Turkish Lira Showing Signs Of StrengthI posted a monthly chart for the Dollar a few months back that showed the Dollar will continue to lose value in the future. This will obviously not happen overnight, but I expect over the course of 2021 the dollar will continue to it downtrend. Looking at the Turkish Lira monthly chart, we see bullish divergence, and several indicators showing strength. If you look into the emerging currencies market vs. the Doallr you will see the same exact picture. DO NOT be fooled, the Dollar will lose value this will impact the US economy on a global scale.

TRYUSD

Big Day For USD-TRYUSD TRY shouldn't close today above 7.1 for a lot of technical reasons I cannot possibly mention here.

Let me just say that there should be a ton of resistance there.

Right now it is surprisingly holding very close to the top.

If it doesn't close and spends a few days in this area the possibility's become increasingly bullish.

In the event that it closes above 7.1 at any point within next week it's mid term target becomes 9.2 and there will be very little resistance to get there.

In the event that it closes today above 7.1 the price will rally like a rocket and 9.2 will be reached in a much shorter timeframe.

This is very sad for all Turkish people. And what's even worse is that no one there has a clue about this.

ridethepig | Turkish Lira Strategy🔸 Ceilings and profit taking

I am starting to unwind partials in the USDTRY longs with all of these moves so full of energy in the current chapter it wont be long until the retailers and bloomberg crowd are on board. There is lots of thunder and lightening across the global economy, Turkey will catch more than the sniffles but it is prudent we stick to the plan - the same plan since 2018 (yes 2018).

In this position, wave 5 was an obvious impulse, because after buyers held support they could then start to promote their positions and adding to winners. The 30% upside once looked miles away and is now shining us right in the face, will sellers dare to come out? Will other sharp speculators riding this for months/quarters want to also take profits?

If buyers hold 7.82xx it will trigger the collapsing of local banks, so we make this play with a heavy heart. It would be interesting to investigate further whether we will get the intermediate highs in USDTRY, so lets leave some partials running incase we get capitulation...

BTC Breaking Out in the Weakest CurrenciesBitcoin is measured in dollars. So every chart that you see is bitcoin gaining or losing against the US dollar. At the start of bull markets, commodities start to break out in the weakest currencies. Then it starts to break out in the intermediates currencies, then finally it breaks out in USD. So let’s have a look at BTC compared to some of the weakest currencies and see if we are at the early stages of a bull market.

So here we have the Brazilian Real, the Turkish Lyra, the South African Rand, and the Russian Ruble. They have all made new monthly closing highs. These can act as clues for the start of a bull market, which I believe we are in. It also goes to show you that the US dollar is eating other currencies alive! That is it for today. Keep your head on a swivel!

Happy Trading!

Gold Price Action Indicator Nobody is Watching: Turkish LiraLatest CFTC COT positioning data on Gold futures actually shows hedge funds took down long positions, and upped the shorts - albeit very marginally and still net long.

In the retail world, at the very top of the list of largest ETF inflows was GLD at +$3.6 billion for July, bringing the YTD net inflow total to a record $20 billion.

Add in a down dollar and US real rates deeply negative through -1% record lows, and you get gold prices slicing through $1920 prev all time highs and $2000 psychological resistance like a knife through butter.

However, there is another major buyer in the markets - Turkey's central bank, who is going through a currency crisis as we speak, and a Trump-Powell style relationship between the head of state directly intervening in central bank monetary policy. Turkey has been aggressively buying up gold and stocking up its gold reserves, up 3x YoY in first half 2020 as the country faces a serious currency crisis unraveling as we speak - lira hits record lows vs dollar and euro. Prez Erdogan's flawed understanding of basic economics refuses necessary rate hikes to stem the lira's decline, and would be far better off holding fx reserves rather than accumulating gold to combat a COVID hit dead tourism industry. Central Bank of Turkey began aggressively and price indiscriminately accumulating gold reserves, overtaking Russia as the world's largest buyer of gold YTD.

But the lira, which has been a price leading indicator for gold as of the last few weeks' rally, just took a sharp leg stronger vs the dollar (USDTRY ↓). Lira's directional moves have shown to be useful indicators of lagging price action on gold:

So keep an eye on USDTRY for cues on near term cap to gold's recent rally. I guarantee the majority of market participants will not be looking at this indicator.

4 CYCLES IN TRY/USD AND 2020 PREDICTIONTRYUSD (Reverse of USDTRY)

Starting from 2014 :

There have been 3 similar cycles.

All cycles starts with a reverse cup&handle and

ends with a sharp fall from the support line that is the bottom of that reverse cup & handle.

We are in the 4th cycle now and if it continues like that my prediction is :

On January 1st : 1USD = 11 TRY

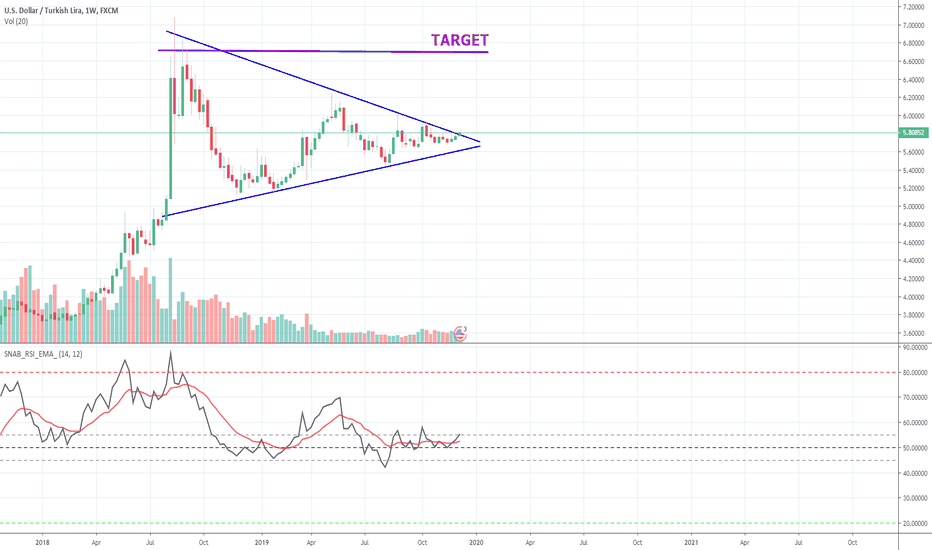

Turkish Lira heading for retest of the support Well, chart says it all:

1. No financial advise

2. Couple weeks ago 50 MA crossed 200 MA (Golden Cross)

3. High 6.22 have been taken out by SFP (local top)

4. PA heading down to retest of major "resistance flipped into support" level of 5.75

5. RSI Hidden Bullish Divergence is building (important)

I don't care about news, politics, manipulations. Only price action. Market discounts everything.

USDTRY Target reached and much more even :)A textbook trade the previous analysis on usdtry. Showing how easy trading can be sometimes if we are willing to wait for a good setup.

As we can see on the left, it respects that big bull flag that i drew a week ago. So we could be closing in on a temp low on the lower time frame. My game plan now is, waiting for a potential inverse H&S with the low in that green support. So waiting for things to play out first and then making an attempt if things look good.

Previous analysis:

USDTRY potential H&SUptrend on the right broke and the one on the left as well. It is around the breakout zone now which can be a resistance level and there is a chance to see an H&S getting completed here. Since the right shoulder got high, it needs to drop fast to become reliable. So i good risk reward here which i am going to give a try with a small size here and will make it normal when the neckline breaks.

Previous analysis: