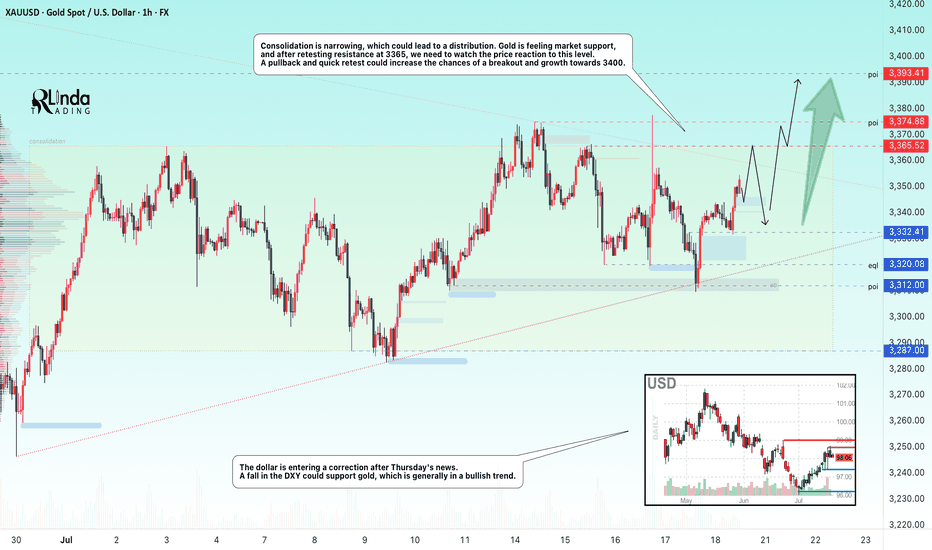

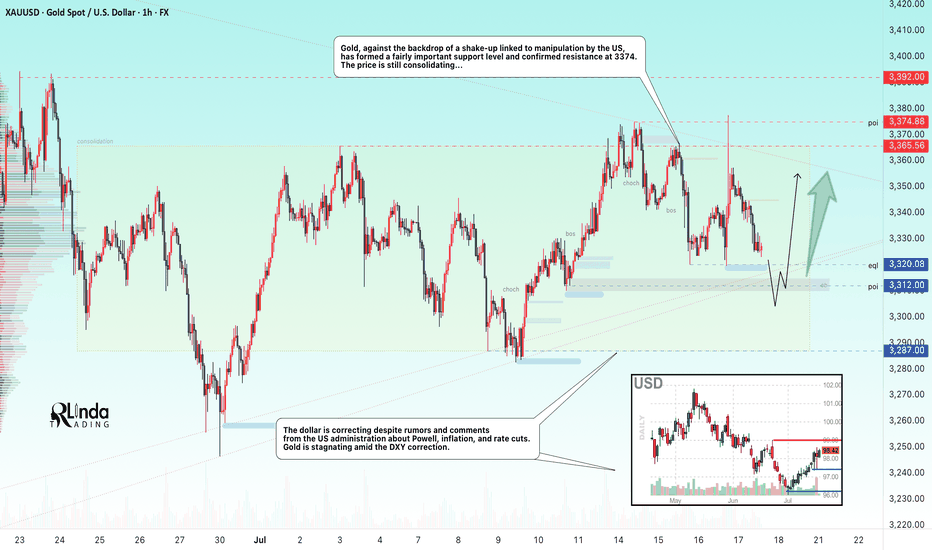

GOLD → Retest of consolidation resistance. Chances of a breakoutFX:XAUUSD bounces off support at 3312, forming a false breakdown at 3320. The price is heading towards consolidation resistance. The chances of continued growth are increasing...

Gold rebounded from its low amid statements by Fed member Waller about a possible rate cut in July. However, strong US sales and labor market data strengthened the dollar and held back XAU/USD growth. Despite statements by some Fed members about maintaining a tight policy, traders continue to expect rate cuts before the end of the year. The focus is on new economic data that could affect the dollar and gold prices.

Technically, consolidation is narrowing, which could lead to distribution. Gold is feeling market support, and after retesting resistance at 3365, we need to watch the price reaction to the level. A pullback and quick retest could increase the chances of a breakout and growth to 3400.

Resistance levels: 3365, 3375

Support levels: 3332, 3320, 3312

There is a high probability that there will be an attempt to break through the consolidation resistance amid expectations of a rate cut. This phase may be accompanied by either a correction to retest and return for a breakout, or a breakout and consolidation of the price above the level. Today, Friday, I expect a retest and correction, as there may not be enough local potential for a breakout of this level, and the price has already lost some of its momentum since the opening of the session...

Best regards, Linda!

