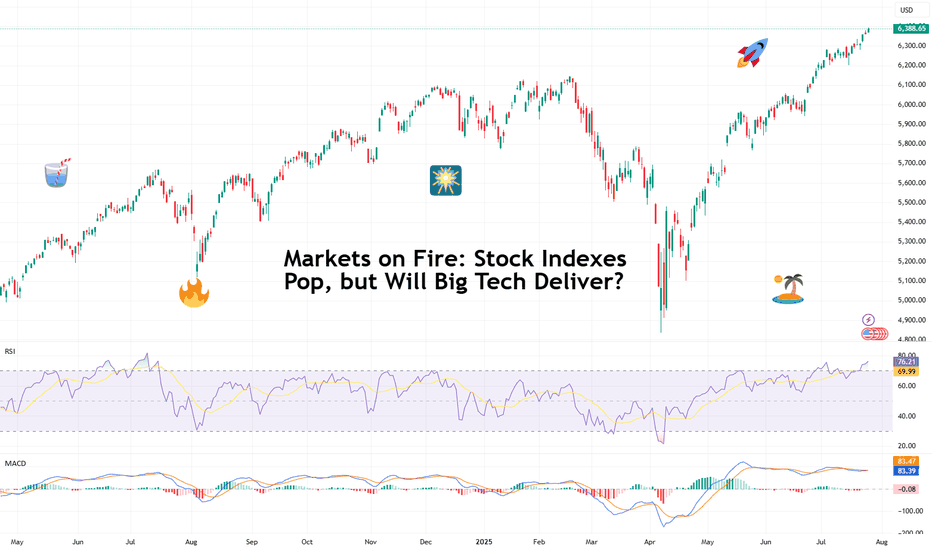

Markets on Fire: Stock Indexes Pop, but Will Big Tech Deliver?S&P 500 and Nasdaq set records. Now it's up to big tech to justify that.

Talk about forward-looking valuation. Tech companies’ valuations are largely based on future potential rather than current performance. And that’s what we’re seeing right now getting priced in across the big indexes.

You’d think we’d be bored of record highs by now. But no — Wall Street keeps hitting refresh on its all-time-high counter. 🎵 Over and over again. 🎵

On Friday, the S&P 500 SP:SPX notched its 14th record close this year, ending at 6,388.64. The Nasdaq Composite NASDAQ:IXIC followed with its 15th at 21,108.32. Even the Dow TVC:DJI — the older sibling who prefers yield over hype — climbed nearly 0.5% to 44,901.92, within a latte’s foam of its December record .

And while indexes are breaking personal bests, investors are buying ahead of some big data deliveries. Why? Because the week ahead is the Super Bowl of Earnings, and the bigger chunk of the Magnificent Seven is up next.

😎 What in the Magnificent Seven?

A highly exclusive club with just seven members, the Mag 7 has entered the earnings spotlight — and the audience isn’t going mild. Traders are pricing perfection, and the script better deliver.

Meta NASDAQ:META kicks things off Wednesday after the close with expected revenue of $44.8 billion and EPS of $5.87. Can Zuckerberg’s AI narrative get investors to forget about the metaverse?

Microsoft NASDAQ:MSFT shows up at the same time, hoping to dazzle with $73.8 billion in revenue and $3.38 EPS. Copilot AI better be doing overtime.

Then on Thursday, again after lights out, Amazon NASDAQ:AMZN joins the chat with its AWS and ecommerce empire expected to pick up $162.1 billion in revenue. Right behind is Apple NASDAQ:AAPL , fighting to stop its slide into meh-land with projected revenue of $89.2 billion and $1.43 EPS. (Fast fact: AAPL is down 12% year to date — among the worst performers in the crew.)

So far, Alphabet NASDAQ:GOOGL already crushed its quarter , posting $96.4 billion in revenue and $2.31 EPS, plus a spicy raise in capex to $85 billion.

Tesla NASDAQ:TSLA ? Not so great. The EV maker reported a 12% revenue drop and a 16% net income decline, spooking investors with a warning of “rough quarters ahead.” The stock is lower by 17% year to date.

Nvidia NASDAQ:NVDA , the AI trailblazer, reports in late August. Until then, it’s chilling on a $4 trillion throne, as per our Top companies rankings, watching its friends sweat it out.

💸 Can the Mag 7 Keep Carrying?

Here’s a harsh dose of reality: the entire S&P 500 is riding on the backs of these seven stocks. Analysts expect them to post 14% earnings growth, while the other 493 companies limp along at 3.4%. Talk about top-heavy things.

So what happens if even one tech titan misses the mark big time and spooks with scary guidance? A market correction? A buy-the-dip opportunity?

And let’s not forget: valuations are stretched. The S&P 500 is now trading at nearly 23x forward earnings (that’s projected profits per share). And the Nasdaq? Don’t even ask. (We’ll tell you anyway — it’s close to 30x). In all that, now’s a great time to keep a close eye on the Earnings Calendar .

📊 Not All Is Big Tech: Fed and Jobs Loom

As if this week wasn’t already packed enough, macro is back on the menu. The Federal Reserve meets Tuesday and Wednesday, and Chair Jay Powell is expected to hold rates steady at 4.5%.

But don’t rule out drama. A single hawkish word and this party could quickly get some rain on. Powell, the man who moves trillions with a simple “Good afternoon,” has a track record of putting markets in their place when they get too euphoric.

And then there’s Friday’s nonfarm payrolls report. Consensus calls for just 108,000 jobs added in July — soft, but not disastrous, and fewer than June’s 147,000 . Blame summer hiring slumps, tariff uncertainty, or the market finally digesting its own hype.

Off to you : Can the Magnificent Seven keep this market magnificent? Or are we about to learn what happens when you ride too close to the sun on AI-generated wings?

Community ideas

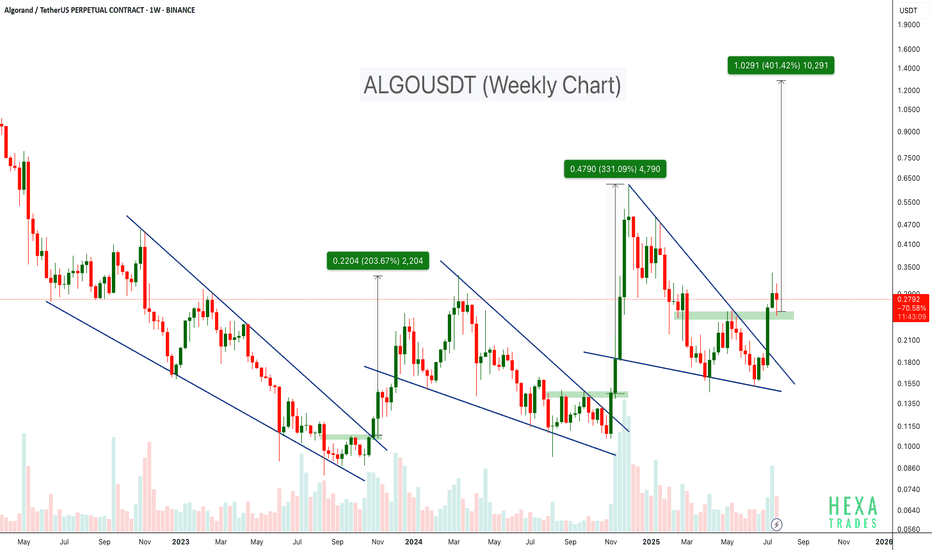

ALGO Breaks Out of Falling Wedge – 400% Target Ahead?BINANCE:ALGOUSDT has consistently followed a bullish pattern on the weekly timeframe. Each major rally has been preceded by a falling wedge breakout, as shown by the three highlighted instances on the chart.

- First breakout: ~200%+ move

- Second breakout: ~300%+ move

- Current breakout projection: Potential target up to +400%

The price has just broken above the wedge and is currently retesting the breakout zone. If history repeats itself, ALGO may be poised for a strong upside move from its current levels.

Cheers

Hexa🧘♀️

COINBASE:ALGOUSD EURONEXT:ALGO

Retro Editors' picks 2021Going further in our retro EP selection , we present to you a collection of additional scripts from 2021 that have earned a spot in our Editors' picks. These retrospective selections reflect our continued commitment to honoring outstanding contributions in our community, regardless of when they were published. To the authors of these highlighted scripts: our sincere thanks, on behalf of all TradingViewers. Congrats!

Circular Candlestick Chart - alexgrover

Dominance Pie Chart - fikira

Tape - LucF

ta (library) - TradingView

MathConstants (library) - RicardoSantos

MathStatisticsKernelFunctions (library) - RicardoSantos

Zigzag Candles - Trendoscope

Over the next three months, in the last week of each month, we will share retro Editors' picks for subsequent years:

July: retro EPs for 2022

August: retro EPs for 2023

September: retro EPs for 2024

They will be visible in the Editors' picks feed.

Previously published retro Editors' picks:

May: retro EPs for 2020

█ What are Editors' picks?

The Editors' picks showcase the best open-source script publications selected by our PineCoders team. Many of these scripts are original and only available on TradingView. These picks are not recommendations to buy or sell anything or use a specific indicator. We aim to highlight the most interesting publications to encourage learning and sharing in our community.

Any open-source script publication in the Community Scripts can be picked if it is original, provides good potential value to traders, includes a helpful description, and complies with the House Rules.

— The PineCoders team

Retro Editors' picks 2022Going further in our retro EP selection , we present to you the third collection of additional scripts that have earned a spot in our Editors' picks, now from 2022.

