TSLA Backtest: A robo-taxi launchpad? TBD ... 𝗧𝗲𝘀𝗹𝗮 𝗕𝗮𝗰𝗸𝘁𝗲𝘀𝘁: A robo-taxi launchpad? 🤖🚗

After a 20%+ breakout, NASDAQ:TSLA is retesting its 200dma with $295–300 now key support. Hold that — and bulls have room to run to $400+.

𝘉𝘶𝘭𝘭𝘪𝘴𝘩 𝘴𝘦𝘵𝘶𝘱 𝘸𝘪𝘵𝘩 𝘢 𝘥𝘢𝘵𝘦: June 12 robo-taxi reveal in Austin could mark Tesla’s first real step toward autonomous ride-hailing at scale.

𝘏𝘪𝘨𝘩 𝘱𝘳𝘪𝘤𝘦, 𝘩𝘪𝘨𝘩 𝘩𝘰𝘱𝘦𝘴: Tesla's valuation has always priced in the future. This time, the future might show up in a self-driving Model Y.

$NQ_F NASDAQ:NDX NASDAQ:QQQ NASDAQ:NVDA NASDAQ:AAPL AMEX:SPY NASDAQ:SOX CBOE:ARKK #Tesla #Robotaxi #FSD #ElonMusk #Stocks

Tslalong

$TSLA Weekly Chart Analysis🚀 NASDAQ:TSLA Weekly Chart Analysis

🔹 Strong Momentum: Launching off the volume shelf and cruising with the market’s bullish energy.

🔹 Room to Run: Approaching the red barrier, but not there yet—still has upside before a pullback.

🔹 Healthy RSI: Sitting at 56.60, meaning plenty of room for further gains.

🔹 Catalyst Ahead: Robotaxi event incoming! (Sell the news? You bought the rumor. 🤔)

🔹 Key Resistance: Watch levels at $350–$400.

Stay sharp—let’s see if TSLA keeps charging forward! ⚡📈

$TSLA : The road to 400 $In this space we have discussed about NASDAQ:TSLA multiple times. In one of our very recent blogs on 21 April 2025, we flipped bullish for the first time and presented a case to accumulate NASDAQ:TSLA between 214 $ – 250 $. Congrats to everyone who did it. On Friday’s close the stock is above 250 $ and its currently sitting above its 20-Day and 50-Day SMA. This can be taken as a first bullish sign and maybe the start of a primary reversal trend towards up. After some turbulent time and more than a 50% dip the stock is holding up very well.

As Elon will be back on the helm of the NASDAQ:TSLA we can expect some more macro tailwind for the stock itself. In the daily chart below, we see that the RSI chart has flipped bullish and on the Fib retracement levels we are well above the 0.382 Fib retracement levels which is at 272 $. The next stop as per the chart is 310 $ @ 0.5 Fib level. My assessment is that once the momentum is flipped bullish the stock can end above 400 $ once this is all said and done.

Verdict: Go Long $TSLA. 400 $ see you there $TSLA.

𝗧𝗲𝘀𝗹𝗮 𝗕𝗿𝗲𝗮𝗱𝗸𝗼𝘄𝗻: Priced for perfectionPriced for perfection in an imperfect market

NASDAQ:TSLA nearly hit its 200dma and key resistance area (~288–292) after a roughly 20% post-earnings squeeze, and as long as it stays below that level, it risks retesting the long-term uptrend line that has marked major lows twice since COVID.

𝘛𝘢𝘳𝘪𝘧𝘧 𝘢𝘯𝘥 𝘴𝘶𝘱𝘱𝘭𝘺-𝘤𝘩𝘢𝘪𝘯 𝘳𝘪𝘴𝘬: Tesla depends heavily on Chinese-made battery and electronic components now hit by reciprocal U.S. tariffs, while over 60% of global neodymium and dysprosium—vital for its EV motors—are mined and processed only in China, creating a critical bottleneck that could sharply elevate its input costs.

