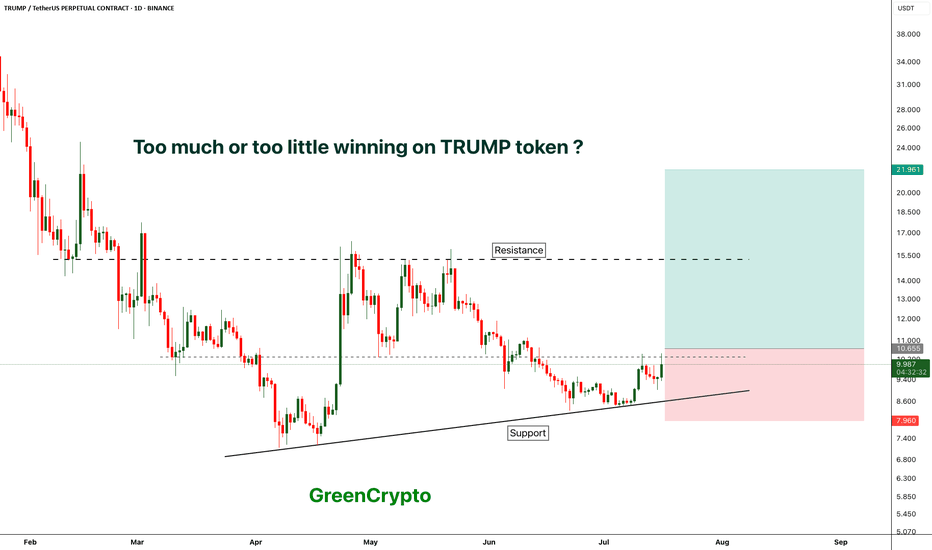

TRUMP - TOO MUCH WINNING ?Trump token is finally seeing some greens after hitting the bottom

currently price is trading near the local resistance.

We have long trade opportunity if the candle closes above local resistance.

Entry Price: Above 10.655

Stop Loss: 7.9

TP1:12.592

TP2: 15.218

TP3: 21.843

TP4++: Keep 20% of the position running with trailing stoploss.

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

Trump

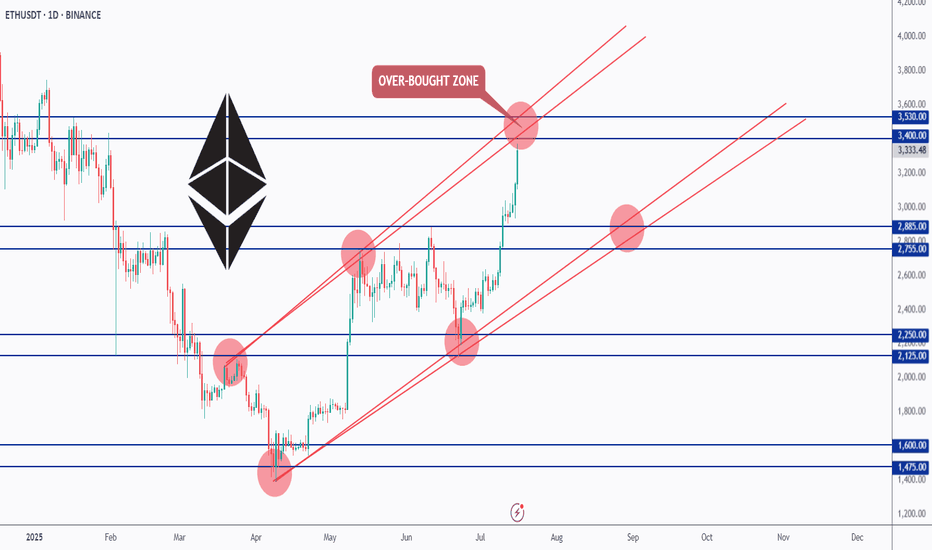

ETH Testing Overbought Zone — What’s Next?📊ETH has been overall bullish, trading inside this rising red channel for months.

After breaking above the $2,885 resistance, bulls took full control, and price is now approaching the upper red trendline — an overbought zone where we’ve seen rejections before.

As long as ETH holds above the $2,885 zone, the bulls remain in control. But since we’re near a strong resistance and the top of the channel, we’ll be waiting for a potential correction or at least a slowdown in momentum before looking for fresh entries.

