Bitcoin can rebound from triangle pattern to 90K pointsHello traders, I want share with you my opinion about Bitcoin. Not long ago, the price was trading within a range, where it quickly entered the seller zone and remained near this area for quite some time. BTC attempted to rise but failed, and after nearly reaching the upper boundary of the range, it dropped sharply. The price broke through the 94000 level, exiting the range as well, and then fell to the support level, which aligned with the buyer zone. Shortly after, the price made a strong upward impulse toward the resistance level before starting a decline within a downward triangle. Inside this pattern, BTC initially made a correction, climbed back to the resistance line of the triangle, and then resumed its decline. Eventually, the price dropped to the 78900 support level, where it touched the triangle’s support line and then began to rise. At the moment, BTC continues to climb near this level, and I expect it to rebound from the support line of the triangle and break above the resistance, signaling an exit from the pattern. If this happens, I anticipate further growth, so my target is set at 90000 points. Please share this idea with your friends and click Boost 🚀

Triangle

Bitcoin Rebounds with Dovish FOMC, Preparing to Test TrendlineBitcoin has broken out of the ascending triangle and is starting to regain some lost ground. While the medium-term trend remains downward, if BTC holds above the upper boundary of the triangle (around 85K), another leg higher with a potential target between 90K and 91K becomes more likely, depending on the pace of the move.

Supporting the bullish case are factors such as the Ripple case drop, a slightly dovish FOMC, and rumors of new crypto-related actions from Trump.

However, if Bitcoin falls back below the 85K level today, the next key support to watch is around 82,500. A move down to this level alone wouldn't completely negate the bullish outlookfor short term. But if Bitcoin also breaks below the lower boundary of the former triangle too, it would significantly increase bearish pressure.

Further Underperformance for the US Dollar Index? Down nearly 4.0% this month, the US Dollar Index demonstrates scope to navigate deeper waters on the monthly chart towards the 50-month simple moving average (SMA) at 101.72. A similar vibe is evident on the daily chart. Following a test of support-turned-resistance at 103.94, a possible bearish scenario could unfold if price breaches the lower edge of the current descending triangle pattern (103.22/104.09). If a breakout lower materialises, follow-through downside could see support at 101.92 make an entrance (set just north of the 50-month SMA).

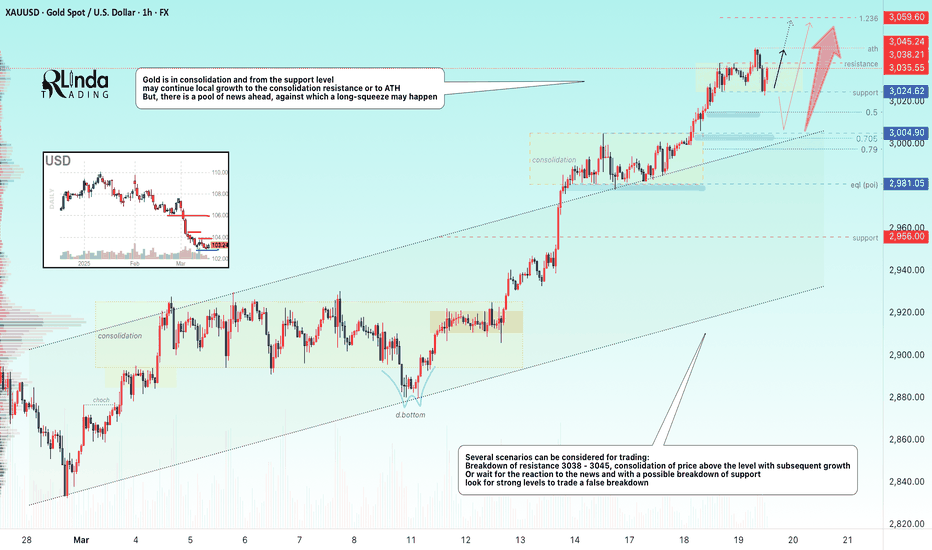

GOLD → Fading out before the news. Possible long-squeezeFX:XAUUSD continues its bullish trend, but locally, the movement is in a very narrow channel (wedge). To form a potential for further movement, the price may form a long-squeeze before or at the time of news...

Fundamentally, gold remains a bullish asset due to the Fed's rate cut forecasts and economic risks associated with Trump's tariff policy. Gold hit a new high on Wednesday after the Fed reiterated plans to cut rates twice this year, raised its inflation forecast and worsened growth and employment estimates.The price is further supported by escalating geopolitical tensions in the Middle East, with Israel announcing the resumption of ground operations in Gaza.