These retrospective selections reflect our continued commitment to honoring outstanding contributions in our community, regardless of when they were published. To the authors of these highlighted scripts: our sincere thanks, on behalf of all TradingViewers. Congrats!

Volume Profile, Pivot Anchored by DGT - dgtrd

Estimated Time At Price - KioseffTrading

Signs of the Times - LucF

Strategy (library) - TradingView

Intrabar Efficiency Ratio - TradingView

Over the next two months, in the last week of each month, we will share retro Editors' picks for subsequent years:

August: retro EPs for 2023

September: retro EPs for 2024

They will be visible in the Editors' picks feed .

Previously published retro Editors' picks:

May: retro EPs for 2020

June: retro EPs for 2021

█ What are Editors' picks ?

The Editors' picks showcase the best open-source script publications selected by our PineCoders team. Many of these scripts are original and only available on TradingView. These picks are not recommendations to buy or sell anything or use a specific indicator. We aim to highlight the most interesting publications to encourage learning and sharing in our community.

Any open-source script publication in the Community Scripts can be picked if it is original, provides good potential value to traders, includes a helpful description, and complies with the House Rules.

— The PineCoders team

XRP 4H – Golden Pocket Bounce, But Will Bulls Reclaim $3.60?XRP pulled back cleanly into the golden pocket (0.618 Fib) after a strong rally — and buyers stepped in with force. Momentum flipped quickly, and Stochastic RSI is curling up with bullish intent.

Now price is holding above short-term support, but faces a key challenge:

→ $3.60 marks the prior high

→ Reclaiming that level would confirm bullish continuation

→ A rejection here would set up a lower high and shift structure bearish

This is a make-or-break moment for XRP in the short term. The golden pocket held — now the top of the range needs to flip.

#XRP #GoldenPocket #Fibonacci #CryptoAnalysis #StochasticRSI #LowerHighRisk #PriceAction #QuantTradingPro

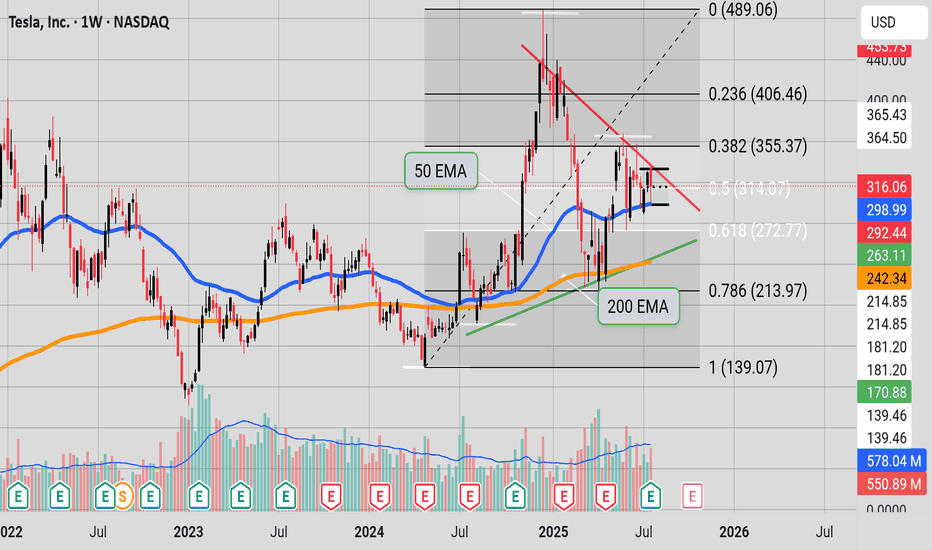

Inflection point"Tesla is at a binary point on the chart. The stock is wedged tightly between the red, downward-sloping resistance line (upper boundary) and the green, upward-sloping support line (lower boundary)—the classic apex of an asymmetrical triangle.

At this stage:

A breakout above the red resistance would be a clear bullish signal, potentially starting a new upward trend.

A rejection at resistance and breakdown below the green support would signal bearish momentum, with likely downside toward lower Fibonacci levels like 272.77 or 213.97.

With price at this inflection zone, the next decisive move—either up or down—will likely define Tesla’s short-to-medium-term trend. This is a textbook example of a binary technical situation: whichever direction is confirmed next, that’s likely to dictate the coming weeks' price action." (Some help from Perplexity)

Trading Divergences With Wedges in ForexTrading Divergences With Wedges in Forex

Divergence trading in forex is a powerful technique for analysing market movements, as is observing rising and falling wedges. This article explores the synergy between divergence trading and wedges in forex, offering insights into how traders can leverage these signals. From the basics to advanced strategies, learn how you could utilise this approach effectively, potentially enhancing your trading skills in the dynamic forex market.

Understanding Divergences

In forex trading, the concept of divergence plays a pivotal role in identifying potential market shifts. A divergence in forex, meaning a situation where price action and a technical indicator like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) move in opposite directions, often signals a weakening trend. This discrepancy is a valuable tool in divergence chart trading, as it may indicate a possible reversal or continuation of the current trend.

There are two primary types of divergence in forex—regular and hidden. Regular divergence occurs when the price makes higher highs or lower lows while the indicator does the opposite, often signalling a reversal. Hidden divergence, on the other hand, happens when the price makes lower highs or higher lows while the indicator shows higher highs or lower lows, typically suggesting a continuation of the current trend.

Trading Rising and Falling Wedges

Rising and falling wedges are significant patterns in forex trading, often signalling potential trend reversals. A rising wedge, formed by converging upward trendlines, often indicates a bearish reversal if it appears in an uptrend. Conversely, a falling wedge, characterised by converging downward trendlines, typically reflects a bullish reversal if it occurs in a downtrend.

Traders often look for a breakout from these patterns as a signal to enter trades. For rising wedges, a downward breakout can be seen as a sell signal, while an upward breakout from a falling wedge is often interpreted as a buy signal. When combined with divergences, this chart pattern can add confirmation and precede strong movements.

Best Practices for Trading Divergences

Trading divergence patterns in forex requires a keen eye for detail and a disciplined, holistic approach. Here are key practices for effective trading:

- Comprehensive Analysis: Before trading on divergence and wedges, be sure to analyse overall market conditions.

- Selecting the Right Indicator: Choose a forex divergence indicator that suits your trading style. Common choices include RSI, MACD, and Stochastic.

- Confirmation Is Key: It’s best to watch for additional confirmation from price action or other technical tools before entering a trade.

- Risk Management: Traders always set stop-loss orders to manage risk effectively. Divergence trading isn't foolproof; protecting your capital is crucial.

- Patience in Entry and Exit: Be patient as the divergence develops and confirm with your chosen indicators before entering or exiting a trade.

Strategy 1: RSI and Wedge Divergence

Traders focus on regular divergence patterns when the RSI is above 70 (overbought) or below 30 (oversold), combined with a rising or falling wedge pattern. The strategy hinges on identifying highs or lows within these RSI extremes. It's not crucial if the RSI remains consistently overbought or oversold, or if it fluctuates in and out of these zones.

Entry

- Traders may observe a regular divergence where both the price highs/lows and RSI readings are above 70 or below 30.

- After the formation of a lower high (in an overbought zone) or a higher low (in an oversold zone) in the RSI, traders typically watch as the RSI crosses back below 70 or above 30. This is accompanied by a breakout from a rising or falling wedge, acting as a potential signal to enter.

Stop Loss

- Stop losses might be set just beyond the high or low of the wedge.

Take Profit

- Profit targets may be established at suitable support/resistance levels.

- Another potential approach is to exit when the RSI crosses back into the opposite overbought/oversold territory.

Strategy 2: MACD and Wedge Divergence

Regarded as one of the best divergence trading strategies, MACD divergence focuses on the discrepancy between price action and the MACD histogram. The strategy is particularly potent when combined with a rising or falling wedge pattern in price.

Entry

- Traders typically observe for the MACD histogram to diverge from the price. This divergence manifests as the price reaching new highs or lows while the MACD histogram fails to do the same.

- The strategy involves waiting for the MACD signal line to cross over the MACD line in the direction of the anticipated reversal. This crossover should coincide with a breakout from the rising or falling wedge.

- After these conditions are met, traders may consider entering a trade in anticipation of a trend reversal.

Stop Loss

- Stop losses may be set beyond the high or low of the wedge, which may help traders manage risk by identifying a clear exit point if the anticipated reversal does not materialise.

Take Profit

- Profit targets might be established at nearby support or resistance levels, allowing traders to capitalise on the expected move while managing potential downside.

Strategy 3: Stochastic and Wedge Divergence

Stochastic divergence is a key technique for divergence day trading in forex, especially useful for identifying potential trend reversals. This strategy typically employs the Stochastic Oscillator with settings of 14, 3, 3.

Entry

- Traders may look for divergence scenarios where the Stochastic readings are above 80 or below 20, mirroring the RSI approach.

- This divergence is observed in conjunction with price action, forming a rising or falling wedge.

- Entry may be considered following a breakout from the wedge, which signals a potential shift in market direction.

Stop Loss

- Setting stop losses just beyond the high or low of the wedge might be an effective approach.

Take Profit

- Profit targets may be set at key support/resistance levels.

The Bottom Line

Divergence trading, coupled with the analysis of rising and falling wedges, offers a comprehensive approach to navigating the forex market. By integrating the discussed strategies with sound risk management and market analysis, traders may potentially enhance their ability to make informed decisions in the dynamic world of forex.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Flat, Quiet… and Full of Clues .Most traders only see the middle.

