Huge Bear Trap next in line??Ethereum Exit Queue: 518,180 ETH

Half a million ETH is currently queued for unstaking on Ethereum...

Keep in mind, August 1st, Trump's Reciprocal Tariffs get in effect

Everyone's talking about BTC's new ATH, ETH's rally, XRP new ATH, but no one is talking about August 1st...

Manipulation is taking place. Stay safe, because a huge bear trap might be next in line (BTC back to 90K)

*NOT INVESTMENT ADVICE*

#crypto #ethereum #eth #btc #bitcoin #trading #xrp #trump #tariff #finance #economy

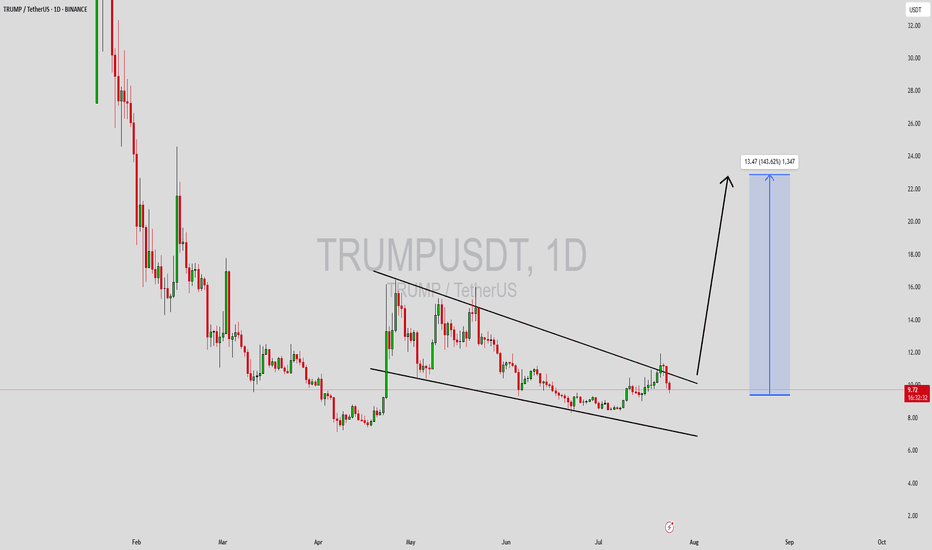

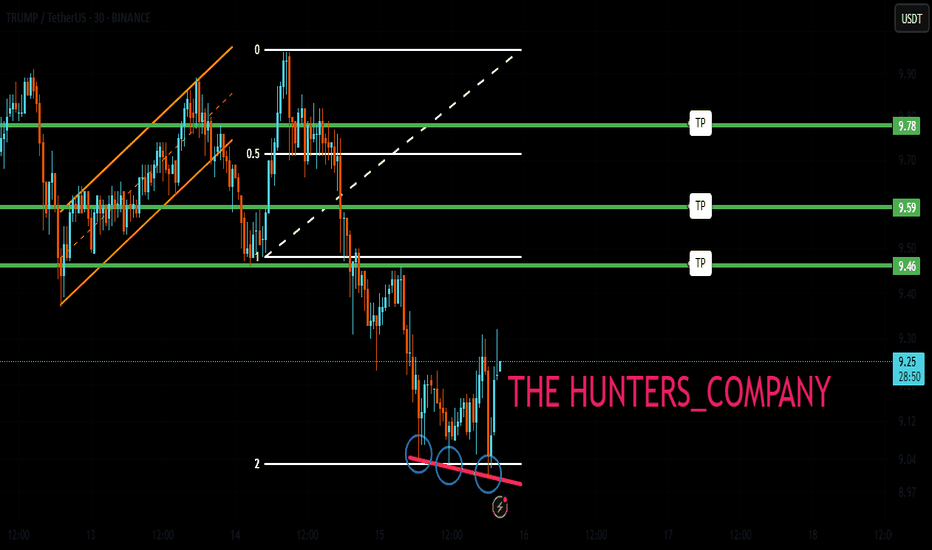

Trump

TRUMPUSDT Forming Falling WedgeTRUMPUSDT is currently forming a well-defined falling wedge pattern—a bullish reversal structure that often leads to significant upside breakouts. The price has been consolidating within narrowing trendlines and now appears to be approaching a breakout point. Historically, falling wedge patterns in the crypto market have led to aggressive rallies, especially when combined with rising volume and strong community sentiment. With good volume backing this setup, a breakout could trigger a sharp move to the upside, projecting an expected gain of 90% to 100%+ in the coming sessions.

Investor interest in the TRUMPUSDT project has been steadily increasing, likely fueled by the coin’s strong branding and community-driven momentum. Meme-based and politically themed tokens have seen explosive growth in recent bull cycles, and TRUMPUSDT may be positioning itself to capitalize on similar attention. With sentiment aligning positively and technicals flashing bullish signals, the coin is attracting both short-term swing traders and long-term speculative holders.

If TRUMPUSDT confirms a breakout above the upper wedge resistance with volume confirmation, we could see rapid price expansion. Traders should monitor key levels and consider re-entry on retests or strong bullish candles. The momentum shift is already becoming apparent, and this coin could turn into a trending asset in the meme-token segment very soon.

