Liquidity Grab Ahead? Why TRX (Tron) May Retrace Soon TRX (Tron) is currently trading near a significant resistance zone, aligning with the upper boundary of a descending channel on the 4-hour timeframe 📉. This area is likely to hold liquidity in the form of buy stops resting above the previous range highs. Given the broader downtrend and the strong resistance overhead, the price may retrace as it taps into this liquidity pool.

This setup presents a compelling short opportunity, with the expectation that TRX will reject this level and move lower, targeting support zones below. Traders should remain cautious and monitor price action closely for confirmation before entering a position ⚠️.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves significant risk, and you should consult with a financial advisor before making any investment decisions. Always trade responsibly! 🚨

Trxusdt

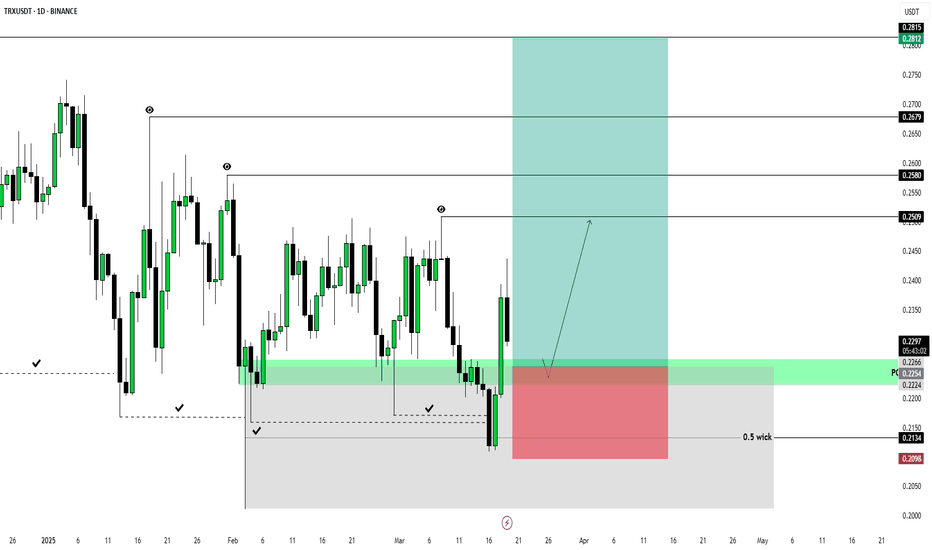

TRXUSDT 1D LONG [UPdate]In line with the expectations I outlined in my main TRXUSDT 1D LONG review the price interacted perfectly with the key liquidity block and turned around confidently.

To feel safe in this position, I move the stop order to breakeven and continue to wait for my targets to be reached!

Targets:

$0.2509

$0.2580

$0.2679

$0.2815

TRX/USDT: Consolidation Holds with Upside PotentialThe TRX/USDT market recently saw a false breakout below a key support level, followed by a rebound toward the upper boundary of the channel. On the broader timeframe, the price has been in a two-month consolidation, forming a range near the 0.2200 support, which has held firm through multiple tests.

This consistent rebound highlights the significance of the 0.2200 level, suggesting it may continue to act as a launch point for upward movement. A retest of the trendline is possible, with potential for the price to approach the channel's upper boundary. The next target is the resistance zone at 0.2370

TRX ANALYSIS📊 #TRX Analysis

✅There is a formation of Falling Wedge Pattern on 12 hr chart and currently trading around its major support zone🧐

Pattern signals potential bullish movement incoming after a breakout

👀Current Price: $0.2290

🚀 Target Price: $0.2500

⚡️What to do ?

👀Keep an eye on #TRX price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#TRX #Cryptocurrency #TechnicalAnalysis #DYOR

TRXUSDT 1D LONGStudying the market, I have not traded much lately. Daily manipulation, as daily news very often breaks formations and trends within the day.

Therefore, I decided to look at 1D TF and I really liked the situation with TRX

Most likely, the price is in the final stage of reaccumulation before aggressive growth.

I am waiting for the testing of the bullish POI to start looking for an entry point into the position and work out such targets:

$0.2509

$0.2580

$0.2679

$0.2815

Risk for stop order -1%

TRX - asset Punchingasset Punching a slant on a third touchdown.

the target after the breakthrough is the minimum (marked with a blue unit).

