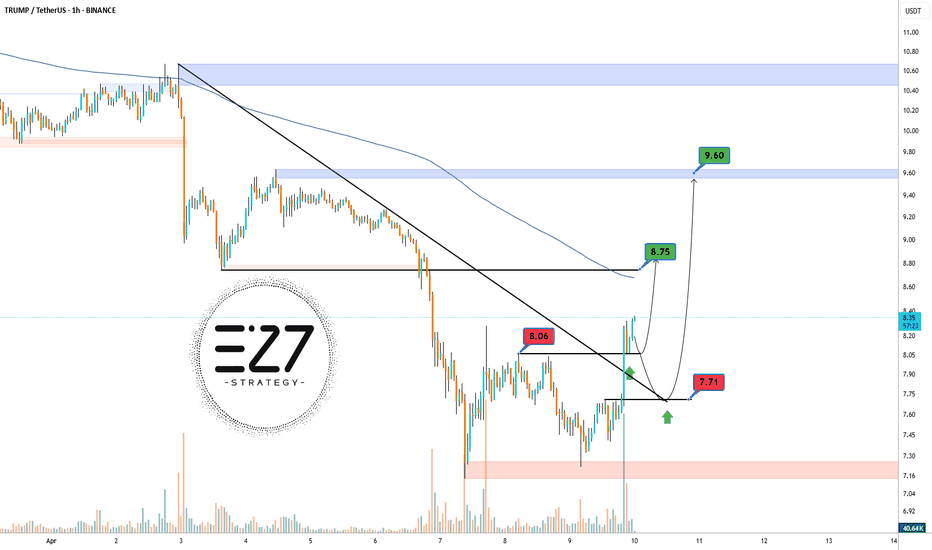

Trump token bullishKey Levels: The main resistance is at 10.40 dollars , and the main support is at 7.71 dollars . The descending trendline keeps the price below it, and the 200-period moving average above the price confirms the bearish trend .

Closer Zones: A nearby resistance is observed at 8.06 dollars, overlapping with the trendline. The closer support is at 7.71 dollars. A break above 8.06 dollars could push the price toward 9.60 dollars .

Intermediate Level: On the way up, the 8.25 dollars level acts as an intermediate resistance.

Target: Based on the previous move of 2.50 dollars, the potential upside target is around 9.60 dollars .

Conclusion: A breakout above the nearby resistance could signal a weakening bearish trend and the start of an upward move .

Trumpeffect

Trump's coin impact!The recent surge of Trump Coin highlights how sudden market movements can disrupt price patterns and influence trading behavior across the broader cryptocurrency market. The rapid rise of Trump Coin, which soared by over 600%, sparked a wave of euphoria and speculation, drawing attention away from other cryptocurrencies and creating a ripple effect that reshaped

market dynamics.

The Trump Coin Phenomenon

Trump Coin's explosive price increase captivated both traders and investors, significantly shifting market focus. This wasn’t just a temporary spike, but an event with lasting consequences that drained liquidity and trading volume from other coins, concentrating interest on Trump Coin.

Impact on Other Cryptocurrencies

As Trump Coin gained traction, the wider market began to stagnate, with overall market indicators like TOTAL (representing total market capitalization) and TOTAL2 (excluding Bitcoin) showing little movement. This period of stagnation reflected a lack of fresh capital flowing into other cryptocurrencies, as most traders redirected their focus to the Trump Coin rally.

The following consequences were observed:

[/b ]Liquidity Drain: As attention turned to Trump Coin, many altcoins saw a significant drop in trading volume, resulting in price stagnation and periodic sell-offs.

Market Dump: Investors exiting their positions in other cryptocurrencies to join the Trump Coin rally contributed to temporary market dumps, amplifying the broader consolidation phase.

Psychological Shift: The excitement surrounding Trump Coin led to a more cautious "wait-and-see" mentality among traders, reducing overall market volatility as fewer positions were opened.

Consolidation Phase

In the wake of Trump Coin's rapid rise, other cryptocurrencies entered a consolidation phase, a common occurrence when the market experiences a lull or imbalance. This phase reflects a market seeking stability before the next significant movement, with many investors holding back as they await further developments.

