GBPUSD → Correction to the liquidity zone. Waiting for a FBFX:GBPUSD gets a negative CPI report in the early session and tests key support, but failing to reach the liquidity area a rebound is formed. The pair is in consolidation...

The CPI report provoked a small liquidation in the market, within the framework of which the price tested one of the key supports at 1.2886, but the price did not enter the liquidity area, i.e. technically the chances to return to this area are quite high.

A correction to the imbalance zone is being formed, from which the decline may continue. In the short term I am interested in 1.2868, which can still hold the market and form a bullish impulse.

Resistance levels: 1.2926

Support levels: 1.2886, 1.2868, 1.2811

False break of the global range support at 1.2868 may trigger a rebound to 1.2926. I do not exclude a deeper correction to the support from D1, for example to 1.2811 from which, against the background of the bull market, we can wait for an upward correction.

Regards R. Linda!

Trend Line Break

IPUSDT → Exit from the triangle may trigger a distribution ofBINANCE:IPUSDT.P is forming positive preconditions for possible growth. Bitcoin slightly revitalized the market after positive news related to SEC and XRP (the crypto community did not miss this fact)

The IP coin was in consolidation for a long time - a symmetrical triangle. Rising lows, consolidation, breakout of triangle resistance give positive signs of readiness for distribution (realization of consolidation). Ahead is the key resistance at 5.6297 separating the market from the free zone

Resistance levels: 5.6297, 6.631

Support levels: 5.116, 4.783

Price has been sticking to triangle resistance for the past few days and is gaining potential for breakout and realization. Numerous intraday retests of the area indicate the market's interest to break beyond this zone. A breakout of 5.6297 and price consolidation above the triangle will be a good signal of readiness to go up.

Regards R. Linda!

XAUUSD: Battle for New Highs – Bullish or Bearish?🚨 Attention Traders!🚨

🔥 XAUUSD is on FIRE! Price action is 🔥, and we're seeing a major battle at 3004 - 3014! Will it break out?

Bearish Alert 📉: If price dips below this zone, we could see targets around 2988 and 2998. Keep an eye on these support levels!

Bullish Opportunity 📈: A breakout above 2911 could lead to buying opportunities! Watch for moves above 3025 with targets at 3035 and 3050.

💬 Join the convo! Share your thoughts & strategies — let’s ride the gold wave together and catch these opportunities! 🚀✨

GOLD → Tense fundamental environment and retest of 3025FX:XAUUSD is forming a correction within the descending channel. The situation is becoming complex and confusing. The focus is on the channel resistance and on the support at 3004.9. Further price movement depends on the fundamental data...

The problem is the uncertainty around the US tariff policy and the outcome of talks between Russia and the US on ceasefire in Ukraine.

The market is focused on US consumer confidence data and comments from Fed officials. The rise in the dollar, supported by Bostic's hawkish statements and strong PMIs, is pressuring gold, but the lack of clarity on tariffs and geopolitical tensions are limiting its further decline

Technically, the situation is simple in that it all depends on the resistance of the current channel. A break and consolidation above 3025 will trigger growth. A false break of the channel resistance will provoke a continuation of the decline both to 3004 and to 2980.

Resistance levels: 3024.6, 3038, 3056

Support levels: 3004.9, 2987, 2981

Based on the difficult fundamental environment, which is far from any positive decisions, the tensions in the Middle East, and the tariff war, I can conclude that gold will try to strengthen once again, as we have technical support: a strong bullish trend, a strong 3004 level, and a cascade of locally rising lows.

A failed breakdown will be false and in this case, a price consolidation under 3017 will trigger a fall to 3004.

Regards R. Linda!

Silver (XAG/USD) Double Top Reversal – Bearish Trading SetupThe provided 1-hour chart for Silver (XAG/USD) presents a well-structured bearish trade setup, highlighting key price action patterns, technical indicators, and confluence factors that suggest a potential downside move. Let's analyze the chart step by step to understand the logic behind this bearish trade setup.

1. Market Structure & Trend Overview

Silver (XAG/USD) has been in a short-term uptrend, as indicated by the ascending trendline. However, the trend now shows signs of exhaustion, with a clear shift in market behavior. The price action reveals the formation of a double top at a strong resistance level, coupled with a Change of Character (CHOCH), which signals a possible reversal.