📌 Key levels to watch:

Resistance: $3,400 – $3,530

Support: $2,885 – $2,755

Let’s stay patient and follow the market’s lead. 🧠

Let me know your thoughts in the comments 👇

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

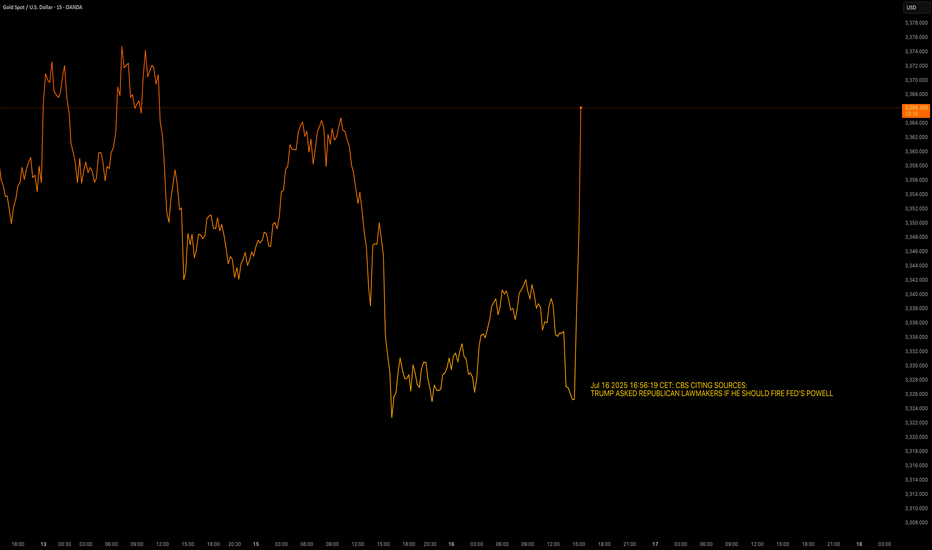

Market Outlook - Trump Questions Powell’s Job - Gold RalliesNordKern active market outlook, reacting to the latest news.

Market Alert | Trump Questions Powell’s Job - Gold Rallies, Dollar Slips

Jul 16 2025 16:56:19 CET: CBS CITING SOURCES:

TRUMP ASKED REPUBLICAN LAWMAKERS IF HE SHOULD FIRE FED'S POWELL

Market Reaction:

OANDA:XAUUSD +$45/oz intraday, currently trading near session highs.

Safe-haven demand and inflation hedge as Fed credibility is questioned.

TVC:DXY Weakens notably against both the TVC:EXY and the TVC:JXY

Markets pricing in higher political risk premium, potential dovish tilt under Trump.

Volatility: Spiking across FX and commodities. VIX and MOVE indexes also showing upward pressure.

Context Matters:

While the Fed Chair cannot be dismissed without cause, even the suggestion of removal injects significant uncertainty into the macro backdrop. Historically, markets react negatively to perceived threats to Fed autonomy (see: Nixon-Burns, Trump-Powell 2018). This development comes just months before the U.S. election, adding a new layer of complexity for macro traders.

What to Watch:

- Fed Speakers: Any defense of Powell or pushback could stabilize markets. Or not.

- Trump Campaign Statements: Will he double down or walk it back?

- Upcoming Data: A dovish-leaning CPI/Jobs print could supercharge gold and further weigh on the dollar.

- Volatility: Traders should adjust position sizing and risk accordingly.

Increased geopolitical and monetary risk are back on the table. Traders should remain nimble, reduce leverage where appropriate, and stay alert to headline risk. Gold and FX are likely to remain reactive into the US session.

NordKern

Breaking News - Trump vs. PowellJul 16 2025 16:56:19 CET: CBS CITING SOURCES:

TRUMP ASKED REPUBLICAN LAWMAKERS IF HE SHOULD FIRE FED'S POWELL

OANDA:XAUUSD sees upside +35$/oz after Trump has asked the republican lawmakers if he should fire Powell.

TVC:DXY weakens against TVC:EXY and TVC:JXY after Trumps question.

Volatility is increased.

