Why Apple Could Be Entering a Structural Correction ⚠️🔍

After scanning major tech names today, one stock stood out— for all the wrong reasons : NASDAQ:AAPL .

Technically, Apple has broken below long-standing trendline support , and my chart now assigns a 70% probability(roughly guys...roughly and rounded) of further downside vs only 30% upside . But it's not just about the chart...

Here’s the macro storm Apple is walking into:

🧭 1. Trade War Revival

New tariffs on Chinese electronics could cost Apple up to $1.1B/quarter , even as it tries to diversify production. India and Vietnam are promising, but not mature enough to offset risk.

🤖 2. Lagging in the AI Arms Race

While Nvidia, Google, and Microsoft pour $30B+ into AI, Apple is spending less than half that. Analysts weren’t impressed with “Apple Intelligence.” Siri still isn’t leading.

🇨🇳 3. China: Flatlining Growth, Rising Risk

~18% of Apple’s revenue still comes from China. With Huawei resurging and tightening regulations, Apple’s dominance is being chipped away.

🛑 4. Innovation Pipeline: Empty?

There’s no iPhone super-cycle ahead. Vision Pro remains niche. Apple now looks like a mature tech stock without a breakout catalyst —risky when valuation is still premium.

⚖️ 5. Legal Pressure on Both Sides of the Atlantic

The DOJ and EU are targeting Apple’s App Store dominance. If changes are enforced, the service revenue moat weakens.

🔽 Summary: This Isn’t Panic. It’s Repricing.

The market is re-rating Apple based on real structural risks.

Downside levels I’m watching:

📉 177.65 (first support)

📉 154.53 (next key level)

❗️134–113 zone if macro pressure escalates

Chart = structure. Narrative = pressure. Both are aligned.

Let me know your thoughts—still long NASDAQ:AAPL , or hedging this weakness?

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

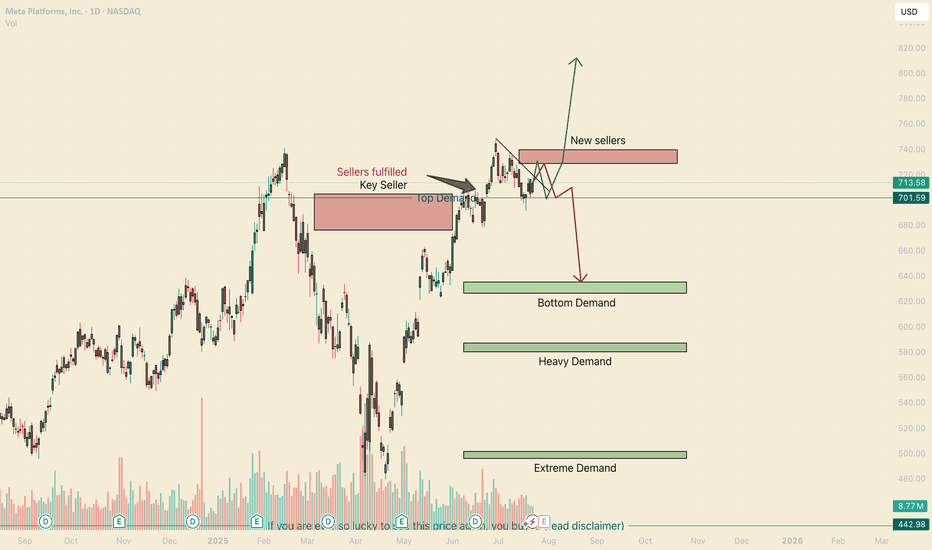

META Double Top? Think Again. Hello, my name is The Cafe Trader.

As part of our MAG 7 Series, we tackle META next on the list.

This article is for:

– Long-Term Investors

– Long-Term Hedges

– Swing Traders

– Options Traders

⸻

Brief Notes:

1. Meta is going all-in on AI, integrating it across all platforms (Instagram, Facebook, WhatsApp…).

2. 97% of Meta’s revenue still comes from ads. They’ve rebounded strongly from Apple’s policy changes—thanks in large part to AI targeting.