A break below the trendline suggests that the bullish momentum is losing strength, and sellers are beginning to dominate the market. The combination of these elements makes this setup a high-probability short trade opportunity.

2. Key Technical Levels & Zones

A. Resistance Zone ($33.96 - $34.20) – The Selling Pressure Area

The chart marks a clear resistance zone, where price has struggled to break higher.

Two price rejections from this level indicate that sellers are actively defending this region.

This zone serves as an ideal stop-loss area for short trades, as a breakout above this level would invalidate the bearish setup.

B. Double Top Formation – Reversal Pattern

The price tested the resistance zone twice and failed to establish new highs, forming a double top structure.

A double top is a well-known bearish reversal pattern, indicating a shift from bullish to bearish momentum.

The second top (Top 2) aligns with a downward trendline, further confirming that sellers are stepping in at lower levels.

C. Support Level ($32.60 - $32.80) – Initial Reaction Zone

This area has previously acted as a demand zone where buyers stepped in.

If the price breaks below this support, it would confirm further downside movement towards the final target.

D. Trendline Breakdown – Loss of Bullish Momentum

The dotted trendline represents the previous bullish trend, supporting price action for several days.

A break below this trendline suggests a structural shift in market dynamics, meaning buyers are losing control.

The failure to reclaim the trendline increases the probability of a deeper move downward.

E. Target Level ($32.11 - $32.20) – The Bearish Objective

The projected target is based on the double top’s measured move, which suggests a price drop to at least $32.11.

This level also coincides with previous historical price action, making it a strong confluence zone for profit-taking.

3. Trading Strategy & Execution Plan

📌 Entry Point:

Aggressive Entry: Short position around $33.40 - $33.50, near the second top where price rejected the trendline.

Conservative Entry: Wait for a confirmed break and retest of the support level at $32.80 before entering short.

📌 Stop-Loss Placement:

The stop-loss should be placed above the resistance zone at $33.96.

This level ensures that the trade is invalidated if the price breaks out higher.

📌 Take-Profit Target:

Primary Target: $32.60, which is the first support level where price may temporarily react.

Final Target: $32.11, aligning with the double top breakdown target and historical support.

📌 Risk-Reward Ratio:

A minimum 1:2 risk-reward ratio, meaning for every 1% risked, there is a potential 2%+ gain.

This makes the trade favorable in terms of risk management.

4. Confluence Factors Supporting the Bearish Outlook

✅ Double Top Formation – A classic bearish reversal pattern.

✅ Lower Highs Formation – Indicates increasing selling pressure.

✅ Trendline Breakdown – A significant loss of bullish momentum.

✅ Resistance Zone Rejection – Strong seller presence.

✅ CHOCH (Change of Character) – Confirms a shift in market sentiment.

5. Risk Management & Alternative Scenario

📌 What If Price Moves Against the Trade?

If the price breaks above $33.96, the bearish outlook becomes invalid, and a potential bullish continuation could follow. In this case:

Stop-loss is triggered, and the setup is considered invalid.

Traders should then wait for a new setup before re-entering the market.

📌 Market Conditions to Monitor:

Volatility: Ensure there is enough momentum in the market before entering.

Volume Confirmation: A break below support should have strong volume.

News Events: Watch out for fundamental catalysts, such as US Dollar strength, economic data, and geopolitical events, which could influence Silver’s price movement.

6. Final Thoughts & Summary

This chart setup provides a clear bearish trade opportunity based on technical analysis. The combination of double top formation, resistance rejection, trendline breakdown, and lower highs strongly supports the idea of further downside movement.

💡 Key Takeaways:

Bearish bias is valid as long as price stays below $33.96.

Target is set at $32.11, with an intermediate support at $32.60.

Risk-to-reward is favorable, making it an ideal short trade setup.

If the market follows this expected scenario, this trade has the potential to yield significant profit while maintaining disciplined risk management. However, always stay alert to market conditions and adjust strategies accordingly.

USOIL To Retest $70.5I'm watching TVC:USOIL for a strong push towards at least the $70.5 level, though this area presents significant resistance.

A confirmed break of the bearish trend could fuel strong buying momentum, but patience is key.

Ideally, I’d like to see a solid rejection off the $68.5 level as confirmation before a move higher.