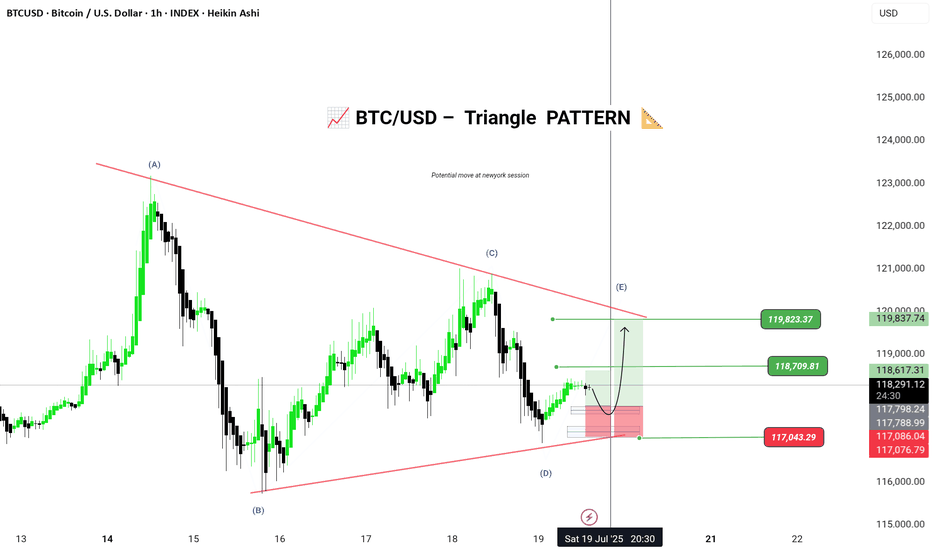

Triangle

BTC/USD – Triangle Wave E Setup (Potential Bullish Breakout)Bitcoin is currently forming a contracting triangle (ABCDE) structure on the 1H chart. The market appears to be respecting the lower trendline support and could be completing Wave D, now preparing to push into Wave E.

🟢 Entry Zone: 117086 – 117076

🎯 Targets:

• 118709

• 119823

⛔ Stop Loss / Invalidation: Below 117043

🧩 Pattern: Elliott Wave Contracting Triangle

📅 Timeframe: 1H (Heikin Ashi)

📌 Chart by: @Greenfireforex

📌 Wait for a bullish confirmation candle above the support zone for a safe long setup. Triangle break could lead to momentum continuation toward the targets.

---

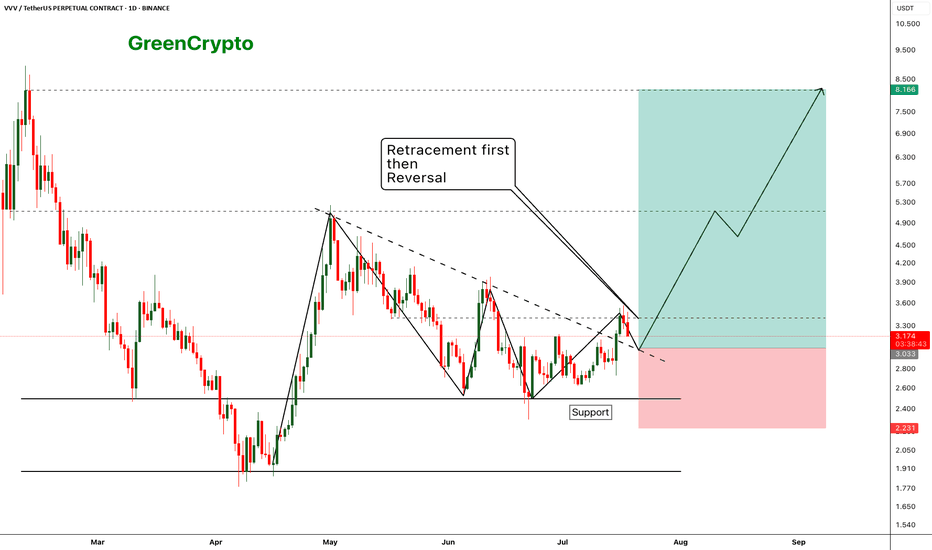

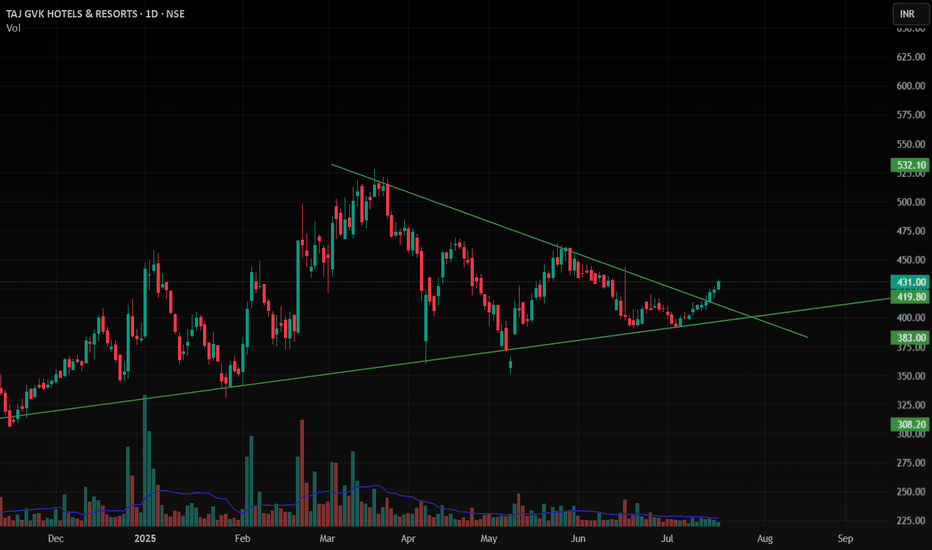

VVV - Expecting perfect reversal after the retracement- price has broken out from the resistance trendline and now we are seeing a retracement as expecting

- Price should hold the support (previous resistance) and reverse from the suppport zone.

