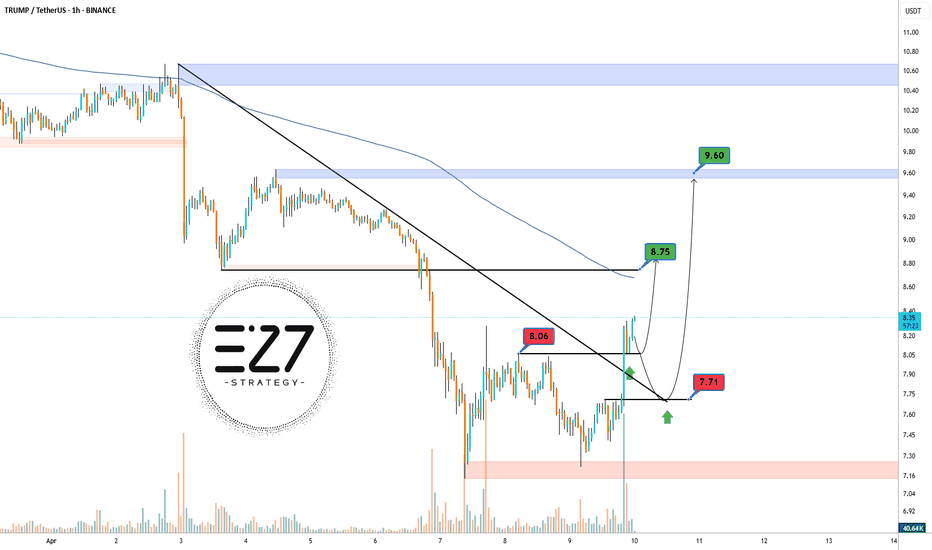

Trump token bullishKey Levels: The main resistance is at 10.40 dollars , and the main support is at 7.71 dollars . The descending trendline keeps the price below it, and the 200-period moving average above the price confirms the bearish trend .

Closer Zones: A nearby resistance is observed at 8.06 dollars, overlapping with the trendline. The closer support is at 7.71 dollars. A break above 8.06 dollars could push the price toward 9.60 dollars .

Intermediate Level: On the way up, the 8.25 dollars level acts as an intermediate resistance.

Target: Based on the previous move of 2.50 dollars, the potential upside target is around 9.60 dollars .

Conclusion: A breakout above the nearby resistance could signal a weakening bearish trend and the start of an upward move .

Trumpmedia

Key Levels TRUMP🔹 Key Levels:

Supports: 20 - 28 - 35 - 65

Resistances: 90.06 🔥 and 100.00 🚀

🔹 Analysis:

The price may correct to the 65.30 zone and then rise 📈, targeting 90.06 and 100.00. If support breaks, the price could drop to 28.71 ⚠️.

🔹 Recommendation:

Using a stop loss is essential 🚨

Ensure proper risk management

Can DJT Trump Media & Technology Group Hit 171? Hey, trading family

DJT from Trump Media & Technology Group is hovering around $42 right now. If we can rally it up to $62.50 and break out of that triangle, we're in for an epic run. We're talking potential jumps to $106, then $142, and if the stars align, we could see $171! With all the buzz around the inauguration, this could be DJT's moment to shine.

If you're as excited about this potential breakout as I am, please give this post a boost, leave some love in the comments, or share it around! And if you want to chat more about this or need more trading insights, feel free to DM me or check out my profile for more.

Let's watch this one together and see if we can hit those numbers!

Kris/Mindbloome Exchange

Trade What You See

DJT: Will It Break $33.85 or $38.55 First? DJT is at a tipping point, and it could go either way. Here’s what to watch so you’re ready for the next big move.

1) If DJT Drops Below $33.85

If this level breaks, things could get rough. Here’s what might happen:

-$28–$26: This is the first stop where the price might chill for a bit.

-$10: If the selling gets heavy, this is where we could end up.

2) If DJT Pops Above $38.55

If the bulls take charge, it could be time to ride the wave higher:

A break above $38.55 could spark a nice rally and push the price upward.

What’s the Plan?

-Keep an eye on $33.85 and $38.55—they’re the magic numbers.

-Be patient and wait for a clear move before jumping in.

