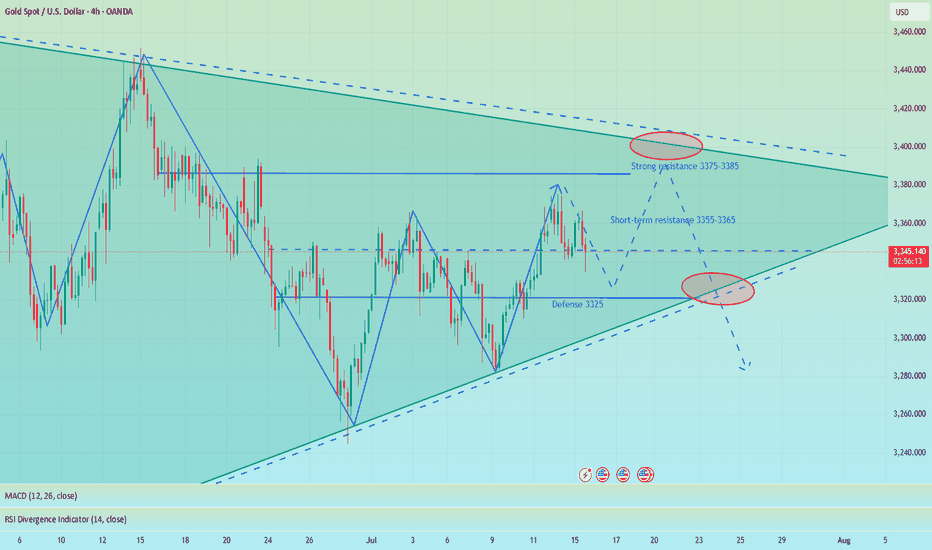

As risk aversion wavers, will gold rise or fall?