- we can enter our trade once the retracement completed

Entry Price: 3.033

Stop Loss: 2.231

TP1: 3.411

TP2: 4.037

TP3: 4.851

TP4: 6.360

TP5: 8.028

Max Leverage 5x.

Don't forget to keep stoploss.

Cheers!

GreenCrypto

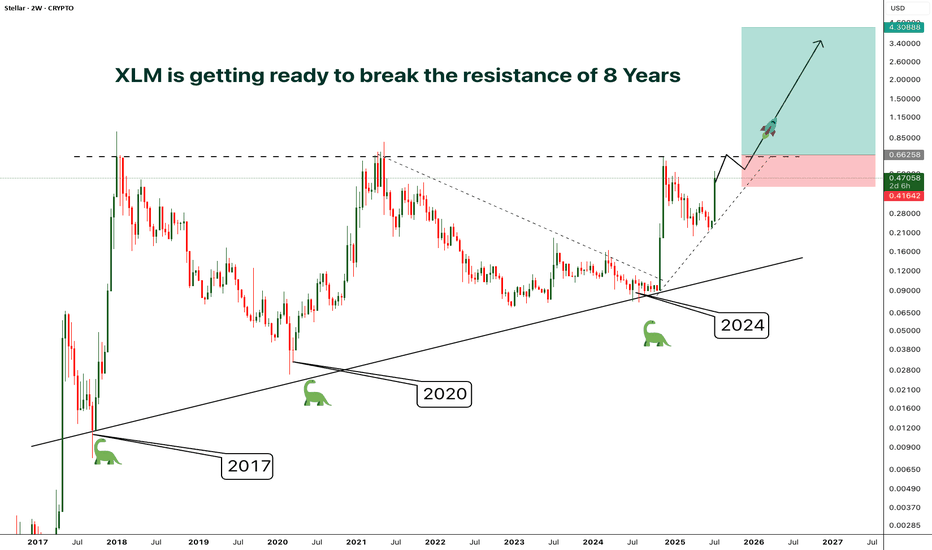

XLM - Resistance/Consolidation of 8 Years- Finally after 8 years of consolidation and getting rejected by the resistance at the same level around 0.65, XLM is preparing to break out from the almost decade old resistance

- A clear breakout from this resistance will phenomenal

- The price surge after the breakout will be unlike anything you've ever seen.

- I'm planning to enter after a confirmed breakout, entry before the breakout will be risky in case if the price gets rejected again.

Entry Price: Candle closeAbove 0.65

Stop Loss: Below 0.41

TP1: 0.88574

TP2: 1.21012

TP3: 1.92545

TP4: 2.68849

TP5: 4.27772

Don't forget to keep stoploss

Cheers

GreenCrypto

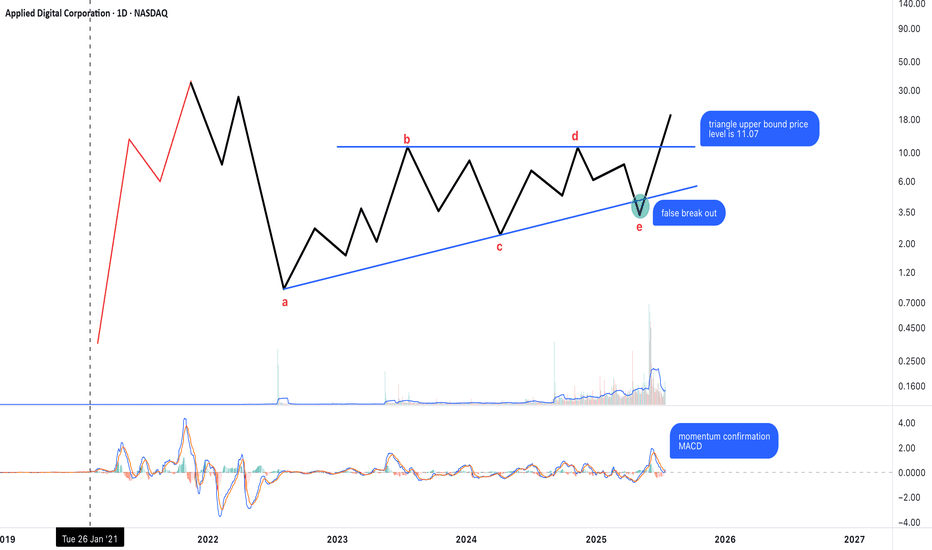

Possible Neutral Triangle Breakout – Key Level at 11.07The chart appears to show a completed neutral triangle (a–b–c–d–e), with a breakout emerging above the upper boundary at 11.07.

Wave a looks like a complex structure (possibly elongated flat or flat + zigzag).

The rest of the legs are mostly zigzag forms, consistent with triangle rules.

False breakdown below wave e followed by a strong reversal.

MACD is confirming momentum during the breakout attempt.

As long as price stays above 11.07, this breakout may be sustained. If confirmed, the next target zone could align with the height of the triangle projected upward.