3. Meta is thinking long-term with AR/VR.

4. International user growth has exploded.

Conclusion: Bullish winds continue to blow behind META.

⸻

Long-Term Levels

• Aggressive Buy = $701.59 → Marked as “Top of Demand.” This is where aggressive buyers are looking to add.

• Good Value = $626–$635 → Marked “Bottom of Demand.”

• STEAL = $496–$501 → Marked “Extreme Demand.”

Why not buy at the ‘Heavy Demand Zone’?

Great question. If bears take out those buyers above this zone, it suggests something major has shifted in sentiment around META.

Even though there’s heavy demand here, I’d want to observe how sellers approach the area. You’ll likely get multiple chances to enter if buyers defend it. But if it breaks down, the best pricing lies at “Extreme Demand.”

For long-term holders looking to hedge downside, I suggest a Bear Put Spread or outright puts. More on this under the Red Scenario Options.

⸻

For Traders

Let me be real—this chart is tricky.

The V-shaped recovery signals strong bullish interest. That insane rally took out a major seller, further fueling the bulls.

That said, how we pulled away from the previous ATH (all-time high) shows weakness—low buying interest, followed by a real seller stepping in.

So yeah, I’m mixed on sentiment. But I’m confident in identifying liquidity and managing exits fast.

⸻

Two Scenarios

✅ Green Scenario

– Stock:

The bounce off “Top of Demand” is a strong bullish signal. Bears will be under pressure around $729, though I expect one more rejection before we break through.

I liked the original entry at “Top of Demand.” If entering again, I’d wait for a crack below that zone and watch the close—if we recover and close above it (especially if the dip was deep), that’s a strong signal to re-enter.

Target: take partial or full profits around $729. Hold the rest for highs or a breakout.

– Options:

If you can grab the 715 Calls with 3–5 days out for under $4.50, this setup could easily hit 2–3R.

Even better if you can get closer-to-the-money contracts for cheaper.

⸻

❌ Red Scenario

– Stock:

I believe this “new seller” is a fabricated seller—likely to get squeezed.

But if no new buying interest shows up to challenge that seller, we could see pressure on “Top of Demand” and a legit correction, maybe even a broader consolidation range.

Next few days will reveal the strength of buyers.

If no aggressive buying steps in, I like the short setup, targeting “Bottom of Demand” for TP.

– Options:

Long-Term Holders:

Use 2–3% of your META share value on a Bear Put Spread or put options.

If using puts, get 2–3 weeks of time. Go as close to the money as your risk allows.

Active Traders:

This could move fast if it plays out. If you can grab a 710 Put with 3–5 days for under $1.00, hold until a big red candle (3–5%) forms.

If it keeps dragging down, roll into a new contract the following week.

⸻

Follow for more analysis and updates — and as always,

Happy Trading.

📲 @thecafetrader

COMPUSDT in a Strong Demand Zone! Reversal Potential / Breakdown🔍 In-Depth Analysis (Timeframe: Weekly / 1W)

The COMP/USDT pair is currently hovering above a long-term demand zone that has held strong since mid-2022. Price is sitting around $44.90, just above the key support area of $32 – $45 (highlighted in yellow), which has acted as a major accumulation zone for over 2 years.

🧱 Critical Zone: Smart Money Accumulation or Exhaustion?

The $32–$45 demand zone has been tested multiple times, indicating smart money interest and hidden buying pressure.

Price action in this range forms a clear base structure or horizontal accumulation pattern, a classic setup before a large directional move.

However, the prolonged sideways consolidation hints at an imminent breakout or breakdown — momentum is building.

---

📊 Key Technical Pattern:

🟨 Rectangle Range (Accumulation Structure)

Price has been ranging between $32 and $63.28 with no clear breakout.

