#TRU/USDT Low Risk vs High Rewards#TRU

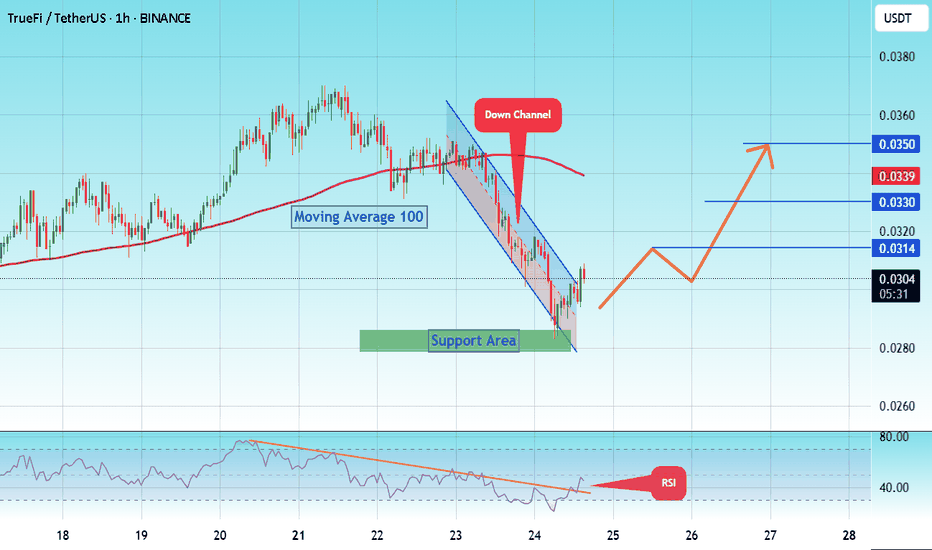

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.0285, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0280.

Entry price: 0.0300

First target: 0.0314

Second target: 0.0328

Third target: 0.0350

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Trust

#TRU/USDT#TRU

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0350

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0438

First target 0.0511

Second target 0.0553

Third target 00630

#TRU/USDT Ready to go higher#TRU

The price is moving in a descending channel on the 30-minute frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.0780

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0795

First target 0.0810

Second target 0.0836

Third target 0.0863

Trust Stamp ($IDAI): Strategic Developments Signal Potential UpsI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Trade Setup:

- Entry Price: $6.71

- **Stop-Loss:** $5.03

- **Take-Profit Targets:**

- **TP1:** $18.83

- **TP2:** $34.58

Company Overview:

Trust Stamp ( NASDAQ:IDAI ) is a global provider of AI-powered identity solutions, specializing in biometric and cryptographic technologies for secure identity verification across various sectors, including finance, government, and healthcare.

Recent Developments:

- Strategic Partnership: On January 6, 2025, Trust Stamp announced a strategic transaction with Qenta Inc., resulting in a 10% ownership stake in QID Technologies LLC, a newly formed subsidiary. This partnership is projected to generate up to $4.3 million in revenue receipts in 2025, enhancing Trust Stamp's market position and revenue streams.

- Reverse Stock Split: Effective January 6, 2025, Trust Stamp implemented a 1-for-15 reverse stock split to meet NASDAQ's minimum bid price requirement. This move is expected to attract institutional investors by stabilizing the stock price and reducing volatility.

Technical Analysis:

- Current Price: $7.42

- Support Levels: Immediate support at $6.50, aligning closely with the activated entry price of $6.71.

- Resistance Levels: Initial resistance at $10.00, with significant resistance near TP1 at $18.83.

- Moving Averages: The 50-day EMA is trending upwards, indicating positive momentum.

- Relative Strength Index (RSI): Currently at 65, suggesting moderate bullish momentum with room for further upside.

Market Sentiment:

The recent strategic partnership and corporate restructuring have positively influenced market sentiment, with increased trading volumes and investor interest.