𝘔𝘢𝘳𝘨𝘪𝘯 𝘱𝘳𝘦𝘴𝘴𝘶𝘳𝘦 𝘷𝘴. 𝘭𝘰𝘧𝘵𝘺 𝘷𝘢𝘭𝘶𝘢𝘵𝘪𝘰𝘯: Q1 price cuts of up to 20% on core models drove Tesla’s auto gross margin to its lowest since 2020, calling into question the sustainability of its >70× forward P/E multiple, which assumes exceptionally high profits from future ventures like robotics and autonomous fleets.

$NQ_F NASDAQ:NDX NASDAQ:QQQ NASDAQ:AMZN NASDAQ:META NASDAQ:NVDA NASDAQ:SOX $ES_F AMEX:SPY SP:SPX TVC:DXY NASDAQ:TLT TVC:TNX TVC:VIX #Stocks #TrumpTariffs 🇺🇸 #ChinaTariffs 🇨🇳

Breaking: Tesla Up 6% In Premarket Albeit Q1 Profit Drops 71%Shares of Tesla (NASDAQ: NASDAQ:TSLA ) stock surged 6% in early premarket trading on Wednesday amidst missing expectation, Q1 profit drops 71%.

Tesla investors breathed a sigh of relief after CEO Elon Musk said he would refocus his attention on the electric automaker, but that promise did not entirely dispel worries that his right-wing shift had irrevocably damaged the company's image.

The automaker's shares (NASDAQ: NASDAQ:TSLA ), rose about 6.5% in premarket trading on Wednesday after Musk said he would cut back, opens new tab his work for U.S. President Donald Trump to a day or two per week from sometime next month after the automaker posted a 71% slump in net income and a sharp drop in automotive revenue.

Since hitting a record high in December, Shares of Tesla (NASDAQ: NASDAQ:TSLA ) have lost about half its value reducing its market capitalization by more than $500 billion, largely on concerns that brand damage could hurt sales for a second straight year.

Tesla said it will a review of its full-year delivery forecast amid shifting global trade policies in the second quarter earnings update, which is expected in July.

While Tesla is less likely to be affected by global tariffs than legacy automakers, it still expects an outsized impact on the fast-growing energy storage business that uses battery cells from China.

Technical Outlook

As of the time of writing, NASDAQ:TSLA shares are up 6.5% in premarket trading. The asset is undergoing a bullish reversal pattern after bouncing off from the critical support point of $218.

TSLA shares are aiming for a 118% surge should the asset break the key Fibonacci levels highlighted on the chart. With the last trading session's RSI at 46, NASDAQ:TSLA is well primed for a bullish campaign since consolidating late December, 2024 losing almost 56% of value, TSLA shares are looking to capitalize on that.

TSLA Setting Up for the Next Big Move?🚘Tesla's been cooking up some serious price action — and now it’s getting interesting. After holding above key supports, bulls might be eyeing their next shot. Here’s the plan I’m watching:

📥 Entry zones:

• 240 (aggressive)

• 215 (ideal support zone)

• 195 (deep discount territory)

🎯 Profit targets:

• 265

• 290

• 355+ (if momentum takes off)

TSLA has been showing signs of accumulation — and if buyers step in near 215–195, we could be looking at the early stages of a powerful move. Of course, nothing is guaranteed. The EV space is competitive, and macro volatility can flip the script fast.

🔍 Keep an eye on volume, trend confirmations, and news that could push sentiment one way or the other.

⚠️ Disclaimer: This is not financial advice. Just sharing my personal analysis and trade idea. Always do your own research and manage risk according to your own strategy.

