Learn These Patterns And You'll Never Regret ItEVERYTHING ON THE TRIANGLE PATTERN

a triangle chart pattern involves price moving into a tighter and tighter range (like a consolidation phase which has a triangle-like shape) as time goes by and provides a visual display of a battle between bulls and bears.

The triangle pattern is generally categorised as a “continuation pattern”, meaning that after the pattern completes, it’s assumed that the price will continue in the trend direction it was moving before the pattern appeared.

note: the triangle pattern depends on the trend however don't hold on to that thought since fake-outs are possible. the point i am trying to make is that you should not be obsessed with which direction the price goes, but you should be ready for movement in either direction.

there are three triangle patterns:

a) the ascending (upward slope consisting of higher-lows and a consistent resistance),

b) descending (downward slope consisting of lower-highs and a consistent support)

c) symmetrical (equal slopes the market is forming lower-highs and higher-lows)..

the triangle is different from a wedge. however, a wedge can be in a triangle or better put the general formation of a wedge is a triangle-like shape (in some cases).

point to note:

• you need at least two points (bullish or bearish) to connect for a triangle to be considered, and a consistent support or resistance.

• the volatility of price of any instrument decreases when there's a triangle pattern and increases on breakout of the pattern.

• measuring the size of the triangle can serve as a good profit target (will explain in meeting)

• keep an open mind at all times.

📝..

Triangle

COMI Egypt can exceed 104 in 6 monthsWeekly chart,

The stock EGX:COMI has formed a symmetrical triangle chart pattern, and crossed the Resistance line R.

One more week above R, to confirm, the target will be 104.3 - passing through several resistance levels as shown on the chart.

A new entry (buy) can be made immediately before confirmation with higher risk, and consider a stop loss below 76.0

Technical indicators RSI and MACD are positive.

NOTE: Keep a near Profit Protection/ Stop Loss level.

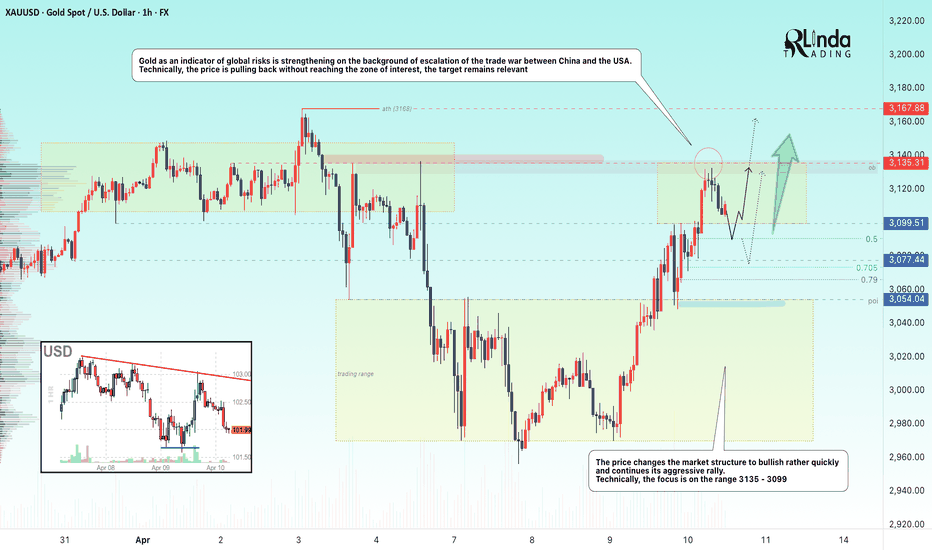

GOLD → Global economic risk indicator consolidates ahead of CPIFX:XAUUSD , rather quickly changes the market structure to bullish and continues its aggressive rally. The economic risk indicator is working perfectly. Technically, the focus is on the range 3135 - 3099