If we get a decisive breakout above $70.5 with sustained bullish momentum, my next target would be the major resistance around $75.

EURUSD → Price is in consolidation. Emphasis on false breakdownFX:EURUSD is forming a correction within the consolidation that was formed on the uptrend. The reason for the consolidation is the halt in the movement of the dollar index...

The dollar is forming a counter-trend correction due to political and econmoic data, but the general background is bearish. But, the fall of the dollar, to which the index may soon return, may strengthen the growth of the currency pair. EURUSD consolidation within the uptrend (against the background of the dollar index correction). The zone of interest is the support at 1.078 and the imbalance area

Resistance levels: 1.078, 1.074

Support levels: 1.0936.1.1009

The price has not tested the support and is forming a correction to the imbalance zone 1.087 - 1.09 from which the price may return to the downward movement to 1.078. The emphasis is on the range support from which we should wait for a false breakdown before further growth.

Regards R. Linda!

GOLD → Long squeeze (false break of uptrend support) FX:XAUUSD within the liquidation the price is testing the key support at 3004.9 and forms a false break of support. The trend is generally bullish as the geopolitical situation remains tense and carries high risks.

Friday saw a liquidation phase relative to the consolidation at 3024-3045. Reason: the White House is expected to revise tariff policy, easing measures against key trading partners. Negotiations over the conflict in eastern Europe, where the U.S. is a key link, also support the positive sentiment. On Monday, market attention will focus on Russia-US talks, as well as preliminary PMI data that could affect the global economic outlook.

The focus is on the current consolidation and the 3024 level. If the bulls hold their defenses above this level, gold will continue to strengthen.

Resistance levels: 3045 - 3056

Support levels: 3024, 3004

The growth within the bullish trend may continue. The price is forming a consolidation between trend support and resistance at 3024. The emphasis is on 3024, if the bulls hold the defense over this zone, gold may head for a retest of the high (the initial reaction to ATH may trigger a pullback down)

Regards R. Linda!

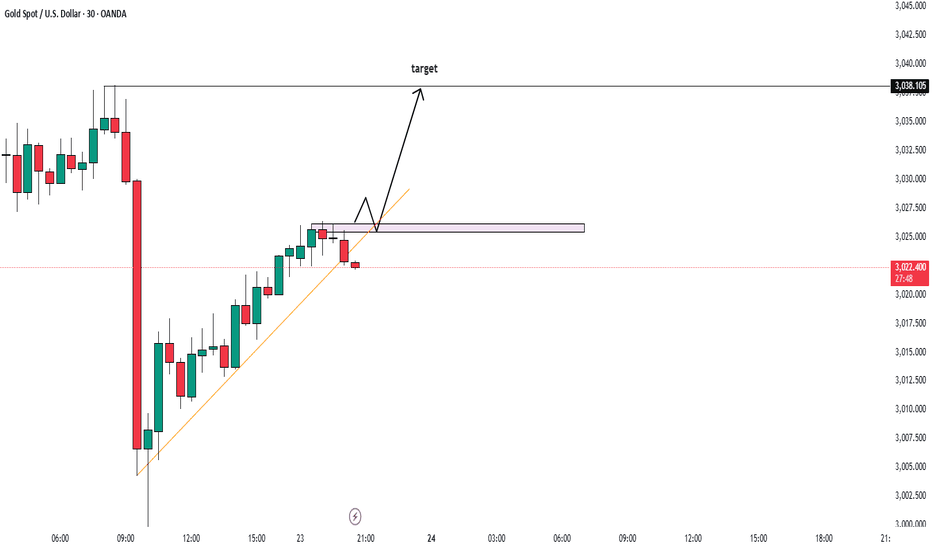

BULLISH MOVEMENT AFTER 3000 LEVEL RETEST ALERT!Hello trader

today market is higher high mark and continue bull pattern and also make a trend line in m30

so we wait to break and test for change the trend wanna gold see 4 Time tap and go for BUY

and trend also bullish so going with bull bias

key level for target 3045 and 3060

EUR/JPY – Double Bottom Breakout & Trendline Retest, Trade Setup📊 Chart Type: 1-Hour (H1)

💹 Asset: EUR/JPY

📈 Technical Patterns: Double Bottom, Trendline Breakout, Retest

📌 Overview of the Chart

The EUR/JPY chart showcases a bullish reversal setup, characterized by a Double Bottom pattern, a trendline breakout, and a successful retest. This combination suggests a potential continuation towards higher price levels, making it an ideal setup for traders looking for breakout entries.