Keep this setup on your radar as it may provide high-reward opportunities. Monitor community updates, upcoming events, and broader meme coin momentum across the market for additional confirmation.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

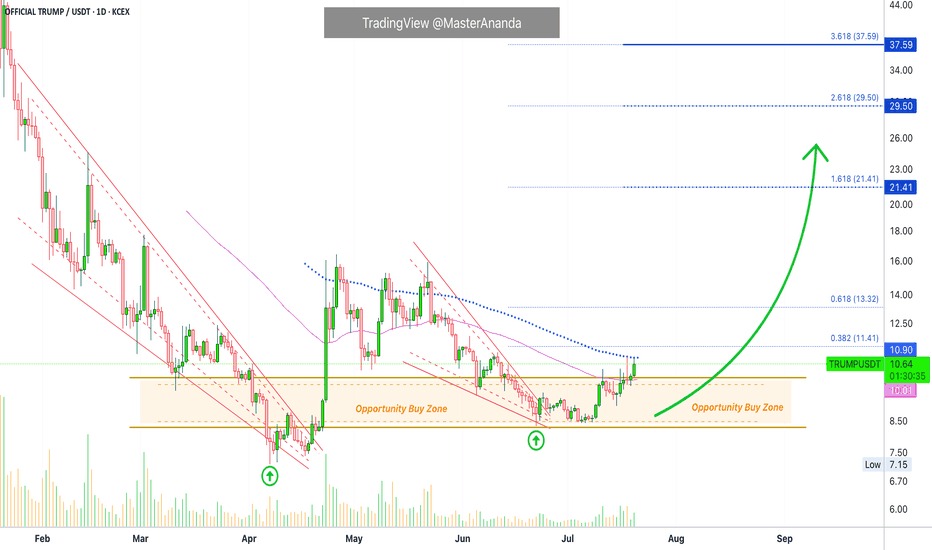

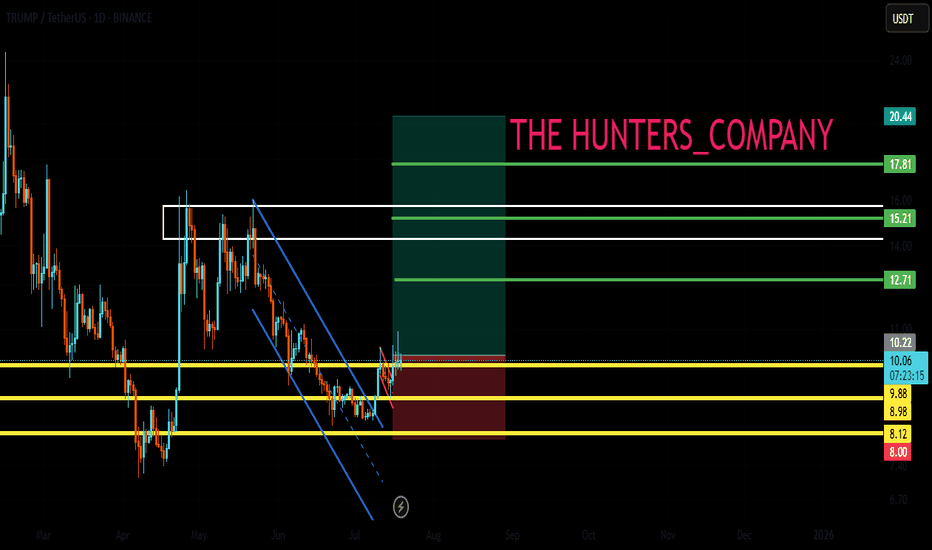

TRUMPUSDT: Massive Reversal Incoming? Reaccumulation Zone!

📉 Current Market Outlook:

TRUMPUSDT is currently positioned at a highly strategic technical level. After an extended downtrend since February—dropping from the 60 USDT region to a low of around 7.13 USDT—price has now stabilized and entered a strong reaccumulation zone between 8.50 and 10.20 USDT.

This zone has acted as a reliable support range and shows signs of smart money accumulation, as evidenced by volume spikes and strong price reactions off this base.

---

🧠 Technical Pattern & Structure:

🔸 Base Accumulation / Reaccumulation Rectangle

Price has been consolidating in a tight horizontal range, forming a classic reaccumulation pattern, often seen before major breakouts.

🔸 False Breakdown – Bull Trap Reversal Setup

The brief dip below 8.50 USDT (to 7.13) followed by a strong recovery suggests a potential “shakeout” phase to remove weak hands before a rally.

🔸 First Higher Low Formation

Recent price action has formed a higher low, a key structural signal of a potential trend reversal from bearish to bullish.

---

🟢 Bullish Scenario (Primary):

If price continues to hold above the reaccumulation zone and breaks above 12.48 USDT with strong volume:

Short-Term Targets:

🔹 15.11 USDT

🔹 17.11 USDT

Mid-to-Long Term Targets (if bullish momentum sustains):

🔸 21.59 – 27.96 USDT

🔸 Ultimate target: 46.65 USDT (retest of previous major supply zone)

📈 Potential upside: Over 200% from current levels

---

🔴 Bearish Scenario (Alternative):

If the price fails to hold above the demand zone (drops below 10.00 USDT):

Possible retest of key supports:

🔹 8.50 USDT

🔹 7.13 USDT (major swing low)

⚠️ A confirmed breakdown could signal a continuation of the macro downtrend.

---

🔍 Key Levels to Watch:

Price Level Type Notes

7.13 USDT Major Support Previous swing low

8.50–10.20 USDT Demand Zone Reaccumulation / strong buyer interest

11.25 – 12.48 USDT Key Resistance Breakout trigger zone

15.11 – 17.11 USDT Minor Resistance First bullish targets

21.59 – 27.96 USDT Extension Targets Bullish breakout continuation

46.65 USDT Major Supply Historical resistance zone

---

🧠 Conclusion:

TRUMPUSDT is showing early signs of a macro reversal, with clear accumulation structure and breakout potential forming above a well-defined base. If confirmed by volume and price structure, the upside could be significant.

However, traders should remain cautious and watch for volume confirmation and failure points around key support.

