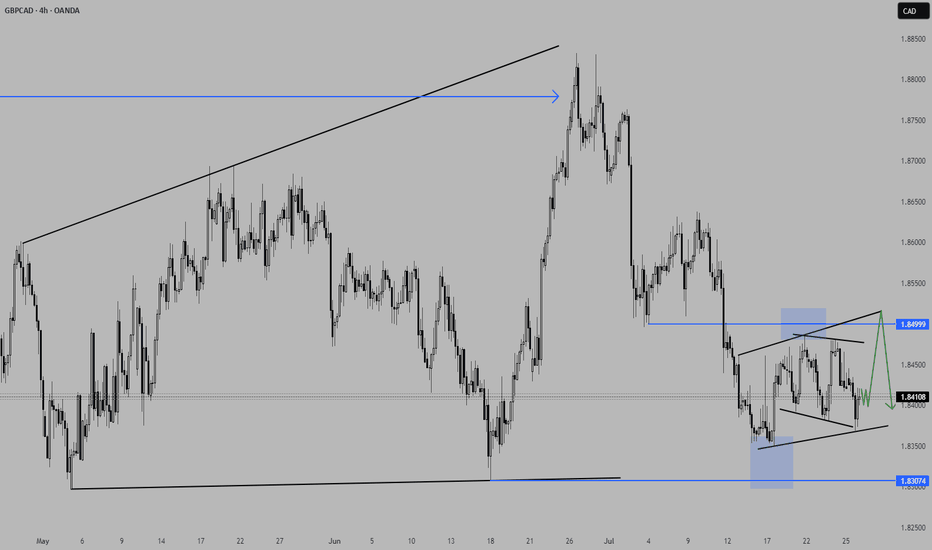

GBPCAD a short-term long trade into a HTF short area.GBPCAD presents a potential LTF long trade into a HTF short area. I am overall still bearish biased, but considering we have gaps to the top of the structure we might get an opportunity for a short-term counter long trade to finish the consolidation before we see the next bigger move to the downside.

📈 Simplified Trading Rules:

> Follow a Valid Sequence

> Wait for Continuation

> Confirm Entry (valid candlestick pattern)

> Know When to Exit (SL placement)

Remember, technical analysis is subjective; develop your own approach. I use this format primarily to hold myself accountable and to share my personal market views.

⚠ Ensure you have your own risk management in place and always stick to your trading plan.

Trendanlysis

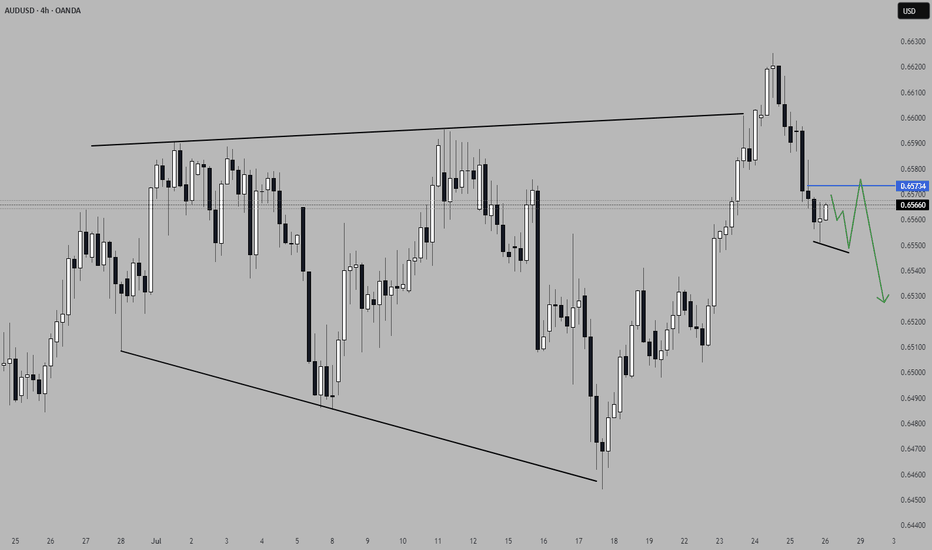

AUDUSD looks promising for a continuationThis pair presents a potential trade opportunity in the form of a short continuation. The price did reach a significant Area of Interest (AoI) in form of an expanding 3-touch structure before turning around. Price did close outside the structure on the H4 with a candlestick reversal pattern and printed a bearish high-test candle on the daily timeframe. This clearly shows a shift in momentum and I am now waiting for a lower time frame (LTF) continuation pattern to confirm the direction and a valid candlestick pattern for entry.

📈 Simplified Trading Rules:

> Follow a Valid Sequence

> Wait for Continuation

> Confirm Entry (valid candlestick pattern)

> Know When to Exit (SL placement)

Remember, technical analysis is subjective; develop your own approach. I use this format primarily to hold myself accountable and to share my personal market views.

