Bitcoin Nears $85K as Strategic Talks Grow. Where To Next?Bitcoin, the king crypto, is currently trading at $84,848.36. It has gained 3.10% in the last 24 hours, with a daily trading volume of $30.09 billion. Bitcoin’s market capitalization now stands at $1.68 trillion.

Globally, Bitcoin continues to gain attention at the policy level. In the U.S., there are growing discussions about recognizing Bitcoin as a national strategic asset. A U.S. Senator recently suggested the country acquire 1 million BTC, reinforcing the idea. Florida has introduced legislation allowing public funds to invest in Bitcoin.

North Carolina is considering recognizing Bitcoin as a legal payment method. Arizona’s Senate is evaluating the creation of a home-based Bitcoin activity policy and the possibility of a state reserve. Meanwhile, New Hampshire passed a bill allowing up to 10% of its state funds to be invested in Bitcoin. In Europe, Sweden is assessing the idea of adding Bitcoin to its national reserves for financial stability.

Technical Analysis

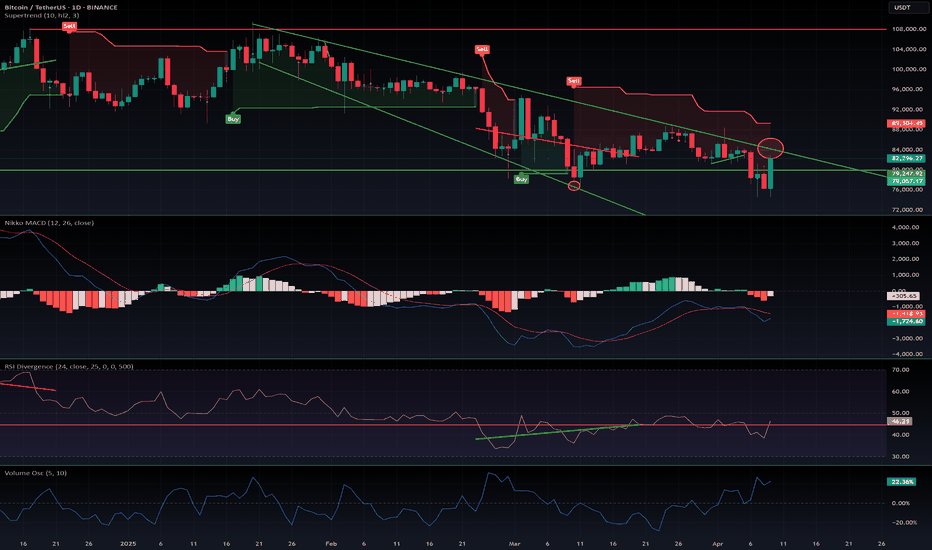

From a technical view, Bitcoin has been in a bearish phase since reaching its all-time high of $109,358 on January 19. Since then, the price has been forming an internal structure of lower highs and lower lows, a clear sign of a downtrend. It dropped to a low of $74K after Trump-era tariffs hit the market but has since rebounded to current levels.

The recent lower high stands at $88,996. The trend remains bearish until that level is broken with a strong candle close above it. If Bitcoin breaks and closes above this point, analysis show a potential move toward new highs. Without that breakout, bearish pressure may resume, possibly pushing the price back down to test support near $73K.

Trump

Gold ETF(GLD) - Gold is the Safe Haven?Is Gold the safe haven from all the market turmoil? Looking at the chart, it would appear that Gold is unfazed by current market conditions. Price is still making All-Time Highs as price continues to swing above the 25(green), 100,(yellow) and 200(blue) day EMAs. Further fears in the Bond market may increase interest in Gold as a stable asset. What are you thoughts? What are some other assets that are defying 'gravity'?

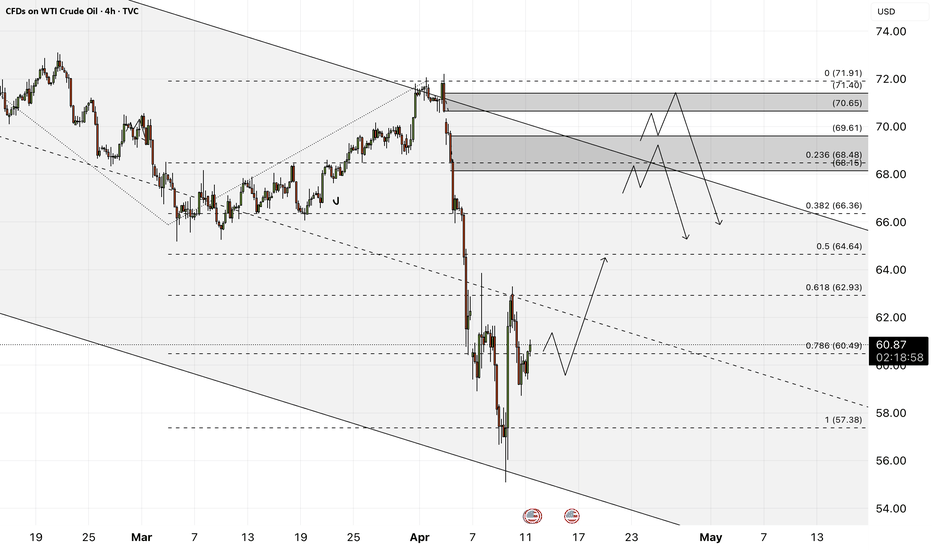

WTI - Will Iran return to the group of oil producers?!WTI oil is below the EMA200 and EMA50 on the 4-hour timeframe and is moving in its medium-term descending channel. If the correction towards the supply zone continues, the next oil selling opportunity with a suitable reward for risk will be provided for us. In this direction, with confirmation, we can look for oil buying transactions.

The U.S. Energy Information Administration (EIA), in its latest report, has downgraded its forecasts for oil and natural gas production, consumption, and prices for 2025 and 2026, while warning about the uncertain outlook of the energy market amidst economic volatility and escalating trade tensions.

According to the updated estimates, U.S. crude oil production in 2025 is expected to reach 13.51 million barrels per day, down from the previous forecast of 13.61 million barrels. For 2026, the figure has been revised to 13.56 million barrels per day, a reduction from the earlier 13.76 million forecast. Monthly data shows average U.S. oil output stood at 13.44 million barrels per day in April and 13.55 million in March, with similar levels expected in May.

Globally, EIA projects oil production in 2025 to be around 104.1 million barrels per day, slightly down from the earlier estimate of 104.2 million. For 2026, the revised figure stands at 105.3 million barrels per day compared to the previous 105.8 million.

On the demand side, global oil consumption forecasts have also been reduced. In 2025, demand is now estimated at 103.6 million barrels per day instead of 104.1 million, and for 2026 it is projected at 104.7 million barrels per day, down from the prior estimate of 105.3 million.

Regarding natural gas, the EIA reports that average U.S. gas production in April will be around 115 billion cubic feet per day, slightly lower than the 115.3 billion cubic feet reported in March. May’s forecast stands at 115.4 billion cubic feet. Demand has also dipped, with estimates for 2025 now at 91.2 billion cubic feet per day (down from 92), and for 2026 at 90.5 billion (previously 91.1).

In terms of pricing, EIA has made significant downward revisions. The average price of West Texas Intermediate (WTI) crude oil is now forecast to be $63.88 per barrel in 2025, compared to the earlier $70.68. For 2026, this drops further to $57.48. Brent crude is now estimated at $67.87 for 2025 and $61.48 for 2026, both notably lower than prior projections.

One key highlight from the report is EIA’s warning about high volatility in major commodity prices, especially crude oil. The agency underlined that reciprocal tariffs between China and the U.S. could heavily impact markets, particularly the propane sector.

EIA noted that U.S. liquefied natural gas (LNG) exports are likely to remain resilient despite trade disputes. This is attributed to strong global demand and the flexible nature of U.S. export contracts, which allow unrestricted shipments to multiple destinations.

However, when it comes to oil and petroleum products, the agency maintained a more cautious tone, emphasizing that recent shifts in global trade policies and oil production patterns may slow the growth of demand for petroleum-based products through 2026.

Altogether, the downward revisions by the EIA carry a clear message: the energy market outlook over the coming years is fraught with uncertainty. From supply and demand to pricing, political and economic forces such as trade wars and potential global recessions are expected to play decisive roles.

Meanwhile, according to Reuters, after U.S. President Donald Trump once again threatened military action if Tehran refuses to agree to a nuclear deal, a senior Iranian official responded by warning that Iran may halt its cooperation with the U.N.’s nuclear watchdog.