#TRUMPUSDT #CryptoBreakout #AltcoinSetup #BullishReversal #TechnicalAnalysis #ReaccumulationZone #SmartMoneyMoves #PriceActionCrypto #AltcoinAnalysis#CryptoSignals #AltseasonReady

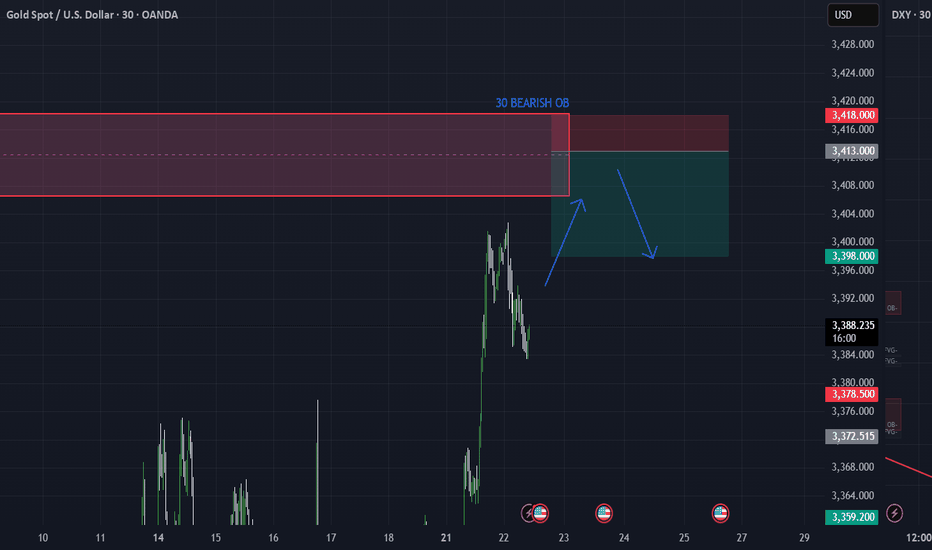

XAUUSD 30M – OB Sell Limit Setup for 3R Opportunity by PhoenixFXGold 30M Chart – Smart Money Sell Limit

We’re watching a clean Order Block (OB) on the 30-minute timeframe as price retraces into a key supply zone. This setup offers a high-probability reversal opportunity with a 3R risk-to-reward ratio. ✅

📍 ENTRY: 3413

🛑 SL: 3418 (above structure)

🎯 TP1: 3408 (1R)

🎯 TP2: 3403 (2R)

🎯 TP3: 3398 (3R)

The price action shows signs of exhaustion and premium pricing as it returns into a previous OB. We’re positioning with precision and tight risk.

📌 Strategy:

– 30M OB zone

– Clear BOS + retracement

– Set & forget execution

#XAUUSD #Gold #OrderBlock #SupplyZone #SmartMoney #PhoenixFX #RiskReward

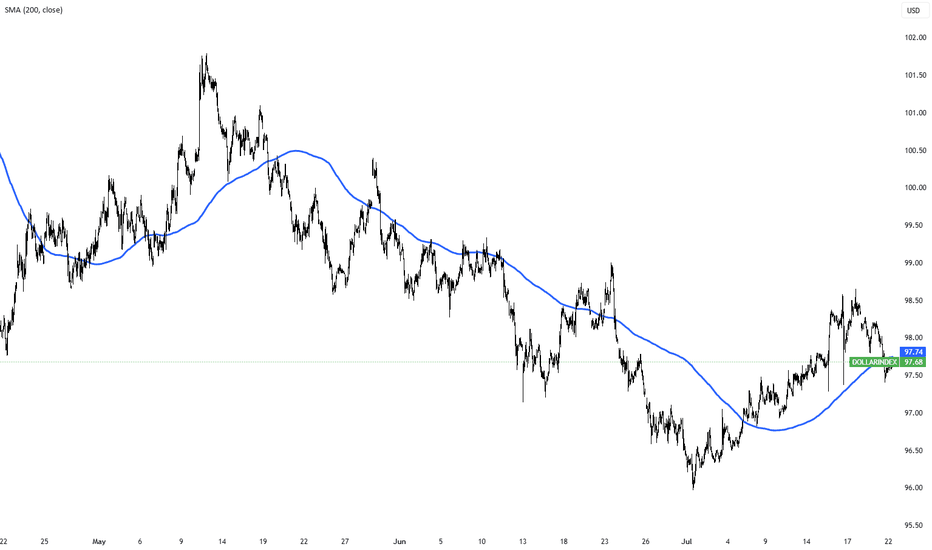

Dollar Index Holds Below 98 as Markets Await Trade Deal ProgressThe dollar index remained below 98 today, extending its two-day decline as investors watched trade negotiations ahead of the August 1 deadline. Treasury Secretary Scott Bessent said deal quality is the priority, suggesting Trump could grant extensions to countries showing real progress.

Markets are also focused on Fed Chair Powell’s speech for signals on interest rates. Despite Trump’s push for a cut, traders are not expecting action this month.

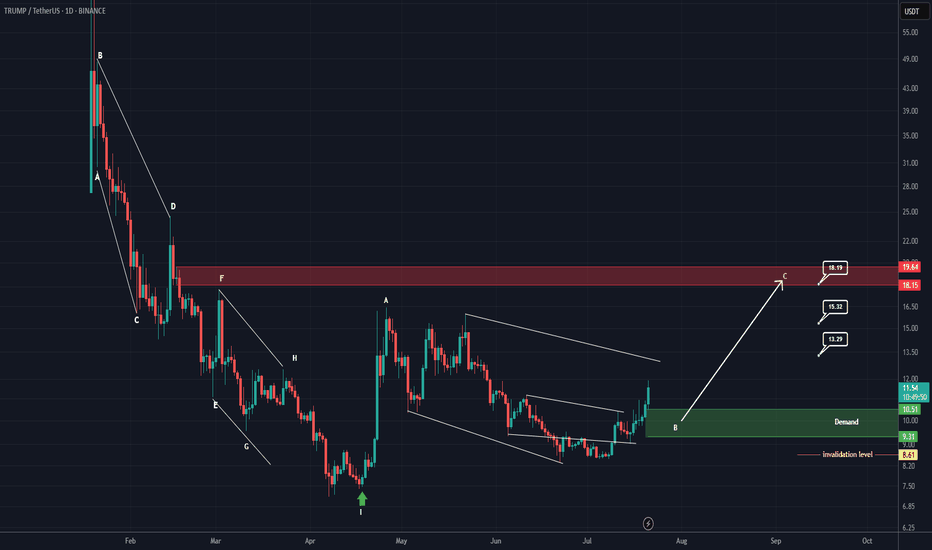

TRUMP Looks Bullish (1D)It seems that the bullish phase of the Trump coin has started from the point where we placed the green arrow on the chart.

