Trump's signalHello friends🙌

🔊Given the good growth we had, you can see that the price has hit resistance and you can see that the upward waves are getting weaker, which indicates that we are likely to have a correction until the support areas are identified...

You can buy in the identified support areas in steps and with capital management and move with it to the specified targets.

🔥Join us for more signals🔥

*Trade safely with us*

Trumpwins

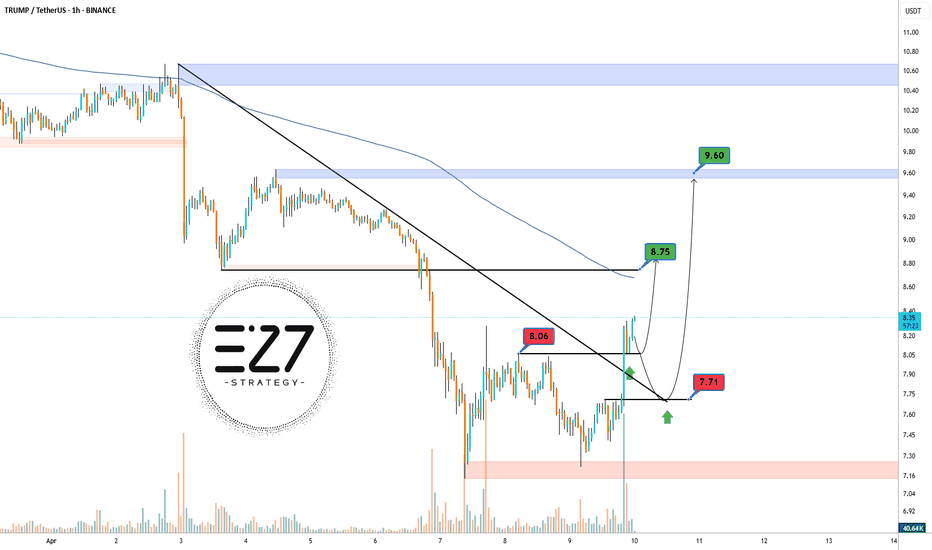

Trump token bullishKey Levels: The main resistance is at 10.40 dollars , and the main support is at 7.71 dollars . The descending trendline keeps the price below it, and the 200-period moving average above the price confirms the bearish trend .

Closer Zones: A nearby resistance is observed at 8.06 dollars, overlapping with the trendline. The closer support is at 7.71 dollars. A break above 8.06 dollars could push the price toward 9.60 dollars .

Intermediate Level: On the way up, the 8.25 dollars level acts as an intermediate resistance.

Target: Based on the previous move of 2.50 dollars, the potential upside target is around 9.60 dollars .

Conclusion: A breakout above the nearby resistance could signal a weakening bearish trend and the start of an upward move .

Trump Memecoin crash – is the hype over?The cryptocurrency market faced a sharp pullback following Donald Trump's oath-taking ceremony, with Bitcoin retesting its low of $102,000. Trump’s failure to address cryptocurrencies in his inauguration speech triggered a ripple effect, sparking widespread FOMO and panic selling in the market.

Leading the crash were Solana-based Trump and Melania meme coins, both experiencing dramatic drops in valuation. The Trump Meme Coin plunged over 23% in just one hour and a staggering 38.83% in the past 24 hours, pushing it out of the top 20 cryptocurrencies to the 23rd spot with a market cap of $8.52 billion.

This isn't the first time political-themed coins have faced turmoil. During the election campaign, PolitiFi meme coins similarly collapsed by over 60% within 48 hours. The current scenario mirrors that history, with top altcoins also breaking critical support levels in the aftermath of Trump’s speech.

Despite an impressive start—tied to the buzz around Trump’s reentry into the political spotlight—the lack of acknowledgment for crypto has left investors questioning the meme coin's long-term potential. The crypto community responded negatively, with the global market valuation dropping by over 1%.

Trading volumes for Trump-related tokens hit $39.11 billion, but rising uncertainty and increased liquidations could push these coins even lower. Analysts predict a bearish 2025 outlook, with the Trump Meme Coin potentially ending the year at a low of $35.

Is this the end of the Trump token fever, or just a speed bump on its volatile journey? The next few days will be crucial for its survival.

Key Levels TRUMP🔹 Key Levels:

Supports: 20 - 28 - 35 - 65

Resistances: 90.06 🔥 and 100.00 🚀

🔹 Analysis:

The price may correct to the 65.30 zone and then rise 📈, targeting 90.06 and 100.00. If support breaks, the price could drop to 28.71 ⚠️.

