Tesla to bounce from hereNASDAQ:TSLA

Tesla has reach and bonce from a key support level, as seen on the chart, in the Golden Pocket, between the 61.8% and the 78.6% Fibonacci Retracement, and it is shown two weekly hammer candlestick bar near each other, which is bullish. Odds that it has already found a mid-term bottom is high.

Now I expect a multi-week bounce from here, probably to the next Golden Pocket at the top, which is between $385 to $430 USD.

And yes, Elon Musk upset his customer base, and the stock is very expensive compared to other car manufacturers, and will probably see little to no growth in sales this year, or even a decline, insiders has sold big amounts of shares and it is all looking bad. And yes, we have probably already seen the top in Tesla in December last year for a long time.

However, stocks don’t generally go down in a straight line, the stock, as well as the stock market in general is oversold and do for a bounce, maybe a big bounce.

After the bounce, I will be looking for shorts, but now, I’m looking for longs.

Good luck to you

Tesla Motors (TSLA)

Tesla Bull Trap is copiumThere is currently 0% probably of a substantial breakouts in either direction.

Tesla is crabbing and will likely continue to crab with high volatility until May.

Nothing about the fundamentals has changed, and no technicals in terms of trend, volume, momentum, volatility and options chains suggests a reversal is nessary.

The overall damage Elon has done to the brand is likely irreversible at this point. Sales in Germany are down I believe 90%, and more than 50% in the US, meanwhile in China BYD is dominating. Moreover, China or Germany could seize the gigafactory in retaliation for tarrifs if they wanted. That only leaves Texas and Nevada as manufacturing hubs on products without any sales.

The promise of a fleet is a pipedream because FSD is not safe. Though this regime may push it through for Elon's benefit, it would only serve to incr3ase liabilities on their balance sheet and further damage the brand so it's not the moon shot he presents it to be.

The entire brand was built on climate pledges and hope.

The CEO has now endorsed big oil, he's running massive gas generators for AI, supports the regime that backed out of the Paris Agreement (again) and the protests are growing in momentum without any sign of slow down.

In short TSLA is in the "find out" phase.

Tsla Lesson Tesla Stock Always Pay YOURSELFI say this time and time again and this is a PRIME EXAMPLE SO FAR.

🌍Now I suggested THAT IF YOU WERE A TESLA BULL that you might want to start to PAY ATTENTION TO THE STOCK TWO WEEKS AGO.

❓️"OK SO WHAT'S THE LESSON"❓️

I emphasise ALWAYS that TIME TRUMPS PRICE...

TESLA has been rather docile since its initial POP.

But take a look at the HIGHER TIMEFRAME WEEKLY CHART❗️

Whats clear to see is that although the PRICE RANGE hasn't been MASSIVE there has been plenty OF ⏳️TIME TO CAPITALISE AND PAY YOURSELF. £$€¥ 💰

Two 📈HIGHER CLOSES ON THE WEEKLY and the call made whilst the weekly looked EXTREMELY BEARISH📉

EVEN RIGHT NOW we are currently UP ON THE WEEK UNTIL NOW.

ℹ️ If you WERE UNABLE to STRUCTURE A TRADE TO TAKE advantage of this PRICE RANGE whilst DAY TRADING you may need to LOOK BACK and STUDY WHY NOT.

⚠️You could have paid yourself several times over already and even if TESLA was to seek lower prices from here you SHOULD HAVE BACKED SOMETHING ALREADY.

✅️AS ALWAYS TRADE YOUR PLAN & WAIT FOR YOU SIGNAL✅️

WOW $2.50 to $19.69 in 2 days 687% power squeezeWOW 💥 $2.50 to $19.69 in 2 days 🚀 687% power squeeze on 9 Buy Alerts

First buy at $4.93, last sell at $19.24

I sent commentary about NASDAQ:MLGO what's happening in the background and how I see shortseller behind manipulation losing the battle and blowing up to $15 - $20+ while it was still below $10 🎯

A month ago it triggered the exact move.

