#TRU/USDT Low Risk vs High Rewards#TRU

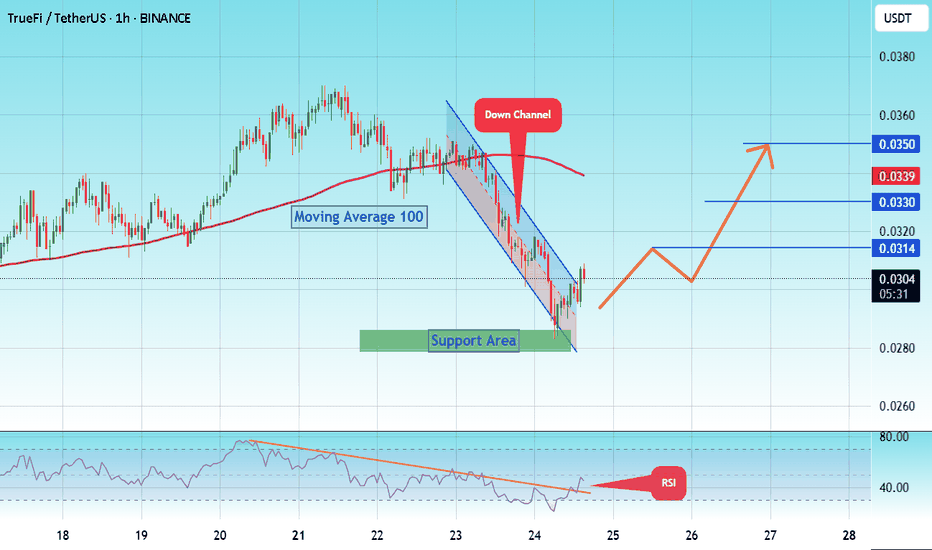

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.0285, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0280.

Entry price: 0.0300

First target: 0.0314

Second target: 0.0328

Third target: 0.0350

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

TRUE

TrueFi (TRU)#TRU

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.0270, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0260.

Entry price: 0.0275

First target: 0.0281

Second target: 0.0290

Third target: 0.0301

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#TRU/USDT#TRU

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0300.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are in a trend of consolidation above the 100 Moving Average.

Entry price: 0.0315

First target: 0.0327

Second target: 0.0337

Third target: 0.0350

#TRU/USDT#TRU

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0350

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0438

First target 0.0511

Second target 0.0553

Third target 00630

#TRU/USDT Ready to go higher#TRU

The price is moving in a descending channel on the 30-minute frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.0780

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0795

First target 0.0810

Second target 0.0836

Third target 0.0863

#TRU/USDT#TRU

The price is moving in a descending channel on a 30-minute frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.1200

Entry price 0.1200

First target 0.1250

Second target 0.1300

Third target 0.1370

Tru/UsdtBINANCE:TRUUSDT

### ** NYSE:TRU Update 🚨**

** NYSE:TRU ** has **broken out** of its **main falling wedge pattern** after consolidating for the past few months! 📉➡️📈 This is a major technical signal indicating potential for significant upward movement in the near future. 🔥

---

### **What's Happening?**

- **Falling Wedge**: The falling wedge pattern is typically a **bullish continuation pattern**, where the price gradually narrows between two converging trendlines. A breakout from this pattern often signals the start of an uptrend.

- **Consolidation**: Over the past few months, NYSE:TRU has been in a period of consolidation, meaning it was trading in a relatively tight range with no strong direction. Now that it has **broken** out of this pattern, the potential for **strong price movement** is on the table.

---

### **Potential Gains 💰**

- After breaking the wedge, there’s potential for **100%+ gains** if the bullish momentum continues. 🚀

- **First Target**: The immediate goal is to watch for the price to maintain its breakout level and potentially target **previous highs** or resistance areas from before the consolidation.

- **Long-Term Potential**: A sustained breakout could push NYSE:TRU even higher, depending on the market's response and broader trends.

---

### **Why This Matters:**

- **Bullish Breakout**: Breaking a falling wedge is often a sign that the asset is gearing up for strong upside movement. Investors who catch the breakout early could benefit from substantial returns.

- **Volume Confirmation**: Watch for **increased volume** accompanying the breakout. A strong breakout with high volume is usually more reliable than one with low volume, which might indicate a false breakout.

---

### **Next Steps 🔍:**

- Keep an eye on ** NYSE:TRU ’s price action** over the next few days. If the breakout holds, we could see rapid price increases as more buyers come in.