💡Message Strategy

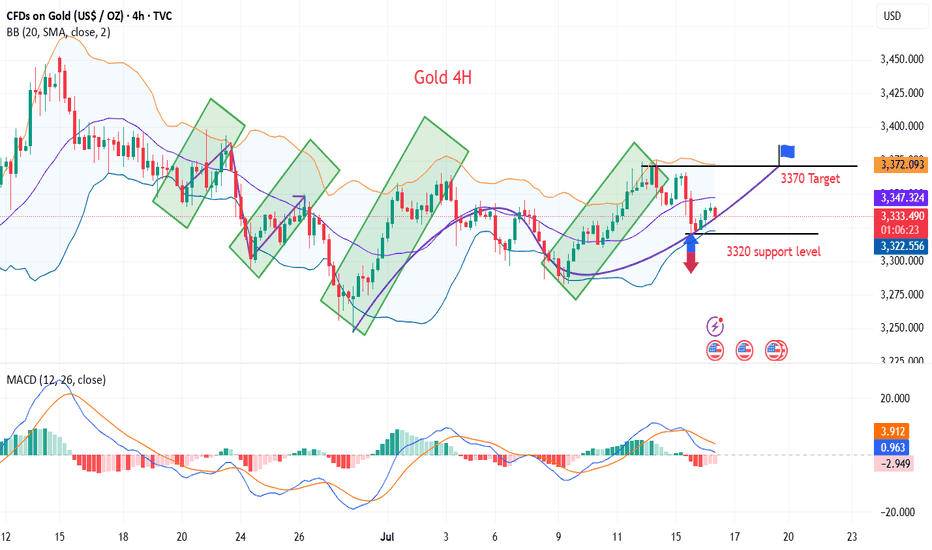

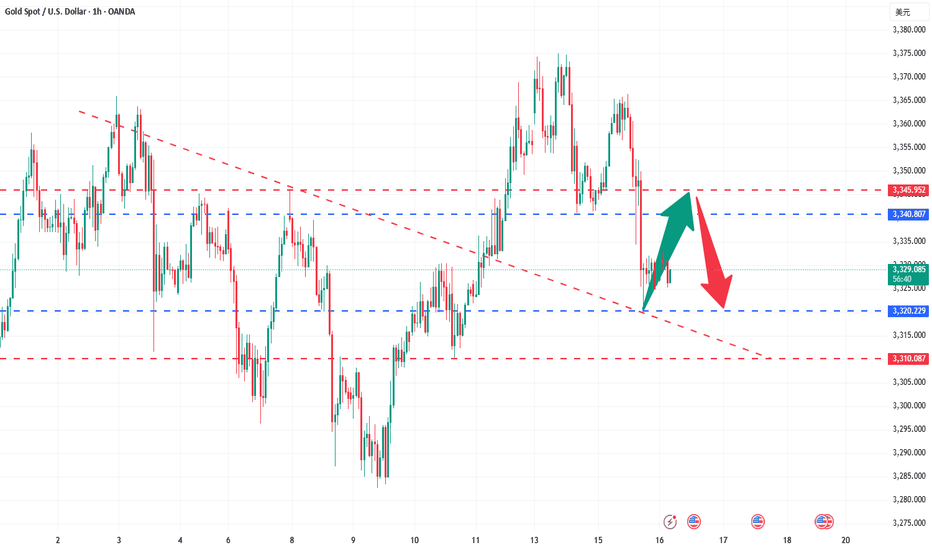

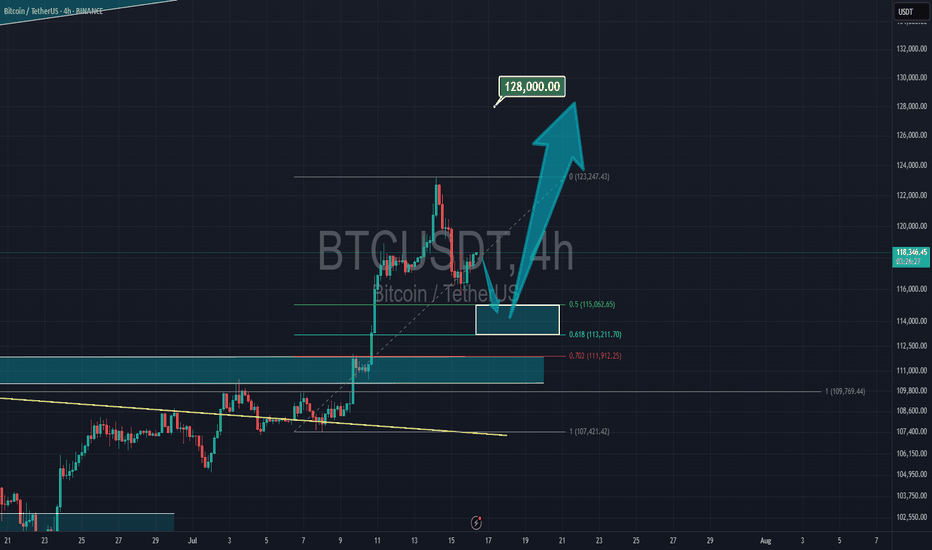

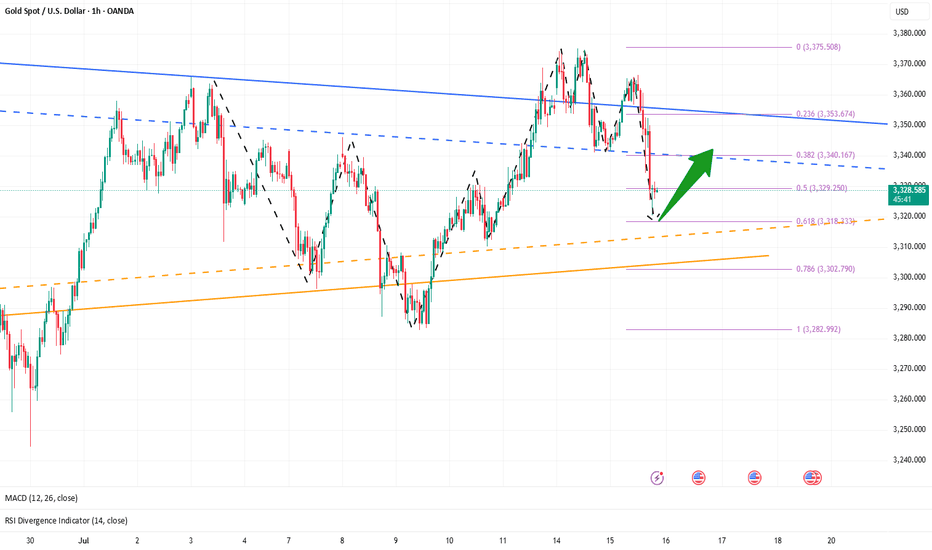

After falling for two consecutive days, gold (XAU/USD) rebounded slightly in the Asian session on Wednesday, stabilizing above $3,320, attracting some bargain-hunting buyers. The market has paid close attention to the tariff policy that US President Trump continues to increase, and the rising risk aversion has become the core factor supporting gold prices.

The US CPI data for June showed that overall prices rose by 0.3% month-on-month, the largest increase in five months, and the core CPI rose to 2.9% year-on-year, both higher than expected. This has caused the market to worry that tariffs are gradually pushing up inflation, prompting the Federal Reserve to extend the high interest rate policy cycle.

📊Technical aspects

The current trend of gold is constrained by both fundamentals and technical factors.

On the one hand, Trump's tariff policy has pushed up inflation expectations, triggering risk aversion and rethinking of the Fed's policy path, providing support for gold;

On the other hand, the Fed's tone of "maintaining high interest rates for longer" has limited the room for gold prices to rebound.

From the 4-hour chart, gold prices found support near the 100-period SMA (about $3,320) on Tuesday, stopping the decline from the three-week high. In the short term, if it can stand above the 3340-3345 resistance band, it may test the 3365-3370 area again, and the further target is the 3400-dollar round mark.

💰Strategy Package

Long Position:3320-3330,SL:3305,Target: 3365-3370

Trend Lines

Treat intraday fluctuations as long first and short later!Gold started to rebound near 3322 at the opening. Our long positions near 3324 are also in floating profit. We first focus on the short-term suppression of 3340-3345 on the upper side. The support below is at 3325-3320. We operate in this range. Technically, it needs to rebound and repair the demand when it falls back to 3320, so we can find opportunities to go long to grasp the profit space of the rebound.

4-hour cycle analysis: The strong dividing line of long positions below is at the 3320 first-line mark, and the short-term support focuses on the 3325-3320 range. The overall bullish rhythm of pulling back to lows and going long is maintained. Short-term pressure focuses on around 3340-3345. The overall main tone of participating in the high-altitude and low-multiple cycles remains unchanged relying on this range.

Gold operation strategy: Go long on gold when it falls back to around 3325-3320, target 3335-3340, and continue to hold if it breaks through.

