Tesla Shares (TSLA) Drop Following Earnings ReportTesla Shares (TSLA) Drop Following Earnings Report

Yesterday, after the close of the main trading session on the stock market, Tesla released its quarterly earnings report. While both earnings per share (EPS) and gross profit slightly exceeded analysts’ expectations, the results reflected a negative trend driven by declining sales. This decline is being influenced by intensifying competition from Chinese EV manufacturers as well as Elon Musk’s political activity.

According to Elon Musk:

→ The company is facing “a few tough quarters” due to the withdrawal of electric vehicle incentives in the US;

→ The more affordable Tesla model (mass production expected in the second half of 2025) will resemble the Model Y;

→ By the end of next year, Tesla's financials should become "highly compelling".

Tesla’s share price (TSLA) fell by approximately 4.5% in after-hours trading, clearly reflecting the market’s reaction to the report. Today, the stock is likely to open around the $317 level, down from over $330 just the day before.

Technical Analysis of TSLA Stock Chart

In our analysis of TSLA charts dated 2 July and 8 July, we outlined a scenario in which the stock price could form a broad contracting triangle, with its axis around the $317 level.

The new candlesticks that have appeared on the chart since then have reinforced the relevance of this triangle, as the price rebounded from the lower boundary (as indicated by the arrow) and headed towards the upper boundary. However, yesterday’s earnings report disrupted this upward move.

Thus, while the broader stock market is trending higher (with the S&P 500 reaching a historic high yesterday), TSLA may remain "stuck" in a consolidation phase, fluctuating around the $317 level—at least until new fundamental drivers shift market sentiment.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Tslaidea

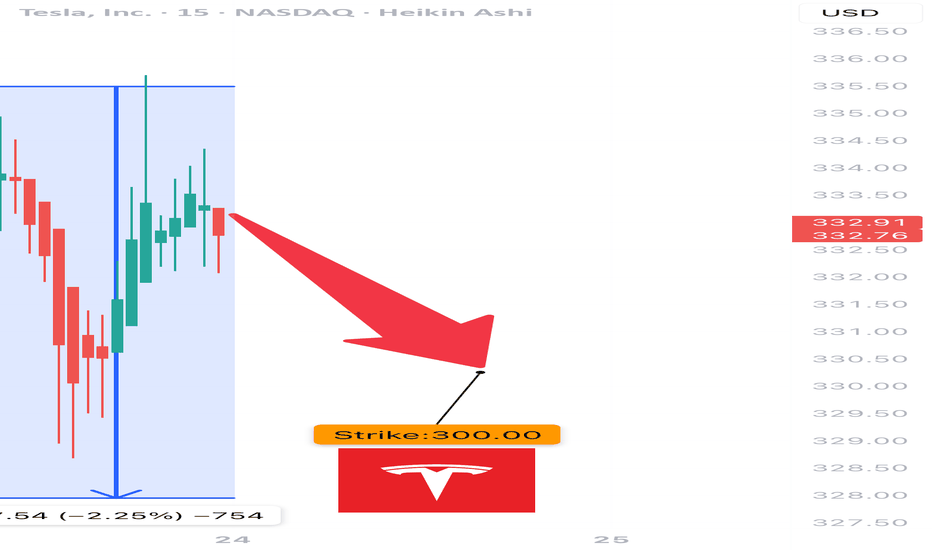

TSLA Earnings Play (Bearish Bias)

🚨 TSLA Earnings Play (Bearish Bias) 🚨

Earnings Date: July 23, 2025 (AMC)

🧠 Confidence: 75% Bearish | 🎯 Target Move: -10%

⸻

🔍 Key Takeaways:

• 📉 TTM Revenue Growth: -9.2% → EV demand weakness

• 🧾 Margins Under Pressure: Gross 17.7%, Operating 2.5%, Net 6.4%

• ❌ EPS Beat Rate: Only 25% in last 8 quarters

• 🐻 Options Flow: High put volume at $330 strike

• 🧊 Low Volume Drift: Trading above 20/50MA but losing steam

• 📉 Sector Macro: EV competition + cyclical headwinds

⸻

🧨 Earnings Trade Setup:

{

"instrument": "TSLA",

"direction": "put",

"strike": 300,

"expiry": "2025-07-25",

"entry_price": 2.02,

"confidence": 75,

"profit_target": 6.06,

"stop_loss": 1.01,

"entry_timing": "pre_earnings_close",

"expected_move": 7.1,

"iv_rank": 0.75

}

⸻

🛠️ Trade Details:

Parameter Value

🎯 Strike Price $300 PUT

💰 Premium Paid $2.02

📅 Expiry Date 2025-07-25

🛑 Stop Loss $1.01

🚀 Profit Target $6.06

📏 Size 1 Contract

⏱ Entry Timing Pre-Earnings

📊 IV Rank 75%

🕒 Signal Time 7/23 @ 14:14 EDT

⸻

📈 Strategy Notes:

• 🧯 IV Crush Risk: Exit within 2 hours post-earnings

• 🎲 Risk/Reward: 1:3 setup | Max Loss: $202 | Max Gain: $606+

• 🧭 Volume Weakness & put/call skew signal downside

• 🧩 Macro + Tech + Flow Alignment = Tactical bearish play

⸻

🧠 “Not all dips are worth buying — this might be one to short.”

📢 Drop your thoughts — would you take the trade or fade it?

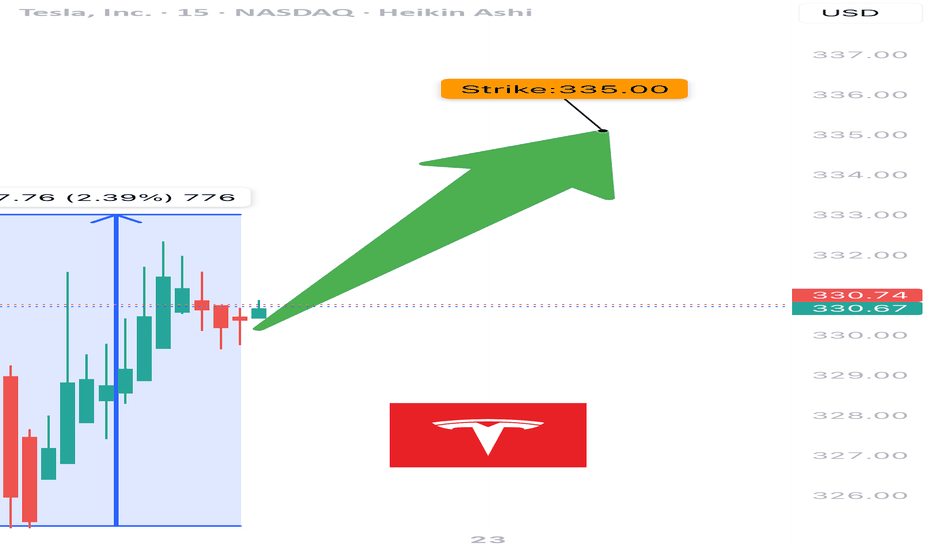

$TSLA Weekly Call Play – 07/22/25

🚀 NASDAQ:TSLA Weekly Call Play – 07/22/25

RSI Bullish 📈 | Options Flow Strong 🔁 | Volume Weak 💤 | 3DTE Tactical Entry

⸻

📊 Market Snapshot

• Price: ~$332–335 (spot near strike)

• Call/Put Ratio: 🔁 1.24 – Bullish Flow

• Daily RSI: ✅ 57.6 – Rising momentum

• Weekly RSI: ⚠️ 54.8 – Neutral / flattening

• Volume: ❌ Weak – Institutional absence

• Gamma Risk: ⚠️ Moderate (DTE = 3)

• VIX: ✅ Favorable

⸻

🧠 Trade Setup

{

"Instrument": "TSLA",

"Direction": "CALL",

"Strike": 335.00,

"Entry": 9.90,

"Profit Target": 15.00,

"Stop Loss": 6.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔬 Sentiment Breakdown

Indicator Signal

📈 Daily RSI ✅ Bullish – confirms entry

📉 Weekly RSI ⚠️ Flat – no long-term edge

🔊 Volume ❌ Weak – no institutional bid

🔁 Options Flow ✅ Bullish (C/P = 1.24)