If this makes sense, toss me a like or follow. Got questions about DJT or another stock you’re stuck on? Hit me up in the DMs—I’m here to help.

And hey, if you’re feeling burned out or stressed about trading, let’s talk. I’m all about helping you find your balance and keeping things sustainable. Chill, stay focused, and let’s catch the next wave together!

Kris/ Mindbloome Exchange

Trade What You See

Is the Trump Trade Fading? The sugar high from Trump’s victory may be wearing off in a few areas.

Tesla, once a post-election favorite after Elon Musk’s support of Trump’s campaign, has now reversed direction. Reports suggest that Republicans will end the $7,500 EV tax credit—a move that’s sent Rivian tumbling 9%, while Tesla is down nearly 4%.

Shares of Trump Media & Technology slid 8% today. But being a meme stock, analysis here won't tell us much. In a notable signal, the CFO and two other insiders sold over $16 million of stock in the week following the election.

Yet, the U.S. dollar remains resilient, possibly buoyed by the Cabinet picks coming out of the Trump administration. Marco Rubio’s nomination as Secretary of State suggests a tough stance on China. Known for his anti-communist positions and support for Hong Kong’s democracy movement, Rubio has advocated for tighter export controls on U.S. technology and visa sanctions against Chinese officials, hinting at a policy that may go well beyond tariffs.

Trump Media on the Move: Will We See $62 or a Bigger Reset?Alright, trading family, let’s talk about what’s brewing with Trump Media Group (DJT). Here’s what I’m seeing:

1️⃣ Scenario 1: If we close above $34.52 on the 4-hour chart, we could see a strong push up to $42, $51, $62, and maybe beyond.

2️⃣ Scenario 2: A pullback to $28.94–$28 could set the stage for a bounce back up to those same zones.

3️⃣ Scenario 3: If we break below $25.41, we might head down to the $17–$20 range before finding support and potentially pushing back up.

Stay patient, let the price action guide you, and remember—it’s all about riding the waves the market gives you. Always trade what you see, not what you think!

Mindbloome Trading/ Kris

Will Trump win?🔍 Technical Analysis of STRUMP/USDT 📉

Key price levels marked in green 🟢 and red 🔴 show potential "Winner" and "Loser" zones:

1️⃣ Winner Zones (Resistance)

Break above 0.007312 could drive price higher 🚀

Stronger resistance at 0.010810 to confirm uptrend 🔼

Higher targets at 0.017108 and 0.025640 📈

2️⃣ Loser Zones (Support)

First support at 0.004441; a fall below signals potential downtrend 🚨

Further support at 0.003255 and 0.002162 🛑

📉 Channel & Trend Lines: Price is moving within a descending channel ➡️ Breakout from this could indicate a reversal 🔄

Trading Strategy:

📈 If price enters green zones and breaks resistances, consider buying positions.

📉 If price drops into red zones and fails to hold support, selling or avoiding buys might be wise.

TRUMP MEDIA (DJT) Skyrockets After NYC Rally! Next Big Move?TRUMP MEDIA (DJT) Analysis:

Trump Media & Technology Group Corp (DJT) experienced a sharp rise in price, gaining over 10% in Tuesday’s pre-market trading following a high-profile rally by Donald Trump at Madison Square Garden. This rally, which attracted a wave of attention, likely fueled the surge in buying interest. The stock closed 21.59% higher the previous day, marking a significant increase.

Trade Setup:

Entry Point: $30.15

Stop Loss: $20.95

Target Levels:

TP 1: $41.53

TP 2: $59.93

TP 3: $78.33

TP 4: $89.70

Technical Indicators:

The Risological dotted trend line indicates bullish momentum, suggesting that buyers are stepping in forcefully. With TP 1 already reached, the stock has shown strong momentum, making the higher targets achievable if this rally sustains.

Market Sentiment:

Post-event enthusiasm and Trump’s push on key issues seem to resonate with certain investor groups, potentially sparking further interest. Given the volume spike to 110.35M, far above its 30-day average, momentum remains high.

Outlook:

With further upside potential, the stock could reach its higher target levels if the rally and media attention continue to bolster confidence. Keep a close watch on volume and price action to capture potential profit-taking points or to ride the bullish wave to higher targets.

Trump Media Surges! TP1 & TP2 Done – More Targets in Sight!DJT (Trump Media) on the 15-minute time frame, long trade.