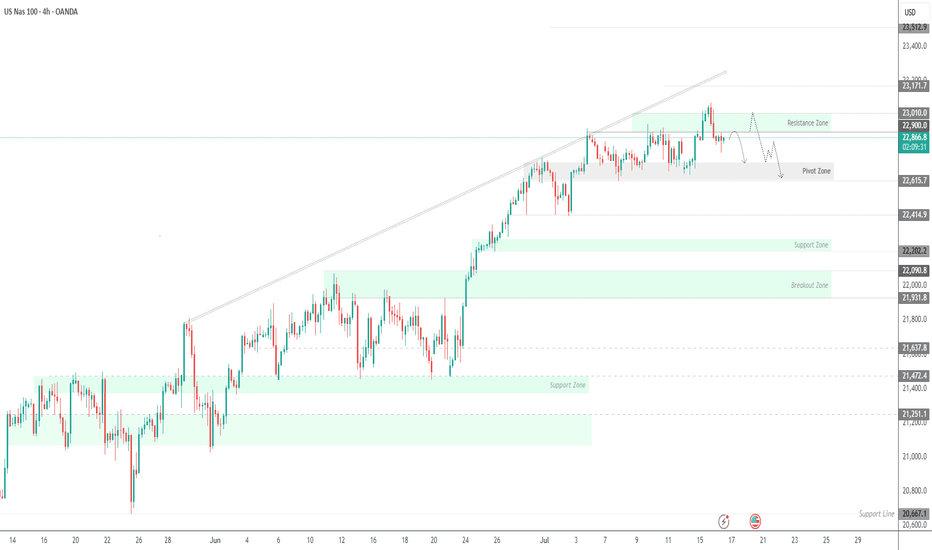

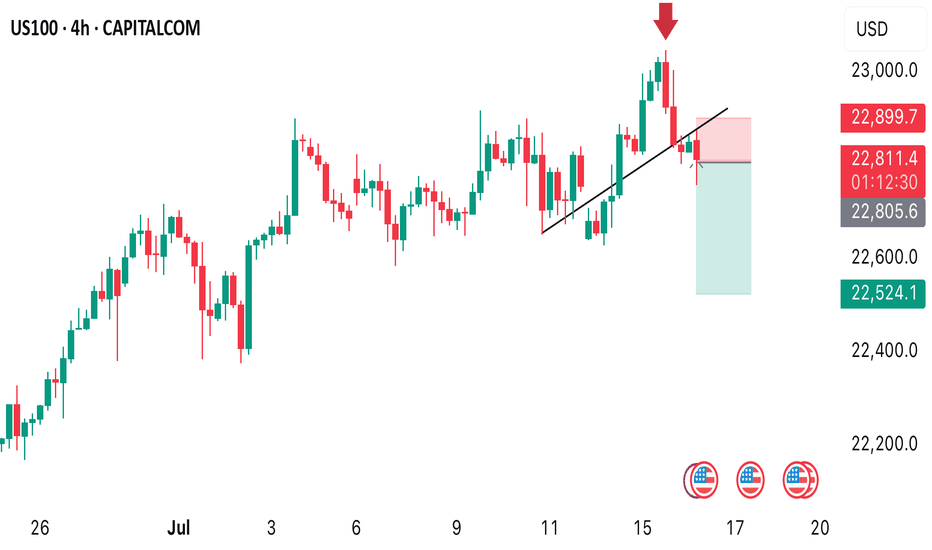

USNAS100 – Bearish Below 22900 as Earnings & Tariffs Hit MarketUSNAS100 – Bearish Bias Ahead of Earnings, PPI & Tariff Tensions

S&P 500 and Nasdaq futures are slightly lower as traders weigh rate outlook, tariff developments, and major earnings reports.

📊 Earnings in Focus:

Goldman Sachs NYSE:GS , Morgan Stanley NYSE:MS , and Bank of America NYSE:BAC are set to report today.

JPMorgan Chase NYSE:JPM and Citigroup NYSE:C posted strong results yesterday, but expressed caution over U.S. tariff policies.

🌍 Tariff Watch:

Trump announced a 19% tariff on Indonesian goods, with more deals anticipated ahead of the August 1 tariff deadline. The EU is reportedly preparing retaliatory measures if negotiations stall.

🔧 Technical Outlook:

The Nasdaq100 shows bearish momentum as long as it trades below 22900 and 23010, with potential downside targets:

Support: 22720 → 22615 → 22420

Resistance: 23010 → 23170

To shift back to a bullish trend, price must stabilize above 22900 and break 23010.

Key Events Today:

• Corporate Earnings

• Tariff Developments

• U.S. PPI Report

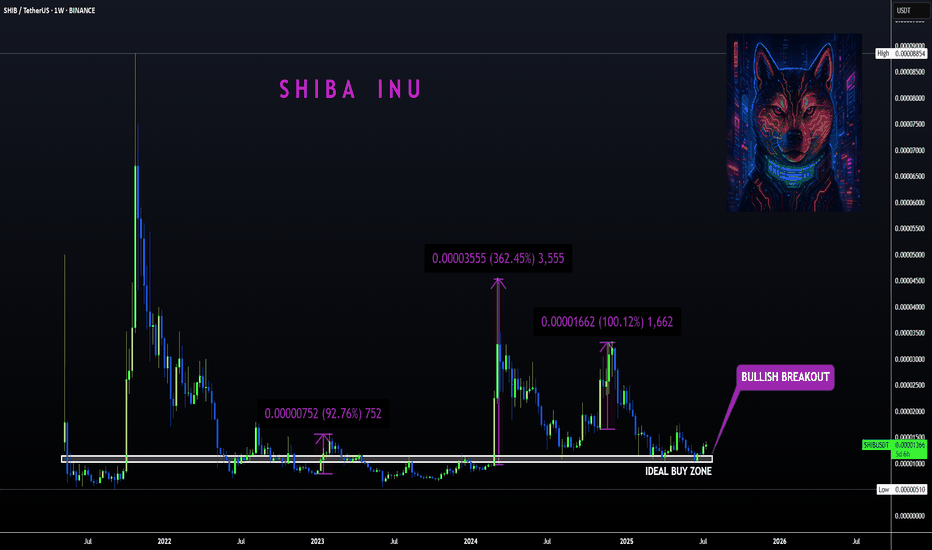

SHIBA | Bullish Breakout ABOVE Ideal Buy ZoneBINANCE:SHIBUSDT

Shiba is know to make big increases in short periods of time... that's why we love it!

The tricky thing about SHIBA is that the pumps can be unpredictable so the best way to ensure a position is to buy as low as possible to the ideal buy zone.

In the weekly timeframe, the technical indicators are not quite bullish yet. The moving averages is still above the price, meaning the bulls have yet to take full control of the price in lower timeframes.

The same can be said for the daily, although we are seeing progress as the 200d moving averages have been reclaimed:

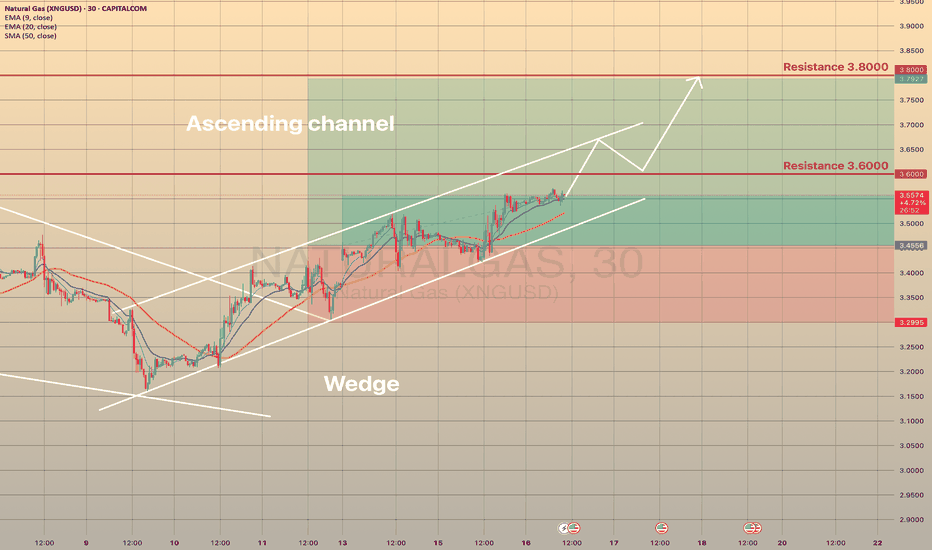

NATURAL GAS - STILL IN THE GAME TRADING IDEA UPDATE -

NATURAL GAS - STILL IN THE GAME🔥

The XNGUSD goes quite well, as predicted. It held the trendline and moving upwards slowly, but surely. Short-term support here is the EMA20 on 4h timeframe. The asset is just below 3.600 resistance level and sma200. Since the July 10, the asset seems to be moving within the ascending channel (pic 2). I expect that the price will break the 3.6000 resistance level, will go towards upper channel border and then, after quick retest, move towards 3.8000. Not a trading advice! Trade cautiously!

ENA | Waiting for Trendline BreakENA is demonstrating strength by trading above its weekly SMA-10, indicating underlying bullish momentum.

Key Technical Levels:

Current resistance: Green descending trendline around $0.38

Critical pivot: $0.5140 level

Bullish Scenario:

A break above the descending trendline could trigger significant upside momentum toward the $0.94 resistance zone. The projected path (pink arrow) suggests potential for substantial gains once this key barrier is cleared.

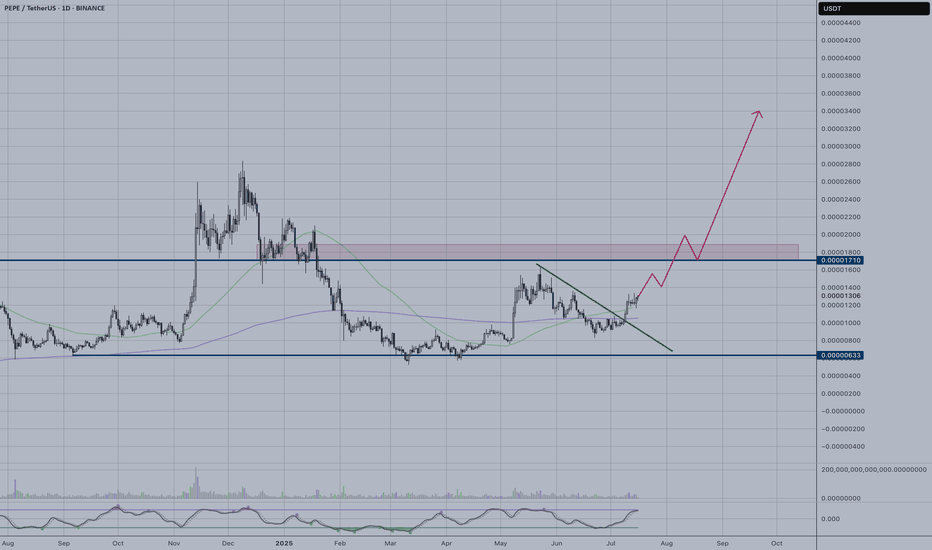

PEPE | On the Way to New HighsPEPE shows a compelling bullish setup following a successful breakout from a descending wedge pattern. The price has broken out and is now positioned for a potential rally toward new highs, as indicated by the upward trajectory arrow.