I suspect that bad news about this asset is coming.

if you like the idea, please "Like" it. This is the best "Thanks!" for the author 😊 P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your friends.

Will Tron Correct 11% and Hit $0.20 Strong Support?Hello and greetings to all the crypto enthusiasts, ✌

Let’s dive into a full analysis of the upcoming price potential for Tron 🔍📈.

Tron is positioned within a parallel channel, nearing a key resistance level. Given its relative strength in the current market compared to other altcoins, I foresee a potential correction of up to 11%. This could lead the price to $0.20, a significant psychological support zone with strong technical backing.📚🙌

🧨 Our team's main opinion is:🧨

Tron is approaching key resistance, with an 11% drop likely to $0.20 support.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

TRX at the Edge: Bounce or Break?TRX is trading at 0.2256, presenting a mixed picture with both bullish and bearish signals. The 50-period moving average (MA) is above the 200-period MA, pointing to a longer-term uptrend, but the price is currently below both MAs, reflecting recent weakness. The Relative Strength Index (RSI) sits at 45, which is neutral territory, while the Moving Average Convergence Divergence (MACD) shows a bearish crossover, suggesting potential downward pressure. Key support levels are at 0.221 and 0.2141, with resistance at 0.232 and 0.240. The price is nearing the support at 0.221, which could trigger a bounce if it holds firm. A break below might see it drop to 0.2141, whereas a push above 0.232 could target 0.240. If TRX lingers between 0.221 and 0.232, it might consolidate until a decisive breakout occurs.

Looking at the broader market, Bitcoin’s current mixed signals could impact TRX, as it often follows Bitcoin’s lead. However, Tron’s growing network activity and adoption might offer some independent support, potentially softening the blow from any market-wide pullbacks. Volume remains steady for now, but a noticeable increase could signal the next move, keep an eye out for a surge on either a bounce from support or a breakdown below it.

For trading: Set alerts at 0.221 and 0.232 to track potential reversals or breakouts. It’s smart to wait for confirmation, like a 4H candle closing outside these levels, before jumping in. Given the market’s volatility, use stop-losses to manage risk, and stay tuned to Bitcoin’s price action and any Tron-related news, as these could steer TRX’s next steps.

TRXUSDT: Is a Major Sell-Off Incoming? Yello, Paradisers! Is #TRXUSDT about to face a sharp rejection? The price is struggling at a critical level and with buyers failing to push through, the risk of a deeper correction is growing fast. A breakdown below key support levels could trigger a much larger move downward.

💎The bullish momentum is fading, and a clear bearish shift is in play. The break of the ascending trendline combined with a probable rejection from the Bearish Order Block and Supply Zone at $0.2376 – $0.2425, reinforces strong downside momentum. TRX is now trading below both the 50 EMA and 200 EMA, further confirming a bearish outlook.

💎If sellers maintain control, #TRON could drop toward the $0.2160 demand zone as the next key support. A deeper correction could take the price to $0.2072, where strong buyers might attempt to step in.

💎Unless TRX breaks above $0.2490, the bearish continuation remains the dominant play. The recent candlestick action shows strong rejection from the imbalance zone,with long upper wicks a clear sign of aggressive selling pressure.

Bearish bias still in control! Be ready, Paradisers!

MyCryptoParadise

iFeel the success 🌴

AUCTIONUSDT UPDATE

AUCTIONUSDT is a cryptocurrency trading at $14.18. Its target price is $26.00, indicating a potential 100%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about AUCTIONUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. AUCTIONUSDT is poised for a potential breakout and substantial gains

TRX/USD "Tron vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the TRX/USD "Tron vs US Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.25000) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA or placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.22800 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.30000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

TRX/USD "Tron vs US Dollar" Crypto Market is currently experiencing a bullish trend,., driven by several key factors.