Gold is consolidating around $3,100 in anticipation of US inflation data. The escalating trade war between the US and China keeps demand for defensive assets alive despite the pause in price gains. Trump imposed 125% tariffs on Chinese goods and China retaliated with duties of 84% on U.S. imports. Increased tariff tensions are raising recession expectations and encouraging bets on a Fed interest rate cut, which supports gold. However, a rise in March CPI inflation (expected 2.6% y/y) could trigger a downward correction, although the impact could be short-lived - tariff news remains the main driver

Technically, the price failed to reach the 3135 liquidity zone and reversed, which attracted the crowd willing to sell (deceptive maneuver). But, after correction the price may return to the target quite quickly

Resistance levels: 3135, 3167

Support levels: 3100, 3090, 3077

Emphasis on the range boundaries, possible retest of 3100-3090- 3075 before continuation of growth. On the news or before the opening of the American session there may be a long squeeze before the continuation of growth.

Regards R. Linda!

DOGE → Will the market hold strength or lose it all?BINANCE:DOGEUSDT is testing the liquidity and resistance zone amid a downtrend as part of a news-induced rally. Will the market hold this trend or return to a sell-off?

The downtrend continues. As part of the correction triggered by the news backdrop, bitcoin strengthened and pulled the altcoins with it. But the market may lose all its growth quite quickly, as bearish pressure on the market is still very strong (There are no fundamental positive changes for the market). The fall of BTC may be followed by DOGE as well.

Technically, the price is forming a false break of the resistance zone 0.1622 - 0.15700, consolidation of the price below this zone will provoke the continuation of the fall to the nearest zone of interest 0.13646.

Resistance levels: 0.157, -0.1622

Support levels: 0.13646, 0.1277, 0.1154

A retest of the trend resistance is possible, but price consolidation below the key zone will be a good signal indicating the seller's strength, the decline may continue. On the weekly timeframe we have a trigger at 0.14217, break of which will open the way to 0.1277 - 0.1025.

Regards R. Linda!

Nickel Commodity Quote Settings | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Nickel Stock Quote

- Double Formation

* ((Triangle Structure)) | Completed Survey

* 012345 Wave Feature & Ongoing Wave (3)) | Subdivision 1

- Triple Formation

* (Continuation Argument)) | Short Set Up | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Logarithmic Settings

- Position On A 1.5RR

* Stop Loss At 17.100 USD

* Entry At 14.600 USD

* Take Profit At 10.900 USD

* (Downtrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

GOLD → Bounce back to accumulate energy before growthFX:XAUUSD confirms interim bottom at 2970 after a false breakdown and as part of the escalating trade war, price is strengthening from support to the important medium-term level of 3054.

Further dynamics will depend on the market reaction to the minutes of the March Fed meeting and the introduction of reciprocal tariffs between the US and China. The introduction of 104% duties on Chinese goods increases trade tensions, reduces investor confidence and supports the price of gold against the background of a weakening dollar. Even with the Fed's cautious rhetoric, gold may keep rising due to the escalating trade war.

The medium-term situation depends on the Fed (namely hints or actions on rate cuts), the trade war and negotiations on the situation in Eastern Europe

Resistance levels: 3054, 3077, 3099

Support levels: 3033, 3013 (0.5f), 2995

Since the opening of the session (the price has passed the daily norm) gold has exhausted the technical potential and the 3054 area may push the price down (false breakout). As part of a technical pullback, gold may test 3033 - 3013 before looking at upside attempts again.

Additional scenario: pullback to the fvg zone (0.7 - 0.79 fibo) before further growth.

Regards R. Linda!

USDCNH - 30 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

Breakout Area, Target, Levels, each line drawn on this chart and any other content represent just The Art Of Charting’s personal opinion and it is posted purely for educational purposes. Therefore it must not be taken as a direct or indirect investing recommendations or advices. Entry Point, Initial Stop Loss and Targets depend on your personal and unique Trading Plan Tactics and Money Management rules, Any action taken upon these information is at your own risk.

