TRY

World Cup of Leaders - Road to Disaster or FreedomThere are similarities with Venezuela.

It's look like Trump and Israel doesn't wan't to loose power in middle east.

They are some good projects like:

*new silk road to istanbul

*drilling for oil and gas near Cyprus in the near future

Battle cards tell you truth.

Turkey+Russia+China+Iran have now more power and control in middle east.

Trump + Israel have more finance and weapons.

2019/2020 will tell us what will happen next.

It's Endgame and there is no more time left to try again.

2020-2025 are critical years for world freedom.

Gold, Silver, Crypto will skyrocket this year.

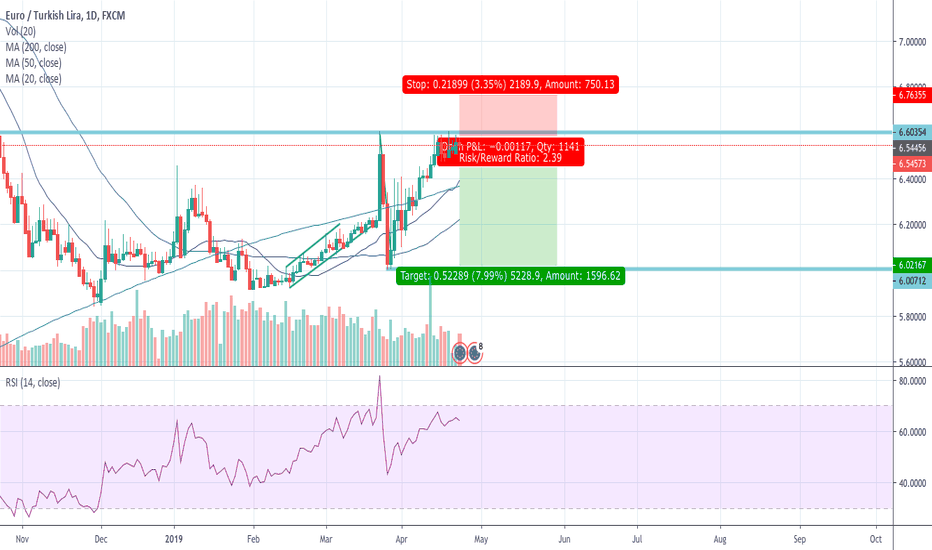

USDTRY potential H&SUptrend on the right broke and the one on the left as well. It is around the breakout zone now which can be a resistance level and there is a chance to see an H&S getting completed here. Since the right shoulder got high, it needs to drop fast to become reliable. So i good risk reward here which i am going to give a try with a small size here and will make it normal when the neckline breaks.

Previous analysis:

USDTRY: Bullish on symmetrical Targets.The pair is on a strong uptrend on 1D (RSI = 58.592, MACD = 0.072, Highs/Lows = 0.0000) forming the right side of the 1W cup formation. It appears that the uptrend targets the Lower Highs of the previous downtrend in the form of Resistance Levels. Based on this we are long with 6.38740 our next TP and 6.64497 the extension.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Turkish Lira fall and Bitcoin surge correlationJust dropping a though about the recent correlation between the fall of TRY and surge in Bitcoin, that came simultaneously (within days).

This can be explained by capital flowing through the black market, having bitcoin as a medium.

Investors wanting to flee, converting the turkish to bitcoin then converting the bitcoin to another currency.

It looks like bitcoin is now expensive for this traffic, and thinking that this outflowing capital may turn to other crypto's, such as ripple and etheruem.

It will be interesting to look for other crypto's that allow such traffic and buy them, and also join the down rally of the lira at a convenient point.

USD/TRY 4H Looking for long tradeA .

We can get a long trade if the price close

above strong resistance channel at 5.8600

To:

TP1: 5.9500

TP2 : 6.2000

stop lose : 5.7800

B.

If the price breakdown upward channel

we can get short trade or wait for new

long trades from

5.64500 and 5.5100

with small stop lose

This is not an investment recommendation or any call to buy or sell

It is just an analysis based on a study of the history of price action

Behavior , that may not be a necessarily reason for the success of

the structure or repetition. So please make your decision based on your vision .

To protect capital and manage your deals and trading successfully

the maximum loss in each transaction for the same currency or

commodity in the same direction should not exceed ( 2% ) of the capital .