⭐Market Overview

Current Price: 0.24000

Daily Change: 3.5%

Weekly Change: 12.1%

⭐Fundamental Analysis

Tron Adoption: Growing adoption of Tron's blockchain technology, with increasing partnerships with major companies and organizations

DApp Ecosystem: Tron's DApp ecosystem is growing rapidly, with new DApps being launched regularly

Regulatory Environment: The regulatory environment for TRX is still uncertain, which could impact its price

⭐Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for cryptocurrencies, including TRX

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for cryptocurrencies as a hedge against inflation

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting cryptocurrency markets

⭐COT Data

Net Long Positions: Institutional traders have increased their net long positions in TRX to 58%

COT Ratio: The COT ratio has risen to 2.3, indicating a bullish trend

Open Interest: Open interest in TRX futures has increased by 18% over the past month, indicating growing investor interest

⭐Sentimental Outlook

Institutional Sentiment: 62% bullish, 38% bearish

Retail Sentiment: 58% bullish, 42% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +35

⭐Technical Analysis

Moving Averages: 50-period SMA: 0.22000, 200-period SMA: 0.20000.

Relative Strength Index (RSI): 4-hour chart: 64.21, daily chart: 60.14.

Bollinger Bands: 4-hour chart: 0.24000 (upper band), 0.22000 (lower band).

⭐Next Move Prediction

Bullish Move: Potential upside to 0.28000-0.30000.

Target: 0.28000 (primary target), 0.30000 (secondary target)

Stop Loss: 0.20000 (below the swing low)

Risk-Reward Ratio: 1:2 (potential profit of 0.06000 vs potential loss of 0.03000)

⭐Overall Outlook

The overall outlook for TRX/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in Tron adoption, growing DApp ecosystem, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Buy time: When supported around 0.2209

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

(TRXUSDT 1D chart)

The chart was broken due to the surge on December 3rd.

-

The Fibonacci ratio 1.902 (0.2135) ~ 2 (0.2217), where the surge began, is an important support and resistance area.

Also, the M-Signal indicator on the 1W chart is passing around 0.2209, showing the role of important support and resistance.

If the price is maintained around the 5EMA+StErr indicator and rises above the MS-Signal indicator, there is a high possibility that it will turn into a short-term uptrend.

However, since a high boundary zone is formed in the 0.2543-0.27 section, it is important to see whether this section can be broken upward.

Therefore, if possible, I think it would be good to buy when the MS-Signal indicator approaches 0.2209 and shows support near 0.2209.

The reason is that it plays the role of a trend reversal based on the MS-Signal (M-Signal on the 1D chart) indicator.

In other words, it plays the role of support and resistance.

-

If it falls based on the Fibonacci ratio 1.902(0.2135) ~ 2(0.2217) section,

1st: Fibonacci ratio 1.618(0.1888) ~ 0.1967

2nd: 0.1567-0.1712

You need to check whether there is support near the 1st and 2nd sections above.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire section of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

As you can see from the LOG chart, the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we do not expect to see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the upward trend that started in 2015.

In other words, it is the Fibonacci ratio of the first wave of the upward wave.

The Fibonacci ratio on the right is the Fibonacci ratio of the upward trend that started in 2019.

Therefore, it is expected that this Fibonacci ratio will be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you to decide how to view and respond to this.

When the ATH is updated, there are no support and resistance points, so the Fibonacci ratio can be used appropriately.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous when used as support and resistance.

This is because the user must directly select the important selection points required to create Fibonacci.

Therefore, since it is expressed differently depending on how the user specifies the selection points, it can be useful for chart analysis, but it can be seen as ambiguous when used for trading strategies.

1st : 44234.54

2nd : 61383.23

3rd : 89126.41

101875.70-106275.10 (Overshooting)

4th : 134018.28

151166.97-157451.83 (Overshooting)

5th : 178910.15

-----------------

TRX/USDT 1H: Discount Zone Accumulation – Ready for a Bounce?TRX/USDT 1H Chart Analysis

🚀 Follow me on TradingView if you respect our charts! 📈

Current Market Structure:

Bearish trend with strong selling pressure still dominant.

Hidden Bearish Divergence confirmed on RSI vs price action from Jan 31 to Feb 2.

Price currently sitting at $0.2285, testing key support level.

Smart Money Activity:

Market Makers engineered a move to $0.2560 (premium zone) before aggressive distribution.

Current phase suggests accumulation may be starting at discount zone.

Liquidity hunt below $0.2300 could be part of MM strategy before reversal.

Key Levels:

Entry Zone: $0.2285 - $0.2290 (support zone).

Targets:

T1: $0.2420 (previous equilibrium).

T2: $0.2540 (FVG fill).

Stop Loss: Below $0.2260 (recent swing low).