═════════════════════════════

EURUSD Forms Triangle Just Below 17-Year Long-Term TrendlineAfter a strong rally from around 1.03 to the 1.10s, EURUSD traders now appear undecided. The white line shown is the 17-year-long trendline, which is currently acting as major resistance. However, this is not a typical short-term resistance level, it's more appropriate to focus on weekly and monthly closes around this area.

Still, its presence alone is enough to give Euro bulls something to think about.

For more context about long-term outlook, please check our earlier post below:

In the short term, the chart has taken the shape of a descending triangle. If the TVC:DXY bounces, EURUSD may face some downward pressure. 1.0880 seems to be the support to follow for direction. Although descending triangles are typically bearish patterns, this one still has a chance to break to the upside due to supportive fundamentals.

In either case, the medium- to long-term outlook for EURUSD is turning increasingly bullish.

USDCNH Tests Key Pattern Resistance on PBOC’s Loose Yuan FixThe trade war between China and the U.S. is escalating, and the Chinese yuan is starting to feel the pressure. After the U.S. raised tariffs to a total of 54%, China responded with a 34% increase of its own. Now, Trump has threatened an additional 50% tariff hike if China doesn’t withdraw its retaliation.

It appears unlikely that either side will back down at this stage, and the trade war is set to intensify further.

In addition to retaliating, China is also preparing to defend its economy. According to several news reports, Beijing is planning to frontload stimulus measures aimed at boosting domestic consumption, subsidizing exporters to cushion the blow from reduced U.S. trade, and supporting stock market stability. The People’s Bank of China will likely play a central role in this effort, using tools such as rate adjustments and daily yuan fixings.

The latest yuan fixing came in above 7.20, the highest level since 2023. With this looser fixing and ongoing trade war pressure, USDCNH is pushing higher. The ascending triangle formation which typically breaks to the upside is also supporting bearish bets on the yuan.

If China proceeds with a small and controlled devaluation, as many expect, a breakout from this triangle pattern is likely.

The potential target for the breakout could align with one of the parallel lines of the lower boundary of the formation, which are currently around 7.61 and 7.75, and gradually rising. With time, a move toward 7.80 is well within reach by the end of the year.

CADJPY → Consolidation before the news. DowntrendFX:CADJPY continues to forge a downtrend, but within the current movement a symmetrical triangle of accumulative nature is forming

The currency pair may continue its decline due to the strengthening of the Japanese Yen, while the Canadian is consolidating in a narrow range.

The situation may be accelerated by today's news, namely Trump's speech, where he may announce new tariff measures.

Technically, the price is correcting after the false break of 103.56, being below the previously broken upside support. Price is testing key resistance at 104.90, and against 0.5 Fibo is forming a false breakout. A consolidation below 104.69, a break of 104.525 could trigger further decline.

Resistance levels: 104.900, 105.36, 105.74

Support levels: 104.525, 103.56

There are important news ahead, high volatility is possible, especially at the moment of Trump's speech, which may set a medium-term tone in the market.

The currency pair is in consolidation on the background of the downtrend and the priority is to expect a continuation of the fall

Regards R. Linda!

GBPCAD bearish view

OANDA:GBPCAD whats next?, we are have two times bounce on trend line,

currently on D is visible DESCENDING TRIANGL,

in triangl we have RECTANGLE PATTERN 4h which is breaked,

below rectangle pattern we have on lower TF better visible BEARISH FLAG pattern 1h (violet doted), which currently looks breaked,

here expecting bearish push now till next trend zone.