Reports indicate that American and Iranian diplomats will meet in Oman on Saturday to begin talks on Tehran’s nuclear program. Trump stated that he would have the final say on whether the negotiations are failing, which could place Iran in a highly dangerous position.

Ali Shamkhani, a senior adviser to Iran’s Supreme Leader, posted on X (formerly Twitter) that ongoing foreign threats and the looming threat of military confrontation could lead to deterrent actions such as expelling International Atomic Energy Agency (IAEA) inspectors and cutting ties with the agency.He also mentioned that relocating enriched uranium to secure, undisclosed locations within Iran may be under consideration

Revolving Credit Recession?YES! We are!

Revolving credit does not roll over like this unless people are scared! The question is are we already in a recession? We won't know until after the fact. But my guess would be YES!

My question is will we end up in a depression or not?

Click Boost, Follow, Subscribe, and let me help you navigate these crazy markets.

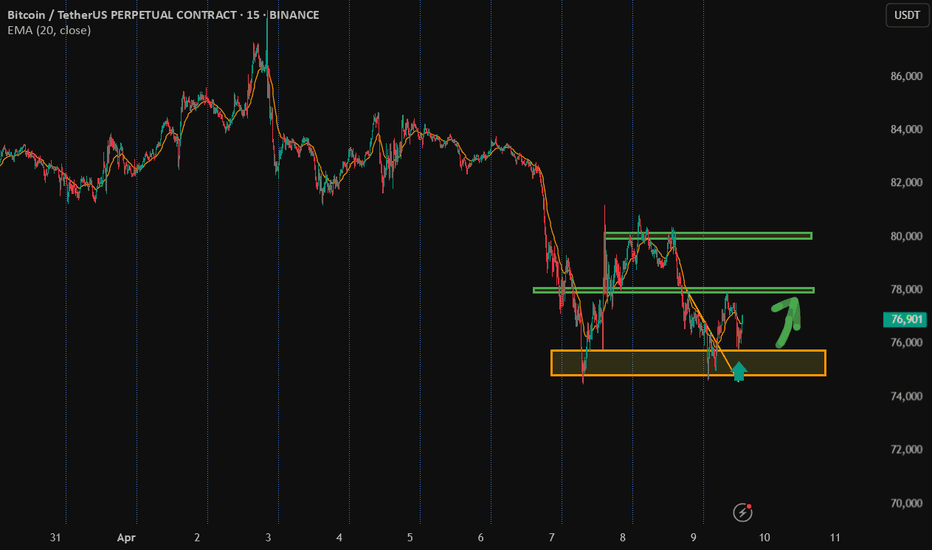

Trump Manipulates the Market Again: Tariffs ON/OFF PlayOnce again, we’re watching how political narratives are used to shake the markets — and Bitcoin was no exception this time.

🔻 Step 1: "TARIFFS ON" Announcement

Market instantly reacts with a sharp sell-off

BTC drops from 81K to nearly 75K

Fear spikes, media goes wild

📉 That’s your classic short squeeze setup.

🔺 Step 2: "TARIFFS OFF" Retraction

Massive green candle, BTC rebounds from lows

Shorts get liquidated

Price rips back up in minutes

💸 It’s a textbook fake panic followed by a well-timed reversal. Someone knew what was coming. Someone profited. And it wasn’t retail.

🔎 What does this mean? This is not just market volatility — this is narrative-based manipulation. If you're trading without paying attention to headlines, you're already behind.

🧵Follow the money. Follow the timing. Follow the candles. #Bitcoin #BTCUSD #MarketManipulation #Tariffs #Trump #PoliticsInMarkets #Whales #NarrativeTrading #PriceAction

SPY Analysis & Tariff TurmoilLast Friday, the market pressure was intense, and my bullish call option, targeting $537.64 on SPY, seemed overly ambitious as tariffs and political uncertainties peaked. I stated, " AMEX:SPY Trump went all in thinking he had the cards. We were getting sent back to the McKinley era," wondering when or if Trump would fold under international pressure and market realities.