Risk Management:

The stop-loss at $5.03 limits downside risk to approximately 25% from the entry point. TP1 offers a potential gain of 180%, while TP2 presents an opportunity for a 415% return, indicating a favourable risk-to-reward ratio for this trade setup.

Conclusion:

Trust Stamp’s innovative identity solutions and recent partnerships position it for significant growth.

Awaiting a pullback to $6.71 for an optimal entry point into this promising trade setup.

Strict adherence to stop-loss and take-profit levels is essential to managing risk and volatility.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

TRUST - Much more high to put in yetTRUST looks like a great coin that has a really nice strong, positive trajectory ahead. It's strength looks like its coming from a very strong, solid foundation from Elliot Waves with the first impulse of higher degree of trend 1 being put in. The long, slow, churn we've seen of late is very typical of an Elliot wave 4. So, it we can see a higher high that will give us confirmation that we're on the road to complete wave 5 of 1, which by all accounts is likely to match the distance travelled of 1. Good luck and follow for more.

#TRU/USDT#TRU

The price is moving in a descending channel on a 30-minute frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.1200

Entry price 0.1200

First target 0.1250

Second target 0.1300

Third target 0.1370

#TRU/USDT#TRU

The price is moving within a bearish channel pattern on the 12-hour frame, which is a strong retracement pattern and was broken to the upside.

We have a bounce from a major support area in green at 0.0900

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum, and the price is based on it to rise after it was broken upward.

Entry price is 0.1250

The first target is 0.1800

The second target is 0.2100

The third goal is 0.2472

MPW Medical Properties Trust concerning float short of 34.96% Medical Properties Trust, a real estate investment trust specializing in acquiring and developing net-leased hospital properties since 2003, currently has a concerning float short of 34.96% as of June 20.

This high short interest signals significant bearish sentiment among investors.

For the first quarter of FY2024, MPW reported a stark decline in total revenue, dropping to $271.3 million from $350.2 million in the previous year. The company also faced a staggering net loss of $736 million, or $1.23 per share. This substantial loss was primarily due to $693 million in impairments related to the Steward Health Care System.

Adding to the company's woes, Prospect Medical Holdings, one of MPW's largest and struggling tenants, revealed it had received a subpoena last year from the Justice Department. This development further underscores the potential risks and challenges facing Medical Properties Trust.

I'm looking at purchasing the $3 strike price puts expiring on January 17, 2025, currently priced at $0.40.

#TRU\USDT#TRU

The price is moving in a descending channel on a 4-hour frame.

The price is moving within it and is adhering to it to a large extent.

We have a support area in green and bounced from it at the 0.0800 level.

We have a tendency to hold above moving average 100.

We have a downtrend on the RSI indicator that supports the rise and is about to break higher

Entry price is 0.1000

The first target is 0.1190

The second goal is 0.1377

the third goal is 0.1554

#TWT/BTC 12h (Binance) Falling wedge breakout and retestTrust Wallet Token pulled back to support and entered oversold territory in sats, looks like a great reward opportunity for a bounce towards 200MA daily.

⚡️⚡️ #TWT/BTC ⚡️⚡️

Exchanges: Binance

Signal Type: Regular (Long)

Amount: 9.2%

Current Price:

0.00002342

Entry Targets:

1) 0.00002335

Take-Profit Targets:

1) 0.00003096

Stop Targets:

1) 0.00002081

Published By: @Zblaba

$TWT BINANCE:TWTBTC #TrustWallet #BSC trustwallet.com

Risk/Reward= 1:3.0

Expected Profit= +32.6%

Possible Loss= -10.9%

Estimated Gaintime= 1 month

LTCN Litecoin Grayscale Trust LTCN is about ready to pop. The inverse head and shoulders measured move would bring it to around $10 then a small correction before a massive rally to $35 and beyond, all depending on what Litecoin does. I believe Litecoin will be thousands of dollars in the next bull run as its is one of the very few that are not securities and are commodities. If that happens and Litecoin goes parabolic to 2 3 4 $5000 dollars then the Litecoin Trust will explode. There could be a massive premium at that point to making one share of the trust cost $7000 or more. 1000x-2000x totally possible. Litecoin is poised for a massive rally I believe. Its going to outperform every single other crypto out there this next real run. Besides maybe your random dog coin that could go up 100000000% but as soon as someone cashes out $5 the price drops by 60%. But for real I think this is a good play.

