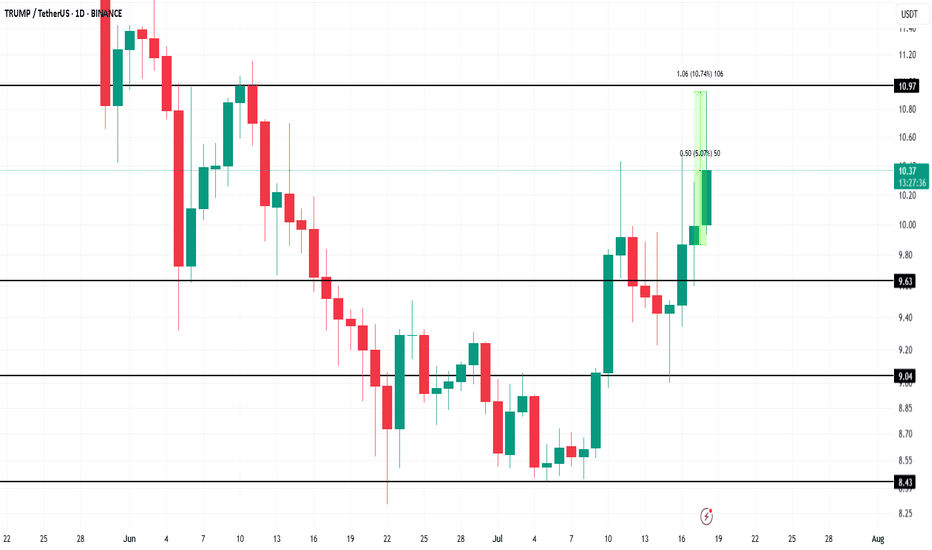

TRUMP Token's $950 Million Unlock Sparks Short-Lived Price RallyBINANCE:TRUMPUSDT recently saw its first major token unlock in six months, which flooded the market with fresh supply. The 90 million TRUMP tokens unlocked today are much smaller than the previous unlock in January, yet they still increased liquidity significantly.

However, the lack of response to the unlock, despite the substantial capital entering the market, further indicates a cooling of investor enthusiasm around the meme coin

BINANCE:TRUMPUSDT price rose by 5% today, trading at $10.39 at the time of writing. It briefly surged by 10% during the intraday high , but the rally was short-lived, and the price retraced.

If BINANCE:TRUMPUSDT fails to breach the $10.97 resistance level again, the coin could face potential corrections to $9.63 , making recovery difficult. The token will need strong demand to push past this resistance and secure more gains.

However, should BINANCE:TRUMPUSDT capitalize on broader market bullish momentum, it could break past $10.97 and reach $11.00 . This would likely invalidate the current bearish outlook and provide an opportunity for a further rise to $12.18.

TRUMPUSDT

OFFICIAL TRUMP Main trend. 16 05 2025Logarithm. Time frame 3 days. After a super pump and a drive of "stupid money", a descending channel was formed on a natural dump. The price came out of it. Now a triangle is forming. The price is clamped. The reversal zones and percentages to the key support/resistance levels are shown extremely accurately according to TA.

If there is no aggressive exit in the medium term, then there will be consolidation and, as a consequence, the formation of a horizontal channel "sholtai / chattai", its key zones are shown.

Now, this "cryptocurrency" is now on 16 05 2025 in 41st place by capitalization.

Reductions from the price highs are about -90%.

From the liquid zone about -84%.

These are not the minimum values of the decline of such hype cryptocurrencies. Just take this into account in your money management. For clarity, the level zones and the % of potential decline if the trend breaks again are shown on the chart (pull the chart down).

Even with such a decline, the price is now at a huge profit. I am not speaking for the creators of the cryptocurrency, but for the first speculators and "investors" who may not have sold everything on the hype.

For the creators of the cryptocurrency, perhaps these are manipulators close to the Trump family, for them, any sale is super profit. But in order to sell, you need to maintain liquidity, and from time to time make interest in speculation and asset retention by investors, that is, do pumps and hype. Use this, and do not be greedy...

Levels and zones, pump/dump, which the price will "feel" are shown in advance. Click "play" on the chart and move the chart up. With a high degree of probability, the hype and pumping of the price of this cryptocurrency will be repeated, given the hype and the long term of the political figure whose name this cryptocurrency bears. Now it is a Trump dump, in the future it will become a Trump pump for some time.

