Trend linesStraight forward idea. The green line represents this cycle's sellers. The blue line has been this cycle's buyers. The red line has formed across multiple cycles and has yet to break. If the blue line breaks, the cycle is likely over. The white line is just an approximate mid-point between the green and blue. Also, seeing RSI bearish divergences is certainly less than ideal.

My longer term bags wants this red line break, but the price action could certainly look better. It could be that bitcoin dominance should be much lower for there to be a cyclical top. You could argue speculative alts rising in parabolic fashion creating a bubble is what causes the cycles to be over, but that could be a false assumption.

Trend Lines

Trump closed green on line break chart daily

It's not often we see Trump close green on the line break chart but today's daily finally did. Trump has also yet to make a higher high on the daily and I believe once it does we'll see a big pump to the target I have placed.

Trump's ATR is currently 0.46 with a volatility of 6.13% possible movement in a day. Assuming things go south, I don't recommend holding more than 20% of your portfolio as Trump due to the volatility. This will help keep your portfolio safe via risk management should the line break green candle not result in a pump. That said I am quite bullish on Trump, let's see how this goes.

ZRO/USDT Wave AnalysisSince 2024, CSE:ZRO established a key level around $3. Moving into 2025, the price experienced a sharp decline, breaking below $3 and finding support near $1.5.

In mid-March, the long-term downtrend channel was decisively broken with a +140% move. However, the price failed to reclaim the $3 key level on the back-test, resulting in a prolonged sideways range between $2.3 and $3.

During this consolidation phase, there was a notable upthrust right at the $3 key level, which triggered another strong correction, sending price back to retest the $1.5 support zone.

Currently, we are seeing a clear breakout from the descending channel. With Bitcoin reaching new all-time highs, the outlook for CSE:ZRO has turned positive, and a new bullish wave is expected. The primary target remains a break above the $3 key level. Importantly, this breakout is developing with a healthier structure compared to the rapid, unsustainable move in March.

Risk management: Place stop-loss orders below $1.7 to protect capital.

Short gold, the bears will still counterattack after the reboundGold rebounded to the 3305-3315 area as expected, and our gold long position successfully won 360pips profit. So after standing above 3,300 again, will gold resume its bullish trend?

I think that although gold has stood above 3300 again, it cannot be confirmed that the decline has been completely reversed for the time being. Relatively speaking, gold bears still have the upper hand. In the short term, gold is under pressure in the 3325-3335 area, so before recovering this area, gold bears still have repeated fluctuations, and may even test the 3305-3295 area again. So we can't blindly chase gold in trading.

Before gold recovers the 3325-3335 area, gold can only be regarded as a rebound, not a reversal. So gold bears may counterattack at any time, so in short-term trading, we can consider shorting gold with the 3325-3335 area as resistance after gold rebounds. The first entry area that must be paid attention to is 3320-3330.

GBPUSD InsightHello to all our subscribers!

Please feel free to share your personal thoughts in the comments. Don’t forget to hit the boost button and subscribe!

Key Points

- U.S. President Trump revealed letters sent via Truth Social to the leaders of seven countries, including the Philippines and Algeria. Notably, he warned of a 50% tariff on imports from Brazil.

- The June FOMC minutes confirmed that key Fed members are divided on the outlook for rate cuts within the year.

- The U.S. 10-year Treasury yield reversed course and fell for the first time in six sessions, following strong demand in the latest bond auction.

Major Economic Events This Week

+ July 10: Germany – June Consumer Price Index (CPI)

+ July 11: United Kingdom – May Gross Domestic Product (GDP)

GBPUSD Chart Analysis

While the pair recently faced resistance near the 1.38000 level and experienced a pullback, it appears to be regaining momentum, supported by the trendline near 1.36000.

If this support holds and the price moves as expected, a rally toward the 1.40000 level could be anticipated.

However, if the current support fails, the pair could retreat toward the 1.34000 level. Therefore, it is important to closely monitor the price action in the current zone.

The risks of shorting at low levels have been informed!Today, I have reminded you many times not to chase short positions at low levels. Now you can see that gold has bottomed out and rebounded. We also bought gold in batches at 3285-3295, and the long positions also made perfect profits. I believe that friends who follow my articles can see that I have always emphasized not to short at low levels. It is also obvious to everyone that we bought long positions near 3295-3285. In the future, we will continue to pay attention to the suppression of the upper 3318-3325 line. If the rebound does not break, we will look for opportunities to short. I hope everyone can grasp the entry position and hold the profit. The rebound will first look at the previous break point of the 3325 line, and then short when the rebound is suppressed! If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with me!

From the current analysis of gold trend, today's upper short-term resistance focuses on the hourly top and bottom conversion position of 3318-3325. The intraday rebound relies on this position to go short once and look down. The lower short-term support focuses on 3280. The overall support relies on the 3280-3325 area to maintain the main tone of high-altitude low-multiple cycles. In the mid-line position, keep watching and do less, be cautious in chasing orders, and wait for the opportunity to enter the market after the key points are in place.