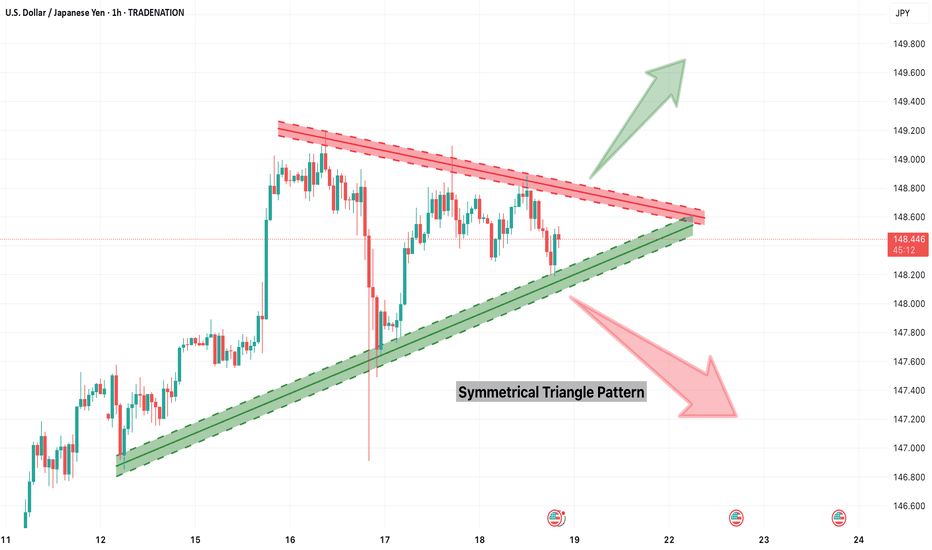

USDJPY Symmetrical Triangle – Be Ready for Breakout or BreakdownUSDJPY is currently squeezed inside a well-formed symmetrical triangle, indicating a breakout is imminent. This consolidation pattern is nearing its apex, and price action is getting tighter. A sharp move in either direction could unfold soon. Here's how to prepare:

🟢 Bullish Breakout Setup:

Entry Trigger: 1H candle close above 148.70

Stop Loss: Below last higher low or triangle support (~148.15)

Targets:

TG1: 149.20

TG2: 149.60

Final TG: 149.95–150.00

Bias: Favors trend continuation (previous uptrend)

🔍 Confirmation: Strong breakout candle with momentum and/or volume.

🔴 Bearish Breakdown Setup:

Entry Trigger: 1H candle close below 148.15

Stop Loss: Above triangle resistance (~148.70)

Targets:

TG1: 147.60

TG2: 147.20

Final TG: 146.80

Bias: Reversal or failed trend continuation

🔍 Confirmation: Clean breakdown with bearish candle close + possible re-test rejection.

⚠️ Avoid premature entries inside the triangle. Wait for a confirmed breakout or breakdown with candle close and rejection follow-up.

🎯 Tip: Triangle breakouts often result in fast directional moves. Plan your lot size based on volatility and stick to your risk parameters. This is a high-probability setup — trade with discipline.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

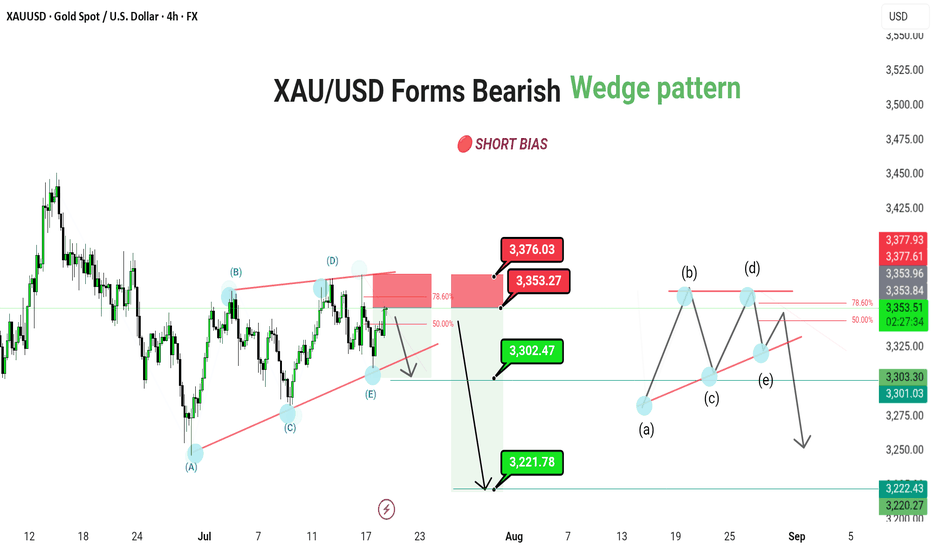

XAU/USD Forms Bearish Continuation Triangle – Future Downside

XAU/USD (4H) | FX | Gold Spot vs US Dollar

🔴 SHORT BIAS

📅 Updated: July 18

---

🔍 Description

Gold is trading within a bearish contracting triangle, suggesting a continuation move to the downside after the recent corrective bounce. Price is currently approaching the key 3,371–3,376 resistance zone, which aligns with the 78.6% Fibonacci retracement and upper triangle boundary.

This resistance confluence could mark the termination of the (E) wave of the triangle, paving the way for a larger downward thrust. A confirmed break below 3,302 would open the door toward 3,221 as the next major target.

The structure also leaves room for a minor internal triangle (a)-(b)-(c)-(d)-(e) pattern within the broader range, reinforcing the bearish setup.