We appear to be at the end of wave B of the bullish phase. As long as the price holds above the green zone, it can potentially move toward the targets marked on the chart.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

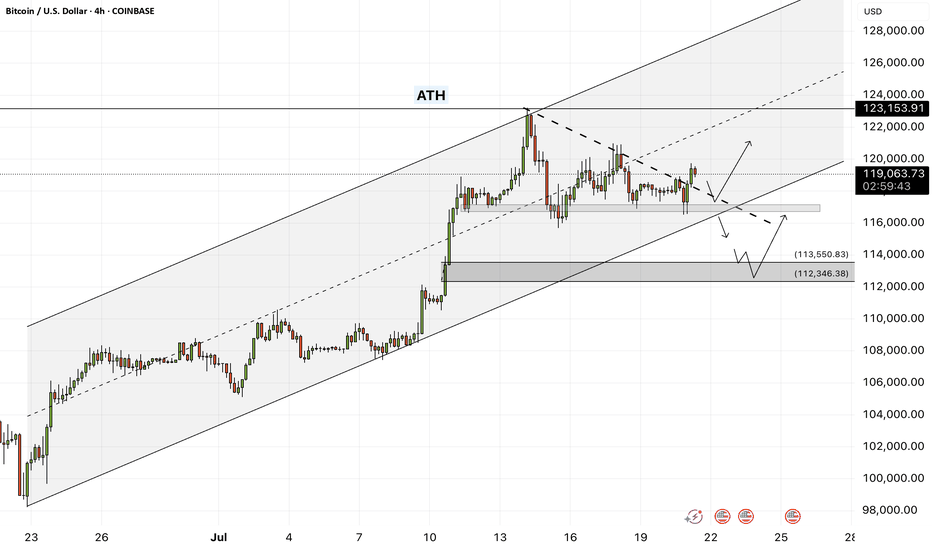

Bitcoin - Will Bitcoin reach its previous ATH?!Bitcoin is above the EMA50 and EMA200 on the four-hour timeframe and is in its ascending channel. Bitcoin’s current upward momentum has the potential to reach its previous ATH. If it corrects, we can look for Bitcoin buying positions from the specified support area, which is also at the intersection of the bottom of the ascending channel.

If this support is lost, the decline will continue to around $113,000, where we can again buy Bitcoin with a better risk-reward ratio.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market, and capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand area.

Last week, the U.S. House of Representatives passed the CLARITY Act (Crypto-Asset National Regulatory Transparency for Investors and Consumers Act) with 294 votes in favor and 134 against, including support from 78 Democrats. The bill represents the first comprehensive legislative effort to regulate the cryptocurrency industry and is considered a major regulatory win for digital asset proponents.

Key features of the legislation include:

• Clearly defining the regulatory roles of agencies like the SEC and CFTC

• Establishing a new category for registered digital assets

• Facilitating broader integration of cryptocurrencies into traditional financial systems

Status in the Senate: Despite bipartisan approval in the House, the bill’s future in the Senate remains uncertain. Senators are still in the early stages of drafting their own version, and significant revisions are expected. Some Senate Democrats insist that the bill must explicitly address President Trump’s and his family’s cryptocurrency holdings.

The CLARITY Act is part of a broader Republican-led legislative initiative dubbed “Crypto Week,” which includes two additional major digital asset bills aimed at modernizing blockchain regulation and the broader digital finance ecosystem.

Meanwhile, Donald Trump is preparing to issue an executive order that would open up U.S. retirement markets to cryptocurrencies, gold, and private equity. This order would allow 401(k) fund managers to incorporate alternative assets into retirement portfolios.

The move follows the rollback of Biden-era restrictions and the recent passage of three crypto-related bills in the House. While major investment firms have welcomed the proposal, critics warn that alternative assets may expose retail investors to greater financial risks.

Also last week, Bitcoin reached a new all-time high, pushing its market capitalization to $2.43 trillion. It has now surpassed Amazon, Google, and even silver, becoming the fifth-largest asset globally by market value.

Looking ahead, one of the key events on the economic calendar is Federal Reserve Chair Jerome Powell’s upcoming speech at an official central bank-hosted conference on Tuesday. This event comes just before the release of the preliminary S&P Global Purchasing Managers’ Indexes (PMIs) on Thursday. Given Trump’s escalating verbal attacks on Powell, a central question is whether this political pressure has influenced the Fed Chair’s stance.

Trump has repeatedly urged Powell to lower interest rates. This week, reports emerged suggesting that the President had discussed with some Republicans the possibility of removing Powell from his position. However, Trump was quick to downplay the reports, stating that the likelihood of Powell being dismissed was “very low.”

In this context, if Powell uses his speech to reassert the Fed’s independence and calls for patience to assess the impact of tariffs more thoroughly, the U.S. dollar may continue its recent upward trend. Still, it’s too early to confirm a definitive bullish reversal for the dollar. While the global reserve currency has responded positively to headlines fueling tariff concerns, markets could mirror April’s behavior—when fears of recession led investors to sell the dollar instead of buying it—should those concerns intensify again.

OFFICIAL TRUMP Last Barrier · $30 or $100 Next · MixedThe last barrier is on now. The last barrier as in the last and final resistance level TRUMPUSDT (OFFICIAL TRUMP) needs to conquer before a major rise. Will this rise reach $30 or $100 or higher? Continue reading below.

Make sure to boost this publication and follow to show your support.

Hah! Resistance is confirmed as EMA89, what a drag. This is the blue dotted line on the chart but notice something else. Look at the magenta line, EMA55. TRUMPUSDT is trading above EMA55 but below EMA89. Bullish and bearish. Bearish and bullish. Mixed?

There is nothing mixed.