Do not forget to sell on the next hype. If you understand that you are very greedy, and the news background affects you, then sell in parts, or use stop losses to protect profits.

There is no need to guess the minimums and maximums. It is important to know these zones, and have an acceptable average price, from the position of the trend, and its potential. It is regulated by the distributed entry volume (in advance) at potential reversal zones.

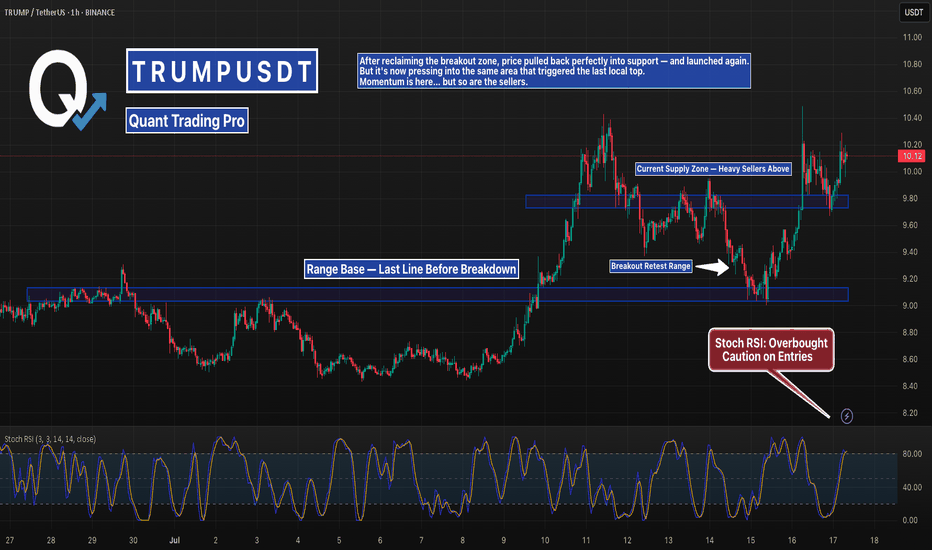

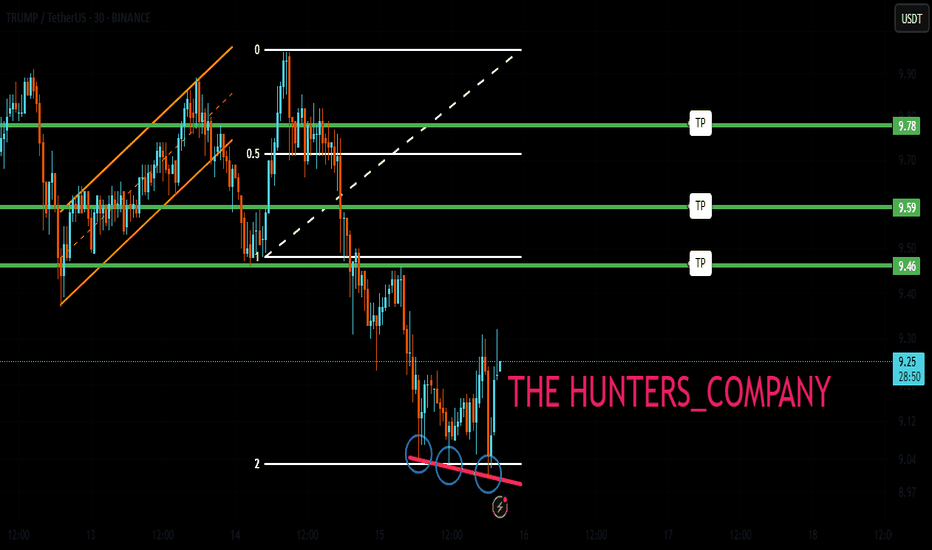

TRUMP Held the Retest — Now Pushing Into Resistance AgainTRUMP bounced clean off the retest zone after holding structure at $9.80.

Now it’s knocking on the same resistance that sparked a sharp pullback just days ago.

If buyers want a real breakout, this is where they’ve got to show up loud.

Risk is rising, but so is the setup.

#TRUMPUSDT #MemecoinCharts #BreakoutRetest #CryptoMomentum #ChartAnalysis #BacktestEverything #QuantTradingPro #TradingView

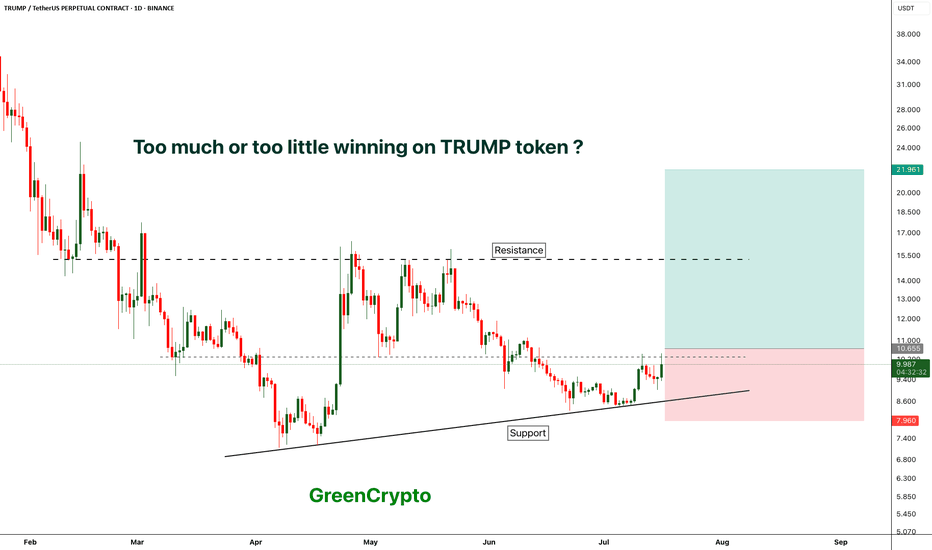

TRUMP - TOO MUCH WINNING ?Trump token is finally seeing some greens after hitting the bottom

currently price is trading near the local resistance.

We have long trade opportunity if the candle closes above local resistance.

Entry Price: Above 10.655

Stop Loss: 7.9

TP1:12.592

TP2: 15.218

TP3: 21.843

TP4++: Keep 20% of the position running with trailing stoploss.

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

TrueFi (TRU)#TRU

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.0270, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0260.

Entry price: 0.0275

First target: 0.0281

Second target: 0.0290

Third target: 0.0301

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

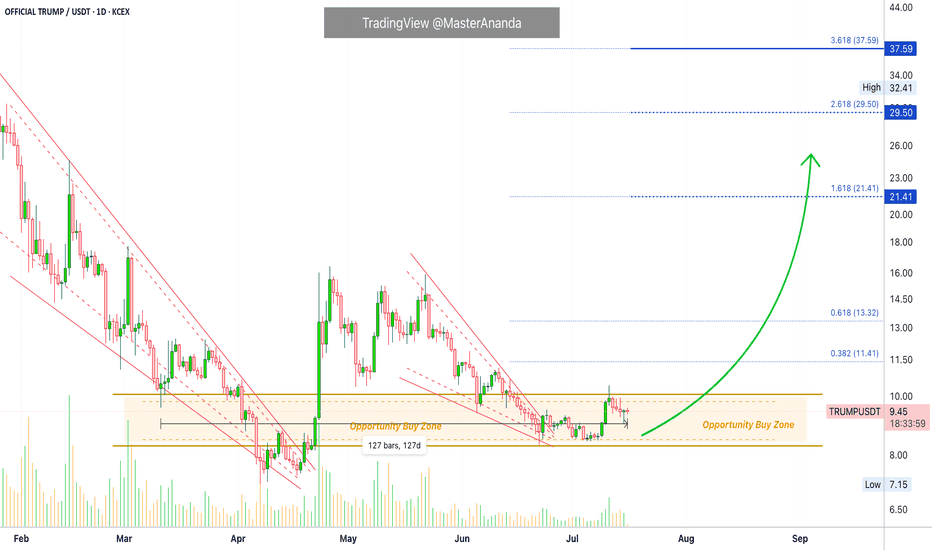

OFFICIAL TRUMP Trading Within Opportunity Buy Zone—About To ExitThis is the last chance to get OFFICIAL TRUMP (TRUMPUSDT) within the opportunity buy zone, the best possible entry prices before a major bullish wave.

Good morning my fellow Cryptocurrency trader, this market has endless opportunities to offer. There is always a second chance; it is never too late.

This "Opportunity Buy Zone" has been available only once briefly before the current period. The first three weeks of April. The second entry into the opportunity buy zone within a higher low happened in June and has been active for 41 days. Time is running out.

Since 11-March, when the current zone was activated through present day, we have more than four months. That's four months of consolidation, sideways... The market can remain neutral only for so long, and it isn't bearish anymore.