---

📊 Technical Structure (4H)

✅ Bearish contracting triangle: (A)-(B)-(C)-(D)-(E)

✅ 78.6% Fibonacci + supply zone = ideal rejection point

✅ Internal triangle projection aligns with lower support test

📌 Downside Targets

Target 1: 3,302.47

Target 2: 3,221.78

🔻 Invalidation: Above 3,376.03

---

📈 Market Outlook

Macro View: Rising real yields and cooling inflation reduce gold’s appeal

Fed Watch: Hawkish tone supports USD, weighing on XAU

Technical View: Structure favors downside break from triangle formation

---

⚠️ Risks to Bias

Break and daily close above 3,376.03 invalidates triangle structure

Sudden risk-off sentiment or dovish Fed shift could boost gold demand

Sharp reversal in dollar strength

---

🧭 Summary: Bearish Breakout Setup Forming

XAU/USD is completing a bearish triangle structure, with price sitting just below resistance. A rejection from the 3,371–3,376 zone can trigger a breakout lower, first toward 3,302, then extending to 3,221. As always, confirmation and tight risk control are key.

---

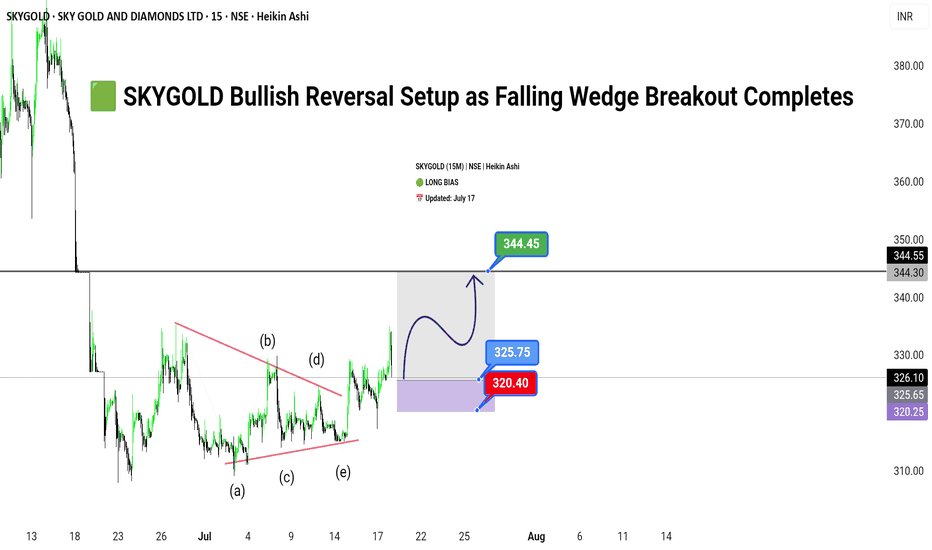

SKYGOLD Bullish Reversal Setup as Falling Wedge Breakout Complet🟩

SKYGOLD (15M) | NSE | Heikin Ashi

🟢 LONG BIAS

📅 Updated: July 17

---

🔍 Description

SKYGOLD has emerged from a prolonged corrective phase, breaking out of a well-defined falling wedge pattern on the 15-minute chart. The price action has respected a clean Elliott Wave ABCDE structure within the wedge, suggesting a completed consolidation cycle. With bullish momentum building above ₹325, the stock now appears poised for a breakout rally towards ₹344.45.

This setup reflects both a technical breakout and possible short-covering rally, making it an attractive opportunity for short-term swing traders. However, risk remains below the ₹320.40 zone, which invalidates the breakout structure if breached.

---

📊 Technical Structure (15M)

✅ Breakout above wedge resistance

✅ ABCDE wave structure complete (classic consolidation)

✅ Impulse targets in sight

📌 Upside Targets

First: ₹325.75

Final: ₹344.45

🔻 Risk Zone

Below: ₹320.40 (Breakdown invalidates setup)

---

📈 Fundamental/Flow Highlights

Sector Sentiment: Positive traction in mid-cap jewellery and gems segment.

Volume Spike: Notable rise in volume on breakout candle.

Short-Covering Potential: Highly likely due to prolonged consolidation.

---

⚠️ Risks to Watch

Sudden broad market correction in Nifty Midcap segment.

Lack of follow-through volume post-breakout.

Intraday rejection near ₹344 zone (previous supply).

---

🧭 Summary: Bias and Watchpoints

SKYGOLD is bullish above ₹325 with a breakout structure favoring continued upside toward ₹344.45. As long as the price holds above ₹320.40, the long thesis remains valid. Watch volume confirmation, and use trailing SL to lock gains.

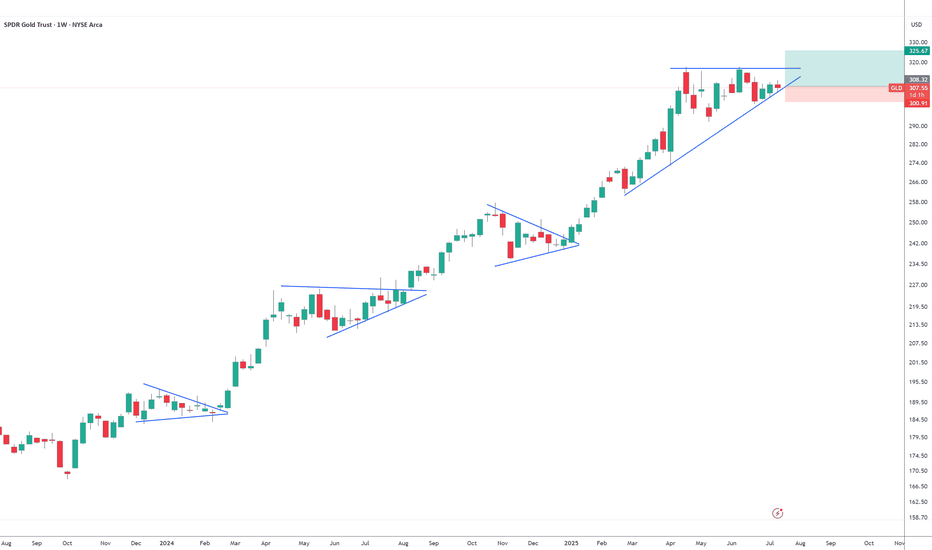

GOLD → The triangle is contracting. Retest of support...FX:XAUUSD tested a local high of 3375 but quickly returned to consolidation. The reason is manipulation by the US administration related to Powell, inflation, and interest rates...