Gold is forming a bull market. Before further growth (before the news) the price may enter the liquidity zone (fvg, 3028, 3024), after which it will continue to grow. Dollar enters local correction before the news, which creates pressure on gold

Resistance levels: 3046, 3051, 3056

Support levels: 3038, 3030, 3024

Price is forming a retest of the wedge support, which increases the chances of a breakdown. If the support fails to hold, the price may go down to the above support before rising further.

But! If gold bounces from 3038 and consolidates above 3044, the growth will continue without a deep pullback

Regards R. Linda!

How to Trade News!Heads up, everyone! The Federal Reserve's interest rate decision will be announced in one hour! Currently, gold is consolidating in a narrow range around the 3035 level. At this point, it's not advisable to enter short positions on gold just yet.

📍From a technical perspective, gold has formed an ascending triangle pattern. If it fails to break below the 3027-3025 support zone, the bullish momentum could persist, with an upside target in the 3045-3055 range. Therefore, it's best to hold off on aggressive short positions for now.

📍However, if gold, driven by the upcoming announcement, struggles to break above the 3045-3055 resistance area, 3045 may establish itself as a short-term top. In that scenario, short positions can be considered using the 3040-3050 zone as a resistance level.

🔎Xauusd:@3040-3050 Sell,TP:3030-3020;

📍On the other hand, if gold decisively breaks below the 3025-3020 support level, attention should be focused on the 3010-3000 range. Should gold find support and stabilize within this range, it may present a favorable opportunity to go long once again.

🔎Xauusd:@3010-3000 Buy, TP:3030-3040

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

PLUME 1D: Breakout After 54-Day ConsolidationPLUME has finally broken out of a 54-day consolidation phase on the daily timeframe, forming a clear triangle pattern. This breakout could signal the start of a new upward trend, making it an interesting spot market buy opportunity. Are you watching PLUME? Let’s discuss the potential! Share your thoughts below!

Bitcoin - This indicator is always right! Crash to 40k in 2026.What we can see on the chart is Bitcoin cycles. We can statistically predict Bitcoin moves with this simple chart, because it's always right and never wrong. What can we say with certainty?

Statistically:

Bitcoin's bull markets last for 742 to 1065 days

Bitcoin's bear markets last for 364 to 413 days

Correction is every time weaker, but still huge

The recent uptrend on Bitcoin started in December 2022 and ended in January 2025 (791 days). We know that statistically bull markets last for 742 to 1065 days, so this indicator tells us that the bull market ended! This indicator was never wrong, so do your own research. It's always like this. Moon boys calling for 300k, 500k, or 1M in 2025 do not follow my TradingView profile because otherwise they would know this strong fundamental fact. The market cap of Bitcoin is already too big, so forget about 500K or 1M in the short term because the market cap would be higher than gold. Gold is the number 1 asset in the world.

Statistically, Bitcoin crashes every 4 years by 86% to 77%. The market cap is getting bigger as institutions step in, so this time I expect a weaker crash (around 65%). Still, it's a huge crash, and many investors will sell at a loss as usual. Knowledge of the Bitcoin cycles will save you a lot of money.

Bitcoin halving is coded to occur once every 210,000 blocks, or roughly every four years, and will continue in this fashion until the final supply of 21 million BTC is reached. It is assumed that the last BTC will be mined in 2140. After that, transaction fees are supposed to be the only source of block rewards for miners.

Write a comment with your altcoin, and I will make an analysis for you in response. Also, please hit boost and follow for more ideas. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

GOLD → Consolidation ahead of Fed rate meeting...FX:XAUUSD goes into consolidation 3038 - 3024 before the news - Fed rate meeting. The situation is generally predictable, but gold is reacting to rising geopolitical risks.

Gold is stabilizing before the Fed decision , markets are waiting for the data. The regulator is expected to keep rates, but Powell's forecasts will determine further dynamics.

“Hawkish” tone of the Fed may lead to the strengthening of the dollar and gold correction.

“Dovish” signals about economic risks will support the growth of metal prices.

Geopolitical tensions and Trump's tariffs continue to have an impact.The market is preparing for high volatility on the background of the Fed's decision and events in the world

Resistance levels: 2038, 2045

Support levels: 3024, 3015, 3004.9

Several scenarios can be considered for trading:

Breakdown of resistance 3038 - 3045, consolidation of the price above the level with subsequent growth to 3050 - 3060.