Key Technical Signals:

- Clean breakout from descending wedge formation

- Strong momentum building after extended consolidation period

- Volume supporting the breakout move

Price Targets:

- First resistance: 0.00001800 (pink resistance zone)

- Extended target: 0.00003500+ (following the projected path)

Risk Considerations:

- Meme coin volatility requires careful position sizing

The technical setup suggests PEPE is well-positioned for a significant upward move, with the breakout confirming renewed buying interest after months of consolidation.

NZDCHF → Pre-breakdown consolidation on a downtrendFX:NZDCHF is forming a pre-breakout consolidation amid a downtrend. Focus on support at 0.4759. Global and local trends are down...

On July 10-11, the currency pair attempted to break out of the trend. In the chart, it looks like a resistance breakout, but technically it was a short squeeze aimed at accumulating liquidity before the fall. We can see that the price quickly returned back and the market is testing the low from which the trap formation began. The risk zone for the market is 0.4759 - 0.475. In simple terms, this is a bull trap against the backdrop of a downtrend. The NZD has passed through the risk zone. At this time, the currency pair is forming a pre-breakout consolidation relative to the support level of 0.4759 with the aim of continuing its decline.

Support levels: 0.4759, 0.4753

Resistance levels: 0.477, 0.4782

A breakout of the 0.4759 level and consolidation in the sell zone could trigger a continuation of the decline within the main and local trends.

Best regards, R. Linda!

TIA Double Bottomed, $4.5 PossibleBYBIT:TIAUSDT.P bottomed out at the $2.3 level. From there, its initial rally took it to the $3.4 level. If a bottom formation occurs again at its current level, another rally could push it first to the $3.8 level, and if the rally is strong, potentially up to $4.5. Strength into higher levels are critical.

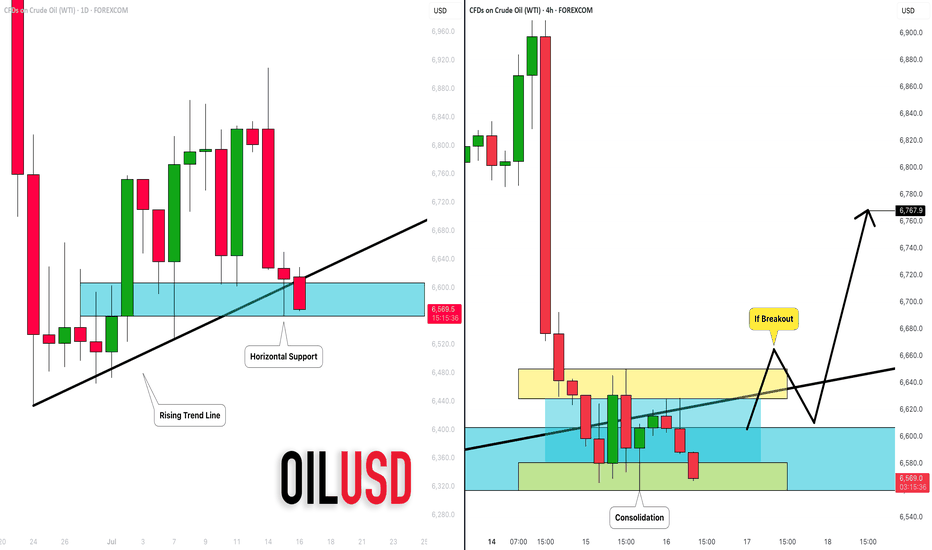

CRUDE OIL (WTI): Your Trading Plan Explained

Do not forget that today we expect Crude Oil Inventories data

release - it will be 10:30 am NY time.

Ahead of this news, the market is testing a significant daily support cluster

that is based on a rising trend line and a horizontal structure.

You signal to buy will be a bullish breakout of a minor intraday

horizontal resistance on a 4H.

4H candle close above 66,5 will be your confirmation.

A bullish continuation will be expected to 67.6 then.

I suggest waiting for the news release first and then check how

the market prices in the news. If our technicals align with fundamentals,

it will provide an accurate setup.

Alternatively, a bearish violation of a blue support will push the prices lower.

❤️Please, support my work with like, thank you!❤️

SMCI going to breakout soon, targeting $200NASDAQ:SMCI hasfound support at $28, it is currently trading around the $46 level. It is attempting to test the $50-$61 range for the third time and will likely turn this level into support with a breakout.

$200 could be a good psychological target. The relative strength against the SP:SPX is about to turn positive in favor of the stock, and I expect volume to increase in the coming days.