Risk Score:

7/10 (Moderate risk – favorable R:R setup).

Market Maker Intent:

MM appears to be accumulating at current levels for a potential bounce play.

Volume profile suggests liquidity building up in the discount zone.

Wait for confirmation of higher timeframe support holding before entering longs.

Recommendation:

Long positions are favorable within the $0.2285 - $0.2290 range.

Maintain tight stops below $0.2260 for risk management.

Monitor price action for confirmation of bullish structure before entering.

Confidence Level:

7/10 for potential reversal play.

🚀 Follow me on TradingView if you respect our charts! 📈

CRYPTO. Buying opportunitiesHello everyone!

Let's take a look at the following crypto assets. They have formed patterns that increase the likelihood of price growth. Buyer zones have formed on all assets (green rectangles on the charts) and buyer's current vectors.

The nearest targets are indicated on the charts:

1. BTCUSDT

Potential long target: 102,724.38. +2.94%

2. ADAUSDT

Potential long target: 1.1819. +11.63%

3. AAVEUSDT

Potential long target: 390.15. +24.67%

4. LINKUSDT

Potential long target: 25.99. +19.58%

5. AVAXUSDT

Potential long target: 45.05. +14.68%

6. TRXUSDT

Potential long target: 0.2596. +9.26%

Wishing you all successful trades and a profitable day!

tron (TRX)trx usdt daily analyses

time frame 4 hours

risk riwards ratio > 3.5 (woooow)

****** ( My condolences to those who lost their lives in the California fires.) *******

there is no volume in the market yet.

RSI is in the bottom of chart

price is in the down side of triangle and sellers couldn't break the support line ( 0.225$)

I set LS on the down of another support line on 0.195$

if we hear a good news about cryptocurrency market or tron , maybe a pump happens and good benefit for traders.

be careful for stop hunters. in this situations

TRON - Is Sun so to the Sun or to the Moon?TRXUSDT - SOOOOOO, WHAT IF? WHAT If NOT? This time you tell me whats going to happen and why? Just I can say if u short then what if it goes to blue line? If you long? What if it tests Mid's Low? Dont say me why i am not giving you a short or a long call, i am showing you the path, you have to walk alone

Fresh Demand Zones Hold the Key - Don't Get Caught in the Hype! TRXUSDT: Fresh Demand Zones Hold the Key - Don't Get Caught in the Hype! 🔑📉

Key Insights:

Ignore the Big Rally: Using the recent major upswing for analysis may not yield actionable insights.

Fresh Demand Matters: Focusing on the first untested fresh demand zone gives a stronger foundation for entries.

Low Time Frame Strategy: When price reaches these zones, shift to lower time frames and look for upward market structure breaks. This approach leads to better risk-to-reward ratios and higher success rates.

Why This Works?

Fresh zones often attract institutional interest, making them ideal for precision entries. By combining these zones with lower time frame analysis, you minimize risk and maximize reward.

Pro Tip: Don’t let emotions take over during large price moves—stick to the plan, and let the chart guide you.

Enjoyed this insight? Boost, comment, and follow for more strategies to dominate the charts! 🚀

Let me tell you, folks, this is amazing. Nobody does analysis like I do. Believe me. If this helps you, don't forget to boost and comment! It’s a big deal, motivates me to share even more winning insights with you. Tremendous insights.

I keep my charts the best, clean, simple, and clear. You know it, I know it, clarity leads to better decisions. No question about it. My approach? Built on years of tremendous experience. Incredible track record. I don’t claim to know it all, but I spot high-probability setups like nobody else. Trust me.

Want to learn how to use the heatmap, cumulative volume delta, and volume footprint techniques I use to determine demand regions with stunning accuracy? Send me a private message—totally free, folks. That’s right. I help anyone who wants it, absolutely no charge. Unbelievable value.

Here’s the list, long list, great list, of some of my previous incredible analyses. Each one, a winner:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

And that’s just the start. The list goes on and on, folks. It’s a tremendous list, the best. I stopped adding because, frankly, it’s tiring. So many wins. People are amazed. You can check my profile and see for yourself, winning moves, all the time. Believe me, nobody does it better.

#TRX/USDT Ready to go higher#TRX

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.2500

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2530

First target 0.2572

Second target 0.2607

Third target 0.2647