Or wait for the reaction to the news and with a possible breakdown of support to look for strong levels to trade a false breakdown, for example 3024, 3015, 3005.

Regards R. Linda!

USDJPY → Resistance retest (wedge) before the Fed meetingFX:USDJPY is forming a correction to trend resistance as part of the dollar index consolidation. An interesting situation is forming which could be a continuation of the downtrend.

Fundamentally, today is an important day. The FED interest rate meeting is ahead. Traders are waiting, the dollar is consolidating at this time. Most likely the rate will remain unchanged, but in this key everyone is interested in Powell's comments on monetary policy and their future actions.

USDJPY at this time is forming a correction to the bearish trend resistance, before the news the currency pair may test the resistance conglomerate: a wedge, 0.79 fibo, or an orderblock located outside the channel

Resistance levels: 150.16, 150.95

Support levels: 148.92

False breakout of the resistance zone can provoke a fall, as well as breakdown of the support of the “wedge” with the subsequent consolidation of the price in the selling zone. The price may test the zone of interest at 147.6, 146.54.

Regards R. Linda!

Gold (XAU/USD) Breakout & Retest Trade Setup - Bullish Move!Gold (XAU/USD) has successfully broken out of the consolidation zone after a strong rally. The price action recently tested the previous resistance level, which is now acting as new support.

Trade Setup:

Entry: Price has retested the breakout zone and is showing signs of bullish momentum.

Support: The previous resistance area (now turned support) is holding well.

Stop Loss: Placed just below the support at $3,034.562 to manage risk.

Target: A potential upside move towards the $3,055 zone, which aligns with the next key resistance level.

This setup follows a breakout-retest continuation pattern, a classic technical strategy where price revisits a breakout level before resuming the trend. If bullish momentum continues, we can expect a move towards the projected target.

📌 Key Levels to Watch:

Support: $3,034.562

Resistance/Target: $3,055

Current Price: $3,039.925

💡 Risk-to-Reward Ratio: Favorable, as the stop loss is placed strategically below support.

⚠️ Disclaimer : This is not financial advice. Always manage your risk and use proper risk management techniques.

What are your thoughts on this setup? Will Gold push higher or face rejection? Let me know in the comments! 🚀💬

Analysis of USD/JPY Chart**Analysis of USD/JPY Chart**

**Chart Pattern & Market Structure**

- The chart identifies a **triangle chart pattern**, which often signals a potential breakout.

- Price has been consolidating within this structure and recently **broke above the pattern**, indicating possible bullish momentum.

**Key Technical Levels**

- **Resistance Zone (~149.8 - 150.0):** Price is testing this area, which previously acted as a supply zone. A breakout above could open doors for higher levels.

- **Support Zone (~148.5 - 149.0):** If price retraces, this area could act as a strong demand zone.

- **EMA50 (~149.2):** Currently acting as a dynamic support, maintaining the bullish structure.

**Potential Price Movement**

- The chart suggests a possible pullback toward **support** before continuing higher toward the next resistance zone (~151.5 - 152.0).

- If price breaks below the **support zone**, the uptrend could weaken, leading to a bearish scenario.

**Trading Considerations**

- A **successful breakout above resistance** (~150) could push price towards **152.0**.

- A **rejection at resistance** might bring price back to **support (~148.5 - 149.0)** before another bullish attempt.

- Traders should watch for **confirmation signals** (candlestick patterns, volume spikes) before entering trades.

Copper breaks out but misses target, what's next?Copper formed an ascending triangle from mid-February, triggering the pattern on March 12. The price moved higher as expected but remains just shy of its target at 5.12. If there is a pullback toward 4.91, or in the worst case down to the breakout point at 4.84, traders will likely see this as a buying opportunity to align with the pattern's upward momentum. The pattern remains valid as long as the price stays above 4.78, a level just below the strong retest of the breakout point on March 13.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

XAUUSD still hoping for retracementThis is an update to my related chart (see link below)

Update:

Gold is rising quickly. I am still hoping for a retracement. I have updated my entry positions to:

First Entry: 3023.365 which is in the middle of a new support level on the 1hour chart. Using Fib on the Bullish Pennant target, this entry is at the 0.5 level.

Second Entry: 3012.392 which is within a support area as well. Using Fib on the Triangle target, this entry is just below 0.618 level.

XAUUSD small retracement then longI see two outstanding targets from a previous Triangle and a Bullish Pennant on the 1hour chart.

Right now Gold keeps hitting a soft resistance block.