💨 VIX ✅ Favorable for upside trades

⏳ Gamma Decay ⚠️ High risk (3DTE)

⸻

📍 Chart Focus

• Support Zone: $328–$330

• Breakout Watch: $335+

• Target Zone: $340–$345

• ⚠️ Risk Watch: Volume divergence + gamma decay on low move

⸻

📢 Viral Caption / Hook (for TradingView, X, Discord):

“ NASDAQ:TSLA bulls flash 335C with confidence, but volume’s asleep. RSI’s in, gamma’s ticking. 3DTE lotto with caution tape.” 💥📉

💵 Entry: $9.90 | 🎯 Target: $15.00+ | 📉 Stop: $6.00 | ⚖️ Confidence: 65%

⸻

⚠️ Who This Trade Is For:

• 🔁 Options traders chasing short-term call flows

• 📈 Momentum scalpers riding RSI pop

• 🧠 Disciplined risk managers eyeing 3DTE setups

⸻

💬 Want a safer bull call spread (e.g., 330/340) or risk-defined iron fly for theta control?

Just ask — I’ll build and optimize it for you.

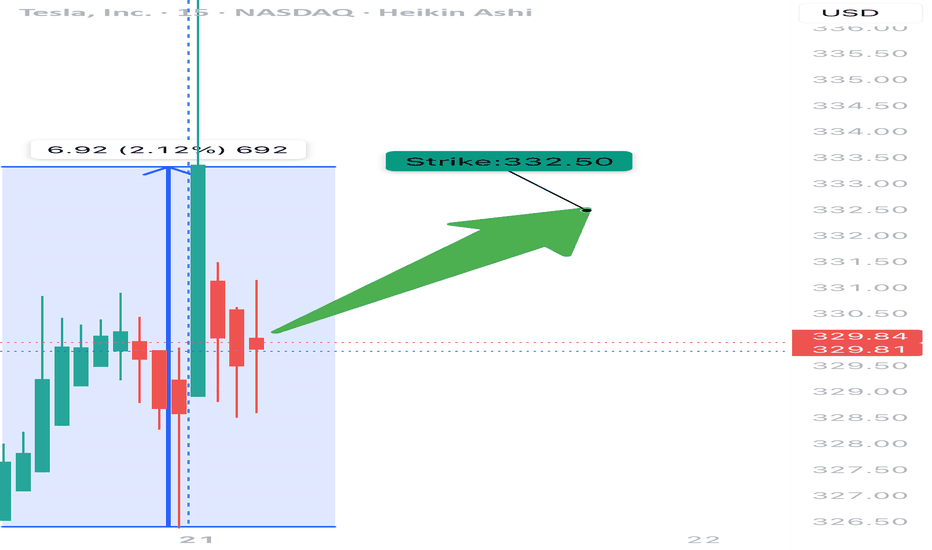

TSLA WEEKLY TRADE IDEA – JULY 21, 2025

🚀 TSLA WEEKLY TRADE IDEA – JULY 21, 2025 🚀

🔔 Bullish Play, But Handle With Caution 🔔

Models split, but momentum wins (for now)…

⸻

📈 Trade Setup

🟢 Call Option – Strike: $332.50

📆 Expiry: July 25, 2025 (Weekly)

💰 Entry: $11.05

🎯 Target: $22.11 (100% Gain)

🛑 Stop: $5.53 (50% Loss)

🕰️ Entry Time: Monday Open

📊 Confidence: 65% (Moderate)

⸻

🧠 Why This Trade?

✅ RSI trending bullish on both daily + weekly

⚠️ Weak volume & bearish options flow (C/P ratio > 1)

📉 Institutions may be hedging into earnings

🌪️ Earnings risk looms – volatility expected

📉 Some models say no trade – we say: controlled risk, tight leash

⸻

🧨 Strategy:

🔹 Single-leg naked call only

🔹 Avoid spreads due to IV & potential gap risk

🔹 Scale out if gain >30% early-week

🔹 CUT FAST if volume + price diverge

⸻

🔥 Quick Verdict:

Momentum > fear, but don’t ignore the smoke.