INVERSE CUP AND HANDLE $TSLA TO $120 The inverted cup and handle, also known as the upside-down cup and handle pattern, is a bearish chart formation that can occur in both uptrends and downtrends. Unlike the traditional bullish cup and handle pattern, this inverse pattern features two key components: the "cup," which forms an inverted U-shape, and the "handle," a brief upward retracement following the cup.

Sell NASDAQ:TSLA right now with fact check:

brand reputation risk, high competition, loss of EV market leadership, cyber truck/ product recalls, declining sales with lower margin, stock volatility concern, insider selling, investors buy it based on expected future earnings rather than its current profitability.

+ Head and shoulder/ inverse cup and handle, P/E ratio 79.8-161.23 (overpriced), falling knife, dead cat bounce, the lowest target estimate stands at $120.00, below the 50-day, 100-day, and 200-day moving averages, MACD indicator is -19.8, bearish signals.

+ potential stagflation, tariff war, slow economic growth, inflation, rising public debt, geopolitical tensions, ai bubble, and more

TSLA Stock LONG Investment Opportunity

Hello, I am trader Andrea Russo and today I have a LONG buy opportunity on TSLA stock.

Entry Price: $253.59

Target Price (TP): +27.84%

Stop Loss (SL): -9.91%

Tesla, Inc. (TSLA) is one of the most innovative and dynamic companies in the automotive and technology sector. With its commitment to sustainable energy and the continuous expansion of its product range, Tesla represents a solid long-term investment opportunity.

Technical Analysis: The entry price was set at $253.59, a level that represents a key support point. Our strategy includes a target price of +27.84%, which reflects our confidence in Tesla's growth potential. At the same time, we have set a stop loss at -9.91% to limit losses in case of adverse market movements.

Investment Rationale:

Continued Innovation: Tesla continues to innovate in electric cars, batteries, and renewable energy.

Global Expansion: The company is expanding its global presence with new factories and markets.

Market Leadership: Tesla maintains a leadership position in the electric car market, with strong demand for its vehicles.

Bottom Line: This LONG TSLA buying opportunity is supported by solid technical analysis and strong business fundamentals. I encourage investors to consider this strategy to capitalize on Tesla's growth potential.

Happy Trading!

Here's Why I'm Bullish on TSLA: Smart Money is Buying...Here's Why I'm Bullish on NASDAQ:TSLA Multi-Timeframe Analysis Using Larry Williams' Methods

After a significant downtrend, NASDAQ:TSLA is presenting multiple bullish signals based on Larry Williams' methodology. The weekly and daily timeframes are aligning for a potential reversal opportunity with clearly defined risk parameters.

Weekly Timeframe Analysis

The weekly chart reveals several key bullish indicators:

- The COT Proxy Index shows commercials are buying at significantly higher levels compared to 6 months ago, 1 year ago, and 3 years ago.

- Seasonality patterns have reached a turning point, now indicating the beginning of an uptrend phase

- The WillVal indicator shows NASDAQ:TSLA is currently undervalued at multiple securities (DXY, QCCH, ZBLU all showing "Under")

- ADX reading above 60 (currently at 62.42) signals the existing downtrend is likely exhausting and nearing completion

Daily Timeframe Analysis

On the daily chart, we're seeing initial confirmation signals but still waiting for the optimal entry setup:

- The general market has created a Rally Day, and we're now watching for a Follow Through Day to confirm the new uptrend

- Price structure requires further confirmation through a change of character before entry

- The ProGo indicator has already turned positive, providing an early bullish signal

- Williams %R is showing oversold conditions, suggesting a potential bounce

- We need the Large Traders index to turn its slope upward for additional confirmation

Entry Strategy

I'm looking for one of these entry triggers:

- Primary : First pullback after change of character , using Williams %R for precise timing

- Alternative : Entry on first pullback after price moves above the WillTrend line

- Aggressive option : Entry if price breaks above the $245 resistance level

Profit Targets & Risk Management

Targets:

- First target: $327 (1.27 Fibonacci level)

- Second target: $390 (Larry Williams Target Shooter -> 2.00 Fibonacci level )

Risk Management:

- Initial stop loss: $228 or 120% of ATR(3) from entry point

- Once in profit, trailing stop based on price closes at WillTrend levels

The confluence of indicators across timeframes suggests a significant reversal potential in NASDAQ:TSLA , but waiting for daily chart confirmation will provide a higher probability setup with clearly defined risk parameters.