- Be mindful of possible **retests** of the breakout level (a pullback to the breakout zone), as this can provide a better entry for traders.

---

**Reminder**: Always do your own research (DYOR) and keep track of broader market conditions. 📚📊

(Not financial advice, just sharing the technical analysis! 😉)

#TRU/USDT#TRU

The price is moving within a bearish channel pattern on the 12-hour frame, which is a strong retracement pattern and was broken to the upside.

We have a bounce from a major support area in green at 0.0900

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum, and the price is based on it to rise after it was broken upward.

Entry price is 0.1250

The first target is 0.1800

The second target is 0.2100

The third goal is 0.2472

#TRU/USDT#TRU

The price has been moving in a descending triangle since the beginning of 2022

The price has now reached the downtrend and is about to break it.

We got support in the 0.03400 zone.

Price Now 0.0607

First Goal 0.1012

Second Goal 0.1494

Approximately 200% of the price

We have oversold on MACD

Moving Average 100 was broken, which gave a push for the price

TRUE BREAK THE IMPORTANT TREND LEVEL --> UP $0,30 POSSIBILITYThanks for reading this update.

True coin did break an important level, Our data shows that there is high interest for TRUE, which could break in the next time frames up $0,30, this based on the extra study we did on this coin.

We will follow the true trend to see if it's able to break.

Further study shows that this is a building coin.

This is not trading advice and will stay our view and expecting for the coming time.

TRUE NEW INCREASE VOLUMETRUE shows a new increase in volume, which could be confirmed in the coming time frames.

We will follow the coin to see if it's able to confirm.

The reason for the volume is the trend data that this coin shows.

This coin is at basic choice on daily trends.

True can show in the coming time frames interesting targets.

Building coins can take some time before action.

General Market – True Market Leaders?Here are the dates when the next wave of potential True Market Leaders (TMLs) have broken out.

We are seeing mixed action.

🟨 Yellow notes shows the stocks that are still above their pivot point

🟥 Red shows those who have been more volatile and have breached the pivot point

ATR - A theory on ATR Stop Loss and ATR Take ProfitsJus how to trade on ATR. Using ATR on XAUUSD, the ATR i found has alwasy been retested. So I meight be taking a profit and targeting 2 ATR but i found that price after 2 ATR will just touch and not stay there for long time,, and it will return at original point and start making a loss to stop me out of the position at a loss.

So to counter this, I decided to take profits at every 1++ ATR or 2 ATR. Then within 1-2 candles, the price will U-turn and start to target the ATRSL.

If the price moves fisrt to make a profit then quickly take out the position. But if price immediately going agianst you and targeting the ATRSL, it is better to wait out and not use a stop loss as price will retarget the original SL.

True Dollar Index - Adj. for IMF Currency Reserve Weight (2022)As there appears to be much discourse around the status of the dollar as "the world reserve currency", it seems interesting to me that the standard measure of the dollar's strength is not weighted in this way.

Here I am attempting to reconcile the standard dollar index (DXY), which measures the strength of the USD against a basket of other currencies (see below), with the dollar's presence within the IMF's World Currency Reserves (see below). I have chosen to call this the "True Dollar Index" (TDI)

To do so, I have first taken the ratio of the Dollar's IMF weight against each currency and multiplied it by the dollar denominated exchange rate. Then I attempt to normalize the value by dividing it by the average of the 9 dollar denominated exchange rates.

The equation I used for the 2022 TDI is as follows(*):

(USDEUR * (58.81/20.64) + USDJPY * (58.81/5.57) + USDGBP * (58.81/4.78) + USDCNH * (58.81/2.79) + USDCAD * (58.81/2.38) + USDAUD * (58.81/1.81) + USDCHF * (58.81/0.2) + USDSGD * (58.81/1.505) + USDHKD * (58.81/1.505)) / ((USDEUR + USDJPY + USDGBP + USDCNH + USDCAD + USDAUD + USDCHF + USDSGD + USDHKD)/9)

(*) This is in standard TradingView equation format and can be directly copy/pasted into the search bar - though values will convert to decimal

As the weighting of the IMF World Currency Reserves is shuffled and reported at the end of the year, this should only be taken to be valid as of Q1 2022.

For comparison, I have included the DXY in Orange. Note that I have adjusted the DXY by 41.0351, this is the difference in their starting values on Dec 31, 2021.

This should allow us to capture deviation from this starting point. I chose this action as opposed to adjusting the existing equation to for simplicity, though one could easily drag the TDI down by subtracting the same amount.

