Travelers: One last climbWe expect Travelers to continue its corrective rise in the form of the magenta wave (B) to just below resistance at $232.75 before a significant sell-off sets in. If, on the other hand, the price were to decline earlier and slip below the support at $200.40, our alternative scenario will come into play (35% likely). In this case, we will expect a lower low of the magenta-colored wave alt.(A).

TRV

TRV: RECTANGLE PATTERN BREAK WATCHRectangles can extend for a few weeks or many months, and provide great trade opportunities every time the stock touches the top or bottom of the rectangle, until it finally breaks to the upside or downside.

TRV has been trading in a range (146.75 / 162.77) since February, forming a rectangle pattern. Generally, the longer the pattern, the more significant the breakout .

I will watch for a break of 162.77 and enter a long trade only if we break this level.

First target at more or less 180.

The triangle pattern on TRV is finished | What's next?Today, we will look at a beautiful chart from a technical perspective and all the relevant levels that we should pay attention to.

Key Elements on the chart:

a) The dynamic Resistance level working since 2018. That's our Major level in terms of defining the turning point for bullish movements. Once we have clarity about "major levels," we may see two types of behavior there. Either the level keeps working, and you observe a reversion. OR the price creates sideways structures below on the edge or above, and generally speaking, we tend to observe new impulses coming out of those structures.

b) The ABCDE triangle pattern: Corrective Structures are not more than a tool, and when used as isolated signals, it is a great formula to achieve nothing. However, when we add context to a corrective structure, we increase our odds of being in front of a situation where the price may start a new massive impulse or wave. In this case, the proportions with the previous impulse are perfect, and the inner formation of it is from a technical analysis book. So we can consider it finished.

Activation level and directions:

a) Targets: we are using fibo extensions to define the possible targets of this movement. Remember, we ALWAYS use 1.618 as taking profit and 1.272 as a level to be cautious and protect the full position or part of it.

b) Activation Level: the ONLY way to say "My Bullish view is active" is IF the price reaches our horizontal green line, which basically means a new ATH. IF that becomes true, my invalidation level will be below C; at that point, I would say, "I'm hesitant of the bullish hypothesis," therefore I'm out. However, if the price doesn't reach our activation level, there's nothing to do more than wait or cancel the idea if the price starts falling.

Thanks for reading! Share your view or charts on the comment.

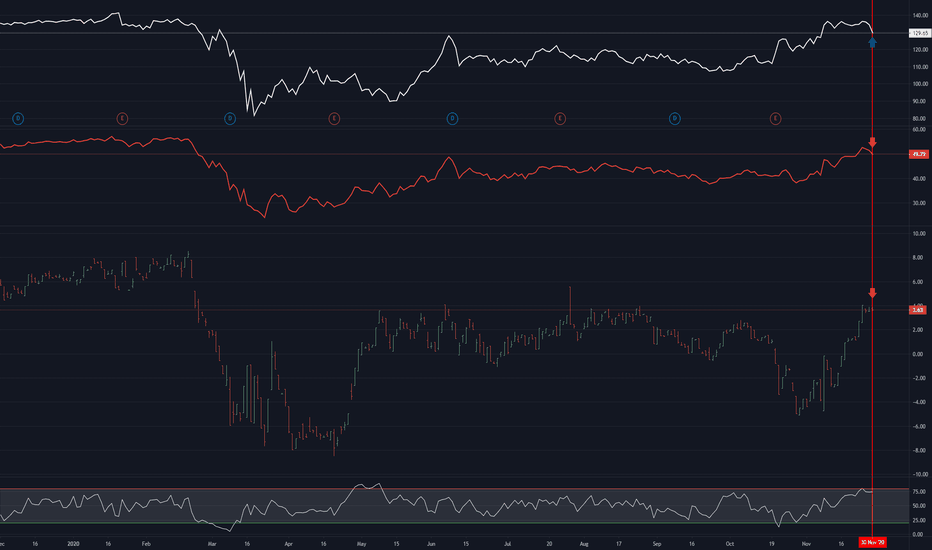

TRV Potntial Short 5th Wave Swing Trading OpportunityUsing our Elliott Wave Indicator Suite for the TradingView Platform we have identified a potential Short 5th Wave Swing Trading Opportunity on TRV. The 5th wave move in an elliottwave sequence is the highest probability move.

The wave 4 pull back after the earnings gap down has found resistance in the green zone of our probability pullback zones, which represents an 85% probability that our automated 5th wave target zone, in blue on the chart will be hit.

We see yellow dots formed in the oversold zone on our special False Breakout Stochastic indicator, which signals strong Bearish momentum. When, during a wave 4 pullback, the stochastic pulls back against these false break out dots and crosses in the overbought zone, there is a high probability the stocks price action will resume the overall bearish trend.

We also measure the wave 4 behaviour with our Elliottwave oscillator, which has pulled back within our pre-determined zone.

So overall we have identified, using our Elliott Wave Indicator suite for TradingView, a high probability short swing trading opportunity on TRV with the following entry strategy:

Short entry through $132.22

Stop Loss $136.22

Target $126

Giving a Risk to Reward over 1:1.6

Learn more about our Tradingview indicator suites by watching the video tours >>HERE<<

TRV @ daily @ nearest to ATL (30 dow shares), but good picture This is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

.zip (with PDF`s) @ my Google Drive

drive.google.com

4XSetUps for next week - friday close (DOW 30 Index & all shares)

Best regards :)

Aaron

$TRV Buy LevelTravelers Companies Inc (NYSE:TRV) is finally having a corrective move. The stock had an amazing move from $103.50 to $123.00 between November and December 2016. In Travelers' history, this percentage move in such a short time is unparalleled. As impressive a move as that was, the stock is now correcting sharply lower. As the stock collapses, smart investors are looking for the perfect entry price. The buy level that stands out is found by simply looking at the daily moving averages. The 50 and 200 moving averages are together at a price of $114.75. In addition, the Fibonacci 38.2% retrace is right above that. This gives the best investors and traders in the world a solid entry range of $115.00. I will be looking to buy here.

Check out every trade I take on Verified Investing: verifiedinvesting.com

DOW JONES OVERVIEW: TRAVELERS IN FIRM 10-YEAR UPTRENDTravelers is the second best looking stock in our Dow Jones Overviews so far (after Nike)

On long term basis it is trading firmly above 10-year uptrend border - 1st standard deviation from 10-year mean (at 87.75) - and did not even tag it during the August market-wide sell-off

Price is also currently testing the 5-year uptrend, trading close to its border - the 1st standard deviation from 5-year mean (at 100.25)

On short term perspective nothing stops the price from trending upwards - as it is showing no trends here (trading within 1-st standard deviations from 1-year and quarterly means)

TRV Travelers Co trimmedLonger term supply signals since December, January mid term supply and now difficulty getting through L7 Cyclical Resistance. I have trimmed to a 1/3 position and tightened stops. This is more than normal since the SPY, IVV, ES E-mini, etc are all showing excess supply coming in.

Travelers (NYSE:TRV): Potential Topping TailTravelers Companies Inc (NYSE:TRV) is pulling back off the highs of the day and could be putting in a top. The signal is a topping tail which is a bearish sign for Travelers. Please note, this must close the day as a topping tail to be fully formed. At 4PM check this chart again. If a topping tail exists, downside is extremely likely. The fall would find first support at $99.85.

Gareth Soloway

Chief Market Strategist

www.InTheMoneyStocks.com