Trump

April 28, 2025 - Broken Supply Chains, and the DC CircusHello everyone, it’s April 28, 2025. The week ahead promises to be spectacular (or a complete disaster) depending on which way the wind blows out of Washington. So far, the futures are down about 0.6% this morning, as everyone’s trying to cut risk ahead of a week crammed with Big Tech earnings ( NASDAQ:AAPL , NASDAQ:MSFT , NASDAQ:AMZN , NASDAQ:META ), a mountain of macro data (PCE, GDP, ISM, jobs), and of course, the never-ending Trump tariff soap opera.

On the US politics front, Trump stayed uncharacteristically quiet over the weekend, no new bombshells. But whispers about “talks” with China surfaced, without any real confirmation. Meanwhile, several countries are supposedly rushing to negotiate tariff deals with the US. Expect headlines (and chaos) throughout the week.

Supply chains are starting to crack. Container traffic from China to the US has plunged 60%, and if deals aren’t made by mid-May, we could be staring down empty shelves and layoffs in transport and retail sectors. Think “Black Friday” without anything to buy.

Meanwhile, the drama at the Fed continues. Kevin Warsh, still salty about not replacing Powell, attacked the Fed’s “media circus” style, blaming it for post-Covid inflation. Warsh wants the Fed to go old-school: shut up, protect the dollar, and stop playing superhero. No forecasts, no endless press conferences. Just cigars and silence.

On the macro side, this week’s economic data could turn into a horror show: weak jobs numbers, soft GDP, slowing PCE, all raising the probability of recession. If that happens, expect markets to start begging the Fed to cut rates sooner rather than later.

Assets snapshot:

• BLACKBULL:WTI : $63.36

• OANDA:XAUUSD : $3,307

• INDEX:BTCUSD : $94,000

In short: expect maximum volatility, endless surprises from DC, and a market that could spin on a dime. Stay sharp, stay skeptical, and brace for anything.

XAUUSD - Gold trend reversed?!Gold is trading below the EMA200 and EMA50 on the hourly timeframe and is in the specified pattern. The continuation of gold's movement depends on the breakdown of one of the two established trend lines, and after a valid breakdown, we expect to reach the established targets.

In recent weeks, gold prices have experienced significant volatility. This precious metal, long regarded as a safe-haven asset during periods of economic uncertainty, faced a decline in Monday’s trading session. The primary reason behind this drop was signs of easing trade tensions between the United States and China, leading to decreased demand for safe assets. This decline occurred while investors awaited clarity regarding ongoing trade negotiations between the two countries.

Last week, media reports indicated that China exempted some American imports from 125% tariffs, signaling a reduction in bilateral tensions. In response, Donald Trump stated that trade talks were underway; however, this claim was rejected by China. Additionally, the U.S. Treasury Secretary announced that he was unaware of any active negotiations, further fueling market doubts.

According to a recent Federal Reserve survey, participants cited the outflow of foreign capital from U.S. assets and a decline in the dollar’s value as potential new economic shocks. Some respondents believed that increased tariffs might only cause limited market disruptions. The survey indicated that despite market turmoil in April, prices remained elevated relative to fundamental indicators.

Meanwhile, investors were closely awaiting key U.S. economic data set to be released over the coming week. While the previous week was relatively quiet in terms of economic indicators, market focus has shifted toward a series of critical U.S. employment reports. These include the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday, the ADP private-sector employment report on Wednesday, and weekly jobless claims on Thursday—all paving the way for the most crucial event of the week: the April Non-Farm Payrolls (NFP) report, to be released Friday morning.

Beyond these reports, several major events are scheduled in the economic calendar: Canada’s federal election on Monday, the U.S. Consumer Confidence Index on Tuesday, preliminary first-quarter GDP data, pending home sales figures, and the Bank of Japan’s monetary policy decision on Wednesday, followed by the U.S. ISM Manufacturing PMI on Thursday—all of which could impact market sentiment.

On another front, the China Gold Association reported that gold consumption fell by 5.96% in the first quarter of 2025, reaching 290,492 tons. Although gold jewelry demand declined by 26.85%, investment-related gold demand surged by 29.81%, reflecting investors’ pursuit of safe assets amid economic and geopolitical uncertainty.