Gold operation strategy: short gold rebounds near 3318-3325, target 3305-3295.

GOLD (XAUUSD): Classic Breakout Trading📈GOLD has surpassed and closed above a significant intraday resistance level.

After retesting this level, the price created a small ascending triangle on the hourly chart, and we've observed a confirmed breakout of its neckline.

I plan to go long on the pair during the retest, anticipating further growth, with the next resistance target at 3327.

Ethereum Wave Analysis – 9 July 2025- Ethereum broke the resistance area

- Likely to rise to resistance level 2885.00

Ethereum cryptocurrency recently broke the resistance area located between the resistance level 2645.00 (which stopped wave 1 at the start of July) and the resistance trendline of the weekly Triangle from January.

The breakout of this resistance area accelerated the active short-term impulse wave 3 of the intermediate impulse wave (3) from June.

Given the strongly bullish sentiment seen across the crypto markets today, Ethereum cryptocurrency can be expected to rise to the next resistance level 2885.00 (top of wave (1) from June).

BTC/USDT Technical Analysis, 2025-07-07 11:30 UTC📊 BTC/USDT Technical Analysis, 2025-07-07 11:30 UTC

🕒 Binance Spot

📆 July 7, 2025 | 11:30 GMT Candle Observations

───────────────

💡 Price: 108712.97 USDT

📉 EMA200 (Dynamic): 108938.31

🟩 Support Watch: 107512.97

🟦 Resistance Target: 109782.97

───────────────

🔍 We're observing price action developing below EMA200, with a recent Piercing Line formation at a noted dip zone. This setup may suggest buyers are attempting to reclaim short-term control.

⚠️ Key tactical support remains near 107512.97, where historical reaction zones and liquidity zones intersect.

📈 A move toward 109782.97 is being monitored as a potential resistance test, in line with local OBV divergence and recovering bid pressure.

📌 Market Microstructure Notes:

• Order Book Imbalance leaning toward bids (+0.45)

• OBV Trend: +10.17% vs 5-period MA

• Thunder Engine Volume Acceleration: ⚡ Observed

• Whale Ask Cluster: ~640k USDT near top of range

📉 No guarantees of breakout or reversal watching how price reacts around key levels. Maintain cautious positioning near support/resistance pivots.

#TON Update #4 – July 8, 2025🟡 #TON Update #4 – July 8, 2025

Tonecoin has reached the area we previously marked as a potential entry zone. We’re now seeing early signs of a bounce from that level.

For this reason, I'm considering entering a trade here, with a risk-to-reward ratio of approximately 2.63.

▫️ Entry: 2.754

▫️ TP1: 2.850 (50%)

▫️ TP2: 2.910 (50%)

▫️ Stop: 2.694

❗️ I do not recommend moving the stop loss. Stick to the plan. This trade will be actively monitored and updated if necessary.

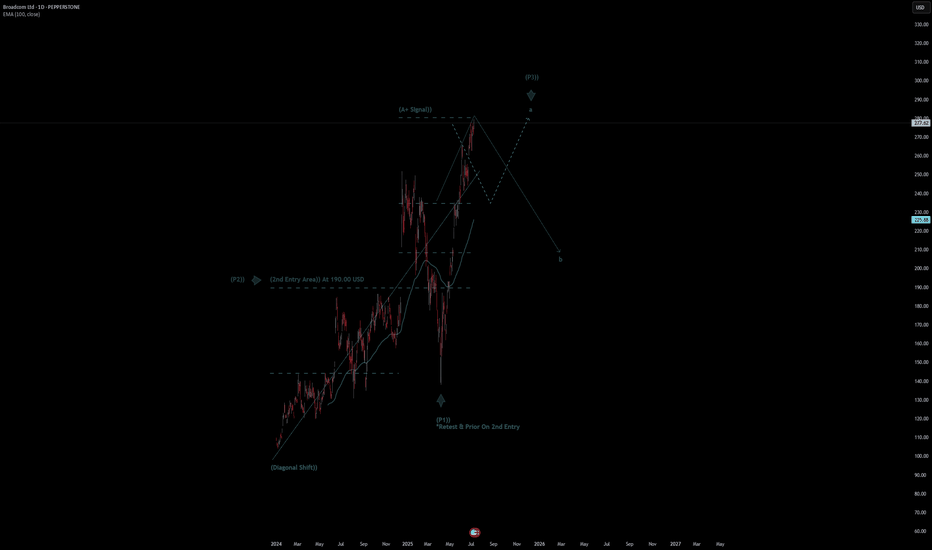

Broadcom Ltd Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Broadcom Ltd Quote

- Double Formation

* (Diagonal Shift)) At 95.00 USD | Completed Survey

* (A+ SIgnal)) - *Swing High(Developing) | Subdivision 1

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* (TP1) = a / Long Consecutive Range

* (TP2) = b / Short Consecutive Pullback | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Regular Settings

- Position On A 1.5RR

* Stop Loss At 242.00 USD

* Entry At 277.00 USD

* Take Profit At 330.00 USD

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Gold is Nearing The Daily TrendHey Traders, in today's trading session we are monitoring XAUUSD for a buying opportunity around 3,260 zone, Gold is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 3,260 support and resistance area.