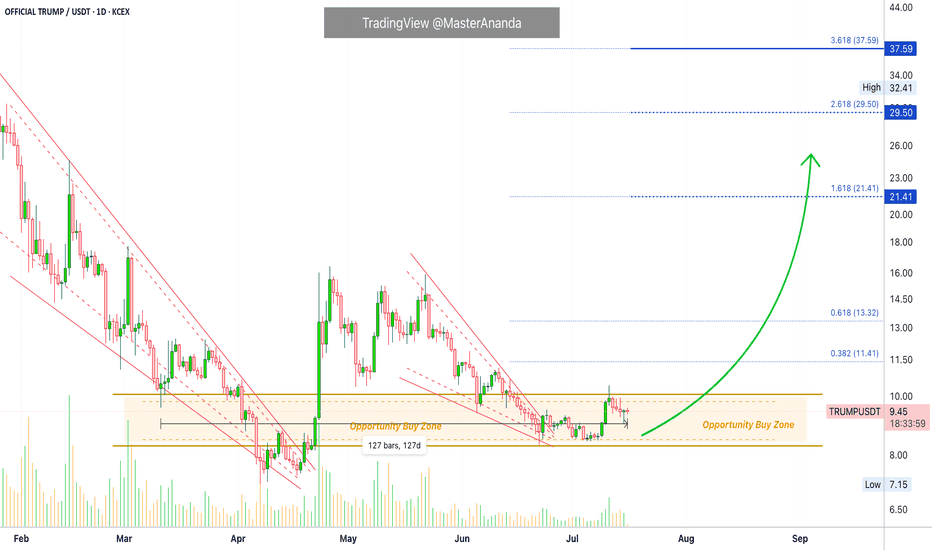

OFFICIAL TRUMP Trading Within Opportunity Buy Zone—About To ExitThis is the last chance to get OFFICIAL TRUMP (TRUMPUSDT) within the opportunity buy zone, the best possible entry prices before a major bullish wave.

Good morning my fellow Cryptocurrency trader, this market has endless opportunities to offer. There is always a second chance; it is never too late.

This "Opportunity Buy Zone" has been available only once briefly before the current period. The first three weeks of April. The second entry into the opportunity buy zone within a higher low happened in June and has been active for 41 days. Time is running out.

Since 11-March, when the current zone was activated through present day, we have more than four months. That's four months of consolidation, sideways... The market can remain neutral only for so long, and it isn't bearish anymore.

The downtrend ended with the 7-April low, the big red falling wedge. After this date the market started a recovery and then we have a retrace—the small falling wedge—and within this retrace market conditions remain bullish based on a higher low.

The main low and market bottom happened 7-April 2025 and the higher low 22-June 2025. This means we are already on the bullish train.

The higher low will lead to a higher high which simply means higher prices. Let's skip the technical analysis and move to the good part.

Maximum growth

How do you see the market right now? How do you see TRUMPUSDT?

It is not going to be the same forever actually, we are expecting big change.

All those days going sideways, down, boring, the market retrace; when it changes it will be so much different. Imagine, visualize, 100%+ in a single day. Then repeat this process over and over. Still some swings and corrections, but that is how you get to 1,000%+ or even 2,000% growth in 30 days.

The meat of the bullish move can happen within 1-2 months. It can also take 4-6 months. What happens is that the start date is not the date when prices start to rise fast but the date the market hit bottom. This means that we are already three months in (100 days) into this bullish wave. Why? Because the low happened 7-April. When you get a strong bullish breakout and the market peaks after two months, total duration of the bullish cycle wouldn't be two months but five months.

We are already on the other side. Now that the next low is in, TRUMPUSDT will be moving to produce a higher high.

Patience is key. The best is yet to come.

Hold strong; rest easy... You will be happy with the results.

Namaste.

EURUSD – From Structure to Shift

1H Technical Outlook by MJTrading

EURUSD moved cleanly through a sequence of structural phases:

• Previous Base

• Multi-day Consolidation (potential quiet accumulation)

• Transition into a well-respected Descending Channel

Price has since shown repeated rejections from the upper boundary, including a decisive selloff from the 1.1750 zone, forming what we now label a "Pressure Gap" — a space where aggressive sellers overwhelmed price.

🧭 Key Scenarios Ahead:

🔻 Bearish Continuation:

Breakdown below 1.1700 opens room toward:

• 1.1640 (channel bottom)

• 1.1600 Liquidity Zone

Watch for impulsive sell candles + EMA rejection

🔁 Short-Term Bounce or Trap:

Holding above 1.1700 could spark a rebound toward 1.1750

This may serve as a final test before another leg lower

Only a clean break and hold above 1.1763 flips structure bullish

🔍 Bonus Confluence:

1D Chart shows broader bullish context (inset)

EMAs tightening = expect volatility burst

Well-defined structure gives clear invalidation and targets

Every trend tells a story — from base building to breakout, and now a possible breakdown. Trade the structure, not the prediction.

#EURUSD #Forex #TradingView #TechnicalAnalysis #PriceAction #DescendingChannel #LiquidityZone #SmartMoney #MJTrading

Trump's signalHello friends🙌

🔊Given the good growth we had, you can see that the price has hit resistance and you can see that the upward waves are getting weaker, which indicates that we are likely to have a correction until the support areas are identified...

You can buy in the identified support areas in steps and with capital management and move with it to the specified targets.

🔥Join us for more signals🔥

*Trade safely with us*

What Happens the Day Jerome Powell Is Fired or Quits?A sudden exit by Fed Chair Jerome Powell would create both a political and monetary shock.