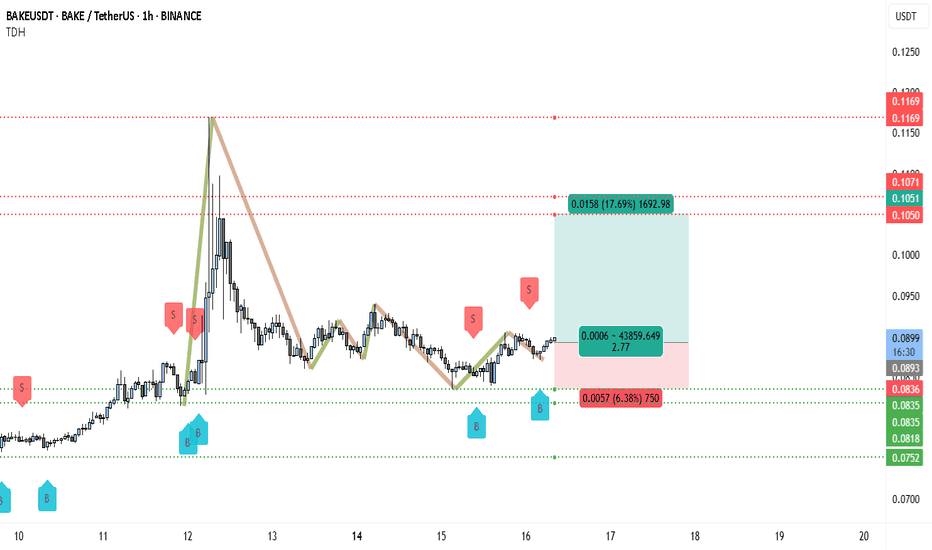

BAKE Bulls Targeting 0.105, +1692% Volume SurgeThe chart shows BAKEUSDT trading around 0.0898 USDT on Binance. Overall, the structure indicates that after a strong upward impulse from approximately 0.0835 USDT to 0.117 USDT, the price entered a correction and is now consolidating. This consolidation sits just above an important support level, signaling a possible preparation for the next leg up.

There is a clearly defined support area between 0.0835 and 0.0836 USDT, which has been tested multiple times. The most recent lows were bought up strongly, forming what looks like a potential double bottom or higher low, both common reversal patterns. Beneath this zone, the next deeper support rests near 0.0752 USDT, which would be considered only if the main support fails.

Overhead, the chart identifies resistance levels at 0.1050–0.1071 USDT, where price previously stalled and retraced. This zone aligns with the first target area for any bullish continuation. Further up, 0.1169 USDT marks the prior swing high and the most significant resistance to break for confirmation of a larger trend reversal.

Visually, the chart illustrates how the strong impulse rally was followed by a structured pullback, resembling an ABC correction pattern. The correction appears mature, as price action is tightening within a smaller range. This often suggests that momentum is getting ready to shift back upward if buying pressure sustains.

Several buy signals ("B") are marked on the chart near support zones, while sell signals ("S") have appeared near previous short-term peaks. The clustering of buy signals around the current levels reinforces the idea that traders have been accumulating positions in this area.

Below is the trading setup outlined on your chart:

• Entry Zone: Around 0.0898 USDT

• Stop Loss: Slightly under 0.0836 USDT to protect against a deeper retracement

• Take Profit Target: Between 0.1050 and 0.1071 USDT (initial target)

• Risk/Reward Ratio: Approximately 2.77, which is favorable for long positions

• Potential Gain: +17.69% from entry to target

• Potential Loss: -6.38% if the stop is hit

The highlighted risk/reward box shows the trade aims to capture a substantial move while limiting downside exposure.

The overall price behavior indicates that sellers failed to create new lows, and instead, the market printed a higher low above the key support zone. This is often one of the first signs that demand is absorbing supply and can set the stage for an upside breakout.

While volume data isn’t visible in the chart you shared, typically in this kind of setup, volume contracts during the correction phase and begins expanding again when price approaches a breakout point. Watching for rising volume on any move above 0.0900 USDT could confirm bullish intent.

If price breaks and closes above 0.0900 USDT on the hourly timeframe, this would be the first signal that momentum is flipping decisively in favor of the bulls. Ideally, you want to see a retest of this level hold as support, which would further validate the move. From there, a push into the 0.1050–0.1071 USDT resistance area becomes more probable. If this level is cleared on strong momentum, the extended target near 0.1169 USDT could be achievable.

In terms of sentiment, the fact that multiple buy signals have appeared near the support zone while sellers are absent near the lows reinforces a bullish bias. The risk is primarily centered around whether the 0.0835 USDT level holds. If price closes decisively below it, that would invalidate the current bullish thesis and potentially expose the market to a deeper drop toward the 0.0752 USDT support area.

Overall, the chart presents a constructive technical picture favoring further upside, provided that support holds and buyers can reclaim the short-term resistance above 0.0900 USDT. The consolidation phase appears to be maturing, and the combination of higher lows and consistent rejection of support zones increases the likelihood of a breakout.

Summary of the Bullish Scenario:

• The trend structure shows a strong impulse and controlled pullback.

• The price has respected a key support area repeatedly.

• Buy signals are clustered near the lows, suggesting accumulation.

• A breakout above 0.0900 USDT could trigger a rally toward 0.1050 USDT and potentially higher.

• The risk/reward profile is attractive, offering nearly 3 times the reward relative to the risk.