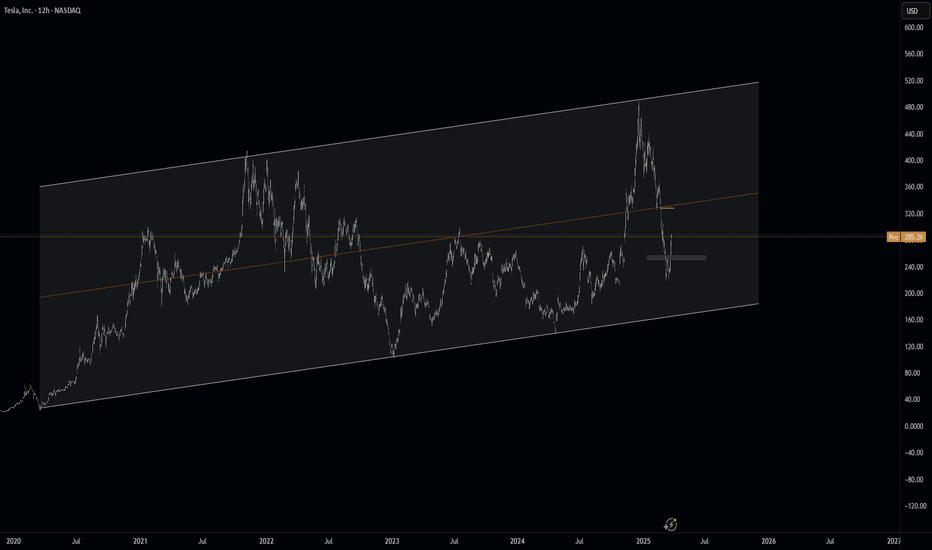

Tesla (TSLA) Long-Term Analysis: Retesting Key SupportHello traders! Let’s dive into a long-term analysis of Tesla (TSLA) on the monthly chart to understand where the stock might be headed next. I’ll walk you through my thought process, focusing on a comparison between the recent correction and a similar setup in 2020, while also analyzing the current correction’s alignment with the triangle formation from the 2021–2024 consolidation. My goal is to help you see the context of this setup and make an informed decision if you’re considering a trade.

Step 1: Understanding the Big Picture and Historical Context

Tesla has been in a strong uptrend since 2013, as evidenced by the ascending channel (highlighted in blue). This channel has guided the stock’s long-term trajectory, with the lower trendline providing support during pullbacks and the upper trendline acting as resistance during peaks. Within this uptrend, Tesla has experienced significant breakouts followed by corrections, and I’ve identified a compelling similarity between the current price action and a setup from 2020, alongside a key technical level from the recent consolidation.

Step 2: Comparing the Recent Correction to 2020

In 2020, Tesla consolidated in a range between $12 and $24 (labeled "Consolidation 1" on the chart). It then broke out, rallying to a high of $64.60—a gain of about 169% from the upper end of the consolidation range. Following this breakout, Tesla experienced a sharp pullback, dropping to $23.37, which represents a 63.8% correction from the $64.60 high. After finding support at this level, Tesla resumed its upward trajectory, soaring to $166.71—a 613% increase from the pullback low. Now, let’s look at the current situation: Tesla broke out of "Consolidation 2" (around 2021–2024), rallying from $212.11 to a high of $488.54—a 130% increase. It has since corrected by 51%, dropping to the current price of $239.43. This 51% pullback is slightly less severe than the 63.8% correction in 2020, but the structure is similar: both followed significant breakouts from consolidation zones.

Step 3: Current Price Action and the Triangle Retest

Tesla is currently trading at $239.43, down 55% from its recent high of $488.54. If the correction deepens to around 60%, it would bring the price to approximately $195.42 (calculated as $488.54 × (1 - 0.60) = $195.42), which aligns perfectly with the upper trendline of the triangle formation from "Consolidation 2" and the "Retest support?" zone around $170–$200. This confluence suggests that the current correction could be setting the stage for a significant bounce, just as the 2020 correction did. If this $170–$200 level fails to hold, I’m watching for a deeper pullback to the "Retest support" zone around $138–$150, which aligns with the lower trendline of the ascending channel and has acted as support during previous pullbacks (e.g., in 2023).

Step 4: My Prediction and Trade Idea

Here’s where I put myself in your shoes: if I were trading Tesla, I’d be watching for a retest of the $170–$200 support zone as a potential buying opportunity, drawing from both the 2020 playbook and the current technical setup. Why? In 2020, Tesla found support at $23.37 after a 63.8% correction, which set the stage for a 613% rally to $166.71. Similarly, a 60% correction now would bring Tesla to the upper trendline of the Consolidation 2 triangle at $170–$200, a level that could act as a springboard for the next leg up. If Tesla holds this support, I expect a move back toward the $300–$339 range, where it faced resistance before the recent drop. A break above $339 could signal a continuation toward $488.54, retesting the recent high.