The main low happened 7-April. A higher low in 22-June. Can you see?

This is not mixed, this is bullish confirmed.

If the market were to move lower, then in 22-June we would have either a test of the 7-April low or a lower low. The fact that the drop stopped higher means that buyers were present. People were actually expecting for prices to drop and once they dropped they bought everything that was being sold. Prices couldn't move any lower because people were buying up. These are smart trader, smart money; experience for sure.

They managed to buy some tokens at a lower price within the "opportunity buy zone." This zone is available no more and now we have the mix of resistance and support; EMA89 and EMA55. What happens next?

Based on the previous signal I just showed you and marketwide action, Bitcoin super strong, we know that TRUMPUSDT will follow and break-up. Yes! Massive growth.

Both targets are good and will hit. Short-term, we will see a challenge of $30 and long-term we will see $100 and beyond.

Thanks a lot for your continued support.

Namaste.

TRUMP UPDATEHello friends🙌

👀You can see that the price formed a reversal pattern after falling at the specified support and the buyers supported it.

⚠Considering the entry of buyers, the price is expected to move to the specified targets, of course, don't forget about capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

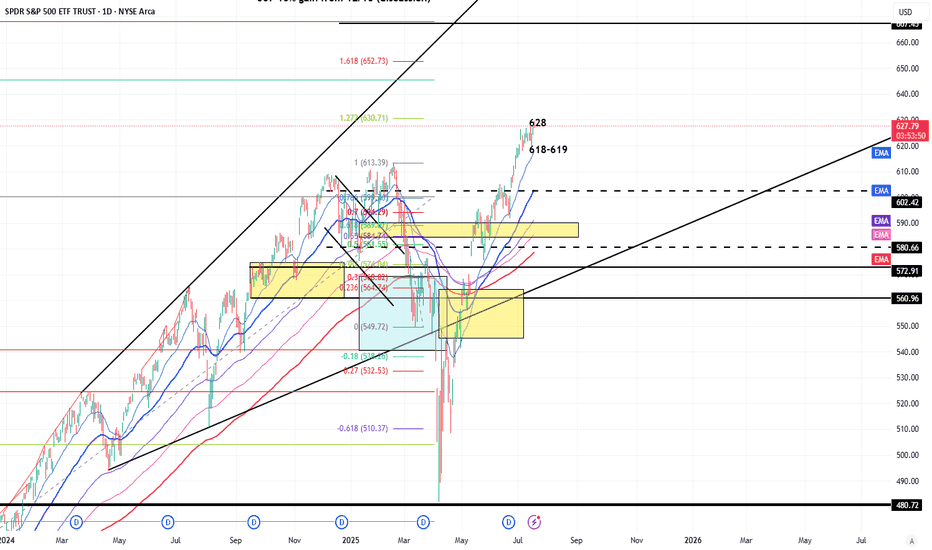

Earnings Heat Up - 6300 and 6200 SPX Key Levels RemainMarket Update

SPX Key Levels

-SPX poked 6300 Tuesday, Thursday, and poked higher Friday (but settled back to 6300)

-6200 support remains a key level

-6050/6000/5800 next floor levels, I'll be looking for dips

I can see the market slowly (and I mean SLOWLY) grinding higher but preparing for a

reasonable seasonal selloff through end of July into end of September window

July 28-August 1 is a monster week in the markets

-Megacap Earnings (MAG7 Tue/Wed/Thu)

-Wed July 30 - FOMC (Pause expected but Powell's Press Conference is important)

-Friday August 1 - Non-Farm Payroll, Tariff Deadline

I'm hitting fresh YTD highs so I'm not complaining about this melt-up and grind, I'm simply wanting to allocate positions and add to my positions at better levels and with a slightly

higher VIX to help take advantage of the expected move being greater than the actual move

Have a great weekend and thank you watching!!!

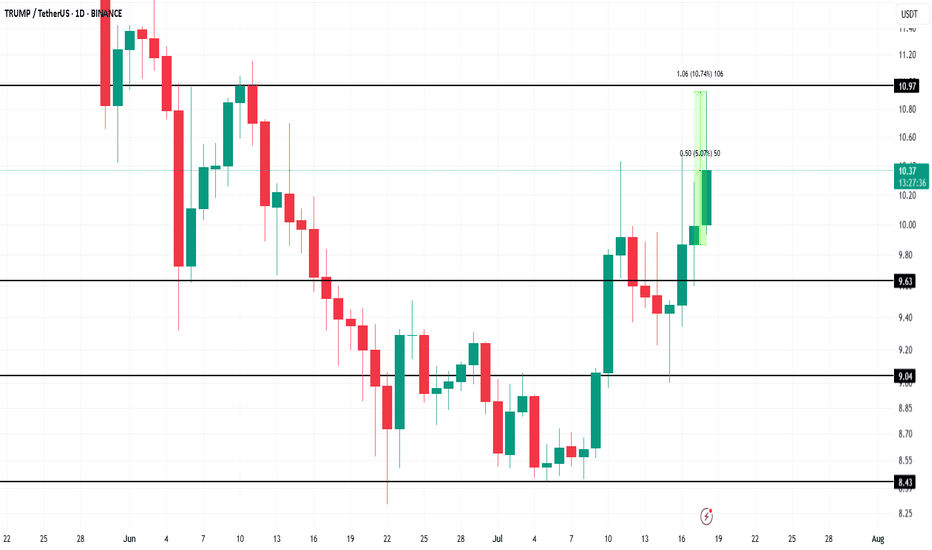

TRUMP Token's $950 Million Unlock Sparks Short-Lived Price RallyBINANCE:TRUMPUSDT recently saw its first major token unlock in six months, which flooded the market with fresh supply. The 90 million TRUMP tokens unlocked today are much smaller than the previous unlock in January, yet they still increased liquidity significantly.

However, the lack of response to the unlock, despite the substantial capital entering the market, further indicates a cooling of investor enthusiasm around the meme coin

BINANCE:TRUMPUSDT price rose by 5% today, trading at $10.39 at the time of writing. It briefly surged by 10% during the intraday high , but the rally was short-lived, and the price retraced.