Strong rejections every time price dips below $35 indicate consistent buyer defense.

🔃 Mean Reversion Behavior

Repeated moves back to the mid-range reflect an indecisive market (equilibrium phase), often seen before expansion.

---

📈 Bullish Scenario (Potential Reversal):

If price breaks above major resistance at $63.28:

1. Upside Targets:

🎯 $90.84 (key resistance zone)

🎯 $119.13 (prior distribution zone)

🎯 $165.94 (macro target if sentiment turns highly bullish)

2. Confirmation needed via weekly close above $63 with strong volume.

3. A bullish breakout may form a new Higher Low and Higher High structure on both daily and weekly timeframes.

🟢 Bullish confirmation: Weekly bullish engulfing + volume breakout above $63.

---

📉 Bearish Scenario (Potential Breakdown):

If price closes below the $32 support:

1. Possible downside targets:

⚠️ $22.76 (next logical support)

🚨 $16 (last consolidation base pre-2021 rally)

2. A break below this long-term support could trigger a final capitulation flush before a potential macro reversal.

🔴 Bearish confirmation: Weekly close below $32 with increased volume and sustained selling.

---

⚖️ Strategic Takeaway:

COMP/USDT is currently at a pivotal decision zone — a crossroads between massive upside potential and deeper downside risk.

This is not just another support area, it’s a macro-level demand zone that will likely dictate trend direction in the coming months.

⏳ A major move is brewing — whether breakout or breakdown, be ready.

#COMPUSDT #CryptoOutlook #TechnicalAnalysis #AltcoinSeason #DeFi #CryptoTrading #AccumulationZone #BreakoutSetup #BearishScenario #BullishSetup #CryptoAnalysis

Elliott Wave Analysis Points to Gold (XAUUSD) Support Near 3320Gold (XAUUSD) appears poised for a double correction from its 16 June 2025 high. A double three consists of two corrective patterns, typically zigzags. From the June peak, wave (W) concluded at 3246.55, and wave (X) rallied to 3438.58, as shown on the 1-hour chart. Wave (Y) is now unfolding lower with internal subdivision as a zigzag. From wave (X), wave ((i)) ended at 3351.17, and wave ((ii)) peaked at 3377.45. Wave ((iii)) declined to 3324.80, followed by a wave ((iv)) rally to 3340.34. The final wave ((v)) completed at 3311.62, forming wave A in a higher degree. A corrective wave B rally reached 3345.35 before gold resumed its downward move.

Within wave C, wave ((i)) finished at 3301.47, and wave ((ii)) rallied to 3334.08. Wave ((iii)) dropped to 3267.94, with wave ((iv)) ending at 3314.85. Gold should continue lower in wave ((v)) to complete wave C. The potential target lies within the 100%–161.8% Fibonacci extension from the 16 June high. This projects a support zone between 3104 and 3230, where a three-wave rally is anticipated. Traders should monitor this area for potential reversal signals, as it may offer support for a corrective bounce.

QTUM/USDT – Make or Break? Testing the Edge of Accumulation?🧠 Overview:

After going through a volatile multi-year cycle, QTUM is now back at one of the most critical historical support zones. This demand area has acted as a strong reversal point multiple times since 2020 and is once again being tested as price consolidates near the bottom of its macro range.

---

📉 Price Structure & Key Levels:

📍 Major Support Zone (1.70 – 2.10 USDT):

A proven accumulation zone based on multiple long wicks and price rejections in the past.

This is where smart money tends to accumulate during market uncertainty.

📍 Layered Resistance Levels (Bullish Targets):

2.70 USDT → Initial breakout validation

3.53 USDT → Mid-range resistance

4.93 USDT → Key structural level

8.70 USDT → Mid-term breakout target

17.36 USDT → Peak from previous macro cycle

---

🧩 Current Pattern: "Sideways Accumulation Range"

QTUM is clearly in a range-bound accumulation phase, with tight price action within a key support area. Historically, such patterns often precede large impulsive moves, especially when accompanied by volume surges and breakouts from structure.