DISCLAIMER

This analysis is provided for informational and educational purposes only. The ideas and strategies presented should never be used without first assessing your own personal and financial situation. This content is not financial advice and should not be construed as a recommendation to buy, sell, or hold any securities or to engage in any specific investment strategy. All investment carries risk, including the possibility of losing some or all of your initial investment. Past performance of securities, including the patterns, signals, and indicators discussed, is not indicative of future results. The author does not guarantee the accuracy, completeness, or usefulness of any information presented. Each investor should conduct their own research and consult with qualified financial professionals before making investment decisions. Trading Tesla ( NASDAQ:TSLA ) stock involves significant risks that may not be appropriate for all investors. You should only invest funds that you can afford to lose.

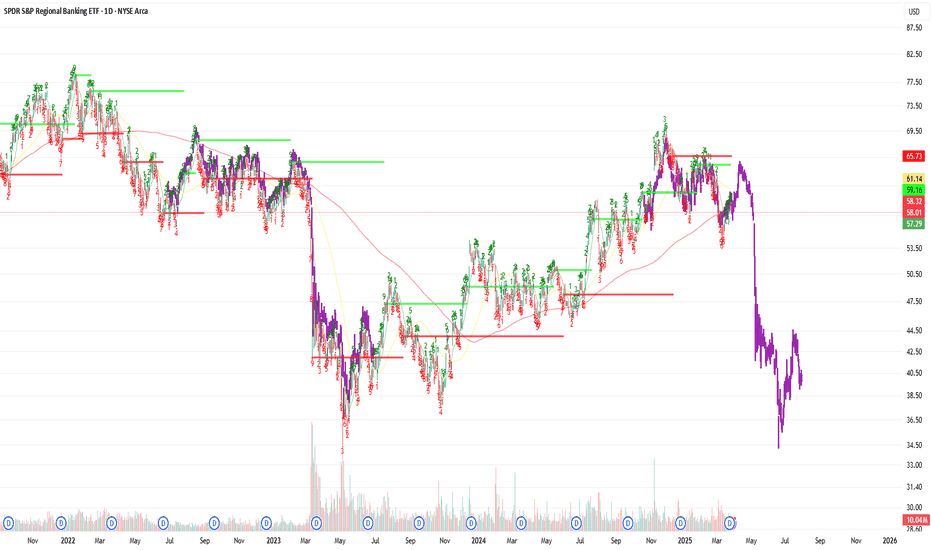

$KRE CRASH COMING ... Not yet tho..we'll find out..Regional Banks seem to be heading on a slippery path identical to the most previous crash pattern back when they needed all the loan Bailouts. Now that all the loans have stopped, I'm sure some banks may be heading towards loan restructuring perhaps, maybe defaults, I'm not sure honestly. I just know that the chart never lies and I've been watching and waiting for a long while. I predicted the first crash back then and I currently have no doubts with the current chart ahead of me. As always, I will do my best to provide the best insight possible into these speculations. Currently we have the Daily breaking trend and the bar count getting close to the previous 141 bars. The only difference is that we bounce off the 100% retracement. If we continue to lose the 1.27, we'll be headed for the 1.61..... updates soon.

TSLA Volatility Continues?NASDAQ:TSLA

Outlook - -GEX and -DEX with put support at 220 which would fill the Earnings gap up from last October.

Weekly -- Rejected the EMA

Daily -- Closed right above EMA

Hourly -- Consolidating

10m -- Consolidating

Bias - Neutral until one side breaks. Too much volatility to pick a side.

Pivot - 263.5

Upside Targets:

* 263.46--274.06--277.63--287.26

Downside Targets:

* 258.04--256.43--253.48--249.63

Tesla's Tipping Point: The $662 Bet That Could Return $12K TSLA bearish play thesis focused on buying 2 contracts of the $190 PUT (May 2, 2025) at $3.31 each. This version scales up all profit/loss values and ROI calculations to reflect a 2-contract position (i.e., 200 shares total).