The price action initially followed a downtrend, but buyers stepped in at key support zones, leading to the formation of a strong reversal pattern. Now, the price is testing a key resistance level, and if it breaks out, we could see a significant upward move.

🟢 Key Technical Analysis Breakdown

1️⃣ Double Bottom Formation – A Bullish Reversal Signal

🔹 The Double Bottom is a classic reversal pattern that forms after an extended downtrend.

🔹 In this case, price found strong support at 160.139, forming two lows (Bottom 1 & Bottom 2), indicating buyer dominance.

🔹 The confirmation of the pattern comes with a break above the neckline at around 162.000, suggesting a shift from bearish to bullish momentum.

2️⃣ Trendline Breakout & Retest

🔹 A descending trendline had been acting as dynamic resistance, pushing prices lower.

🔹 Recently, the price broke above the trendline, signaling a potential trend shift.

🔹 Now, price is retesting the trendline, which is a key factor in confirming whether the breakout is valid.

🔹 If the retest holds, it could trigger a strong bullish move towards the next resistance zone.

📍 Support & Resistance Zones

🔹 Support Level (160.139):

The lowest point in the chart, where price tested twice and formed the Double Bottom.

Buyers stepped in aggressively at this level, preventing further decline.

Stop Loss Placement: Below this support zone for long trades.

🔹 Resistance Zone (163.725 - Target Level):

The previous swing high and a major supply zone.

A breakout above this area could lead to further bullish momentum.

📈 Trading Strategy – How to Trade This Setup?

✅ Bullish Trade Setup (Breakout & Retest Confirmation)

This setup is ideal for traders looking to capitalize on breakout and retest strategies.

📌 Entry:

Wait for a strong bullish candle to confirm the retest of the trendline.

A break above the 162.500 level could be a good entry confirmation.

📌 Target:

First target: 163.725 (Resistance Zone).

If momentum continues, the next upside target could be around 164.500.

📌 Stop Loss:

Below 160.139 (previous support level) to minimize risk.

Alternatively, place it below the trendline retest zone if entering aggressively.

📌 Risk-to-Reward Ratio (RRR):

This trade offers a strong RRR, as the downside risk is limited, while the upside potential is higher.

🔴 Bearish Scenario – What if the Retest Fails?

While the bias is bullish, traders must be prepared for a fake breakout scenario. If price fails to hold above the trendline and neckline, the structure might break down.

📌 Bearish Entry:

If price rejects the retest zone and closes back below 161.500, it could indicate a false breakout.

📌 Target:

160.139 (Support Level).

📌 Stop Loss:

Above the trendline retest zone to protect against unexpected bullish moves.

🔎 Key Takeaways & Final Thoughts

✅ The Double Bottom pattern signals a potential trend reversal.

✅ The trendline breakout & retest adds further confirmation to the bullish bias.

✅ A breakout above 162.500 could accelerate buying pressure toward 163.725.

✅ Risk management is essential: A well-placed stop loss below the support level ensures minimal downside risk.

✅ If price rejects the retest zone, traders should be prepared for a possible bearish reversal.

📌 Overall Bias: Bullish ✅

📌 Trade Confirmation: Needs trendline retest hold + bullish breakout 📈

📌 Key Level to Watch: 162.500 (Breakout Confirmation Zone) 🔥

💡 Pro Tip : Always wait for confirmation before entering a trade. A strong bullish candlestick pattern (e.g., engulfing candle) on the H1 or H4 timeframe could provide extra confidence in the setup! 🚀

Trading Setup for CHF/USD – Triple Bottom Breakout Strategy📌 Chart Pattern: Triple Bottom with Trendline Breakout

This CHF/USD chart showcases a triple bottom formation, a bullish reversal pattern that signals a potential uptrend after three consecutive lows at a strong support level. The price action respects this support zone and attempts a trendline breakout, suggesting a shift in momentum from bearish to bullish.

📊 Full Chart Breakdown & Professional Analysis

1️⃣ Key Levels & Structure:

✅ Support Level (1.1300 - 1.1270):

The price has tested this region three times, indicating strong buying interest.