The acceleration. The “trend”. The movement.

But that’s just one-third of the story.

If you really want to understand the market’s rhythm,

you need to study how moves begin, evolve, and die.

Let’s break down the 3 key phases every market goes through —

again, and again, and again.

📌 1. Accumulation Phase

This is the part no one talks about.

Why? Because it’s boring. Choppy. Range-bound. Confusing.

Most traders get shaken out here.

But smart money? They’re quietly buying.

You’ll often see:

Flat price action with no clear trend

Fake breakdowns (to trigger stop-losses)

Volume starting to shift

Long wicks — both directions

This phase is a test of patience, not prediction.

And if you learn to read it well, you’ll start catching moves before they go parabolic.

🚀 2. Markup / Acceleration Phase

Here’s where everyone wakes up.

Momentum kicks in.

News gets bullish.

Breakouts start working.

Pullbacks are shallow.

And suddenly, everyone’s calling it a bull market.

But don’t be fooled.

This is not where smart money enters — this is where they ride the wave they already created.

Learn to:

Ride trends, not chase them

Add on pullbacks

Avoid FOMO entries

This is the fastest and most emotional part of the cycle — which means it rewards discipline, not excitement.

🧯 3. Distribution Phase

The party’s still on… but the hosts are quietly leaving.

Price starts to stall.

Breakouts stop working.

Volume gets heavy at the top.

And the same excitement that brought everyone in?

It’s now being used to sell into.

Distribution is sneaky.

It’s not an obvious top.

It’s a process — just like accumulation.

You’ll often see:

Lower highs forming quietly

False breakouts to trap buyers

Increasing volatility

Bullish news… with no follow-through

If you’re not paying attention, you’ll keep buying strength —

right before the rug gets pulled.

So what’s the lesson here?

Markets don’t just “go up or down.”

They prepare, move, then exhaust.

And if you learn to spot these transitions —

you’ll stop reacting late

and start positioning early.

That’s the real edge.

currently we are on the accumulation phase so in this idea I tried to show you the real story behind it and as well talk about the two others to beware of them also in the right moment I will talk about them , but for now let's focous on the current phase because we want to be part of the smart money and enjoy the next phase which is 🚀Markup / Acceleration Phase .

—

🧠 Save this post.

🔁 Revisit it when you’re confused.

📊 Because the chart isn’t random — it’s just cycling

And also remember our golden rule :

🐺 Discipline is rarely enjoyable , but almost always profitable. 🐺

🐺 KIU_COIN 🐺

Understanding ROI in Crypto: More Than Just a NumberHello, Traders! 👏

Return on Investment (ROI) is often the first metric new investors focus on when evaluating an asset, a strategy, or even their trading performance. It’s easy to see why. It's simple, intuitive, and widely used across both traditional finance and the cryptocurrency sector. One formula, and suddenly you have a "score" for your investment. Green is good. Red is bad. Right?

Well…Not quite.

In the crypto market, where price swings can be extreme, timelines are compressed, and risk profiles differ significantly from those in traditional markets, a simplistic ROI figure can be dangerously misleading.

A 50% ROI on a meme coin might look great, until you realize the token is illiquid, unbacked, and you're the last one holding the bag. Conversely, a 10% ROI on a blue-chip crypto asset with strong fundamentals might be significantly more meaningful in risk-adjusted terms.

In this article, we'll delve beyond the basic formula and break down what ROI really tells you, how to use it correctly, and where it falls short. Let's go!

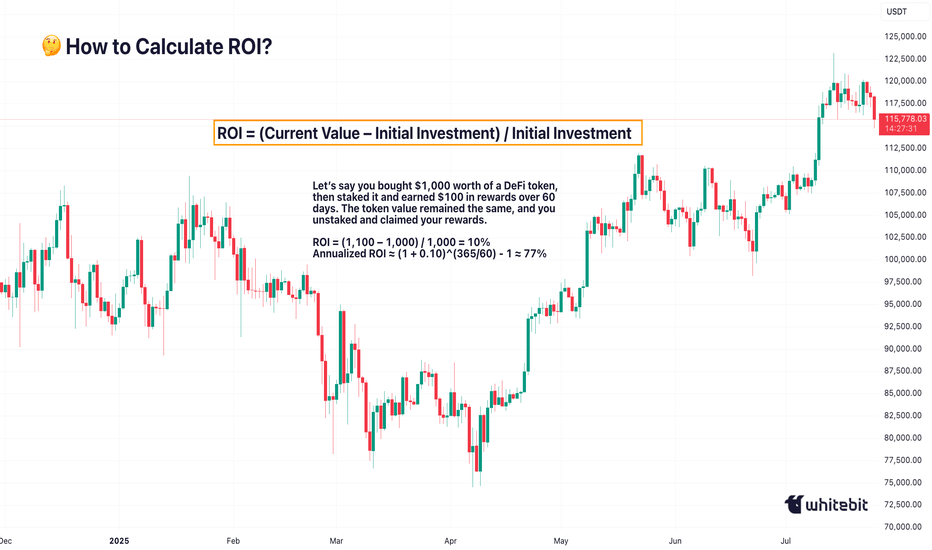

What Is ROI and How Do You Calculate It?

The Basic Formula for Return on Investment Is: ROI = (Current Value – Initial Investment) / Initial Investment.

Let’s say you bought ETH at $2,000 and sold it at $2,600: ROI = (2,600 – 2,000) / 2,000 = 0.3 → 30%. Seems straightforward. You made 30% profit. However, crypto is rarely straightforward.

What if you held it for 2 years? Or 2 days? What if gas fees, staking rewards, or exchange commissions altered your real costs or returns? Did you include opportunity cost and the profits missed by not holding another asset? ROI as a raw percentage is just the beginning. It’s a snapshot. However, in trading, we need motion pictures, full narratives that unfold over time and within context.

Why Time Matters (And ROI Ignores It)

One of the most dangerous omissions in ROI is time.

Imagine two trades: Trade A returns 20% in 6 months. Trade B returns 20% in 6 days.

Same ROI, very different implications. Time is capital. In crypto, it’s compressed capital — markets move fast, and holding a position longer often increases exposure to systemic or market risks.

That’s why serious traders consider Annualized ROI or utilize metrics like CAGR (Compound Annual Growth Rate) when comparing multi-asset strategies or evaluating long-term performance.

Example: Buying a Token, Earning a Yield

Let’s say you bought $1,000 worth of a DeFi token, then staked it and earned $100 in rewards over 60 days. The token value remained the same, and you unstaked and claimed your rewards.

ROI = (1,100 – 1,000) / 1,000 = 10%

Annualized ROI ≈ (1 + 0.10)^(365/60) - 1 ≈ 77%

Now that 10% looks very different when annualized. But is it sustainable? That brings us to the next point…

ROI Without Risk Analysis Is Useless

ROI is often treated like a performance badge. But without risk-adjusted context, it tells you nothing about how safe or smart the investment was. Would you rather: Gain 15% ROI on a stablecoin vault with low volatility, or Gain 30% ROI on a microcap meme token that could drop 90% tomorrow?

Traders use metrics such as the Sharpe Ratio (which measures returns versus volatility), Maximum Drawdown (the Peak-to-Trough Loss During a Trade), and Sortino Ratio (which measures returns versus downside risk). These offer a more complete picture of whether the return was worth the risk. ⚠️ High ROI isn’t impressive if your capital was at risk of total wipeout.

The Cost Side of the Equation

Beginners often ignore costs in their ROI math. But crypto isn’t free: Gas fees on Ethereum, trading commissions, slippage on low-liquidity assets, impermanent loss in LP tokens, maybe even tax obligations. Let’s say you made a 20% ROI on a trade, but you paid 3% in fees, 5% in taxes, and lost 2% in slippage. Your actual return is likely to be closer to 10% or less. Always subtract total costs from your gains before celebrating that ROI screenshot on X.

Final Thoughts: ROI Is a Tool, Not a Compass

ROI is beneficial, but not omniscient. It’s a speedometer, not a GPS. You can use it to reflect on past trades, model future ones, and communicate performance to others, but don’t treat it like gospel.

The real ROI of any strategy must also factor in time, risk, capital efficiency, emotional stability, and your long-term goals. Without those, you’re not investing. You’re gambling with better math. What do you think? 🤓

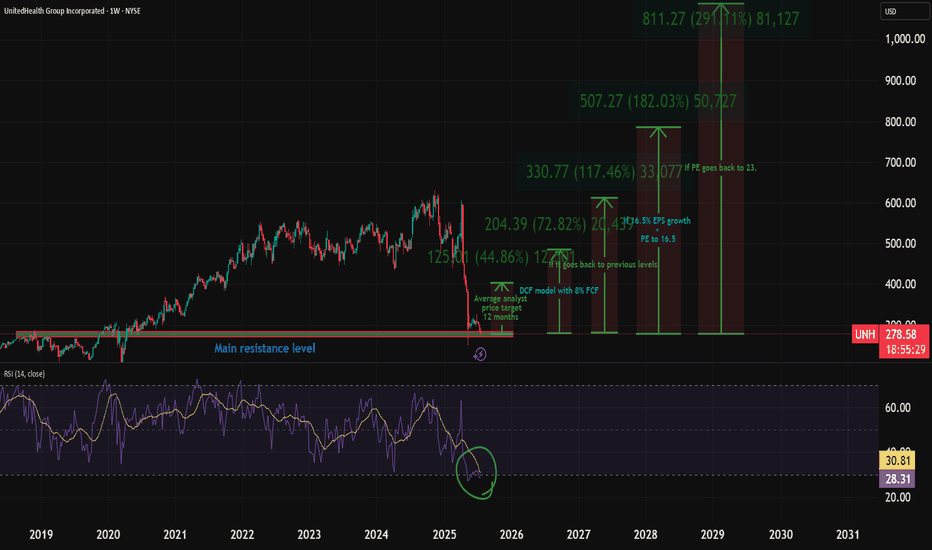

My UNH Thesis: Betting on a Healthcare Giant's Come BackThe healthcare sector has been in decline, which creates interesting opportunities. I recently talked about a few pharma plays - Eli Lilly, Novo Nordisk, and Pfizer.