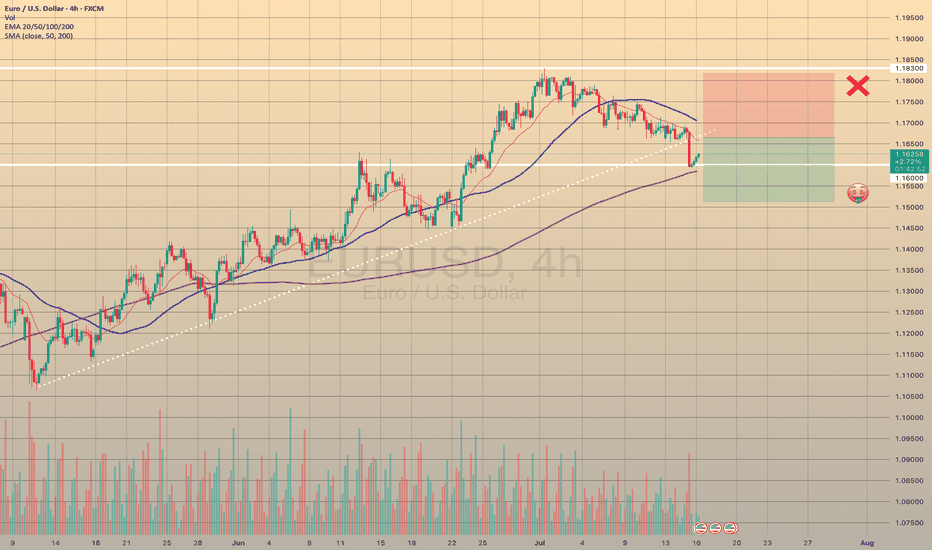

EURUSD TRIGGERED STOP LOSSTRADING IDEA UPDATE - EURUSD TRIGGERED STOP LOSS

The U.S. CPI report data came out right what the market expected (2.7% vs. 2.7% annually). After this report the pair went downwards on increased volume, triggering my stop loss and found the support only on 4-h sma200 and 1.16000 level.

What will be the possible scenario next?

I assume that the asset will go testing the trendline at 1.16650. If the test is successful, I will consider opening a

🔽 a pending sell stop order at 1.16651 with

❌a stop loss at 1.18180 and

🤑a take profit at 1.15122

Only if the retest is successful, not earlier! Let's observe first. Additionally, today is the U.S. PPI report coming out at 12:30 p.m. UTC, so got to be careful around this time

Golden Support Holds — Bulls Poised for Another Leg Higher"If gold cannot break through the 3365-3375 area, gold will fall under pressure again, or refresh the recent low of 3341, and continue to the 3335-3325 area." Gold's performance today is completely in line with my expectations. Gold just retreated to a low of around 3320, but soon recovered above 3325, proving that there is strong buying support below.

From the current gold structure, the short-term support below is mainly concentrated in the 3320-3310 area. If gold slows down its downward momentum and its volatility converges when it approaches this area, then after the gold bearish sentiment is vented, a large amount of off-site wait-and-see funds will flow into the gold market to form strong buying support, thereby helping gold regain its bullish trend again, thereby starting a retaliatory rebound, or a technical repair rebound.

Therefore, for short-term trading, I still insist on trying to go long on gold in the 3330-3320 area, first expecting gold to recover some of its lost ground and return to the 3340-3350 area.

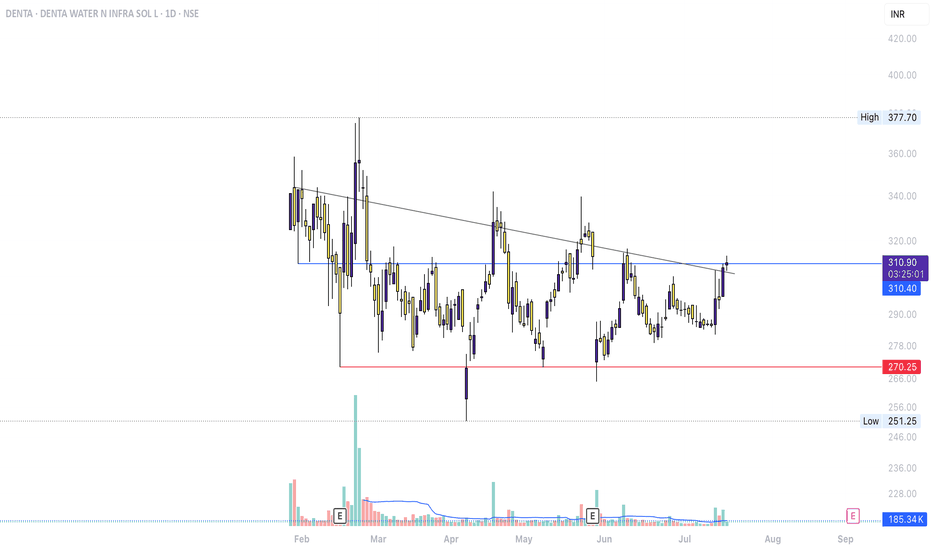

DENTA – SMC & Breakout Structure Analysis (Jul 2025)Accumulation/Distribution: Long consolidation near ₹270–₹311

Break of Structure (BOS): Trendline breakout + recent close above prior top

Neutral toward Bullish: Awaiting volume and price action confirmation to validate trend shift

1. Defined Range Structure

Support ~₹270 (red line) holding over 4+ months

Resistance ~₹311–₹315 (blue line) tested multiple times before today

2. Possible Breakout Attempt

Price has breached the descending trend line—an early mark of bullish structure shift

Close is marginally above resistance, but lacks volume confirmation for breakout validation

3. Volume & Confirmation

No substantial volume spike yet—breakouts typically require accompanying volume

Watch for multi-session closes above ₹315 with sustained volume to support continuation

4. Pullback as an Opportunity

Retracing into ₹305–₹310 could form a higher-low

Such a move would align with healthy trend behavior, offering clearer structure and stronger validation