Fast-forward to Wednesday, April 8—Trump didn't just blink; he folded utterly, reversing the harsh tariff policies he initially defended aggressively. Prompted by China's aggressively dumping of U.S. Treasuries and stark recession warnings from Goldman Sachs, BlackRock, and JPMorgan, Trump pivoted significantly:

• Base tariffs: 10%

• Tariffs on China: Increased to 125%

• Tariffs on U.S. goods entering China: Increased to 84% starting April 10

While temporarily bullish, these sudden, dramatic policy swings underline ongoing instability and volatility. However, with big bank earnings on deck this Friday, short-term momentum looks positive.

Technical Levels & Trade Ideas

Hourly Chart

The hourly chart reveals a critical zone—dubbed "Liberation Day Trapped Longs"—between $544.37 (H. Vol Sell Target 1b) and $560.54 (L. Vol ST 2b). Bulls trapped here from recent highs may now look to exit on a relief rally.

• Bullish Scenario:

• Entry: SPY reclaiming and holding above $544.37.

• Target 1: $560.54 (top of trapped longs)

• Target 2: $566.54 (next resistance area)

• Stop Loss: Below recent lows near $535 to limit downside.

• Bearish Scenario (if tariffs intensify again or earnings disappoint):

• Entry: Breakdown confirmation below $535.

• Target 1: $522.20 (Weeks Low Long)

• Target 2: $510.00, potential further support

• Stop Loss: Above $544.50 to manage risk effectively.

Daily Chart Perspective

The broader daily chart shows SPY stabilizing around key lower supports after significant volatility. Recent price action suggests cautious optimism for an upward bounce, but considerable headwinds remain if tariff escalations resume.

Final Thoughts

The rapid tariff reversals and heightened volatility are unsettling. The short-term bullish move offers potential quick upside trades into earnings, but caution remains paramount. You can continue managing risks prudently and watch closely for political or economic headlines that could quickly shift market sentiment again.

$BTC consequences of the Trump 90 days tariff pauseCan It Last? Is This a Trend Reversal?

Today, #Bitcoin surged over +8%, but surprisingly, #Tesla outperformed with a massive +20%—almost as much as $FARTCOIN! 🤯

History is being written, and we’ll remember this day… but is this truly the end of the consolidation phase?

What to Watch:

📈 Price Action: Bitcoin must break above the descending trendline (in green) and close a daily candle above it to flip resistance into support. The price to watch is $84.5k. Closing under 80k would invalidate this pump.

📊 RSI: Currently in mid-range—could swing either way.

🔁 MACD: Was turning bearish. We need a clear bullish crossover to confirm a trend continuation.

Conclusion:

With all the recent global tensions, many investors are feeling a sense of relief, especially as the trade war appears paused until September. This gives markets some breathing room to recover.

However, it’s not all clear skies yet:

Bitcoin is still stuck inside the descending bearish channel.

The recession risk hasn't gone away.

Trump may have been pressured to offer good news to avoid a full-blown market crash.

🕵️♂️ Let’s see how the weekly candle closes after this sharp move to the upside.

HOW IS CRYPTO SHAPING UP?Trump and tariffs have a firm grip on the economic world as of late, so where does that leave the crypto market?

TOTAL has a clear structure since the beginning of the bull market in 2023, in the last 3 days TOTAL has wicked into the bullish trendline support but sits within a bearish trend channel. This level also coincides with the bullish orderblock that started the leg up post US election so a very strong level of support here.

Do I think this is the end and the bottom is in? The chart would make a very good case for it however I believe that the Geo-politics outweigh Technical Analysis currently, at least in the short term. Everyone is watching for the latest news release/Trump announcement and all the time that is going on the market is very reactionary with less passive orders and more reactionary news based market orders. That taken into account in the short term this is a game of musical chairs with massive volatility swings and liquidations left right and center, a traders dream.

I'm very interested in how the FED will react to this, once we start getting emergency or early interest rate cuts that for me is when BTC will take the next step up and will flip to an investor/buy and hold environment, whether that's from here, lower or higher I'm not sure but but BTC needs a risk-on environment to thrive and Trump is doing his best to force J Powells hand.

HAPPENING NOW?! HERTZ CUP AND HANDLE BREAKOUT 1D CHART?HERTZ (HTZ) Price rose significantly to $4.26 on the 1 Day chart. Is this a sign of an impending bullish breakout? My personal target opinion for bullish movement is $5.50. Will this be a major bullish turning point for Hertz? Or will it be a easy grab for traders running short positions?