Domestic gold production in China increased by 1.49%, and assets held in gold ETFs rose sharply by 327.73%, indicating heightened financial caution among Chinese consumers in 2025.

A recent report from Goldman Sachs suggests that the downward trend of the U.S. dollar is far from over and that the currency remains significantly overvalued. Jan Hatzius, the bank’s chief economist, stated that despite the dollar’s recent 5% drop, it still stands roughly two standard deviations above its long-term real average since 1973. Historically, such levels have marked the beginning of multi-year correction cycles for the dollar.

Similar patterns occurred during the mid-1980s and early 2000s when the U.S. dollar experienced declines of around 25% to 30% following such valuations. Based on this, Goldman Sachs expects a similar scenario to unfold in the coming years.

One of the key structural factors fueling this anticipated correction is the portfolio composition of global investors. Specifically, non-U.S. investors hold about $22 trillion worth of assets in the United States, roughly one-third of their total portfolios.Half of these investments are unhedged against currency risk, which could lead to sharp fluctuations in the currency markets if investor sentiment shifts.

Goldman Sachs analysts believe that even a modest reallocation of global capital away from U.S. assets could significantly lower the dollar’s value. Therefore, they view the dollar’s gradual yet sustained decline not as a temporary fluctuation, but as a long-term structural trend.

From Financial Markets to Pope Francis' Funeral

From Easter to April 28, 2025, financial markets have been in a period of great turbulence, influenced by economic, geopolitical and social events. The Forex market, in particular, has reacted to central bank decisions, commodity fluctuations, global trade tensions and the major event of Pope Francis' funeral, which has seen the participation of world leaders and talks that could have a lasting impact on international relations. This article offers an in-depth analysis of the key events of these weeks.

1. Monetary Policies and Forex Markets The decisions of major central banks have dominated the movements of currency markets. The Federal Reserve, in an attempt to balance recession and inflation risks, has decided to keep interest rates unchanged. This approach has caused a temporary weakness in the US dollar, prompting many traders to move towards more stable currencies such as the euro and the pound.

In Europe, the European Central Bank took a more hawkish stance, hinting at a possible tightening of monetary policy to combat inflation. This move boosted the euro, which posted significant gains against major currencies.

The Bank of Japan, on the other hand, continued its ultra-accommodative policy, causing the yen to weaken further. Traders then showed a preference for the dollar and the euro over the Japanese currency.

2. Commodity Prices and Impact on Related Currencies The commodity market saw significant movements. Oil prices fell, influenced by a rise in inventories in the United States and weak global demand. This trend penalized currencies that are highly correlated to commodities, such as the Canadian dollar (CAD) and the Australian dollar (AUD).

On the other hand, gold continued to gradually increase, with investors choosing it as a safe haven in a context of economic and geopolitical uncertainty. Gold’s strength had an indirect impact on currencies tied to the precious metal.

3. Geopolitics and Conversations During Pope Francis’ Funeral The funeral of Pope Francis, held on April 26, 2025 in Rome, was a crucial moment for global diplomacy. The participation of world leaders allowed for significant discussions:

Meeting between Donald Trump and Volodymyr Zelensky: During the ceremony, a possible peaceful solution to the conflict in Ukraine was discussed. The opening to a ceasefire represents a real possibility for stability in the region.

Statement by Vladimir Putin: The Russian president expressed Russia’s willingness to negotiate without preconditions, a signal that could positively influence global tensions.

Focus on dialogue and peace: The funeral itself emphasized the importance of building bridges between nations, a central message of Pope Francis’ pontificate.

These talks, if followed up with concrete actions, could have long-term effects not only on geopolitical relations, but also on investor confidence and, consequently, on financial markets.

4. Economic Data and Influence on Forex Markets Economic data released during this period played a central role in the movements of the Forex market:

United States: The Consumer Price Index (CPI) showed a slowdown, suggesting that inflationary pressure could ease. This fueled speculation that the Federal Reserve could cut interest rates in the coming months.

Eurozone: Inflation exceeded expectations, strengthening the euro and increasing the likelihood that the ECB will adopt further monetary tightening measures.