Entry: $28.64

Current Price: $34.33 (TP2 hit)

TP1: $30.81 (Hit)

TP2: $34.33 (Hit)

TP3: $37.85

TP4: $40.03

Stop Loss (SL): $26.88

With two targets already hit, the momentum suggests we could see the next targets getting hit soon!

Trump Media Tumble After Ex-President Found Guilty in NYCTrump Media & Technology Group, ( DJ:DJT ) the owner of Truth Social, experienced a slump in shares after former President Donald Trump was found guilty in his hush money trial. A New York jury found Trump guilty of falsifying business records in a scheme to illegally influence the 2016 election through hush money payments to a porn actor who said the two had sex. Trump Media's stock fell about 9% in after-hours trading on Thursday as news of the verdict emerged. The stock, which trades under the ticket symbol "DJT," has been extremely volatile since its debut in late March and has been prone to ricochet from highs to lows as small-pocketed investors attempt to catch an upward momentum swing at the right time.

Trump Media ( DJ:DJT ) reported that it lost more than $300 million last quarter, according to its first earnings report as a publicly traded company. For the three-month period that ended March 31, the company posted a loss of $327.6 million, which it said included $311 million in non-cash expenses related to its merger with a company called Digital World Acquisition Corp.

Trump Media & Technology ( DJ:DJT ) fired an auditor this month that federal regulators recently charged with "massive fraud." The media company dismissed BF Borgers as its independent public accounting firm on May 3, delaying the filing of its quarterly earnings report. Trump was charged with 34 counts of falsifying business records at his company in connection with an alleged scheme to hide potentially embarrassing stories about him during his 2016 Republican presidential election campaign.

The almost 10% stock price drop amounts to a $330 million decline in the value of Trump's shares. Trump's net worth was $7.5 billion Friday morning, making him the 356th-richest person on the planet. A majority of Trump's fortune stems from his $5.6 billion stake in Trump Media, holdings that were worth $5.9 billion as of Thursday.

Trump Media ( DJ:DJT ) went public in March via a reverse merger with a blank-check company after two years of regulatory and legal hiccups. In its two months on the public markets, Trump Media has performed shockingly well, with its after-hours share price still about 25% higher than its blank-check predecessor's stock traded at before the merger's completion.

The stock is down from its All-time high of $80 now trading at $48.90 down by 5.5%.

SEC Charges Trump Media Auditor With Massive Fraud Stock Slides The US Securities and Exchange Commission (SEC) has charged former president Donald Trump's auditor, Benjamin Borgers, with a "massive fraud" and a "sham audit mill." The SEC alleges that Borgers did not properly prepare and maintain audit documentation, fabricated audit planning meetings, and passed off previous audits for the current audit period. The SEC claims that Borgers and his firm were responsible for one of the largest wholesale failures by gatekeepers in financial markets, putting investors and markets at risk and undermining trust and confidence in markets.

Of 369 BF Borgers clients whose filings from January 2021 through June 2023 incorporated BF Borgers' audits and reviews, at least 75% incorporated audits that did not comply with the SEC's rules. The company acted for Trump Media ( NASDAQ:DJT ) during the period of the SEC's complaint. In late March, Trump Media merged with a publicly traded shell company, Digital World Acquisition Corp, in a deal that valued the minnow social network at close to $8bn. The company now trades under the ticker symbol "DJT", using Trump's initials.

Trump Media's shares ( NASDAQ:DJT ) have fallen sharply since their debut but have continued to significantly boost the former president's wealth. The company is now valued at more than $6.5bn, with Trump as the company's largest shareholder and recently qualified for a bonus for the company's share performance that boosted the paper value of his stake to $3.7bn.

🚨$DJT: It's Not Over Yet! 🚀🚀🚀Hi everyone,

Despite a significant drop of 21% today, our indicators suggest the downtrend might not persist. A rebound above the daily level could signal a bullish trend, potentially leading to a weekly cross above the monthly. This could aim the price towards the $63 mark, aligning with the 0.618 Fibonacci resistance level. Conversely, if the price dips below the daily level, the monthly level could offer support. Let's see where this goes in the next few weeks.

Good luck!