I make no claims to the accuracy of this chart as a measure of the strength of the dollar. I am not an economist, and I am happy to hear suggestions on how to improve this model.

DXY Geometric Weightings:

Euro (EUR), 57.6% weight

Japanese yen (JPY) 13.6% weight

Pound sterling (GBP), 11.9% weight

Canadian dollar (CAD), 9.1% weight

Swedish krona (SEK), 4.2% weight

Swiss franc (CHF) 3.6% weight

Currency composition of official IMF foreign exchange reserves:

Dollar (USD), 58.81%

Euro (EUR), 20.64%

Japanese yen (JPY), 5.57%

Pound sterling (GBP),4.78%

Chinese renminbi, 2.79%

Canadian dollar (CAD), 2.38%

Australian dollar (AUD), 1.81%

Swiss franc (CHF), .2%

Other, 3.01%*

*To account for this ambiguity, I have opted for a 50/50 split of the Hong Kong Dollar (HKD) and the Singapore Dollar (SGD). These are roughly equal in their use as a global payment currency at the time of writing and are the only top payment currencies not already included in the weighting.

Sources:

en.wikipedia.org

data.imf.org

🚨BTC Macro Cycle: "Hidden Death Cross" & "True Golden Cross"🚨In this idea, I identify what I call the 'Hidden' Death Cross & 'True' Golden Cross.

They are the the cross of the weekly 50 SMA & 50 EMA.

- With 8/8 historical cross cycles completed, this is statistically significant in the macro economic trend of Bitcoin and currently has a with 100% success rate.

a. "Hidden Death Cross" consistently delivers a significant market contraction

b. "True Golden Cross" consistently delivers a significant market expansion

This trend displays significant statistical probability, and while I propose we cannot expect future cycles to repeat past results, we can assume there is a high likely hood of the trend repeating in some form and used past results as guidelines for future performance.

Weekly "Hidden Death Cross" Data

5 Hidden Death Cross (HDC);

1. 26-Sep-2011: -60%

2. 07-Jul-2014: -73%

3. 28-May-2018: -62%

4. 24-Feb-2020: -61%

5. 30-Aug-2021: .......

6. .......................

Success Rate: 100%

Failure Rate: 0%

Average Contraction: -64%

2 Standard Deviations Range (99% Confidence):

Min -57% / Max -71%

BTC Weekly "True Golden Cross" Data

4 True Golden Cross (TGC);

1. 16-Jul-2012: +16'890%

2. 20-Jul-2015: +7'192%

3. 29-Apr-2019: +179%

4. 03-Aug-2020: +531%

5. ......................

Success Rate: 100%

Failure Rate: 0%

Average Expansion: +6'198%

2 Standard Deviations Range (99% Confidence):

Min - / Max 15'000%

Comparison wit the famous Daily Death Cross & Golden Cross Trend

BTC Daily "Death Cross" Data

BTC Daily: 7 Death Cross (DC);

1. 10-Apr-2014: +56%

2. 07-Sep-2014: -69%

3. 15-Sep-2015: +23%

4. 04-Apr-2018: -60%

5. 22-Oct-2019: -29%%

6. 26-Mar-2020: +50%

7. 23-Jun-2021: -22%

8. .......................

Success Rate: 57%

Failure Rate: 43%

Average Contraction: -50%

2 Standard Deviations Range (99% Confidence):

Min -20% / Max -70%

BTC Daily "Golden Cross" Data

BTC Daily: 5 Golden Cross (DC);

1. 08-Apr-2012: +24'169%

2. 13-July-2014: -23%

3. 21-July-2015: -30%

4. 02-Nov-2015: +6722%

5. 25-Apr-2019: +163%

6. 17-Feb-2020: -62%

7. 23-May-2020: +643%

8. 15-Sep-2021: .......

9. ........................

Success Rate: 57%

Failure Rate: 43%

Average Expansion: +7'924%

2 Standard Deviations Range (99% Confidence):

Min - / Max 21'000%

Additional Hidden Trend

Daily Death Cross & Golden Cross Triplets.

In addition to the standard crosses, we can identify a pattern of 3 crosses together;

1. Daily Death Cross, Golden Cross, Death Cross: This results in a bear market with a 100% success rate

2. Golden Cross, Death Cross, Golden Cross: This results in a bull market with 100% success rate

I will be posting on these trends more, since they are statistically significant and I believe will continue to display similar results, regardless of the FOMO or FUD that may be happening at the time.

What are your thoughts?

yemala