🧠 TSLA Bearish Earnings Thesis – 2 Contract Play

Earnings Date: April 28, 2025

Option Expiration: May 2, 2025

Strategy: Buy 2x TSLA $190 PUTs @ $3.31

Total Cost (Premium Paid): $662 ($3.31 × 100 × 2)

Breakeven: $186.69

Thesis: Multiple Converging Catalysts Suggest Sharp Downside Risk

Tesla is facing a perfect storm of fundamental, technical, and sentiment-driven challenges. These create a highly asymmetric opportunity for short-dated PUT buyers heading into earnings.

⚠️ 1. Earnings Risk – Underperformance Expected

Delivery Misses: Q1 delivery numbers fell short of analyst expectations. Slower ramp in key markets like China and Europe due to economic slowdowns.

Margin Compression: Aggressive price cuts to maintain volume are eating into margins. Expectations for gross margin contraction YoY are high.

Disrupted Guidance: Potential downside revision to full-year forecasts as competition heats up (BYD, Ford, Rivian, etc.).

❝ Street is pricing in perfection. Any earnings or margin disappointment could send shares sharply lower. ❞

🧨 2. Brand Boycotts & Political Fallout

Public Backlash: Tesla faces intensifying boycott pressure in parts of Europe and the U.S. due to Elon Musk's political affiliations and controversial stances.

Brand Dilution: Musk’s polarizing presence has damaged Tesla's once-premium EV image. High-income, eco-conscious buyers are switching brands.

Retail Sentiment Shift: Reddit, X (formerly Twitter), and retail forums show sharp decline in "diamond hand" loyalty.

❝ Tesla’s brand equity is eroding. Negative sentiment is now a structural overhang. ❞

🔺 3. Headline Volatility – The “Musk Premium” Now a Liability

SEC & DOJ Scrutiny: Multiple ongoing investigations. Any bad headline can crash the stock.

X (Twitter) Overhang: Distraction and capital risk tied to Musk’s ownership of X are ongoing market concerns.

AI Pivot Uncertainty: Musk’s recent AI pushes have created confusion about Tesla’s core vision, with no clear monetization path.

❝ Musk headlines, once a tailwind, are now a systemic volatility trigger. ❞

📊 Modeled P&L for 2 Contracts

TSLA Price on May 2 % Drop Option Value per Contract Total Value (x2) Net Profit ROI (%)

$220 -16.5% $30.00 $6,000 $5,338 806%

$210 -20.3% $40.00 $8,000 $7,338 1,108%

$200 -24.1% $50.00 $10,000 $9,338 1,410%

$190 -27.9% $60.00 $12,000 $11,338 1,712%

$186.69 (Breakeven) -29.2% $63.31 $12,662 $12,000 1,812%

$263.55 (No drop) 0% $0.00 $0 - $662 -100%

💡 Strategy Recap – 2 Contract Position

Metric Value

Strike $190 PUT

Contracts 2

Premium $3.31 × 100 × 2 = $662

Breakeven $186.69

Max Risk $662

Max Reward $12,662

Reward/Risk Ratio ~19:1

✅ Final Thesis (2 Contracts)

"With $662 risked, a move to $200–$210 can yield ~$8,000. A move to $190 or below offers potential returns of over $11,000, making this a powerful short-term asymmetric play post-earnings. While risky, it’s tightly capped with a clearly defined thesis."

Tesla Stock Continues to Trade Within a Bearish ChannelThe monthly movements of Tesla's stock continue to reflect persistent downward pressure, with a decline of just over 10% since the beginning of March, showing steady selling interest. The bearish sentiment has remained in place as growing discontent over Elon Musk's political positioning has damaged the brand's image, while concerns over a potential trade war have raised fears that Tesla’s international sales may be negatively affected.

Bearish Channel:

Currently, the most important formation on the chart is a strong bearish channel that has remained intact since the final days of December 2024. So far, recent bullish attempts have failed to break out of this structure, reinforcing the broader bearish bias in the long-term outlook.

MACD Indicator:

The latest movements in the MACD histogram have started to show a notable decline, indicating that momentum in the moving average trend may be fading in the short term. This is likely due to the price reaching the upper boundary of the bearish channel, where resistance remains strong.