This forms a triple bottom, a reliable reversal pattern in technical analysis.

✅ Resistance Zone (1.1400 - 1.1420):

The price previously reversed from this zone, making it a key short-term resistance level.

✅ Target Level (1.1457):

A breakout above resistance could drive the price toward this measured move target, representing a 1% potential gain.

✅ Stop Loss (1.1269):

Placed below the support zone to minimize risk in case of a breakdown.

2️⃣ Price Action & Trendline Breakout:

📌 Triple Bottom Formation:

Price hits the same support level three times, signaling strong demand.

Each bounce from support indicates a gradual weakening of bearish momentum.

📌 Trendline Breakout:

The price broke a downward-sloping trendline, suggesting a potential bullish move.

A successful retest of the trendline could confirm further upside.

📌 Expected Move:

Scenario 1: Price confirms the breakout, retests, and moves toward resistance.

Scenario 2: If resistance is broken, price targets the next major level at 1.1457.

3️⃣ Trading Strategy – How to Trade This Setup?

🎯 Buy Entry:

Enter long after a confirmed breakout and retest of the trendline.

📉 Stop Loss:

Below 1.1269 (beneath triple bottom support) to limit downside risk.

🎯 Take Profit Targets:

Target 1: 1.1400 (Resistance Area)

Target 2: 1.1457 (Measured Move Projection)

💡 Risk-Reward Ratio:

Favorable risk-reward ratio of 1:3, making it an attractive setup for traders.

4️⃣ Market Psychology Behind This Move:

Bears losing strength: Multiple failed attempts to break support indicate sellers are exhausted.

Bulls gaining momentum: Trendline breakout shows buyers are stepping in with confidence.

Breakout confirmation: If resistance breaks, a strong rally toward 1.1457 is likely.

📌 Summary: Bullish CHF/USD Trade Idea

🔹 Pattern: Triple Bottom + Trendline Breakout

🔹 Entry: Buy on retest confirmation

🔹 Stop Loss: 1.1269

🔹 Target: 1.1400 & 1.1457

🔹 Risk-Reward: Favorable 1:3 setup

🚀 This is a high-probability trade setup with strong technical confirmation, making it a great opportunity for breakout traders! 🚀

S&P500 Next Key Levels I will be waiting to see if we get some short term buying before continuing down to $5,200 levels.

Waiting for price to reach the $5,800 area and anticipating a strong rejection to continue the bearish trend.

After confirmation of the rejection, I will be looking for simple lower lows, lower highs before entering a sell, preferably around the $5,600 mark.

What are your thoughts on the AMEX:SPY and the THINKMARKETS:USDINDEX in general?

STRONG REVERSAL COMMING FROM NEW ATH ALERT!📈 Description:

This is a 2-hour timeframe analysis of Gold, the market is currently consolidating between a strong support zone 📉 and a weekly high resistance level 📈. Two possible breakout scenarios can be expected:

✅ Bullish Scenario: If the price holds the strong zone at 3028 and gains momentum, it may break out above the weekly high 🚀.

❌ Bearish Scenario: If the price breaks below this strong support zone i.e 3028, it could trigger a downward move toward a lower support level 📉.