If BINANCE:TRUMPUSDT fails to breach the $10.97 resistance level again, the coin could face potential corrections to $9.63 , making recovery difficult. The token will need strong demand to push past this resistance and secure more gains.

However, should BINANCE:TRUMPUSDT capitalize on broader market bullish momentum, it could break past $10.97 and reach $11.00 . This would likely invalidate the current bearish outlook and provide an opportunity for a further rise to $12.18.

OFFICIAL TRUMP Main trend. 16 05 2025Logarithm. Time frame 3 days. After a super pump and a drive of "stupid money", a descending channel was formed on a natural dump. The price came out of it. Now a triangle is forming. The price is clamped. The reversal zones and percentages to the key support/resistance levels are shown extremely accurately according to TA.

If there is no aggressive exit in the medium term, then there will be consolidation and, as a consequence, the formation of a horizontal channel "sholtai / chattai", its key zones are shown.

Now, this "cryptocurrency" is now on 16 05 2025 in 41st place by capitalization.

Reductions from the price highs are about -90%.

From the liquid zone about -84%.

These are not the minimum values of the decline of such hype cryptocurrencies. Just take this into account in your money management. For clarity, the level zones and the % of potential decline if the trend breaks again are shown on the chart (pull the chart down).

Even with such a decline, the price is now at a huge profit. I am not speaking for the creators of the cryptocurrency, but for the first speculators and "investors" who may not have sold everything on the hype.

For the creators of the cryptocurrency, perhaps these are manipulators close to the Trump family, for them, any sale is super profit. But in order to sell, you need to maintain liquidity, and from time to time make interest in speculation and asset retention by investors, that is, do pumps and hype. Use this, and do not be greedy...

Levels and zones, pump/dump, which the price will "feel" are shown in advance. Click "play" on the chart and move the chart up. With a high degree of probability, the hype and pumping of the price of this cryptocurrency will be repeated, given the hype and the long term of the political figure whose name this cryptocurrency bears. Now it is a Trump dump, in the future it will become a Trump pump for some time.

Do not forget to sell on the next hype. If you understand that you are very greedy, and the news background affects you, then sell in parts, or use stop losses to protect profits.

There is no need to guess the minimums and maximums. It is important to know these zones, and have an acceptable average price, from the position of the trend, and its potential. It is regulated by the distributed entry volume (in advance) at potential reversal zones.

MELANIA Main Trend. Memes with high hype and risk. July 17, 2025Main trend. Time frame 3 days (less is not necessary). Showed conditional levels (zones near them), and percentages of decrease from the maximum (note, I showed from the zone where the main retail of “affected investors” began to connect, that is, the maximum is much lower than on the chart).

Note that now a conditionally large volume “enters”, it is displayed on the price chart (this is important), a sideways squeeze has begun. Local impulse and rollback are now in the moment.

Also showed a large % (intentionally) for orientation, from minimum to maximum zones. On such hype assets, as a rule, medium-term - long-term holding (bought in the right zone) shows significant income.

All level zones are conditional, due to liquidity, but the price will most likely “play” after the breakdown of the downward trend in this range, another alt season (which many do not notice due to the slow breakdown of their opinions, news chaff, and inadequate goals). As for me, above these huge % (resistance zone, or up to 0.869, so as not to waste time), you should get rid of this meme, or its % from the previous position should already be minimal (5-10%).

There are hype zones, there are zones of potential gain (fading hype, interest, and a large % from the maximums). On such assets of "manual trading", where cryptocurrency has no value, it is always sold little by little (many do not understand this), but in order to sell, you sometimes need to make interest, and "instill hope" in previously deceived "investors" who want to get out at least at a loss (it is unlikely to happen). At the right time, 1-2 tweets - statements from the "powers that be" - are pumped up due to low liquidity by a huge percentage.

On such cryptocurrencies, you do not need to guess the “bottom” or maximums. Pricing is formed differently here, as there is no real supply/demand, utility, but only psychology and "hitting the jackpot" of gambling addicts. Be smarter. Diversify such assets, distribute the risk in advance. Make purchases/sales according to plan, without emotions.

When the price goes up, you think it will go much higher, but even if it does, you must sell a certain volume in certain planned zones, without any emotions or sense of lost profit.

Similarly, when the price goes down, people are driven by fear and refuse to buy, and these were probably the minimums of fear.

The average price of the set and reset is important. No minimums and maximums are needed. Be patient and consistent in your actions and plans.

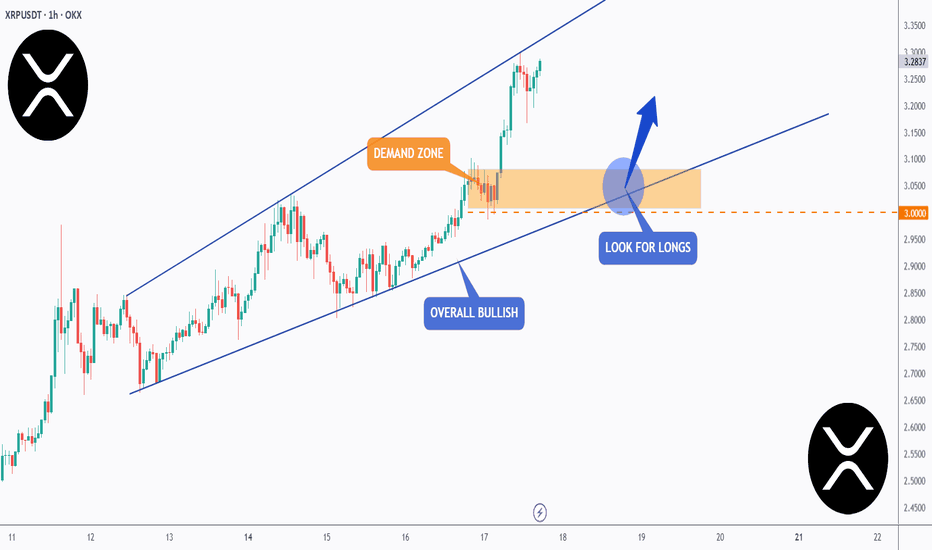

XRP - One More Wave Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈XRP has been overall bullish trading within the rising wedge pattern in blue.