While the Chair is technically protected from arbitrary removal. Recent reports confirm that President Trump and his allies are scrutinising the Fed’s $2.5 billion renovation project—potentially laying the groundwork for a “for cause” dismissal.

A surprise departure would undermine confidence in the Fed’s independence. The U.S. dollar could fall sharply across major pairs.

USD/JPY could fall toward ¥145, with safe-haven demand favouring the yen. However, the reaction may be less severe than in pairs like Swiss franc which we have noted in the past is the potentially preferred safe haven. A panic selloff could extend to 142.20—a prior consolidation floor.

GBP/USD could surge as traders anticipate a more dovish Fed stance under the new Trump-stooge Fed Chair. From a technical perspective, GBP/USD is maybe already oversold and potentially poised for a potential rebound anyway—Powell’s resignation or firing could potentially exacerbate this. The first level to watch being a return to 1.3700, assuming the likely expectation of Fed rate cuts rise.

Bitcoin - Bitcoin, Unrivaled in the Market!Bitcoin is above the EMA50 and EMA200 on the four-hour timeframe and is in its ascending channel. Bitcoin’s current upward momentum has the potential to reach the target of $130,000. If it corrects, Bitcoin buying opportunities can be sought from the specified demand zones.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and compliance with capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand area.

In recent days, Bitcoin has managed to set a new historical high by crossing the $118,000 level; a jump that followed the strong accumulation of institutional capital, the upward trend of spot ETFs and the remarkable consolidation of such indices. This growth is not only the result of technical conditions or short-term market excitement, but is a clear reflection of the structural maturity of the Bitcoin ecosystem in the second half of 2025. A careful and comprehensive examination of the fundamental parameters shows that Bitcoin is moving differently than in the past: slower, but with much stronger support. On the other hand, more than $205 million in Bitcoin short selling positions have been liquidated following the jump in the price of Bitcoin and its crossing the $122,000 level.

First, the flow of investment from Bitcoin spot ETFs has broken records over the past week. In one day, more than $1.18 billion entered these funds, and the total annual inflow of these financial instruments has reached more than $51 billion. This is while ETFs such as IBIT (managed by BlackRock) and FBTC (managed by Fidelity) are attracting hundreds of Bitcoins daily, without causing any negative divergence in price indices. This phenomenon clearly shows that the participation of institutional investors through regulated channels is not only stable, but also accelerating. Along with this flow of capital, the parameters of the chain also paint a picture of a market with a balance of supply and demand. The MVRV ratio, an indicator for measuring market profitability, fluctuates between 2.2 and 2.34, meaning that the market is in a reasonably profitable state, but is still some way from the warning zone of profit saturation. Meanwhile, long-term holders (LTHs) are also continuing to accumulate. Long-term wallet holdings have reached a record high of 14.7 million BTC, representing nearly 70% of the total supply. In the last quarter alone, more than 13,000 BTC have been added to this group’s reserves.

On the other hand, the SOPR indicator, which measures realized profit ratio, shows that profit-taking is taking place at a gentle slope in the market, away from heavy selling pressure. This logical trend of profit-taking is a testament to mature investor behavior. Bitcoin flows to exchanges are also at very low levels; Bitcoin held on exchanges now account for just 1.25% of the total supply—the lowest level in over a decade. This significant reduction in potential selling pressure has kept Bitcoin’s price stable in the face of short-term volatility.

Behaviorally, the market is also showing signs of maturation. The number of daily active addresses has remained stable, but unlike during the buying frenzy, we are no longer seeing retail traders rushing into exchanges or mass wallet outflows. In other words, on-chain activity has stabilized, similar to the behavior of traditional mature markets—markets driven by data and structure, not emotion. From a macro perspective, the outlook for Bitcoin in the medium term is also positive. Many analysts and institutions, including Global X ETFs, see Bitcoin’s growth to $200,000 within the next 12 months as achievable. Technical analysis from some sources has also outlined the $140,000 range as the next price target in the next 100 days, provided that the VIX volatility index remains low and macroeconomic data maintains its current trajectory. However, a more conservative scenario sees a price consolidation in the $95,000-$100,000 range if geopolitical pressures increase or ETF inflows weaken.

Overall, Bitcoin is moving ahead in the summer of 2025 not only on the back of crypto market excitement, but also on the back of strong fundamentals and structured institutional capital inflows. Accumulation by long-term holders, a steady decline in supply on exchanges, a reasonable profit-taking balance, and a formal investment structure via ETFs have all combined to bring the market to a stable state and ready for further increases. If this trend holds, levels of $125,000-$140,000 in the short term, and a range of $180,000-$200,000 by the end of the year, are not far off!