Fluctuations in economic data caused greater volatility in the Forex market, offering opportunities and risks for traders.

5. Implications for the Future Looking ahead, investors should carefully monitor geopolitical developments stemming from Pope Francis’ funeral talks, central bank decisions, and key economic data. The combination of these factors could continue to generate volatility in currency markets, making FX a dynamic and complex space for the coming months.

OFFICIAL TRUMP Update —Your Guide Through Light & DarkIt gets better and better. Yesterday TRUMPUSDT produced the highest session close since 3-March. Think about it... The bottom is fully in and confirmed and now almost two months of bearish action have been completed obliterated. The action is happening now the same as if it were early February 2025.

Another interesting fact is that almost two months of bearish action has been deleted but the chart is only a little over 3 months old. The bears are no more we are in the bullish zone.

This is important and a strong confirmation.

TRUMPUSDT started trading when the market was bearish and moving within a strong corrective phase. The correction for the last major 2024 bullish wave.

Corrections are tough I agree and the market bleeds but they end and once they end the action turns the other way and that's what you are seeing today.

There is no doubt here, nothing to fear, the rise won't stop it is only getting started. Make no mistakes.

How far up TRUMPUSDT will grow is only speculation but you can expect a new All-Time High for sure. And that's easy for a Cryptocurrency project and one with so much buyers, holders, attention and market support.

This is a simple update mentioning the highest close in months, the bottom is in and bullish continuation confirmed. Keep holding and you win. Keep buying, double-win. Only sell when the market reaches new All-Time High and is full green.

Right now is the time to buy and hold, when prices are low. Only when prices are high we take the profits and move on.

Trading is meant to make money. To make money, you have to let go of your position once the market grows.

Prepare now. Plan ahead of time.

You will do great. You have my support.

Thanks a lot for your continued support.

I will be your guidance through the light and through the dark.

Namaste.

Solana | BULLISH ON SOL | SOL Dominates Blockchain RevenueEven with a dip in activity particularly around memecoins, Solana has managed to hold its ground impressively when it comes to generating revenue.

While you might think fewer transactions would automatically mean less money coming in, Solana's performance shows otherwise. This ability points to the solid value being created by the different applications and uses on the network right now.

A big reason for this financial resilience is the continued strength of dApps on Solana. These apps have been really effective at bringing in fees and adding value to the network. It seems that while the hype around certain speculative tokens has died down significantly, the core utility and economic activity within Solana's dApps are still going strong. This shift towards more fundamental uses for generating revenue is a really positive sign for how the network can keep growing in the long run.

Looking ahead the future for SOL is bright imo as more projects are linking Artificial Intelligence with Solana, taking advantage of its speed and low costs to build new things. Plus, the introduction of Solana ETFs in Canada is a big step.

Other Solana-based alts including Official Trump (TRUMP), Jupiter (JUP), Raydium (RAY), and Bonk (BONK), have followed SOL with good price increases.

It seems like the focus is shifting towards building more lasting and useful applications. With ongoing support for developers and increasing interest from the traditional financial world, Solana seems well-positioned to handle market ups and downs and keep finding new ways to create value in the future. I'll definitely be watching to accumulate for the long-term.

______________________________

BINANCE:SOLUSDT

TRUMP COIN BUY...Hello friends

Given the price growth we had, the price correction has now managed to make good bottoms, which indicates the strength of the trend, so we can enter the trade.

The purchase and target points have also been identified...

Follow capital management.

*Trade safely with us*

MAGS SUPER STRUCTURE FORMING CAUTION!We have MEGA superstructures forming everywhere. H&S Eiffel Towers, etc.. None will be more devastating to 401ks and people's portfolios than the MAGS breaking down from this mammoth structure.

Last chance to GTFO forming.

CAUTION is in order!

Click Boost, Follow, Subscribe. Let's get to 5,000 followers ))

Important section: 12.560-18.301

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(TRUMPUSDT.P 1D chart)

The HA-Low indicator on the 1D chart is showing an upward trend after being created.

The HA-Low indicator is currently formed at 7.933.

-

The 12.560-18.301 section corresponds to the Close value of Heikin-Ashi on the 1M chart.