Key Levels TRUMP🔹 Key Levels:

Supports: 20 - 28 - 35 - 65

Resistances: 90.06 🔥 and 100.00 🚀

🔹 Analysis:

The price may correct to the 65.30 zone and then rise 📈, targeting 90.06 and 100.00. If support breaks, the price could drop to 28.71 ⚠️.

🔹 Recommendation:

Using a stop loss is essential 🚨

Ensure proper risk management

TRUMPomania - 3 variants of possibly Bulls RallyCrypto markets have been rocked by the launch of an "official" Donald Trump memecoin this weekend—with traders braced for more mayhem this coming week.

Unlock over $3,000 in NFT, web3 and crypto perks — Apply now!

The price of the "official" Trump memecoin has surged since its Friday evening launch, breaking into the crypto top 20 by market capitalization and hitting an eye-watering $14 billion.

Now, as leaks reveal Trump is readying a flurry of crypto-focused executive orders, Trump's wife Melania has launched her own rival cryptocurrency—tanking the price of Trump's coin.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

Stock market correction in 2025??I personally believe we'll see a stock market correction in 2025.

1. 30yr treasury yield going higher while FED cut interest rates. Similar situation in 1970s and 1980s where we say a 50% correction in just 2 years in the 1970s (can't remember exact dates)

2. US 10yr/3m yield curve has turned positive. Last times it's done this has been 2000, 2008 and 2020. I'm guessing you know what happened each of those times.

3. Institutional investors increasing long contracts in the yen. The Japanese Yen is a 'risk-off' investment and investors tend to favour it when they don't have much faith in the stock market.

4. US have a volatile president in Trump. The power also seems to be getting to his head a bit - he disagrees with Fed Chair Powell over interest rates, despite not being as educated in economics. He has a lot of power right now and I don't think he will be able to stop a potential market crash for the first year or 2 of his presidency.

5. Back-to-back 20%+ years from the S&P500, could be due a pullback.

These are some reasons, I have some more but I don't want to be sat here writing all day.

Important to note that if you're a long term investor it's best to just ignore this. "Time in the markets beats timing the markets" as they say.

But if you're a day trader I wouldn't be taking many long positions on stocks this year. Could be better to start looking at opportunities in the currency markets.

Then again - you don't have to trust me. This isn't financial advice, just my opinion.

Will Trump win?🔍 Technical Analysis of STRUMP/USDT 📉

Key price levels marked in green 🟢 and red 🔴 show potential "Winner" and "Loser" zones:

1️⃣ Winner Zones (Resistance)

Break above 0.007312 could drive price higher 🚀

Stronger resistance at 0.010810 to confirm uptrend 🔼

Higher targets at 0.017108 and 0.025640 📈

2️⃣ Loser Zones (Support)

First support at 0.004441; a fall below signals potential downtrend 🚨

Further support at 0.003255 and 0.002162 🛑

📉 Channel & Trend Lines: Price is moving within a descending channel ➡️ Breakout from this could indicate a reversal 🔄

Trading Strategy:

📈 If price enters green zones and breaks resistances, consider buying positions.

📉 If price drops into red zones and fails to hold support, selling or avoiding buys might be wise.

BTC: ATH Imminent? U.S. Election Could Be the Catalyst!Hey everyone!

If you’re finding value in this analysis, don’t forget to hit that 👍 and follow for more updates!

Welcome to this BTC Update!

BTC has broken out of the parallel channel on the daily time frame and is currently hovering near the retest area. The market has been unusually quiet lately—this feels like the calm before the storm, and I’m anticipating a major pump from here.

It seems the whole market is waiting on the outcome of the U.S. elections. After the election, I expect BTC to break its ATH, aiming for $90k-$100k by year-end.

Invalidation: Daily close below the $64.8k level.

What’s your take on BTC’s current price action? Are you spotting this bullish setup too? Share your analysis in the comments, and let’s ride this wave together!

TRUMP MEDIA (DJT) Skyrockets After NYC Rally! Next Big Move?TRUMP MEDIA (DJT) Analysis:

Trump Media & Technology Group Corp (DJT) experienced a sharp rise in price, gaining over 10% in Tuesday’s pre-market trading following a high-profile rally by Donald Trump at Madison Square Garden. This rally, which attracted a wave of attention, likely fueled the surge in buying interest. The stock closed 21.59% higher the previous day, marking a significant increase.