On the other hand, BlackRock’s Bitcoin ETF (IBIT) managed to record the fastest growth in history among all ETFs, surpassing $80 billion in assets in just 374 days! For comparison, it should be noted that the S&P500 Index ETF needed about 5 times this time! BlackRock now holds about 706,000 Bitcoins (equivalent to 56% of the total ETF share).

Nvidia (NVDA) 2025+ Catalysts & Risks: Analyst Views🚀 Nvidia (NVDA) 2025+ Catalysts & Risks: Analyst Views

🔑 Key Catalysts Driving Nvidia’s Stock Growth (2025+)

1. 🏆 AI Chip Dominance

Nvidia maintains >90% market share in data-center AI chips (Blackwell, Hopper, Rubin). Its CUDA ecosystem and relentless innovation keep it as the “default” supplier for advanced AI, giving NVDA massive pricing power.

2. 🏗️ Surging Data Center Demand

Cloud and enterprise AI spending remains white-hot. Tech giants (Meta, Microsoft, Amazon, Google) are collectively pouring $300B+ into 2025 AI CapEx. Data center revenues are at all-time highs; analysts expect this uptrend to extend through 2026 as “AI infrastructure arms race” persists.

3. 🌐 Mainstream AI Adoption

AI is now integrated in nearly every industry—healthcare, finance, logistics, manufacturing, retail. As companies embed AI at scale, NVDA’s hardware/software sales rise, with “AI everywhere” tailwinds supporting 15–25% annual growth.

4. 🤝 Strategic Partnerships

Big wins: Deals with Snowflake, ServiceNow, and massive sovereign/international AI collaborations (e.g., $B+ Saudi Arabia/“Humain” order for Blackwell superchips; UAE, India, and Southeast Asia ramping up AI infrastructure using Nvidia).

5. 🚗 Automotive/Autonomous Vehicles

NVDA’s automotive AI segment is now its fastest-growing “new” business line, powering next-gen vehicles (Jaguar Land Rover, Mercedes, BYD, NIO, Lucid) and expected to surpass $1B+ annual run rate by late 2025.

6. 🧑💻 Expanding Software Ecosystem

Nvidia’s “full stack” software (CUDA, AI Enterprise, DGX Cloud) is now a sticky, recurring-revenue engine. Over 4M devs are building on Nvidia’s AI SDKs. Enterprise AI subscriptions add high-margin growth on top of hardware.

7. 🌎 Omniverse & Digital Twins

Industrial metaverse and simulation/digital twin momentum is building (major partnerships with Ansys, Siemens, SAP, Schneider Electric). Omniverse becoming the industry standard for 3D AI/simulation, unlocking new GPU/software demand.

8. 🛠️ Relentless Innovation

Blackwell Ultra GPUs debuting in late 2025, “Rubin” architecture in 2026. Fast-paced, aggressive product roadmap sustains Nvidia’s tech lead and triggers constant upgrade cycles for data centers and cloud providers.

9. 📦 Full-Stack Platform Expansion

Grace CPUs, BlueField DPUs, and Spectrum-X networking mean Nvidia is now a “one-stop shop” for AI infrastructure—capturing more value per system and displacing legacy CPU/network vendors.

10. 🌏 Global AI Infrastructure Buildout

Recent US export rule rollbacks are a huge tailwind, opening up new high-volume markets (Middle East, India, LatAm). Nvidia remains the “go-to” AI chip supplier for sovereign and enterprise supercomputers outside the US, supporting continued global growth.

________________________________________

📈 Latest Analyst Recommendations (July 2025)

•Street Consensus: Overwhelmingly bullish—~85% of analysts rate NVDA as “Buy/Overweight” (rest “Hold”), with target prices often in the $140–$165 range (post-split, as applicable).

•Target Price Range: Median 12-month PT: $150–$160 (representing ~20% upside from July 2025 levels).

•Key Bullish Arguments: Unmatched AI chip lead, accelerating enterprise AI adoption, deep software moat, and a robust international/sovereign AI order pipeline.

•Cautious/Bearish Notes: Valuation premium (45–50x P/E), high expectations priced in, geopolitical and supply chain risks.

________________________________________

⚠️ Key Negative Drivers & Risks

1. 🇨🇳 US–China Tech War / Chip Export Restrictions

• US restrictions: While the Biden administration eased some export bans in May 2025 (allowing more AI chip exports to Gulf/Asia partners), China remains subject to severe curbs on advanced NVDA AI chips.

• Workarounds: Nvidia is selling modified “China-compliant” chips (H20, L20, A800/H800), but at lower margins and lower performance.