SUP zone: 1.85000

RES zone: 1.82250, 1.81600

Bitcoin will grow inside upward channel to resistance levelHello traders, I want share with you my opinion about Bitcoin. Previously, the price moved inside a triangle pattern, where it faced pressure from the resistance line while holding above the lower boundary. After the breakout from this formation, BTC began forming an upward channel, signaling a shift toward a bullish structure. Inside the channel, the price reacted multiple times to the support line, especially within the buyer zone between 79600–81000 points. Every touch of this zone triggered a rebound, indicating that buyers consistently protect it. Most recently, BTC bounced again from the 81000 support level, which aligns with the lower channel boundary. This rebound shows that bullish momentum is still present, and the structure remains intact. Now, the price is stabilizing and preparing for another upward move. I expect BTC to continue rising toward the 88500 resistance level, which is both the TP1 and the upper boundary of the current channel. This level also aligns with the lower edge of the seller zone, making it a natural target for the next wave. With the price holding above key support, the confirmed channel structure, and repeated bullish reactions from the lower zone, I remain bullish and anticipate a continued move upward toward 88500 points. Please share this idea with your friends and click Boost 🚀

Ripple dives as predicted; what is next?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Can EURUSD Take Out the Major High 1.12000?EURUSD Major Forex Pair

Following Trump’s tariff policies announced on Friday, the price of the EURUSD forex pair broke the daily higher high structure and is now returning to retest that level. This morning, the price bounced off the 0.618 daily Fibonacci level, suggesting that it may move upward again, potentially reaching the major high around 1.12000 or hitting one of the Fibonacci extension levels.

Price Action on the 4-Hour Chart

I have shifted down to the 4-hour chart to analyze the price action in more detail. While it appears somewhat chaotic due to Friday's news and the aggressive bullish impulse, it’s encouraging that the price broke through the higher high structure and is now retesting it.

At this point, I would like to see the price remain above the 0.618 daily Fibonacci level and stay within the upward trendline. Additionally, the price is forming a symmetric triangle. Once it breaks out of this pattern, I plan to enter a buy position with a risk-to-reward ratio of 1:2, targeting the supply area near the major high.

I will provide an update as more price action develops later in the week, so stay tuned!

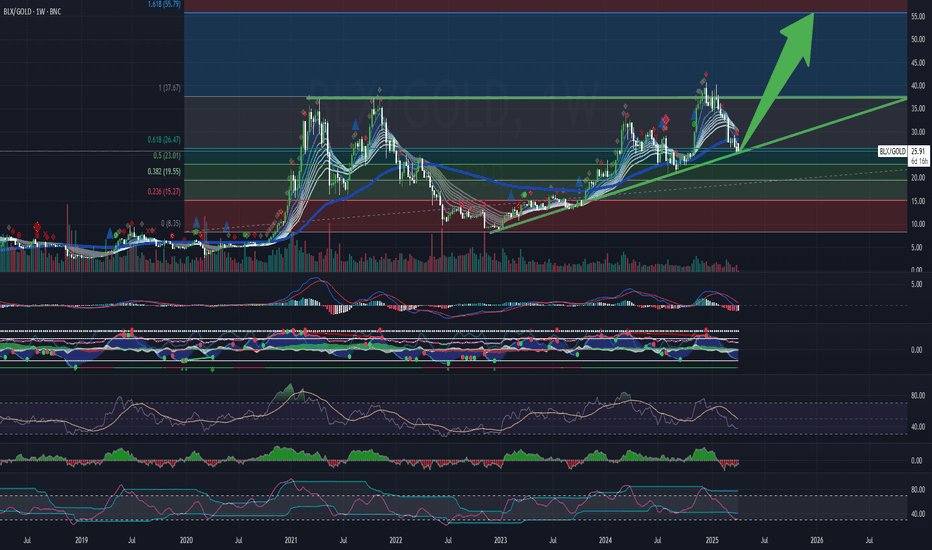

BTC vs Gold at a Critical Support – Bounce or Breakdown?📊 Weekly Chart Analysis – BLX/GOLD (Bitcoin to Gold Ratio)

📉 Current Price: 25.90

Price is sitting at a key support zone, aligned with the ascending trendline (green).