TSLA 332.5C — Risk 1 to Make 2+

Ready? Let’s ride the wave 📊⚡

#TSLA #OptionsTrading #CallOption #TradingSetup #WeeklyTrade #EarningsSeason #MomentumPlay #TradingViewIdeas #SwingTrade #SmartMoneyMoves

TESLA (TSLA) ARE WE HEADING TO 336? Morning Folks

It appears we are trying to break the highs of 304 and if we are successful a nice range up to 327-336 makes sense. However be careful if sink back down under 289 which then can see levels of 259 getting hit.

What are your thoughts on Tesla? Put in the comments section below

Kris Mindbloome Exchange

Trade Smarter Live Better

Tesla (TSLA) Shares Rebound After Sharp DropTesla (TSLA) Shares Rebound After Sharp Drop

When analysing the Tesla (TSLA) stock price chart six days ago, on the morning of 5 June, we:

→ highlighted Elon Musk’s critical comments regarding the spending bill promoted by the US President;

→ noted that a potential rift between Musk and Trump could have long-term implications, including for TSLA shares;

→ outlined an ascending channel (marked in blue);

→ suggested that the price might correct from the upper to the lower boundary of the channel.

This scenario played out rather aggressively: later that same day, during the main trading session, Tesla’s share price dropped sharply to the lower boundary of the channel amid a scandal involving Musk and Trump.

However, the lower boundary of the channel predictably acted as support. Yesterday, TSLA shares were among the top five performers in the S&P 500 index (US SPX 500 mini on FXOpen), gaining around 5.6%.

As a result, TSLA stock price climbed back above the psychologically important $300 mark, recovering from the previous week’s sell-off.

Why Are Tesla (TSLA) Shares Rising?

Bullish drivers include:

→ The upcoming launch of Tesla’s robotaxi service, provisionally scheduled for 22 June. Elon Musk has stated he intends to use the service himself.

→ Easing of tensions with the US President. Donald Trump declared that he has no intention of "getting rid of Tesla or Starlink" should he return to the White House.

→ Continued support from Cathie Wood, the prominent asset manager, who once again reaffirmed her confidence in Tesla’s future success.

Technical Analysis of TSLA Chart

Today, TSLA’s share price is hovering near the median line of the previously identified ascending channel – a zone where supply and demand typically seek equilibrium.

Also worth noting is the $320 level: in May, it acted as support, which suggests it may now function as resistance.

Given these factors, it is reasonable to expect that the sharp recovery from the 5 June low may begin to lose momentum, with the price likely to stabilise and form a consolidation range following the recent spike in volatility.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bullish on TSLA if its stay above 290$ USD**INDICATOR SAY BULL🚀 TESLA (TSLA): The Ultimate Showdown – Bullish Surge or Bearish Collapse? 🚀

Tesla (TSLA) has all eyes locked on it , standing at a crossroads that could dictate its next explosive move. Hovering at $295.14 USD , it’s holding onto the crucial $290 USD support level , a make-or-break zone that could either ignite a spectacular rally or trigger a sharp decline.

🔥 Bulls Are Ready to Take Off: If Tesla defends $290 USD , it’s GAME ON. This level acts as a launchpad—a pressure point where accumulation fuels momentum, setting the stage for a surge toward $460 USD. Investors, traders, and market enthusiasts are all watching for this breakout moment, knowing that breaching higher resistance could spark an avalanche of buy orders. Tesla’s chart suggests a brewing storm of demand, one that could shatter expectations and push the stock into new highs.

⚡ Bears Are Lurking in the Shadows: But danger is never far away. A slip below $290 USD could signal the end of bullish dominance, dragging TSLA into a downward freefall toward $220 USD or even $200 USD . This break would suggest weakening momentum, market hesitation, and potential large-scale selling pressure. Bears will seize the opportunity, forcing Tesla into a recalibration phase—one that could reshape investor sentiment for weeks to come.

🔥 Tesla’s Next Move? A Market-Defining Moment! 🔥

This isn’t just another stock movement—it’s a battle between fear and ambition, bulls and bears, excitement and caution. Tesla is standing on the edge of innovation and volatility, making its current price action one of the most thrilling showdowns in the market today.

Will it skyrocket toward greatness , or will the bears drag it down?