> ⚠️ Important Note: Sideways movement at historical support, combined with increasing accumulation volume, often leads to a breakout into the markup phase.

---

📈 Bullish Scenario: Potential Upside Momentum

Trigger: A confirmed breakout and weekly candle close above 2.70 USDT.

Additional Confirmation: Strong bullish candle with increased volume.

Targets:

3.53 USDT (local resistance)

4.93 USDT (mid-range structural level)

8.70 USDT (swing target)

17.36 USDT (macro cycle high)

🎯 High reward-to-risk potential if entries are made near support with a stop-loss under 1.70 USDT.

---

📉 Bearish Scenario: Breakdown Risk

Trigger: Weekly candle closes below 1.70 USDT.

Implication: Breakdown from long-term demand zone.

Downside Targets:

1.20 USDT → Minor horizontal support

0.71 USDT → Historical all-time low

Warning Sign: High volume breakdown = likely sign of institutional selloff or panic exit.

---

📊 Strategic Summary:

> QTUM is at a pivotal crossroads.

The 1.70 – 2.10 USDT range is a decisive area.

A bullish breakout could spark a major recovery rally,

while a breakdown may lead to a deeper capitulation.

This is a “calm before the storm” situation. Traders should monitor closely as the next few weekly candles could define the trend for the rest of 2025.

#QTUMUSDT #QTUM #CryptoAnalysis #AltcoinSetup #TechnicalAnalysis #AccumulationPhase #SupportAndResistance #BreakoutPlay #CryptoBreakout

This is why I firmly believe we'll witness BTC reach 150K soon.No caption needed and every reasons are kept in the chart. Zoom In and analyze every single lines in the chart and hope you will see what I tend to see as far as my capabilities allows me. Let me know your comments on the idea. I am looking forward to witness $150K in the next 3 to 4 months time. I will be updating my confluences to say this on higher timeframes too.

With Regards. And stay Tuned.

BITCOIN: THE PERFECT STORM - MULTIPLE BREAKOUT PATTERNS ALIGNED⚠️ CRITICAL SUPPORT LEVELS

🛡️ Support 1: $115,000 (-3%) - Triangle support

🛡️ Support 2: $110,000 (-7%) - Channel support

🔴 DANGER ZONE: $105,000 (-11%) - Multiple pattern failure

So...

Strategy: Quick profits on pattern completion 🎨

Entry: $115k (Triangle breakout confirmation) 📊

Stop Loss: $114k below (Tight risk management) ❌

Target: $125k (+10%) ✅

Time Horizon: 2-3 weeks 📅

Risk/Reward: 1:6 🎯

________________ NOTE _____________

⚠️ This is not financial advice. Bitcoin is highly volatile and risky. Only invest what you can afford to lose completely. Always do your own research and manage risk appropriately 🚨

Gold Surges on Non-Farm Data; 3330 Key Next WeekGold was strongly boosted by the significantly bullish non-farm payroll data, surging sharply like a rocket 🚀, with gains that completely "wiped out" all the weekly losses. The current gold trend, as if injected with super momentum, has completely broken the previous long-short stalemate. Starting from the 3300 level, it has been breaking through obstacles all the way up to 3350. At present, 3330 is like a critical "battleground" ⚔️ fiercely contested by both long and short sides.

This week, when gold was still "lingering" below 3300, I emphasized repeatedly that a rebound was inevitable – we just needed to stay calm and wait for the opportunity. As it turns out, our judgment was spot on, and we successfully took profits around 3340, reaping good gains 💴. Now, gold prices are oscillating back and forth in the 3340-3350 range. Based on a comprehensive analysis of the current trend, I boldly predict that gold is likely to pull back to around 3330 next week, so everyone can prepare in advance 🤗

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Sell@ 3350

🚀 TP 3330 - 3320 - 3310

🚀 Buy@ 3300 -3310

🚀 TP 3320 - 3330 - 3340

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

IOTXUSDT🚀 IoTeX (IOTX): A Hidden Gem for Short-Term Gains & Long-Term Growth?