🔹 Recommendation:

Using a stop loss is essential 🚨

Ensure proper risk management

$TRUMP - Forming a continuing Head and Shoulders pattern

A continuing head and shoulder pattern has formed on the intraday time frame.

The best point to enter the trade is when the neckline breaks and touches it again.

Also, if the $36 support line is touched again and a price rejection is seen from it, it can be another technical entry point.

This is only a technical analysis and is in no way an investment or trading recommendation.

TRUMPomania - 3 variants of possibly Bulls RallyCrypto markets have been rocked by the launch of an "official" Donald Trump memecoin this weekend—with traders braced for more mayhem this coming week.

Unlock over $3,000 in NFT, web3 and crypto perks — Apply now!

The price of the "official" Trump memecoin has surged since its Friday evening launch, breaking into the crypto top 20 by market capitalization and hitting an eye-watering $14 billion.

Now, as leaks reveal Trump is readying a flurry of crypto-focused executive orders, Trump's wife Melania has launched her own rival cryptocurrency—tanking the price of Trump's coin.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

Trump Media & Technology Group (DJT): Big Moves Ahead?Good morning, trading family!

Trump Media & Technology Group (DJT) is at a critical juncture, and here’s what we’re watching:

If the price falls below $33.87: It could drop to $30-$28, with a chance of bouncing back to $59.57 afterward.

If the price breaks above $38.51: We could see momentum push it to $59 or higher.

If it fails to hold $28: Deeper declines may follow.

These levels are key, and how the price reacts will set the direction. Let’s stay sharp and trade smart!

Comment, like, follow, or send me a DM if you want more insights on this setup!

Kris/Mindbloome Exchange

Trade What You See

Bitcoin BTC Forecast: Trump Wins, What’s Next for Crypto?Hello, Skyrexians!

Earlier this year we made the predictions for Bitcoin and Ethereum. We assumed that price has finished the wave 4 for Bitcoin and wave 2 for Ethereum. Here you can find predictions:

Today it looks like our forecasts are playing great. Trump won the elections in USA and cryptocurrency showed us the significant growth in one day. Bitcoin was even able to set the new ATH, some altcoins are also feel good. In today's article we are going to discuss if Trump really triggered new wave of bull run, or this is just a fake pump and soon we will see huge crash.

Navigating Bitcoin bull run: where is the final target

First of all let's take a look at the entire bull run which started at $15k. We can see on the chart below the beautiful impulsive wave.

This bull run shall consists of 5 Elliott waves. Maximum Awesome Oscillator value corresponds to the wave 3. Then we have seen the corrective wave 4 to 0.5 Fibonacci level. Look at this perfect touch! Do you remember the panic on the market on August 5? But we were sure that this is the end of dump. Awesome Oscillator crossed zero line also at this period of time. It was the early indiction that all this annoying correction is almost done. Then we saw the growth with the new ATH for Bitcoin.

Now price is printing the wave 5. Where is the target? Using our methods we predict the finish of bull run in the range between $85k and $107k. If you noticed - targets are unchanged! So, we suppose that bull run for BINANCE:BTCUSDT is almost over. It will continue climbing up on this optimism, but not so far. Now let's try to understand more global price action.

Will Trump win?🔍 Technical Analysis of STRUMP/USDT 📉

Key price levels marked in green 🟢 and red 🔴 show potential "Winner" and "Loser" zones:

1️⃣ Winner Zones (Resistance)

Break above 0.007312 could drive price higher 🚀

Stronger resistance at 0.010810 to confirm uptrend 🔼

Higher targets at 0.017108 and 0.025640 📈

2️⃣ Loser Zones (Support)

First support at 0.004441; a fall below signals potential downtrend 🚨

Further support at 0.003255 and 0.002162 🛑

📉 Channel & Trend Lines: Price is moving within a descending channel ➡️ Breakout from this could indicate a reversal 🔄

Trading Strategy:

📈 If price enters green zones and breaks resistances, consider buying positions.

📉 If price drops into red zones and fails to hold support, selling or avoiding buys might be wise.

🚨$DJT: It's Not Over Yet! 🚀🚀🚀Hi everyone,

Despite a significant drop of 21% today, our indicators suggest the downtrend might not persist. A rebound above the daily level could signal a bullish trend, potentially leading to a weekly cross above the monthly. This could aim the price towards the $63 mark, aligning with the 0.618 Fibonacci resistance level. Conversely, if the price dips below the daily level, the monthly level could offer support. Let's see where this goes in the next few weeks.

Good luck!