Accordingly, in order to continue the upward trend, it is expected that the price will have to rise above 12.560-18.301 to maintain the price.

-

If it falls below 11.796-12.560, it is likely to meet the HA-Low indicator on the 1D chart again, so a response strategy is needed.

-

If it rises above 18.301 and maintains the price, it is expected to determine the trend again by touching around 27.329.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

Trump Short & Long-Term With Targets ($263, $192 & $121 —1,627%)This is the long-term chart for TRUMPUSDT (OFFICIAL TRUMP), all bullish signals are strong and 100% confirmed. Higher prices next with a high lever of certainty. An uptrend will develop now, higher highs and higher lows.

The weekly session is full green, current session.

The trading volume on this session is the highest ever. Check.

There is a falling wedge pattern fully broken.

The downtrend has been broken.

There is a rounded bottom pattern (stop-loss hunt event) that work as a reversal signal.

The action is happening back above support, recently a resistance zone. These are the blue lines on the chart.

All these are bullish signals.

Next comes the targets:

1) The first and easy target sits at $24.

2) This one is followed by $34 and $42.5.

3) The main target in the coming weeks is $51.

4) Mid-term, within 3 months, we have $63, $94 and $122.

5) The remaining set of targets will be hit long-term, 6 months or more. These are in the range of a strong new All-Time High, it can be seen on the chart.

Thank you for reading.

Boost for more frequent updates and comment.

Namaste.

WELCOME TO THE BEGINNING OF ALT COIN SEASON!Traders, Hodlr's and Soon to be Liquidity (late retail buyers),

This is likely the moment we have been waiting for. Last week in our weekly VIP market update we discussed just a few things that would really show us if we just saw the bottom of the alts and if it was now time to start seeing some new local HH's and then HL's showing us a shift in trend. I had posted a few trades pointing this out. We have now at this point accomplished what we were looking for to see if we would be starting Alt coins season.

We have been watching a few things. The first being Bitcoin Dominance or CRYPTOCAP:BTC.D as this is a great chart to watch and look for reversals prior to looking at the chart of the specific alt coin against BTC to see if it also is showing it could have a rally or a pullback based on your bias on this BTC.D chart. For instance if I were to want to see maybe when XRP would likely start breaking out say that this BTC.D chart is in fact correct and the triangle trend line will end up being the top for btc dominance at around 64.4% of the total market I would go to BITSTAMP:XRPBTC to give myself some insight on confluence of market movements.

Being that we are now here at the point that I believe we will start to see money flow into alts based on this chart and others such as CRYPTOCAP:TOTAL2 , CRYPTOCAP:TOTAL3 and CRYPTOCAP:TOTALDEFI and the specific BTC pairings that I am holding by looking up the ticker of my alt coin/BTC and studying that chart I will honestly say that I am in the 90%/10% bullish on alts to bearish.

I hope this information helped you in your journey to get more information and come up with your own analysis to base your investment decisions and you become prosperous for doing soo!

Stay Profitable Folks,

Savvy!

OFFICIAL TRUMP 100X Chart Setup Now PossibleLook at this, the bottom is in.

I draw a black line on the chart that matches the wick low from the 3-April candle. Today, the action is back above this low.

All the action below this line is the bottom pattern. It takes time for a bottom to form and this bottom is now confirmed. Once the bottom is in, nothing else can happen other that sustained long-term growth. If the action wasn't sustained long-term, then this wouldn't be the bottom, just another low in place.

This is it, feel free to go All-In with 100X...

I am just kidding of course, leveraged trading is for experts and experts will never gamble their money away.

We trade with 2-3X maximum when we are doing our daily work and we go to higher leverage when the market is trading at its lowest prices possible and this happens only once every 6-8 months.

So, no 100X.

On top of the bottom pattern there is also a falling wedge. The falling wedge has been broken and this means a broken downtrend. What happened with the token unlock?

People were saying that prices were to drop because there was going to be a token unlock, but the market cycle does not care about these things. When prices are low we buy and hold, we sell when prices are high and green.

The targets on the chart are just easy targets, it can go much higher... Much, much higher than what is shown on this chart.