This is definitely not financial advice, this is just what I think and my opinion. Do your own research and so what is best for you. Thank you.

🔥 TWT Huge Bullish Hedge Opportunity: Oversold SignalA couple of weeks ago I made an analysis on TWT where I discussed that TWT had likely more selling to come, but that there was a major support which could keep TWT from falling further.

At the moment, TWT is currently slightly bouncing from the diagonal support, as well as being severely oversold on the 3D timeframe.

Seeing that the overall direction is relatively bearish, this can be considered as a counter trend hedge trade. The trade has a massive risk-reward ratio of 41.4, which can lead to some amazing gains if the target is hit.

You could take earlier profits at 1.00 and 1.85 if you're more risk averse.

Ethereum Bulls to Target $2,100 on Easing Recession Fears Cryptocurrencies have also been seen by some investors as a speculative hedge against inflation and the Fed's plans to curb inflation could weigh on the broader cryptocurrency sector.

On Friday, ETH joined the broader crypto market in a bullish session, gaining 6.28% to end the day at $1,996.

US economic indicators and staking statistics supported an ETH return to $2,000.

However, the technical indicators remained bullish, signaling a return to $2,100.

BIAS SHORT- and MIDTERM BULLISH

Stong Supports 1594 D-POC AND 1034

NEXT WEEK IS IMPORTANT

A PULLBACK TO 1034 WITH LOW VOLUME MEANS THE BULLS

WILL DISTIBUTE THEIR POSITIONS AND MOBILIZE TO ATTACK THE BEARS VERY AGRESSIVELY

A PULL BACK WITH HIGH FAT THICK LONG VOLUME MEANS BEARS

GONNA TAKE FULL CONTROL OF THE MARKET AND SEND ETHEREUM TO THE DEEPEST LEVELS POSSIBLE

LOSING OF 1034 MEANS CRYSTAL CLEAR ABSOLUTE BEAISH TREND

ON THE SAME TIME THIS ZONE IS A LOW VOLUME AREA: IF VOLUME IS INCREASING IN THIS AREA AND THE BULLS DO NOT ANSWER AGGRESSIVELY AND QUICK, we will ceate a midtem sideways and consolidating area: WHAT DOES THAT MEAN?

WELL THE BULLS TRY TO TAKE PARTIAL POFITS OR COMPENSATE THEI LOSSES WHILE SELLERS AND BEARS WILL ACCUMULTAE MORE CAPITAL AND LIQUIDITY TO PRESS DOWN THE COIN

THEN 1034 WILL BECOME THE FIST BUT VERY STRONG RESISTANCE!

MY 8Q STRATGY: 6Qs ae bullish 2Qs neutral: bUT THE MOST IMPORTANT AND LAT CONFIRMATION IS BEARISH

I CALL THIS BULL/BEAR TRAP DESTROYER!!!

AND SEE YOURSELF THE PAST RESULTS!!!! AMAZING HUH?

WELL UNTIL THIS LAST CONFIRMATION IS RED I TRADE THE BEARISH SETUP: GOING SHOT NEAR OF THE HIGH

AND PUTTING A VERY TIGHT STOP AT AROUND 2180USD!

WHY?

BECAUSE THE 2093 THE CONFLUENCE WEDGE LINE IS VERY IMPORTANT TRIGGER

THAT ALMOST WORKS AS SUPPORT AND RESISTANCE!