Looking for a crypto project with real-world utility and strong upside potential? IoTeX (IOTX)—a decentralized platform powering the Internet of Things (IoT)—might be worth your attention.

Why IoTeX?

✔ Innovation Meets IoT: Combines blockchain + IoT for secure, privacy-focused machine-to-machine (M2M) ecosystems.

✔ Partnerships & Adoption: Backed by industry giants (like Samsung) and used in real-world applications (smart devices, DePIN).

✔ Price Potential: Volatility offers short-term trading opportunities, while long-term growth aligns with IoT’s explosive expansion (projected $2.4T market by 2029).

📌 Short-Term: Watch for bullish trends amid crypto market rebounds and project updates.

📌 Long-Term: HODL potential as IoT adoption grows and IoTeX cements its niche.

XAUUSD 4H – Massive Sell Setup: Gold Crash Incoming? Gold (XAUUSD) just tapped into a key liquidity zone near the 38.2% Fibonacci retracement at $3,364, followed by a sharp rejection. This aligns with the upper channel resistance and a bearish confluence from previous supply zones.

Price has failed to break above the dynamic EMA cluster and is showing signs of exhaustion after a relief rally. If momentum follows through, this could mark the beginning of a deeper selloff targeting major downside levels.

Short Setup

Entry: Around $3,349–$3,364 (rejection zone)

SL: Above $3,379

🚨Strong bearish engulfing candle confirms seller pressure

🎯 Take Profit Targets (Fibonacci):

TP1: $3,305 (38.2%)

TP2: $3,275 (61.8%)

TP3: $3,241 (Full move – 100% Fibonacci extension)

This setup offers high risk-reward if the rejection holds and price breaks below the mid-zone structure at $3,330. A drop below $3,305 could accelerate the move as liquidity gets swept.

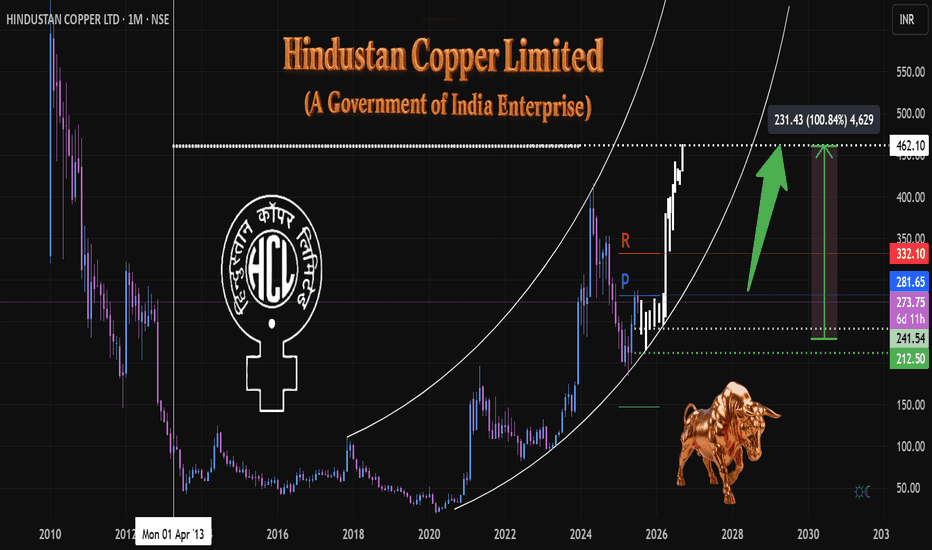

HCL Copper 1M, TF Anticipating Growth & Key Levels ⚙️ Materials: Commodity Cycle Turnaround

(Green energy metals, China recovery)

Government of India Enterprise

Hindustan Copper Limited (HCL)

The company is undergoing a significant mine expansion, projecting a 5x increase in output. This positive development is already reflected in institutional interest, with DIIs increasing their exposure by 8.2% in Q1.