Bitcoin Eyes $81,500 Resistance Following Trump's Tariff Pause. 🚨 **Market Update** 🚨

President Donald Trump has announced a 90-day pause on the full effect of new tariffs for certain countries, and the markets are reacting strongly! 📈 Both the stock and crypto markets are surging as a result.

Right now, **Bitcoin** is testing the $81,500 resistance level on the 1-hour timeframe. 💥 Our trading strategy: let it break the resistance and sustain above it, then look for a solid entry on the pullback.

Stay tuned and trade wisely! 🚀💰

Ethereum Surges Past Resistance as Trump Halts Tariff Plans..!🚨 **Market Update** 🚨

President Donald Trump has announced a 90-day pause on the full effect of new tariffs for certain countries, and the markets are reacting strongly! 📈 Both the stock and crypto markets are surging as a result.

Right now, Ethereum is testing the $1600 resistance level on the 1-hour timeframe. 💥 Our trading strategy is to let it break the resistance and sustain above it, then look for a solid entry on the pullback.

Stay tuned and trade wisely! 🚀💰

Trump's Tariff Wars : Why It Is Critical To Address Global TradeThis video, a continuation of the Trump's Tariff Wars video I created last week, tries to show you why it is critically important that we, as a nation, address the gross imbalances related to US trade to global markets that are resulting in a $1.5-$1.8 TRILLION deficit every fiscal year.

There has been almost NOTHING done about this since Trump's last term as President.

Our politicians are happy to spend - spend - spend - but none of them are worries about the long-term fiscal health of the US. (Well, some of them are worried about it - but the others seem to be completely ignorant of the risks related to the US).

Trump is raising this issue very early into his second term as president to protect ALL AMERICANS. He is trying to bring the issue into the news to highlight the imbalances related to US trade throughout the world.

When some other nation is taking $300B a year from the us with an unfair tariff rate - guess what, we need to make that known to the American consumer because we are the ones that continue to pay that nation the EXTRA every year.

Do you want to keep paying these other nations a grossly inefficient amount for cheap trinkets, or do you want our politicians and leaders to take steps to balance the trade deficits more efficiently so we don't pass on incredible debt levels to our children and grandchildren?

So many people simply don't understand what is at risk.

Short-term - the pain may seem excessive, but it may only last 30, 60, 90 days.

Long-term - if we don't address this issue and resolve it by negotiating better trade rates, this issue will destroy the strength of the US economy, US Dollar, and your children's future.

Simply put, we can't keep going into debt without a plan to attempt to grow our GDP.

The solution to this imbalance is to grow our economy and to raise taxes on the uber-wealthy.

We have to grow our revenues and rebalance our global trade in an effort to support the growth of the US economy.

And, our politicians (till now) have been more than happy to ignore this issue and hide it from the American people. They simply didn't care to discuss it or deal with it.

Trump brought this to the table because it is important.

I hope you now see HOW important it really is.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trumpenomics - Market Volitility - How low will it go?What we know:

When Trump entered office he said the stock market was too high and he was not investing in the markets.

The Tariffs have caused volatility and a decline in the markets.

Market drops in the past have been between 30% and 60%.

How far do you think the market will drop this time?

GBPCHF PoV - BUY POINT 1.07000???The GBP/CHF exchange rate has shown a significant bearish trend, especially after breaking the support at 1.110. Currently, the pair is heading towards the 1.07 area, indicating sustained selling pressure.

One possible cause of this movement could be related to tariff issues and the economic uncertainties associated with them. Trade policies, including tariffs, can significantly affect currencies as they impact expectations about economic growth and international trade. Recent news about the introduction or tightening of tariffs between the UK and other countries may have contributed to a negative sentiment toward the British pound, strengthening the Swiss franc as a safe-haven currency.

To fully understand the reasons behind the current trend of GBP/CHF, it's essential to monitor the latest economic and political news, especially those related to trade policies and the UK's international relations. A close examination of economic data and political developments can provide clearer insights into the future outlook for this currency pair.

Spy what I see with my little eyeTraders,

Fear, trade wars, WW3, Tariffs and a bunch of I told you soo's..... "You voted for this!" just a bunch of chirping. Because this man got to being a billionaire being a silly goose yeah? What happens when them 401k's start 3x'n, what happens when we see one of the biggest bull markets we have experienced in our lifetime?