Here's why I'm investing in NYSE:UNH :

UnitedHealth Group (UNH) has tanked ~50% in the past year, but the July 29 (VERY SOON) earnings could flip the script. As a historically dominant player, UNH is now undervalued amid sector weakness, offering massive upside if regulatory fears ease.

Here's my full bull case. 👇 FUNDAMENTAL ANALYSIS

Why the Sell-Off? A Perfect Storm of Bad News

UNH crushed the market for 15 straight years (2009-2023) with positive returns, predictable EPS growth, and 134% gains over the last decade.

But 2024 brought chaos:

Feb: Massive cyber attack caused a one-time EPS hit (non-recurring).

Ongoing: DOJ antitrust probe, criminal fraud investigation, rising Medicare costs, and Optum losses.

April: Disastrous Q1 earnings miss + lowered guidance.

Leadership drama: CEO death.

This erased gains (down 7% over 5 years), amplified by healthcare sector outflows—the biggest since 2020. But is this overblown? Signs point to yes. The markets almost always overreact to bad news.

Bullish Signals: Insiders Betting Big

The tide is turning:

Insider Buying Boom: $32M+ in 2024 (vs. $6.6M in 2019), including new CEO/CFO—highest in 15 years.

Congress Buying: Q2 2024 saw net purchases for the first time in 5 years (vs. historical selling).

DOJ Shift: Probe refocusing on pharmacy benefits (PBM) unit, dropping acquisition/monopoly scrutiny—implies no major findings. Great news!

Sector Tailwinds: Healthcare is one of 3 S&P sectors below historical valuations. Super investors (usually tech-obsessed) are piling in, despite the sector's -10% YTD vs. S&P's +13%.

Plus, UNH's dividend yield is at a record ~3% (vs. 1.5% avg), with 16%+ historical growth and 100%+ free cash flow conversion. Rare combo of yield + growth!

Valuation: Screaming Buy?

UNH trades at PE ~11.9 (vs. 10-year avg 23)—a steal.

Analysts project 16.7% EPS CAGR through 2029.

Conservative Scenario: 16.5% EPS growth + PE to 16.5 = $780/share by 2030 (173% total return, 18% CAGR ex-dividends).

Optimistic: PE back to 23 = $1,084/share (280% return).

Models confirm:

DCF (8% FCF growth): ~$484/share (70% upside).

DDM (7% div growth): ~$607/share (112% upside).

Blended Fair Value: ~$545/share (75-90% upside from ~$300). Buy below $436 for 20% safety margin.

Still, there is fear of DOJ uncertainty—investors hate unpredictability and that's why the stock is so low.

Key Catalyst: July 29 Earnings

This could be UNH's "most important report ever." Watch for:

Regulatory/legal updates (DOJ progress).

Full-year guidance revisions.

Metrics like medical loss ratio and PBM performance.

Positive news = potential rocket 🚀. Expectations are low (20 bearish EPS revisions vs. 0 bullish), so a beat could spark volatility... upward.

Risks: Not Without Bumps

Regulatory escalation (e.g., PBM issues) could tank it further.

Short-term headwinds: Medicare costs, sector selling.

Mitigants: DOJ de-risking, strong FCF buffer, insider confidence. Enter cautiously—size positions small.

TECHNICAL ANALYSIS

I also did a little technical analysis:

UNH price is at a resistance level

My EVaR indicator tells me we are in a low-risk area

RSI says the stock is oversold

I added the different price targets for better visualization

THE PLAN

My plan:

Later today, I will allocate 1% to 1.5% of my portfolio to the stock. If it drops, I will continue to DCA. The stock is already really beaten down, and I think a company this large cannot drop much more.

Quick note: I'm just sharing my journey - not financial advice! 😊

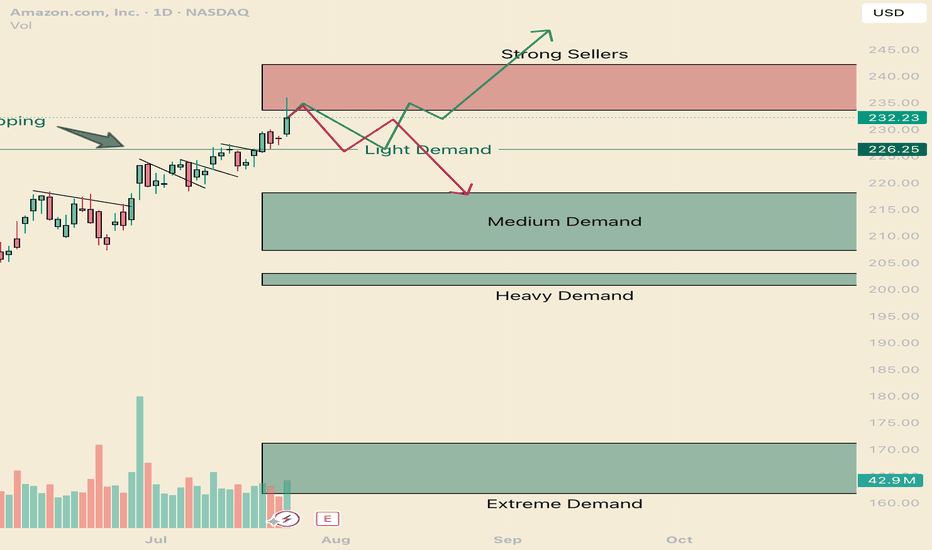

How to navigate the Amazonian Squeeze. AMZNHello I am the Cafe Trader.

This week has been a deep dive on the MAG 7 and today AMZN is up next.

We are going to look at long term and short term opportunities.

We are near the All Time Highs, with one final Seller to get through before making the break.

Today we tested to see if those sellers are there still (and indeed they are). Today was a key reaction, I'm going to give you the keys to profit.

Long Term

It's important to consider how aggressive you would like to be with pricing. This list of prices should align with your conviction with Amazon.

Aggressive: $226 is where the current aggressive players are sitting. They are going to look to buy again at this level, although they should be the weakest of the buyers.

Fair sentiment: 203-210 is where stronger buyers are sitting. I think this price is still realistic to get to.

Conservative: 161 - 171 Is a great price, buyers have shown to buy this with extreme demand. Amazon at this price is a fantastic purchase, if you are holding from here or lower, congradulations.

Short term

Testing the supply and rejecting tells us that sellers are still really active in this zone. We will see how tomorrow closes, if we do not close in the supply zone, there is a good chance that net week will have some bearish winds and a great chance of testing the light demand at 226. this brings us to the two trading ideas.

1 Green line

I think we will test those sellers by next week. and i think its very possible that we break trend and touch the light demand line. If its a slow drag down to the light demand, Shorts will have to cover as soon as any real demand shows up (Light Demand Line).

Entry 226.50

Stop 221.50

Partial TP 233, or you can hold for a test of the highs (242 would suffice)

2 Red Line

If we get a Hot reaction from the supply zone, or if we close below 233.50 tomorrow, Look for a retest and short entry off the supply zone. If the reaction starts to be slow (more than 5 days of red bars) it's likely this will turn into the green scenario.

Entry 233.5

Stop 237

Partial TP 226.5

Full TP 218

That's all for AMZN Follow for more!

Also comment if you would like me to chart a stock you are considering.

@thecafetrader

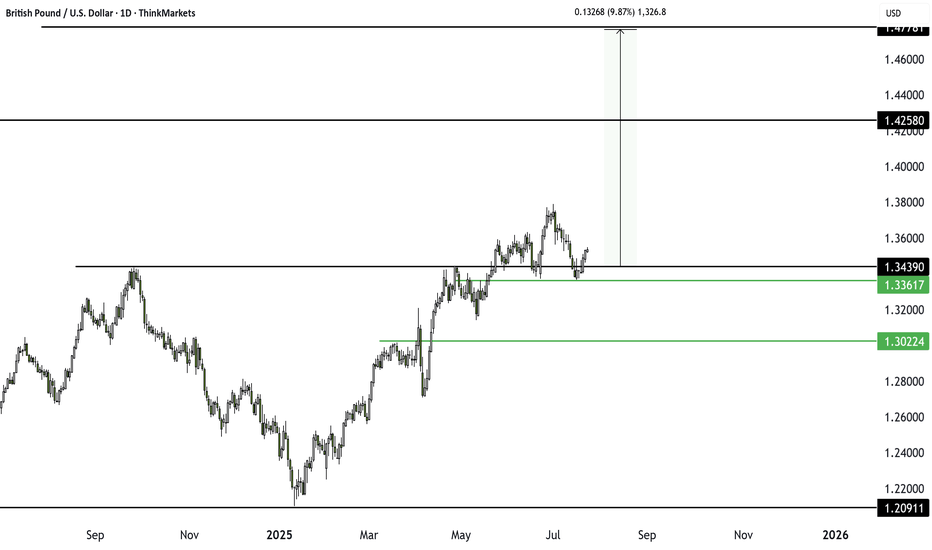

GBPUSD Traders Beware: A Major Drop Could Be ComingThe classic rule says what doesn’t go up must come down. After a failed breakout at 1.3439, GBPUSD is struggling. With longs sitting on big gains from January’s low, a drop toward 1.3361 or even lower looks likely. Watch this key level now.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

TradingView Show: Trade Ideas You Can't Miss with TradeStationJoin us for a timely TradingView live stream with David Russell, Head of Global Market Strategy at TradeStation, as we break down the latest rebound in the markets and what it could mean for traders and investors. In this session, we’ll dive into:

- New sectors to watch, like homebuilders

- Prior insights on companies like Coinbase and Micron

- What trades are setting up, why, and educational concepts to plan for them

- Upcoming economic news and more to have on your calendar

- Key charts, indicators, and technical patterns to watch for signs of sustained momentum

- Essential strategies for navigating market recoveries, corrections, and upcoming Federal Reserve decisions

Bonus: Discover our latest broker integration update with TradeStation—now supporting equity options trading directly on TradingView. This upgrade brings advanced tools like the strategy builder, options chain sheet, and volatility analysis to your fingertips, making it easier to trade through uncertain market conditions.