Trade safe, Joe.

USDCAD Potential DownsidesHey Traders, in today's trading session we are monitoring USDCAD for a selling opportunity around 1.36900 zone, USDCAD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.36900 support and resistance area.

Trade safe, Joe.

AUD/USD Struggles at ResistanceAUD/USD is now nearly 1.6% off the highs with the weekly opening-range taking shape just below Fibonacci resistance- looking for a potential breakout in the days ahead.

A look at Aussie price action shows AUD/USD reversing pitchfork resistance with the weekly opening-range taking shape just below resistance at the 61.8% retracement of the 2024 decline / weekly open at 6550/53- looking for a reaction off this mark.

A top-side breach of the weekly opening-range exposes the upper parallel again, currently near ~6600. Ultimately, a close above the September low at 6622 is needed to fuel the next major leg of the advance with subsequent resistance objectives eyed at the 2019 low at 6671 and the 78.6% retracement near 6723.

Initial support rests with the June low-day close (LDC) at 6458- note that the 75% parallel converges on this threshold into the close of the week and a break / close below would threaten a larger Aussie pullback. Subsequent support objectives rest at the 200-day moving average (currently ~6411) and 6332/62- a region defined by the 38.2% retracement of the yearly range, the April / August 2024 lows, and the May swing low. Losses beyond this threshold would suggest a more significant high is in place / larger reversal is underway.

Bottom line: The Aussie rally failed into the trendline resistance with the monthly opening-range taking shape just below. While the broader outlook is still constructive, the advance remains vulnerable here and the immediate focus is on a breakout of the weekly range (6486-6553) for guidance. From a trading standpoint, losses would need to be limited to 6458 IF Aussie is heading for a breakout on this stretch with a close above 6622 needed to mark uptrend resumption.

-MB

Start buying gold, a rebound may come at any time!Gold is undoubtedly weak at present, and bears have the upper hand. However, since gold touched the 3290-3280 area, gold bears have made more tentative moves, but have never really fallen below the 3290-3280 area, proving that as gold continues to fall, bears have become more cautious.

From the perspective of gold structure, multiple technical structural supports are concentrated in the 3285-3275 area, which makes it difficult for gold to fall below this area easily. After gold has failed to fall below this area, gold is expected to build a short-term bottom structure with the help of multiple supports in this area, thereby stimulating bulls to exert their strength and a rebound may come at any time.

Therefore, in the short term, I do not advocate chasing short gold; instead, I prefer to try to find the bottom and go long gold in the 3290-3280 area; but we should note that because gold is currently in an obvious short trend, we should appropriately reduce the expectation of gold rebound, so we can appropriately look at the rebound target: 3305-3315 area.

Gold is in the Bearish direction from a Support levelHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Cable One | CABO | Long at $130.82Cable One NYSE:CABO is a leading broadband communications provider under the Sparklight brand, offering high-speed internet, cable TV, and phone services across 24 U.S. states.

Book Value: $315.50.

Positive:

Strong liquidity: Quick ratio 1.47 (above industry avg ~1.0).

Undervalued vs. industry (1.91x).

Large customer base: ~1.1M customers, 2.8M data subscribers.

Stable revenue: Broadband focus in non-metropolitan markets.

Insiders buying over $1 million in share recently while also being awarded options.

Recent change in leadership.

Negatives:

Medium-high bankruptcy risk: Altman Z-Score 1.36 (below industry ~2.5).

High leverage: D/E 1.78 (above industry ~1.0).

Weak earnings: Negative margins, declining profitability.

Suspended dividend.

Classify this one as a risky investment, but it is very undervalued at this price and the upcoming decline in interest rates may have a very positive effect on the company's stock (at least short-term: 5 million float, 19% short interest). Regardless, not one to put your life savings into. From a technical analysis perspective, I foresee a potential drop between $115 and $120 in the near-term and rise from there. It all depends on the upcoming earnings, so label this one a "gamble" with high bankruptcy risk.

Regardless of bottom predictions, NYSE:CABO is in a personal buy zone at $130.82 for a swing trade.

Targets into 2027:

$190.00 (+45.2%)

$250.00 (+91.1%)

GOLD (XAUUSD): Time to Recover?!

Gold reached an important rising trend line on a daily.

I see 2 nice intraday bullish reactions to that on a 4H time frame

and a double bottom pattern formation.

Its neckline breakout and a 4H candle close above 3309

will confirm a start of a bullish correctional movement.

Goal will be 3327.

Alternatively, a bearish breakout of the trend line will push

the prices lower.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.