Demand for gold has risen sharply amid global risks: Trump's aggressive tariff plans, strong inflation, and uncertainty about the Fed's actions have increased interest in defensive assets. Despite the temporary strengthening of the dollar, gold remains a popular hedging instrument. Technical analysis also points to a bullish outlook. However, growth potential is limited until the Fed clarifies its interest rate policy

Technically, on the D1 chart, it is clear that the price is consolidating, with the range continuing to narrow. Due to the bullish factors listed above, we can expect growth to continue. However, it is difficult to say where and when the growth will begin due to the uncertainty factor. All attention is on the support at 3320-3312, the triangle support, as well as the consolidation support at 3287.

Resistance levels: 3365, 3375

Support levels: 3320, 3312, 3287

Since the opening of the session, the price has spent part of its daily range, so there may not be enough potential for the decline to continue. A false breakdown of support and consolidation of the price above the key zone may attract buyers, which will trigger growth towards resistance.

Best regards, R. Linda!

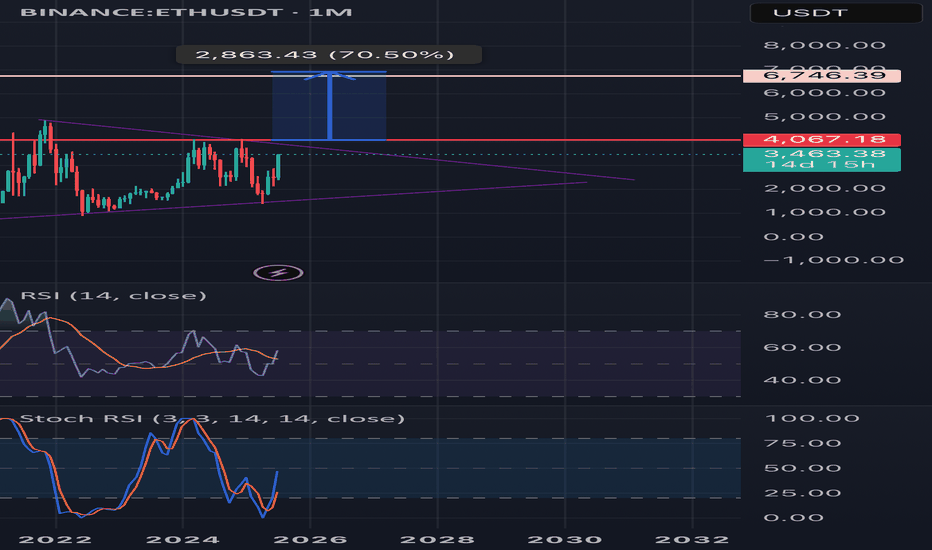

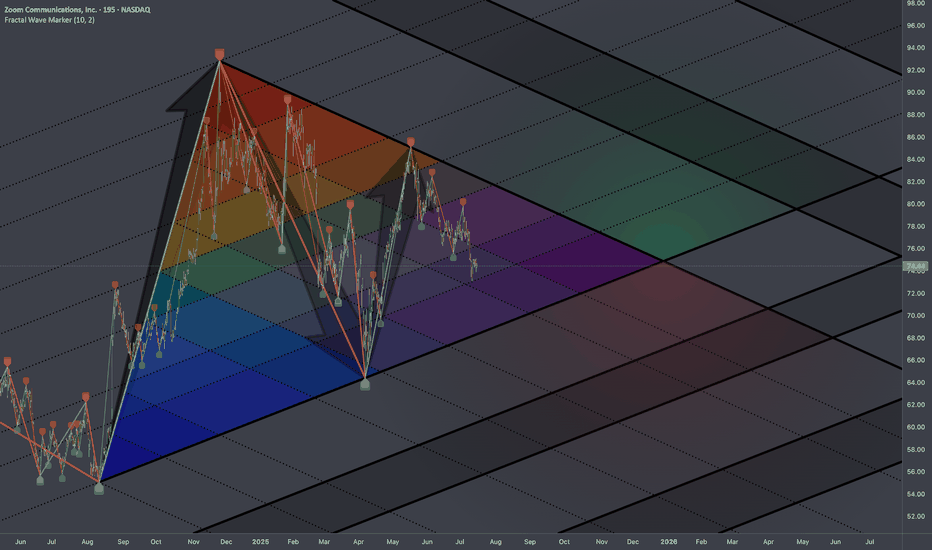

Upward breakout for ETH monthly?🟣 Ethereum Monthly Timeframe Analysis – Large Symmetrical Triangle

📌 Current Situation:

• On the monthly chart (1M), Ethereum (ETH) has formed a large symmetrical triangle pattern.