This session is sponsored by TradeStation, whose vision is to provide the ultimate online trading platform for self-directed traders and investors across equities, equity index options, futures, and futures options markets. Equities, equity options, and commodity futures services are offered by TradeStation Securities Inc., member NYSE, FINRA, CME, and SIPC.

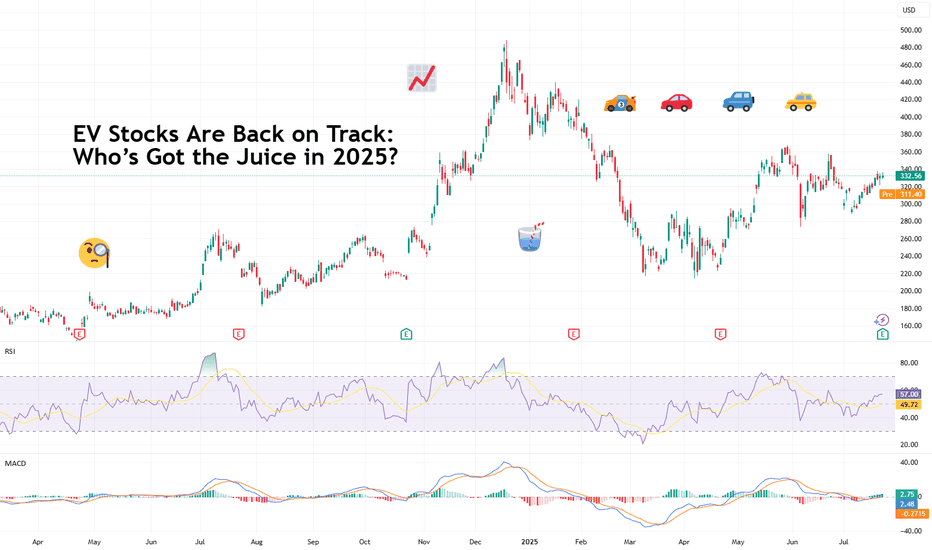

EV Stocks Are Back on Track: Who’s Got the Juice in 2025?This year is big for the EV sector so we figured let’s do a piece on it and bring you up to speed on who’s making moves and getting traction — both in the charts and on the road.

What we’ve got here is a lean, mean lineup of real contenders. Let’s go for a ride.

🚗 Tesla: Still King of the Road (for Now)

Tesla NASDAQ:TSLA isn’t just an EV company. It’s a tech firm, an AI shop, a robotaxi rollout machine, and an Elon-flavored media event every quarter. Even so, when it comes to margins, global volume, and name recognition, Tesla is still the benchmark everyone else is chasing.

In 2025, Tesla’s bounceback is fueled not just by EV hype but by its push into autonomous driving and different plays into the AI space.

The stock is down about 13% year-to-date. But investors love a narrative turnaround. Apparently, the earnings update didn't help the situation as shares slipped roughly 5%. Well, there's always another quarter — make sure to keep an eye on the Earnings Calendar .

🐉 BYD: The Dragon in the Fast Lane

BYD 1211 is calmly racking up sales, expanding across continents, and stealing global market share without breaking a sweat. The Chinese behemoth is outselling Tesla globally and doing it with less drama and more charge… literally .

Vertical integration is BYD’s secret weapon — they make their own batteries, chips, and even semiconductors. The West might not be in love with BYD’s designs, but fleet operators and emerging-market governments are. And that’s where the real growth is.

⛰️ Rivian: Built for Trails, Not Earnings (Yet)

Rivian NASDAQ:RIVN still feels like the Patagonia of EV makers — rugged, outdoorsy, aspirational. Its R1T pickup truck has cult status, but the company had to tone down its ambitions and revised its guidance for 2025 deliveries to between 40,000 and 46,000. Early 2025 projections floated around 50,000 .

The good news? Rivian is improving on cost control, production pace, and market fit. The bad news? It’s still burning cash faster than it builds trucks. But for investors betting on a post-rate-cut growth stock rally, Rivian may be the comeback kid to watch. It just needs a few solid quarters.

🛋️ Lucid: Luxury Dreams, Reality Checks

Lucid NASDAQ:LCID , the one that’ll either go under or make it big. The luxury carmaker, worth about $8 billion, came into the EV game promising to out-Tesla Tesla — with longer range, more appeal, and a price tag to match.

But here’s the rub: rich people aren’t lining up for boutique sedans, especially when Mercedes and BMW now offer their own electric gliders with badge power and a dealer network.

Lucid’s challenge in 2025 is existential. The cars are sleek, the tech is strong, but the cash runway is shrinking and demand isn’t scaling like the pitch deck promised.

Unless it nails a strategic partnership (Saudi backing only goes so far), Lucid could end up as a cautionary tale — a beautifully engineered one, but a cautionary tale nonetheless. Thankfully, Uber NYSE:UBER showed up to the rescue ?

💪 NIO : Battling to Stay in the Race

Remember when NIO NYSE:NIO was dubbed the “Tesla of China”? Fast forward, and it’s still swinging — but now the narrative is more about survival than supremacy. NIO's battery-swap stations remain a unique selling point, but delivery volumes and profitability are still trailing.

The company’s leaning into smart-tech partnerships and next-gen vehicle platforms. The stock, meanwhile, needs more than just optimism to get moving again — it’s virtually flat on the year.

✈️ XPeng: Flying Cars, Literally

XPeng’s NYSE:XPEV claim to fame used to be its semi-autonomous driving suite. Now? It's working on literal flying vehicles with its Land Aircraft Carrier. Innovation isn’t the problem — it's execution and scale.

XPeng is beloved by futurists and punished by spreadsheets. It’s still getting government love, but without a clear margin path, the stock might stay grounded.

🏁 Li Auto: The Surprise Front-Runner

Li Auto NASDAQ:LI doesn’t get the headlines, but it’s quietly killing it with its range-extended EVs — hybrids that let you plug in or gas up. A smart move in a country still building out its charging infrastructure.

Li is delivering big numbers, posting improving margins, and seems laser-focused on practicality over hype. Of all the Chinese EV stocks, this one might be the most mature.

🧠 Nvidia: The Brains of the Operation

Okay, not an EV stock per se, but Nvidia NASDAQ:NVDA deserves a spot on any EV watchlist. Its AI chips are running the show inside Tesla’s Full Self-Driving computers, powering sensor fusion in dozens of autonomous pilot programs, and quietly taking over the brains of modern mobility.

As self-driving becomes less sci-fi and more of a supply-chain item, Nvidia's value-add grows with every mile driven by data-hungry EVs.

🔋 ChargePoint & EVgo: Picks and Shovels

If you can’t sell the cars, sell the cables.

EV charging companies were once seen as the “safe bet” on electrification. Now they’re just seen as massively underperforming.

ChargePoint BOATS:CHPT : Still the leader in US charging stations but struggling with profitability and adoption pacing. Stock’s down bad from its peak in 2021 (like, 98% bad).

EVgo NASDAQ:EVGO : Focused on fast-charging and partnerships (hello, GM), but scale and margin pressures remain.

Both stocks are beaten down hard. But with billions in infrastructure funding still flowing, who knows, maybe there’s potential for a second act.

👉 Off to you : are you plugged into any of these EV plays? Share your EV investment picks in the comments!