The downtrend ended with the 7-April low, the big red falling wedge. After this date the market started a recovery and then we have a retrace—the small falling wedge—and within this retrace market conditions remain bullish based on a higher low.

The main low and market bottom happened 7-April 2025 and the higher low 22-June 2025. This means we are already on the bullish train.

The higher low will lead to a higher high which simply means higher prices. Let's skip the technical analysis and move to the good part.

Maximum growth

How do you see the market right now? How do you see TRUMPUSDT?

It is not going to be the same forever actually, we are expecting big change.

All those days going sideways, down, boring, the market retrace; when it changes it will be so much different. Imagine, visualize, 100%+ in a single day. Then repeat this process over and over. Still some swings and corrections, but that is how you get to 1,000%+ or even 2,000% growth in 30 days.

The meat of the bullish move can happen within 1-2 months. It can also take 4-6 months. What happens is that the start date is not the date when prices start to rise fast but the date the market hit bottom. This means that we are already three months in (100 days) into this bullish wave. Why? Because the low happened 7-April. When you get a strong bullish breakout and the market peaks after two months, total duration of the bullish cycle wouldn't be two months but five months.

We are already on the other side. Now that the next low is in, TRUMPUSDT will be moving to produce a higher high.

Patience is key. The best is yet to come.

Hold strong; rest easy... You will be happy with the results.

Namaste.

TRUMP UPDATEHello friends🙌

👀You can see that the price formed a reversal pattern after falling at the specified support and the buyers supported it.

⚠Considering the entry of buyers, the price is expected to move to the specified targets, of course, don't forget about capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

Trump's signalHello friends🙌

🔊Given the good growth we had, you can see that the price has hit resistance and you can see that the upward waves are getting weaker, which indicates that we are likely to have a correction until the support areas are identified...

You can buy in the identified support areas in steps and with capital management and move with it to the specified targets.

🔥Join us for more signals🔥

*Trade safely with us*

TRUMP BUY ???Hello friends🙌

🔊As you can see in the picture, we have brought you two Trump charts:

1_TRUMP/USDT, in which we see an upward trend.

2_TRUMP/BTC, in which we see a downward trend.

✔Now what is the conclusion? When this negative divergence occurs, it means that money flows from Bit to Tether, and we can expect good growth from it to the specified targets, given the price reaching important support and its return📈

🔥Join us for more signals🔥

Trade safely with us.

Middle East War Whispers: Is Bitcoin About to Crash?The scent of conflict is once again in the air over the Middle East. Tensions are rising, and traders are starting to worry.

If war erupts once more in the region, will Bitcoin and the crypto market survive? Or should we prepare for a heavy drop?

In this analysis, we’ll explore realistic scenarios and tools that experienced traders use to protect themselves in moments like these.

Hello✌

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on Official Trump:

Official Trump continues to exhibit high sensitivity to political narratives and has recently entered a multi-leg correction phase amid escalating Middle East tensions 🌍. Based on current price structure and sentiment flow, a potential drawdown of approximately 30% appears likely, with a key downside target projected near the $6 region 📉.

Now , let's dive into the educational section,

📌 How Markets Have Reacted to Geopolitical Tension

Historically, during major geopolitical flare-ups, risk markets like crypto have shown heightened sensitivity. What matters most isn’t the exact nature of the conflict — it’s how the market interprets the situation. Price doesn’t move on truth; it moves on perception.

🔍 TradingView Tools to Navigate Crisis and Spot Potential Sell-Offs 📊

When fear dominates the market and uncertainty clouds every candle, TradingView’s built-in tools become essential for staying ahead. Let’s explore the most practical ones for moments like this:

Market Sentiment Indicators

Tools like the Crypto Fear & Greed Index combined with higher time-frame volume analysis can help you track the mood swings that drive market volatility.

Layered Watchlists

Create watchlists that compare major projects with volatile meme coins or micro-caps. Early exits often show up as disproportionate drops in smaller assets before the big ones move.

Smart Alerts Based on Price Behavior

Set up alerts not just for price levels, but for candle closes, trendline breaks, and sudden volume shifts. These help you act swiftly, without letting fear control you.

Cross-Market Correlation Tracking

Use TradingView’s Compare function to monitor Bitcoin’s correlation with assets like gold, oil, or the dollar index. Shifts in capital flow toward safe havens may signal a crypto downturn.