👀 Traders should watch for breakout confirmations before entering trades! 📊📉📈

follow risk management

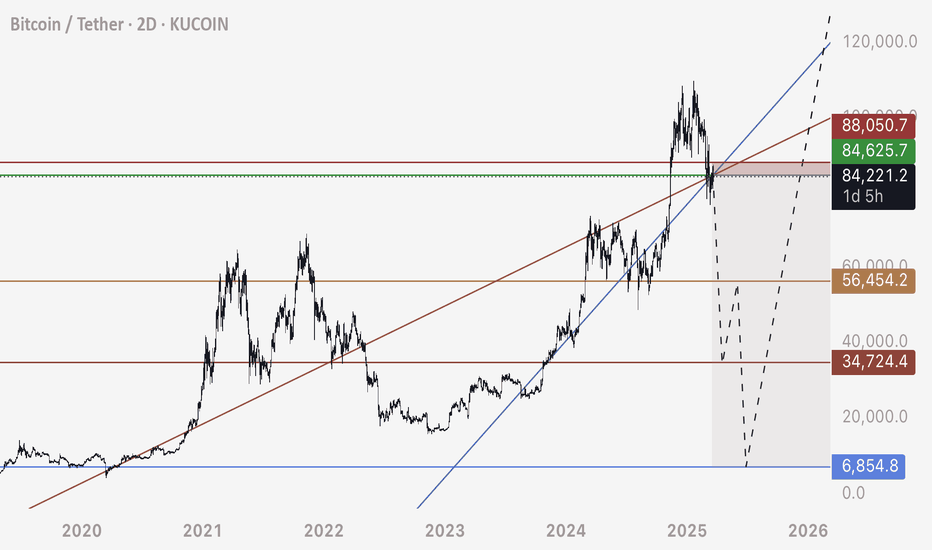

Reminder - Bitcoin back below these trendlinesI encourage you guys to draw these trendlines on your chart and experiment by doing some exercises.

1. Draw the main two trendlines.

2. Spend time on each by duplicating it, keeping the angle the same, and moving it to different spots on the chart. Notice how Bitcoin works on this ascending diagonal support resistance structure. You’ll find that the correct trendline can be duplicated infinitely and the price respects it at any point you place it.

3. Notice that price consolidates on these ascending lines. We see breaks above or below depending on the stop losses from futures positions and liquidity that’s collected. In other words, a break above doesn’t invalidate it.

4. Notice that Bitcoin moves above and below these trendlines.

5. It’s in my opinion that THIS is the structure that explains why Bitcoin isn’t moving higher, telling me the market wants to keep price below these trendlines and take back the liquidity in these zones (look at my previous posts for liquidity maps)

Personally this is still my trade.

God bless and may you live to trade another day!

JPY/USD Technical Analysis - Head & Shoulder Chart Bearish Move1️⃣ Chart Type & Timeframe:

Market: Japanese Yen (JPY) / U.S. Dollar (USD)

Timeframe: 1-hour chart (H1)

Platform: TradingView

This is an intraday chart used by traders to identify short-term price action and trend reversals.

2️⃣ Identifying the Key Chart Pattern – Head & Shoulders

The dominant pattern on this chart is the Head & Shoulders (H&S), a well-known bearish reversal signal that forms after an uptrend. Let’s break it down:

A. Formation of the Pattern

Left Shoulder: The price forms a peak, then retraces down to a support level.

Head: A higher peak is formed, followed by another decline, indicating buyers are losing control.

Right Shoulder: The price attempts another rise but fails to reach the previous high, showing bearish momentum is increasing.

B. Neckline & Trendline Support

The neckline acts as a key support level. A break below it confirms the bearish move.

The trendline, which has been supporting price action for a while, is also at risk of breaking.

3️⃣ Key Support & Resistance Levels

Resistance Level (0.006750 - 0.006819):

This is the previous high area where sellers are active. A stop-loss is placed above this level.

Support Level (0.006567 - 0.006468):

Key demand zones where buyers may step in. These are the take profit (TP) levels.

4️⃣ Price Action & Expected Movement

📉 Bearish Outlook – A potential breakdown from the neckline and trendline would confirm further downside.

If price breaks the trendline, a pullback to retest resistance is expected before dropping further.

Take Profit (TP) 1: 0.006567 – Minor support, possible bounce.

Take Profit (TP) 2: 0.006468 – Stronger support, deeper correction possible.

🚨 Stop Loss: Above 0.006819, just beyond the right shoulder and all-time high (ATH).

5️⃣ Trading Strategy & Execution

💡 Entry Strategy:

Sell Breakout Entry: Short the market when the neckline/trendline is broken with strong volume.

Retest Confirmation: Wait for a pullback to the broken trendline and enter when price rejects it.

📌 Risk Management:

Risk-to-Reward Ratio: 1:2 or higher for an optimal setup.

Use trailing stop-loss to secure profits if TP1 is hit.

6️⃣ Market Psychology & Smart Money Behavior

The Head & Shoulders pattern reflects buyer exhaustion and increased seller strength.

Smart money often enters after the breakdown when weak hands get stopped out.

Conclusion: Trade with Confidence!

This chart presents a high-probability bearish trading opportunity based on a textbook Head & Shoulders formation, support/resistance dynamics, and trendline analysis. A disciplined approach with risk management will ensure better execution.