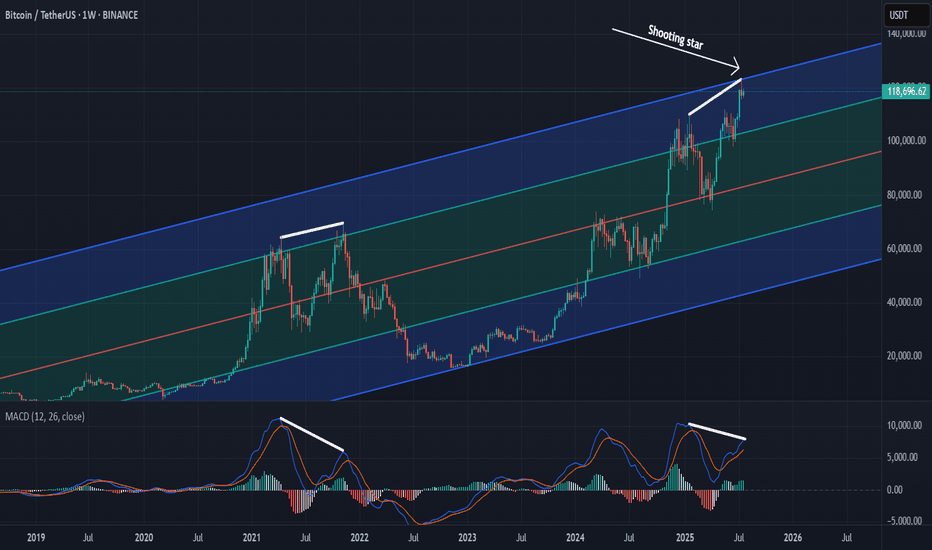

Calling the Unthinkable: Why a Bitcoin Drop May Be ComingCOINBASE:BTCUSD BITSTAMP:BTCUSD OKX:BTCUSD BINANCE:BTCUSDT.P

Predicting a drop in Bitcoin's price during a strong uptrend is extremely difficult and calling it takes real courage. It puts my credibility at risk, but based on everything I see, I believe BTC has reached dangerously high levels.

From a psychological perspective , investor behavior is sending warning signs. There’s a rush of people buying in out of FOMO, amplified by heavy promotion on social media and mainstream claiming BTC is the safest investment out there. Many who missed earlier buying opportunities now regret betting on altcoins instead, and they see this as a last chance to profit. Even if BTC drops below their entry points, most of these “late buyers” won’t sell. They’ll convince themselves it’s just another minor correction like what happened in the previous 2 years, and that they’re in it for the long term.

From a technical analysis point, the signs are just as concerning. A “ shooting star ” candle has formed on the weekly chart. This candle is often seen at market tops. The MACD histogram on the same timeframe is showing a potential divergence, suggesting weakening momentum. The Fear and Greed Index is approaching 70, indicating strong market greed. On top of that, traders are opening high-leverage long positions in anticipation of another big bullish candle.

These technical and psychological signals combined paint a risky picture. If this kind of setup is confirmed , it will lead to sharp corrections.

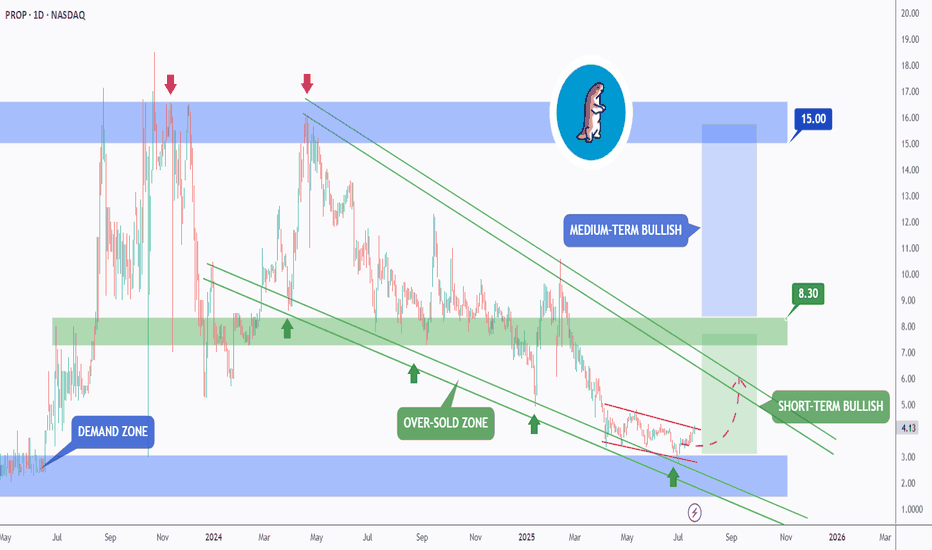

A Sleeping Giant in the Energy Sector?While everyone’s chasing the next hot AI stock, a quiet opportunity might be taking shape in the energy sector; and it could be a big one.

🔋 As AI data centers explode in size and number, the demand on our power grid is rising fast. Nuclear is still years away, and renewables are struggling to scale in time. That leaves oil and gas as the most reliable players; and one U.S. company may be perfectly positioned to ride that wave.

📊 Technical Analysis

NASDAQ:PROP PROP has been in a steady downtrend, moving within a falling wedge pattern (marked in green). Right now, it’s retesting the bottom of that wedge, typically where things get oversold.

Even more interesting, PROP bounced off a major monthly demand zone last week, a signal that buyers may be stepping in.

In the short term, if the blue demand zone holds, we could see a push toward the $7 mark, which lines up with the top of the wedge.

But to really confirm a medium-term reversal, we’ll need a clean break above the $8.3 resistance. If that happens, the door could open to a rally toward $15, a key level from early 2024.

🛢️ Why PROP? A Hidden Play With Room to Run

Prairie Operating Co. (NASDAQ: PROP) isn’t your typical small-cap oil stock. They own 65,000 acres in Colorado’s DJ Basin and use modern drilling tech to stay lean and efficient. That means they can still make money even when oil prices dip.

As energy demand continues to climb, PROP could be sitting in the sweet spot , especially with the world so focused on tech stocks. But behind every AI boom is a growing energy need, and companies like PROP are the ones powering it.

One well-known Wall Street firm recently gave PROP a Buy rating with a $21.75 price target; that’s a potential 281% upside from where it stands today. And that’s not even counting the potential boost from energy-friendly policies under the current administration.

📌 One to Watch in 2025

PROP might just be one of the most under-the-radar energy plays going into the new year.

The biggest moves often start quietly; and this one has all the ingredients to surprise.

➡️ As always, speak with your financial advisor and do your own research before making any investment decisions.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

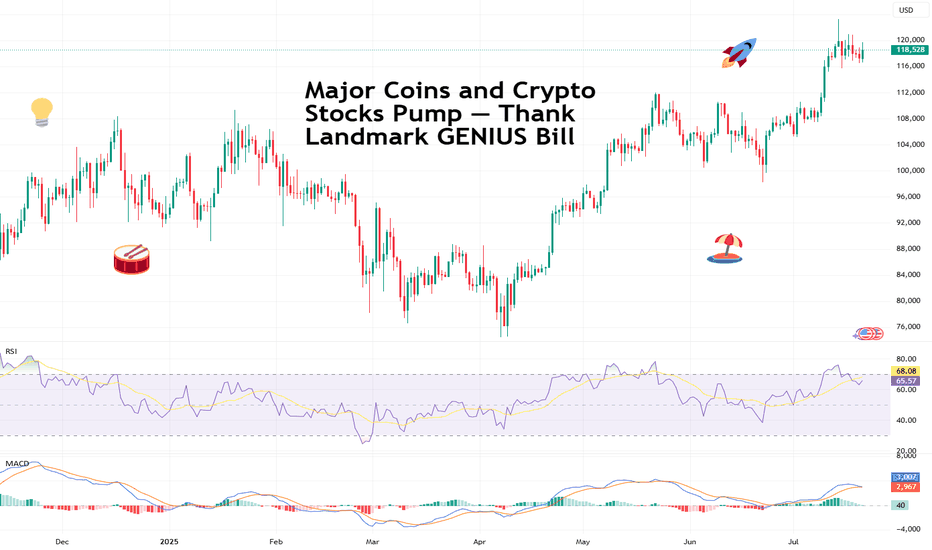

Major Coins and Crypto Stocks Pump — Thank Landmark GENIUS BillBitcoin BITSTAMP:BTCUSD making ATHs? Old news. But Coinbase NASDAQ:COIN and Robinhood NASDAQ:HOOD hitting those record-high notes? And XRP BITSTAMP:XRPUSD dangerously close to eclipsing its own peak, while Ethereum keeps chugging along toward $4,000? Now we’re talking.

In a market-friendly twist, President Trump signed the GENIUS Act into law on Friday — a sweeping legislative win for crypto. Short for Guiding and Establishing National Innovation for US Stablecoins, the GENIUS Act marks the first major federal framework for digital assets and, more importantly for traders, triggered a firestorm of price action across the space.

Flanked by crypto executives, Republican lawmakers, and a few NFT bros in suits, Trump called the stablecoin-focused bill “perhaps the greatest revolution in financial technology since the birth of the internet.” Bold claim. But judging by what the market’s doing — he might actually be onto something.

The bill, passed 308 to 122 in the House, lays the groundwork for US banks to issue their own stablecoins and create a regulatory moat that finally separates innovation from legal whack-a-mole.

But wait, that’s not all. The House also passed the CLARITY Act and the Anti-CBDC Surveillance State Act. The first one will help determine if cryptos will be considered securities and the second one bans the Federal Reserve from issuing its own coin.

🚀 Crypto Market Cap Hits $4 Trillion

As the bill cleared Congress and Trump picked up the pen, the entire crypto market cap exploded past $4 trillion for the first time in history with the orange coin holding more than 60% of the market .

It wasn’t just Bitcoin BITSTAMP:BTCUSD making noise (although it did quietly retest $120,000 boasting a $2.4 trillion valuation, or more than that of Google parent Alphabet NASDAQ:GOOGL ).

The real momentum was coming from the stocks and altcoins — especially those with exposure to the suddenly green-lit US regulatory scene.

📈 Coinbase: To the Moon and Beyond

Let’s talk about Coinbase, ticker symbol NASDAQ:COIN , and now also, apparently, ticker symbol 🚀.

Shares surged over 8% on Friday to hit a new record session high of $445, giving the US-based exchange a market cap of over $100 billion. Not bad for a company that spent most of 2022 playing dodgeball with the SEC.