First Entry at 3,009.388 near 0.5 Fib

Second Entry at 2,998.41 between 0.618 and 0.786 Fib

Risk to Reward: 3.15

Gold remains bullish.

In support:

Name Simple Exponential

MA5 3020.87 Buy 3020.99 Buy

MA10 3015.91 Buy 3016.22 Buy

MA20 3007.51 Buy 3009.40 Buy

MA50 2996.65 Buy 2995.01 Buy

MA100 2972.48 Buy 2977.08 Buy

MA200 2941.12 Buy 2953.95 Buy

Market Trading is risky. The above is just my idea and you should do your own analysis before comparing it with mine. Never risk more than you can afford to loose.

Good Luck!

Gold (XAU/USD) Sell-Off Continues | Bearish Target insightGold Spot (XAU/USD) indicates a potential continuation of the current downtrend.

🔹 Sell Limit at 3082: A significant level where a sell order was placed, marking the start of the recent decline.

🔹 Strong Downtrend: After rejecting the 3082 level, gold has been making lower highs and lower lows, confirming bearish momentum.

🔹 Support & Target Zone: Price is approaching a key support area near 2880-2900, which aligns with the marked target level.

📉 Bearish Outlook:

If the price breaks below the current support, further downside is expected.

A potential bounce could occur at the target zone before a trend reversal.

💡 Key Levels to Watch:

Resistance: 3082

Support/Target: 2880-2900

Traders should monitor price action at support to determine if further downside is likely or if buyers step in for a potential reversal.

What’s your outlook on gold? Will the bearish trend continue? 📉💰

DexCom Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# DexCom Stock Quote

- Double Formation

* A+ Set Up)) | Completed Survey At 125.00 USD

* ((Triangle Structure)) | SideWays, No Entry | Subdivision 1

- Triple Formation

* ABC Flat Feature & Retest | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 52.00 USD

* Entry At 61.00 USD

* Take Profit At 76.00 USD

* (Downtrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Gold (XAU/USD) Chart Analysis**Gold (XAU/USD) Chart Analysis**

📌 **Current Price:** $3,014.41

📊 **Chart Pattern:** Uptrend with Higher Highs & Higher Lows

🎯 **Short-Term Target:** $3,020

**🔹 Key Levels:**

- **Support:**

- $3,012 (7 EMA)

- $3,008 (21 EMA)

- $3,003 (50 EMA)

- **Resistance:**

- $3,015 (Immediate)

- $3,020 (Psychological Level)

**✅ Trade Setup (Scalping Strategy):**

- **Entry:** On retracement near $3,012 (7 EMA)

- **Stop-Loss:** Below $3,008

- **Take Profit:** $3,020

📢 **Gold is in a strong uptrend. Bullish momentum remains intact unless price drops below $3,008!** 🚀

GOLD → Consolidation for continued growth. 3025?FX:XAUUSD is consolidating between 2981 - 2993. After strong growth there is no hint of a possible reversal, and consolidation above the channel boundary indicates readiness to continue growth

The gold price remains below the record $3,005 but is supported by the trade war, geopolitical tensions and expectations of Fed policy easing. The escalating US conflict with Yemen, the escalation in Gaza and possible talks between Trump and Putin are boosting demand for defensive assets. China's stimulus is also supporting prices. U.S. retail sales data may influence the dollar and further gold movement, but investors are cautious in anticipation of the Fed meeting.

Resistance levels: 2993, 3008

Support levels: 2891, 2956

Consolidation is being formed, regarding which, against the background of the bullish trend, two strategies can be considered:

1) resistance breakdown and consolidation above 2993 with the purpose of growth continuation

2) false breakdown of support 2981 and further growth after liquidity capture.

Regards R. Linda!

OMUSDT → Paranormal behavior. Rally readinessBINANCE:OMUSDT as a whole looks stronger than the market. After a strong rally a correction in the format of a bearish wedge is formed, subsequently the price broke the resistance and is trying to consolidate above the key support

Against the background of a weak market OM coin has good prospects as technically someone is interested in this project and the coin as a whole behaves strongly and looks stronger than the market.

A breakout of the bearish wedge (consolidation pattern within the correction) is forming. If the bulls keep the coin above the previously broken figure resistance and above the base of the 6.752 reversal pattern, the growth may continue in the short to medium term

Resistance levels: 7.39, 7.98

Support levels: 6.752, 6.51

One of the few coins that is rising while bitcoin is falling. Focus on the previously mentioned support levels, as well as on the local resistance 7.05, the break of which may provoke a prolongation of growth

Regards R. Linda!