📉 Final Verdict: Bearish Breakdown Expected – Sell the Retest!

🔥 Tags for TradingView Idea:

#JPYUSD #ForexTrading #HeadAndShoulders #TechnicalAnalysis #BearishReversal #SmartMoney #PriceAction #RiskManagement #TradingSetup #TrendlineBreak

BITCOIN → Flag (consolidation) before falling to 78-73KBINANCE:BTCUSD is consolidating after a short-squeeze relative to 85-87K. A bearish set-up is being formed, the break of which may strengthen further decline to the key target of 73K

A symmetrical triangle is forming within the downtrend on D1, a breakdown of this structure may strengthen the decline. Locally, within the channel a flag - bearish figure is formed (on the local TF false uptrend, the crowd enters to buy from the support or at the break of local resistance, at accumulation of the necessary potential the big player removes the limit order and releases the price, which is dispersed by liquidation of traders), regarding 85K-86.6K the liquidity capture is formed and the price returns to the selling zone. Consolidation below 85K may trigger a breakdown of the figure support and further fall to 80K-78K

Fundamentally: the market sells off any positive news very quickly (negative background is created):

crypto summits, (Trump said nothing new at the second summit)

positive resolutions of problems (for example between SEC and XRP, or removal of restrictions from local exchanges)

crypto reserve

The only nuance, bitcoin's dominance index is still high despite the price drop...

Resistance levels: 85150, 866700, 89400

Support levels: 82K, 80K, 78200

There are no positive signs for growth. The zone where we can consider a trend reversal ( if something supernatural happens ) is 89-91K, but it is very far away.

But now I would consider a breakdown of the flag, or 83.5 - 82.5 and price consolidation below this zone with the purpose of further fall to the local important level 78173. Then another consolidation or correction is possible before a further fall to 73.5K

Regards R. Linda!

EURUSD | 4H | WAIT BREAKOUTHey there, Traders,

I’ve put together an analysis for EUR/USD. Right now, I’m watching it like a hunter, waiting for a breakout. As soon as it happens, I’ll drop updates right here under this analysis.

Big thanks to everyone who supports me with likes—you guys are awesome!

God bless you all

GOLD → Consolidation (correction) before growth to $3100FX:XAUUSD is going into consolidation after strong growth on the back of dollar correction. The metal may test deeper support areas before attempting a new high

Gold is correcting, but remains in an uptrend

The decline in quotations may be seen as a buying opportunity, given the economic uncertainty due to Trump's tariffs and expectations of Fed rate cuts.

The Fed reiterated its forecast of two rate cuts in 2025 despite Powell's cautious comments. Gold is further supported by rising inflation risks and geopolitical tensions in the Middle East.

Resistance levels: 3045, 3057

Support levels: 3024, trending, 3004

Reaction to support is weakening, even amid the uptrend. Gold may stay in this consolidation until the middle of next week, or it may try to break out of the consolidation to retest deeper support zones, such as the rising trend line or the 3004 imbalance zone, from which the growth may resume.

Regards R. Linda!

Bitcoin April 2025 Forecast - Bullish Continuation, or Bearish?Here is a simple visualization of the decision time coming up for BTC, where trendline support meets trendline resistance, with decision time around the middle of May. Break to the upside would target $150K, with a break to the downside sending us into $40K panic selling levels. I am leaning more towards the bullish continuation scenario, but we will have to wait and see.

GL, hit thumbs up.

EURJPY → False breakout of key resistance ...FX:EURJPY is forming a false breakdown of resistance and draws us a reversal pattern against the upper boundary of the descending price channel, as well as the pressure on the market creates the correction of the dollar...

On the daily chart the structure is bearish. After the false breakout of the global resistance a correction is formed, within which the price can test the imbalance zone or the previously broken resistance and continue its fall after the liquidity capture. The global trend is neutral and in this case it is worth considering local support levels as targets

Resistance levels: channel boundary, 162.3, 163.0

Support levels: 160.84, 158.9

A retest of the channel resistance or the area of 162.4 - 163 is possible. But any return of the price under the resistance of the descending channel and consolidation of the price in the selling zone may provoke further decline

Regards R. Linda!