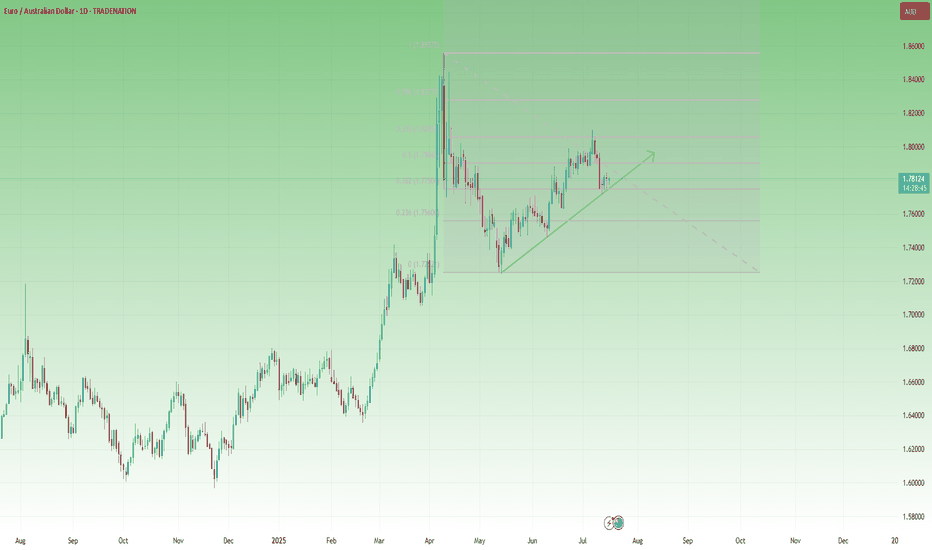

EURAUD Flag Forming Below 1.80 – Time to Sell the Rally?📈 The Big Picture

In mid-February, EURAUD exploded to the upside, gaining over 2000 pips in just two weeks. After peaking near 1.85, the pair corrected sharply, returning to more balanced levels around 1.72.

🕰️ What’s happened since?

The market has resumed its climb and just recently made a new local high at 1.81. On the surface, it looks like bulls are still in control – but a closer look reveals warning signs.

🔍 Key structure observations:

• The current rally appears to be a measured move, topping out near the 61.8% Fibonacci retracement of the previous drop

• Price structure is overlapping, suggesting weak momentum

• A large flag pattern is developing – typically bearish in this context

• The pair still trades above the ascending trendline, but a breakdown is looming

📍 Current price: 1.7805

🎯 Swing Trade Plan

From a swing trading perspective, I’m looking to sell rallies near the 1.80 zone, with:

• Negation: if the price breaks clearly above the recent high

• Target: the recent low around 1.7250 – where the last correction ended

________________________________________

📌 Conclusion:

EURAUD may have exhausted its bullish energy. The technical picture suggests we are in the late stage of the rally, with bearish patterns stacking up. Unless bulls manage a clean breakout above 1.80, this looks like a great place to position for a medium-term reversal. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

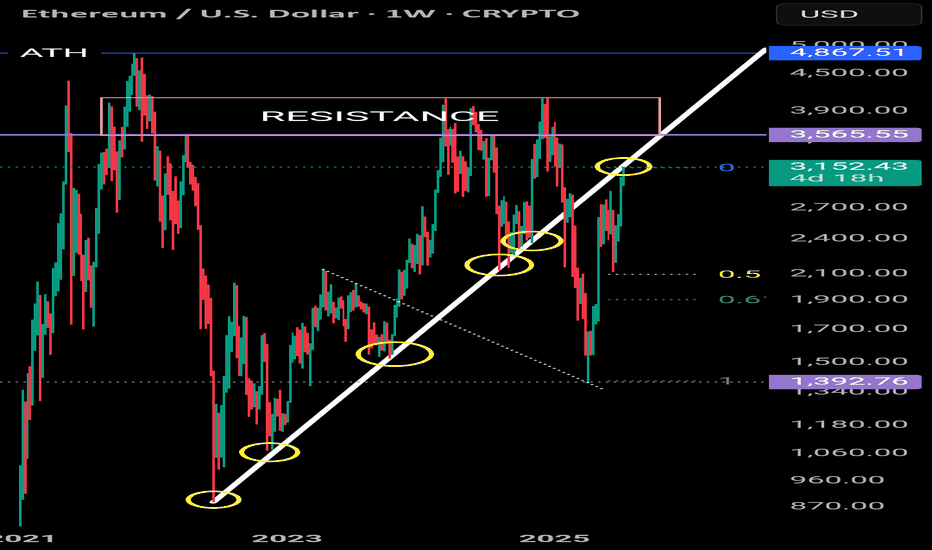

ETH - what next??Ethereum is perfectly touching a macro uptrend (5 touches acting as Support). Price has recently rallied but is currently pausing for breath. Could the uptrend begin to act as resistance? A break above this line would invalidate this thesis. Equally there is a huge resistance zone @ 3,550 - 4,100

And then there is the ATH

So there are a few hurdles in the way of printing a new ATH.

If Ethereum fails to break above the uptrend the fib retracement tool could take price to 1,900 (.618).

The next few days/weeks will give us an indication as to which direction we are headed.

Public short selling profit, NY short-term multiple layoutInterest rate futures data showed that the results were in line with our previous expectations, with a lower rate cut this month and a higher probability of a 25 basis point cut in September. In the short term, gold may first take profits and then rebound. NY session trading has just begun. Bros can pay attention to the 3335-3330 area below. If it falls back and stabilizes, you can consider participating in long positions, defending 3325 and targeting 3355-3365.

OANDA:XAUUSD