• Risk: If US tightens controls again (post-election), China sales could fall further. Chinese firms (Huawei, SMIC, Biren) are also racing to build their own AI chips—posing long-term competitive risk.

2. 🏛️ Political/Regulatory Risk

• Election year: A US policy shift (e.g., harder tech stance after Nov 2025 election) could re-restrict exports, limit new markets, or disrupt supply chains (especially TSMC foundry reliance).

3. 🏷️ Valuation Risk

• NVDA trades at a substantial premium to tech/semiconductor peers (45–50x fwd earnings). Any AI “spending pause” or earnings miss could trigger sharp volatility.

4. 🏭 Supply Chain & Capacity Constraints

• As AI chip demand soars, there’s ongoing risk of supply/delivery bottlenecks (memory, HBM, advanced packaging), which could cap near-term revenue upside.

5. 🏁 Competitive Threats

• AMD, Intel, and custom in-house AI chips (by Google, Amazon, Microsoft, Tesla, etc.) are scaling up fast. Loss of a hyperscaler account or a successful open-source software alternative (vs CUDA) could erode Nvidia’s dominance.

6. 💵 Customer Concentration

• A small handful of cloud giants account for >35% of revenue. Delays or pullbacks in their AI spending would materially impact results.

________________________________________

📝 Summary Outlook (July 2025):

Nvidia’s AI chip monopoly, software moat, and global AI arms race create a powerful multi-year growth setup, but the stock’s high valuation and US-China chip tension are real risks. Analyst consensus remains strongly positive, with most seeing more upside as data-center and enterprise AI demand persists—but with increased focus on geopolitical headlines and potential supply chain hiccups.

________________________________________

BTC is Back in Price Discovery Mode — Targeting $140K!After a clean break above the previous all-time high, Bitcoin has officially entered a new impulse phase, trading within a steep rising channel.

The green zone around the previous ATH is now acting as a strong support zone, confirming the shift in market structure.

🟠 The macro trend remains intact, and bulls are clearly in control.

🌀 Corrections continue to offer opportunities for trend-following entries, and if momentum holds, BTC could be on its way toward the $140,000 mark — the upper boundary of the macro channel.

Until then, every dip is a gift in this bullish cycle. 🔥

🧠 Trade with the trend. Manage your risk. Stay ready.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

AUDUSD SHORT & LONG FORECAST Q3 D11 W28 Y25AUDUSD SHORT & LONG FORECAST Q3 D11 W28 Y25

It’s Fun Coupon Friday! 💸🔥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCAD LONG DAILY FORECAST Q3 D11 W28 Y25USDCAD LONG DAILY FORECAST Q3 D11 W28 Y25

It’s Fun Coupon Friday! 💸🔥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Trump’s 50% tariff sparks USD/BRL breakout The Brazilian real weakened sharply against the U.S. dollar after US President Trump announced 50% tariffs on Brazilian exports, effective 1 August.

In response, Brazilian President Luiz Inacio Lula da Silva announced Brazil would retaliate with the same rate on U.S. imports. Trump has already pledged to retaliate if Brazil retaliates.

USD/BRL rallied from just under 5.44 to a high near 5.63. On the 1-hour chart, the pair is now retracing but perhaps consolidating in a narrow range between the 61.8% and 38.2% Fibonacci zones.

With tariffs set to begin in under a month and both sides not ready to back down, USD/BRL remains sensitive.

TRUMP BUY ???Hello friends🙌

🔊As you can see in the picture, we have brought you two Trump charts:

1_TRUMP/USDT, in which we see an upward trend.

2_TRUMP/BTC, in which we see a downward trend.

✔Now what is the conclusion? When this negative divergence occurs, it means that money flows from Bit to Tether, and we can expect good growth from it to the specified targets, given the price reaching important support and its return📈

🔥Join us for more signals🔥

Trade safely with us.

Gap below… but copper’s breakout still in playCopper markets erupted higher this week following President Trump's proposal to impose a 50% tariff on copper imports. The price ripped from just above $5.20 to nearly $5.80 in a single 4-hour candle.

Now, copper could be forming a bullish flag or pennant on the 4-hour timeframe. After the vertical spike, price is consolidating in a tight, potentially downward-sloping channel between ~$5.45 and ~$5.60.

If confirmed with a clean breakout above the flag’s upper trendline - perhaps near $5.62—the next leg could project toward the previous high near $5.80

There’s also a gap below current price action, between $5.20 and $5.35, formed during the explosive move up. While gaps can act as support zones, they also tend to get revisited.

Gold at a Decision Point-Just as Tariff Headlines Return(July 9)📌

4H Technical Outlook by MJTrading

Price is compressing inside a falling channel, nested within a large symmetrical triangle, and now sits right at a high-stakes confluence zone — a perfect intersection of dynamic EMAs, rising trendline support, and local structure.