Profit Targets and Stop Loss

Entry: Consider buying around $170–$200 if the price retests this support and shows signs of reversal (e.g., a bullish candlestick pattern or increased volume).

Profit Target 1: $300 (a conservative target based on recent resistance).

Profit Target 2: $339 (a more aggressive target at the prior resistance zone).

Stop Loss: Place a stop below $160 to protect against a breakdown of the $170–$200 support zone. This gives the trade a risk-reward ratio of up to 13:1 for the first target.

Risks to Consider

If Tesla fails to hold the $170–$200 support, we could see a deeper correction toward $138–$150, and potentially even $64–$90, another historical support level. Additionally, keep an eye on broader market conditions, as Tesla is sensitive to macroeconomic factors like interest rates and consumer sentiment in the EV sector. While the 2020 setup and the triangle retest provide a historical and technical parallel, the current 55% drop suggests heightened volatility, so be prepared for potential whipsaws around these key levels.

Conclusion

Tesla’s recent 55% correction from $488.54 to $239.43 echoes the 63.8% pullback in 2020 after the breakout from "Consolidation 1." If the correction deepens to 60%, it would retest the upper trendline of the Consolidation 2 triangle at $170–$200, suggesting a potential opportunity for a high-probability trade with clear profit targets and a defined stop loss. This setup could mirror the 2020 recovery, where Tesla rallied 613% after finding support. What do you think of this setup? Let me know in the comments—I’d love to hear your thoughts!

TSLA is coming down to my buy zoneTSLA is coming down to my buy zone. I will be accumulating at 229 and below.

I will start first by selling cash covered naked puts to collect credits until it drops to that zone. The goal is to get assigned with the naked put options at a cost of 229 and below to purchase TSLA shares.

There is a good possibility that the next earnings of TSLA will disappoint and we might get a quick dip. In that case we may even see early 200s. I would be adding more shares there.

Note that this is a weekly chart so it will take some time to play out.

This is a long term hold for me.

Upside Target:

- Nearest upside target is 11.9% above the current price, approximately $267.86.

Downside Target:

- Nearest downside target is -1% below the current price, approximately $237.04.

- Next downside target is approximately $195.65-196

- Support and Resistance: Monitor the support at $217.02 and resistance at $291.85 for potential breakouts or breakdowns.

- Action: Given the bearish sentiment, consider waiting for a clearer bullish signal or confirmation of support holding before entering long positions. Up Volume to Down Volume Ratio 30-Days is 0.86 and 50-Days is 0.78, both below 0.8, indicating bearish sentiment in the near term so wait for it to come down to the buy zone.

Tsla Lesson Tesla Stock Always Pay YOURSELFI say this time and time again and this is a PRIME EXAMPLE SO FAR.

🌍Now I suggested THAT IF YOU WERE A TESLA BULL that you might want to start to PAY ATTENTION TO THE STOCK TWO WEEKS AGO.

❓️"OK SO WHAT'S THE LESSON"❓️

I emphasise ALWAYS that TIME TRUMPS PRICE...

TESLA has been rather docile since its initial POP.

But take a look at the HIGHER TIMEFRAME WEEKLY CHART❗️

Whats clear to see is that although the PRICE RANGE hasn't been MASSIVE there has been plenty OF ⏳️TIME TO CAPITALISE AND PAY YOURSELF. £$€¥ 💰

Two 📈HIGHER CLOSES ON THE WEEKLY and the call made whilst the weekly looked EXTREMELY BEARISH📉

EVEN RIGHT NOW we are currently UP ON THE WEEK UNTIL NOW.

ℹ️ If you WERE UNABLE to STRUCTURE A TRADE TO TAKE advantage of this PRICE RANGE whilst DAY TRADING you may need to LOOK BACK and STUDY WHY NOT.