⚠ Ensure you have your own risk management in place and always stick to your trading plan.

Silver Price Setup = Major Move Ahead?Silver (XAG/USD) Analysis – Breakout Incoming?

Silver (XAG/USD) is currently testing a key resistance zone after a strong upward move, supported by a rising trendline. The price has respected this trendline multiple times, confirming its role as a strong support level. If bulls push beyond the resistance zone, a breakout could trigger further upside momentum.

Key Insights:

🔹 Trendline Support – The ascending trendline has acted as a strong base for price action, providing steady higher lows.

🔹 Key Resistance Zone – Price has faced multiple rejections here in the past, making it a crucial breakout level.

🔹 Potential Breakout Setup – If Silver breaks and holds above resistance, we could see a rally towards $31.50–$32.50+

GOLD TOMORROW INTRADAY ANALYSIS - The current gold price is around 2535 (likely referring to the USD per ounce price).

- If the price breaks above 2535, it's a buy signal, with a target price of 2550.

- If the price breaks below the support area of 2403-2402, it's a sell signal, and you'll take a short position (betting on price decrease).

Please note that this is a very short-term trading strategy and gold prices can be volatile. It's essential to consider your risk tolerance, market conditions, and other factors before making trading decisions. Additionally, it's always a good idea to consult with a financial advisor or conduct your own research before entering any trade

Are we heading into euphoria or a technical reset?Here we can clearly see that the market structure keeps trending up, in very aggressive manners. Many technical resets have been made, and recently we went through one that lasted almost the entire Biden administration. Even though this reset is great for price action, it seems that it is quickly becoming parabolic. If price continues to behave in this manner, then we could be headed into euphoria. It's crazy to think that the yield curve has been inverted for this long.

Failure to reset technicals could bring us into a period with great short term yield. This could potentially captivate novice traders to become overconfident. Start paying attention to people around you if we keep on trending upward. Is your common foe suddenly talking about stocks and investments? I personally don't feel that way yet. But I can't deny the excitement people feel of finally reaching new time highs.

I'm not saying we are heading into a crash right now. But technicals and fundamentals are beginning to line up for what seems to be extreme optimism with flashing warning signs. I don't feel too confident in this market and would prefer to be buying at lower prices and see price trend up slower. A reset is necessary, or else we will be headed into an unhealthy and very violent uptrend.

Golden Star| Gold daily ICT AnalysisGold with selling pressure that happened on Friday.

-It has reached its support level which is the price (2012-2017).

-By retesting the resistance level (2032-2038) and collecting the available liquidity at this level, the price can start its downward movement from this area to the level of 2013.

-If there is more buying pressure, it may grow to collect its next level of liquidity at the (2045-2050) level and return from this area to start its downward move towards the 2013 level.

EURUSD Support zone long position potentialFX:EURUSD Price is near the support zone. Price can rise to the top of the channels trend line.

*Your likes and boosts helps me so much to grow up my profile so please don't forget to like and follow❤

*Please do your research first and then open a position( Not just by my analysis )🧐

*If you liked this idea or if you have any other opinion about it, write in the comments.✍

IGL BREAKOUT DONEAfter 9 Months Accumulation Period , Finally Price Breaks the Accumulation Zone of 445--455 And closes above the breakout Zone. Volume Also Supporting the price which indicates sustainable breakout in price after long time.

Keep eyes on #IGL. Add your quantity when any dip seen in price or price comes down to retest the Breakout zone. Good Return Expecting in coming day's. My target will be 500/555/600+

AUD/USD lilkely to fall!Hey tradomaniacs,

looks like we had a fakeout on AUD/USD and so a nice chance to short it if confirmed.

We usually wait for a re-test and rejection to be safe, but if u want to trade aggressively u can also early-enter with a potential re-test.

However, recent news were mixed so market is very wild and risky to trade.

What do you think?

EURUSD NEXT MOVES!Ill be keeping an eye on price action towards market close and early next week. I'm very interest in a longer term swing short trades but for the mean time I'm looking at a short term continuation long.. hope everyone has had a good trading week and ill be back on Sunday to cover any possible setups.

SYRS Squeeze $ the premarket is above our support the orang line , we should hold to confirm the price continuation till the first profit taking , then if we broke this level we going to have a test for the other 2 profit taking .

remember the profit taking area is area of possible rejection and short coming in , the only way to find out that we will continue to go up, is breaking those level and holding above it .

let's hunt for Friday .

S&P 500 - Not Time to Get Bullish (yet)SP:SPX Hello traders. Let's take a look at the S&P500 to see if the chart matches the sentiment over the last few days.