Heatmaps for Crowd Behavior

Heatmaps let you see real-time buying and selling intensity. During panic phases, expanding red zones on the map could indicate larger market fear and potential liquidation zones.

🎯 What Should You Do? Scenarios and Strategic Responses

When the headlines are hot but the charts unclear, neither blind holding nor panic selling helps. Let’s break down potential paths:

Scenario One: Sudden and Escalating Conflict

A quick escalation may trigger immediate sell pressure. Watch for key levels and volume patterns to protect or hedge open positions.

Scenario Two: Prolonged News-Driven Tension

This usually creates choppy, range-bound price action. Combining momentum indicators like RSI with moving averages can help filter out fake-outs.

Scenario Three: The Dangerous Silence

A flat, quiet market can hide a ticking bomb. Underlying sell pressure might build unnoticed. Combining macro news with multi-timeframe analysis is key here.

🧠 Psychology of Fear in Unstable Times

In unstable markets, emotion drives action. When fear spreads faster than facts, many traders get caught off guard. Relying solely on what your eyes see in price action can mislead you. Instead, look at alerts, volume shifts, sentiment data, and crowd reactions.

⛑️ Final Tip for Traders

During crisis rumors and uncertainty, the worst decisions often come from rushing or overreacting. If you don’t have a clear plan, stay out. Use the tools available, prepare for multiple outcomes, and remember — your capital is your power. Don’t gamble it on noise.

🧾 Final Thoughts

The market stands at a psychological and strategic crossroad. With Middle East tensions rising again, crypto traders must prepare, not panic. Use the depth of TradingView tools, plan for different outcomes, and react with logic — not fear.

In times of crisis, survival comes before profit.

✨ Need a little love!

We put so much love and time into bringing you useful content & your support truly keeps us going. don’t be shy—drop a comment below. We’d love to hear from you! 💛

Big thanks, Mad Whale 🐋

📜Please remember to do your own research before making any investment decisions. Also, don’t forget to check the disclaimer at the bottom of each post for more details.

OFFICIAL TRUMP 1,244% Target Revealed & Map UpdateI have several questions for you:

1) Did the market break your patience? Are you still holding?

2) How much are you going to take? Will you go for 278% or maybe 1,244%?

TRUMPUSDT has been really uneventful lately and this is good, it means that consolidation is still happening and consolidation is a form of exercise for a trading pair; TRUMPUSDT is building strength.

From a technical analysis perspective, the chart is great, still bullish continues bullish; looks good. Because the action continues to happen as a higher low compared to 7-April. 7-April is the market bottom, as long as this level is not challenged or broken we are now in the bullish zone.

The move that peaked in late April is the initial bullish breakout. The higher low 22-June marks the point where the retrace from the initial bullish breakout ends. 22-June can also signal the start of the next upthrust. From here on we will see growth.

Higher lows lead to higher highs. We have a very clear, strong and ecologically sustainable higher low. This means that a higher high comes next.

Here is the tricky, not so tricky part: TRUMPUSDT will grow to $50, $62, beyond $100 and so on, but, not all growth happens in a single wave. Just as TRUMPUSDT moved from $7 to $16 and then stopped, it can move from $9 to $34 and then make another stop, this one short. Then another rise toward $50 and so on. The market never moves straight down but neither straight up. And this gets us to my point. Will you sell when resistance is hit to later buy back lower, or, will you continue waiting until the market top, higher targets?

That's the question you need to answer to maximize profits when the action goes green. If you decide you want to sell the wave, then make sure to prepare to sell when the market is green. What happens is that if you don't sell when green but wanted to take some profits then you will do so when the market is red. In this case you will not be taking out the maximum possible...

Anyway, we have to leave something for another day. TRUMPUSDT will grow, for certain, but it takes time. Patience is key.

Thank you for reading.

Namaste.

Trump:New update(don't miss it)hello friends👋

This time we came with the analysis of Trump's famous coin meme, which you requested a lot.

Well, as you can see, by making a double floor, the price has broken its downward channel and has grown well.

After the price growth, we saw the price suffering and then the price correction, which caused the formation of an upward pattern.

Now, according to the successful formation of this ascending pattern, it should be seen whether the buyers support the price in the specified support areas or not...

Pay attention that our trend is upward and the pattern made also shows an upward trend, that's why we have identified the support areas for you to enter the transaction step by step with risk and capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

#TRU/USDT#TRU

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0300.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are in a trend of consolidation above the 100 Moving Average.