Trade Setup:

Entry Point: $30.15

Stop Loss: $20.95

Target Levels:

TP 1: $41.53

TP 2: $59.93

TP 3: $78.33

TP 4: $89.70

Technical Indicators:

The Risological dotted trend line indicates bullish momentum, suggesting that buyers are stepping in forcefully. With TP 1 already reached, the stock has shown strong momentum, making the higher targets achievable if this rally sustains.

Market Sentiment:

Post-event enthusiasm and Trump’s push on key issues seem to resonate with certain investor groups, potentially sparking further interest. Given the volume spike to 110.35M, far above its 30-day average, momentum remains high.

Outlook:

With further upside potential, the stock could reach its higher target levels if the rally and media attention continue to bolster confidence. Keep a close watch on volume and price action to capture potential profit-taking points or to ride the bullish wave to higher targets.

12 Year old Buys Trump's Stonk ;)ELON MUSK WON'T BUY TWITTER SO THIS STOCK IS GOING TO PROBABLY BE TWITTER MAIN COMPETITOR, SO IT IS GONNA AN BE A BIG OPPORTUNITY TO BUY THIS STOCK.

*Remember this is not financial advice and this is not political*

I KNOW WE POSTED A LONG BUT!!!I know we posted a long. On here. Free channel milked the long then took a short. Closed for Friday NFP.

Looking now we have potentially a short position coming up.

Trump got covid, but shared he is doing well, so reduces the chance of uncertainty which then some fundamentals point towards gold going down just like the charts.

Remember just because we post something here. Does not mean we are taking the trade. The market can change very quickly. So we can be long 1 min then short the next. x

USDJPY (UJ)Hello Everyone! Time for USDJPY "DUH DUH DH"

So I'm expecting the price to Drop mainly because the overall trend is still down. This is a confirmation which means I would not short the market.

- I can see the 0.618 fib which was held previously.

- This might a pull back but It's a good place to look for entry guys.

- There are more market gaps to the upside as it is on a downtrend.

- Need to look out for the market gap on the downside too.

- As you can see the order were filled and price pushed up.

- If the price break above 107.900 I would consider this trade to be invalid but I would risk less on this trade (which is 0.5% )

*This pair can be easily influence from the news*

Thanks for positive message and feedback. I hope all of you are doing well and let's kill the market and be victorious.

Remember there is always a reason why price move the way they move. You cannot be always right but you can have advantage over the markets.

S&P 500: May You Live In Interesting TimesThe SPXUSD (the perpetual contract of the SP 500) is somewhat of an indicator for domestic US investor sentiment. In comparison, I consider the DJIA to be an indicator of foreign capital flows to the US.

The US appears to be triggered by the nomination of a Supreme Court judge, or rather, the slander and innuendo associated with the nomination... and despite all the howling and nashing of teeth, the S&P500 goes nowhere but up, for slander and innuendo cannot be traded.

I mention this because US political instability is a fundamental headwind. The Supreme Court nomination is a flashpoint that reveals the deep polarization, unfocused discontent, and indoctrination in the US. Meaning, if Kavanaugh is appointed, investor sentiment will be maintained, as it represents a win for Trump, and a win for Trump is a win for business. But, a lot of people will not accept this nomination, and it will only deepen political contention. Any threat to Trump may impact the markets negatively.

But for now, the markets are optimistic. Was today the dip to buy? It was trendline and horizontal confluence. I would like to see the lower parallels tested for an even better buy entry.

As traders, the best we can do is do what needs to be done, when it needs to be done. In a bull market, that means buying the dip. If the lower parallel is taken out on a closing basis, I will naturally readjust. For now, no damage has been done.

I find it troubling that daily, weekly and monthly stock/rsi are flashing bearish divergence. Bear div can always be negated, but this needs to be monitored.

In short, stay long. Buy dips. Re-adjust if levels are taken out to the downside.

USD Downside trend projection.Firstly fundamentals: Trumps specific policy, his trade wars, etc. makes me think, that US Dollar index is under big pressure, and it might affect with a bearish movement for that currency.

In the other hand, if we look what happens on the chart, we can see really strong supply zone, that has been respected by DXY. In my opinion USD is going south, with the targets that I have marked.

Taking everything into the conclusion, my long term view of DXY is bearish, and seeing it on the 88 level is just matter of time.