I don't know much but I know this..... the bull market may not be over. Just taking a break!

Enjoy the hopium!

Stay Profitable!

Savvy

Fil has BottomedTraders,

Like it or love it, this is an unpopular opinion in a sketchy time in the market. Regardless, our team thinks we have bottomed for alt, its discount season! You name it and it is at the bottom!!

We hope you enjoy a little hopium in these uncertain times!!

Stay Profitable,

Savvy!

TSLA Best Level to BUY/HOLD 100% bounce🔸Hello traders, today let's review daily chart for TSLA. we are

looking at a 67% correction, almost complete now, another 67%

recent correction presented on the right.

🔸Most of the bad news already price in and we are getting

oversold, expecting a bottom in weeks now not months.

🔸Recommended strategy bulls: BUY/HOLD once 67% correction

completes at/near strong horizontal S/R 140/150 USD, TP bulls

is 280/300 USD, which is 100% unleveraged gain.

**Tesla (TSLA) Market Update – April 9, 2025**

📉 **Stock Decline:** TSLA closed at $221.86, down 4.9%, amid new tariffs and CEO Elon Musk's political involvement

**Analyst Downgrades:*

Wedbush's Dan Ives cut the price target by 43% to $315, citing a "brand crisis"

Wells Fargo's Colin Langan set a target at $130, anticipating a potential 50% drop

📊 **Delivery Shortfall:** Q1 deliveries fell 13% year-over-year to 336,000 vehicles, missing expectations by about 40,000 unis.

🌍 **Tariff Impact:** President Trump's new tariffs are expected to increase costs and disrupt Tesla's supply chain, especially concerning Chinese operatins.

💡 **Investor Sentiment:** Analysts express concern over Musk's political ties affecting Tesla's brand and sales, particularly in China.

The Trump PatternWhen Donald Trump took office in 2017, the U.S. stock market experienced dramatic fluctuations—marked by steep declines followed by eventual rebounds.

This pattern, which we'll call the "Trump Pattern," repeated itself during his presidency and is now emerging again as a point of interest for investors.

While the specific causes of these market shifts varied, key factors—particularly tariffs, inflation concerns, and Federal Reserve (FED) actions—played critical roles in the market's rise and fall during Trump’s presidency.

The Trump Pattern: The Market Fall and Recovery

🏁 1. The Start of the Trump Presidency (2017)

When Donald Trump was elected in 2016, the market responded with a combination of excitement and uncertainty. Initially, the market surged due to tax cut expectations, deregulation, and optimism about a business-friendly administration. But as Trump's presidency fully began in January 2017, concerns over trade wars and tariff policies began to dominate investor sentiment.

The market initially dipped after Trump began pursuing a protectionist trade agenda, especially with China.

As concerns about tariffs escalated, stock markets reacted negatively to potential trade wars.

💶 2. The Tariff Crisis of 2018

The first major example of the "Trump Pattern" emerged in 2018 when Trump began implementing tariffs, particularly on Chinese imports, and announced new tariffs on steel and aluminum. This caused major market disruptions.

The S&P 500 fell dramatically during this period, dropping by as much as 8.6% from its February peak in 2019.

Companies that relied heavily on international trade, like Apple, General Motors, and Ford, experienced significant stock price declines. In fact, Apple’s stock fell 9.5% on days when new tariffs were announced, as their costs for manufacturing overseas rose.

The uncertainty surrounding the global economy, combined with rising tariffs, created fears of a trade war, leading to sharp market declines.

📈 3. Market Recovery: FED Rate Cuts and Tax Cuts

Despite the tariff-induced volatility, the market didn’t stay down for long. After significant market falls, the Federal Reserve (FED) began implementing interest rate cuts to combat slowing economic growth. These actions helped stabilize the market and even fueled a rebound.

FED rate cuts made borrowing cheaper for consumers and businesses, stimulating economic activity and boosting investor confidence.

Additionally, tax cuts, a cornerstone of Trump’s economic policy, provided further support, particularly for corporations.

As a result, after the initial market drop in 2018 and early 2019, the market rebounded, continuing to climb as investors reacted positively to these fiscal and monetary policies.