DJT Dead Below $32 | Bullish Above $32Unbiased scenarios for DJT media of Truth Social, based on simple conditions of holding or losing a neckline at 32 bucks.

Below $32 = Bearish:

A weekly close below $32 that isn't immediately recovered in the following week likely means it is headed further down towards 12.50. There is an unfilled gap around ~17.50-18.50, so at the very least it could revisit that area.

Above $32 = Bullish:

Should the weekly remain above $32 instead, expect to see it revisit $82 with an eventual weekly close near that level, and then continuation up towards $132

Best of luck!

Donald Trump’s Media Company Spikes 50% On Wall Street DebutIn a whirlwind of market activity, Donald Trump's media company, Trump Media & Technology Group ( NASDAQ:DJT ), made its much-anticipated debut on Wall Street, sparking fervent investor interest and a flurry of speculation about the former president's latest venture.

Shares in Trump's media empire surged an astonishing 50% in early trading, as eager investors clamored for a piece of the action in the inaugural session of trading on the Nasdaq index. The company, trading under the ticker name NASDAQ:DJT —aptly representing the initials of its founder—saw its stock soar to remarkable heights, with Trump's majority stake valued at a staggering $5.9 billion.

The meteoric rise in Trump Media & Technology ( NASDAQ:DJT ) Group's stock price was fueled in part by news of Trump's success in securing a substantially reduced bond of $175 million in his ongoing civil fraud case—a development that injected newfound optimism into the company's prospects. However, the exuberant market response belied underlying concerns about the company's financial performance, with Truth Social, Trump's social media platform, reporting significant losses in its operations.

Analysts, while acknowledging the enthusiasm of Trump's supporters driving the stock's valuation, cautioned against overstating the company's underlying business prospects. Thomas Hayes, chairman of Great Hill Capital, characterized the valuation as "rich relative to its underlying fundamentals," suggesting that investor enthusiasm may be outpacing rational assessment of the company's true value.

The emergence of Trump Media & Technology Group ( NASDAQ:DJT ) comes on the heels of its merger with Digital World Acquisition Corp, a blank-check company, underscoring Trump's knack for leveraging strategic partnerships to propel his business endeavors. The use of the DJT ticker, a nostalgic nod to Trump's earlier ventures in the 1990s, adds a touch of familiarity to the company's Wall Street debut, evoking memories of Trump's foray into the hospitality and gaming industries.

Yet, amidst the jubilation surrounding Trump's resurgence in the business world, lingering legal challenges loom large, casting a shadow of uncertainty over his financial fortunes. Trump's ongoing legal battles, including the civil fraud case and a criminal hush money case, threaten to disrupt his plans for leveraging his newfound wealth from Trump Media & Technology Group.

Despite the jubilant mood among Trump's supporters, skepticism remains regarding the company's long-term viability and its potential impact on Trump's political aspirations. The success of Truth Social and Trump Media & Technology Group hinges not only on financial performance but also on the broader cultural and political landscape, where Trump's polarizing persona continues to command attention and controversy.

As Trump navigates the complexities of both the business and legal arenas, the fate of Trump Media & Technology Group hangs in the balance, poised between triumph and turmoil. While the company's soaring stock price may herald a new chapter in Trump's entrepreneurial journey, it also underscores the volatile intersection of politics, media, and finance in today's ever-evolving landscape.

In the corridors of power and the boardrooms of Wall Street, the saga of Trump Media & Technology Group unfolds—a compelling narrative of ambition, resilience, and the enduring allure of the Trump brand. Whether it emerges as a triumph or a tempest remains to be seen, but one thing is certain: the world will be watching closely as the story unfolds.

DWAC shareholders & Trump approve merger then fake news LONGDWAC voted to merge with former presidental Trump social media enterprise. Then a CNBC staff

writer has an article:

Donald Trump told followers, “I LOVE TRUTH SOCIAL” — but shareholders in the newly merged company that will own that social media app might not feel so great.

The shell company Digital World Acquisition Corp. saw its share price plunge nearly 14% in the hours following shareholder approval Friday morning of a merger with the former president’s social media company to take it public.

The drop could reflect concerns about whether Trump Media & Technology Group, which is being merged with DWAC, can ultimately deliver significant revenue — and whether Trump will try to cash in on his share early because of his many legal problems.