As prices grow, I will publish updates. If you are interested, make sure to boost and follow to show your support.

More comments and boosts, more updates.

Just let me know and I'll get it done.

Namaste.

Trump's World Liberty Financial to add SUI to strategic reserve!CRYPTOCAP:SUI , a leading Layer-1 blockchain, has entered into a significant partnership with World Liberty Financial (WLFI), a decentralized finance (DeFi) platform affiliated with Donald Trump.

This collaboration involves integrating Sui's native token (SUI) into WLFI's "Macro Strategy" reserve, a strategic token fund designed to diversify holdings and support emerging blockchain projects.

The partnership also aims to explore product development opportunities leveraging Sui's technology.

WLFI's Macro Strategy reserve already includes prominent digital assets such as Bitcoin, Ethereum, and tokenized real-world assets like U.S. Treasury-backed tokens.

The addition of SUI reflects WLFI's focus on supporting innovative blockchain projects while expanding decentralized finance access to a broader audience.

The announcement of this partnership coincides with broader developments in the U.S. crypto landscape.

President Trump is expected to unveil details about a proposed "Crypto Strategic Reserve" during the White House Crypto Summit on March 7, 2025.

This reserve is anticipated to focus primarily on Bitcoin while also considering other digital assets

Trump-backed World Liberty Financial plans to add SUI to its strategic reserve.

I think the upside for SUI is Huge from here!

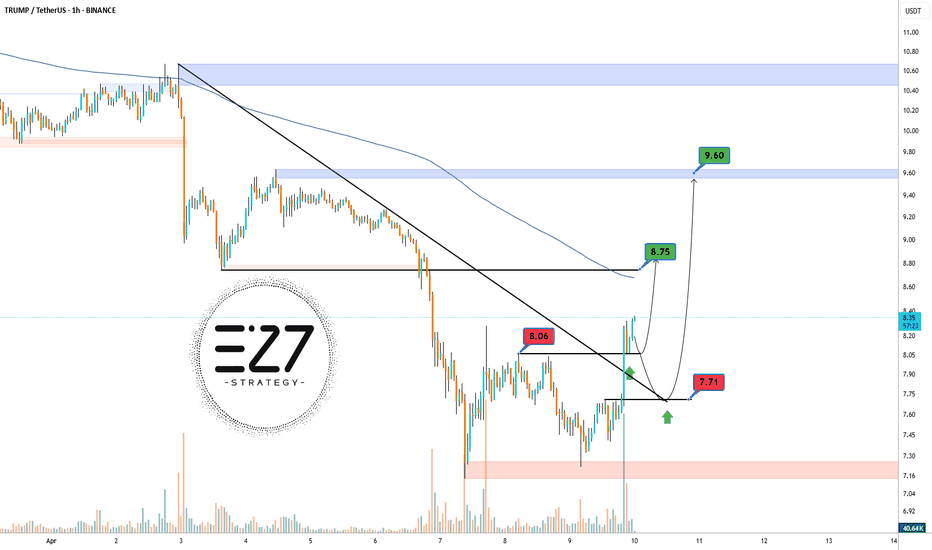

Trump token bullishKey Levels: The main resistance is at 10.40 dollars , and the main support is at 7.71 dollars . The descending trendline keeps the price below it, and the 200-period moving average above the price confirms the bearish trend .

Closer Zones: A nearby resistance is observed at 8.06 dollars, overlapping with the trendline. The closer support is at 7.71 dollars. A break above 8.06 dollars could push the price toward 9.60 dollars .

Intermediate Level: On the way up, the 8.25 dollars level acts as an intermediate resistance.

Target: Based on the previous move of 2.50 dollars, the potential upside target is around 9.60 dollars .

Conclusion: A breakout above the nearby resistance could signal a weakening bearish trend and the start of an upward move .

April 25, 2025 - Trump’s Tango, Tech, and Insider DramaHello everyone, it’s April 25, 2025. We’re closing in on Trump’s 100-day mark back in the White House, and if there’s one word to sum up his impact on markets: chaos. With 137 executive orders signed already, he’s turned global markets into a high-stakes rollercoaster though this week saw signs of recovery, confidence remains fragile, and volatility is still running the show.