⚠️You could have paid yourself several times over already and even if TESLA was to seek lower prices from here you SHOULD HAVE BACKED SOMETHING ALREADY.

✅️AS ALWAYS TRADE YOUR PLAN & WAIT FOR YOU SIGNAL✅️

TESLA Market Outlook: Strong Reversal Expected at $200 SupportNASDAQ:TSLA is currently trading within a well-defined ascending channel , a structure that has guided price action since 2020. This channel reflects the broader bullish trend, with higher highs and higher lows consistently forming over the years. The recent sharp decline from the upper boundary of the channel is best interpreted as a temporary retracement rather than a structural shift. Such pullbacks have presented strong buying opportunities before, particularly when price approaches key support levels within the channel. The key area to watch is the $200 demand zone. This level coincides with the lower boundary of the ascending channel and has before drawn significant buying interest.

Given the broader bullish structure, a reversal from this zone could reestablish the uptrend and lead to a retest of higher levels. If a bounce occurs at the $200 demand zone, the immediate target is $263, which aligns with a key resistance level where prior rejection occurred. This area represents a logical point to watch for, but a successful breakout above $263 could lead to further move toward the upper boundary of the channel.

Fundamental Outlook:

From a fundamental perspective, the recent decline could be due to Tesla facing a unique set of challenges stemming from Elon Musk’s increasing involvement in the U.S. government. His role in the Department of Government Efficiency (DOGE) under the Trump administration has triggered mixed reactions across the financial landscape. The DOGE program, aimed at cutting bureaucratic waste and enhancing operational efficiency, has led to concerns about Musk’s ability to maintain focus on Tesla. Some investors do worry that his attention, divided among a few ventures such as Tesla, SpaceX, and also the federal program, might slow the company’s innovation pipeline in addition to running efficiency.

People are quite divided in their opinions. While some view Musk’s governmental involvement as a strategic advantage, believing his influence could drive favorable policy outcomes, others see it as a distraction that threatens Tesla’s future success. Additionally, if the DOGE program prompts budgetary austerity measures, there could be cuts to clean energy incentives, an outcome that would directly impact Tesla’s profits directly.

Despite these concerns, the market’s long-term outlook for Tesla remains bullish. Many investors view any significant retracement as a buying opportunity, particularly near major technical support zones like $200. This area is widely recognized as a strong accumulation zone where institutional buyers are likely to step in. Furthermore, the electric vehicle market continues to expand globally, and Tesla’s brand strength and technological lead remain intact, reinforcing the long-term growth narrative.

Market View & Predictions

While short-term volatility is expected due to ongoing uncertainties surrounding Musk’s government involvement, the broader technical structure suggests that the uptrend is still intact.

The recent pullback from the upper channel boundary appears to be a healthy correction rather than a trend reversal. If the price tests the $200 support zone, it could trigger a new wave of buying pressure, potentially driving the stock back toward the $263 resistance and beyond. As long as the price remains within the ascending channel, the bullish case for Tesla remains valid, with the potential for further upside as market confidence stabilizes.

SeekingPips sees TSLS Tesla GAIN $60 ! What's Next?It's hard for many traders to do. 🤔

⭐️ I still see it today with traders and investors alike. Even with some who have been at it for many years...

BUT some of the BEST ENTRIES & EXITS for me have been when the OPEN CANDLE IS COMPLETELY AGAINST ME.

The LAST WEEKLY TESLA chart that I shared is another prime example of this.

🟢SeekingPips🟢 shared a BULLISH BIAS when the WEEKLY CHART was looking as BEARISH as hell. 🔥

ℹ️ Now it really is not a method that works for everyone.

Trading against momentum always looks SCARY BUT the SECRET is MULTI TIMEFRAME ANALYSIS and also being able to...

VISUALISE DIFFERENT OBSCURE TIMEFRAMES IN REAL-TIME USING THE CURRENT OPEN CHART.

⚠️I plan on going DEEPER INTO this rabbit hole with some information and examples in the TUTORIAL SECTIONS soon.⚠️

🚥 In it's simplest terms an example would be beaing able to note where price is on a 20 or 10 min chart just only by having a 5 minute chart in front of you.