My review of the chart is that DWAC underwent normal volatility going into a merger vote

without complications. The volatility is healthy and traders/investors are contesting fair

value. Share price is the same as it was two weeks ago. Astute traders may consider this a

discount move for a long position. Trump is a majority shareholder. Of course, a buy of shares

benefits both the buyer and Trump in stabilizing market cap which has slowly fallen. He

cannot sell shares to fund legal proceedings and their costs for six months. The writer

who I have not named, in my opinion only, does not know jack____. He is simply trying

to put up a headline gets some reading volume and capitalize on it. He should get

one of the stock analysts that consult on his network to give him an education and then

publish a retraction. The headline might be " This clueless writer but out fake news and

is now better informed. He apologizes to the subjects of that fake news"

Enough said.

DWAC Dead Cat BounceIf Elon Musk doesn`t buy Twitter, that doesn`t mean he`s affiliated with Truth Social.

If you haven bought DWAC they announced the merger:

or short it at $55:

then this rally today seems to me the perfect opportunity to buy $10 puts expiring early 2023.

Not because i don`t believe in the project, but because it`s overvalued at this point.

The market cap should go down.

You can buy most of the SPACs lower than the original price.

I think this will be the case with DWAC too by Jan 2023.

Looking forward to read your opinion about it.

If Elon redefines Twitter, what`s the purpose of DWAC anyways ??I first bough DWAC at $12:

Thinking that Truth Social will take some market capitalization from Twitter and Facebook:

But since Elon Musk wants and most likely Will buy Twitter and enable true free speech on the platform, where Donald Trump won`t get banned that easily, then what is the purpose of DWAC (Truth Social and the rest) anyways???

Ok, let`s say it`s a republican new media platform, but then how you justify the approx. 10 Bil market capitalization at the current price, after the merger???

To be honest, i think this stock could easily go to the $23.50 support and even lower than $10, like most of the SPACs, if they don`t deliver great news for the shareholders.

Since the Musk takeover of Twitter, DWAC has already retraced significantly:

DWAC Donald Trump vs Elon MuskAfter it took some of the market capitalizations of both Twitter and Facebook:

now Trump media is facing a real opponent: Elon Musk. one of the most admired men in the planet.

Musk transformed TSLA into a cult, the first meme stock, before meme stocks were cool.

And it looks like the only one who can save Twitter too. In which he bought a 9.2% stake, worth $3Bil.

In this situation, considering also Trump`s appreciation for Putin and that the US should leave NATO, i think its SPAC won`t get too much sympathy in the near future.

In fact, i even expect a retracement to the 23.50 support.

and you know that i am not bias when it comes to the stock market. i was the first calling the 150 price target for DWAC (it reached $175):

Looking forward to read your opinion about it.

DWAC Truth Social released in App Store on Presidents Day Truth Social was released in App Store on Presidents Day, like expected:

If you haven`t bought it when the merger was announced:

Or see this comparison:

Then you should know that $110 is my price target!

DWAC Trump Media & Technology Group $1 billion investment If you haven`t bought it before the $180 pump:

or after the retracement and short term price target:

Then you should know that DWAC had received a $1 billion investment from a group of institutional investors.

Coincidentally or not, Saba Capital Management announced on Dec. 9 that it had purchased a stake in DWAC.

Now that Jack Dorsey has left Twitter, i think it`s a place left for a rival to compete in this area, TruthSocial!

My price target is the 103usd resistance. looking forward to read your opinion about it.

CRTD Price Target based on FundamentalsCRTD is one of the most undervalued Trump related stocks right now based on fundamentals.

Creatd Q3 net revenues increased 178% YoY and 22% quarter-over-quarter.

Revenue guidance for FY 2022 of $10 to $15 million, a 100+% increase over expected FY 2021 revenues.

My valuation is 90mil mk cap. The Market Cap right now is 36.828Mil

My price target is 5.5usd.

PHUN Phunware Price TargetsPhunware (PHUN), a Trump related stock, is a software company, which collaborated on Trump’s re-election campaign.

On 11/15/2021 HC Wainwright brokerage Boosted the Price Target to Buy from $2.00 to $5.50

My short term price target is the 5.7usd resistance and on medium term i see the stock trading at 8.6usd.

Looking forward to read your opinion about it.