However, it is approaching its all-time high at $3.4.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

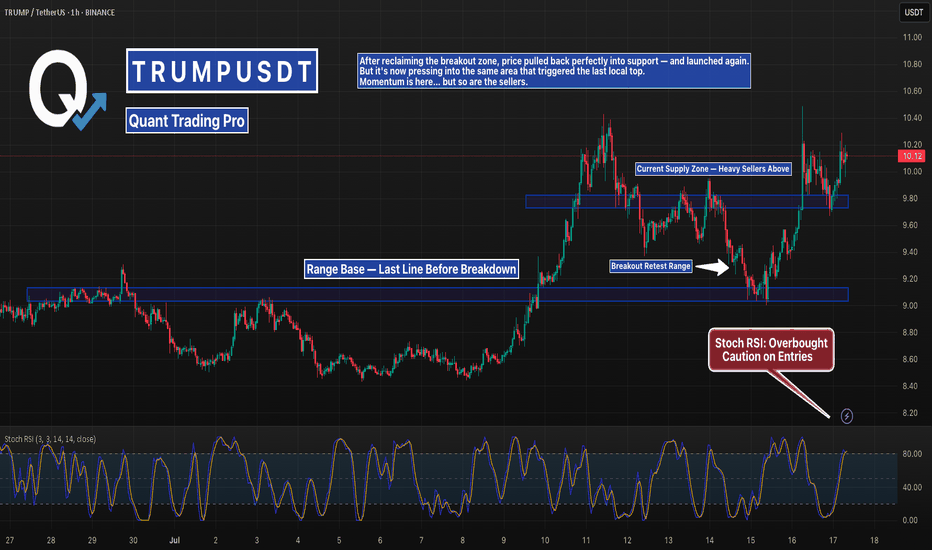

TRUMP Held the Retest — Now Pushing Into Resistance AgainTRUMP bounced clean off the retest zone after holding structure at $9.80.

Now it’s knocking on the same resistance that sparked a sharp pullback just days ago.

If buyers want a real breakout, this is where they’ve got to show up loud.

Risk is rising, but so is the setup.

#TRUMPUSDT #MemecoinCharts #BreakoutRetest #CryptoMomentum #ChartAnalysis #BacktestEverything #QuantTradingPro #TradingView

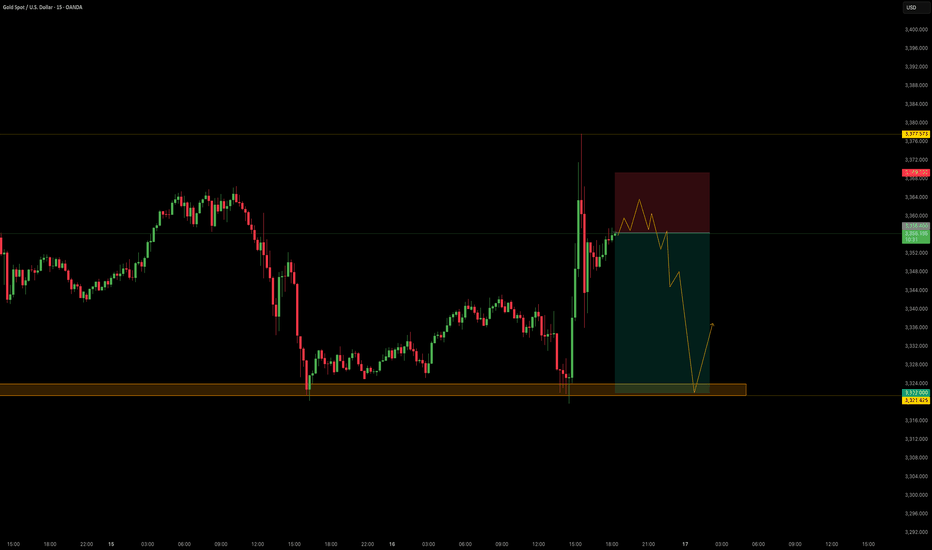

NordKern - XAUUSD InsightNordKern | Simplified Insight OANDA:XAUUSD Short Opportunity Ahead

Gold saw a sharp surge in price today, primarily driven by political headlines that temporarily shook market sentiment. To be specific:

📅 Jul 16, 2025 – 16:56 CET

CBS Reports: Trump asked Republican lawmakers whether he should fire Fed Chair Jerome Powell. This headline alone triggered an intraday spike of +$52/oz in gold as markets priced in increased macro and institutional risk.

As previously stated "Context Matters."

While the President cannot remove the Fed Chair without cause, even the suggestion introduces uncertainty and undermines confidence in the Fed’s independence especially ahead of a high-stakes election cycle.

However, further developments quickly followed: 📅 Jul 16, 2025 – 17:58 CET

Trump: “Firing Powell is highly unlikely.” 📅 Jul 16, 2025 – 18:06 CET

Trump: “Reports on me firing Powell are not true.” With this clarification, the initial rally appears overstretched and sentiment-driven, leaving room for a corrective pullback as the market digests the full picture.

Trade Setup - Short Bias

Parameters:

Entry: 3356.40

Stop Loss: 3690.30

Take Profit: 3322.00

Key Notes:

- The spike was headline-driven and not supported by policy shift or macro data.

- Trump’s denial removes much of the political risk premium that had been briefly priced in.

- Watch for momentum fading near resistance and confirmation via intraday structure.

This remains a tactically driven setup. Manage risk appropriately and stay alert for any renewed political developments.