🎯 The 2024 and 2025 "Trump Pattern" Emerges Again

Fast forward to 2024 and 2025, and we’re seeing echoes of the "Trump Pattern" once again. New tariffs, introduced in 2025, have reignited concerns about a trade war. These tariffs, particularly on Chinese imports, have once again caused market volatility.

The stock market has fallen in recent months due to concerns about these tariffs and the impact they might have on global trade. For example, when new tariffs were introduced in early 2025, the market saw a sharp sell-off, with the S&P 500 falling by over 1.8% in a single day.

Companies that rely on international trade, like Tesla and Ford, have seen their stock prices drop in response to concerns about increased production costs.

The broader market decline, much like in 2018, was driven by fears that tariffs could slow down the global economy and hurt corporate profits.

However, there is optimism that the same pattern will unfold, where the market eventually recovers after these initial drops.

⚠️ 4. FED Rate Cuts Again?

As inflation concerns persist, the Federal Reserve is likely to step in once again. Like previous cycles, we expect the FED to cut interest rates to stimulate the economy. This would be aimed at reducing borrowing costs, encouraging investment, and helping businesses weather the impact of higher tariffs and global uncertainty.

The FED’s actions are typically a key driver of market recovery in the "Trump Pattern." Investors have come to expect that a market downturn triggered by political or economic disruptions can be offset by the FED’s supportive monetary policies.

⚖️ Navigating the Trump Pattern: What Should Investors Do?

The "Trump Pattern" highlights that during periods of heightened uncertainty, especially due to trade policies like tariffs, the market will often experience short-term declines followed by long-term recovery. Here are a few strategies investors might want to consider:

Stay Diversified : During periods of volatility, having a diversified portfolio can help cushion against the risks posed by market swings.

Invest in Domestic Companies : Companies that rely less on international supply chains might fare better during periods of trade policy changes and tariff uncertainty.

Focus on Growth : Once the initial market decline subsides, look for sectors that stand to benefit from a recovering economy, such as tech or consumer discretionary stocks.

Look for Inflation Hedges : Given the potential for inflation, consider investments that tend to perform well during these times, such as real estate or commodities like gold.

📝 Conclusion: The Trump Pattern in Action

The "Trump Pattern" demonstrates how the market tends to react in cycles during the early months of each presidency. Typically, the market falls at the start due to the uncertainty surrounding Trump’s trade policies, particularly tariffs. However, after these initial drops, the market often rebounds thanks to FED rate cuts and other policies aimed at stimulating the economy.

Looking ahead to 2025, we're already seeing signs of this pattern in action as tariffs are back on the table and market volatility has followed. However, history suggests that patience might pay off. Once the FED steps in and cuts rates, a market rebound is likely, following the same trend we saw in 2017-2019.

USDCHF PoV - Long POINT 0.82$!Currently, the USD/CHF pair is going through a bearish phase, influenced by several economic and geopolitical factors.

Influence of US Trade Tariffs: Recent trade tariffs imposed by the United States have strengthened the Swiss franc, creating pressure on Switzerland's export-oriented economy. This scenario could push the Swiss National Bank (SNB) to consider introducing negative interest rates to counter the appreciation of the currency and support the economy.

Monetary Policy of the SNB: In June 2024, the SNB reduced interest rates by 25 basis points, bringing them to 1.25%. Inflation forecasts were revised downward, indicating 1.3% for 2024 and 1.1% for 2025. These adjustments reflect economic challenges and the SNB's intent to avoid deflation.

Swiss Franc Forecast: Analysts from Bank of America have expressed doubts about the sustainability of the Swiss franc's weakness in 2025. Despite expectations of lower interest rates, the SNB may be reluctant to implement unconventional measures, given the limited effectiveness of such policies in the past.

Technical Analysis: The daily chart shows a range between a maximum of 0.82 and a minimum of 0.92, which has been respected for the past three years. Currently, the price is approaching the upper limit of the channel, suggesting a possible downward correction. However, a break above 0.92 could indicate an extension of the bullish movement.

Conclusion: The bearish trend of USD/CHF is influenced by both internal and external factors, including SNB policies, US trade tariffs, and market dynamics. Investors should closely monitor SNB decisions, international trade policies, and key economic indicators to assess potential developments in the USD/CHF exchange rate.