This could be a pivot point for the next major leg.

🧭 Key Scenarios:

🟢 Bullish Breakout Potential:

If price breaks above the falling channel and holds above $3,310–$3,320:

🎯 Target: $3,400, and eventually upper triangle resistance near $3,480–$3,500

✅ Watch for impulsive breakout + retest confirmation

🟡 Bearish Breakdown Risk:

If the rising trendline gives way and price closes below $3,275 (High Risk) and $3,245(Low Risk):

🎯 Targets: First $3,232, then key level $3,166

⚠️ Further weakness may expose $3,000 psychological support

🔍 Why It Matters:

• Symmetry + compression = potential volatility expansion

• Trump tariff headlines today (July 9) could trigger safe haven demand

• Strong historical respect of these trendlines

• EMAs aligning around decision zone

“Another BreathTaking Edge” — because this is one of those moments where market structure whispers louder than words.

🗣 Boost if you find value, and follow MJTrading for more clean setups.🚀🚀

#XAUUSD #Gold #TradingView #TechnicalAnalysis #ChartPatterns #PriceAction #BreakoutTrade #Forex #MJTrading

Zoom in to get closer to battlefield:

Zoom out to see where we are:

Cronos Rallies 18% After Truth Social Files for Blue-Chip ETFOKX:CROUSDT is a leading candidate for a Binance listing this month, following the proposed Crypto Blue-Chip ETF filed by Truth Social with the SEC. The fund includes 70% Bitcoin, 15% Ethereum, 8% Solana, 5% Cronos, and 2% XRP , positioning Cronos as a key asset in the fund.

Of the tokens in the proposed fund, only Cronos (CRO) is not currently listed on Binance. If the SEC approves the Crypto Blue-Chip ETF, Binance could fast-track the listing of Cronos . This move would likely draw more liquidity and investor interest toward CRO, fueling its price growth.

OKX:CROUSDT price surged by 17.8% over the last 24 hours, signaling strong momentum. If the ETF listing is approved and Binance acts swiftly, CRO could break through key resistance levels, potentially surpassing $0.1007. This upward movement would benefit investors, continuing the positive trend for the altcoin.

Orangeman vs The Federal Reverse: Season 1 (2018–2020)It all started in 2018... 🎬

🧱📈💼 March 21, 2018: Jerome Powell steps in as the new Fed Chair. Almost immediately, the Fed hikes rates from 1.50% to 1.75%, citing a strong U.S. economy.

💬📊🇺🇸 June 13, 2018: Another hike to 2.00%. Powell says the U.S. economy is “in great shape.” But markets? Not so thrilled.

🗣️📉🇺🇸 July 19, 2018: Enter The Orangeman—President Trump publicly attacks the Fed's policy, breaking tradition. He’s “not thrilled” with the hikes.

📉🏦 September 26, 2018: Yet another hike to 2.25%. The Fed stays firm. Trump? Getting louder.

❗😠💬 "I'm not happy with the Fed." – Trump

⚠️📉📉 December 19, 2018: Fourth hike of the year to 2.50%. Markets tank. Rumors swirl: Trump wants Powell gone.

🔥💣👔 Behind the scenes: Trump reportedly explores ways to dismiss Powell. The pressure is on.

📛🇺🇸📉 June 10, 2019: The battle heats up. Trump calls the hikes a “big mistake” and demands rate cuts.

✂️📉📉 July 31, 2019: Powell blinks. The Fed cuts rates by 0.25%—first cut since 2008. Trump tweets:

👎🐦💸 “Powell let us down.”

⬇️📉🔁 September 18, 2019: Second cut.

⚖️🔁🧩 October 30, 2019: Third consecutive cut. The Fed pivots completely. The Orangeman’s influence is undeniable.

🦠🧪📉 March 2020: COVID strikes. The Fed responds with emergency rate cuts.

🌀🧻💸 March 15 & 23, 2020: Rates slashed to near zero. QE infinity unleashed. Powell goes full printer mode. Bitcoin begins to stir...

Season 1 closes with markets melting down, a pandemic, and the Fed surrendering to zero rates.

But The Orangeman isn’t done...

And The Federal Reverse still lurks in the shadows.

Next up: tariffs, China, currency wars, and another campaign trail. 🐉💵⚔️

Season 2 is coming.

Stay tuned...

One tweets.

The other tightens.

Who controls our future?

One Love,

The FXPROFESSOR 💙

Gold Weekly Recap – Week 27 (30 Jun – 04 Jul)🟡 XAUUSD | MJTrading

Overview

Gold (XAUUSD) staged a significant recovery this week after retesting a critical support zone. Price action reflected strong buying interest at lower levels, followed by consolidation near mid-range resistance.