ADX Indicator:

The ADX line is currently trending downward, hovering just above the neutral 20 level. As this pattern continues, it reflects a lack of strength in recent price movements, pointing to growing indecision, which in turn reinforces the current resistance zone where the price is consolidating.

Key Levels to Watch:

$290: A significant resistance zone, aligning with the top of the bearish channel and the 200-period moving average. Sustained buying above this level could threaten the current bearish structure and signal the start of stronger bullish pressure.

$220: A key support level, representing the recent lows in the stock. A clean break below this zone could confirm a stronger bearish trend, opening the door for more aggressive selling in the sessions ahead.

By Julian Pineda, CFA – Market Analyst

Tesla - There Is Hope For Bulls!Tesla ( NASDAQ:TSLA ) is just crashing recently:

Click chart above to see the detailed analysis👆🏻

After Tesla perfectly retested the previous all time high just a couple of weeks ago, we now witnessed a quite expected rejection of about -50%. However market structure remains still bullish and if we see some bullish confirmation, a substantial move higher will follow soon.

Levels to watch: $260, $400

Keep your long term vision!

Philip (BasicTrading)

Tesla (TSLA) - The Big Short?Can Tesla save itself from the Big Short? With earnings coming up on April 29, the anticipated sales and earnings may be dismal. If hedge funds and retirement managers decide to lighten their exposure, this could lead to abrupt moves in the price of Tesla. Basically, if people want to sell and no one wants to buy at this price, then price has to go down. Also if Tesla hits a certain price on the way down, then all the loans like those used to purchase Twitter may margin call due to risk, more selling. This would not be good for Tesla or the market in general. Also keep in mind that April may be a pullback month for the S&P500 and Nasdaq anyway. So, what does Tesla need to do to combat this? 1. Deliver new products or announce the delivery of new product. 2. Deliver on full self driving along with the Robo Taxi service 3. Deliver on a new cheaper Tesla Model that can be used by individual owners to participate in the Robo Taxi network (Income for the buyer). 4. Deliver on a redesigned Cyber Truck. The current design in getting banned in European countries. Therefore, missing out on sells. 5. Deliver on mass productoin of humanoid robots and AI agents (someone has to be first). This will create excitement but can be tricky since it will unleash AI on the world which can be great but also introduce risk that have not been vetted. Such as, who controls the AI? Who is the AI 'loyal' to? What can people or Tesla ask AI to do? Are there morality rules? Is AI subject to the law? Who's laws based on the Country, State, or county/city it resides or where it was manufactured? 6. Advertise all the positive things about Tesla as a company and the cars as a product. Explain why someone should buy a Tesla over a BYD brand electric car in markets around the world.

These are just a few suggestions for Tesla to avoid The Big Short. What are some of your ideas?

$KRE REGIONAL BANK Crash? Identical Setup to March 23'Identical Setup to 23' Regional Bank Crash. As always, not sure what the trigger will be, but I will do my best to keep everyone updated as usual. Target of $58 from $60s reached. I'll be expecting a bit more come June. Watch for the sideways movement and rally until then.

TSLA the companyReviewing my charts out loud. I like the month and week view best. Watch the zones. Above 250 TSLA is above water. Will take a look at how week and month close to see if anything pops out at me. Tootles!

*I watch for setups

*BYD is gaining market share in China

*Europe may not want to affiliate right now

*Dubai for funding?... I happened to read years ago that Dubai investors put their money behind Lucid (LCID). Their earnings Q1 2025 was stellar.

*Currently, TSLA sales are in a slump

TESLA formed the new bottom and is going for $600.Tesla / TSLA is on the 2nd straight green 1week candle, crossing above the 1week MA50.

With the 1week RSI bouncing on the 2 year Rising Support, the Channel Up has technically formed its new bottom.

Both the current and the previous one were formed on the 0.618 Fibonacci retracement level after a -55% decline.

If the bullish wave is also as similar as the bearish waves have been, the price should reach as high as the -0.382 Fib extension.

Buy and target the top of the Channel Up at $600.

Follow us, like the idea and leave a comment below!!