GOLD → Fading out before the news. Possible long-squeezeFX:XAUUSD continues its bullish trend, but locally, the movement is in a very narrow channel (wedge). To form a potential for further movement, the price may form a long-squeeze before or at the time of news...

Fundamentally, gold remains a bullish asset due to the Fed's rate cut forecasts and economic risks associated with Trump's tariff policy. Gold hit a new high on Wednesday after the Fed reiterated plans to cut rates twice this year, raised its inflation forecast and worsened growth and employment estimates.The price is further supported by escalating geopolitical tensions in the Middle East, with Israel announcing the resumption of ground operations in Gaza.

Gold is forming a bull market. Before further growth (before the news) the price may enter the liquidity zone (fvg, 3028, 3024), after which it will continue to grow. Dollar enters local correction before the news, which creates pressure on gold

Resistance levels: 3046, 3051, 3056

Support levels: 3038, 3030, 3024

Price is forming a retest of the wedge support, which increases the chances of a breakdown. If the support fails to hold, the price may go down to the above support before rising further.

But! If gold bounces from 3038 and consolidates above 3044, the growth will continue without a deep pullback

Regards R. Linda!

BIKAJI : Breakout Candidate#bikaji #vcppattern #vcpsetup #trendline #breakout

BIKAJI : Swing Trade

>> Good Strength in stock

>> Volumes Dried up

>> Trendline Breakout

>> VCP Structure - Ready to Blast

>> Low Risk High Reward Trade

Swing Traders can lock profit at 10% and keep trailing

Disc : Charts shared are for Study Purpose, Do your own Analysis and consult your Financial Advisor before taking Position in it. Take Position as per Proper Risk Management.

Pls Boost, Comment & Follow us for More Learnings.

Gold (XAU/USD) Trading Setup – Short Opportunity with Key Target📌 Chart Overview

This is a 1-hour (H1) candlestick chart of XAU/USD (Gold to US Dollar), displaying a potential short (sell) trading setup. The price action suggests that gold is testing a strong resistance zone, and if it gets rejected, a bearish move could follow. The chart includes key technical elements like trendlines, support/resistance levels, and take-profit (TP) zones.

🛠️ Technical Breakdown

1️⃣ Uptrend and Resistance Test

Gold has been in a strong uptrend, as seen from the ascending trendline supporting price movements since March 14.

The price is currently testing a major resistance zone around the ATH (All-Time High) + Resistance Level (~$3,057-$3,072).

A rejection from this level would indicate a potential trend reversal or pullback before any further bullish continuation.

2️⃣ Sell Stop Placement – Waiting for Confirmation

Instead of entering a trade immediately, a Sell Stop order is placed below the trendline.

This means the trade will only activate if the price breaks down from the trendline support, confirming bearish momentum.

3️⃣ Target Levels (Take Profit Zones)

Once the sell trade is activated, the price is expected to move toward the following TP (Take Profit) zones:

TP 1 (~$3,045) – First minor support; price might pause or bounce briefly.

TP 2 (~$3,037-$3,040) – A stronger support zone, where profit can be partially secured.

TP 3 (~$3,029-$3,028) – The final target, aligning with a significant support level. This is the most crucial zone where price could reverse or consolidate.

4️⃣ Support Zone and Potential Bounce

The green-shaded area represents a strong support level (~$3,028-$3,030), previously tested in past price action.

If the price reaches this area, buyers might step in, potentially pushing gold back up.

📉 Trade Execution Plan

✔️ Entry: Below the trendline, activated by the Sell Stop order.

✔️ Stop Loss: Above the resistance level (~$3,072) to limit risk.

✔️ Profit Targets: TP1, TP2, and TP3 (scaling out profits).

✔️ Confirmation Factors: Rejection from resistance, trendline breakdown, and bearish momentum indicators.

🔎 Final Thoughts & Market Sentiment

If price fails to break the trendline, gold might continue its bullish run toward new highs.

If the breakdown occurs as anticipated, a strong short trade opportunity is present.

Always monitor fundamental factors (like economic data and news) that could impact gold prices.

Risk Management Tip: Use proper position sizing and a trailing stop to lock in profits if the trade moves in favor. ✅

📊 Conclusion : A well-structured short setup, with a solid risk-reward ratio and defined execution plan. Happy trading! 🚀📉