🔹 Key Levels:

Strong Support Zone: 3,246 – 3,250

Weekly Low: 3,246.35 (30 June)

Weekly High: 3,365.77 (3 July)

Closing Price: ~3,343

🔹 Price Action Summary:

✅ Early Week Retest & Reversal

After the prior week’s decline, gold opened the week near the major support area around 3,246. This zone acted as a strong demand pocket, triggering a swift rejection and initiating a bullish reversal.

✅ Sustained Rally to Resistance

Price climbed steadily, riding the 15-period EMA to reach the weekly high of 3,365.77 on 3 July. This move represented a nearly 4% recovery off the lows, fueled by renewed safe-haven flows and short covering.

✅ Midweek Consolidation

Following the rally, gold entered a sideways consolidation phase between 3,340 and 3,365. EMA flattening reflected a pause in momentum as traders assessed the next directional catalyst.

✅ Late-Week Pullback

Toward the end of the week, price tested the 3,310–3,320 area before modestly bouncing into the Friday close. Overall, the market maintained a cautiously bullish tone while holding above the prior support.

🔹 Technical Perspective:

🔸 Bias: Cautiously Bullish

Price defended the strong support and printed a higher low structure.

Sustained closes above 3,300 maintain the bullish outlook.

🔸 Near-Term Resistance:

3,365–3,390 remains the immediate supply zone to monitor for breakout attempts.

🔸 Key Support:

The 3,246–3,250 area continues to be the primary downside line in the sand.

🔹 Special Note – 4th July US Bank Holiday

Trading volumes were notably lighter on Thursday, 4th July, due to the US Independence Day holiday. This contributed to reduced liquidity and muted volatility, with many traders and institutions off desks. The thinner market conditions likely influenced the late-week pullback and consolidation, as participation was limited heading into the weekend.

🔹 Sentiment & Outlook

The decisive rebound from support suggests that buyers are defending value zones aggressively. However, failure to close the week above 3,365 leaves gold vulnerable to another retest of mid-range levels if fresh catalysts don’t emerge.

Traders should watch for:

A clean breakout above 3,365 to confirm continuation higher.

Any sustained weakness below 3,300 as a signal of fading bullish momentum.

🧭 Next Week’s Focus:

Monitoring whether the consolidation evolves into accumulation or distribution.

Watching for a breakout or deeper pullback

Reactions to upcoming economic data

EMA alignment: If the 15 EMA continues to track above the 60 EMA, it supports a bullish bias.

Chart Notes:

The main chart highlights this week’s action, while the inset provides a fortnight overview of the broader decline and recovery for context.

Thank you for your time and your support...

🚀🚀Boost it if you like it (Thanks)🚀🚀

#Gold #XAUUSD #GoldTrading #Forex #Commodities #TechnicalAnalysis #PriceAction #TradingRecap #MJTrading #GoldForecast #MarketReview #WeeklyRecap #TradingView

TSLA bearish: Musk vs Trump! Subsidy Spotlight & Sentiment RisksIf you haven`t bought TSLA before the recent breakout:

Now you need to know that Tesla (TSLA) is sitting around $315, but the vibe is getting shakier. Elon Musk’s feud with Donald Trump — complete with jokes about “putting the DOGE on him” if deported — might feel like another meme moment, but it spotlights Tesla’s huge dependency on federal and state support.

Estimates show Tesla could face up to $48 billion in lost government contracts and incentives over the next decade if the political tide turns. With Trump’s base calling out “green subsidies” as wasteful, Tesla’s funding pipeline could get squeezed — just as competition ramps up and margins get tighter.

Key Bearish Points

1) Political Risk Is Real

Musk’s public fight with Trump is a double-edged sword: he risks losing goodwill on both sides of the aisle. If the next administration decides to gut EV credits, Tesla could take a huge hit — far more than its rivals who rely less on U.S. incentives.

2) Subsidy Dependence

Tesla’s success is partly built on a foundation of tax credits, carbon credits, and favorable policies. $48B in potential lost value is nothing to shrug off — especially when competitors like BYD are gaining ground.

3) Bearish Technical Setup

TSLA’s chart is rolling over inside a bearish channel. It recently failed to hold the $330 level and now sits around $315. A clean breakdown below $300 could open the door to your target zone at $262 — a major support area from earlier this year.

Catalysts:

Any new comments from Trump’s camp about EV subsidies

Weak delivery/margin numbers from Tesla

Broader tech/equity pullback

Musk’s crypto distractions no longer propping up sentiment

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.