• This pattern typically signals a major price consolidation before a significant move.

• The descending resistance line connects the 2021 all-time high to recent lower highs.

• The ascending support line is drawn from the 2018 low through the 2022 bottom.

• Price is nearing the apex of the triangle, indicating a breakout is likely soon.

⸻

🔼 Bullish Scenario (Breakout to the Upside):

If ETH breaks above the triangle resistance and confirms the move:

✅ Signs of a Bullish Continuation:

• Strong breakout above the $4,000–$4,500 zone

• Increased volume confirming breakout

• Price holds above resistance-turned-support

🎯 Potential Price Targets by 2027 (based on triangle height & Fibonacci projections):

1. Target 1: $6,800 – $7,500

2. Target 2: $9,000 – $10,000

3. Long-term Target: $12,000 – $15,000 (if macro bull market continues)

⸻

🔽 Bearish Scenario (Fakeout or Breakdown):

If the breakout fails or price breaks down:

• ETH could revisit lower supports around $2,000 or even $1,400

• Bullish momentum delayed until another strong base forms

⸻

🔍 Conclusion:

• This triangle could mark the beginning of a major rally into 2027, especially if supported by fundamentals (e.g., ETF approval, DeFi growth).

• Wait for a confirmed breakout with volume and retest before entering a long-term position.

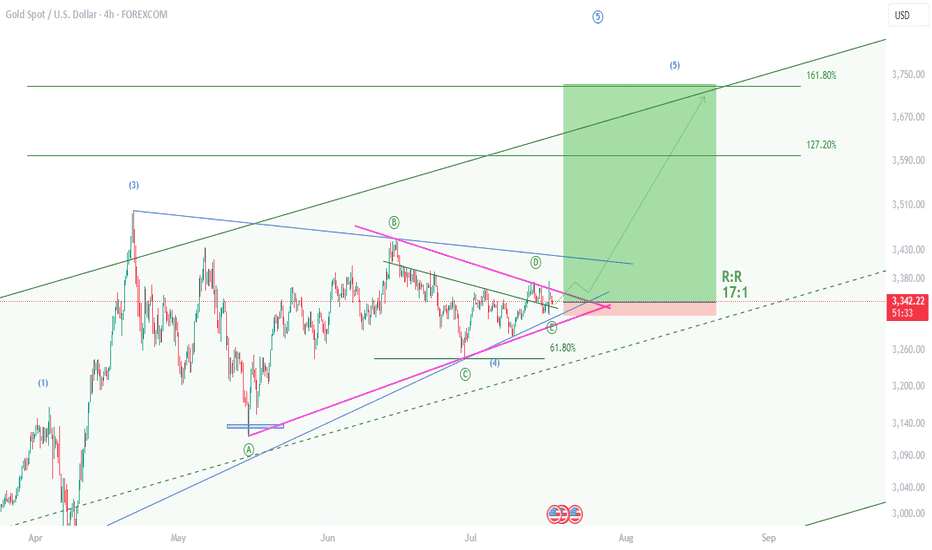

XAUUSD , Bullish Setup , R:R 17Hello friends

I am back after a long time and I want to share the results of my efforts of several years with you.

Gold is starting a 5th wave of bullishness and yesterday it gave us the necessary confirmations by rejecting the previous ceiling. I have identified the best buying position for you now. With a reward to risk 17

Take advantage of this opportunity.

If you are interested in Elliott waves or work in this field at a professional level, contact me and share your analysis with me.

I hope we will all be profitable together.

GOLD → Borders are shrinking. Consolidation continues...FX:XAUUSD is adjusting amid controversial CPI data and confirming the local bearish market structure. The PPI is ahead, and gold is consolidating, with its boundaries continuing to narrow...

Gold is recovering slightly but remains under pressure amid rising bond yields and a stronger US dollar. Higher inflation in the US reduces the chances of a quick Fed rate cut. Traders are cautious ahead of the PPI data release. If producer inflation exceeds forecasts, the dollar may rise again, putting further pressure on gold

Technically, we see consolidation in a symmetrical triangle pattern. Trading within the consolidation has a negative side - low volatility and unpredictable movements. The purpose of such movements is accumulation. However, decisions can be made based on relatively strong levels. In the current situation, we are seeing a rebound from 0.5 Fibonacci (I do not rule out a retest of the 0.7 zone before correction). The price may head towards the liquidity zone of 3322 before rising to the upper boundary of the consolidation and the zone of interest of 3350-3360.

Resistance levels: 3345, 3353, 3369

Support levels: 3322, 3312, 3287

The problem is that the price is in a consolidation phase. That is, technically, it is standing still and moving between local levels. You can trade relative to the indicated levels. Focus on PPI data. At the moment, gold is in the middle of a triangle and is likely to continue trading within the boundaries of a narrowing channel due to uncertainty...

Best regards, R. Linda!