The 0.618 Fibonacci retracement level (26.47) from the full impulse move (8.35 → 37.67) is being tested.

The 200-week MA is also nearby, adding strength to this support area.

🔍 Indicators:

MACD (Weekly):

Still bearish, with a confirmed downward crossover.

No visible bullish divergences yet — bearish sentiment persists.

RSI:

Hovering near 40 — not oversold but approaching the zone.

Room for further downside, but also potential for a bounce from oversold conditions.

Stochastic RSI & Momentum:

Stoch RSI is bottomed out, suggesting a possible upside reversal.

Volume is declining on the sell-off — a possible sign of seller exhaustion.

🧠 Market Structure:

The overall pattern resembles a rising wedge, potentially broken to the downside.

However, price is now retesting the bottom of a long-term parallel channel — a historically favorable zone for long entries.

🧭 Possible Scenarios:

📈 Reversal & Bounce Holding 25–26 support, Stoch RSI reversal Medium-High

📉 Break to 20–23 Failure to hold Fibonacci & trendline Medium

⚠️ Sharp Drop to 15–20 Only if BTC crashes or gold rallies hard Low

🟢 Summary:

Price is at a critical confluence zone: Fibonacci, horizontal support, trendline, and oscillators all align here. A bounce is likely unless this level is decisively broken. If it holds, this may be a strong mid-term long entry signal.

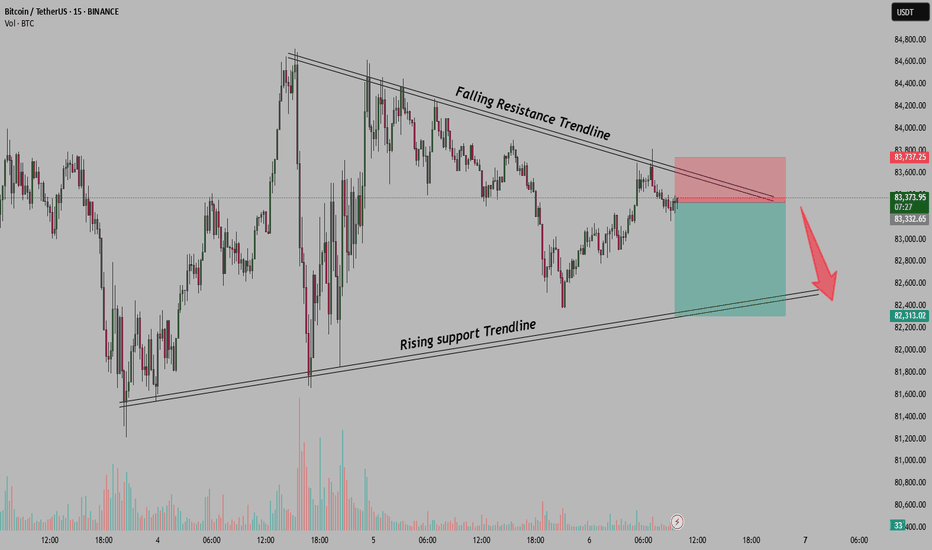

Bitcoin's Symmetrical Triangle – a short trade possible here!Bitcoin is currently forming a symmetrical triangle on the 15-minute chart, with a falling resistance trendline and a rising support trendline. This setup is a classic indication of consolidation, and the price is likely to move for downside soon as it is reversing from upper band now. If Bitcoin manages to break above 83,737, we could see a breakout of this symmetrical triangle, On the flip side, if it breaks below the rising support, 82,313 could breakdown for downside and we can see further downside then, but now we are playing inside the symmetrical triangle only and we will try to book profit once price reaches lower band of the symmetrical triangle pattern.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share, and drop your thoughts in the comments below.