Whatever happens next, one thing is certain— this ride will be unforgettable . Buckle up! 🚀⚡🔥

Let me know if you want even more refinements or additional angles! 😎🔥

Subscribe for more!

TSLA cooling offI know Tesla lovers hate to see a short post on the stock. Okay... it's cooling off... lol.

*another news report states he's leaving gov't; trump holding on tight... we shall see

*alleged new growth story incoming... check news and see what you see

*TA (technical analysis) look like a pullback in order... 330-325

Do you see what I see? Or you are feeling like it's a straight moon shot?

Have a great weekend.

Tesla Stock: Neutral Bias Persists Following Earnings ReportTesla’s stock is currently hovering near the $250 level, after a bullish gap formed following the release of its latest earnings report. Initially, the company's results fell short of expectations: earnings per share came in at $0.27 versus the expected $0.39, and total revenue reached $19.3 billion versus $21.11 billion anticipated by the market. Despite this, the stock's initial reaction was a bullish gap, fueled by brief, fleeting optimism, but the session ultimately closed with a notable indecision candle, casting some doubt on whether a new short-term uptrend is truly beginning.

Bearish Channel Remains in Play:

Despite the recent upward jump in the latest session, buying momentum has so far failed to break through the upper boundary of the descending channel that has persisted since late December. For now, this bearish channel remains the most important formation to monitor, based on recent price behavior.

MACD:

The MACD histogram is currently oscillating close to the neutral zero line, indicating that the average strength of the recent moving average swings remains largely neutral. If this behavior continues, the market may lack a clear short-term trend.

ADX:

The ADX indicator is showing a similar setup. The line continues to hover around the 20 level, which typically signals indecision in the market. This reflects a neutral tone in the current price movement, suggesting that a lack of momentum is driving a series of directionless swings. Unless the ADX line starts to rise steadily, a neutral bias may continue to dominate the stock in the short term.

Key Levels:

$220 – Key Support: This level marks the lowest point in recent months. A break below this support could reactivate the bearish channel that has defined short-term price action.

$290 – Technical Barrier: Aligned with the 200-period simple moving average, a bullish breakout above this level could pose a serious threat to the current bearish trend channel.

$330 – Final Resistance: This level is aligned with the 100-period simple moving average. If the stock reaches this area, it could confirm a shift in market momentum and pave the way for a more sustained bullish trend on the chart.

Written by Julian Pineda, CFA – Market Analyst

TSLA Setting Up for the Next Big Move?🚘Tesla's been cooking up some serious price action — and now it’s getting interesting. After holding above key supports, bulls might be eyeing their next shot. Here’s the plan I’m watching:

📥 Entry zones:

• 240 (aggressive)

• 215 (ideal support zone)

• 195 (deep discount territory)

🎯 Profit targets:

• 265

• 290

• 355+ (if momentum takes off)

TSLA has been showing signs of accumulation — and if buyers step in near 215–195, we could be looking at the early stages of a powerful move. Of course, nothing is guaranteed. The EV space is competitive, and macro volatility can flip the script fast.

🔍 Keep an eye on volume, trend confirmations, and news that could push sentiment one way or the other.

⚠️ Disclaimer: This is not financial advice. Just sharing my personal analysis and trade idea. Always do your own research and manage risk according to your own strategy.

Tesla What Next? TSLA Buy Bargain OR Bust?✅️Now you guys know my thoughts on this and although TESLA has been beaten ⚫️black⚫️ and 🔵blue🔵 recently somehow there may be an opportunity on the horizon.🚀

ℹ️ The way I look at it is unless you think TSLA is dead forever and to be cast to the dustbin 🟢SeekingPips🟢 would be looking for a buying opportunity.

👌I don't know who coined the phrase first however it's one that 🟢SeekingPips🟢 loves and uses often it's

⭐️"BUY WHEN THERES BLOOD IN THE STREETS"⭐️

⚠️Now don't get me wrong it doesn't mean I will be loading up gun ho RIGHT AT THIS MOMENT but it certainly DOES MEAN I'M NOT A SELLER AND STALKING BUYING OPPORTUNITIES✅️

❓️What's you thoughts on Tesla❓️

Share your thoughts with 🟢SeekingPips🟢

TSLA’s Next Big Move: Collapse or Skyrocket? Key Levels to WatchTesla (TSLA) is approaching key price levels that will determine its next move.