In my opinion SPX isn't quite ready on higher time frames for serious bullishness. Others may disagree but when an objective method of trend analysis is applied to the weekly chart it becomes difficult to make a bullish argument. When two methods of objective trend identification are used and they both suggest a down trend, it is nearly impossible to draw another conclusion.

Now before anyone thinks that I'm bearish on the S&P500 let me put my personal stance in the spotlight. I'm actually trend neutral at this juncture due to the fact that higher time frames are ranging in a wide, slightly chaotic range. We'll objectively identify that as well, of course.

In the first photo of the SPX weekly chart I have used a method of trend identification identifying key levels of support and resistance. For any one of these swing highs or lows to be identified it had to pass three tests:

(1) Price action must have broken a key level of support or resistance

(2) Price must have pulled back with two consecutive candles of the same color.

(3) These candles must be red if price recently broke resistance or blue if price recently broke support

Using these rules we see that the SPX was in an objectively defined uptrend from 23 March 2020 (Covid Low) to 03 January 2022 (all time high).

During this timeframe the market was taking out objectively established swing high resistances and respecting them as a level of support. This led to higher highs and higher lows. Technical traders understand this as the definition of an uptrend.

Once the all time high was reached, the market began shifting behaviors. It began taking out objectively defined support and respecting them as levels of resistance. This led to a series of lower highs and lower lows.

Recently, SPX was able to peek above a critical resistance level but could not hold above it. This is a disruption to the down trend but does not rule out the possibility of downward continuation. There is no pattern of higher highs and lows established (yet) and there is only one higher high (yellow circles).

Currently the higher high theory is subjectively defined according to our rules and has not been clearly respected as a level of support or resistance since. Additionally the move comes from a lower low in between our two circles which suggests disruption and weakness but not necessarily a reversal.

Our second objective trend identification method will come from the anchored VWAP tools. We'll use the same two key reference points - Covid low and all time high. We see these with the blue AVWAP dynamic lines.

Price action has validated both of these anchored vwaps in the past as both support and resistance. The read is pretty simple with them. Price is bracketed on both sides by support and resistance. It has not convincingly broke and held above or below either one, leaving price in a range.

In my experience when price is ranging I do not break out my bear claws or my bull horns. I take a position of neutrality in the market and look at the extremes of the range. It is there that I find opportunity to fade the market back to the other extreme.

There is great confluence between the anchored vwaps and simple line work to suggest that these zones of support and resistance are valid. If treated as such, then the appropriate time to get bullish (or bearish) would be when price breaks out of the range. Until then my game will be to fade the range and continue to be neutral. This is also a disciplined, measured, and objective approach to technical trading and doesn't involve the predictions that many will make.

EURGBP LONG TERM SHORT!!Looking for a right shoulder to form giving a nice opportunity for a long term short position. Look for 4 hr rejection from the sell zone to confirm entry, we may not see the move this week but ill definitely be on the look out as this resistance level to hold strong and create if not a long term position another easy opportunity for a quick move down.

BBBY Breakout Zone $we formed a triangle last Friday , now we have one critical level to confirm the breakout and going towards the 16.20$+, which is breaking the 12.51$+ resistant.

cause if we didn't had that reaction and broke the triangle from below we going to have a visit for the support above the 8.24$, and the bottom above the 6.50$ , if we didn't hold above support level .

NIFTY STUDY (Trend Reversal?)After showing a trend of Lower Lows & Lower Highs market recently showed a trend of Higher Lows & Higher Highs.

So if the marker breaks the previous swing low, we can expect trend reversal.

If this happens we can look for sell on rise.

COMMENT YOUR VIEWS

Disclaimer: Above is for educational purposes and not buy/sell advice.

SEBI Unregistered

A Divergence Signal!The candlestick indicates a low price momentum compared with the T-2 candlestick with the price closed above the opening price. Hence, the candlestick indicates a divergence signal where high volume momentum; crosses above the MA20 line.

MACD and OBV indicators indicate a divergence signal and confirm the price candlestick towards the MA20 line.

The price Point of Control (POC) of 0.840 will be a price resistance for today trading. If the price closed above 0.840 or 0.865then it will begin a price uptrend towards the MA20 line as new resistance.

To place a bid, use VWAP as a guideline and place the bid below the VWAP line or POC.

Let's save TOPGLOV in WL and watch out for significant price movement towards the next price resistance.

R 0.840, 0.865

S 0.795

CHFJPY > Strong Sell Entry May Come Soon!Analysis of #CHFJPY

It Seems today all ideas are on JPY pairs, here is another one Similar to my AUDJPY & CADJPY analysis a couple of minutes ago, here we have trendline resistance with supply zone, and a bearish harmonic Bat pattern completing near this supply zone & trendline resistance, to provide a reason to get in a big sell entry.

________________________________________

💭 | Comment your thoughts below, I always answer.

📥 | Feel free to message me if you have any questions.

Thanks for your continued support!