DWAC Acquisition Faces Rollercoaster Ride Amid Trump Merger The tumultuous journey of NASDAQ:DWAC stock, the special purpose acquisition company (SPAC) aiming to take former President Donald Trump's tech and social media platform public, continues to captivate investors amidst a whirlwind of events. From surging highs to staggering lows, the stock's trajectory reflects the intricate interplay between market expectations, legal challenges, and the enigmatic allure of the Trump brand.

In recent weeks, NASDAQ:DWAC shares have faced downward pressure as traders grapple with the implications of Trump's financial struggles. Amidst mounting concerns, the stock plunged to a monthly low of $32.25 before staging a partial recovery to $36.42. However, buoyed by optimism surrounding the pending merger with Trump Media & Technology Group (TMTG), DWAC saw a resurgence in pre-market trading, reaching a high of $38.

The merger between NASDAQ:DWAC and Trump Media has been fraught with controversy, marked by lawsuits, regulatory scrutiny, and speculation surrounding the viability of Truth Social, the conservative social media platform owned by Trump Media. Allegations of stock grabs, legal battles, and Trump's efforts to secure substantial bond funds to appeal a civil business fraud judgment have added to the uncertainty surrounding the merger.

Despite the challenges, NASDAQ:DWAC shareholders are poised to vote on the merger with Trump Media on Friday, signaling a pivotal moment in the company's trajectory. If approved, the merger could see Trump's stake in TMTG valued at a staggering $4 billion, a testament to the enduring allure of the Trump brand in the eyes of investors.

However, DWAC's fortunes remain intrinsically linked to Trump's political ambitions and legal battles. The former president's status as the top Republican candidate for president has fueled optimism among investors, with hopes of a Trump victory in the election potentially driving further gains for the stock.

Yet, concerns linger over the impact of federal charges and ongoing legal battles on the Trump brand and, by extension, NASDAQ:DWAC stock. Despite a recent decline in March and a substantial drop from its peak in October 2021, DWAC shares remain up 128% in 2024, underscoring the enduring interest in the company's potential.

As NASDAQ:DWAC navigates the choppy waters of Trump's financial woes and legal challenges, investors remain on edge, eagerly awaiting the outcome of Friday's merger vote and the subsequent implications for the company's future. With volatility likely to persist in the short term, DWAC's journey serves as a testament to the unpredictable nature of the market and the enduring fascination with the Trump phenomenon.

Make America Great Again Bullish OutlookLet's MAGA guys.

BITMART:MAGAUSDT is in a good buying zone + that gap is delicious.

TP: 0,0000000267

SL: 0,0000000022

FB projection 2021with the influence of big tech companies rising i foresee a potential aggressive break of the facebook empire and gvt will come down heavy on them with new regulations and limitations on what they have power and control of

S&P 500 Bullish Pennant Incoming???Do they play around with bears? is this a massive bull pennant ready to explode to 4k? Check all the companies that announce earnings this week for hints!!!

We already have multiple formations like Inverse H&S, Bull Flag, Cup & Handle and now we have this one as well... The stakes are high and although i am not a US citizen i have a feeling that Trump is going to get re-elected. Take that in consideration together with the fact that FED stated it will keep interest rates to 0% until 2023 we may be in front of the biggest bubble in financial history!!! Big up till 2022 and then Michelle Obama will come as a savior to unite the United States of America.Stay on the sidelines is the best strategy for me at the moment, wait for strong confirmation and enjoy the ride :)

Trump will win?despite of the news that Biden is leading i think Trump will get re-elected and will have the adequate acceptance rate by date 27 October.

I KNOW WE POSTED A LONG BUT!!!I know we posted a long. On here. Free channel milked the long then took a short. Closed for Friday NFP.

Looking now we have potentially a short position coming up.

Trump got covid, but shared he is doing well, so reduces the chance of uncertainty which then some fundamentals point towards gold going down just like the charts.

Remember just because we post something here. Does not mean we are taking the trade. The market can change very quickly. So we can be long 1 min then short the next. x

USDCAD ShortsPrice is in a daily range, as we look at the weekly bulls seem to have weaken based off of last weeks closure. todays daily has failed to make a new high. buy entry is based off of a 4hr bearish engulfing candle at current daily resistance levels. pure speculation analysis based off of last weeks weekly candle.

EURO LONG NOW OR NEVERLooking at the monthly EUR/USD chart the confluences are more so evident. The Stochastic Oscillator showing divergence of the lows. Price currently sitting just below the 61.8% Fib retracement, You can see the ascending channel beginning to form with our 1.3900 handle target being confluent with channel resistance and the D2 Fibonacci extension -61.8% respectively. I want a monthly close on Wednesday after the rate decision above the 6 month EMA and above the 1.1300 handle to confirm the start of the next leg up. This will also couple with a EURO Long summer rally. X MARKS THE SPOT