Potential Downside:

-If TSLA drops below $297, the next level to watch is $292.

-A break below $292 could lead to $283.

-If $283 fails, the price may drop significantly toward $222.

Potential Upside:

-If TSLA reverses, it could rise back to $384.

-A breakout above $384 could push it to $431 and beyond.

If this analysis added value to you, please like and share!

Kris/Mindbloome Exchange

Trade Smarter Live Better

Quick 4-Min Tesla Analysis: Deeper Pullback or Ready for LiftoffJust wrapped up a quick Tesla analysis (under 4 min)! Right now, we could see a dip to the $289 zone before pushing higher, or a deeper move down to $250 before driving up toward $475.

Where do you think Tesla is headed next? Let me know your thoughts!

Kris/Mindbloome Exchange

Trade Smarter Live Better

TESLA bounced right where it was supposed to! NASDAQ:TSLA bounced right where it was supposed to!

Tesla has had resistance turned support turned back to resistance dating back to 2021 on the chart, as seen by the white circles. It has broken the $300 level for the second time in the past three or so years. Now that it's broken, it has pulled back to the 9ema on the weekly chart, and the area that was once resistance has turned...you guessed it... SUPPORT. See you at $400 plus!

-HighFiveSetup is still intact with massive measured moves higher from our 1 and 3-year inverse H&S patterns.

-Tesla is up over 3% on a day, and the market is pulling back, which shows even more bullishness.

NFA

Tesla Weekly to 4 Hour Deep Analysis EVERYTHING YOU NEED TO KNOWMorning Trading Family

Tesla broke out of the zone we expected it would with a quick fake for the bears then the positive news punched Tesla up like no tomorrow.

Today I break Tesla down into the nitty gritty using all the tools to give you levels to look out for in the coming days.

Overall Tesla can hit 300 and beyond but we have a few levels to hit before we get there.

Enjoy the video

If you liked this content, follow, like, share and boost: truly grateful for your time and your comments

Mindbloome Trading

Trade What You See

Tesla are we going to 268 or 272 which one is IT???? Good morning Traders

Grab some coffee or a tea and lets get into it

First I do a little bit of wave counting to get you up to speed on where we are going and why

Second I do some four hour projections and 30 minute to figure out our levels going up

Third add in a little spice and throw that pitchfork in to wrap it up all nice

Enjoy the video, if you want more videos or different types of videos please let me know in the comments section.

My ultimate goal is give you the audience what you need and the skills to become a more profitable and better trader so you too can hit your trading and lifestyle goals

Happy hunting for those trades

MB Trader

TSLA ( Tesla ) BUY TF H1 TP = 248.08 Good luck!On the H1 chart the trend started on Aug. 8 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 248.08

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

Tesla on the Rise: Can We Hit $350Hey traders! MB Trader here—hope everyone had a great week of trading. Let's dive into Tesla and talk about two potential scenarios I'm watching closely. There are some key levels in play, so here’s a quick breakdown of what could happen next:

Scenario 1: Correct and Push Higher

-We could see a correction, but Tesla might still head upwards toward the $250 range.

-This means a short-term pullback followed by a rise to $250 before any bigger correction hits.

This is the scenario I’m leaning toward until we get more data confirming the move.

Scenario 2: Deeper Correction Before Rebound

-If the correction goes deeper, Tesla could drop to $223-$228 before rebounding.

-This range is a crucial support level to watch—if it holds, we correct back up.

But, if that level doesn’t hold, we could break down toward $200 or even lower.

What I'm Thinking:

Right now, I’m more inclined toward the idea of hitting $250 first, then seeing a deeper pullback.

However, I'm staying cautious until we get more data, as Tesla’s moves can be unpredictable.

Let’s see how this plays out—stay sharp and keep those key levels on your radar. Talk soon!

Tesla Four Hour how far is this market going up ???????Good morning Traders

I created a video for you all in relation to how far this market for Tesla is moving up along with 4-5 scenarios I can see possibly playing or to watch out for.

Any questions, thoughts, comments send them my way or comment below

We dont predict the market we follow it

MB Trader

Happy Trading