The GENIUS Act (and its siblings) cleared a path for institutional crypto adoption — and no one stands to gain more than Coinbase. It’s the go-to exchange for institutional custody and compliance. And now, with banks dipping their toes into stablecoin waters, guess who gets to facilitate those flows? Exactly.

Coinbase has now rallied over 63% year-to-date, putting it back into market darling territory — and giving early bulls a solid reason to post their PnLs again.

📊 Robinhood: Meme Stock No More?

Wait, what’s that clamor? It’s the “HOOD to $100” crowd dusting off their 2021 hats.

Robinhood NASDAQ:HOOD also saw a serious lift from the legislative push — hitting an all-time session high of $113 on Friday. The shares are up 180% in 2025 alone.

While most remember Robinhood for its meme stock legacy, the app has quietly built a towering crypto trading platform in the US. And now, with Congress cracking open the stablecoin lane and clearing legal fog, it’s suddenly a real contender in the digital asset arms race.

Add to that Trump’s pledge to dismantle crypto-hostile policies from the previous administration (many of which affected Robinhood’s crypto operations), and it’s no wonder the stock is flying.

💰 Stablecoins: Boring Coins Are Now Big Biz

You’d be forgiven for snoozing through most stablecoin headlines. After all, they don’t moonshot or do anything but sit idle.

But make no mistake — this is where the real money’s watching. JPMorgan CEO Jamie Dimon, not known for casual crypto endorsements, said last week his bank will now be “involved in both JPMorgan deposit coin and stablecoins.”

That’s a seismic shift. For years, traditional banks sat on the sidelines while Circle CRYPTOCAP:USDC and Tether CRYPTOCAP:USDT built billion-dollar stablecoin empires. Now, thanks to the GENIUS Act, the door is open for regulated banks to issue digital dollars backed by FDIC-level trust — and potentially eat into the DeFi-native players’ lunch.

Boring’s about to get very profitable.

💥 XRP: Return of the Ripple?

You know it’s a bull market when XRP BITSTAMP:XRPUSD shows up uninvited and still gets the VIP booth.

The one-time courtroom drama token surged over 60% in the past two weeks, hitting $3.50 and inching dangerously close to its all-time high. Ripple’s comeback arc may finally be getting its payoff.

With legal pressure fading and Congress setting new guardrails for digital assets, XRP’s regulatory risks just got a lot less scary. Plus, institutions looking for faster cross-border rails may find XRP’s network a bit more attractive when Washington’s no longer breathing down its neck.

🐂 Ethereum: Quietly Eyeing $4,000

Ethereum BITSTAMP:ETHUSD might not be making headlines like Bitcoin or XRP, but don't let the quiet confidence fool you.

ETH has been rising steadily, gaining almost 50% in the last two weeks, and Monday morning was trading just shy of $3,800. With regulatory uncertainty waning, and the market treating Ether more like an investment than a utility token, it’s slowly reclaiming its 2025 highs.

Factor in the growing number of ETH-based ETFs , tokenized real-world assets (hello, Treasury bills onchain), and the boom in stablecoins running on Ethereum rails… and you’ve got a slow-burn bull case building brick by brick.

🦅 Washington, WAGMI?

So, what’s the takeaway?

For the first time, Congress passed crypto legislation that didn’t come with a hidden poison pill. The GENIUS Act, along with the CLARITY Act, have made more legislative progress in a week than years of courtroom wrangling and ETF lobbying combined.

Trump, with his pro-crypto stance and deep industry ties (after all, he did launch his own coin not too long ago), just turned crypto into a political weapon — and a market darling. Is 2025 shaping up to be the year Washington went full Web3?

Let’s hear it from you : Drop your thoughts in the comments and let’s spin up the discussion.

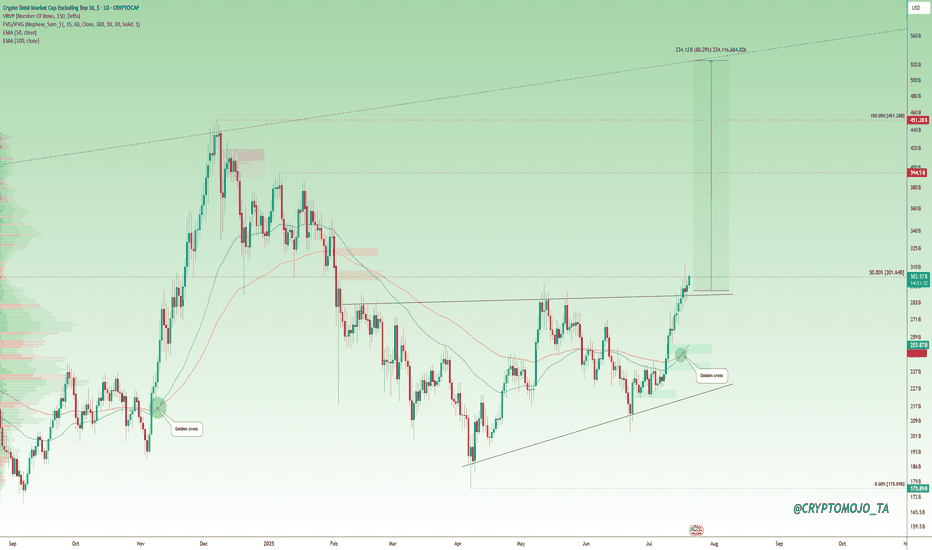

Altcoins Waking Up? Here’s What the Charts Are Telling Us!Altcoin Watch: Momentum Is Building!

A major shift is unfolding in the OTHERS chart, it just broke above its previous high and is on track to form a golden cross, a strong technical signal that often leads to a rally.

But here's the key: a confirmed breakout needs a solid close above the 50% retracement level (from the cycle top to the latest low). That’s when things can really turn bullish.

Right now, the broader altcoin market hasn’t truly taken off. We’re still early.

This is the time to scan the charts. Look for altcoins that are showing similar strength and structure.

🔍 One standout? CRYPTOCAP:LINK is already flashing signs of what's to come.

#Altseason2025

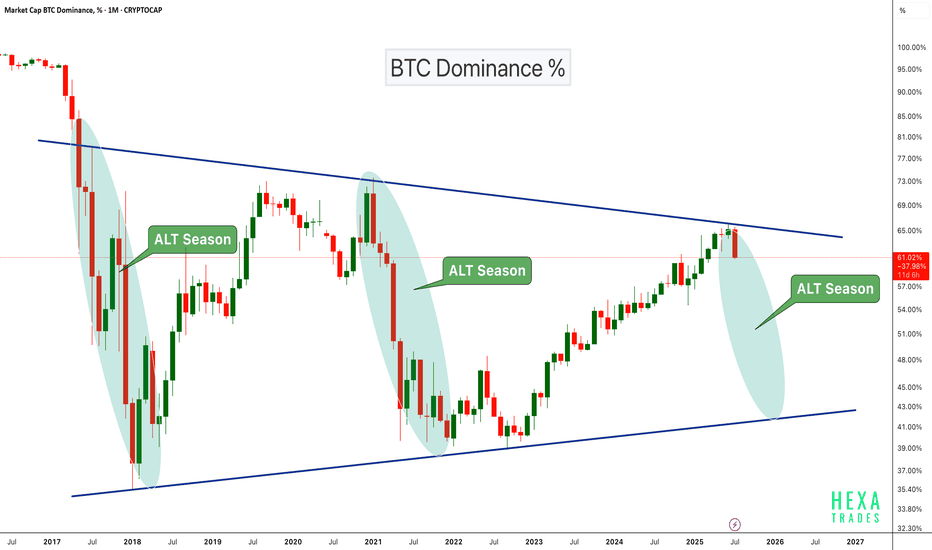

Altseason Loading?BTC Dominance chart has once again respected the long-term descending trendline resistance, showing a sharp monthly rejection. Historically, similar rejections have marked the beginning of ALT seasons, where capital flows out of Bitcoin into altcoins, boosting their performance significantly.

Chart Highlights:

-Major triangle pattern since 2017

-Clear rejections from the upper trendline coincide with previous ALT seasons (2018, 2021)

-Current rejection resembles those past cycles

-A move down in dominance could fuel strong altcoin rallies

If BTC dominance continues to decline, we could be entering another powerful altcoin season in the coming months.

Cheers

Hexa🧘♀️

CRYPTOCAP:BTC.D BINANCE:BTCUSDT

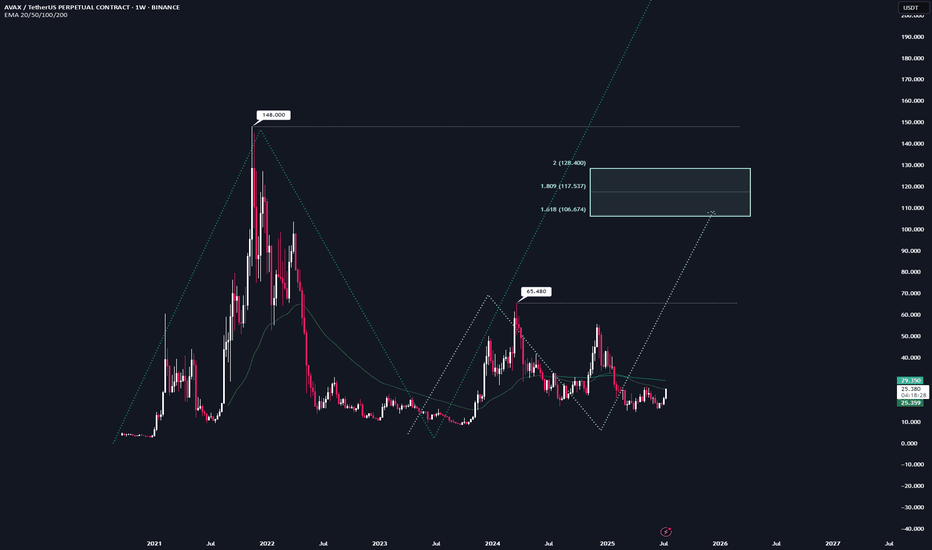

AVAX | Full Analysis Here is the top-down analysis for AVAX as requested 🫡

Weekly Timeframe:

We currently have two potential bullish structures on the weekly chart, but neither has been activated yet.