BITCOIN → The price is consolidating, but there is a BUT!BINANCE:BTCUSDT is forming a consolidation after a false breakout of trend resistance. Against the backdrop of the global market crash (stock market, futures, forex) bitcoin looks quite strong, but I wouldn't get excited ahead of time

Bitcoin is trading inside a downtrend and also inside a range (global 81200 - 88800 and local 81200 - 85600). As long as the price is inside the local range and below trend resistance it is worth considering selling. There have been periods in history when the price seemed strong in the moment, but then, bitcoin caught up with the fall of indices...

The fundamental background for bitcoin is unstable:

First of all, the price has hardly reacted in any way to the introduction of tariffs, backlash and economic data. The Fed is not giving a clear signal, the market is in uncertainty. Any info noise ( China, Fed rhetoric, company reports ) can cause shake-ups. But at the same time, the same old problems remain: the crypto community is not getting any support. Bitcoin's dominance is growing against the backdrop of its decline. Altcoins continue to storm the bottom.

Technically , the situation is weak, the price cannot update local highs and consolidate above any strong support. It is possible to retest the trend resistance, or the zone of interest 85590 before the reversal and fall. Or, emphasis on the trigger 81187. A breakdown will provoke an impulse.

Resistance levels: trend, 85585, 88840.

Support levels: 81187, 78170, 73500

Buying in the medium term can be considered either after reaching the main target - 73-66K, or after the exit from the descending channel and price fixation above 88840. Now the emphasis is on a possible fall either from the resistance 85580, or when the support 81180 is broken

Regards R. Linda!

BTCUSDT: key pointsI think the price is going to go from here to $82000 and then to $85000. There's liquidity at the $85,000 level, so I expect it to take the liquidity there and try the $82,500s again. But if it doesn't return from $85,000 and breaks directly, it may work as in option 2. this isn't investment advice.

WTI Breakout LowerWTI shed nearly 10% last week and tested levels not seen since early 2021. As a result, the downside move punctured the lower boundary of a descending triangle formation on the weekly chart, extended from a high of US$95.01 and a low of US$64.34. Technically, this opens the door to possible bearish scenarios in the weeks to come toward a decision point zone at US$51.38-US$53.92. With that in mind, if you drill down to the H1 timeframe, you will note a bearish decision point zone formed at the lower boundary of the weekly chart’s descending triangle at US$64.90-US$64.24. This could be a location that traders look to fade from in the event of a pullback-retest play unfolding this week.

Written by FP Markets Chief Market Analyst Aaron Hill

Crude OIL CRASH - OPEC & Trump - Recession Catalyst#Recession is here, Markets are bleeding.

Crude #Oil is the kicker.

I shorted TVC:USOIL on Friday.

Hunting on this trade for a while now.

Very #Bearish outlook on #WTI.

MARKETSCOM:OIL Weekly

#FundamentalAnalysis

- #OPEC+ Output Hike (411K bpd)

- #Trump #Tariffs & #TradeWar

I'm looking at a #CrudeOIL #MarketCrash, similar to the #Covid era, when NYMEX:CL1! went in minus on #Nymex #Futures.

TVC:USOIL & my BIG SHORT

#Trading EASYMARKETS:OILUSD via CFDs with #Leverage.

Executed my #Sell Position on #WTI at $64.

* DYOR before, it's not a financial advice, I just share.

#TechnicalAnalysis

- #ElliottWave Impulse Cycle a (white)

- #Correction in Primary ABC (red)

- #LeadingDiagonal in Primary A (red)

- #Descending Triangle in Primary B (red)

Why will BLACKBULL:WTI Crash?

#Bearish Primary C (red) has started.

#Break-out below the Triangle Flat Line.

Important Note:

The #Bearish #Impulse will continue lower.

After the short-lived pull-back, Sellers will dominate.

$63-64 Range is the Entry.

MARKETSCOM:OIL Daily

TVC:USOIL #Short #TradeSignal

- Entry @ $63-64 Range

- SL @ $73

- TP1 @ $40

- TP2 @ $30

- TP3 @ $20

Stay in the green and many pips ahead!

Richard (Wave Jedi)