Good luck

Disaster cooking in Turkey=> For those who believe in the bearish Turkey story, we are in the early stages of a 5th wave which we mentioned in our previous ideas... it can be seen clearly here and shows how the floodgates for the highs are wide open.

From a technical perspective the 5th wave target, the first major target is 7.85 (assuming wave 5 is a 1.00 ratio in length of wave 1).

Given the nature of this rally so far there is a very large chance this can extend well beyond the initial targets as far as the 2.168 extension above the highs.

It is also worth noting for those following EW that the 5th wave usually marks new highs... confidence in this view will increase above the 161.8% so for those wanting a less aggressive entry you can sit tight and watch closely and good luck to those wanting to pull the trigger early for the next few Quarters in 2019.

This is going to be a monstrous move and worth tracking for those interested in watching the EM collapse continue.

USDTRY 1:4 Risk Reward SHORT (Fundamentals)If you get involved in provocative acts, saying ‘foreign currencies will strengthen, this will happen, that will happen’, you will pay a very heavy price - Erdogan

TRY

Fundamental Quant Score +60

USD

Fundamental Quant Score -4

Investors seek reforms, fear populism

Lira initially weakened 2.5 percent

Shares rise 1 percent (Updates lira, adds London swap rates, dollar bonds)

Global bond yields fall over fears of an economic recessionBond yield inversion

Bond yields across the globe continued to decline this week, as bond traders offered the strongest indication yet that a global economic recession may be coming. The US ten-year bond yield dipped below the yield of the three-month Treasury bill for the first time in over seven years, while German and Japanese 10-year bond yields continued to plummet. Traditionally when Treasury yields start invert, the bond market is offering a signal that an economic recession is nearing. Financial markets also become fearful about the economy when yield inversion occurs, as bank lending becomes more difficult when short-term rates are higher than longer-term yields

• The USDJPY pair is bearish while trading below the 110.90 level, key support is found at the 109.70 and 108.80 levels.

• If the USDJPY pair trades above the 110.90 level, buyers may test towards the 111.10 and 111.68 resistance levels.

RBNZ turn dovish

The New Zealand dollar fell sharply lower against the US dollar and the Japanese yen currency this week after the Reserve Bank of New Zealand struck a dovish tone towards future rate increases. RBNZ Governor Adrian Orr said that the next rate move would likely be lower, as below trend inflation and worsening global growth weighed on the New Zealand economy. The change in policy language was seen as a major shift for the New Zealand central bank, who previously held a neutral stance towards rates. The NZDUSD pair tumbled on the news, as traders priced-in a rate cut from the RBNZ coming as soon as the third quarter of this year.

• The NZDUSD pair is bearish while trading below the 0.6840 level, key support is found at the 0.6740 and 0.6685 levels.

• If the NZDUSD pair trades above the 0.6840 level, buyers may test towards the 0.6860 and 0.6890 resistance levels.

Brexit uncertainty increases

The British pound remained volatile against the US dollar, and the Japanese yen this week, as UK lawmakers failed to find a way forward for Brexit. British Prime Minter Theresa May signaled that she would step down as Prime Minister once she has delivered Brexit for the people of the UK. The House of Commons Parliament continued to reject the third vote of Theresa May’s Brexit plan, despite being unable to reach an agreement on an alternative Brexit deal. The GBPUSD pair struggled to find buying interest above the 1.3200 level and settled back toward the lower end of its medium-term trading range.

• The GBPUSD pair is bearish while trading below the 1.3100 level, key support is found at the 1.2975 and 1.2660 levels.

• If the GBPUSD pair trades above the 1.3100 level, key resistance is found at the 1.3260 and 1.3388 levels.

Lira’s woes continue

The Turkish lira fell against the US dollar this week after the Central Bank of the Republic of Turkey attempted to raise transaction costs in order to stop speculators short selling the nation’s currency. Traders looked past the action and sold the Turkish lira, as data revealed that the central bank had lost ten billion US dollars in currency reserves in just three weeks. The Turkish lira had plummeted by over five percent last week against the greenback, over fears about continued economic stresses inside emerging market economies.

• The USDTRY pair is only bullish while trading below the 5.6454 level, key resistance is found at the 5.8445 and 6.1000 levels.

• If the USDTRY pair trades below the 5.6454 level, sellers may test towards the 5.4220 and 5.2200 support levels.