The first one (light turquoise) will be activated once we break the local high at $65. Until then, there's no valid trade setup. This sequence has it target range at $106–128.

The second structure (turquoise) gets activated once we break the all-time high at $148. It then targets the $242–298 range, which also represents my conservative bull run targets for $AVAX.

On the weekly chart, the strategy is to HODL. I wouldn't buy at this point, and I definitely wouldn't sell—because if we see another altcoin season (which in my view is nearly guaranteed), there's no reason AVAX shouldn't reach its targets around $242.

I would personally start taking profits at $106, then again at $148, and be fully out at $242.

Daily chart:

Here we have a potential structure that will be activated once we break the recent high at $26.

From that point on, according to the rulebook, every pullback into the B–C correction level (Fib 0.5–0.667) becomes a tradable opportunity.

Local Priceaction:

Three days ago, we successfully broke through the bearish reversal zone (red) and reached the bullish target zone (turquoise).

Now, every pullback into the B–C correction area becomes a valid long entry. If the price turns around and reaches that area again, I’ll trade each level with a stop-loss just below the next key level.

--------

Thats the my full Analysis for CRYPTOCAP:AVAX , hope it was helpful if yall have anymore questions feel free to ask, and if you want me to do another analysis for any other pair just comment down below.

Thanks for reading❤️

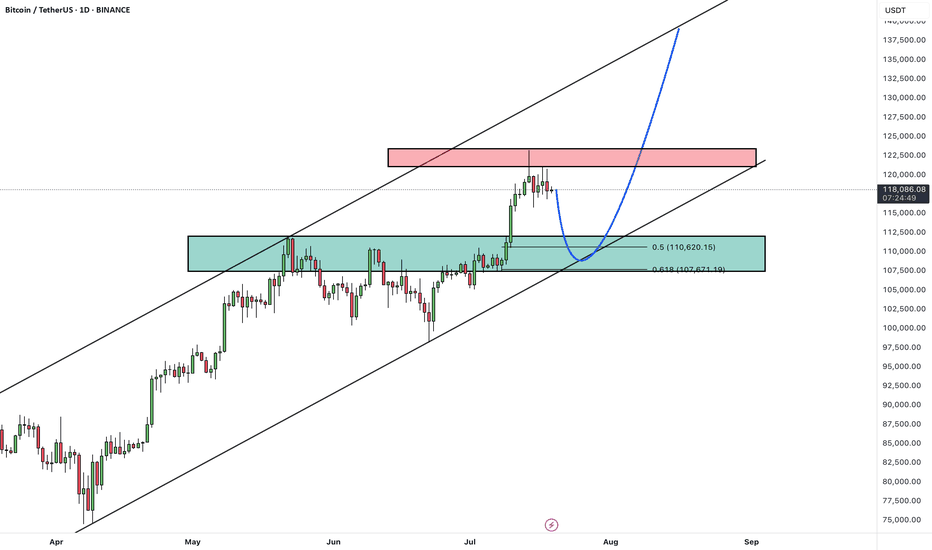

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin has recently posted a new all-time high and is now undergoing a healthy correction. This pullback is expected to extend toward a key support zone, which aligns with both the previous breakout level and the bottom of the ascending channel.

Once the correction is completed near the channel support / previous high, we anticipate a bullish continuation.

The next leg higher could take Bitcoin toward the upper boundary of the current channel.

As long as price remains above the key support area, the overall structure stays bullish and this correction is likely to be a buy-the-dip opportunity within a broader uptrend.

Will Bitcoin use this pullback as a launchpad for new highs? Share your view in the comments! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

Survival First, Success LaterThere was once a stone that lay deep in the heart of a flowing river.

Every day, the water rushed past it, sometimes gently, sometimes with force. The stone wanted to stay strong, unmoved. It believed that by holding its ground, it could outlast the river.

For years, the stone resisted. It didn’t want to change. It believed that strength meant standing still, no matter how hard the current pulled.

But slowly, almost without noticing, the stone began to wear down. The river wasn’t trying to destroy it. The water wasn’t cruel. It was simply doing what rivers do - moving, shifting, carving its own path.

One day, the stone realised it wasn’t the same shape anymore. It was smoother now, smaller in places. It hadn’t won by resisting. It had survived by adapting. It had learned to let the river shape it without breaking it apart.

The stone couldn’t control the river. All it could do was endure without letting itself be shattered.

Trading is NOT so different.

The market moves like a river. It doesn’t care if you want it to go left or right. It doesn’t reward those who stand rigid against its flow. It rewards those who learn when to hold their ground, when to let go, and how to survive the constant pull of forces bigger than themselves.

This is NOT a story about rivers and stones. It’s a story about YOU.

About learning to endure without breaking. About understanding that survival comes not from fighting the current, but from learning how to live within it.

Much like the stone, every trader begins with the same illusion, that strength means control, that certainty can be conquered with enough knowledge or willpower.

But time in the markets teaches you otherwise. It shows you, again and again, that survival isn’t about resisting the flow. It’s about learning to move with it, to protect yourself from the inevitable storms without being broken by them.

And so, this is where the real story of trading begins.

Trading often appears simple from a distance. You buy, you sell, you make a profit, and then you repeat the process.

But anyone who has spent enough time in the markets will tell you the truth. This isn’t a game of certainty. This is a game of survival.

The market humbles you early. It doesn’t care how much you know, how brilliant you think you are, or how much confidence you bring. The market doesn’t reward ego; it breaks it down piece by piece.

Almost everyone starts with the same mindset. You want to win. You want to make money. You believe you can figure it out if you study hard enough, work smart enough, hustle more than the next person.

But eventually, reality steps in. You begin to understand this game isn’t about knowing where the price will go next. It’s about knowing where you will stop, where you will cut a loss, where you will step aside and wait.

The traders who survive are not the ones who chase perfection or seek to predict every move. They are the ones who learn how to lose properly - small losses, controlled losses. Losses that don’t bleed into something bigger, mentally or financially.

Most people can’t do that. They fight the market. They fight themselves. They refuse to accept small losses, believing they can somehow force a different outcome.

Those small losses eventually snowball. Blowups rarely come from one bad trade. They come from ignoring the small signs over and over again. The market isn’t cruel. It’s just indifferent. It’s your responsibility to protect yourself.

Good trading isn’t loud. It isn’t exciting. It isn’t full of adrenaline and big calls.

Good trading is quiet, repetitive, and frankly, a little boring. It’s built on discipline, not drama. Your job is to manage risk, protect your capital, and let time do its work.

There is no holy grail. There is only process. A process you can repeat with a clear head, day after day, year after year, without losing yourself in the noise.

Wins will come. Losses will come. Neither defines who you are. What defines you is how you respond.

⦿ Can you stay calm after a red day?

⦿ Can you follow your plan even after a mistake?

⦿ Can you sit on your hands when there’s nothing to do and trust the work you’ve already done?

Patience, in the end, is the real edge. Most won’t have it.

They’ll bounce between strategies, searching for certainty where none exists. They’ll burn out chasing shortcuts. They’ll forget that progress comes through small, steady steps taken over years, not through chasing big wins.

Trading is a mirror. It reflects your fear, your greed, your impatience. It shows you who you really are. Ignore what it reveals and you’ll keep paying for the same lesson until you finally learn it.

In the end, this game isn’t about the market. It’s about YOU.

⦿ Learn to protect yourself.

⦿ Learn to sit with boredom.

⦿ Learn to lose well.

⦿ Learn to wait without losing faith.

If you can do that, the market has a way of rewarding you in time.

The Market Rewards the PatientLast week was probably one of the slowest weeks I’ve ever had. I found two setups, but neither one truly materialized. They just didn’t meet all the conditions in my plan. It was tough. I won’t pretend it wasn’t tempting to drop my rules and chase other strategies just so I could be in the market.

But deep down, I knew exactly what I wanted. I want to be consistent . I want to trade like a professional . So I held back. All week, I watched and waited. No trades taken. It was boring, honestly . But that boredom protected my capital.

Instead of forcing trades, I spent the entire weekend backtesting , drilling into my strategy even more. I wanted to be sure that when my moment came, I’d recognize it without hesitation.

Then this week started. I didn’t know if it would be any different, but I trusted my process and stayed ready. Eventually, one clean setup appeared. I shared it here on TradingView. I managed my risk properly , took half my usual size at just 0.5%, and let the trade run. It almost hit my stop, but I didn’t touch it. It was simple: either TP or SL .

And this time, it hit TP. A clean 1:4.

This was a powerful lesson. Following my plan didn’t just lead to a winning trade. It protected my capital all of last week when the market wasn’t offering quality setups. That patience and discipline paid off.

That’s how you build consistency. That’s how you survive long enough to catch the trades that truly matter.