BREAKING ABOVE 2096+ pullback and holding above this area+ High volume means BULLISH SET UP. Better: Use divergence if pullback

(SEEL PULLBACK SCENARIO in PINK)

You must have highe highs and higher lows and then take the move after the 2nd HH and HL

Stop. I give more rooms to trae and try to myake it very difficult for the maket to hit me.

You Stop. DEPENDS ON YOU RISK AVERSION ;CAPITAL SIZE;ACCOUNT SIZE;LOT SIZE

But I recommand ALWAYS TO WORK WITH STOPS !!!ALWAYS!!! AS PROTECTION YOUR CAPITAL IS THE MOST IMPORTANT LAW AND RULE OF SUCCESSFULL TRADING!!!! EVER!NEVER!

A mixed start to the day saw ETH slip to an early low of $1,876. Steering clear of the First Major Support Level (S1) at $1,858, ETH rallied to a late afternoon high of $2,000. ETH broke through the Major Resistance Levels to end the day at $1,996.

US Jobs Report Eased Recession Jitters but Leave Fed Rate Hikes Subdued

It was a busy Friday session for the global financial markets. The all-important US Jobs Report drew interest ahead of next week’s US CPI Report.

Nonfarm payrolls jumped by 253k in April versus a forecasted 180k increase. In March, nonfarm payrolls rose by 165k. Significantly, average hourly earnings were up 4.4% year-over-year versus 4.3% in March. Economists forecast average hourly earnings to increase by 4.2%.

As a result of the better-than-expected NFP number, the US unemployment rate fell from 3.5% to 3.4%. Economists forecast the unemployment rate to rise to 3.6%.

The Jobs Report eased recessionary fears, supporting riskier assets. However, market bets on a 25-basis point Fed interest rate hike in June remained subdued. According to the CME FedWatch Tool, the probability of a 25-basis point June interest rate hike rose from 0.0% to 8.5%. The Jobs Report did wipe out bets of a June rate cut, with the chances of a rate cut falling from 9.2% to 0.0%.

While the combination of easing recessionary fears and subdued bets of another Fed rate hike delivered support, sentiment could change on Wednesday. The US CPI Report has to show softer inflation to keep the Fed hawks silent.

✅ UPDATE 5: Whaley Breadth SignPostThis is update 5 for the Signpost after the Whaley Breadth idea post in Feb'23

If you remember The Whaley Breadth Trust is a powerful signal that has a great success rate. It was invented by Wayne Whaley in 2009. Since 1970 to 2009, the signal has occurred only 12 times!

🛠️ INDICATOR

For my followers, I even made a special indicator for the Whaley Breadth here:

🆕 UPDATE

We are seeing constructive action from the SP500 and we can see that we are catching up with the 6month mark on the +17% from the bottom. This is very encouraging as the signal projects up to +28% as per the January Trifecta (look to my older notes to understand more). We are however running in some seasonal dormant period and it will be interesting how we are going to make the H2 2023.

BTC Bitcoin ETF Optimism Drives Towards $37,900 ResistanceIf you haven`t bought BTC here:

Then you should know that the inclusion of Coinbase surveillance sharing agreement (SSA) in a spot Bitcoin ETF refiling by BlackRock is a game-changer. As the world's largest asset manager with over $9 trillion in assets under management, BlackRock's involvement brings a new level of credibility and institutional support to the cryptocurrency market. This move demonstrates their confidence in the potential of Bitcoin as an investment asset.

Nasdaq's inclusion of the Coinbase SSA further solidifies the positive sentiment surrounding Bitcoin. Nasdaq is a renowned stock exchange and their involvement in facilitating the surveillance and regulation of a Bitcoin ETF enhances investor confidence.

The endorsement from Bernstein, a reputable $650 billion asset manager, adds fuel to the bullish case for Bitcoin. Their belief that the Securities and Exchange Commission (SEC) is likely to approve a spot Bitcoin ETF indicates growing acceptance and recognition of the cryptocurrency by traditional financial institutions.