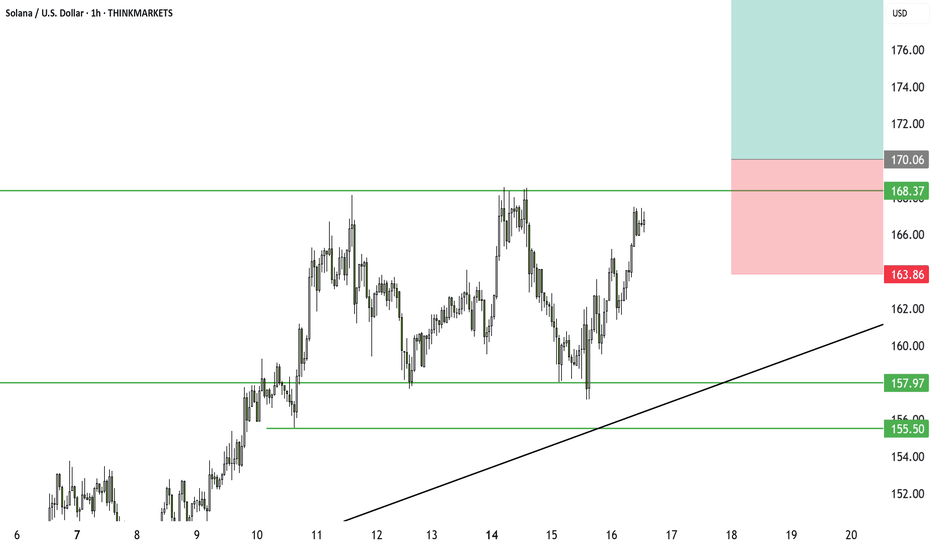

Solana breakout setup: why I am watching this level closelySolana is forming a clear ascending triangle. We already saw one breakout earlier, followed by a few hard retests. Now price has stalled. This might frustrate some, but I see opportunity. A clean break could deliver 14% upside. I also discuss Bitcoin, false moves, and why time stops matter in this environment. Watch closely.

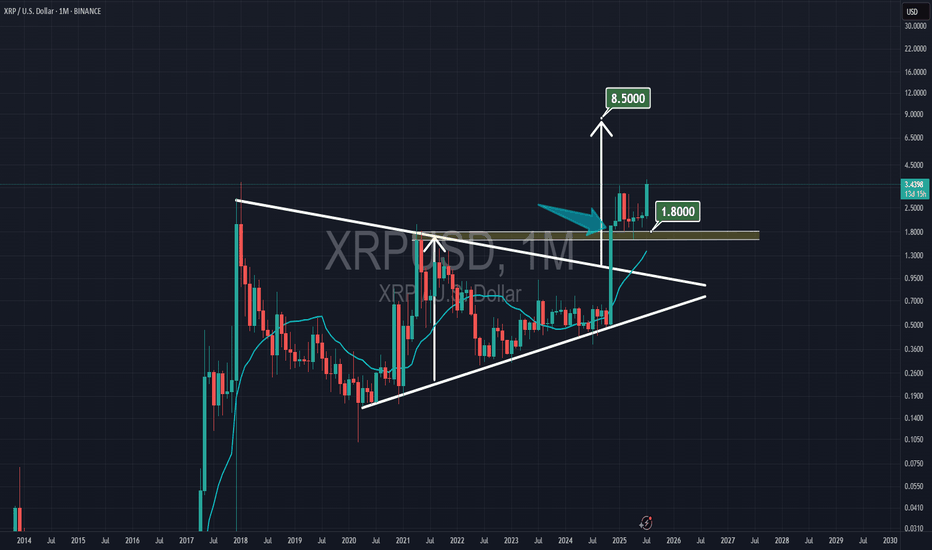

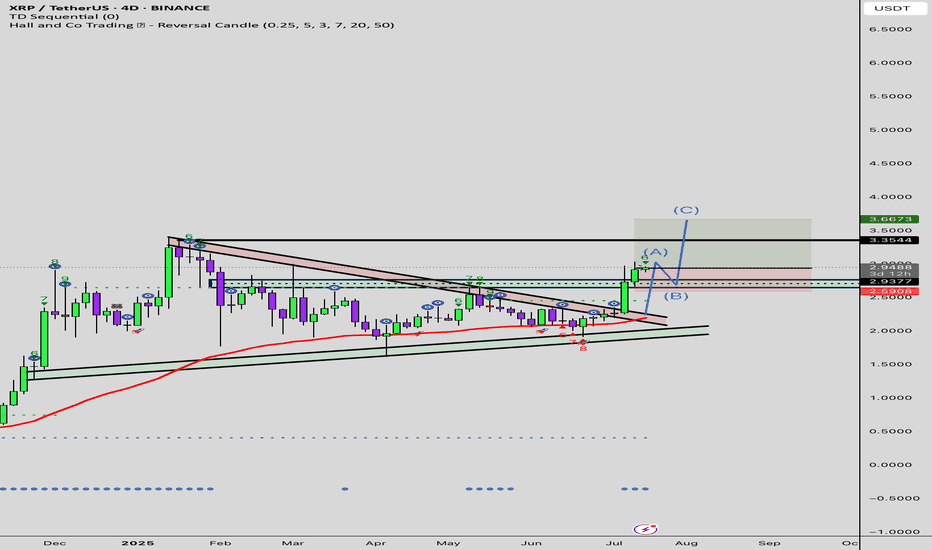

XRP/USD (RIPPLE) BUYtitle: XRP/USD (RIPPLE) BUY

Asset: Crypto

Symbol: XRP/USD

Market Entry Price 1: $2.9450

Limit Entry Price 2: $2.7450

Stop Loss: $2.6450

Take Profit 1: $3.145 (close 10%)

Take Profit 2: $3.345 (close 25%)

Take Profit 3: $3.645(close 50%)

Take profit 4: $3.845 (close 75%)

Let any remaining Xrp run risk free