The main trigger? You guessed it: Trump and his tariff diplomacy. After weeks of U-turns, threats, and NYSE:TWTR meltdowns, he’s finally announced that talks with China have begun. That was enough to send the AMEX:SPY up 2%, pull the CME_MINI:NQ1! out of correction territory (+2.74%), and ignite a 5.63% jump in the Philadelphia Semiconductor Index, even though it’s still miles below its all-time high.

OANDA:XAUUSD is sitting at $3,332, BLACKBULL:WTI hovers around $63.21, and INDEX:BTCUSD has skyrocketed to $93,200. Not bad for a week that started in total disarray.

Now here’s where things get fishy: US indices started climbing before Trump’s announcement—classic “somebody knew something.” Insider trading? Just your average Thursday. And while Trump claims talks are underway, the Chinese side played coy, denying any ongoing negotiations. Either someone’s lying, or the talks are happening over dim sum in DC.

Beyond geopolitics, NASDAQ:GOOG crushed earnings expectations and added a juicy dividend and GETTEX:70B in buybacks, exploding 6% after-hours. Meanwhile, NASDAQ:INTC flopped—flat profits, poor outlook, and a CEO trying to turn cost-cutting into a growth story. The market wasn’t buying it: down 5.7% after-hours.

NYSE:NOW , though, is living its best life. Strong results, AI momentum, and federal contracts boosted shares 15%. Other names like NASDAQ:PEP , NYSE:PG , and NASDAQ:AAL warned on the future thanks to—you guessed it—political and economic uncertainty.

On the macro front, ECONOMICS:USIJC (US jobless claims) ticked higher, inflation seems to be cooling, and if next week’s PCE and employment data confirm the slowdown, the Fed might just blink and cut rates in May. Market hopes are pinned on Powell holding steady—unless, of course, Trump decides to live-tweet through it.

Futures are up 0.37% ( CME_MINI:ES1! ) this morning, signaling optimism—possibly misplaced—in Trump’s “friendly” overtures toward China. Let’s just say we’re one golf game away from another market tantrum.

Enjoy your weekend, stay alert, and cross your fingers for a quiet Sunday tweet-wise.

Gold is still Strong; Long-Term!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GOLD has been overall bullish from a macro perspective trading within the rising wedge pattern in orange.

After rejecting the $3,500 round number and upper bound of the wedge, XAUUSD signaled the start of the correction phase.

Moreover, the $3,100 - $3,150 zone is a strong support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower orange trendline acting non-horizontal support.

📚 As per my trading style:

As #XAUUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DexeDexe usdt Daily analysis

Risk rewards ratio >5 👈👌

Time frame daily

First target =16$

2th target = 19.5 $

Stop is very tight. Below of support line.

If price break the support line and my stop , I don't lose because it's very tight. On the other hand, if price reach to my target , I get good benefit

Xrp (Ripple)Ripple

Xrp usdt Daily analysis

Time frame daily

Risk rewards ratio >3.2 👈👌

Target 3.2$

Ripple technical analysis ✅️

My last short position reached the target.

Head and shoulders pattern completed.

Now it is a good time to start

My critical area is red box that you see on the chart. It is very important area .

If Ripple can reach and break this resistance, we will have a good pump

But now 3 _3.2$ is a good target

TRUMP price analysis✊ At the end of March, we last wrote about #Trump and “looked like water” predicting a price drop to $7-7.20 if the “great and brilliant leader” did not stop doing stupid things.... but then came the April sanctions...

We can comment and discuss it for a long time, but it's no use - you can't get the rust out of the metal or out of your head...

It was interesting on 19.04 - when a large unlock of 40 million #Trump coins took place and participants expected the price dump to continue.... but no...

and already on 23.04 - the news comes out that #Trump will have dinner with the largest holders of his token and, oh, miracle = 75% of the OKX:TRUMPUSDT price pump

There are already jokes on Twitter that the TOP-5 holders will be able to choose to who will be the next to set or remove abnormal taxes during dinner)

But seriously, there is every chance that the #TRUMUSDC price pump will continue and God grant us patience to keep and hold this small amount of #Trump coins to $24-$32 or maybe to $40...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more