Adding to the positive outlook, Fidelity, a massive $4.2 trillion asset manager, has officially filed for a spot Bitcoin ETF, designating Coinbase as their surveillance sharing agreement counterpart. Fidelity's involvement reinforces the notion that established financial giants see the potential of Bitcoin and are actively seeking opportunities to enter the market.

With these major players entering the scene, it is reasonable to anticipate increased adoption and acceptance of Bitcoin as a legitimate investment asset. The combined weight of BlackRock, Nasdaq, Bernstein, and Fidelity lends credibility and creates a favorable environment for regulatory approval of a spot Bitcoin ETF.

Considering these recent developments, along with the growing mainstream acceptance of cryptocurrencies, it is highly plausible that Bitcoin will reach the next resistance level of $37,900 and potentially continue its upward trajectory.

SUIUSDTcharts are very simple without heavy dumb market cannot go to upside i will buy in 2 parts you can see on the charts when fear in market keep start buying when greed in market take profits this is the simple rule of crypto market just i thing is worried and that is bitcoin if bitcoin fail in june bottom will around 10 to 12k do not invest more than you cannot afford to lose

🔥 Trust Wallet Token: Waiting For The Perfect OpportunityTWT has generally been trading sideways over the last two years, which is a lot better than most cryptos. Furthermore, this token has a well-established name in the industry and is backed by Binance, the largest exchange.

This makes me believe that the token has much more upside potential in the future.

So far, 2023 has been a letdown for TWT, since we're now ~14% below the start of the year value. However, I think that at some point TWT will change the long-term trend towards bullish.

I'm waiting for the price to reach the bottom diagonal support. It's a strong support with three previous touches, so it will most likely cause some kind of bounce, potentially even a trend reversal.

im forced to assume dumpsterfire in real estate still oncomparisons are telling us simply when more people are able to borrow money real estate does better. interest rate data from whale crew tells us as long as we climb this indication the risk gets worse for borrowers. as long as those go in the specified direction im looking at higher prices in this fund. all is normal as in everyone is doing fine, and still doesnt want to buy a home; snafu reit. housing market could recover i just want these metrics to go the opposite way before i call it a recovery.

US Bancorp (USB) bullish scenario:The technical figure Channel Down can be found in the daily chart in the US company US Bancorp (USB). U.S. Bancorp is an American bank holding company. It is the parent company of U.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. The company also owns Elavon, a processor of credit card transactions for merchants, and Elan Financial Services, a credit card issuer that issues credit card products on behalf of small credit unions and banks across the U.S.The Channel Down broke through the resistance line on 30/11/2022. If the price holds above this level, you can have a possible bullish price movement with a forecast for the next 60 days towards 50.00 USD Your stop-loss order, according to experts, should be placed at 38.39 USD if you decide to enter this position.

Investors will be hoping for strength from U.S. Bancorp as it approaches its next earnings release. The company is expected to report EPS of $1.14, up 6.54% from the prior-year quarter. Investors might also notice recent changes to analyst estimates for U.S. Bancorp. These recent revisions tend to reflect the evolving nature of short-term business trends. With this in mind, we can consider positive estimate revisions a sign of optimism about the company's business outlook.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

TWTUSDTNot a financial advise.

No problem for TWT until break down the acsending channel down side at the Horizontal Support at 0.92 level. The target for the current triangle is 4.7, don't look up for the direct target as shown on chart, but will take time.

DYOR

TRUST-USDTCoin of the Trust hot wallet, quite handy, with the possibility, recovery on a seed phrase, and support for many coins.

Coin repeating the price movements of bitcoin, stands in a rectangular consolidation. Nearest support 0.55-0.5, nearest resistance 0.7-0.88.

When bitcoin comes out of the sidewall, this coin can also be used for extra profits.

If you liked this article, please like it and subscribe to it, so as not to miss anything.

Always use STOP, and do not use a leverage higher than x3.

A trader must always have tomorrow.