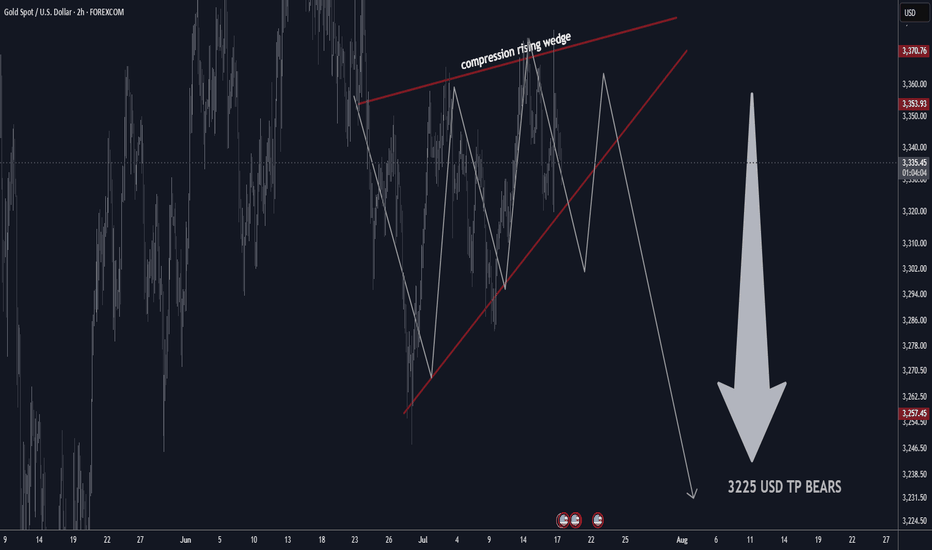

GOLD H2 Rising Wedge Expecting SellOFF TP BEARS 3225 USD📊 Gold Technical Outlook Update – H4 & 2H Chart

📰 Latest Summary Headlines

• Gold stalls near highs as technical compression signals possible breakdown

• Bearish rising wedge on 2-hour chart hints at sharp move lower

• Market volatility stays elevated amid global economic risks

• Short-term sellers targeting $3,225 if wedge pattern breaks

________________________________________

🏆 Market Overview

• Gold remains in a choppy range, struggling to clear key resistance.

• 2H Chart: Bearish rising wedge pattern identified, showing compression—expecting a potential breakdown soon.

• Overhead resistances: $3,410 / $3,460 USD will likely cap further upside.

• Major supports: $3,160 / $3,240 USD.

• If support fails, next key bear target is $3,225 USD.

• Range trading remains favored for now.

• Volatility likely to persist with no major bullish headlines on the horizon.

________________________________________

⭐️ Recommended Trade Strategy

• Bearish Setup (2H): Short sell gold at market on wedge breakdown.

o Stop loss: Above recent highs (set according to your risk tolerance and latest 2H swing high).

o Take profit: Target $3,225 USD.

• Continue to focus on selling near resistance, buying near support.

• Momentum: Watch for sharp moves as wedge resolves—be nimble!

• Always manage risk and adjust stop as price develops.

________________________________________

💡 Gold Market Highlights

• Safe-haven demand still strong due to tariffs, geopolitical tension, and U.S. fiscal concerns.

• Central banks & investors remain net buyers, but jewelry demand slides at high prices.

• Price action is dominated by institutional flows, with banks forecasting potential for gold above $4,000 next year—but short-term correction likely if wedge breaks.

• Current price: ~$3,358 per ounce. Compression suggests a larger move coming soon.

________________________________________

Summary:

Gold is at a crossroads, with a bearish wedge pattern building on the 2-hour chart. A breakdown could see a quick move to $3,225. Short sellers should act on confirmation, while bulls will look to reload at key support. Stay tactical!

2025 Trading Final Boss: Daily Market Manipulation, The New NormMarking this point in history because we'll likely forget and move on.

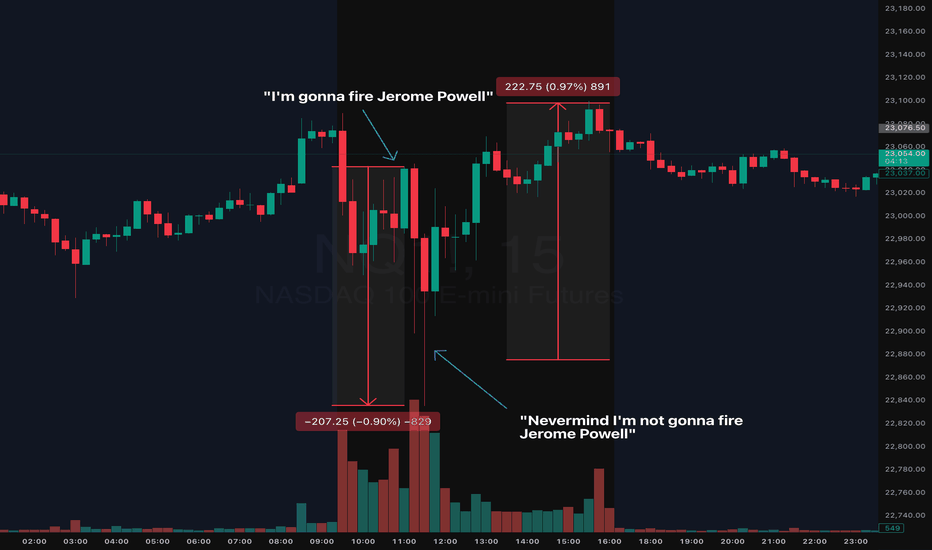

During the early hours of the July 16th NYC session, we saw indices quickly flush ( CME_MINI:NQ1! CME_MINI:ES1! ) nearly 1% on the news that Trump will fire Jerome Powell. The dip was bought almost instantly.

Shortly after the dip was bought (roughly 0.50% recovery), guess what? Trump announced, he is "not considering firing Jerome Powell". The dip then recovered and achieved a complete V to finish the day somewhat green. Make what you want of it but always use a stop loss in these tough conditions.

Welcome to 2025 Trading Final Boss