Entry price: 0.0315

First target: 0.0327

Second target: 0.0337

Third target: 0.0350

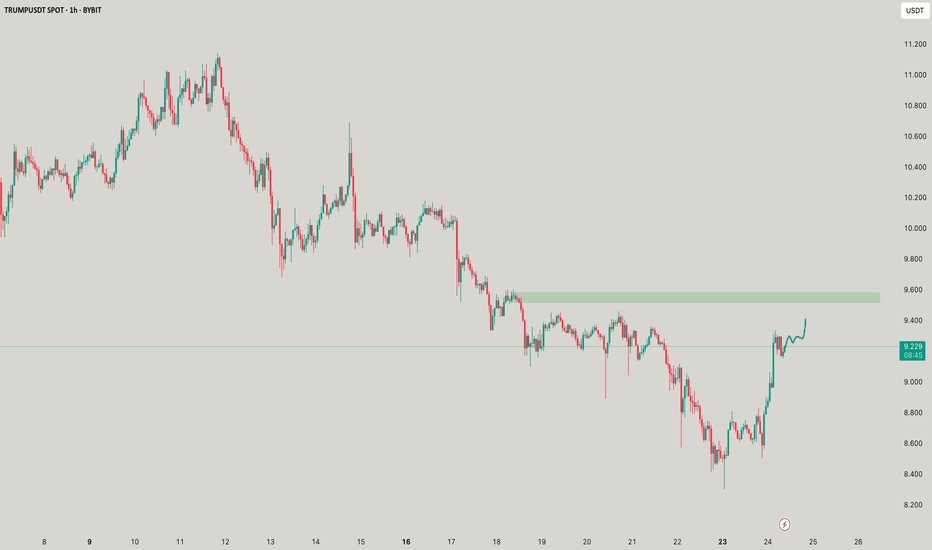

TRUMPUSDT In my opinion, we could still see a further 10% drop, considering the market’s cyclical nature — though it does feel like we’re near the bottom at this point.

Based on the indicators below, MACD and CCI are also showing signs of compression, similar to what we're seeing in the technical analysis.

Overall, I think by June 20th we’ll have a clearer picture of where the breakout from these triangle formations is headed

TRUMPUSDT price analysis✊ It seems that the price of $Trump will only skyrocket when #Trump is impeached!

And we're keeping our fingers crossed that this happens as soon as possible... Mr. #Musk, you have nothing to lose — spill the beans!

As a Ukrainian classic wrote: “I gave birth to you — I will kill you.”

🕯 As for the price of OKX:TRUMPUSDT , it is moving very harmoniously and according to the canons of TA, regardless of who makes some “news throws” and does it on time or not.

And this is not surprising, as the crypto market titan Justin Sun has invested in it. His reputation is controversial, but he knows how to defend his “creations” and investments, pump them up, and make money on them.

So, it's purely hypothetical to assume that the price of $Trump will continue to rise, but this is by no means a call to invest in the red-haired jerk's coin. ✊

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#TRUMP/USDT#TRUMP

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 9.53, acting as strong support from which the price can rebound.

Entry price: 9.70

First target: 10.07

Second target: 10.40

Third target: 10.70

TRUMPUSDT – Daily Technical AnalysisTRUMPUSDT – Daily Technical Analysis

The price has reached a key daily support level at $10, showing potential signs of a bullish reversal.

If the support holds, we may see a move toward the resistance area around $14, offering a decent upside opportunity.

In a more bearish scenario, the price could extend its correction to the $9 support zone, which may serve as a stronger foundation for the next upward impulse.

🟢 Key Support Levels: $10 (daily), $9 (secondary support)

🔴 Resistance Zone: $14

Stay tuned for more technical insights and updates.

#TRU/USDT#TRU

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel.

This support is at 0.0375.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.0378

First target: 0.0387

Second target: 0.0395

Third target: 0.0403

#TRUMP/UDT#TRUMP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 11.10.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 11.22

First target: 11.37

Second target: 11.55

Third target: 11.77

$TRUMP Bounces from Golden Pocket – Rally Incoming?$TRUMP has bounced from a strong support zone around $10.30–$10.50, which lines up with the 0.618 Fib level.

As long as this support holds, price could push toward $11.78 and possibly higher to $13.00+ if momentum builds.

The structure looks healthy, and buyers are stepping in again.

Keep watching, a move toward the upper levels may be starting! 👀

#Trump #ALTSEASON