At the time of this analysis, the price stood at 273.

We've observed a volume climax at the bottom, suggesting a potential exhaustion of selling pressure and a base formation.

The white ghost candles pattern illustrate an anticipated future price path, which I project based on current market dynamics and patterns. This projection outlines a potential trajectory we will monitor closely as price develops.

A strong engulfing bullish candle formation above the 281 pivot (🔵) would signal significant bull strength and confirm a strong upward momentum.

A confirmed breakout above the monthly resistance level (🔴) would be a critical bullish signal. initiating further long positions upon a successful retest of this breakout level.

My primary accumulation zone for potential entries is identified in green (🟢 dotted), ranging between 241 and 212. This range represents an area where I anticipate favorable risk-reward for entry.

Target & Time Horizon:

While precise timing is always challenging, I estimate the projected target up to 100% ( above in the white dotted line) could be reached around Q2 2026 or before as markets perform.

Disclaimer:

This analysis represents a personal projection

based on current market observations.

Trade Safely,

Always DYOR

#हिन्दुस्तान कॉपर लिमिटेड

#indianeconomygrowth

$UVXY Signaling Trouble — $SPY Could Drop 10%+ In this video, I discuss why August/September could bring serious downside for the market, despite my long-term bullish stance.

Right now, SPY is trading around $632, but I have a downside target of $573 in the short term. If we get volume beneath $573 — especially a break below the daily EMA — SPY could drop quickly, with a potential fall all the way to $480 in the coming weeks/months.

At the same time, UVXY is signaling a correction for the overall market after rallying from the low's of April. I have a target of $30 and when UVXY starts to move, it often reflects sharp market corrections — and the setup is beginning to mirror that now.

Despite this short-term bearish outlook, I want to make it clear: I am very bullish long term. Any 10–20% correction will be a major buying opportunity for me. I'm watching key levels closely and preparing to take advantage when the market overreacts.

Litecoin H4 | Bullish bounce off 50% Fibonacci supportLTC/USD is falling towards the overlap support and could bounce to the take profit

Buy entry is at 101.85, which is an overlap support that lines up with the 50% Fibonacci retracement.

Stop loss is at 97.43, which is a pullback support that aligns with hte 61.8% Fibonacci retracement.

Take profit is at 110.38, an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

BTC 4H – Support Tapped 2x After Breakout, Will Bulls Step In?Bitcoin is retesting a major demand zone that launched the last breakout. After a sharp impulse move, price has ranged tightly and just tapped this support area for the second time.

A clear double bottom attempt is forming, but failure to hold $115K could open the door to deeper downside. Bulls want to see a quick reclaim of $117K to confirm structure still holds.

Clean levels. Clear reaction zones. Let’s see who takes control.

GBP/JPY Clears July LowGBP/JPY clears the July low (195.37) as it tumbles to a fresh weekly low (195.34), and a close below the 195.70 (61.8% Fibonacci extension) to 196.60 (23.6% Fibonacci extension) region may push the exchange rate toward the June low (192.73).

Failure to hold above the 192.40 (50% Fibonacci extension) to 193.50 (38.2% Fibonacci extension) zone may lead to a test of the May low (190.33), but the selloff in GBP/JPY may turn out to be temporary if it defends the rebound from the June low (192.73).

GBP/JPY may attempt to retrace the decline from the July high (199.98) should it hold/close above the 195.70 (61.8% Fibonacci extension) to 196.60 (23.6% Fibonacci extension) region, with a close above the 199.80 (61.8% Fibonacci retracement) to 200.50 (78.6% Fibonacci extension) region opening up 201.20 (23.6% Fibonacci retracement).

--- Written by David Song, Senior Strategist at FOREX.com