By being able to do so in REAL-TIME KEY LEVELS POP OUT that you may not have noticed from the 5 minute chart perspective only.💡💡💡

Now 🟢SeekingPips🟢 has to wait for a TRIGGER for a NEW ENTRY & SO SHOULD YOU.👍👌👍

Tesla on the Path to New Highs: Correction Before a Major high?hello guys.

let's have a comprehensive analysis of Tesla

__________________________

Technical Analysis

Price Structure & Trend:

The monthly chart indicates a long-term uptrend within a broad ascending channel.

Tesla has recently faced resistance around $300 and is now in a corrective phase.

The expected correction may bring the price down to around $220-$250, where it could find strong support before continuing its bullish move. or it is possible to start an upward movement and form an ATH!

RSI & Divergence:

The RSI indicator previously showed a fake bearish divergence, meaning the price action remains strong despite earlier weakness signals.

Potential Higher Levels

If Tesla successfully follows the projected movement, a break above $575 could open the door to $700-$750, based on the channel extension and historical breakout patterns.

__________________________

Fundamental Analysis

Earnings & Growth:

Tesla's revenue growth remains strong despite market headwinds.

New factory expansions (Giga Texas, Giga Berlin) and production efficiency improvements contribute to long-term profitability.

The Cybertruck ramp-up and expansion in AI-driven automation could drive future stock value.

EV Market Outlook:

Tesla maintains a dominant position, but increasing competition from Chinese EV manufacturers and legacy automakers remains a challenge.

Recent price cuts have impacted margins but helped sustain high sales volume.

Macroeconomic Factors:

Interest rate decisions by the Federal Reserve could impact growth stocks like Tesla.

If rates stabilize or decrease in 2025, Tesla could see renewed investor interest, pushing the stock to new highs.

_________________________

Conclusion

The mid-term bearish retracement toward $250 aligns with healthy correction levels.

If Tesla holds above support and breaks $350, your $575 target is highly probable.

A break above $575 could lead to $700+ in the longer term, assuming positive earnings growth and stable macroeconomic conditions.

Bullish TESLA prediction and bullish theoriesBullish triggers for this event to potenially happen. (I think)

1.If the macro landscape will calm down. (QE/ Lower interest rates / Tariff peace talks)

2.Musk returns to focus on TSLA.

3.Improvements or any new news regarding the optimus robots development.

4.Bitcoin breaking out (to the upside).

5.Retirement funds coming back as investors in TSLA. (Danish funds have left the stock).

6.Peace talks between Russia and Ukraine.

NASDAQ:TSLA

Tesla What Next? TSLA Buy Bargain OR Bust?✅️Now you guys know my thoughts on this and although TESLA has been beaten ⚫️black⚫️ and 🔵blue🔵 recently somehow there may be an opportunity on the horizon.🚀

ℹ️ The way I look at it is unless you think TSLA is dead forever and to be cast to the dustbin 🟢SeekingPips🟢 would be looking for a buying opportunity.

👌I don't know who coined the phrase first however it's one that 🟢SeekingPips🟢 loves and uses often it's

⭐️"BUY WHEN THERES BLOOD IN THE STREETS"⭐️

⚠️Now don't get me wrong it doesn't mean I will be loading up gun ho RIGHT AT THIS MOMENT but it certainly DOES MEAN I'M NOT A SELLER AND STALKING BUYING OPPORTUNITIES✅️

❓️What's you thoughts on Tesla❓️

Share your thoughts with 🟢SeekingPips🟢

TSLA has bottomed. Great Rebound spot!!!TSLA ran up from 200 to 475/shr. On its way up it left to gaps in its price action, one gap up to 245 and another one right after to 275. Gaps in price action are eventually filled 90% of the time. During TSLA's recent decline, it pushed all the way down to close the gaps it had in its chart, with the bottom being 220, where the inital gap started.

Now that it has had its rundown and closed its gaps in price action, its likely this is the bottom for TSLA and it'll rebound from here.